Mongolia Daily 2011 December 19 - Eurasia Capital

Mongolia Daily 2011 December 19 - Eurasia Capital

Mongolia Daily 2011 December 19 - Eurasia Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Mongolia</strong> <strong>Daily</strong> <strong>December</strong> <strong>19</strong>, <strong>2011</strong>POLITICS AND ECONOMYS&P Ratings Services Revised <strong>Mongolia</strong> Outlook to PositiveStandard & Poor’s Ratings Services revised the outlook on <strong>Mongolia</strong> to positives from stable on<strong>December</strong> <strong>19</strong>. The ratings agency affirmed the ‘BB-‘ long-term and ‘B’ short-term sovereign ratings. Thetransfer and convertibility assessment (T&C) is ‘BB’.The agency said that the outlook revision reflects expectations of significant real per capita GDP growththrough to 2014 at least. The growth is underpinned by output and exports expansions in resourcessector. “The associated improvement in general government debt and external leverage position willreduce the vulnerability of the sovereign’s debt-servicing capacity,” – S&P credit analyst Agost Benardsaid. According to S&P, <strong>Mongolia</strong> has exceptionally strong growth outlook over the medium term. Theagency stated that it may raise the sovereign ratings of <strong>Mongolia</strong> “if fiscal and external debt metricscontinue to improve, of if improvements in fiscal, monetary, and banking sector policies materiallyreduce vulnerabilities in these areas.”S&P warned that the ratings may face downward pressure if fiscal profligacy or unexpected bankingsector losses threaten macroeconomic stability and public finances, or the country resorts to excessiveexternal commercial borrowing.Erdenes Tavan Tolgoi IPO May Be in April 2012, B. Enebish SaysIn an interview to Mining Journal on <strong>December</strong> 17, Erdenes Mongol CEO B. Enebish said that ErdenesTavan Tolgoi (ETT) IPO is expected in April, 2012. According to Mr. Enebish 10-20% of ETT will be listed in<strong>Mongolia</strong>. Up to 30% of ETT is expected to be listed in Hong Kong and London with the governmentretaining majority stake in ETT through Erdenes Mongol asset holding company. <strong>Mongolia</strong>n governmenthired Goldman Sachs, Deutsche Bank, BNP Paribas and Macquarie to facilitate IPO of the company.Mr. Enebish also said that mining operations at Tavan Tolgoi property were underway and they hadreceived US$250mn of advance payment, which were deposited to the Human Development Fund. ETTsigned US$250mn coal supply contract with Aluminum Corp. of China Ltd. (Chalco) and Jinan Iron &Steel Co. in July this year. Coal shipments to Chalco started in August, the company reported. The miningoperations are underway at East Tsankhi area of the Tavan Tolgoi field. ETT contracted BBM OpertaGroup and Macmahon Holdings to mine the area. ETT expects to develop West Tsankhi area incooperation with an international strategic partner.Dosbergen Musaevdosbergen.musaev@eurasiac.comwww.eurasiac.com 2

