Table of contents - DSpace Biblioteca Universidad de Talca

Table of contents - DSpace Biblioteca Universidad de Talca

Table of contents - DSpace Biblioteca Universidad de Talca

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

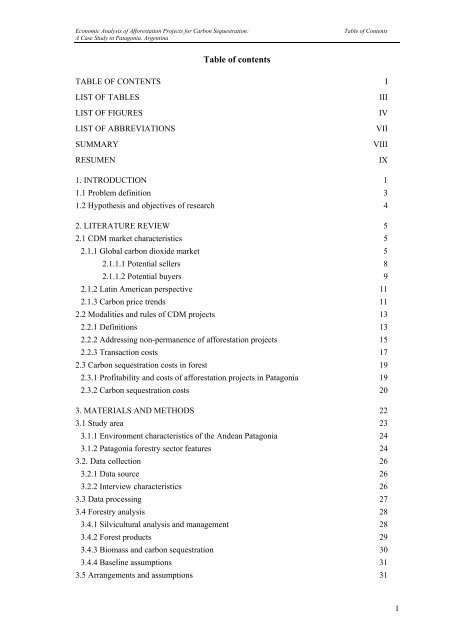

Economic Analysis <strong>of</strong> Afforestation Projects for Carbon Sequestration:A Case Study in Patagonia, Argentina<strong>Table</strong> <strong>of</strong> Contents<strong>Table</strong> <strong>of</strong> <strong>contents</strong>TABLE OF CONTENTSLIST OF TABLESLIST OF FIGURESLIST OF ABBREVIATIONSSUMMARYRESUMENIIIIIVVIIVIIIIX1. INTRODUCTION 11.1 Problem <strong>de</strong>finition 31.2 Hypothesis and objectives <strong>of</strong> research 42. LITERATURE REVIEW 52.1 CDM market characteristics 52.1.1 Global carbon dioxi<strong>de</strong> market 52.1.1.1 Potential sellers 82.1.1.2 Potential buyers 92.1.2 Latin American perspective 112.1.3 Carbon price trends 112.2 Modalities and rules <strong>of</strong> CDM projects 132.2.1 Definitions 132.2.2 Addressing non-permanence <strong>of</strong> afforestation projects 152.2.3 Transaction costs 172.3 Carbon sequestration costs in forest 192.3.1 Pr<strong>of</strong>itability and costs <strong>of</strong> afforestation projects in Patagonia 192.3.2 Carbon sequestration costs 203. MATERIALS AND METHODS 223.1 Study area 233.1.1 Environment characteristics <strong>of</strong> the An<strong>de</strong>an Patagonia 243.1.2 Patagonia forestry sector features 243.2. Data collection 263.2.1 Data source 263.2.2 Interview characteristics 263.3 Data processing 273.4 Forestry analysis 283.4.1 Silvicultural analysis and management 283.4.2 Forest products 293.4.3 Biomass and carbon sequestration 303.4.4 Baseline assumptions 313.5 Arrangements and assumptions 31I

