Realising Value Guinness Peat Group plc

Annual Report 2012 - Coats plc

Annual Report 2012 - Coats plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

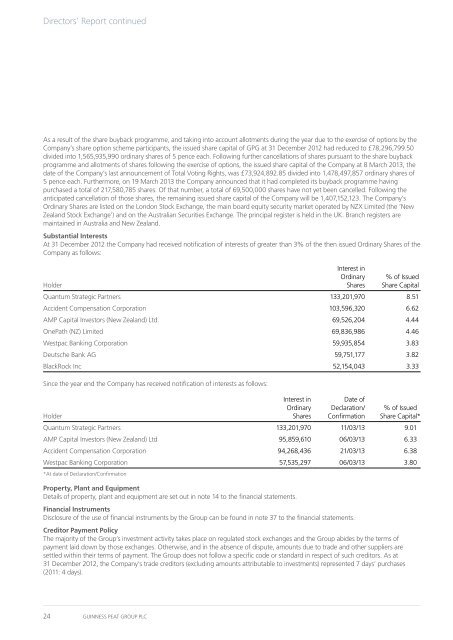

Directors’ Report continuedAs a result of the share buyback programme, and taking into account allotments during the year due to the exercise of options by theCompany’s share option scheme participants, the issued share capital of GPG at 31 December 2012 had reduced to £78,296,799.50divided into 1,565,935,990 ordinary shares of 5 pence each. Following further cancellations of shares pursuant to the share buybackprogramme and allotments of shares following the exercise of options, the issued share capital of the Company at 8 March 2013, thedate of the Company’s last announcement of Total Voting Rights, was £73,924,892.85 divided into 1,478,497,857 ordinary shares of5 pence each. Furthermore, on 19 March 2013 the Company announced that it had completed its buyback programme havingpurchased a total of 217,580,785 shares. Of that number, a total of 69,500,000 shares have not yet been cancelled. Following theanticipated cancellation of those shares, the remaining issued share capital of the Company will be 1,407,152,123. The Company’sOrdinary Shares are listed on the London Stock Exchange, the main board equity security market operated by NZX Limited (the ‘NewZealand Stock Exchange’) and on the Australian Securities Exchange. The principal register is held in the UK. Branch registers aremaintained in Australia and New Zealand.Substantial InterestsAt 31 December 2012 the Company had received notification of interests of greater than 3% of the then issued Ordinary Shares of theCompany as follows:Interest inHolderOrdinaryShares% of IssuedShare CapitalQuantum Strategic Partners 133,201,970 8.51Accident Compensation Corporation 103,596,320 6.62AMP Capital Investors (New Zealand) Ltd. 69,526,204 4.44OnePath (NZ) Limited 69,836,986 4.46Westpac Banking Corporation 59,935,854 3.83Deutsche Bank AG 59,751,177 3.82BlackRock Inc 52,154,043 3.33Since the year end the Company has received notification of interests as follows:HolderInterest inOrdinarySharesDate ofDeclaration/Confirmation% of IssuedShare Capital*Quantum Strategic Partners 133,201,970 11/03/13 9.01AMP Capital Investors (New Zealand) Ltd 95,859,610 06/03/13 6.33Accident Compensation Corporation 94,268,436 21/03/13 6.38Westpac Banking Corporation 57,535,297 06/03/13 3.80*At date of Declaration/ConfirmationProperty, Plant and EquipmentDetails of property, plant and equipment are set out in note 14 to the financial statements.Financial InstrumentsDisclosure of the use of financial instruments by the <strong>Group</strong> can be found in note 37 to the financial statements.Creditor Payment PolicyThe majority of the <strong>Group</strong>’s investment activity takes place on regulated stock exchanges and the <strong>Group</strong> abides by the terms ofpayment laid down by those exchanges. Otherwise, and in the absence of dispute, amounts due to trade and other suppliers aresettled within their terms of payment. The <strong>Group</strong> does not follow a specific code or standard in respect of such creditors. As at31 December 2012, the Company’s trade creditors (excluding amounts attributable to investments) represented 7 days’ purchases(2011: 4 days).24 GUINNESS PEAT GROUP PLC