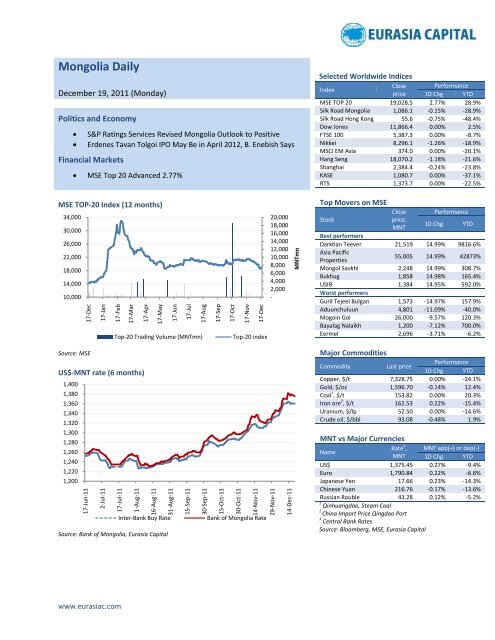

<strong>Mongolia</strong> <strong>Daily</strong> <strong>December</strong> <strong>19</strong>, <strong>2011</strong>FINANCIAL MARKETSMSE Top 20 Advanced 2.77%On Monday, MSE Top 20 advanced back 2.77% to <strong>19</strong>,028.51. In total, 37 companies were traded andtotal trade volume improved to MNT362.2mn, out of which MNT168.2mn was transacted on themembers of the Top 20 Index.15 companies advanced on MNT256.8mn which included MNT150.3mn trade of APU (APU) andMNT93.3mn transacted on Asia Pacific Properties (APP). APU surged 14.92% to MNT3,790 and APP wasup 14.99% at MNT55,005. Other advanced stocks included <strong>Mongolia</strong>n Telecom (MCH) which advanced3.7% to MNT2,800 and Sharyn Gol (SHG) which added only 1 tugrik to MNT11,152.16 stocks declined on MNT107.77mn. Tavan Tolgoi (TTL) lost 3.41% to MNT8,500, Baganuur (BAN)3.06% to MNT9,500, Shivee Ovoo (SHV) slid by 1 tugrik to MNT13,000, Gobi (GOV) was down 1.98% toMNT4,900, Mogoin Gol (BDL) declined 9.57% to MNT26,000, and Aduunchuluun (ADL) lost 11.09% toMNT4,801. 6 companies remained flat MNT0.7mn.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comwww.eurasiac.com 3

<strong>Mongolia</strong> <strong>Daily</strong> <strong>December</strong> <strong>19</strong>, <strong>2011</strong>MSE AND MONGOLIA-FOCUSED INTERNATIONAL MINING COMPANIESSTOCKS PERFORMANCE SUMMARYMSE TOP-20 (<strong>December</strong> <strong>19</strong>, <strong>2011</strong>)NameSymbolPrice Market Cap Performance <strong>Daily</strong> Volume P/E P/BMNT US$ MNTmn US$mn 1D chg y-t-d Shares MNTmn US$'000 2010 2010Tavan Tolgoi TTL 8,500 6.18 447,654 325.5 -3.4% 47.6% 2,760 23.46 17.06 5.8 4.5APU APU 3,790 2.76 281,550 204.7 14.9% 90.5% 39,665 150.33 109.30 14.3 5.6Baganuur BAN 9,500 6.91 <strong>19</strong>9,256 144.9 -3.1% -9.5% 551 5.23 3.81 24.6* 53.8*Shivee Ovoo SHV 13,000 9.45 174,448 126.8 0.0% 0.0% 269 3.50 2.54 13.9* 35.6*Sharyn Gol SHG 11,152 8.11 113,4<strong>19</strong> 82.5 0.0% 6.2% 600 6.69 4.86 527.5* 14.5*<strong>Mongolia</strong>n Telecom MCH 2,800 2.04 72,437 52.7 3.7% -20.0% 40 0.11 0.08 39.4 2.2BDSec BDS 3,700 2.69 40,700 29.6 0.0% 48.0% 0 0.00 0.00 49.7 6.4Gobi GOV 4,900 3.56 38,226 27.8 -2.0% -12.5% 18 0.09 0.06 11.4 1.6Suu SUU 65,000 47.26 22,360 16.3 0.0% 209.7% 0 0.00 0.00 8.3 2.6Mogoin Gol BDL 26,000 18.90 21,570 15.7 -9.6% 120.3% 59 1.53 1.12 626.4* 9.7Khukh Gan HGN <strong>19</strong>0 0.14 <strong>19</strong>,250 14.0 -1.6% 1.6% 4,912 0.93 0.68 -13.2* 2.3State Department Store UID 485 0.35 17,852 13.0 0.4% 12.8% 3,452 1.67 1.22 -12.6* 4.8Aduunchuluun ADL 4,801 3.49 15,129 11.0 -11.1% -40.0% 66 0.32 0.23 31.6 6.0<strong>Mongolia</strong>n DevelopmentResourcesMDR 1,100 0.80 15,125 11.0 0.0% -15.4% 50 0.06 0.04 15.1 1.1Bayangol Hotel BNG 35,000 25.45 14,807 10.8 0.0% 46.4% 8 0.28 0.20 6.5 0.8Remicon RMC 180 0.13 14,162 10.3 5.9% 150.0% 13,767 2.48 1.80 33.6 2.3Genco Tour Bureau JTB 94 0.07 10,340 7.5 0.0% 0.0% 50 0.00 0.00 92.6 1.2Talkh Chikher TCK 10,000 7.27 10,237 7.4 -2.9% 170.3% 39 0.39 0.28 11.5 3.2Hotel <strong>Mongolia</strong> MSH 799 0.58 7,990 5.8 0.0% 42.7% 60 0.05 0.03 53.0 2.5Bayanteeg BTG 23,000 16.72 5,810 4.2 0.0% 228.5% 0 0.00 0.00 NA NASource: MSE, <strong>Eurasia</strong> <strong>Capital</strong> estimatesSelected 5 Non-MSE TOP-20 Member Largest Companies (<strong>December</strong> <strong>19</strong>, <strong>2011</strong>)NameSymbolPrice Market Cap Performance <strong>Daily</strong> Volume P/E P/BMNT US$ MNTmn US$mn 1D chg y-t-d Shares MNTmn US$'000 2010 2010UB Hotel ULN 45,999 33.44 15,423 11.2 0.0% 67.3% 0 0.00 0.00 12.3 2.4Eermel EER 2,696 1.96 9,380 6.8 -3.7% -6.2% 50 0.13 0.10 26.8 0.9Makh Impex MMX 2,120 1.54 8,058 5.9 -1.4% 17.8% 30 0.06 0.05 88.0* 116.2*Darkhan Nekhii NEH 6,999 5.09 7,737 5.6 0.0% 42.8% 0 0.00 0.00 6.3 1.3Nako Tulsh NKT <strong>19</strong>5 0.14 2,460 1.8 0.0% -40.0% 0 0.00 0.00 -21.5* 2.1Source: MSE, <strong>Eurasia</strong> <strong>Capital</strong> estimates*Note: These PE and PB ratios are not meaningful, in our view.www.eurasiac.com 4

