Independent Living Program - Florida's Center for Child Welfare

Independent Living Program - Florida's Center for Child Welfare

Independent Living Program - Florida's Center for Child Welfare

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

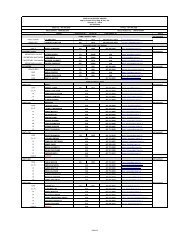

FEBRUARY 2005 REPORT NO. 2005 - 119Finding No. 3: YA Spending CapsAs described in Exhibit 1, the various YA servicesprovided to young adults are subject to annualspending caps. Our analysis of ICWSIS-reported YAexpenditures <strong>for</strong> the 2003-04 fiscal year disclosed that253 clients (11 percent) received payments totalingapproximately $542,000 in excess of the spending capsestablished <strong>for</strong> YA services:‣ Aftercare. 106 of 200 clients receivedpayments totaling $169,382 in excess of the$1,000 per fiscal year spending cap.‣ RTI Scholarships. 40 of 1,267 clientsreceived payments totaling $31,980 in excessof the $10,704 per fiscal year spending cap.‣ Transitional Support. 107 of 800 clientsreceived payments totaling $340,186 in excessof the $5,000 per fiscal year spending cap.Some districts and CBCs indicated they were notaware of the spending caps <strong>for</strong> Aftercare andTransitional Support. Staff also indicated thatAftercare and Transitional Support spending capswere sometimes exceeded on a case-by-case basis dueto emergency needs of the young adults. In otherinstances, posting errors to the financial recordsresulted in spending caps being exceeded.Recommendation: We recommend theDepartment enhance its technical assistance andmonitoring procedures (e.g., exception reportingor system edit checking) to ensure payments toclients do not exceed the established spendingcaps. The Department should establish writtenpolicies and procedures to address whetherAftercare and Transitional Support spending capsmay be exceeded in certain situations and thedocumentation requirements related to thoseinstances.Finding No. 4: RTI Scholarship NeedsAssessmentsRTI scholarships provide young adults enrolled inhigh school, GED programs, and post-secondaryeducational institutions with funds <strong>for</strong> living andeducational expenses. Effective June 24, 2004,Page 5 of 20Chapter 2004-362, Laws of Florida, required thedistricts and CBCs to determine the amount of an RTIscholarship award based on the living and educationalneeds of the young adult. In accordance with therequirements of the law, the Department issued toolsand instructions in September 2004, to be used incompleting needs assessments. However, in responseto concerns that decreasing benefits, as a result of theassessments, would be detrimental to the young adults,the Department notified the districts and CBCs onDecember 1, 2004, to immediately discontinue theimplementation of the needs assessment process.Additionally, the Department instructed the districtsand CBCs to reinstate payment amounts to themaximum $892 per month and to retroactively pay <strong>for</strong>any prior benefit periods during the fiscal year <strong>for</strong>which the client did not receive $892.On December 27, 2004, the Department issued newguidelines and assessment documents. The districtsand CBCs are required to use these documents toprepare a needs assessment <strong>for</strong> all new and existingclients by April 1, 2005. Our review of thesedocuments disclosed that generally, the needsassessment <strong>for</strong> postsecondary students was sufficientto identify all needs and available resources. However,<strong>for</strong> high school students, the needs assessment processdid not require determining the living and educationalneeds (cost of attendance) as a basis <strong>for</strong> the benefitamount. Instead, the Department set the cost ofattendance at the statutory maximum annual awardamount of $10,704.According to Department personnel, after review ofmultiple costs of attendance figures, the Departmentdetermined that the maximum allowed by State lawwould be the most appropriate figure.Notwithstanding the Department’s explanation, sincethe $10,704 statutory maximum amount is computedbased on the income from a 40-hour per weekminimum wage job, it is not clear why requiring a highschool student to prepare a budget based on actualexpenses would not be a better indicator of the livingand educational needs of the young adult.