Mongolia Weekly: 9 July 2010 - Eurasia Capital

Mongolia Weekly: 9 July 2010 - Eurasia Capital

Mongolia Weekly: 9 July 2010 - Eurasia Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)Economic Event CalendarIndicator name Reported period Release date ActualresultPreviousresultFood price index, w-o-w, % <strong>July</strong> 1 – 7, <strong>2010</strong> <strong>July</strong> 7,<strong>2010</strong> -2.6 -3.6CPI, m-o-m, % June <strong>2010</strong> <strong>July</strong> 8, <strong>2010</strong> -1.5 3.2Real GDP y-o-y, % 1H<strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> - - 1.3Industrial output y-o-y, % 1H<strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> 12.4 -7.9Money Supply (M2), MNTbn June, <strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> 3,523.6 3,254.1Money Reserve (M1), MNTbn June, <strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> - 796External trade turnover, US$mnExportsImportsBudget, MNTbnTotal RevenueTotal Expenditure1H<strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> 2,664.91,308.71,356.21H<strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong>1,207.71,273.51,655.7762.9892.8826.3970.2Average monthly wage, MNT 2Q<strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> - 305,300Number of registered unemployed 1H <strong>2010</strong> <strong>July</strong> 9, <strong>2010</strong> 39,941 38,077Source: The Bank of <strong>Mongolia</strong>, National Statistics Office of <strong>Mongolia</strong>International IPO CalendarCompany name IPO size Stock Exchange Type YearWinsway Coking Coal US$800mn HKEx Coal logistics 4Q<strong>2010</strong>Iron Mining Int’l US$1bn HKEx Iron ore 4Q<strong>2010</strong>Gobi Coal and Energy - HKEx Coal 1Q2011Energy Resources - HKEx or LSE Coal 2011Source: Company dataPolitics and EconomyTavan Tolgoi Development Partner to be Announced SoonThe foreign investor for the project would be announced this autumn, UB Post newspaper reported onFriday (<strong>July</strong> 9). On Wednesday, <strong>Mongolia</strong>n Parliament approved Tavan Tolgoi project’s conceptualizedplan. Parliament adopted a resolution concerning development of the Tavan Tolgoi coking coal deposit.The resolution envisages establishment of Erdenes Tavan Tolgoi LLC to hold the licence for the deposit.The new company will be a subsidiary of state-owned Erdenes MGL. Erdenes Tavan Tolgoi LLC alongwith relevant ministries will sign an investment agreement with a contract miner to extract coal.Erdenes Tavan Tolgoi LLC shares will be publicly listed. 10% share of Erdenes Tavan Tolgoi LLC will bedistributed among the people of <strong>Mongolia</strong>. These “shareholders” will not have voting rights; they will beeligible for dividends from the Company. This “shareholder” right inalienable and cannot be transferredto other parties. 30% of Erdenes Tavan Tolgoi LLC equity will be placed publicly on domestic and foreignstock markets. 10% of the company will be sold to the domestic enterprises that were registered beforeJune 30, <strong>2010</strong> and that have paid all taxes. The Minister for Minerals and Energy D. Zorigt said after the2

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)parliamentary vote that no timetable has been set for the share sales overseas or a preference made forwhere they should be held, news.mn reported on Friday.In our view recent developments bring more clarity to the project in terms of the government policy. Itpaves the way to hiring the mining contractor for the project.Monthly Payments from Mining DealsThe Government proposed to give every citizen MNT10,000 a month from the Human DevelopmentFund from August 1, news.mn portal reported on <strong>July</strong> 5. Human Development Fund accumulates excessmining revenue and funds from mining deals. From 2011 onwards, the monthly amount will beincreased gradually to MNT21,000. Everybody, irrespective of age, will receive the monthly payment.The proposal needs parliamentary approval.During the parliamentary elections the ruling coalition parties pledged to distribute MNT1.5mn to eachcitizen from major mining deals. Lump sum payment of MNT70,000 earlier this year contributed toinflation accelerating to 11.6% y-o-y in May. In our view, the Government is trying to dispersedistribution of money from the mining deals over time, to avoid bulges in inflation rates.Citizenry Registration to Distribute Tavan Tolgoi Shares<strong>Mongolia</strong> starts state registration of citizens Montsame Agency reported on <strong>July</strong> 5. The Prime Ministerof <strong>Mongolia</strong> and other government officials participated at the launch of citizenry registration. Citizenryregistration is being updated for the disbursements from the Human Development Fund (HDF), whichaccumulates funds from mining deals. This registration will create an integrated system with citizens’fingertips and recent photos. The register will be used to disburse MNT50,000 from HDF and todistribute 10% of Tavan Tolgoi project equity.NSO Releases Economic Data for 1H<strong>2010</strong>National Statistics Office (NSO) released economic data for 1H<strong>2010</strong> on Friday (<strong>July</strong> 9). NSO reported thatCPI in June declined 1.5% m-o-m. Seasonal food price decline is moving CPI down. Food and nonalcoholicbeverages price declined 4% in June. Furthermore, the inflationary pressure from meat priceincreases and cash distribution earlier this year may be gradually easing. Nevertheless, inflation remainsin double digits at 11.4% y-o-y.Money Supply (M2) at the end of June expanded 8.3% m-o-m and 44.5% y-o-y to MNT3,523.6bn.Currency in circulation was 3.3% down m-o-m, but 25.1% up y-o-y to MNT447.4bn. Loans outstandingincreased 1% m-o-m and 12.6% y-o-y to MNT2,882.6bn. NPL stood at MNT402.9bn, a decline of 2.9% m-o-m, but an increase of 35.2% y-o-y.In 1H<strong>2010</strong> total revenue and grants of General Government budget amounted to MNT1,239.6bn, whilsttotal expenditures and net lending reached MNT1,407.1bn. Budget deficit is down by MNT93.8bn y-o-yto MNT167.5bn. Current revenue of General Government amounted to MNT1,205.6bn and currentexpenditure reached MNT1,101bn. Tax revenue surged by MNT427.6bn or 66.2% y-o-y. Revenue fromthe windfall profits tax jumped 4.2 times, from corporate income tax 2.1 times and from VAT 69%. Total3