Economic Analysis <strong>of</strong> Afforestation Projects for Carbon Sequestration:A Case Study in Patagonia, Argentina<strong>Table</strong> <strong>of</strong> Contents3.5.1 CDM arrangements 313.5.1.1 Transaction costs 313.5.1.2 Carbon prices 323.5.1.3 Calculation <strong>of</strong> CERs 333.5.1.4 Project area 343.5.2 Economic assumptions 353.5.2.1 Decision maker scenarios 353.5.2.2 Discount rate and inflation 353.5.2.3 Opportunity costs 373.5.2.3 Land price 373.5.3 Risk assumptions 383.6 Economic calculations 383.6.1 Pr<strong>of</strong>itability indicators 383.6.2 Critic points 393.6.3 Carbon sequestration costs 393.7 Materials and methods’ summary 404. RESULTS 414.1. Pr<strong>of</strong>itability <strong>of</strong> pon<strong>de</strong>rosa pine afforestation based on timber sales 414.2 Certified emission reduction analysis 424.3. Transaction costs 434.4 Effect <strong>of</strong> accounting methods 454.5 Minimum pr<strong>of</strong>itable project area 504.6 Carbon sequestration costs 514.7 Sensitivity analysis 524.7.1 Changes in the discount rate 524.7.2 Changes in input and output prices 534.7.3 Changes in the project scale 555. DISCUSSION AND CONCLUSIONS 575.1 Limitations <strong>of</strong> the present research 575.2 Economic analysis <strong>of</strong> afforestation projects for carbon sequestration 585.2.1 Impact <strong>of</strong> CER accounting methods 585.2.2 Scale <strong>of</strong> CDM forestry projects 605.2.3 Carbon sequestration costs 605.2.4 Sensitivity analysis 615.3 Final conclusions 626. REFERENCES 677. APPENDIX 71II

Economic Analysis <strong>of</strong> Afforestation Projects for Carbon Sequestration:A Case Study in Patagonia, ArgentinaList <strong>of</strong> FiguresList <strong>of</strong> figuresFigure 1Figure 2Figure 3Figure 4Figure 5Figure 6Figure 7Supply and <strong>de</strong>mand curves in the global carbon marketun<strong>de</strong>r different scenarios.Distribution <strong>of</strong> potential suppliers <strong>of</strong> sink and non-sinkCDM projectsMain buyers and type <strong>of</strong> projects financed from 1996 to2000Comparison between abatement costs in €/t CO 2 , carbonprices paid and carbon price forecastsExamples <strong>of</strong> issuance: TCERs (a) and LCERs (b) on acurve <strong>of</strong> net anthropogenic GHG removal by sinks(carbon stock-curve discounted baseline and leakage).Beginning <strong>of</strong> the certification is year 10.Maximum, minimum, and average transaction costs <strong>of</strong>CDM projects.Distribution <strong>of</strong> capitalized expenditures and income in anafforestation project –turnover 35 years- in Patagonia891012161819Figure 8 Conceptual framework <strong>of</strong> the research. 22Figure 9 Map <strong>of</strong> the research area. Forest Region in Patagonia 23Figure 10 Example <strong>of</strong> a graphic outcome using @RISK s<strong>of</strong>tware. 27Figure 11Figure 12Carbon sequestration in trunks, branches, needles androots <strong>of</strong> Pon<strong>de</strong>rosa pine plantation –35 years project- inPatagonia.Land price for properties in the NW <strong>of</strong> Chubut accordingto the interviews.3037IV

Economic Analysis <strong>of</strong> Afforestation Projects for Carbon Sequestration:A Case Study in Patagonia, ArgentinaList <strong>of</strong> FiguresFigure 13Figure 14Figure 15Figure 16Figure 17Figure 18Figure 19Figure 20Figure 21Pr<strong>of</strong>itability distributions <strong>of</strong> Pon<strong>de</strong>rosa pine afforestationbased on timber product sales when different scenariosare consi<strong>de</strong>red with 8% discount rate.Curve <strong>of</strong> carbon sequestration in a pine plantation andcomparison <strong>of</strong> certified emission reductions generatedwith ‘TCER’ and ‘LCER’ approach.Baseline <strong>de</strong>termination costs and monitoring costs fordifferent scale <strong>of</strong> projects estimated in Patagonia.Present value <strong>of</strong> unitary transaction costs ($/CER)utilising ‘TCER’ and ‘LCER’ approaches for differentplantation project sizes (i = 8%, 8,2 €/ CER).Comparison between three sources <strong>of</strong> income scenariosand four <strong>de</strong>cision maker points <strong>of</strong> view for 600 ha pineplantation project (i = 8% and 8,2 €/t CO 2 ).Cash Flow <strong>of</strong> ‘TCER’ approach on 35 years afforestationproject. Only transaction costs and revenues from carboncredit sales were taken into account (600 ha project).Cash Flow <strong>of</strong> an afforestation project applying the‘LCER’ approach. Only transaction costs and revenuesfrom carbon credit sales were consi<strong>de</strong>red (600 ha project).Maximum annual increment in carbon stocks in absence<strong>of</strong> the afforestation project according to ‘TCER’ and‘LCER’ method at three CER prices.Minimum project area using TCER and LCER approachfor different CER prices (8% discount rate).424344454748484950V

