Mongolia Weekly: 4 April 2011 - Eurasia Capital

Mongolia Weekly: 4 April 2011 - Eurasia Capital

Mongolia Weekly: 4 April 2011 - Eurasia Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

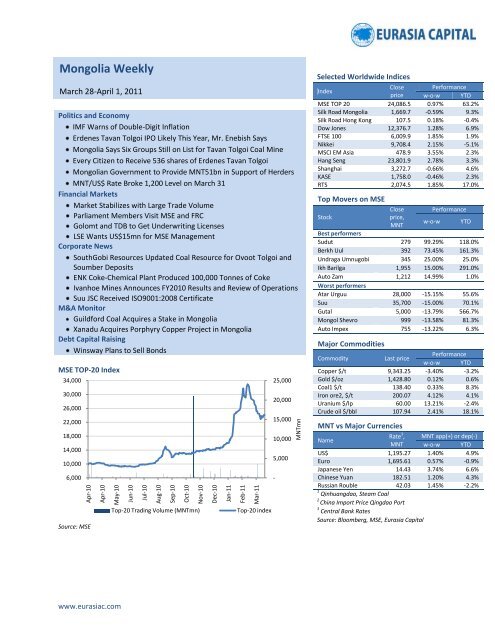

Apr-10Apr-10May-10Jun-10Jul-10Aug-10Sep-10Oct-10Nov-10Dec-10Jan-11Feb-11Mar-11MNTmn<strong>Mongolia</strong> <strong>Weekly</strong>March 28-<strong>April</strong> 1, <strong>2011</strong>Politics and EconomyIMF Warns of Double-Digit InflationErdenes Tavan Tolgoi IPO Likely This Year, Mr. Enebish Says<strong>Mongolia</strong> Says Six Groups Still on List for Tavan Tolgoi Coal MineEvery Citizen to Receive 536 shares of Erdenes Tavan Tolgoi<strong>Mongolia</strong>n Government to Provide MNT51bn in Support of HerdersMNT/US$ Rate Broke 1,200 Level on March 31Financial MarketsMarket Stabilizes with Large Trade VolumeParliament Members Visit MSE and FRCGolomt and TDB to Get Underwriting LicensesLSE Wants US$15mn for MSE ManagementCorporate NewsSouthGobi Resources Updated Coal Resource for Ovoot Tolgoi andSoumber DepositsENK Coke-Chemical Plant Produced 100,000 Tonnes of CokeIvanhoe Mines Announces FY2010 Results and Review of OperationsSuu JSC Received ISO9001:2008 CertificateM&A MonitorGuildford Coal Acquires a Stake in <strong>Mongolia</strong>Xanadu Acquires Porphyry Copper Project in <strong>Mongolia</strong>Debt <strong>Capital</strong> RaisingWinsway Plans to Sell BondsMSE TOP-20 Index34,00030,00026,00022,00018,00014,00010,0006,000Source: MSETop-20 Trading Volume (MNTmn)Top-20 index25,00020,00015,00010,0005,000-Selected Worldwide IndicesIndexClose Performanceprice w-o-w YTDMSE TOP 20 24,086.5 0.97% 63.2%Silk Road <strong>Mongolia</strong> 1,669.7 -0.59% 9.3%Silk Road Hong Kong 107.5 0.18% -0.4%Dow Jones 12,376.7 1.28% 6.9%FTSE 100 6,009.9 1.85% 1.9%Nikkei 9,708.4 2.15% -5.1%MSCI EM Asia 478.9 3.55% 2.3%Hang Seng 23,801.9 2.78% 3.3%Shanghai 3,272.7 -0.66% 4.6%KASE 1,758.0 -0.46% 2.3%RTS 2,074.5 1.85% 17.0%Top Movers on MSEClose PerformanceStockprice,MNTw-o-w YTDBest performersSudut 279 99.29% 118.0%Berkh Uul 392 73.45% 161.3%Undraga Umnugobi 345 25.00% 25.0%Ikh Barilga 1,955 15.00% 291.0%Auto Zam 1,212 14.99% 1.0%Worst performersAtar Urguu 28,000 -15.15% 55.6%Suu 35,700 -15.00% 70.1%Gutal 5,000 -13.79% 566.7%Mongol Shevro 999 -13.58% 81.3%Auto Impex 755 -13.22% 6.3%Major CommoditiesCommodityLast pricePerformancew-o-w YTDCopper $/t 9,343.25 -3.40% -3.2%Gold $/oz 1,428.80 0.12% 0.6%Coal1 $/t 138.40 0.33% 8.3%Iron ore2, $/t 200.07 4.12% 4.1%Uranium $/lp 60.00 13.21% -2.4%Crude oil $/bbl 107.94 2.41% 18.1%MNT vs Major CurrenciesNameRate 3 , MNT app(+) or dep(-)MNT w-o-w YTDUS$ 1,195.27 1.40% 4.9%Euro 1,695.61 0.57% -0.9%Japanese Yen 14.43 3.74% 6.6%Chinese Yuan 182.51 1.20% 4.3%Russian Rouble 42.03 1.45% -2.2%1 Qinhuangdao, Steam Coal2China Import Price Qingdao Port3 Central Bank RatesSource: Bloomberg, MSE, <strong>Eurasia</strong> <strong>Capital</strong>www.eurasiac.com

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)ECONOMIC EVENT CALENDARIndicator name Reported period Release date Actual result Previous resultCPI, m-o-m, % Mar <strong>2011</strong> Apr 11, <strong>2011</strong> - 0.5CPI, y-o-y, % Jan-Mar <strong>2011</strong> Apr 11, <strong>2011</strong> - 8.5Industrial output y-o-y, % Jan-Mar <strong>2011</strong> Apr 11, <strong>2011</strong> - 13.4Money Supply (M2), MNTbn Mar <strong>2011</strong> Apr 11, <strong>2011</strong> - 4,868.8Money Reserve (M1), MNTbn Mar <strong>2011</strong> Apr 11, <strong>2011</strong> - 1,031.4External trade turnover, US$mnExports, US$mnImports, US$mnBalance, US$mnBudget, MNTbnRevenue, MNTbnExpenditure, MNTbnBalance, MNTbnJan-Mar <strong>2011</strong> Apr 11, <strong>2011</strong> ----Jan-Mar <strong>2011</strong> Apr 11, <strong>2011</strong>Source: Bank of <strong>Mongolia</strong>, National Statistics Office of <strong>Mongolia</strong>---1,076.2499.0577.2-78.2554.8664.0-109.2COMPANY EVENTS CALENDARCompany Event Date1 Buhug Annual Shareholders' Meeting 4-Apr-112 UB BUK Annual Shareholders' Meeting 7-Apr-113 Ord Kharsh Annual Shareholders' Meeting 9-Apr-114 Munkh Undes Annual Shareholders' Meeting 11-Apr-115 Ulaanbaatar Carpet Annual Shareholders' Meeting 13-Apr-116 Dornod Auto Zam Annual Shareholders' Meeting 14-Apr-117 Gobi Financial Group Annual Shareholders' Meeting 17-Apr-118 Takhi Co Annual Shareholders' Meeting 18-Apr-119 Agrotechimpex Annual Shareholders' Meeting 18-Apr-1110 Machine Mechanism Annual Shareholders' Meeting 19-Apr-1111 Talkh Chikher Annual Shareholders' Meeting 20-Apr-1112 Juulchin Gobi Annual Shareholders' Meeting 20-Apr-1113 Mongol Savkhi Annual Shareholders' Meeting 20-Apr-1114 Mogoin Gol Annual Shareholders' Meeting 20-Apr-1115 Gan Khiits Annual Shareholders' Meeting 20-Apr-1116 Niislel Urguu Annual Shareholders' Meeting 20-Apr-1117 Mandalgobi Impex Annual Shareholders' Meeting 21-Apr-1118 Makhimpex Annual Shareholders' Meeting 22-Apr-1119 Mongol Nekhmel Annual Shareholders' Meeting 22-Apr-1120 APU Annual Shareholders' Meeting 22-Apr-1121 Hermes Center Annual Shareholders' Meeting 22-Apr-1122 HBOil Annual Shareholders' Meeting 22-Apr-1123 Gobi Annual Shareholders' Meeting 22-Apr-1124 Zoos Goyol Annual Shareholders' Meeting 22-Apr-1125 Moninjbar Annual Shareholders' Meeting 25-Apr-1126 Sharyn Gol Annual Shareholders' Meeting 29-Apr-1127 Suu Annual Shareholders' Meeting 30-Apr-1128 <strong>Mongolia</strong> Development Resources Annual Shareholders' Meeting 30-Apr-1129 Mongol Shevro Annual Shareholders' Meeting 7-May-11Source: Company data, MSEwww.eurasiac.com 2