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)expenditures and net lending soared by MNT319.6bn or 29.4% y-o-y, primarily, due to increase ofMNT177.9bn or 48.6% in subsidies and transfers. <strong>Capital</strong> expenditures rose 57% y-o-y to MNT172.5bn.Foreign trade turnover surged 61% totaling US$2,664.9mn, including 71.5% increase in exports toUS$1,308.7mn and 51.9% increase in imports to US$1,356.2mn. External trade balance showed a deficitof US$47.6mn decreasing by US$82.2mn or 63.3% y-o-y.In 1H<strong>2010</strong> livestock loss due to severe winter and last year’s dry summer reached 9.7mn adult animals,including 12,800 camels, 338,200 horses, 550,100 cows, 4.05mn sheep and 4.8mn goats. 7.3mn or71.1% of the born animals survived as opposed to 13.6mn last year.Total industrial output in the period increased 12.4% y-o-y. Crude petroleum and natural gas extractionincreased 80.2%, mining of coal and lignite, and peat extraction jumped 83% and other mining andquarrying grew 22.2%. Manufacture of food products and beverages surged 39.8%.The <strong>Mongolia</strong>n external trade demonstrates robust recovery on the back of rebound in commodityprices. However, NPL in the banking sector and accelerating inflation remain a concern. Loss of 22.1% oftotal livestock increases reliance on the mining sector in the short term and fuels food prices. Loss of4.8mn goats puts pressure in raw cashmere prices. Macroeconomic recovery remains fragile and anysudden decline in commodity prices may deteriorate economic fundamentals and dramatically affectthe Government’s fiscal position.The Government Raises Fuel Import Excise DutyThe Government of <strong>Mongolia</strong> increased excise duty on gasoline and diesel imported via Sukhbaatar,Zamiin-Uud, Ereentsav and Altanbulag border checkpoints, Montsame Agency reported on Wednesday(<strong>July</strong> 7). The rates remain unchanged to fuel imported via other remote checkpoints. Excise duty ongasoline A-80 was raised from MNT120,000 to MNT220,000 per tonne, on gasoline A-92 fromMNT170,000 to MNT220,00, on diesel from MNT115,00 to MNT215,000. The new rates are effectivefrom <strong>July</strong> 9 onwards.Overall, <strong>Mongolia</strong> imported 322,700 tonnes of gasoline and 413,500 tonnes of diesel in 2009. In the firstfive months of <strong>2010</strong>, the country imported 108,900 tonnes of gasoline and 149,800t of diesel. In ourview, the new rates may increase gasoline prices by about 5%.Dosbergen Musaevdosbergen.musaev@eurasiac.comZultsetseg Chunluunbatzultsetseg.chunluunbat@eurasiac.com4

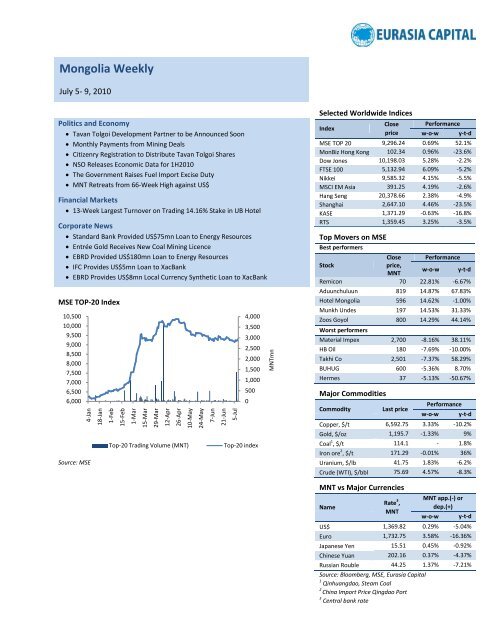

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)MNT Retreats from 66-Week High against US$MNT declined from 66-week high againstUS$ after 6 consecutive week of gain asduring the foreign currency auction, therewas no transaction and offer from theparticipants.The 1-week Central Bank Bill (CBB)interest rate increased little to 11% from10,86% on <strong>July</strong> 7, as during the weeklyCBB auction the Bank of <strong>Mongolia</strong> soldCBB worth of MNT259bn to the banks atweighted average rate of interest rate of11%. Also, the 12-week CBB interest rategained to 13.12% from 11.12% ascommercial banks bought MNT18bn 12-week CBB from the Bank of <strong>Mongolia</strong>.MNT/US$ Exchange Rate1,3971,3921,387Bank of <strong>Mongolia</strong> RateInter-Bank Sell Rate1,3821,3771,3721,3671,362Inter-Bank Buy Rate1,35717-May24-May31-May7-Jun14-Jun21-Jun28-Jun5-JulSource: Bank of <strong>Mongolia</strong>, <strong>Eurasia</strong> <strong>Capital</strong>The Bank of <strong>Mongolia</strong> increased the official rate of US$ vs MNT by 0.24% w-o-w to MNT1,369.38 as oflast Friday and in the interbank and alternative markets, US$ vs MNT buy rate rose 0.18% w-o-w and0.22% to MNT1,361.67 and MNT1,371.00 respectively.Enkhbayar Davaatserenenkhbayar.davaatseren@eurasiac.comFinancial Markets13-Week Largest Turnover on Trading 14.16% Stake in UB HotelLast week 30 companies were traded on theMSE with MNT1.5bn weekly turnover, 13-week highest. The increase was driven bytrading a 14.16% stake valued at MNT1.4bnin UB Hotel, second largest MSE-listed hotelby market cap.MSE Top-20 Index advanced 0.69% w-o-w to9,296.24, led by a new Index-member, ZoosGoyol (+14.29%). The Top-20 basketchanged in accordance with the MSE ruleson <strong>July</strong> 8. 15 members stayed in the basketand Berkh Uul, Mogoin Gol, Darkhan Nekhii,MSE TOP-20 Index10,50010,0009,5009,0008,5008,0007,5007,0006,5006,0004-JanSource: MSE18-Jan1-Feb15-Feb1-Mar15-Mar29-Mar12-Apr26-Apr10-MayTop-20 Trading Volume (MNT)24-May7-Jun21-Jun5-Jul4,0003,5003,0002,5002,0001,5001,0005000Top-20 indexMNTmn5

