Klickitat County Assessor's Office Mass Appraisal Report

2012 Klickitat County Mass Appraisal Report. - Klickitat County Home

2012 Klickitat County Mass Appraisal Report. - Klickitat County Home

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Klickitat</strong> <strong>County</strong><strong>Assessor's</strong> <strong>Office</strong><strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong><strong>Appraisal</strong> Date: January 1, 2012 for 2013 Property Taxes<strong>Report</strong> Date: Aug 14, 2012Prepared For: Darlene R. Johnson, <strong>Klickitat</strong> <strong>County</strong>AssessorBy: Karen Reisenauer, Supervisor Assessor

Preliminary Summary of Value Change:This mass appraisal report is a ‘post revaluation’ ‘report card’ on the performance of the valuationmodel(s) used. It is not a fully self contained appraisal report but rather a summary of theperformance of the model used in the mass appraisal process for <strong>Klickitat</strong> <strong>County</strong>. All real propertyparcels and personal property parcels were valued for this report. This is a preliminary summaryreport as of Aug 14, 2012. This does not include any New Construction values. These values aresubject to change only from Board of Equalization ordered changes and manifest error changes.Preliminary Summary of Real Property Value Change*January 1, 2011 1,887,918,134January 1, 2012 1,916,168,266Value Change 28,250,132Percent Change 1.5%Preliminary Summary of Real Property Value Change by Neighborhood*Nbrhd Description Parcels 2012 2013 Difference1010001 White Salmon Urban 1729 293,481,130 283,709,080 -3.3%1010002 Area 1 Commercial 285 106,358,130 94,172,150 -11.5%1020001 Bingen 266 35,309,500 34,963,540 -1.0%1030001 Rural White Salmon, Snowden 984 127,776,405 125,689,670 -1.6%1040001 Husum to BZ Corner 903 132,522,885 127,483,780 -3.8%1060001 BZ Corner to Trout Lake 1057 140,275,380 143,872,740 2.6%2010002 Lyle I 316 42,502,950 43,644,730 2.7%2010004 Area 2 Commercial 98 20,580,960 21,513,800 4.5%2020012 Lyle II 115 18,913,600 19,225,260 1.6%2020013 Dallesport Murdock 828 104,580,880 105,412,636 0.8%2030012 Appleton, <strong>Klickitat</strong>, and Surrounding 1661 116,029,629 128,940,010 11.1%2050014 Rural Glenwood 959 54,205,174 55,888,770 3.1%2060500 Glenwood, <strong>Klickitat</strong> Urban 271 17,688,880 16,408,450 -7.2%3010001 Area 3 Commercial 298 54,192,290 54,775,860 1.1%3010015 Centerville and Surrounding 1064 64,629,666 68,539,450 6.0%3010016 Goldendale Urban I 1546 128,969,761 134,114,280 4.0%3010017 Goldendale Urban II 45 6,228,700 6,239,560 0.2%3020001 Wishram and River Communities 578 22,157,990 25,576,300 15.4%3040001 N NW Goldendale Rural 2055 173,034,784 191,312,940 10.6%4010001 Area 4 Commercial 75 26,827,130 27,045,030 0.8%4040001 Bickleton Rural and Surrounding 1243 53,885,470 61,864,490 14.8%4040002 Roosevelt and River Communities 746 23,958,500 26,734,410 11.6%4040003 NE Goldendale Rural 1913 120,311,090 114,957,670 -4.4%4060001 Bickleton Urban 108 3,497,250 4,083,660 16.8%<strong>Klickitat</strong> <strong>County</strong> 19143 1,887,918,134 1,916,168,266 1.5%*The Summary of Value Change reflect the aggregate change in value for residential parcels. Personal Property Listings, and NewConstruction will have their assessed value notices sent in September and certified September 15. All data in this Summary Table isfrom pre-certification Residential <strong>Report</strong> dated August 14, 2012. The values in this report may change.

Preliminary Summary of Personal Property Value Change*January 1, 2011 1,211,873,980January 1, 2012 1,202,645,730Value Change -9,228,250Percent Change -0.76%*The Preliminary Summary of Personal Property Value Change reflects the aggregate change in value for personal property accounts,which include real property located on leased land such as wind turbines, and personal property accounts of businesses located in<strong>Klickitat</strong> <strong>County</strong>. All data in this Summary Table is from pre-certification Residential <strong>Report</strong> dated August 14, 2012. The values in thisreport may change.Client and Intended Users:This residential mass appraisal report was prepared for the <strong>Klickitat</strong> <strong>County</strong> Assessor as per theclient's instructions. The intended users include the Assessor (Client), the <strong>Klickitat</strong> <strong>County</strong> Board ofEqualization, the Washington State Board of Tax Appeals and the Washington State Department ofRevenue. No other users are intended or implied.Client Instructions to Appraisers: Appraise all properties in each Residential <strong>Appraisal</strong> Management Region by the datespecified in the approved Department of Revenue <strong>Klickitat</strong> <strong>County</strong> revaluation plan. The appraisals are to be compliant with Washington State Law (RCW), Washington StateAdministrative Code (WAC), Washington State Department of Revenue (DOR) guidelines, andInternational Association of Assessing <strong>Office</strong>rs (IAAO) standard on ratio studies, July 2007edition and the Uniform Standards of Professional <strong>Appraisal</strong> Standards (USPAP) Standard 6:<strong>Mass</strong> <strong>Appraisal</strong>, Development and <strong>Report</strong>ing. The appraisals are to be performed using industry standards mass appraisal techniques. Physical inspections must comply with the 2010 – 2013 revaluation plan approved by theWashington State Department of Revenue November 5, 2009. Physical inspections will at aminimum be a curbside visit and review of the property characteristics. An effort should be made to inspect and review all qualified sales that occurred in the yearprior to the assessment date. A written mass appraisal report that is compliant with USPAP Standard 6 must be completed. The intended use of the appraisals and subsequent report is the administration of ad valoremproperty appraisals.Use of This <strong>Report</strong>The use of this report, its analysis and conclusions, is limited to the administration of appraisals forproperty tax purposes in accordance with Washington State law and administrative code. Theinformation and conclusions contained in this report cannot be relied upon for any other purpose.This document is not intended to be a self contained documentation of the mass appraisal but tosummarize the methods and data used and to guide the reader to other documents or files whichwere relied upon to perform the mass appraisal. These other documents may include the following:Individual Property Records - Contained in <strong>Assessor's</strong> Property System Database / ProValReal Estate Sales File – Part of <strong>Assessor's</strong> Property System Database / ProValLand Sales and Model Calibration Spreadsheets