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)INTERNATIONAL IPO CALENDARCompany name IPO size Stock Exchange Type YearIron Mining Int’l US$1bn HKEx Iron ore <strong>2011</strong>Gobi Coal and Energy - ASX/TSX Coal <strong>2011</strong>Source: Company dataPOLITICS AND ECONOMYIMF Warns of Double-Digit InflationInternational Monetary Fund (IMF) released Staff Report for the <strong>2011</strong> Article IV Consultation and Post-Program Monitoring on March 30. It noted that economy is growing robustly and mineral exports arebooming. The report stated that <strong>Mongolia</strong>n economy growth would remain strong and accelerate tomore than 10%, but inflation could reach 20% later this year and overheating is growing concern due tohighly expansionary <strong>2011</strong> budget. According to the IMF report, FDI reached US$1,574mn in 2010. Thereport projects 10.3% GDP growth this year, and 7.6% in 2012.The updated debt sustainability analysis (DSA) concludes that <strong>Mongolia</strong> continues to be classified as lowrisk of debt distress. <strong>Mongolia</strong> has a strong capacity to repay the Fund, as supported by the DSA, thefavorable medium-term growth prospects, and projections of a continued rise in international reserves.IMF findings in brief:Fiscal spending. The <strong>2011</strong> budget increased spending by nearly 7 percent of GDP more than theauthorities’ commitment under the Stand-By Arrangement. The budget represents a return to theboom-bust fiscal policies of the past, threatening macro-stability and fueling inflation. This combinationof policies will take an especially hard toll on the poor. Staff advised amending the budget tosubstantially reduce spending.Monetary policy. The central bank can only do so much to counteract the inflationary pressures arisingfrom fiscal policy. Nevertheless, staff advised it should actively use the tools at its disposal, starting withan increase in interest rates.Exchange rate policy. There was agreement that the flexible exchange rate regime is working well andshould be continued.Medium-term policies. With two large mining projects in the pipeline, a substantial increase in mineralexports is projected for the coming years. This mineral wealth, however, will only lead to lastingprosperity if accompanied by sound macro-economic management, including strictly adhering to theFiscal Responsibility Law, gearing monetary policy toward containing inflation, and safeguarding thebanking system.Erdenes Tavan Tolgoi IPO Likely This Year, Mr. Enebish SaysIn an interview to Reuters on the sidelines of the Mines and Money conference in Hong Kong, Mr. B.Enebish, CEO of Erdenes MGL said that initial public offering of Erdenes Tavan Tolgoi will take place atthe end of <strong>2011</strong> or the first quarter 2012. The <strong>Mongolia</strong>n government could announce the listing venuewww.eurasiac.com 3

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)for the IPO by as early as June, he said. “Consultation on the stock exchange will be done with the banksafter discussions with the Hong Kong stock exchange and the London stock exchange,” he said. Mr.Enebish declined to comment on the potential size of the IPO.Erdenes Tavan Tolgoi is an operator of Tavan Tolgoi coal mine with reported resources of 6.4bn tonnes.<strong>Mongolia</strong> short-listed six bidders, including ArcelorMittal SA, Vale SA, Xstrata Plc, Shenhua Group andMitsui & Co. Ltd consortium, Peabody Energy, and Russian Railways led Russian-Korean-Japaneseconsortium to develop Western Tsankhi tenement at Tavan Tolgoi.During the official visit to South Korea in March 23-26, <strong>Mongolia</strong>n Prime Minister S. Batbold answeringto journalists about the short-list of strategic investors to develop Western Tsankhi area, said that aninternational consortium consisting of South Korea, Japan and Russia may win a bid for a coal-minedevelopment project in <strong>Mongolia</strong>, the Seoul Economic Daily reported last week.The consortium consists of Russian Railways and SUEK from Russia, Japanese trading houses Sumitomo,Itochu, Marubeni and Sojitz, and KORES led group of Korean companies, including POSCO, Korea ElectricPower and others.<strong>Mongolia</strong> Says Six Groups Still on List for Tavan Tolgoi Coal MineRefuting rumours that a shortlist of six bidders for Tavan Tolgoi Western Tsankhi tenement was cut tothree, a <strong>Mongolia</strong>n official said that the country has not yet decided which of six foreign groups shoulddevelop Tavan Tolgoi, Bloomberg reported on March 31. Discussions are still taking place about thecontract for the central and western part of the site, Mr. Baterdene Ragchaa, a spokesman for ErdenesMGL LLC, the state-controlled owner of the deposit, said in a phone interview to Bloomberg.Bloomberg mentioned Australian Financial Review as initial source, saying the shortlist has beenreduced to three, including Peabody Energy Corp., a China Shenhua Energy Co.-Mitsui & Co. jointventure and a Russia-South Korea-Japan group.A decision on which companies will develop the deposit will be taken within four months, Erdenesexecutive director Mr. B. Enebish said on March 5. The Western and Central area of Tavan Tolgoi holdsmore than 1 billion metric tons of coal, 68% of which can be used for steelmaking and the rest as fuel inpower plants, Mr. Enebish said then.According to the interview of Director at State Property Committee (SPC) D. Sugar on <strong>Mongolia</strong>nNational Television on March 26, either single strategic investor or consortium out of consortiums couldbe selected to work on western part. Mr. Sugar also said that face value of Erdenes Tavan Tolgoi sharesto be distributed to population is not decided yet, but expected it to be in the range of MNT300-1,000.He added the shares distributed to population will have initial lock up period, meaning people will notbe able to sell, gift or transfer it otherwise.<strong>Mongolia</strong>n government hired Deutsche Bank and Goldman Sachs as the managers of Erdenes TavanTolgoi IPO on an international stock exchange, and BNP Paribas and Macquarie were appointed as cobook-runners.www.eurasiac.com 4

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)Every Citizen to Receive 536 shares of Erdenes Tavan TolgoiAccording to news.mn on March 31, Prime Minister S. Batbold and First Deputy Prime Minister N.Altankhuyag told media after a special meeting of the government that all citizens of <strong>Mongolia</strong> bornbefore March 31, <strong>2011</strong> will receive 536 ordinary shares of Erdenes Tavan Tolgoi. This is based on<strong>Mongolia</strong>’s population being 2,796,000. The Bond and Payment Center of the <strong>Mongolia</strong>n Stock Exchangewill note this in the Human Development Fund pass book of every citizen in Ulaanbaatar. The Labourand Welfare Service Office will be responsible for registration in settlements outside Ulaanbaatar.<strong>Mongolia</strong>n Government to Provide MNT51bn in Support of HerdersPrime Minister S. Batbold said at <strong>Mongolia</strong>n Livestock National Programme Conference that developingtraditional livestock into new level has more importance than mining sector, Zuunii Medee newspaperreported on March 30. The event was attended by 500 herders and government officials.Premier Batbold said that the government would provide more support to traditional livestock herding.Within the framework of <strong>Mongolia</strong>n Livestock Programme MNT5.3bn was spent in 2010 to supportherders. The Government budgeted MNT51bn for the programme in <strong>2011</strong>.Minister of Food, Agriculture and Light Industry T. Badamjunai said that livestock herding was asignificant part of the economy and one third of <strong>Mongolia</strong>’s population depends on nomadic herding,news.mn reported. The programme aims to improve livestock quality, livestock farming practices,reduce herders’ dependence on natural factors and make them more profitable. The programme alsoenvisages providing health insurance to over 70% of herders and social insurance to over 50% of them.The share of agriculture in <strong>Mongolia</strong>n GDP has been steadily declining in recent years. The sector was hitby severe winter and declined 16.8% y-o-y in 2010. Agriculture still accounts for 16% of the country’sGDP; however its share is expected to decline further with robust growth of other sectors.Temuulen Munkhbaatartemuulen.munkhbaatar@eurasiac.comwww.eurasiac.com 5

