Realising Value Guinness Peat Group plc

Annual Report 2012 - Coats plc

Annual Report 2012 - Coats plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

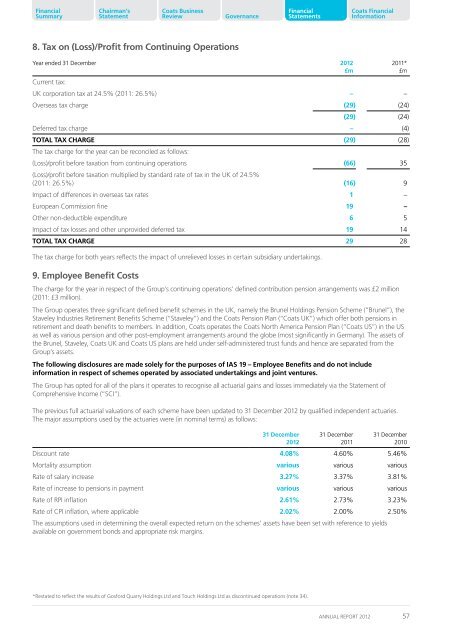

FinancialHighlights SummaryChairman’sStatementCoats BusinessReviewGovernanceFinancialStatementsCoats FinancialInformation8. Tax on (Loss)/Profit from Continuing OperationsYear ended 31 December 2012£mCurrent tax:UK corporation tax at 24.5% (2011: 26.5%) – –Overseas tax charge (29) (24)2011*£m(29) (24)Deferred tax charge – (4)TOTAL TAX CHARGE (29) (28)The tax charge for the year can be reconciled as follows:(Loss)/profit before taxation from continuing operations (66) 35(Loss)/profit before taxation multiplied by standard rate of tax in the UK of 24.5%(2011: 26.5%) (16) 9Impact of differences in overseas tax rates 1 –European Commission fine 19 –Other non-deductible expenditure 6 5Impact of tax losses and other unprovided deferred tax 19 14TOTAL TAX CHARGE 29 28The tax charge for both years reflects the impact of unrelieved losses in certain subsidiary undertakings.9. Employee Benefit CostsThe charge for the year in respect of the <strong>Group</strong>’s continuing operations’ defined contribution pension arrangements was £2 million(2011: £3 million).The <strong>Group</strong> operates three significant defined benefit schemes in the UK, namely the Brunel Holdings Pension Scheme (“Brunel”), theStaveley Industries Retirement Benefits Scheme (“Staveley”) and the Coats Pension Plan (“Coats UK”) which offer both pensions inretirement and death benefits to members. In addition, Coats operates the Coats North America Pension Plan (“Coats US”) in the USas well as various pension and other post-employment arrangements around the globe (most significantly in Germany). The assets ofthe Brunel, Staveley, Coats UK and Coats US plans are held under self-administered trust funds and hence are separated from the<strong>Group</strong>’s assets.The following disclosures are made solely for the purposes of IAS 19 – Employee Benefits and do not includeinformation in respect of schemes operated by associated undertakings and joint ventures.The <strong>Group</strong> has opted for all of the plans it operates to recognise all actuarial gains and losses immediately via the Statement ofComprehensive Income (“SCI”).The previous full actuarial valuations of each scheme have been updated to 31 December 2012 by qualified independent actuaries.The major assumptions used by the actuaries were (in nominal terms) as follows:31 December201231 December201131 December2010Discount rate 4.08% 4.60% 5.46%Mortality assumption various various variousRate of salary increase 3.27% 3.37% 3.81%Rate of increase to pensions in payment various various variousRate of RPI inflation 2.61% 2.73% 3.23%Rate of CPI inflation, where applicable 2.02% 2.00% 2.50%The assumptions used in determining the overall expected return on the schemes’ assets have been set with reference to yieldsavailable on government bonds and appropriate risk margins.*Restated to reflect the results of Gosford Quarry Holdings Ltd and Touch Holdings Ltd as discontinued operations (note 34).ANNUAL REPORT 201257