Economic Analysis <strong>of</strong> Afforestation Projects for Carbon Sequestration:A Case Study in Patagonia, ArgentinaList <strong>of</strong> FiguresFigure 22Figure 23Figure 24Figure 25Present value <strong>of</strong> carbon sequestration per CER (a) and perhectare (b). And, present value <strong>of</strong> sequestering an<strong>de</strong>mitting TCERs and LCER per hectare and per CER atdifferent project sizes. (It inclu<strong>de</strong>s land price, 8%discount rate, and 8,2 €/CER)NPV ($/ha) for the scenarios ‘Investor without subsidies’(a) and ‘Farmer without subsidies’ (b) un<strong>de</strong>r differentdiscount rates and source <strong>of</strong> income (size 600 ha and 8,2€/CER).Comparison <strong>of</strong> NPV using long term and temporary CERat different CER prices and <strong>de</strong>cision maker scenarios (8%discount rate and project area 600 ha)Temporary credits (left) and Long-term credits (right) at8,2 €/CER, and 8% discount rate, with 200, 400, 600, 800and 1000 ha afforestation project area.51535556Figure 26 Comparison between the pr<strong>of</strong>itability <strong>of</strong> 35 years and 40years afforestation project in Patagonia (8,2 €/CER, 8%discount rate, and 600 ha).56Figure 27Figure 28Comparison between the cash flow consi<strong>de</strong>ring timbersales, TCER sales and LCER sales(I+S scenario, scale = 300 ha, i = 8% and 8,2 €/t CO 2 )Example <strong>of</strong> the proposed financial scheme for projectportfolios.5965VI

Economic Analysis <strong>of</strong> Afforestation Projects for Carbon Sequestration:A Case Study in Patagonia, ArgentinaList <strong>of</strong> AbbreviationsList <strong>of</strong> abbreviationsAAUsAssigned Amount <strong>of</strong> UnitsCDMClean Development MechanismCERs or CER Certified Emission ReductionsCIEFAP Patagonian An<strong>de</strong>s Forest Research and Extension CentreCO 2Carbon dioxi<strong>de</strong>DGByP Dirección General <strong>de</strong> Bosques y ParquesEAIExpected Annual IncomeERsEmission ReductionsERUsEmission Reduction UnitsETEmission TradingEU ETS European Union Emission Trading SchemeF – SFarmer without state subsidies scenarioF + SFarmer with state subsidies scenarioGHGGreenhouse gasesGTZGerman Technical CooperationhaHectareiDiscount rateI - SInvestor without state subsidies scenarioI + SInvestor with state subsidies scenarioIETAInternational Emission Trading AssociationINTAInstituto Nacional <strong>de</strong> Tecnología AgropecuariaJIJoint ImplementationKPKyoto ProtocolLCERLong-term Certified Emission ReductionsLULUCF Land Use, Land Use Change and ForestryNPVNet Present ValueOECD Organisation for Economic Co-operation and DevelopmentPCFPrototype Carbon FundPVPresent ValueSAGPyA Secretaria <strong>de</strong> Agricultura, Gana<strong>de</strong>ría, Pesca y Alimentaciónt CO 2Metric tonne <strong>of</strong> carbon dioxi<strong>de</strong>t/haMetric tonne per hectareTCERTemporary Certified Emission ReductionsUNFCCC United Nations Framework Convention on Climate Change$ Argentinean PesosVII