1-Oct15-Oct29-Oct12-Nov26-Nov10-Dec24-Dec7-Jan21-Jan4-Feb18-Feb4-Mar18-Mar1-Apr<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)MNT/US$ Rate Broke 1,200 Level on March 31On Thursday, Bank of <strong>Mongolia</strong>’s officialMNT/US$ exchange rate broke 1,200 levelafter MNT appreciated 1.17% w-o-w. OnFriday, MNT appreciated further 0.24%against US$ to 1,195.27 which is the highestfor MNT since December 3, 2008. Themovement is in line with our projection forMNT appreciation backed by strong capitalinflows and increasing export revenues.Although foreign trade balance is negative,FDI and other investments are increasing.According to monthly balance of paymentsreport from Bank of <strong>Mongolia</strong> (1M<strong>2011</strong>),trade balance lost US$166.1mn, but capitaland financial balance gained US$284.3mn leading to surplus of US$47.5mn. As of today, MNT hasappreciated 4.87% YTD. We project over 10% appreciation for MNT by the end of this year.In the inter-bank market, US$ buy and sell rates depreciated against MNT by 1.12% and 1.28%respectively. US$ was traded at a buy rate of MNT1,187.93 and at a sell rate of MNT1,197.14 on Friday.In the alternative market, US$ buy and sell rates also depreciated against MNT by 1.32% and 1.32%,respectively, and were traded at a buy rate of MNT1,195 and at a sell rate of MNT1,197 on Friday.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comUS$-MNT rate1,3401,3201,3001,2801,2601,2401,2201,2001,180Inter-Bank Buy RateBank of <strong>Mongolia</strong> RateSource: Bank of <strong>Mongolia</strong>, <strong>Eurasia</strong> <strong>Capital</strong>Alternative Market Buy Ratewww.eurasiac.com 6

1-Apr1-May1-Jun1-Jul1-Aug1-Sep1-Oct1-Nov1-Dec1-Jan1-Feb1-Mar1-AprMNTmn<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)FINANCIAL MARKETSMarket Stabilizes with Large Trade VolumeMSE Top 20 Index grew slightly 0.97%w-o-w to 24,086.48, stabilizing afterfour weeks of consecutive decline. MSEtotal volume reached MNT8.1bn(US$6.8mn), of which MNT4.4bn(US$3.7mn) was attributed to Top 20Index members.MSE TOP-20 Index34,00030,00026,00022,00018,00014,00010,000The week started with very low volume6,000-of MNT74.7mn on Monday and itincreased to MNT145.1mn andMNT253.0mn on the following twoTop-20 Trading Volume (MNTmn)Top-20 indexdays. On Thursday, the trade volumeSource: MSEsurged to MNT6.4bn (US$5.3mn) as twolarge blocks of shares were traded. 150,000 Sharyn Gol shares were traded at MNT23,000/share forMNT3.4bn (US$2.9mn) and 7,314,683 Berkh Uul shares were traded at MNT341/share for MNT2.5bn(US$2.1mn). Apart from these two, 273 Tavan Tolgoi shares were traded between MNT900,000-948,500/share for MNT259mn.On Friday, further 2,805,705 Berkh Uul block shares were traded at MNT392/share for MNT1.1bn(US$0.9mn). In two days, 53.1% of Berkh Uul’s total outstanding shares were traded. Berkh Uul (thinlytraded stock; not a member of Top 20 Index) is a mining company focused on fluorite, gold and coalmining. The company annually extracts 6,000 tonnes of fluorspar, 20kg of gold and 30,000 tonnes ofcoal, according to data from 2008.Last week, altogether shares of 52 companies were traded: 26 companies advanced, 19 companiesdeclined and 7 companies remained flat. Among major coal stocks, Baganuur advanced (+7.6%) toMNT24,000/share on trade volume of MNT139.7mn, Tavan Tolgoi (+5.5%) to MNT948,750 onMNT309.2mn, Shivee Ovoo (+6.8%) to MNT32,000 on MNT34.8mn, Sharyn Gol (-4.2%) to MNT22,700 onMNT3,542.2mn, Aduunchuluun (+13.3%) to MNT15,900 on MNT65.0mn, and Mogoin Gol (-0.5%) toMNT38,910 on MNT26.0mn.The most actively traded stocks were Berkh Uul (MNT3,594.1mn), Sharyn Gol (MNT3,542.2mn), TavanTolgoi (MNT309.2mn), Baganuur (MNT139.7mn) and BDSec (MNT91.3mn). The best performers of theweek were not actively traded company shares including Sudut (+99.3%), Berkh Uul (+73.5%), UndargaUmnugobi (+25.0%), Ikh Barilga (+15.0%) and Auto Zam (+15.0%). The worst performers included smalland mid-cap companies as Atar Urguu (-15.2%), Suu (-15.0%), Gutal (-13.8%), Mongol Shevro (-13.6%)and Auto Impex (-13.2%).25,00020,00015,00010,0005,000www.eurasiac.com 7

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)Parliament Members Visit MSE and FRCOn March 25, the Parliament Speaker Mr. D. Demberel and the members of Economic StandingCommittee of the Parliament visited <strong>Mongolia</strong>n Stock Exchange (MSE) and Financial RegulatoryCommission (FRC), news.mn reports. Mr. D. Sugar, Chairman of State Property Committee, Mr. B. Bold,Chairman of MSE, Mr. Kh. Altai, Acting CEO of MSE, Mr. Ts. Bayarsaikhan, Chairman of FRC, and Ms. T.Gandulam, CEO of Securities Clearing House Central Depository, received the Parliament representativesand updated them on the current status of the operations of MSE, FRC and other issues related to thestock market.Answering the questions regarding dual listing of companies with operations in <strong>Mongolia</strong>, Mr. Kh. Altaisaid “Several of these companies proposed to be dually-listed on MSE. However due to the undevelopedlegal environment, dual listing would pose risk for these companies.” In this regard Mr. D. Dembereladded “We will pay attention to the development of the stock market and to the improvement of thelegal environment. We expect from your side submission of well-written proposals and regulations tothe Parliament”. So far draft proposals on Securities Market Law, Company Law, Insurance Law and newInvestment Fund Law are being developed.Mr. Ts. Bayarsaikhan and other professionals of FRC added “Currently, banking sector represents 95% ofthe <strong>Mongolia</strong>n financial market and capital market is only 5%. We expect this proportion to become50%-50% by 5 years.” FRC representatives also informed that they proposed to have supervisory roleover the newly established Development Bank. Proposal will be formally submitted to the Governmentduring the next month. FRC is currently considering applications from more than 10 companies forbrokerage and dealing licenses, news.mn reports.Golomt and TDB to Get Underwriting LicensesOn March 28, news.mn reported that Golomt Bank and Trade and Development Bank (TDB) submittedapplication for a underwriting license. The request from one of the banks was sent back forresubmission due to incomplete application. According to the new Banking Law approved in January2010, commercial banks are allowed to provide underwriting services.LSE Wants US$15mn for MSE ManagementOn March 28, news.mn reported that LSE informed <strong>Mongolia</strong>n counterparts that their service charge forMSE management would equal to US$15mn. This charge includes the payment for Millennium IT systemto be installed at the MSE, and 2 year salary payment (contract term) for the management team fromLSE. State Property Committee of <strong>Mongolia</strong> and LSE signed strategic partnership agreement on thedevelopment of MSE on December 30, 2010, and Master Service Agreement is scheduled to be signedby <strong>April</strong> 20, <strong>2011</strong>. The latter agreement will include payment terms. However, <strong>Mongolia</strong>n side has notresolved financial source for related payments. One option is to amend the state budget to include thepayments. On this issue, Mr. Kh. Altai, Acting CEO of MSE commented: “If it will be necessary to amendthe budget, the Government has to submit its proposal to the Parliament. Then the final decision will bemade by the Parliament.”www.eurasiac.com 8