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)Zoos Goyol and Naco Fuel replaced the previous members, Spirit Bal Buram, NIC, BDSec, <strong>Mongolia</strong>Development Resources (formerly known as Tuul Songino Water Resource) and Material Impex.Out of traded 30 companies, 10 companies rose, 10 companies declined and remaining 10 companiesunchanged.The best performers were Remicon (+22.81%), Aduunchuluun (+14.87%), Hotel <strong>Mongolia</strong> (+14.62%),Munkh Undes (+14.53%), Zoos Goyol (+14.29%) and Eermel (+11.88%), and the worst performers wereMaterial Impex (-8.16%), HBOil (-7.69%), Takhi Co (-7.37%) and Buhug (-5.36%).The most actively traded stocks were Ulaanbaatar Hotel (weekly turnover of MNT1.4bn), Khukh Gan(MNT20.8mn), APU (MNT9.6mn) and Shariin Gol (MNT8.3mn).Enkhbayar Davaatserenenkhbayar.davaatseren@eurasiac.comCorporate NewsMININGStandard Bank Provided US$75mn Loan to Energy ResourcesStandard Bank, South Africa’s largest bank with market capitalization of approximately US$22bn, agreedto provide a US$75mn loan to Energy Resources for a 240km paved road project between Ukhaa Khudagcoal mine and Gashuun Sukhait, the <strong>Mongolia</strong>n-Chinese border crossing point, the <strong>Mongolia</strong>nnewspaper Daily News reported on <strong>July</strong> 8. On December 23, 2008, when production at EnergyResources’ Ukhaa Khudag coal mine started, Standard Bank provided a US$30mn coking coal prepaymentloan. According to Standard Bank’s Managing Director Andrew King, who is in charge of Asiabusinesses, the Bank is ready further to grant loans to support Energy Resources’ infrastructure projects.The Gashuun Sukhait border point previously used for trade in local agriculture goods and imports fromChina to communities in the southern Gobi regions, started to be used for coal exports when small scaleoperation started in certain license areas at Tavan Tolgoi, the world’s largest untapped coking coal mine,in 2004. According to Energy Resources, every day between 200 and 500 heavy trucks transport coalfrom those license areas at the Tavan Tolgoi mine to the Gashuun Sukhait border point into China. Thevolume of coal trucked increased dramatically over the last 6 years. It has grown from 200,000 tonnes ofcoal in 2004 to 2mn tonnes of coal in 2008 and seriously eroded and damaged the existing earth road.In our view, Energy Resources’ timely secured loan from Standard Bank to improve the transportationinfrastructure will pay off significantly especially once the company starts producing high quality cokingcoal using the first coal washing plant in <strong>Mongolia</strong>. Site works for the washing plant already commencedin August last year.6

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)Entrée Gold Receives New Coal Mining LicenceEntrée Gold Inc. (ETG:CN), Canadian resource Company with operations in <strong>Mongolia</strong>, China, UnitedStates and Australia, announced on <strong>July</strong> 6 that it has received a new mining licence for its <strong>Mongolia</strong>nNomkhon Bohr coal mine indicated during the exploration program in 2008-2009. The new mininglicence is 100% owned by ETG and will have 30 years initial term. It is approximately 14,030ha andcovers the northwest territory adjacent to the former Togoot exploration licence. The mine containsthermal coal resources and considered to be of similar age as thermal and coking coal resources atTavan Tolgoi coal mine located approximately 80km to the northwest. In our view, proximity ofNomkhon Bohr mine to Tavan Tolgoi mine, the world’s largest untapped coking coal mine, nearby whichroad and railway are planned to be build, improves considerably marketability of ETG’s products.EBRD Provided US$180mn Loan to Energy ResourcesThe EBRD has provided a US$180mn loan to Energy Resources, a private <strong>Mongolia</strong>n mining company, forthe construction of the first coal washing plant at the Ukhaa Khudag (UHG) coking coal mine, theinternational financial institution wrote in its press release on <strong>July</strong> 6. The Coal Handling and PreparationPlant (CHPP) with annual capacity of 15mn tonnes will be built in 3 phases by Sedgman Ltd., anAustralian based leading provider of multi-disciplinary engineering, project delivery and operationsservices to the global resources industry. Sedgman has already started site works in August 2009 and inthe first phase plans to build a 850 tonnes/hour single module plant with annual capacity of 5mntonnes. The primary coking coal is expected to be exported, and secondary coal product will be usedlocally. The CHPP expected to increase Energy Resource’s exports to China and improve itscompetitiveness both domestically and internationally. Under the loan terms, Energy Resources willsupport clustered small and medium mining companies with the help of the EBRD’s TAM/BASprogramme. The EBRD is also providing a grant of EUR1.2mn to digitalize the mining licences archive ofthe Mineral Resources Authority of <strong>Mongolia</strong>.Early in March 2009, the EBRD took an equity stake of up to US$30mn in Energy Resources to supportthe production of coking coal from UHG with expected production life of 100 years. Moreover, the<strong>Mongolia</strong>n news portal Daily News also reported on <strong>July</strong> 6 that Energy Resources signed a two-year coalsupply agreement with German based Thyssen Krupp MinEnergy GmbH.In our view, these are positive developments for the company which is intending to become a majorcoal exporter in <strong>Mongolia</strong> and to launch its international IPO next year.Akmal Aminovakmal.aminov@eurasiac.comBatbayar Bat-Erdenebatbayar.bat-erdene@eurasiac.com7