Residential Cost Tables – Contained in <strong>Assessor's</strong> Property System Database / ProVal Residential Depreciation Tables – Contained in the <strong>Assessor's</strong> Property System Database /ProVal Revised Code of Washington (RCW) - Title 84 Washington Administrative Code (WAC) – WAC 458 Uniform Standards of Professional <strong>Appraisal</strong> Practice (USPAP) published by the <strong>Appraisal</strong>Standards Board of the <strong>Appraisal</strong> Foundation 2010 – 2013 <strong>Klickitat</strong> <strong>County</strong> Revaluation plan as approved by the Washington StateDepartment of Revenue <strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong> data extracts and sales files Measuring Real Property <strong>Appraisal</strong> Performance in Washington's Property Tax System –<strong>Office</strong> of Program Research, Washington House of Representatives (Accessed athttp://www.leg.wa.gov/House/Committees/FIN/archivedreports.htm). Property Assessment Valuation published by the International Association of Assessing<strong>Office</strong>rs, 3 rd Edition, 2010. Property <strong>Appraisal</strong> and Assessment Administration by the International Association ofAssessing <strong>Office</strong>rs, 1990. <strong>Mass</strong> <strong>Appraisal</strong> of Real Property by the International Association of Assessing <strong>Office</strong>rs, 1993. IAAO <strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong> Template 2011. Snohomish <strong>County</strong> <strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong> 2010.Effective Date of the <strong>Appraisal</strong>: January 1, 2012The appraisal date for properties other than new construction is January 1 st as required byWashington State legislative requirements. The appraisal date for new construction is July 31 st asrequired by Washington State legislative requirements.RCW 84.40.020Assessment date — Average inventory basis may be used — Public inspection of listing, documents, andrecords. All real property in this state subject to taxation shall be listed and assessed every year, withreference to its value on the first day of January of the year in which it is assessed. The appraisal date for newconstruction, that is those properties that were issued a building permit or should have been issued a buildingpermit, is July 31st.RCW 36.21.080New construction building permits — When property placed on assessment rolls. The county assessor isauthorized to place any property that is increased in value due to construction or alteration for which a buildingpermit was issued, or should have been issued, under chapter 19.27, 19.27A, or 19.28 RCW or other lawsproviding for building permits on the assessment rolls for the purposes of tax levy up to August 31st of eachyear. The assessed valuation of the property shall be considered as of July 31st of that year.Type and Definition of Value: Market Value for Assessment PurposesMarket Value: The basis of all assessments is the true and fair market value of property. True and fairmarket value (Spokane etc. R. Company v. Spokane <strong>County</strong>, 75 Wash. 72 (1913); Mason <strong>County</strong>Overtaxed, Inc. v. Mason <strong>County</strong>, 62d (1963); AGO 57-58, No. 2, 1/8/57; AGO 65-66, No. 6512/31/65... or amount of money a buyer is willing but not obligated to buy would pay for it to a sellerwilling but not obligated to sell. In arriving at a determination of such value, the assessing officer canconsider only those factors that can within reason be said to affect the price in negotiations between a

willing purchaser and willing seller, and he must consider all of such factors (AGO 65.66. No. 65,12/31/65).WAC 458-07-030 (1) True and fair value -- Defined. All property must be valued and assessed at onehundred percent of true and fair value unless otherwise provided by law. "True and fair value" means marketvalue and is the amount of money a buyer of property willing but not obligated to buy would pay a seller ofproperty willing but not obligated to sell, taking into consideration all uses to which the property is adapted andmight in reason be applied.(2) True and fair value--Criteria. In determining true and fair value, the assessor may use the sales(market data) approach, the cost approach, or the income approach, or a combination of the three approachesto value. The provisions of (b) and (c) of this subsection, the cost and income approaches, respectively, shallbe the dominant factors considered in determining true and fair value in cases of property of a complex nature,or property being used under terms of a franchise granted by a public agency, or property being operated as apublic utility, or property not having a record of sale within five years and not having a significant number ofsales of comparable property in the general area. When the cost or income approach is used, the assessorshall provide the property owner, upon request, with the factors used in arriving at the value determined,subject to any lawful restrictions on the disclosure of confidential or privileged tax information.Assumptions, Limiting Conditions, and Jurisdictional Exceptions:The properties were assumed to be free of any and all liens and encumbrances. Each property has also beenappraised as though under responsible ownership and competent management.Surveys of the assessed properties have not been provided. We have relied upon tax maps and othermaterials in the course of estimating physical dimensions and the acreage associated with assessedproperties.We assume the utilization of the land and any improvements is located within the boundaries of the propertydescribed. It is assumed that there are no adverse easements or encroachments for any parcel that have notalready been addressed in the mass appraisal, unless otherwise noted in the property system database.In the preparation of the mass appraisal, interior inspections have/have not been made of the parcels ofproperty included in this report. All inspections are made from the exterior only. It is assumed that the conditionof the interior of each property is similar to its exterior condition, unless the assessor has received additionalinformation from qualified sources giving more specific detail about the interior condition.Property inspection dates will have ranged in time from both before and after the appraisal date. It is assumedthat there has been no material change in condition from the latest property inspection, unless otherwise notedon individual property records retained in the assessor’s office.We assume that there are no hidden or unapparent conditions associated with the properties, subsoil, orstructures, which would render the properties (land and/or improvements) more or less valuable, unlessotherwise noted in the property system database.It is assumed that the properties and/or the landowners are in full compliance with all applicable federal, state,and local environmental regulations and laws, unless otherwise noted in the property system database.