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)On March 30, the Government official website www.open-government.mn reported that during itsregular meeting held on Wednesday, MSE proposed to borrow required funds for LSE management feefrom local banks. According to the plan, loans would be paid back later from the state budget. LSE feeunder the Master Service Agreement is US$14.2mn. The Government is eager to sign the agreementbefore <strong>April</strong> 20.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comCORPORATE NEWSMININGSouthGobi Resources Updated Coal Resource for Ovoot Tolgoi and Soumber DepositsOn March 30, SouthGobi Resources announced new NI 43-101 compliant resources and reservesestimate for its Ovoot Tolgoi mine prepared by independent consultant Minarco-MineConsult (MMC). Inaddition, resources estimate was also updated for Soumber deposit. According to the Company,Measured & Indicated coal resources for Ovoot Tolgoi increased approximately by 7% to 266.2mntonnes while Inferred resource increased significantly approximately by 190%.Resource Estimate at Ovoot Tolgoi Mine (as of December 31, <strong>2011</strong>)AreaTypeResource LimitsResources (mn tonnes)ASTM GroupDepth (metres)Measured Indicated InferredSunrise Field Surface Surface to 300m hvB to hvA* 54.5 19.9 11.0Sunset Field Surface Surface to 300m hvB to hvA 81.8 15.9 1.9Sub-Total 136.3 35.8 12.9Sunrise Field Underground 300m to 600m hvB to hvA 5.4 21.2 70.8Sunset Field Underground 300m to 600m hvB to hvA 46.6 20.9 13.4Sub-Total 52.0 42.1 84.2Total 188.3 77.9 97.1Source: Company dataAccording to the Company, the Soumber deposit area is estimated to contain Measured & Indicated coalresources of 61.4mn tonnes which represent approximately 187% increase from previous resourceestimates. Moreover, the Company reported that Inferred coal resources also increased approximatelyby 19% to 65.8mn tonnes. The share price was up 2.4% to HK$113.4 on HKEx today.Akmal Aminovakmal.aminov@eurasiac.comENK Coke-Chemical Plant Produced 100,000 Tonnes of CokeOn March 29, news.mn reported that <strong>Mongolia</strong>’s first coke-chemical plant ENK started producingmetallurgical coke from coking coal of the Tavan Tolgoi deposit. The plant has a capacity to produce300,000 tonnes of coke and 1.2mn tonnes of washed coal per year. However, as of now, the plant isusing only about 25% of its installed capacity due to the lack of domestic professionals. So far, the plantwww.eurasiac.com 9

US$Jan-10Feb-10Mar-10Apr-10May-10Jun-10Jul-10Aug-10Sep-10Oct-10Nov-10Dec-10Jan-11Feb-11Mar-11<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)produced about 100,000 tonnes of coke, of which 5% was sold to domestic steel producers and 95% wasexported to China.According to the Company’s website www.enk.mn, a study to establish a coke-chemical plant started in2005 and the Company was established with an investment from China in May 2006. In August 2007,Tavan Tolgoi Trans LLC, which transports coal from Tavan Tolgoi JSC’s mine to Chinese border, joinedinvesting to the project and the construction work started in Bayan-Ovoo soum (county) of South Gobiaimag (province). The Company completed the construction of the coal washing plant with a capacity of1.2mn tonnes in November 2008, and the 300,000 tonnes coke plant in December 2008. Apart fromcoke, the main product, the Company produces by-products as coke tar and firedamp.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comIvanhoe Mines Announces FY2010 Results and Review of OperationsOn March 28, Ivanhoe Mines announced financial results and review of operations for financial yearended 31 December, 2010. The company reported net loss of US$211.5mn (US$0.42 per share) in 2010as compared to net loss of US$280.2mn (US$0.69 per share) in 2009. The exploration expensesincreased 23% from US$177.1mn in 2009 to US$218.6mn in 2010, and include exploration expendituresof US$134.5mn for Oyu Tolgoi and Ovoot Tolgoi projects in <strong>Mongolia</strong>. Until 31 March, 2010, Ivanhoeincluded the exploration costs in development costs associated with Oyu Tolgoi project. As of 1 <strong>April</strong>,2010, reserve estimates for Oyu Tolgoi were announced and the company started capitalizing theassociated development costs. During the financial year, a total of US$911mn costs were capitalized asproperty, plant and equipment. Total assets more than doubled to US$3,218mn by the year end.Highlights of Ivanhoe’s <strong>Mongolia</strong> focused operations:Construction at Oyu Tolgoi, a copper-goldproject in southern <strong>Mongolia</strong>, is movingforward ahead of schedule and isscheduled to start commercial productionduring the first half of 2013.On-site activities are expected to peak inmid-<strong>2011</strong> with over 14,000 employeesduring the peak period. Oyu Tolgoisponsors 3,700 <strong>Mongolia</strong>n employees forskill training.The company approved an estimatedUS$2.3bn capital budget for <strong>2011</strong>.Share Performance3028262422201816141210Ivanhoe Mines and Rio Tinto reached acomprehensive agreement on funding forconstruction of the first phase of Oyu Source: BloombergTolgoi mining complex.The joint venture between Ivanhoe and BHP Billiton discovered the Ulaan Khud North coppermolybdenum-goldmineralization zone approximately 10 km north of Oyu Tolgoi.www.eurasiac.com 10

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)Ivanhoe’s 57%-owned subsidiary, SouthGobi Resources, produced and realized at US$35, 2.5mntonnes of coal at the Ovoot Tolgoi mine in southern <strong>Mongolia</strong>.Hoosniddin Hakimovhoosniddin.hakimov@eurasiac.comFOOD & BEVERAGESuu JSC Receives ISO9001:2008 CertificateOn <strong>April</strong> 1, Udriin Sonin newspaper announced that Suu JSC (SUU: MSE), a manufacturer of milkproducts in <strong>Mongolia</strong>, received ISO9001:2008 certificate. SAI Global of South Korea audited theoperation of Suu JSC according to ISO9001:2008 quality management system and certified the Company.Ms. I. Tsatsral, Vice President responsible for quality management of Suu JSC, said “we are the firstcompany who got this certificate in our sector in <strong>Mongolia</strong>. The certificate is valid for three years… Weprepared for 2-3 years to get certified… We will strive to improve our operations more…”Suu is the leading milk and dairy products producer in <strong>Mongolia</strong>. The Company was established in 1958and was privatized in 1992. The Company employs over 200 workers and signed supply contracts withover 2500 farmers and herders in 20 locations around the capital. The Company’s factory consists of 3production divisions, which produce 60 types of milk and dairy products, including ice-creams andyoghurts.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comM&A MONITORMININGGuildford Coal Acquires a Stake in <strong>Mongolia</strong>Guildford Coal Ltd (ASX: GUF) announced on March 31 that it has entered into a binding agreement toacquire a 20% stake in Terra Energy LLC, a <strong>Mongolia</strong>n company with coal exploration licenses in SouthGobi and Middle Gobi coal basins. Guildford, subject to certain achievements and resource outcomes,has the option to increase its stake up to 70% within 6 months from the start of the drilling programplanned to commence in <strong>April</strong> this year with three drilling rigs currently available. Under the dealbetween the companies, an upfront payment for the 20% stake is AUS$7mn, and total consideration for70% of Terra Energy is AUS$17mn. Guildford revealed that acquisition value for 150Mt JORC indicatedresource across the projects is just over US$0.16 and if exploration targets are verified, it could be lessthan US$0.05 per tonne. The agreement also gives Guildford the immediate right to have three directorson the Terra Energy Board with the remaining director coming from the <strong>Mongolia</strong>n founders.www.eurasiac.com 11