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)FINANCEIFC Provides US$5mn Loan to XacBankOn <strong>July</strong> 7, Udriin Sonin reported that International Finance Corporation (IFC) and XacBank signed anagreement according to which IFC will provide an eight year term US$5mn loan to XacBank. The loan isprovided to finance small and medium sized enterprises (SMEs). It will become the third loan by IFCafter the international financial institution provided US$5.4mn to the bank in 2005 and 2007 in total.CEO of XacBank, Mr. M. Bold, said that “after the reassessment of XacBank, IFC is providing a longerterm loan compared to the previous ones. It confirms that the bank’s operation is stable, effective andsuccessful”. Investment specialist of IFC, Weichuan Hu, noted that “XacBank is one of the strategicallyimportant partners in <strong>Mongolia</strong> and we are glad to provide the fund which will be lent further to SMEs.We are confident that there are opportunities that IFC and XacBank can cooperate in more areas.”IFC, a member of the World Bank Group, so far has provided US$60mn in total to <strong>Mongolia</strong> throughinvestments, loans and trade financing. IFC also advises <strong>Mongolia</strong> on such issues as corporategovernance, business control and loan information fund.XacBank, one of the leading retail banks in <strong>Mongolia</strong>, is 99.95% owned by TenGer Financial Group. Theshareholders of TenGer Financial Group include EIT <strong>Capital</strong> Management, Mercy Corps, Triodos BankGroup, Blue Orchard Private Equity Fund, IFC and EBRD. The bank has around 80 branch officesthroughout <strong>Mongolia</strong> and can reach customers from 169 soums (counties) of <strong>Mongolia</strong>.EBRD Provides US$8mn Local Currency Synthetic Loan to XacBankOn <strong>July</strong> 7, the EBRD announced that it is providing a US$8mn <strong>Mongolia</strong>n togrog (MNT) denominatedsynthetic loan to XacBank to finance micro, small and medium-sized enterprises (MSMEs). The loan isthe extension of <strong>Mongolia</strong> Financial Sector Framework of the EBRD which is a US$50mn facilityestablished to provide funding for local commercial banks, leasing, insurance and consumer financeinstitutions, pension companies and non-bank micro finance institutions. According to the EBRD, sinceits operation in <strong>Mongolia</strong> in 2006, it has provided over US$294mn in various sectors of <strong>Mongolia</strong>.Head of EBRD team in Ulaanbaatar, Philip ter Woort, noted that “with this transaction and in closecooperation with our partner bank XacBank, the EBRD is deepening its support for <strong>Mongolia</strong>n micro andsmall enterprise sector which is an essential element for private sector growth in <strong>Mongolia</strong>”.This localcurrency facility is the first the EBRD has executed in <strong>Mongolia</strong> which will enable XacBank to mitigate theforeign currency exchange risks for its clients.In our view, XacBank has established a unique and successful growth strategy. In the last ten days, twointernational shareholders of the bank, the EBRD and IFC, have provided a total of US$13mn to thebank. Securing loans from international financial institutions successfully signifies the sustainability,development and success of the XacBank’s operations in <strong>Mongolia</strong>.Rentsendorj Yondonrentsendorj.yondon@eurasiac.com8

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)Economic PerformancePopulation and income2003 2004 2005 2006 2007 2008 2009 <strong>2010</strong>ePopulation, mn 2.50 2.53 2.56 2.59 2.63 2.68 2.74 2.79GDP per capita, US$ 581.7 720.1 905.3 1223.8 1502.9 1939.7 1560.2 2026.6National accountsNominal GDP, MNTbn 1660 2152 2780 3715 4599.5 6020 6056 7500Nominal GDP, US$bn 1.4 1.8 2.3 3.2 3.9 5.1 4.0 5.5Nominal GDP at PPP, US$bn 5.4 6.1 6.7 7.5 8.5 9.4 9.4 10.1Real GDP growth, YoY, % 7.0 10.6 7.2 8.6 10.2 8.9 -1.6 7.2Monetary indicators and inflationM2 growth, YoY, % 49.6 20.4 34.6 34.8 56.3 -5.5 26.9CPI, YoY, % 4.7 11 9.2 4.8 14.1 22.1 4.2 7.5Exchange rate, MNT/US$, annualaverageGross foreign reserves, US$mn,eopGovernment finance1168 1209 1221 1165 1170 1166 1438- 208 333 718 1001 657 822 1200Revenue, % of GDP - 33.1 30.1 36.6 40.9 35.4 32.9 40.2Expenditure, % of GDP - 35.0 27.5 28.5 38.0 40.2 38.3 44.2Budget balance, % of GDP -4.2 -2.1 3.2 3.9 2.2 -5.0 -5.4 -4.0Balance of paymentsExports, US$mn 615.9 872 1069 1545 1952 2539 1903Imports, US$mn 801 1021 1224 1516 2170 3616 2131Exports, YoY, % 17.5 41.2 22.4 44.9 22.5 30.3 -24.9Imports, YoY, % 16.0 27.5 16.0 25.4 36.1 66.6 -34.3Trade balance, US$mn -185.1 -149 -155 30 -218 -1077 -229FDI, US$mn 131.5 92.9 182.3 367 500 709 801Source: National Statistics Office of <strong>Mongolia</strong>, the Bank of <strong>Mongolia</strong>, the IMF, the World Bank, <strong>Eurasia</strong> <strong>Capital</strong>9