It is assumed that all applicable zoning and use regulations have been complied with, unless otherwise notedin the property system database.It is assumed that all required licenses, certificates of occupancy, consents, or other instruments of legislativeor administrative authority from any private, local, state, or national government entity have been obtained forany use on which the value opinions contained within this report are based.We have not been provided a hazardous condition’s report, nor are we qualified to detect hazardous materials.Therefore, evidence of hazardous materials, which may or may not be present on a property, was notobserved. As a result, the final opinion of value is predicated upon the assumption that there is no suchmaterial on any of the properties that might result in a loss, or change in value. It is assumed that there are nohazardous materials affecting the value of the property, unless specifically identified in the property systemdatabase.Information, estimates, and opinions furnished to the appraisers and incorporated into the analysis and finalreport were obtained from sources assumed to be reliable, and a reasonable effort has been made to verifysuch information. However, no warranty is given for the reliability of this information.The Americans with Disabilities Act (ADA) became effective January 26, 1992. We have not made compliancesurveys nor conducted a specific analysis of any property to determine if it conforms to the various detailedrequirements identified in the ADA. It is possible that such a survey might identify nonconformity with one ormore ADA requirements, which could lead to a negative impact on the value of the property(s). Because sucha survey has not been requested and is beyond the scope of this appraisal assignment, we did not take intoconsideration adherence or non-adherence to ADA in the valuation of the properties addressed in this report.Possession of this report does not carry with it the right of reproduction and disclosure of this report isgoverned by the rules and regulations of the State of Washington, and is subject to jurisdictional exception andthe laws of the State of Washington.Fiscal constraints may impact data completeness and accuracy, valuation methods and valuation accuracy.The Assessor’s records are assumed to be correct for the properties appraised.Sales utilized are assumed to be ―arm’s-length market transactions; fiscal constraints limit the Assessor’sability to verify the transactions beyond initial sales screening. Secondary screening is limited to the mailing ofsales questionnaires and/or inspection of 'outlier' sales.The subject property is assumed to be buildable unless otherwise noted in the property system database.It is assumed that the property is unaffected by ―sensitive or critical areas regulations (federal, state or local)unless otherwise noted in the property system database.Maps, aerials, and drawings may be included to assist the intended user in visualizing the property; however,no responsibility is assumed as to their exactness.The value conclusions contained in this report apply to the subject parcels only and are valid only forassessment purposes. No attempt has been made to relate the conclusions in this report to any otherrevaluation, past, present or future.It is assumed that 'exposure time' for the properties appraised are typical for their market area.It is assumed that the legal descriptions stored in the <strong>Assessor's</strong> property system database for the propertiesappraised are correct. No survey or search of title of the properties has been made for this report and noresponsibility for legal matters is assumed.

Rental rates, when employed, were calculated in accord with generally accepted appraisal industry standards.The <strong>Klickitat</strong> <strong>County</strong> <strong>Assessor's</strong> office does not employ a sales database that captures property characteristicsat the time of sale. Staffing resources preclude the level of sales review required to support this activity. Notemploying a static sales database may bias the mass appraisal results when there are few sales with which tocalibrate the market model.Exterior inspections were made of all properties in the physical inspection areas per the revaluation planapproved by the Washington State Department of Revenue dated Nov 5, 2009 and as required by RCW84.41.041. This inspection plan provides that all taxable real property is physically inspected one every fouryears. For the January 1, 2012 valuations, area 1 received physical inspections. Most properties received avisual inspection and some properties received 'walk around' inspections or interior inspections. Timeconstraints and fiscal constraints set by statue limit the ability of the Assessor’s office to complete a morecomplete inspection of all parcels, however we make every effort to do on site and interior inspections forhome owners who request an inspection.RCW 84.41.041Each county assessor shall cause taxable real property to be physically inspected and valued at least onceevery six years in accordance with RCW 84.41.030, and in accordance with a plan filed with and approved bythe Department of Revenue.Jurisdictional ExceptionThe mass appraisal must be completed within the time constraints set by statute and with the workforce and financial resources available. Where these constraints limit the scope of work performed forthe mass appraisal, limiting the ability to fully comply with USPAP Standards 6, the JurisdictionalException as provided for in Standard 6 is invoked.

Property Rights Appraised:Property Rights Appraised – Fee SimpleFee Simple Title: Fee simple title indicates ownership that is absolute and subject to no limitationother than eminent domain, police power, escheat and taxation. (International Association ofAssessing <strong>Office</strong>rs, Glossary for Property <strong>Appraisal</strong> and Assessment, (Chicago. IAAO 1997).Scope of Work:Inspection of PropertyThe modeling process relies on the physical inspections performed by the <strong>Klickitat</strong> <strong>County</strong> InspectionTeam members and the data contained in the <strong>Assessor's</strong> Computer Added <strong>Mass</strong> <strong>Appraisal</strong> (CAMA)property system database (ProVal). CAMA models have the advantage of explicitly controlling for theeffects of all variables tested in the model – neighborhood, lot size, building size, construction grade,year built, and all other features for which variables were included in the model.All known land sales were investigated and site visits performed to verify the physical characteristicsof the parcel unless precluded from doing so due to lack of access or lack of time that coincided withan extreme weather condition such as snow or flooding in which case aerial photographs and ParcelAnalyst maps were utilized.Sales SourceThe <strong>Klickitat</strong> <strong>County</strong> <strong>Assessor's</strong> office utilizes sales obtained from Real Estate Excise Tax Affidavitsfiled with the <strong>Klickitat</strong> <strong>County</strong> Treasurer's <strong>Office</strong>.Sales ReviewSales are assumed to be arm's length transactions based on initial screening in the sales verificationprocess utilizing standards published by the Washington State Department of Revenue (see appendixfor more information on this process). The mass appraisal must be completed within the timeconstraints set by statute and with the work force and financial resources available. These constraintslimit the amount of sales review that can occur.Sales located in the scheduled physical inspection review area receive at a minimum an externalinspection.Identification of PropertiesAll residential parcels located within the boundaries of <strong>Klickitat</strong> <strong>County</strong> were valued. Each parcel isidentified by a 14 digit parcel number. The first two digits represent the Township, the second twodigits represent the Range, the next two digits represent the Section, the next four digits represent thePlat Number, and the next four represent a parcel number for administrative purposes.To help further stratify residential parcels, the <strong>County</strong> is broken into four inspection areas based onthe approved plan. Each inspection area is divided into neighborhoods, which representgeographical areas that share important locational characteristics. As part of our effort in improve thestatistical quality of our neighborhoods, the number of neighborhoods has decreased from 65neighborhoods to a total of 20 residential neighborhoods, 5 commercial neighborhoods, and 2neighborhoods with wind farm parcels. Inspection Area 1 had 18 neighborhoods and now has