AUS$Jul-10Aug-10Sep-10Oct-10Nov-10Dec-10Jan-11Feb-11Mar-11<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)Guildford has a portfolio of exploration areas inQueensland, Australia, and wants to gainexposure to the opportunities in <strong>Mongolia</strong>through South Gobi (4 license areas) and MiddleGobi (2 license areas) projects with a total of sixlicense areas. The company is aiming atproduction with a mining license to be obtainedon South Gobi project by the end of <strong>2011</strong>.Guildford’s Non Executive Chairman, CraigRansley stated, “the <strong>Mongolia</strong>n projects havepotential large scale thermal and coking coalprospects and represent an opportunity forGuildford to become a coal producer within 12months as the South Gobi project is located closeShare PerformanceSource: Bloombergto the Chinese border station of Ceke where coal from <strong>Mongolia</strong> is already trucked into China.”Following the news, Guildford shares soared to AUS$0.945 a share, 25.2% up from March 30 close price.10.90.80.70.60.50.40.30.20.1Xanadu Acquires Porphyry Copper Project in <strong>Mongolia</strong>Xanadu Mines Ltd (ASX: XAM) announced on March 30 that through its subsidiary, Xanadu Metals<strong>Mongolia</strong> LLC, it has acquired 100% ownership of the Mogoin Gol porphyry copper project in northern<strong>Mongolia</strong>. The project is located approximately 200 km northwest of Ulaanbaatar in Bulgan Province,and approximately 40 km northwest of Erdenet porphyry copper-molybdenum deposit, the largestoperating copper mine in <strong>Mongolia</strong> with a link to the Trans <strong>Mongolia</strong> railway.The relatively unexplored Mogoin Gol license area covers 488 sq km with limited, relatively shallowhistorical drilling. High levels of anomalies of Cu, Mo, Au, Ag, and Ba were identified within a larger 7 sqkm are during the previous exploration between 1999 and 2004, and the drilling failed to penetrate theexposed alterations.The company reported that it continues aggressively the dual exploration efforts in copper and coal.Geological mapping is in progress throughout the Mogoin Gol license area, and according to Xanadu,there is a strong possibility of additional mineralized porphyry copper target discovery within the area.Xanadu plans to commence induced polarization, ground magnetic and gravity surveys shortly, and anaggressive drilling program during the late <strong>2011</strong> field season.Xanadu’s Chairman, Brian Thornton said, “Following extensive due diligence, it is Xanadu’s view that theMogoin Gol project is one of the best untested porphyry copper targets in <strong>Mongolia</strong>, having beensubjected to minimal drill test almost a decade ago. Xanadu has continued to evaluate copper goldtargets throughout the country, but Mogoin Gol stands out as an outstanding opportunity against allcriteria, particularly its prospectivity and location to rail and established infrastructure.”Hoosniddin Hakimovhoosniddin.hakimov@eurasiac.comwww.eurasiac.com 12

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)DEBT CAPITAL RAISINGWinsway Plans to Sell BondsOn March 24, Winsway Coking Coal Holdings Ltd (HK: 1733) announced that it is planning to conduct aninternational offering of US$ denominated fixed-rate senior notes with a maturity of five years.According to the Company, the terms of bonds, including their price and coupon, have yet to bedetermined. Deutsche Bank AG (Singapore Branch), Merrill Lynch International, Goldman Sachs (Asia)and ICBC International <strong>Capital</strong> were assigned to manage the proposed bonds issue. According toBloomberg, Winsway started meeting investors in Asia, Europe and the US from March 28, <strong>2011</strong>. Thenet proceeds after deducting expenses and fees related with underwriting are planned to be used asfollows:1. approximately 60% of the net proceeds to finance investments in rolling stock, othertransportation-related vehicles and railway-related infrastructure for the purpose of increasingthe Group’s transportation capacity;2. approximately 25% of the net proceeds to finance investments in upstream resources throughnew acquisitions and/or joint venture projects and to otherwise secure upstream supplies; and3. approximately 15% of the net proceeds for working capital and other general corporatepurposes.Akmal Aminovakmal.aminov@eurasiac.comwww.eurasiac.com 13

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)ECONOMIC PERFORMANCEIndicator 2003 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong>fPopulation and incomePopulation, mn 2.50 2.53 2.56 2.59 2.63 2.68 2.74 2.65* 2.66GDP per capita, US$ 582 720 905 1224 1503 1940 1560 2490 3270National accountsNominal GDP, MNTbn 1660 2152 2780 3715 4599.5 6555 6591 8255 9900Nominal GDP, US$bn 1.4 1.8 2.3 3.2 3.9 5.1 4.6 6.6 8.8Real GDP growth, y-o-y, % 7.0 10.6 7.2 8.6 10.2 8.9 -1.3 6.1 10Monetary indicators and inflationM2 growth, y-o-y, % 49.6 20.4 34.6 34.8 56.3 -5.5 26.9 62.5 50.0CPI, y-o-y, % 4.7 11 9.2 4.8 14.1 22.1 4.2 13.0 25.0Exchange rate, MNT/US$, end-year 1168 1209 1221 1165 1170 1267 1443 1257 1130International reserves, US$mn - 208 333 718 1001 657 822 2000 2300Government financeRevenue, % of GDP - 33.1 30.1 36.6 40.9 35.4 32.9 37.3 42.2Expenditure, % of GDP - 35.0 27.5 28.5 38.0 40.2 38.3 37.3 52.1Budget balance, % of GDP -4.2 -2.1 3.2 3.9 2.2 -5.0 -5.4 0 -9.9Balance of paymentsExports, US$mn 615.9 872 1069 1545 1952 2539 1885 2899 3769Imports, US$mn 801 1021 1224 1516 2170 3616 2138 3278 4425Exports, y-o-y, % 17.5 41.2 22.4 44.9 22.5 30.3 -24.9 53.8 30.0Imports, y-o-y, % 16.0 27.5 16.0 25.4 36.1 66.6 -34.3 53.3 35.0Trade balance, US$mn -185.1 -149 -155 30 -218 -1077 -229 -379 -656FDI, US$mn 131.5 92.9 182.3 367 500 709 801 1400 2000Source: National Statistics Office of <strong>Mongolia</strong>, the Bank of <strong>Mongolia</strong>, the IMF, the World Bank, <strong>Eurasia</strong> <strong>Capital</strong>. *According to November 2010Population and Housing Censuswww.eurasiac.com 14