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)MSE and <strong>Mongolia</strong> focused International Mining Company StocksPerformance SummaryMSE TOP-20 Performance (<strong>July</strong> 5-9, <strong>2010</strong>)Daily TurnoverPrice Performance Market CapCode Name(Avg 52Wk)Close 52 Wk high 52 Wk low w-o-w y-t-d (MNTmn) (US$'000) MNT US$458 Tavan Tolgoi 230,000 240,000 68,000 0.00% 70.37% 121,129.96 88,456.06 5,209,206 3,80490 APU 1,600 2,000 431 0.00% 153.97% 118,860.32 86,798.64 9,044,371 6,605209 <strong>Mongolia</strong>n Telecom 2,950 4,195 1,400 1.72% 28.82% 76,317.31 55,731.29 1,001,954 732460 Shivee Ovoo 4,900 5,200 1,800 0.00% 48.48% 65,753.59 48,017.06 2,336,137 1,706396 Baganuur 3,000 3,965 1,151 0.00% -14.29% 62,923.08 45,950.05 2,036,041 1,487354 Gobi 6,100 7,700 2,600 0.00% 50.62% 47,586.86 34,750.66 14,293,460 10,438309 Shariin Gol 3,200 4,950 1,400 2.89% 88.68% 23,140.44 16,898.48 19,268,869 14,071484 State Department Store 410 620 180 0.00% 7.89% 15,091.22 11,020.48 2,023,201 1,477532 Khukh gan 148 185 85 -1.33% 24.37% 14,995.00 10,950.21 15,614,258 11,402521 Genco Tour Bureau 103 130 80 -1.90% 8.42% 11,330.00 8,273.82 4,005,344 2,92513 Bayangol Hotel 23,000 29,990 12,000 4.55% 27.78% 9,730.50 7,105.77 1,131,834 8273 UB Hotel 26,500 30,475 11,500 0.00% 35.90% 8,885.37 6,488.61 6,137,692 4,482444 Mogoin Gol 8,480 8,490 1,800 0.00% 330.46% 7,035.19 5,137.50 294,499 215208 Makh Impex 1,380 2,080 725 6.15% 20.00% 5,244.99 3,830.20 442,667 323191 Eermel 1,300 1,650 980 11.88% 0.00% 4,523.12 3,303.04 367,520 268450 Zoos Goyol 800 1,080 211 14.29% 44.14% 3,003.96 2,193.66 217,421 159531 Nako Tulsh 270 310 150 -1.82% 36.36% 2,970.00 2,168.86 2,612,710 1,90822 Talkh Chikher 2,810 3,270 1,050 -3.10% 40.50% 2,876.61 2,100.66 200,728 147492 Berkh Uul 150 150 150 0.00% 0.00% 2,859.31 2,088.03 960,448 70171 Darkhan Nekhii 2,100 3,900 1,431 0.00% 0.00% 2,321.51 1,695.30 117,764 86Source: MSE, <strong>Eurasia</strong> <strong>Capital</strong>CodePerformance of MSE Stocks Traded (<strong>July</strong> 5-9, <strong>2010</strong>)NamePrice Performance Market CapDaily Turnover(Avg 52Wk)Close 52 Wk high 52 Wk low w-o-w y-t-d (MNTmn) (US$'000) MNT US$90 APU 1,600 2,000 431 0.00% 153.97% 118,860.32 86,798.64 9,044,371 6,605209 <strong>Mongolia</strong>n Telecom 2,950 4,195 1,400 1.72% 28.82% 76,317.31 55,731.29 1,001,954 732396 Baganuur 3,000 3,965 1,151 0.00% -14.29% 62,923.08 45,950.05 2,036,041 1,487354 Gobi 6,100 7,700 2,600 0.00% 50.62% 47,586.86 34,750.66 14,293,460 10,438309 Shariin Gol 3,200 4,950 1,400 2.89% 88.68% 23,140.44 16,898.48 19,268,869 14,071484 State Department Store 410 620 180 0.00% 7.89% 15,091.22 11,020.48 2,023,201 1,477532 Khukh gan 148 185 85 -1.33% 24.37% 14,995.00 10,950.21 15,614,258 11,402521 Genco Tour Bureau 103 130 80 -1.90% 8.42% 11,330.00 8,273.82 4,005,344 2,92513 Bayangol Hotel 23,000 29,990 12,000 4.55% 27.78% 9,730.50 7,105.77 1,131,834 8273 UB Hotel 26,500 30,475 11,500 0.00% 35.90% 8,885.37 6,488.61 6,137,692 4,482517 Hotel <strong>Mongolia</strong> 596 759 520 14.62% -1.00% 5,960.00 4,352.33 421,406 308530 Remicon 70 100 39 22.81% -6.67% 5,539.68 4,045.39 99,642 73208 Makh Impex 1,380 2,080 725 6.15% 20.00% 5,244.99 3,830.20 442,667 323191 Eermel 1,300 1,650 980 11.88% 0.00% 4,523.12 3,303.04 367,520 268379 Material Impex 2,700 3,450 1,580 -8.16% 38.11% 3,694.16 2,697.69 1,072,804 783450 Zoos Goyol 800 1,080 211 14.29% 44.14% 3,003.96 2,193.66 217,421 15944 Takhi Co 2,501 2,730 1,050 -7.37% 58.29% 2,976.15 2,173.35 12,100 9531 Nako Tulsh 270 310 150 -1.82% 36.36% 2,970.00 2,168.86 2,612,710 1,908528 Hermes 37 75 37 -5.13% -50.67% 2,906.09 2,122.19 1,911,884 1,39622 Talkh Chikher 2,810 3,270 1,050 -3.10% 40.50% 2,876.61 2,100.66 200,728 147461 Aduunchuluun 819 1,160 283 14.87% 67.83% 2,580.92 1,884.73 4,464 310