approximately 5 neighborhoods; Inspection Area 2 had 21 neighborhoods and now has approximately6 neighborhoods, Inspection Area 3 had 12 neighborhoods and now has approximately 5neighborhoods, and Area 4 had 11 neighborhoods and now has 4 neighborhoods. Residentialappraisal neighborhoods are identified with a seven (7) digit number. The first character of theneighborhood codes identifies the area in which inspection cycle the property is located but someneighborhoods now cross inspection areas. The complete neighborhood breakdowns are included inthe appendix.Included in the appendix is a list of the House Types used to provide for coding of improvementhouse styles further stratified by the square footage.Highest and Best Use:This mass appraisal relies on the determinations of Highest and Best Use made by the <strong>Assessor's</strong>appraisal staff as part of Physical Inspection and/or Sales Review.RCW 84.40.030All property shall be valued at one hundred percent of its true and fair value in money and assessed on thesame basis unless specifically provided otherwise by law. (1) …The appraisal shall be consistent with thecomprehensive land use plan, development regulations under chapter 36.70A RCW, zoning and any othergovernmental policies or practices in effect at the time of the appraisal that affect the use of property as well asphysical and environmental influences. An assessment may not be determined by a method that assumes aland usage or highest and best use not permitted, for that property being appraised, under existing zoning orland use planning ordinances or statutes or other government restrictions….WAC 458-07-030(3) True and fair value -- Highest and best use. Unless specifically provided otherwise by statute, all propertyshall be valued on the basis of its highest and best use for assessment purposes. Highest and best use is themost profitable, likely use to which a property can be put. It is the use which will yield the highest return on theowner's investment. Any reasonable use to which the property may be put may be taken into consideration andif it is peculiarly adapted to some particular use, that fact may be taken into consideration. Uses that are withinthe realm of possibility, but not reasonably probable of occurrence, shall not be considered in valuing propertyat its highest and best use.Current Use PropertiesThe market values of parcels enrolled in a 'current use farm and agriculture' or 'current use timber'category are set according to highest and best use. The taxable assessed value of current use timberlands and designated forest lands are set by statue by the Department of Revenue each year. Thetaxable assessed value of parcels enrolled in the Open Space Current Use Farm and Agriculture landshould be set are set according to RCW and WAC, not on Highest and Best Use. These parcelscurrent use value is set by considering “the earning or productive capacity of comparable lands fromcrops grown most typically in the area average over not less than give year, capitalized at the rate setby the Department of Revenue each year. (RCW 84.34.065 WAC 458-30-260) Typically the net cashrental- which represents the leases of farm and agricultural land paid on an annual basis is divided bythe 2012 capitalization rate of 7.06% to determine its current use value. Based on requirements fromthe Department of Revenue’s audits of <strong>Klickitat</strong> <strong>County</strong>’s Current Use Program in 2004, 2009 and2011, we have changed the method of valuing current use farm and agriculture lands to followstatute. This year represents the first year that <strong>Klickitat</strong> <strong>County</strong> has had an Open Space Advisory

Board since 2001 as a method in assisting the Assessor’s office in implementing assessmentguidelines for current use values for farm and agriculture parcels. The advisory committee does notgive advice regarding the valuation of specific parcels however; they supply the Assessor with adviceon typical crops, land quality, leases and expenses. This information assists the Assessor indetermining the appropriate current use values (RCW 84.34.065). In a random selection ofagriculture lands, we found that many current use values haven’t change since 2001 and the 2004audit by the Department of Revenue found “some accounts have had the same value since 1999.”The 2011 Open Space Advisory Board recommended rental rates to the Assessor at their May 3,2012 meeting. All of Open Space Advisory Board meetings are open to the public and all minutes ofthe meetings are available online. The complete lease rates and subsequent rental rates areavailable online and in the separate <strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong> of Current Use.In addition, the Department of Revenue required that all ‘current use farm and agriculture lands lessthan 20 acres,’ ‘current use timber,” current use farm and agriculture conservation, ‘current use openspace” and designated forest lands home sites to be assessed at true and fair market value. Priorvalues for these home sites were at a lower integral home site value only allowed by statute forparcels 20 acres or more in the farm and agricultural land classification. In addition, prior Board of<strong>County</strong> Commissioners resolution was unclear on the value of the home site of those enrolled in thecurrent use open space land. Now the home site value is clearly at true and fair market value whilethe land is valued at 50% of the true and fair market value. These parcels have been recoded toreflect the true and fair market values resulting in a significant change in assessed value for theseparcels.Preliminary Testing Results:WAC 458-07-010 The Washington state Constitution requires that all taxes be uniform upon the same class ofproperty within the territorial limits of the authority levying the tax. In order to comply with this constitutionalmandate and ensure that all taxes are uniform, all real property must be valued in a manner consistent withthis principle of uniformity. Also, to comply with statutory and case law, the county assessor must value alltaxable real property in the county on a regular, systematic, and continuous basis.<strong>Klickitat</strong> <strong>County</strong> now values all taxable real property in the county annually. To help determine if theproperty tax is distributed fairly for local governments and taxing districts, IAAO recommends usingratio studies to measure mass appraisal performance. The Ratio studies measure two primaryaspects of mass appraisal accuracy level and uniformity. In a ratio study, market values arerepresented by qualified individual market transactions or sales prices. The ratios used in a ratiostudy are formed by dividing appraised values made for tax purposes by actual sales prices. Forexample, a property appraised for tax purposes at $80,000 and sold for $100,000 has a ratio of .80 or80 percent. This measures the Level of Assessments and the Assessor is required by statue to valueat 1.00 or 100% percent of market value. Level of Assessment relates to the overall or averagerelationship between assessed values and market valuesUniformity of Assessments relates to the consistency or equity of individual assessments. Uniformitymeasures the extent to which properties are assessed uniformly or at the same percentage of marketvalue. Good uniformity is associated with equitable assessments. Poor uniformity implies inequitableassessments. To measure the uniformity or the fair equitable treatment of individual propertiesadditional statistical analysis is conducted on the ratios. The most common measure is the coefficientof dispersion (COD), which provides a measure of appraisal uniformity independent of the level of

