Realising Value Guinness Peat Group plc

Annual Report 2012 - Coats plc

Annual Report 2012 - Coats plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

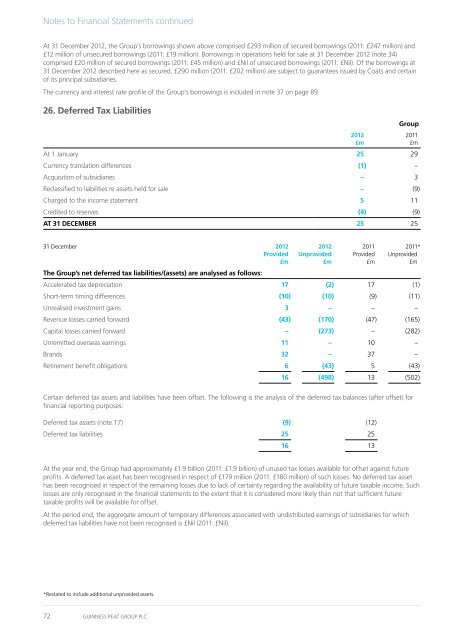

Notes to Financial Statements continuedAt 31 December 2012, the <strong>Group</strong>’s borrowings shown above comprised £293 million of secured borrowings (2011: £247 million) and£12 million of unsecured borrowings (2011: £19 million). Borrowings in operations held for sale at 31 December 2012 (note 34)comprised £20 million of secured borrowings (2011: £45 million) and £Nil of unsecured borrowings (2011: £Nil). Of the borrowings at31 December 2012 described here as secured, £290 million (2011: £202 million) are subject to guarantees issued by Coats and certainof its principal subsidiaries.The currency and interest rate profile of the <strong>Group</strong>’s borrowings is included in note 37 on page 89.26. Deferred Tax Liabilities2012£m<strong>Group</strong>At 1 January 25 29Currency translation differences (1) –Acquisition of subsidiaries – 3Reclassified to liabilities re assets held for sale – (9)Charged to the income statement 5 11Credited to reserves (4) (9)AT 31 DECEMBER 25 252011£m31 December 2012Provided£mThe <strong>Group</strong>’s net deferred tax liabilities/(assets) are analysed as follows:2012Unprovided£m2011Provided£m2011*Unprovided£mAccelerated tax depreciation 17 (2) 17 (1)Short-term timing differences (10) (10) (9) (11)Unrealised investment gains 3 – – –Revenue losses carried forward (43) (170) (47) (165)Capital losses carried forward – (273) – (282)Unremitted overseas earnings 11 – 10 –Brands 32 – 37 –Retirement benefit obligations 6 (43) 5 (43)16 (498) 13 (502)Certain deferred tax assets and liabilities have been offset. The following is the analysis of the deferred tax balances (after offset) forfinancial reporting purposes:Deferred tax assets (note 17) (9) (12)Deferred tax liabilities 25 2516 13At the year end, the <strong>Group</strong> had approximately £1.9 billion (2011: £1.9 billion) of unused tax losses available for offset against futureprofits. A deferred tax asset has been recognised in respect of £179 million (2011: £180 million) of such losses. No deferred tax assethas been recognised in respect of the remaining losses due to lack of certainty regarding the availability of future taxable income. Suchlosses are only recognised in the financial statements to the extent that it is considered more likely than not that sufficient futuretaxable profits will be available for offset.At the period end, the aggregate amount of temporary differences associated with undistributed earnings of subsidiaries for whichdeferred tax liabilities have not been recognised is £Nil (2011: £Nil).*Restated to include additional unprovided assets.72 GUINNESS PEAT GROUP PLC