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)71 Darkhan Nekhii 2,100 3,900 1,431 0.00% 0.00% 2,321.51 1,695.30 117,764 8625 Moninjbar 105 125 75 0.00% 7.14% 1,666.27 1,216.81 374,727 274525 HB Oil 180 241 134 -7.69% -10.00% 1,260.00 920.12 1,164,891 8512 Mongol Savkhi 500 640 401 0.00% 11.11% 1,237.67 903.82 30,630 22236 Mongol Shevro 495 575 400 0.00% 10.00% 455.54 332.66 3,865 39 Mongol Nekhmel 781 1,050 781 -2.38% -17.79% 370.32 270.43 5,751 469 BUHUG 600 634 480 -5.36% 8.70% 274.38 200.36 7,374 5412 Orkhon Bulag 110 110 100 0.00% 10.00% 31.25 22.82 202 0176 Munkh Undes 197 197 150 14.53% 31.33% 17.23 12.59 33,312 24Source: MSE, <strong>Eurasia</strong> <strong>Capital</strong>Fundamental Valuation of MSE Listed Companies (<strong>July</strong> 9, <strong>2010</strong>)Company NameMarket capProfitabilityPriceP/E P/B Debt/EquityGross Net(MNT) (US$'000) (MNTmn) ROA ROEMargin MarginTavan Tolgoi 230,000 88,456.1 121,130.0 2.83 2.29 0.11 103.2% 116.2% 58.2% 44.8%APU 1,600 86,798.6 118,860.3 14.73 3.71 1.24 13.5% 30.8% 22.8% 9.3%<strong>Mongolia</strong>n Telecom 2,950 55,731.3 76,317.3 14.34 2.28 0.24 12.8% 15.9% 22.1% 16.9%Shivee Ovoo 4,900 48,017.1 65,753.6 - - -5.07 -9.0% 36.6% 7.8% -42.9%Baganuur 3,000 45,950.1 62,923.1 - - -5.53 -13.0% 51.2% 10.6% -18.4%Gobi 6,100 34,750.7 47,586.9 31.69 1.97 0.41 4.6% 6.5% 27.1% 7.4%BDSec 2,400 19,278.8 26,400.0 - 5.46 0.01 -8.7% -9.4% - -Shariin Gol 3,200 16,898.5 23,140.4 105.22 16.13 5.65 2.2% 16.6% 10.9% 2.5%State Department Store 410 11,020.5 15,091.2 331.25 3.09 0.54 0.6% 0.9% 100.3% 5.9%Khukh Gan 148 10,950.2 14,995.0 - 1.55 0.18 -3.9% -4.3% - -<strong>Mongolia</strong> Development Resources 990 9,940.6 13,612.5 27.91 0.48 0.00 1.7% 1.7% - -Genco Tour Bureau 103 8,273.8 11,330.0 60.84 1.36 0.41 1.7% 2.4% 62.2% 20.3%Bayangol Hotel 23,000 7,105.8 9,730.5 4.00 0.59 0.29 12.0% 15.7% 60.4% 44.6%Remicon 70 6,524.8 8,935.0 - 1.64 0.03 -14.1% -14.7% 43.5% -94.7%Ulaanbaatar Hotel 26,500 6,488.6 8,885.4 10.57 1.72 0.13 15.4% 17.6% 82.3% 23.5%Mogoin Gol 8,480 5,137.5 7,035.2 1,756.90 3.11 0.40 0.2% 0.3% 24.4% 1.1%Hotel <strong>Mongolia</strong> 596 4,352.3 5,960.0 - 1.88 0.64 -5.3% -8.6% 65.5% -34.9%Makh Impex 1,380 3,830.2 5,245.0 - - -482.50 -4.0% 1942.7% -32.4% -26.9%Eermel 1,300 3,303.0 4,523.1 9.23 0.32 1.03 1.8% 3.8% 100.0% 1228.2%Mongol Securities 140 3,067.1 4,200.0 - 5.75 0.03 -0.2% -0.2% - -Atar Urguu 22,000 2,797.6 3,831.0 4.76 0.79 0.09 16.5% 18.0% 26.2% 10.4%Material Impex 2,700 2,697.7 3,694.2 26.02 3.76 3.95 2.6% 16.0% 10.5% 1.9%Takhi Co 2,501 2,173.4 2,976.1 15.16 3.36 0.18 18.7% 22.2% 99.9% 29.2%Naco Fuel 270 2,168.9 2,970.0 - 3.14 0.40 -2.0% -2.4% - -Hermes 37 2,122.2 2,906.1 40.70 0.37 0.03 0.9% 0.9% 100.0% 10.7%Talkh Chikher 2,810 2,100.7 2,876.6 3.22 2.26 7.86 7.9% 70.2% 17.0% 5.6%Berkh Uul 150 2,088.0 2,859.3 - 3.32 1.42 -5.6% -13.5% 12.8% -16.6%Mon It Buligaar 7,060 2,063.3 2,825.5 - 0.45 0.64 -6.6% -10.8% -10.5% -75.5%Aduunchuluun 819 1,884.7 2,580.9 6.30 1.21 0.48 14.5% 20.8% 33.4% 14.2%Darkhan Nekhii 2,100 1,695.3 2,321.5 2.97 0.66 0.51 14.6% 22.1% 31.9% 19.9%UB Book 1,950 1,606.7 2,200.1 - 2.46 2.25 -3.7% -10.7% 34.4% -9.1%Tumriin Zavod 27,000 1,465.3 2,006.6 - 172.80 7.62 -1.0% -8.3% 100.0% -4.6%Moninjbar 105 1,216.8 1,666.3 132.23 1.00 0.94 0.4% 0.8% 21.8% 0.8%Auto Impex 670 1,131.8 1,549.9 25.34 - -2.17 2.9% -2.1% -14.8% 312.1%Gutal 790 933.8 1,278.8 4.87 0.28 0.02 4.6% 4.8% 24.3% 86.2%HBOil 180 920.1 1,260.0 - 1.60 0.73 -8.8% -14.7% 27.1% -2329.0%Mongol Savkhi 500 903.8 1,237.7 283.48 0.78 0.02 0.3% 0.3% 100.0% 1.9%Ulaanbatar Khivs 3,010 889.8 1,218.5 - 0.25 0.20 -0.6% -0.7% 12.6% -2.1%Niislel Urguu 2,500 795.8 1,089.7 - - -98.26 -1.4% 136.6% 13.3% -4.6%Suu 2,800 703.4 963.2 1.64 0.27 1.08 7.8% 16.4% 16.3% 5.3%11