appraisal. IAAO recommends a COD for single family residential homes of 20.0 or less. CompleteIAAO Ratio Study Performance Standards are included in the appendix of this report.Preliminary to the initiation of the 2012 revaluation, ratio studies were conducted to measure therelationship of current assessed values to 2011 sales prices and to determine examine the uniformityof assessments in <strong>Klickitat</strong> <strong>County</strong>. The Pre-Revaluation analysis showed that the past January 1,2010 assessed values would be not accurate and reliable if used for the assessed values for January1, 2012. To perform the Pre-revaluation analysis, the pre appraisal ratio is calculated by dividing the2010 certified value by the 2010 sales price and performing additional statistically analysis using ourComputed Aided <strong>Mass</strong> <strong>Appraisal</strong> System, ProVal.Neighborhood Description MedianRatioPost Revaluation Ratio StudyArith. Mean Weighted Mean CoefficientofDispersionPriceRelatedDifferential1010001 White Salmon Urban 0.96 0.96 0.95 3.00 1.011010002 Area 1 Commercial 1.00 1.00 1.00 0.30 1.001020001 Bingen 0.97 0.95 0.95 4.60 1.001030001 Rural White Salmon, Snowden 0.95 0.96 0.97 1.50 0.991040001 Husum to BZ Corner 0.93 0.93 0.92 3.60 1.001060001 BZ Corner to Trout Lake 0.99 0.96 0.95 3.40 1.002010002 Lyle I 1.00 1.00 1.00 1.00 1.012010004 Area 2 Commercial n/a n/a n/a n/a n/a2020012 Lyle II 0.96 0.96 0.95 2.70 1.012020013 Dallesport Murdock 0.99 0.98 0.98 2.10 1.002030012 Appleton, <strong>Klickitat</strong>, and Surrounding 0.97 0.94 0.96 4.40 0.992050014 Rural Glenwood 0.94 0.95 0.94 2.80 1.022060500 Glenwood, <strong>Klickitat</strong> Urban 0.99 0.97 0.96 2.60 1.013010001 Area 3 Commercial 0.96 0.96 0.98 3.70 0.973010015 Centerville and Surrounding 0.97 0.97 0.96 3.30 1.013010016 Goldendale Urban I 0.97 0.96 0.96 3.20 1.003010017 Goldendale Urban II 1.00 1.00 1.00 0.00 1.003020001 Wishram and River Communities 0.96 0.96 0.96 2.60 1.003040001 N NW Goldendale Rural 0.95 0.94 0.94 4.20 1.004010001 Area 4 Commercial n/a n/a n/a n/a n/a4040001 Bickleton Rural and Surrounding 0.93 0.93 0.95 3.20 0.984040002 Roosevelt and River Communities 1.00 1.00 1.00 0.00 1.004040003 NE Goldendale Rural 0.97 0.96 0.96 3.40 1.014060001 Bickleton Urban 0.82 0.82 0.82 0.00 1.00Model Specification<strong>Klickitat</strong> <strong>County</strong> uses a "mass appraisal" process to appraise the more than 19,000 real propertieseach year. "<strong>Mass</strong> appraisal" is the processes of valuing large numbers of properties as of a givendate, using standard methods, employing common data and allowing for statistical testing. Standardprocedures are used to collect property data, analyze data, apply the results of the analysis andreport the results. <strong>Klickitat</strong> <strong>County</strong> uses a Sales Adjusted Cost Approach to assessment value wherethe base model is specified by using a Computer Aided <strong>Mass</strong> <strong>Appraisal</strong> System called ProVal whichis owned by the parent company Thompson and Reuter. The ProVal cost model is a derivative of theMarshall & Swift® valuation service cost approach. This approach is often referred by ProVal as aMarket Calibrated Stratified Cost Approach. This computer program applies market derived land

ates by neighborhood and property type. Computer programs apply building costs and depreciationfactors calibrated to local market conditions using sales data, by neighborhood, building style, gradeof construction, and building condition. This approach uses both the cost approach to value and thecomparable sales approach to value.The income approach is not applicable to the appraisal of land, single family residences ormanufactured homes and therefore the income approach was not considered in determiningassessed value. The income approach is applicable in the use of commercial real property valuation.Data RequirementsThe data management system is the heart of the mass appraisal system. Property characteristicsdata are used in the analysis and valuation system to conduct research and to generate values.Some property characteristics that IAAO considers factors that influence the valuation of land werenot in the current property records store in the ProVal system. Major factors that influence thevaluation of land are location, soil and subsoil conditions, climate, utilities, size, shape, topography,appearance, proximity to supporting facilities, drainage and in <strong>Klickitat</strong> <strong>County</strong> views. Our staff hasspent a considerable amount of time adding in the size, topography and view codes for parcels. Wediscovered over 3,500 parcels without any size data in their property records. It appears that the prioradministration lumped parcels into size ranges and gave them lump sum values based on appraiserknowledge. We have improved this method of valuation by entering the size for the majority ofparcels and letting the sales of other parcels set the values of parcels in the Proval System givingconsideration to size. We intend to continue to work toward fully recording and verifying all thecharacteristics in our database that influence value as the time constraints set by statute and thelimited work force and financial resources available allow.The appraisal staff relies on a number of tools to collect and verify property characteristics including: Physical Inspection of Properties Maps including but not limited to:o Aerialso Topographic Maps,o Wetland and Stream Mapso Easement Mapso Utility Mapso Zoning Mapso Comprehensive Plan Mapso UGA Mapso Any map that conveys property characteristic data Blueprints Multiple Listing Service Real Estate Flyers & Brochures Real Estate Web Sites NADA Mobile Home ValuesProperty characteristics data is maintained annually from the various maps, through sales review andproperty re-inspections per the approved revaluation plan. Property characteristics may also beverified and updated in the course of re-inspection of a property in the course of perfecting the<strong>Assessor's</strong> answer to an appeal or in response to a value review initiated by a taxpayer.