<strong>Mongolia</strong> <strong>Daily</strong> <strong>December</strong> <strong>19</strong>, <strong>2011</strong>Silk Road <strong>Mongolia</strong> Index* Companies (<strong>December</strong> <strong>19</strong> 1 , <strong>2011</strong>)Name Symbol CurrencyClosePriceMktCap Price Performance<strong>Daily</strong>Volume(52Wk)US$mn 52 wk high 52 wk low 1D chg y-t-d US$mnIVANHOE MINES LTD IVN:US USD 16.79 12,400.3 29.29 12.11 4.0% -26.7% 50.86CENTERRA GOLD INC CG:CN CAD 18.84 4,282.4 23.72 14.00 1.8% -3.5% 10.61MONGOLIAN MINING CORP 975:HK HKD 5.93 2,822.9 11.50 4.94 -0.5% -34.6% 4.39WINSWAY COKING COAL HOLDINGS 1733:HK HKD 2.34 1,134.4 4.91 1.47 -1.3% -49.9% 6.61SOUTHGOBI RESOURCES LTD 1878:HK HKD 46.00 1,074.5 130.90 43.00 2.2% -53.8% 1.<strong>19</strong>MONGOLIA ENERGY CORP LTD 276:HK HKD 0.75 636.6 2.54 0.46 0.0% -67.7% 4.23HUNNU COAL LTD HUN:AU AUD 1.80 443.2 1.82 1.01 1.1% 34.5% 1.81TAVAN TOLGOI JSC TTL:MO MNT 8,500 325.5 14,400 5,301 -3.4% 47.6% 0.01APU JSC APU:MO MNT 3,790 204.7 3,795 1,850 14.9% 90.5% 0.01ASPIRE MINING LTD AKM:AU AUD 0.30 182.2 1.14 0.28 -4.8% -38.5% 0.96ORIGO PARTNERS PLC OPP:LN GBp 35.00 164.1 54.13 25.75 0.0% -14.6% 0.16BAGANUUR JSC BAN:MO MNT 9,500 144.9 42,000 9,500 -3.1% -9.5% 0.08ENTREE GOLD INC ETG:CN CAD 1.17 142.9 3.47 1.01 4.5% -66.3% 0.26SHIVEE OVOO JSC SHV:MO MNT 13,000 126.8 62,355 12,000 0.0% 0.0% 0.01MONGOLIA GROWTH GROUP LTD YAK:CN CAD 4.17 126.3 6.04 0.60 0.7% NA 0.02SHARYN GOL JSC SHG:MO MNT 11,152 82.5 36,553 10,200 0.0% 6.2% 0.09VOYAGER RESOURCES LTD VOR:AU AUD 0.07 81.4 0.13 0.03 -9.6% 23.1% 0.16PETRO MATAD LTD MATD:LN GBp 26.75 76.5 211.00 13.50 -0.9% -78.1% 0.36PROPHECY RESOURCE CORP PCY:CN CAD 0.40 76.2 1.01 0.39 -7.0% -53.7% 0.79CENTRAL ASIA METALS PLC CAML:LN GBp 55.50 74.1 101.50 54.00 2.8% -38.5% 0.06XANADU MINES LTD XAM:AU AUD 0.34 63.3 0.80 0.34 -2.9% -39.8% 0.03HARANGA RESOURCES LTD HAR:AU AUD 0.31 59.7 0.74 0.16 -4.7% -52.3% 0.03MONGOLIA INVESTMENT GROUP LT 402:HK HKD 0.05 57.9 0.15 0.04 0.0% -66.9% 0.60MONGOLIAN TELECOM JSC MCH:MO MNT 2,800 52.7 4,501 2,500 3.7% -20.0% 0.00SOLARTECH INTERNATIONAL HOLD 1166:HK HKD 0.<strong>19</strong> 42.9 1.10 0.15 -3.1% -80.3% 1.00EAST ASIA MINERALS CORP EAS:CN CAD 0.52 42.1 8.38 0.41 15.6% -93.5% 1.10KINCORA COPPER LTD KCC:CN CAD 0.31 41.2 0.65 0.11 0.0% 14.8% 0.01NORTH ASIA RESOURCES HOLDING 61:HK HKD 0.25 36.0 1.41 0.20 2.5% -73.0% 0.36BDSEC JSC BDS:MO MNT 3,700 29.6 6,500 2,500 0.0% 48.0% 0.01ASIA COAL LTD 835:HK HKD 0.11 28.4 0.30 0.08 0.0% -58.0% 0.02ERDENE RESOURCE DEVELOPMENT CORP ERD:CN CAD 0.32 27.8 1.84 0.32 0.0% -74.2% 0.04GOBI JSC GOV:MO MNT 4,900 27.8 8,000 4,700 -2.0% -12.5% 0.01Source: Bloomberg, MSE, Bank of <strong>Mongolia</strong>, <strong>Eurasia</strong> <strong>Capital</strong>*Note: MonBiz <strong>Mongolia</strong> Index and MonBiz Hong Kong Index were acquired by Silk Road Management and rebranded to Silk Road <strong>Mongolia</strong>and Silk Road Hong Kong indices, respectively, on January 11, <strong>2011</strong>.1Share prices of NYSE, TSX and LSE-listed companies are as of yesterday.Rentsendorj Yondonrentsendorj.yondon@eurasiac.comwww.eurasiac.com 5