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)MSE AND MONGOLIA FOCUSED INTERNATIONAL MINING COMPANYSTOCKS PERFORMANCE SUMMARYMSE TOP-20 Performance (March 28-<strong>April</strong> 1, <strong>2011</strong>)Daily TurnoverPrice Performance Market CapCode Name(52Wk Avg)Close 52 Wk high 52 Wk low w-o-w y-t-d MNTmn US$mn MNT US$396 Baganuur 24,000 41,780 2,800 7.62% 128.6% 503,385 421.1 91,715,582 76,732458 Tavan Tolgoi 948,750 1,439,000 190,000 5.53% 64.7% 499,661 418.0 16,364,799 13,691460 Shivee Ovoo 32,000 62,300 4,260 6.67% 146.2% 429,411 359.3 15,420,837 12,90290 APU 3,200 3,750 1,550 -5.88% 60.8% 237,721 198.9 15,107,730 12,640309 Sharyn Gol 22,700 35,099 3,002 -4.22% 116.2% 193,494 161.9 82,359,954 68,905209 <strong>Mongolia</strong>n Telecom 3,300 4,501 2,900 3.13% -5.7% 85,372 71.4 1,449,782 1,213461 Aduunchuluun 15,900 31,405 450 13.33% 98.8% 50,106 41.9 4,154,004 3,475522 BDSec 4,000 5,900 2,200 5.26% 60.0% 44,000 36.8 10,318,158 8,632354 Gobi 5,500 7,700 5,200 0.00% -1.8% 42,906 35.9 14,297,074 11,961444 Mogoin Gol 38,910 66,463 2,357 -0.49% 229.7% 32,281 27.0 3,644,763 3,049524<strong>Mongolia</strong> DevelopmentResources1,700 2,300 990 0.00% 30.8% 23,375 19.6 14,080,666 11,780532 Khukh Gan 199 217 146 13.71% 6.4% 20,162 16.9 10,655,787 8,915484 State Department Store 520 900 400 4.00% 20.9% 19,140 16.0 2,132,056 1,78413 Bayangol Hotel 29,000 36,450 22,000 5.45% 21.3% 12,269 10.3 1,569,850 1,3133 UB Hotel 35,000 55,000 25,000 -12.50% 27.3% 11,735 9.8 6,058,642 5,069191 Eermel 3,101 6,468 1,151 -3.09% 7.9% 10,789 9.0 360,096 301530 Remicon 134 147 39 0.00% 86.1% 10,543 8.8 2,308,403 1,931521 Genco Tour Bureau 95 118 88 0.00% 1.1% 10,450 8.7 1,720,425 1,439208 Makh Impex 2,162 4,866 1,200 0.42% 20.1% 8,217 6.9 1,223,525 1,02471 Darkhan Nekhii 5,000 10,780 2,100 2.29% 2.0% 5,527 4.6 867,976 726Source: MSE, Bank of <strong>Mongolia</strong>, <strong>Eurasia</strong> <strong>Capital</strong>Selected Non-MSE TOP-20 Member Leading Market Cap Companies (March 28-<strong>April</strong> 1, <strong>2011</strong>)Daily Turnover 1WkPrice Market Cap PerformanceCode Name(52Wk Avg) turnoverMNT US$ MNTmn US$mn w-o-w y-t-d MNT US$ (MNT)22 Talkh Chikher 12,200 10.21 12,489.2 10.4 -2.4% 229.7% 546,746 457 929,385135 Suu 35,700 29.87 12,280.8 10.3 -15.0% 70.1% 110,680 93 3,320,100517 Hotel <strong>Mongolia</strong> 615 0.51 6,150.0 5.1 -3.9% 9.8% 47,795 40 1,860528 Hermes 54 0.05 4,241.3 3.5 1.9% 0.0% 1,816,630 1,520 4,236,665531 Nako Tulsh 300 0.25 3,784.7 3.2 0.0% -7.7% 4,311,599 3,607 24,645,000Source: MSE, Bank of <strong>Mongolia</strong>, <strong>Eurasia</strong> <strong>Capital</strong>www.eurasiac.com 15

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)Performance of MSE Stocks Traded (March 28-<strong>April</strong> 1, <strong>2011</strong>)Daily TurnoverPrice Performance Market CapCode Name(52Wk Avg)Close 52 Wk high 52 Wk low w-o-w y-t-d MNTmn US$mn MNT US$396 Baganuur 24,000 41,780 2,800 7.62% 128.6% 503,385 421.1 91,715,582 76,732458 Tavan Tolgoi 948,750 1,439,000 190,000 5.53% 64.7% 499,661 418.0 16,364,799 13,691460 Shivee Ovoo 32,000 62,300 4,260 6.67% 146.2% 429,411 359.3 15,420,837 12,90290 APU 3,200 3,750 1,550 -5.88% 60.8% 237,721 198.9 15,107,730 12,640309 Sharyn Gol 22,700 35,099 3,002 -4.22% 116.2% 193,494 161.9 82,359,954 68,905209 <strong>Mongolia</strong>n Telecom 3,300 4,501 2,900 3.13% -5.7% 85,372 71.4 1,449,782 1,213461 Aduunchuluun 15,900 31,405 450 13.33% 98.8% 50,106 41.9 4,154,004 3,475522 BDSec 4,000 5,900 2,200 5.26% 60.0% 44,000 36.8 10,318,158 8,632354 Gobi 5,500 7,700 5,200 0.00% -1.8% 42,906 35.9 14,297,074 11,961444 Mogoin Gol 38,910 66,463 2,357 -0.49% 229.7% 32,281 27.0 3,644,763 3,049524<strong>Mongolia</strong> DevelopmentResources1,700 2,300 990 0.00% 30.8% 23,375 19.6 14,080,666 11,780532 Khukh Gan 199 217 146 13.71% 6.4% 20,162 16.9 10,655,787 8,915484 State Department Store 520 900 400 4.00% 20.9% 19,140 16.0 2,132,056 1,78422 Talkh Chikher 12,200 20,816 2,700 -2.36% 229.7% 12,489 10.4 546,746 457135 Suu 35,700 70,000 2,800 -15.00% 70.1% 12,281 10.3 110,680 9313 Bayangol Hotel 29,000 36,450 22,000 5.45% 21.3% 12,269 10.3 1,569,850 1,3133 UB Hotel 35,000 55,000 25,000 -12.50% 27.3% 11,735 9.8 6,058,642 5,069445 Bayanteeg 43,800 70,000 517 -2.67% 525.6% 11,064 9.3 150,138 126191 Eermel 3,101 6,468 1,151 -3.09% 7.9% 10,789 9.0 360,096 301530 Remicon 134 147 39 0.00% 86.1% 10,543 8.8 2,308,403 1,931521 Genco Tour Bureau 95 118 88 0.00% 1.1% 10,450 8.7 1,720,425 1,439208 Makh Impex 2,162 4,866 1,200 0.42% 20.1% 8,217 6.9 1,223,525 1,02488 Gutal 5,000 8,467 700 -13.79% 566.7% 8,093 6.8 34,704 29492 Berkh Uul 392 392 150 73.45% 161.3% 7,472 6.3 14,784,096 12,369517 Hotel <strong>Mongolia</strong> 615 750 350 -3.91% 9.8% 6,150 5.1 47,795 4071 Darkhan Nekhii 5,000 10,780 2,100 2.29% 2.0% 5,527 4.6 867,976 72617 Atar Urguu 28,000 36,683 16,000 -15.15% 55.6% 4,876 4.1 85,072 71528 Hermes 54 75 37 1.89% 0.0% 4,241 3.5 1,816,630 1,520531 Nako Tulsh 300 352 229 0.00% -7.7% 3,785 3.2 4,311,599 3,607379 Material Impex 2,700 3,670 2,338 -11.76% 8.0% 3,694 3.1 54,172 45450 Zoos Goyol 870 1,390 625 -3.33% 10.1% 3,267 2.7 182,999 1532 Mongol Savkhi 1,250 3,839 450 5.04% 127.3% 3,094 2.6 217,971 18225 Moninjbar 120 170 100 0.84% 4.3% 1,904 1.6 175,434 147452 Auto Impex 755 870 600 -13.22% 6.3% 1,747 1.5 21,112 1897 Sor 1,850 2,000 556 -2.63% 146.7% 1,649 1.4 220,531 185527 Olloo 131 178 58 -2.96% -12.7% 1,271 1.1 725,184 60767 Nekheesgui Edlel 900 1,000 330 -10.00% 80.0% 1,160 1.0 4,252 4264 Bishrelt Industrial 1,550 2,200 700 0.00% -22.5% 1,086 0.9 679,221 568236 Mongol Shevro 999 1,367 450 -13.58% 81.3% 919 0.8 9,342 8459 Ikh Barilga 1,955 1,955 440 15.00% 291.0% 776 0.6 3,607 3263 Guril Tejeel Bulga 1,240 1,240 451 14.81% 103.3% 708 0.6 6,897 640 Mongol Ceramic 1,406 1,450 570 -3.03% 146.7% 448 0.4 6,852 6369 Auto Zam 1,212 1,322 1,054 14.99% 1.0% 169 0.1 299,791 25124 Baiguulamj 2,586 2,586 1,701 14.98% 15.0% 132 0.1 2,817 2378 Khasu Mandal 225 225 170 2.27% 15.4% 70 0.1 803 1384 Sudug 279 279 112 99.29% 118.0% 49 0.0 79,050 66314 Undraga Umnugobi 345 345 240 25.00% 25.0% 33 0.0 13 0407 Tsagaan Tolgoi 190 190 140 0.00% 22.6% 21 0.0 47 0377 Erdenet Suvraga 172 172 150 14.67% 14.7% 17 0.0 3 0188 Teever Achlal 155 155 130 14.81% 14.8% 9 0.0 235 056 Khusug Tred 29 29 26 11.54% 11.5% 9 0.0 0 026 Machine Mechanism 20 20 16 11.11% 11.1% 1 0.0 4 0Source: MSE, Bank of <strong>Mongolia</strong>, <strong>Eurasia</strong> <strong>Capital</strong>www.eurasiac.com 16