Data is captured in ProVal.Sales review notes are contained in the analysis spreadsheets and in the <strong>Assessor's</strong> PropertySystem Database ProVal.Model ChosenSales Adjusted Cost Approach for all residential propertiesCost Approach for outbuildings and miscellaneous structures.Value Model CalibrationModel calibration is conducted using ratio studies. The standards applied are those published by theIAAO, July 2007. The level of appraisal is set by RCW.In 2011, preliminary initial ratio studies indicated a need to recalibrate the valuation model(s). Thefollowing steps were employed:1. Recalibration of the base Single Family Residential improvement model2. Update of the land value model / land tables3. Recalibration of the whole property value model.LandWhen sufficient land sales exist, the land calibration is based wholly on land sales. When there areinsufficient land sales, land values are abstracted from improved property sales.Land sales were inspected and their property characteristics verified. The sales were entered on aspreadsheet and stratified by land type, size and other property characteristics. A preliminary landtable was developed and ratio study performed to determine how effective the land model is inpredicting the sales prices. The number and type of land sales available were insufficient to constructthe entire land model so a combination of land sales and residuals were used.Single Family Residences, Manufactured HomesInitial ratio analysis indicated the need to recalibrate the base Single Family Residential value model.The initial calibration of the base single family residential model was based upon the sales of homes.The cost model was adjusted until the ratio studies produced acceptable performance statistics forboth level of appraisal (ratio) and uniformity (see tables later in this document). Base cost modeladjustments include adjusting the base rate cost tables and setting the base house type model.The performance of the base cost model was evaluated on a neighborhood by neighborhood basis;house type by house type; and by year built and specific location and the base cost model refineduntil it produces acceptable performance statistics. Refinements to the base cost model were madeusing house type factor models (applied universally by neighborhood by house style), the applicationof improvement modifiers (AKA Market Modifiers or Relative Desirability Factors (RDF)), lump sum orpercentage land factors and modifications to depreciation tables. Refer to the model performancesummary analysis tables for details.

RCW 84.04.090The term real property shall also include a mobile home which has substantially lost its identity as a mobile unitby virtue of its being permanently fixed in location upon land owned or leased by the owner of the mobile homeand placed on a permanent foundation (posts or blocks) with fixed pipe connections with sewer, water, or otherutilities: PROVIDED, That a mobile home located on land leased by the owner of the mobile home shall besubject to the personal property provisions of chapter 84.56 RCW and RCW 84.60.040.Manufactured Homes – In Parks and on Leased LandThe value of manufactured homes in parks and on leased land may be significantly different than thevalue of manufactured homes on land owned by the owner. The manufactured home on leased landdoes not have the ability to be sold as a package unit. This limits the marketability of themanufactured home and does not allow for the application of improvement modifiers that mayincrease the value of the mobile home based on desirability of location. In addition, they do not meetthe requirements of RCW 84.04.090 to qualify as real property (the treasurer does not have the abilityto charge personal property taxes against the real property they are located on). These mobilehomes are not exempt from personal property taxation. The Assessor’s office has used the SalesAdjusted Cost Approach for Manufactured Homes in parks and on leased land to determine theirmarket value.Initial ratio analysis indicated the need to recalibrate the Manufactured Home value model. Theanalysis was performed county wide and the final model was applied to all manufactured homeslocated in parks and on leased land.Final Testing and Reconciliation:Final value determinations were based on a careful analysis of the quantity and quality of dataavailable to each estimation approach as well as validation through the performance statisticsproduced at the conclusion of each of the approaches used and the final testing validation. ThePost Revaluation Ratio Study results all show that the changes made meet all of the standards set bythe IAAO.Public Disclosure:Disclosure to the taxpaying public of values of individual properties should be administered throughnormal jurisdictional processes. The value in this report may change as a result of processesfollowing that disclosure.Certification of <strong>Appraisal</strong> The appraisers are accredited by the State of Washington, Department of Revenue. By signingthis report, the Appraiser certifies that he or she has the appropriate knowledge andexperience to complete this <strong>Assessor's</strong> <strong>Report</strong> of the <strong>Mass</strong> <strong>Appraisal</strong>, with professionalassistance if required and disclosed. To the best of the Appraisers’ knowledge and belief, all statements and information in thisreport are true and correct, and the Appraiser has not knowingly withheld any significantinformation The reported analyses, opinions and conclusions are limited only by the reported assumptionsand limiting conditions, and is the appraisers’ personal, impartial and unbiased professionalanalysis, opinions and conclusions.

The appraisers have no bias with respect to any property that is the subject of this report or tothe parties involved with this assignment.The appraisers’ engagement in this assignment was not contingent upon developing orreporting predetermined results.The appraisers’ compensation for completing this assignment is not contingent upon thereporting of a predetermined value or direction in value that favors the cause of the client, theamount of the value opinion, the attainment of a stipulated result, or the occurrence of asubsequent event directly related to the intended use of this appraisal.The appraisers’ analyses, opinions, and conclusions were developed and this report has beenprepared, in conformity with the Uniform Standards of Professional <strong>Appraisal</strong> Practice(USPAP).Inspections were performed by members of the <strong>Klickitat</strong> <strong>County</strong> <strong>Assessor's</strong> <strong>Office</strong> inaccordance with the 2010 – 2013 revaluation plan approved by the Washington StateDepartment of Revenue, November 5, 2009.<strong>Assessor's</strong> <strong>Office</strong> mass appraisal is a team effort. Significant participants and tasks are listed below:Property Inspections and Data CollectionKaren Reisenauer, Supervisor AssessorAdam DeHart, AppraiserDan McCabe, AppraiserDarlene Johnson, AssessorModel Specification:Thompson Reuter – ProVal implementation of Marshall & Swift® cost approach.ProVal is a licensed re-distributor of the Marshall & Swift® cost data.<strong>Klickitat</strong> <strong>County</strong> is a licensed user of the Marshall & Swift® cost data.Model Calibration / Analysis and Statistics:Karen Reisenauer, Supervisor AssessorDarlene Johnson, AssessorSignature: ___________________________Date: _______________________________