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)Olloo 66 467.5 640.2 - 0.66 0.01 -3.3% -3.3% 21.0% -18.2%Sor 717 466.7 639.1 - 0.64 0.01 -7.7% -7.8% - -Darkhan Selenge Electricity Distribution 53 401.9 550.4 0.58 0.02 0.44 2.9% 4.2% 23.1% 4.0%Sonsgolon Barmat 256 360.6 493.8 - 1.95 3.82 -3.5% -16.9% 49.5% -19.2%Tulga 3,680 353.7 484.4 15.89 0.66 0.03 4.1% 4.2% 87.6% 22.2%Mongol Shevro 495 332.7 455.5 20.76 0.37 0.90 0.9% 1.8% 35.3% 2.9%Nekheesgui Edlel 350 329.3 451.0 - 0.31 0.02 -5.2% -5.5% -2.3% -25.1%Erdenet Khuns 1,030 296.6 406.1 - 0.18 0.81 -2.4% -4.4% 3.9% -40.5%Mongol Nekhmel 781 270.4 370.3 267.54 1.38 2.70 0.2% 0.5% 32.6% 0.7%Khaniin Material 530 252.7 346.1 4.61 0.60 1.56 5.1% 13.0% 40.1% 3.3%Darkhan Hotel 3,620 236.5 323.8 - 0.41 0.33 -4.0% -5.3% -19.3% -35.7%Gazar Suljmel 3,400 162.3 222.2 1.31 0.53 1.06 19.5% 40.3% 30.4% 12.5%Mongol Keramic 650 151.4 207.3 1.00 0.14 0.44 9.5% 13.7% 71.8% 25.7%Gan Khiits 780 138.1 189.1 - 0.22 5.49 -2.0% -9.8% 15.2% -3.5%Darkhan Khuns 450 124.1 170.0 3.55 0.40 0.68 6.7% 11.3% 22.7% 5.7%Dornod Auto Zam 2,244 122.8 168.1 13.92 0.93 0.59 4.2% 6.7% 2.2% 1.9%Tegsh 1,050 120.3 164.7 - 1.70 0.02 -4.7% -4.8% - -Source: MSE, <strong>Eurasia</strong> <strong>Capital</strong>International Listed Companies Performance (<strong>July</strong> 5-9, <strong>2010</strong>)Name Ticker CurrencyClosePriceMktCap Price PerformanceDaily Volume(52Wk)US$mn 52 wk high 52 wk low w-o-w y-t-d US$mnIVANHOE MINES LTD IVN US USD 14.00 6,832.56 18.94 7.09 5.50% -4.18% 27.74CENTERRA GOLD INC CG CN CAD 12.21 2,780.49 15.10 5.25 7.58% 13.06% 8.60MONGOLIA ENERGY CO LTD 276 HK HKD 2.85 2,237.62 5.79 2.54 5.56% -28.39% 9.91SOUTHGOBI RESOURCES LTD 1878 HK HKD 94.35 2,231.67 130.00 75.00 2.61% - 2.64EAST ASIA MINERALS CORP EAS CN CAD 5.95 416.58 8.73 0.66 3.48% 28.23% 2.46KIU HUNG ENERGY HOLDINGS LTD 381 HK HKD 0.45 278.62 0.59 0.20 3.45% 16.88% 3.85ENTREE GOLD INC ETG CN CAD 1.88 179.13 3.59 1.26 -0.53% -26.27% 0.34NORTH ASIA RESOURCES HOLDING 61 HK HKD 1.40 140.04 3.19 1.18 2.19% -41.42% 0.68PETRO MATAD LTD MATD LN GBp 59.00 136.61 61.00 13.00 38.82% 218.92% 0.03HUNNU COAL LTD HUN AU AUD 0.87 122.03 1.28 0.20 1.76% - 1.07PROPHECY RESOURCE CORP PCY CN CAD 0.53 54.89 0.99 0.33 9.28% 35.44% 0.13BESTWAY INTL HOLDINGS LTD 718 HK HKD 0.23 43.79 0.59 0.17 4.17% -43.75% 0.23SOLARTECH INTL HLDGS LTD 1166 HK HKD 0.04 25.69 0.32 0.03 -23.91% -77.42% 1.08ERDENE RESOURCE DEVELOPMENT ERD CN CAD 0.29 25.06 0.70 0.20 -1.69% 3.57% 0.09Source: Bloomberg, <strong>Eurasia</strong> <strong>Capital</strong>Enkhbayar Davaatserenenkhbayar.davaatseren@eurasiac.comSherzod Rakhimovsherzod.rakhimov@eurasiac.com12

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)Property PriceResidential property prices in Ulaanbaatar1300120011001000US$/sqm900800700600500400Jan-06May-06Sep-06Jan-07May-07Sep-07Jan-08May-08Sep-08Jan-09May-09Sep-09Jan-10May-10Source: <strong>Eurasia</strong> <strong>Capital</strong>M&A Deal SummaryTargetCompany (TC)BuyerBuyerCountryTCListingTC SectorTCReservesStake,%Deal TermsAnnounceDateSWFs dealsIron Mining China Investment Corp. CHN N/A Iron ore N/A N/A US$700mn 29.10.10Iron MiningSouthGobiResourcesSouthGobiResourcesRecent EBRD dealsEnergyResourcesTemasek Holdings/Hopu InvestmentManagementSG/CHNChina Investment Corp. CHN N/A Coal 122.3mntnChina Investment Corp.,Temasek HoldingsN/A Iron ore N/A N/A US$300mn 01.04.08CHN/SG N/A Coal 122.3mntnN/A US$500mn 26.10.10N/AUS$50mneach in HKIPOEBRD Int-l N/A Coal N/A N/A US$180mnloanAPU EBRD Int-l MSE Food &BeveragesPetro Matad EBRD Int-l AIM Oil & Gas 638mnbblsresourcesLeighton<strong>Mongolia</strong>Private Equity dealsNorth AsiaResourcesGroupN/A N/A US$25mnconvertibleloan17 US$6mnconvertibleEBRD Int-l N/A Mining N/A N/A US$35mnloanGreen Global Resources CHN HKSE Iron ore 148.9mntn iron,180,000 tncopper*29.01.1019.02.1022.01.1018.12.0910.11.09100 US$227mn 16.12.0913