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)Silk Road <strong>Mongolia</strong> Index* Companies Performance (March 28-<strong>April</strong> 1, <strong>2011</strong>)ClosePriceMktCap Price PerformanceDaily Volume(52Wk)Name Ticker CurrencyUS$mn 52 wk high 52 wk low w-o-w y-t-d US$mnIVANHOE MINES LTD IVN:US USD 27.39 17,902.9 29.29 11.45 -0.04% 19.5% 44.36MONGOLIAN MINING CORP 975:HK HKD 9.97 4,748.7 11.50 7.02 -0.50% 9.9% 8.97CENTERRA GOLD INC CG:CN CAD 16.85 4,123.7 23.60 9.76 -1.81% -15.1% 12.01SOUTHGOBI RESOURCES LTD 1878:HK HKD 114.40 2,701.3 130.90 74.00 4.47% 15.0% 1.31WINSWAY COKING COAL HOLDINGS 1733:HK HKD 4.32 2,103.8 4.91 3.35 0.47% -7.5% 17.16MONGOLIA ENERGY CORP LTD 276:HK HKD 1.55 1,316.4 4.20 1.40 -4.91% -33.2% 4.24ASPIRE MINING LTD AKM:AU AUD 0.97 536.9 1.06 0.07 9.66% 101.0% 0.72PETRO MATAD LTD MATD:LN GBp 180.00 531.5 199.00 37.50 3.75% 47.5% 0.56EAST ASIA MINERALS CORP EAS:CN CAD 5.83 469.0 8.73 4.80 -2.83% -28.9% 2.04BAGANUUR JSC BAN:MO MNT 24,000 421.1 42,000 2,800 7.62% 128.6% 0.08TAVAN TOLGOI JSC TTL:MO MNT 948,750 418.0 1,440,000 189,999 5.53% 64.7% 0.01HUNNU COAL LTD HUN:AU AUD 1.65 414.6 1.65 0.49 11.11% 23.6% 1.16SHIVEE OVOO JSC SHV:MO MNT 32,000 359.3 62,355 4,260 6.67% 146.2% 0.01ENTREE GOLD INC ETG:CN CAD 2.96 351.7 3.47 1.84 -2.31% -14.7% 0.39ORIGO PARTNERS PLC OPP:LN GBp 43.00 209.4 48.75 21.50 0.00% 4.9% 0.13APU JSC APU:MO MNT 3,200 198.9 3,795 1,540 -5.88% 60.8% 0.01PROPHECY RESOURCE CORP PCY:CN CAD 0.99 194.8 1.28 0.42 4.21% -1.0% 0.72SHARYN GOL JSC SHG:MO MNT 22,700 161.9 36,553 3,001 -4.22% 116.2% 0.07ERDENE RESOURCE DEVELOPMENT CORP ERD:CN CAD 1.54 144.0 1.84 0.26 20.31% 23.4% 0.07SOLARTECH INTERNATIONAL HOLD 1166:HK HKD 0.04 123.2 0.18 0.02 0.00% -20.8% 4.07NORTH ASIA RESOURCES HOLDING 61:HK HKD 1.08 118.2 1.89 0.87 -10.00% 18.7% 1.04XANADU MINES LTD XAM:AU AUD 0.63 110.4 0.80 0.45 5.93% 10.6% 0.08CENTRAL ASIA METALS PLC CAML:LN GBp 76.50 106.2 104.50 73.25 -10.53% -15.2% 0.04HARANGA RESOURCES LTD HAR:AU AUD 0.46 89.2 0.74 0.20 -6.12% -28.1% 0.06MONGOLIA INVESTMENT GROUP LT 402:HK HKD 0.08 73.3 0.74 0.06 5.26% -45.9% 1.44MONGOLIAN TELECOM JSC MCH:MO MNT 3,300 71.4 4,501 2,899 3.13% -5.7% 0.00VOYAGER RESOURCES LTD VOR:AU AUD 0.07 54.3 0.14 0.01 -2.86% 25.9% 0.14ASIA COAL LTD 835:HK HKD 0.24 51.5 0.38 0.18 -2.04% -4.0% 0.07GOBI JSC GOV:MO MNT 5,500 35.9 8,000 5,200 0.00% -1.8% 0.01BESTWAY INTL HOLDINGS LTD 718:HK HKD 0.10 35.3 0.36 0.08 6.19% -27.0% 0.12Source: Bloomberg, <strong>Eurasia</strong> <strong>Capital</strong>*Note: MonBiz <strong>Mongolia</strong> Index and MonBiz Hong Kong Index were acquired by Silk Road Management and rebranded to Silk Road <strong>Mongolia</strong>and Silk Road Hong Kong indices, respectively, on January 11, <strong>2011</strong>.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comSherzod Rakhimovsherzod.rakhimov@eurasiac.comwww.eurasiac.com 17

US$/sqmJan-09Feb-09Mar-09Apr-09May-09Jun-09Jul-09Aug-09Sep-09Oct-09Nov-09Dec-09Jan-10Feb-10Mar-10Apr-10May-10Jun-10Jul-10Aug-10Sep-10Oct-10Nov-10Dec-10<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)PROPERTY PRICEResidential Property Prices in Ulaanbaatar880860840820800780760740720700Source: <strong>Eurasia</strong> <strong>Capital</strong>Target Company (TC)SWFs DealsM&A DEAL SUMMARYBuyerBuyerCountryTC Listing TC Sector TC Reserves Stake, % Deal TermsAnnounceDateIron Mining China Investment Corp. CHN N/A Iron ore N/A N/A US$700mn 29.10.09Iron MiningTemasek Holdings/ Hopu SG/ CHN N/A Iron ore N/A N/A US$300mn 01.04.08Investment ManagementSouthGobi Resources China Investment Corp. CHN N/A Coal 122.3mn tn N/A US$500mn 26.10.09SouthGobi Resources China Investment Corp.,Temasek HoldingsCHN/SG N/A Coal 122.3mn tn N/A US$50mn each inHK IPO29.01.10Recent EBRD DealsEnergy Resources EBRD Int-l N/A Coal N/A N/A US$180mn loan 19.02.10APU EBRD Int-l MSE Food & N/A N/A US$25mn22.01.10Beveragesconvertible loanPetro Matad EBRD Int-l AIM Oil & Gas 638mn bbls17 US$6mn18.12.09resourcesconvertibleLeighton <strong>Mongolia</strong> EBRD Int-l N/A Mining N/A N/A US$35mn loan 10.11.09Private Equity DealsWell Delight HoldingsLtd/ TugrugnuuriinEnergy LLCNorth Asia ResourcesGroupIkh Shijir Erdene LLC/Sun ProgressTwo Tungsten minesWinsway Coking CoalMillennium Hong KongGroup Ltd/ConcessionMing Hing WaterworksHoldings LtdHK HKSE Coal, Copper,goldGreen Global Resources CHN HKSE Iron ore 148.9mn tniron, 180,000tn copper*Solartech InternationalHoldingsCHN HKSE Gopper, gold,silverN/A 100 US$245mn 30.05.101.44mn tncopper, 4 tngold, 196 tnsilver100 US$227mn 16.12.09N/A US$192mn 04.05.10Bestway InternationalHoldingsHK N/A Tungsten N/A 100 US$122mn 03.07.09Hopu Investment/ two CHN N/A Coal N/A 20 US$110mn 02.04.10Chinese firms<strong>Mongolia</strong> Energy Corp Ltd HK N/A Ferrous 504mn tn 100 US$35mn 24.06.09Resourceswww.eurasiac.com 18