Appendix<strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong>s – Sales:Sales meeting the following criteria are included in the ratio analysis:Sales within the Date Range of: .............................................01/01/2011 – 12/31/2010(Although not required, when available we considered sales up to 3/30/2011 to improve number andquality of sales)Sales Qualification Code: ......................................................V (valid sale)'Short Sales' and 'REO Sales' which meet the DOR ration study standards are included as 'Q' sales.Auction sales are not.In a letter dated June 30, 2009, the Department of Revenue instructed the <strong>Klickitat</strong> <strong>County</strong> Assessorto assume Short Sales and Bank Sales were qualified sales, unless the appraiser could determinethey were invalid due to another reason, i.e. Family Sale, Divorce, etc.Based on Washington State Department of Revenue Ratio Procedures Manual – April 1997, thefollowing sales were excluded from the ratio analysis: Outliers - Sales ratios (certified value divided by sales price) below 0.25 or greater than 1.75. Sales that are less than $1,000. Sales with a DOR ratio study invalid code (any sales whose qualification code is not 'V'). Sales that are not transferred by either a Warranty Deed or Real Estate Contract, with theexception of manufactured homes where the deed type is generally other than a WarrantyDeed.Additional sales excluded:Sales involving multiple parcelsSales where the prior year's appraised value did not include an improvement value by thesales price included improvements i.e. new construction that has not yet been appraised forthe current assessment year.Sales where the improvements were appraised at less than 100% as of July 31st of the priorassessment year but the sales price was for a 100% complete home.A sale that included an appraised improvement value and the improvement was subsequentlytorn down or moved and the current appraised value does not include any improvement value.A sale on a parcel that did not exist for the prior assessment year but exists for the currentassessment year (new plats, short plats, condominiums, etc). These parcels are excluded fromthe ratio report as their inclusion would distort the before and after ratio.Sales, which meet the DOR ratio study standard, but which investigation reveals to be nonmarkettransactions. These sales are denoted as such in the appraisal spreadsheets and inthe ProVal database sales file, field 'transaction type' as 'NM' (not market).

Definitions <strong>Mass</strong> <strong>Appraisal</strong> <strong>Report</strong>From Property Assessment Valuation, International Association of Assessing <strong>Office</strong>rs, 2010.Measures of <strong>Appraisal</strong> Level Definitions for Ratio Study TermsMedian Ratio- the median is the midpoint, or middle ratio, when the ratios are arrayed in order ofmagnitude. The median divides the ratios into two equal groups; therefore extreme ratios have littleeffect. IAAO standard is 0.90 to 1.10.Arithmetic Mean- the mean is the average ratio. It is found by summing the ratios and then dividingby the number of ratios. When the sample has been properly obtained and the data have beencarefully screened and processed, the mean provides a valid measure of appraisal level. IAAOstandard is 0.90 to 1.10.Weighted Mean-the weighted mean is an aggregate ratio determined by summing the appraisedvalues for the entire sample, summing the sales prices for the entire sample and divided the total ofthe appraised values by the total of the sales prices. It is a measure of central tendency. IAAOstandard is 0.90 to 1.10.Geometric Mean- a measure of central tendency computed by multiplying the values of all of theobservations by one another and then taking the result to an exponent equal to one divided by thenumber of observations. The geometric mean is particularly appropriate when typical rate of changeis being calculated such as an inflation rate or a cost index.Coefficient of Dispersion (COD)-is the most used measure of uniformity ratio studies. The COD isbased on average absolute deviations but expresses it as a percentage. Thus the COD provides ameasure of appraisal uniformity independent of the level of appraisal and permits directioncomparisons among property groups. IAAO standard for Older, Heterogeneous Areas is 15.0 or less,Rural Residential and Seasonal is 20.0 or less.Standard Deviation is a measure of dispersion. It is computed by subtracting the mean from eachratio, squaring the resulting differences, summing the squared differences, dividing by the number ofratios less 1 to obtain the variance of ratios, and computer the square root to obtain the standarddeviation.Coefficient of Variation (COV) expresses the standard deviation as a percentage makingcomparison of appraisal levels between groups easier.Priced Related Differential (PRD) is a statistics for measuring assessment regressivity orprogressivity. <strong>Appraisal</strong>s are considered regressive if high-value properties are under-appraisedrelative to low-value property and progressive if high-value property are relatively over-appraised. Itis calculated by dividing the mean by the weighted mean. A PRD greater than 1.00 suggests thathigh-value parcels are under-appraised, thus pulling the weighted mean below the mean. On theother, if PRD is less than 1.00, high-value parcels are relatively over appraised, pulling the weightedmean above the mean.

Confidence Level is the required degree of confidence in a statistical test or confidence interval;commonly, 90, 95 or 99 percent. A 95 percent confidence interval would mean, for example, that onecan be 95 percent confident that the population measure (such as the median or mean appraisalratio) falls in the indicated range.Computer Aided <strong>Mass</strong> <strong>Appraisal</strong> (CAMA)- is a system of appraiser property, usually only certaintypes of real property, that incorporates computer-supported statistical analysis such as multipleregression analysis and adaptive estimation procedure to assist the appraiser in estimating value.International Association of Assessing <strong>Office</strong>rs (IAAO) is an international leader in the massappraisal and ad valorem taxation community. Its members have been valuing property of all typesfor more than 75 years by using proven valuation techniques that are taught and endorsed by IAAO.<strong>Klickitat</strong> <strong>County</strong> NeighborhoodsA neighborhood comprises complementary land uses in which all properties are similarly influence bythe factors affecting property value. We anticipate a significant change in the boundaries ofneighborhoods in the next few years as we work to improve the boundaries of neighborhoods for thepurpose of analysis. Larger neighborhoods will improve the number of sales used for analysis andimprove the quality of analysis.Neighborhood Description Parcels1010001 White Salmon 17291010002 Area 1 Commercial 2851020001 Bingen 2661030001 Rural White Salmon, Snowden 9841040001 Husum to BZ Corner 9031060001 BZ Corner to Troutlake 10572010001 Area 2 Commercial Government 912010004 Area 2 Commercial 982010002 Lyle Residential 3162020012 Lyle Residential II 1152020013 Dallesport Murdock 8282030012 Appleton, <strong>Klickitat</strong>, Wahkiacus 16612050014 Glenwood and surrounding range 9592060500 Glenwood <strong>Klickitat</strong> Residential 2713010001 Area 3 Commercial 2983010005 Area 3 Wind Towers 1373010015 Centerville and surrounding 10643010016 Goldendale Residential 15463010017 Goldendale Residential II 453020001 Wishram and River Communities 5783040001 N NW Goldendale Rural 20554010001 Area 4 Commercial 754040003 NE Goldendale Rural 19134040001 Bickleton and surrounding 12434040002 Roosevelt and River 7464040008 Area 4 Wind Towers 3384060001 Bickleton Urban 108