<strong>Mongolia</strong> <strong>Daily</strong> <strong>December</strong> <strong>19</strong>, <strong>2011</strong>CONTACTSResearch:Sardor Koshnazarov Head of Research, Oil & Gas sardor.koshnazarov@eurasiac.comDosbergen Musaev Chief Economist dosbergen.musaev@eurasiac.comAkmal Aminov Associate, Metals & Mining akmal.aminov@eurasiac.comRentsendorj Yondon Associate, <strong>Mongolia</strong>n Equities rentsendorj.yondon@eurasiac.comSales and Trading:Zhyldyz Sadyralieva Associate zhyldyz.sadyralieva@eurasiac.comBolor Ulziisaikhan Associate bolor.ulziisaikhan@eurasiac.comHoosniddin Hakimov Associate hoosniddin.hakimov@eurasiac.comNarantsatsral Batgerel Broker narantsatsral.batgerel@eurasiac.comAddresses:MONGOLIASuite 65, 6 th Floor, Grand Office CenterJamiyangun Street 12, 1 st Khoroo,UlaanbaatarTel: +976 7013 0078Fax: +976 7013 0078HONG KONG33/F One International Finance Centre1 Harbour View Street, Central,Hong KongTel.:+852 2824 8716Fax: +852 2166 8999<strong>Eurasia</strong> <strong>Capital</strong> is a pan-regional investment bank with a focus on <strong>Mongolia</strong> and Central Asia. Headquartered in Ulaanbaatar, theFirm offers cross border M&A and advisory, capital raising, sales & trading and research services to its international and regionalclients including government agencies, major energy and resource companies, sovereign wealth funds, private equity groups andglobal portfolio investors. For more info, please visit our website: www.eurasiac.comDISCLAIMERThis <strong>Mongolia</strong> <strong>Daily</strong> is made for information purposes only, and does not constitute an offer, solicitation of an offer to purchase, hold, sell, invest or make any otherfinancial decision. In making decisions, investors may rely on their own examinations of the parties and risks involved. Information contained in this research productis obtained from the sources believed to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors such informationprovided 'as is" without warranty of any kind and <strong>Eurasia</strong> <strong>Capital</strong> Ltd., in particular, make no representation or warranty, express or implied, as to accuracy,timeliness, completeness, merchantability or fitness for any particular purpose of any such information. Under no circumstances, <strong>Eurasia</strong> <strong>Capital</strong> Ltd. have anyliability to any person or entity (-ies) for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligible or otherwise) or othercircumstances or contingency within or outside the control of any of their directors, managements, officers, employees, or agents in connection with compilation,analysis, interpretation, communication, publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory or incidentaldamages whatsoever (including without limitation, loss profits) even if <strong>Eurasia</strong> <strong>Capital</strong> Ltd. is advised in advance of the possibility of such damages, resulting from theuse of or inability to use, any such information.©<strong>2011</strong> <strong>Eurasia</strong> <strong>Capital</strong> Ltd. All rights reserved.www.eurasiac.com 6