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)areaTaishen Development North Asia Resources Group HK N/A Iron ore 79mn tonnes 100 US$25.1mn 29.07.10LLCPolo-Peabody JV Winsway Coking CoalCHN N/A Uranium, N/A 50 US$25mn 26.05.10HoldingsCoalAspire Mining Ltd SouthGobi Resources CN ASX Ovoot Coking N/A 20 US$20.10 25.10.10Coal ProjectGobi Coal and Energy Origo Partners Plc UK N/A Coal 320mn tn21.3 US$15mn 27.11.09resourcesShine Shivee LLC DeTeam Co Ltd HK N/A Coal 2.14bn 100 US$10mn 20.07.10Khurgatai Khaikang Aspire Mining Ltd AUS N/A Coal N/A 100 US$7.73mn 25.11.09LLCLand <strong>Mongolia</strong> Corp Gloworks Co Ltd SK N/A N/A N/A 50 US$7.63mn 13.07.09<strong>Mongolia</strong> Resource Alamar Resources AUS ASX Gold projects N/A 100 US$4.85mn 27.10.10CompanyMKMN HandySoft Corp SK N/A N/A N/A 51 US$4.19mn 21.12.09Kinkora Ltd Origo Partners PLC UK N/A Bronze Fox N/A 25 US$3mn 13.09.10copper-goldprospectOvoot Coking Coal Windy Knob Resources AUS N/A Coal N/A 100 US$3.5mn26.11.09Project+ Shares<strong>Mongolia</strong>n BML LLC Blina Diamonds AUS N/A Coal 250mn tonnes 100 US$2.18mn 30.09.10Erdenetsogt project Mangreat Ltd British N/A Coal N/A 5 US$2mn 01.11.10VirginIslands"The <strong>Mongolia</strong>n Xanadu Mines AUS N/A Thermal Coal N/A 100 A$1mn Jun-10Company"Troy <strong>Mongolia</strong>n Alt Meritus Minerals CAN N/A Gold N/A 100 US$0.5mn + 20.01.10ResourcesSharesLotus MineralsCompany of Mr. James N/APlus Fluorspar N/A 100 GBP200,000 29.10.10<strong>Mongolia</strong>Rodriguez de CastroMarkets projectsArgalant Gold-Copper Voyager Resources AUS N/A Gold, Copper N/A 100 US$50,00019.01.10Project+ SharesPanAsian Petroleum Sunwing Energy Ltd CAN N/A Oil, gas N/A 100 All Shares 18.11.09"The <strong>Mongolia</strong>n North Asia ResourcesHK N/A The Land N/A 100 N/A 01.07.10Company"Group/Golden Pogada LLCrights licenceto build DockBuyan Coal Project Hunnu Coal AUS ASX Coal N/A 60% N/A 08.06.10Tsohio Coal Project Hunnu Coal AUS ASX Coal N/A 60% N/A 02.06.10Amguulan LLC Lotus Resources PLC UK N/A N/A N/A N/A N/A 19.06.09Erdenes Thermal Coal Hunnu Coal AUS ASX Coal 140-180mn tn 80 N/A 11.03.10ProjectTsant Uul Coal Project Hunnu Coal AUS ASX Coal 50-100mn tn 90 N/A 26.05.10Other DealsWestern Prospector CNNC CHN Delisted Uranium 20mn lbs69 US$18.5mn 15.04.09(9,525 tn)Red Hill Energy Prophecy Resource Corp CAN TSX Coal 1.5bn tn100 Merger21.01.10resourcesAll SharesSMG Oil & Gas BKM Management AUS ASX Oil, gas N/A 100 All Shares,10.03.10A$0.01/shareofferedSource: Bloomberg, <strong>Eurasia</strong> <strong>Capital</strong>www.eurasiac.com 19

<strong>Mongolia</strong> <strong>Weekly</strong> (March 28-<strong>April</strong> 1, <strong>2011</strong>)<strong>April</strong> 4, <strong>2011</strong> (Monday)CONTACTSResearch:Sardor Koshnazarov Head of Research, Oil & Gas sardor.koshnazarov@eurasiac.comDosbergen Musaev Analyst, Strategy dosbergen.musaev@eurasiac.comAkmal Aminov Analyst, Metals & Mining akmal.aminov@eurasiac.comRentsendorj Yondon Analyst, <strong>Mongolia</strong> Equities rentsendorj.yondon@eurasiac.comTemuulen Munkhbaatar Analyst temuulen.munkhbaatar@eurasiac.comSales and Trading:Dima Orazimbetov Director dima.orazimbetov@eurasiac.comZhyldyz Sadyralieva Associate zhyldyz.sadyralieva@eurasiac.comSherzod Rakhimov Analyst sherzod.rakhimov@eurasiac.comBolor Ulziisaikhan Broker bolor.ulziisaikhan@eurasiac.comAnkhgerel Byambanyam Broker ankhgerel.byambanyam@eurasiac.comHoosniddin Hakimov Analyst hoosniddin.hakimov@eurasiac.comAddresses:MONGOLIASuite 71, 7 th Floor, Grand Office CenterJamiyangun Street 12, 1 st Khoroo,UlaanbaatarTel: +976 7013 0078Fax: +976 7013 0078HONG KONG33/F One International Finance Centre1 Harbour View Street, Central,Hong KongTel.:+852 2824 8716Fax: +852 2166 8999<strong>Eurasia</strong> <strong>Capital</strong> is a pan-regional investment bank with a focus on <strong>Mongolia</strong> and Central Asia. Headquartered in Ulaanbaatar, theFirm offers cross border M&A and advisory, capital raising, sales & trading and research services to its international and regionalclients including government agencies, major energy and resource companies, sovereign wealth funds, private equity groups andglobal portfolio investors. For more info, please visit our website: www.eurasiac.comDISCLAIMERThis <strong>Mongolia</strong> <strong>Weekly</strong> is made for information purposes only, and does not constitute an offer, solicitation of an offer to purchase, hold, sell, invest or make anyother financial decision. In making decisions, investors may rely on their own examinations of the parties and risks involved. Information contained in this researchproduct is obtained from the sources believed to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors suchinformation provided 'as is" without warranty of any kind and <strong>Eurasia</strong> <strong>Capital</strong> Ltd., in particular, make no representation or warranty, express or implied, as toaccuracy, timeliness, completeness, merchantability or fitness for any particular purpose of any such information. Under no circumstances, <strong>Eurasia</strong> <strong>Capital</strong> Ltd. haveany liability to any person or entity (-ies) for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligible or otherwise) orother circumstances or contingency within or outside the control of any of their directors, managements, officers, employees, or agents in connection withcompilation, analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatoryor incidental damages whatsoever (including without limitation, loss profits) even if <strong>Eurasia</strong> <strong>Capital</strong> Ltd. is advised in advance of the possibility of such damages,resulting from the use of or inability to use, any such information.©<strong>2011</strong> <strong>Eurasia</strong> <strong>Capital</strong> Ltd. All rights reserved.www.eurasiac.com 20