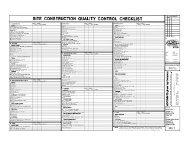

<strong>Klickitat</strong> <strong>County</strong> House TypesHouse TypeNumber Description Detailed Description11 Small Bungalow 0 Bsmt Pre 1940's homes12 Bungalow 750-999 0 Bsmt without a basement13 Bungalow 1000-1499 0 Bsmt14 Bungalow 1500-1799 0 Bsmt15 Bungalow 1800-2299 0 Bsmt16 Large Bungalow 2300+ 0 Bsmt17 Small Bungalow Pre 1940's homes18 Bungalow 750-999 with a basement19 Bungalow 1000-149920 Bungalow 1500-179921 Bungalow 1800-229922 Large Bungalow 2300+23 Small Vintage Multi Story 0 Bsmt Pre 1940's multi-24 Vintage Multi Story 750-999 0 Bsmt story homes without25 Vintage Multi Story 1000-1499 0 Bsmt a basement26 Vintage Multi Story 1500-1799 0 Bsmt27 Vintage Multi Story 1800-2299 0 Bsmt28 Large Vintage Multi Story 2300+ 0 Bsmt29 Small Vintage Multi Story Pre 1940's multi-30 Vintage Multi Story 750-999 story homes with31 Vintage Multi Story 1000-1499 a basement32 Vintage Multi Story 1500-179933 Vintage Multi Story 1800-229934 Vintage Multi Story 2300 +35 Large Historic Grand 0 Bsmt High End Vintage36 Large Historic Grand pre-1940's36 Cabin38 Pole Building with Living39 Contemporary Architectural Custom Home40 A-Frame41 Small Square Foot Ranch 0 Bsmt Ranch 1940 - new42 Ranch 750-999 0 Bsmt without a basement43 Ranch 1000-1499 0 Bsmt44 Ranch 1500-1799 0 Bsmt45 Ranch 1800-2299 0 Bsmt46 Large Ranch 2300+ 0 Bsmt47 Small Square Foot Ranch w/bsmt Ranch 1940 -new48 Ranch 750-999 with a basement49 Ranch 1000-149950 Ranch 1500-179951 Ranch 1800-229952 Large Ranch 2300+

53 Multi Story 750-999 0 Bsmt Multi Story 1940 - new54 Multi Story 1000-1499 0 Bsmt without a basement55 Multi Story 1500-1799 0 Bsmt56 Multi Story 1800-2299 0 Bsmt57 Multi Story 2300+ 0 Bsmt59 Multi Story 750-999 with Bsmt Multi Story 1940 - new60 Multi Story 1000-1499 with Bsmt with a basement61 Multi Story 1500-1799 with Bsmt62 Multi Story 1800-2299 with Bsmt63 Multi Story 2300+ with Bsmt64 Split Entry 750-99965 Split Entry 1000-149966 Split Entry 1500-179967 Split Entry 1800-229968 Split Entry 2300+69 Split Level 750-999 Split - Up70 Split Level 1000-1499 2 or 3 levels above grade71 Split Level 1500-1799 crawl or basement below72 Split Level 1800-229973 Split Level 2300+74 Small SW Pre-Hud MH Less than 750 sf Pre - 197675 SW Pre-Hud MH 750-99976 SW Pre-Hud MH 1000 + sf77 DW Pre-Hud MH 800-99978 DW Pre-Hud MH 1000-149979 DW Pre-Hud MH 1500-179980 DW Pre- Hud MH 1800 - 229981 DW Pre-Hud MH 2300 +82 SW w/tipout pre-hud SW with addition pre 197683 SW w/tipout SW with addition 1977 - 198984 Converted Duplex Home converted into a duplex85 Duplex86 Duplex No Basement87 SW MH 750-999 SW mobile home 1977 newer88 SW MH 1000-149989 DW MH 800-999 DW mobile home 1977 - 198990 DW MH 1000-149991 DW MH 1500-179992 DW MH 1800-229993 DW MH 2300 +94 Triplewide MH95 Octagonal/ Round96 Geodesic Dome98 Over Garage

101 Newer DW MH 800-999 DW mobile home 1990 - new102 Newer DW MH 1000-1499103 Newer DW MH 1500-1799104 Newer DW MH 1800-2299105 Newer DW MH 2300+106 Newer Straw Bale107 Designed Solar108 Berm109 Raised Ranch Ranch Style Above Grade (Steps Up)110 Raised Split EntrySplit Entry Style Above Grade (StepsUp)111 Living Area above Attached112 Multi-Family 3-plex to 6-plex113 Cottage114 Small Log All Log Styles115 Log 750-999116 Log 1000-1499117 Log 1500-1799118 Log 1800-2299119 Large Log 2300+

IAAO <strong>Mass</strong> <strong>Appraisal</strong> StandardsRatio Study Performance Standards*Measure ofCentralTendencyCoefficient ofDispersionPrice RelatedDifferentialType of PropertySingle Family ResidentialNewer, More Homogenous Areas 0.90 to 1.10 10.0 or less 0.98 to 1.03Older, Heterogeneous Areas 0.90 to 1.10 15.0 or less 0.98 to 1.03Rural Residential and Seasonal 0.90 to 1.10 20.0 or less 0.98 to 1.03Income Producing PropertiesLarge, Urban Jurisdictions 0.90 to 1.10 15.0 or less 0.98 to 1.03Smaller, Rural Jurisdictions 0.90 to 1.10 20.0 or less 0.98 to 1.03Vacant Land 0.90 to 1.10 20.0 or less 0.98 to 1.03Other Real and Personal Property 0.90 to 1.10 Varies with localconditions0.98 to 1.03* International Association of Assessing <strong>Office</strong>rs. Standard on Automated Valuation Models (2003).