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)First DeanHoldings LtdGobi Coal andEnergyOvoot CokingCoal ProjectTroy<strong>Mongolia</strong>n AltResourcesArgalant Gold-Copper ProjectPanAsianPetroleumWinswayCoking CoalErdenesThermal CoalProjectIkh ShijirErdene LLC/Sun ProgressTsant Uul CoalProjectPolo-PeabodyJVOther dealsKiu Hung EnergyHoldings LtdCHN HKSE Coal N/A 100 US$180mn 17.03.10Origo Partners Plc UK N/A Coal 320mn tn 21.3 US$15mn 27.11.09resourcesWindy Knob Resources AUS N/A Coal N/A 100 US$3.5mn 26.11.09+ SharesMeritus Minerals CAN N/A Gold N/A 100 US$0.5mn + 20.01.10SharesVoyager Resources AUS N/A Gold,CopperN/A 100 US$50,000+ Shares19.01.10Sunwing Energy Ltd CAN N/A Oil, gas N/A 100 All Shares 18.11.09Hopu Investment/ twoChinese firmsCHN N/A Coal N/A 20 US$110mn 02.04.10Hunnu Coal AUS ASX Coal 140-80 N/A 11.03.10180mn tnSolartech InternationalHoldingsCHN HKSE Gopper,gold, silver1.44mn tncopper, 4tn gold,196 tnsilverHunnu Coal AUS ASX Coal 50-100mntnWinsway Coking CoalHoldingsCHN N/A Uranium,CoalN/A US$192mn 04.05.1090 N/A 26.05.10N/A 50 US$25mn 26.05.10WesternProspectorCNNC CHN Delisted Uranium 20mn lbs(9,525 tn)Red Hill Energy Prophecy Resource Corp CAN TSX Coal 1.5bn tnresources69 US$18.5mn 15.04.09100 MergerAll SharesSMG Oil & Gas BKM Management AUS ASX Oil, gas N/A 100 All Shares,A$0.01/shareofferedSource: Bloomberg, <strong>Eurasia</strong> <strong>Capital</strong>21.01.1010.03.1014

<strong>Mongolia</strong> <strong>Weekly</strong> (<strong>July</strong> 5-9, <strong>2010</strong>)<strong>July</strong> 14, <strong>2010</strong> (Wednesday)ContactsAlisher Ali Djumanov Chairman alisher.djumanov@eurasiac.comOyunbold GomboExecutive Director,oyunbold.gombo@eurasiac.com<strong>Eurasia</strong> <strong>Capital</strong> <strong>Mongolia</strong>Investment BankingMarat Utegenov Director marat.utegenov@eurasiac.comBekzod Kasimov Associate Director bekzod.kasimov@eurasiac.comTurbat Munkhsuren Analyst turbat.munkhsuren@eurasiac.comKhangai Tserenraash Analyst khangai.tserenraash@eurasiac.comResearchSardor Koshnazarov Head of Research, Oil & Gas sardor.koshnazarov@eurasiac.comDosbergen Musaev Analyst, Strategy dosbergen.musaev@eurasiac.comUlugbek AzamovAnalyst, Infrastructure,ulugbek.azamov@eurasiac.comPropertyAkmal Aminov Analyst, Metals & Mining akmal.aminov@eurasiac.comBatbayar Bat-Erdene Analyst, Metals & Mining batbayar.bat-erdene@eurasiac.comRentsendorj Yondon Analyst, <strong>Mongolia</strong> Equities rentsendorj.yondon@eurasiac.comZultsetseg Chuluunbat Analyst, <strong>Mongolia</strong> zultsetseg.chunluunbat@eurasiac.comBahadir Uskenbaev Analyst, Kazakhstan bahadir.uskenbaev@eurasiac.comSales and TradingDima Orazimbetov Director dima.orazimbetov@eurasiac.comZhyldyz Sadyralieva Associate zhyldyz.sadyralieva@eurasiac.comSherzod Rakhimov Analyst sherzod.rakhimov@eurasiac.comBolor Ulziisaikhan Broker bolor.ulziisaikhan@eurasiac.comEnkhbayar Davaatseren Trader enkhbayar.davaatseren@eurasiac.comAddresses:HONG KONG33/F One International Finance Centre1 Harbour View Street, Central,Hong KongTel.:+852 2824 8716Fax: +852 2166 8999MONGOLIASuite 71, 7 th Floor, Grand Office CenterJamiyangun Street 12, 1 st Khoroo,UlaanbaatarTel: +976 7013 0078Fax: +976 7013 0078UZBEKISTAN11A, Almazar StreetTashkent 100003Tel: +998 71 1403538Fax: +998 71 1403533CHINA11 th Floor, North Tower, Beijing Kerry CentreNo.1 Guang Hua Road, Chao Yang District,Beijing 100020,Tel.: +86 (0) 10 6599 7912Fax: +86 (0) 10 6599 9100KAZAKHSTAN6/F, Forum Business Center202 Dostyk AvenueAlmaty, 050060Tel +7 727 295 4514RUSSIAMoscow Enbankment TowerBlock C, 18 Krasnopresnenskaya NaberezhnayaMoscow 123317Tel: +7 495 967 7676Fax: +7 495 967 7600©<strong>2010</strong> <strong>Eurasia</strong> <strong>Capital</strong> Ltd. All rights reserved.DISCLAIMERThis <strong>Mongolia</strong> <strong>Weekly</strong> is made for information purposes only, and does not constitute an offer, solicitation of an offer to purchase, hold, sell, invest or make any other financialdecision. In making decisions, investors may rely on their own examinations of the parties and risks involved. Information contained in this <strong>Weekly</strong> is obtained from the sourcesbelieved to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors such information provided 'as is" without warranty of any kind and<strong>Eurasia</strong> <strong>Capital</strong> Ltd., in particular, make no representation or warranty, express or implied, as to accuracy, timeliness, completeness, merchantability or fitness for any particularpurpose of any such information. Under no circumstances, <strong>Eurasia</strong> <strong>Capital</strong> Ltd. have any liability to any person or entity (-ies) for (a) any loss or damage in whole or in part caused by,resulting from, or relating to, any error (negligible or otherwise) or other circumstances or contingency within or outside the control of any of their directors, managements, officers,employees, or agents in connection with compilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special,consequential, compensatory or incidental damages whatsoever (including without limitation, loss profits) even if <strong>Eurasia</strong> <strong>Capital</strong> Ltd. is advised in advance of the possibility of suchdamages, resulting from the use of or inability to use, any such information.15