academic calendar 2012-2013 - GateWay Community College

academic calendar 2012-2013 - GateWay Community College

academic calendar 2012-2013 - GateWay Community College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

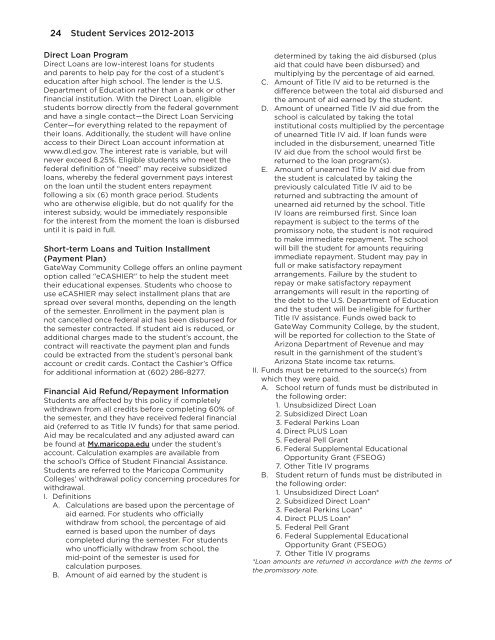

24 Student Services <strong>2012</strong>-<strong>2013</strong>Direct Loan ProgramDirect Loans are low-interest loans for studentsand parents to help pay for the cost of a student’seducation after high school. The lender is the U.S.Department of Education rather than a bank or otherfinancial institution. With the Direct Loan, eligiblestudents borrow directly from the federal governmentand have a single contact—the Direct Loan ServicingCenter—for everything related to the repayment oftheir loans. Additionally, the student will have onlineaccess to their Direct Loan account information atwww.dl.ed.gov. The interest rate is variable, but willnever exceed 8.25%. Eligible students who meet thefederal definition of “need” may receive subsidizedloans, whereby the federal government pays intereston the loan until the student enters repaymentfollowing a six (6) month grace period. Studentswho are otherwise eligible, but do not qualify for theinterest subsidy, would be immediately responsiblefor the interest from the moment the loan is disburseduntil it is paid in full.Short-term Loans and Tuition Installment(Payment Plan)<strong>GateWay</strong> <strong>Community</strong> <strong>College</strong> offers an online paymentoption called “eCASHIER” to help the student meettheir educational expenses. Students who choose touse eCASHIER may select installment plans that arespread over several months, depending on the lengthof the semester. Enrollment in the payment plan isnot cancelled once federal aid has been disbursed forthe semester contracted. If student aid is reduced, oradditional charges made to the student’s account, thecontract will reactivate the payment plan and fundscould be extracted from the student’s personal bankaccount or credit cards. Contact the Cashier’s Officefor additional information at (602) 286-8277.Financial Aid Refund/Repayment InformationStudents are affected by this policy if completelywithdrawn from all credits before completing 60% ofthe semester, and they have received federal financialaid (referred to as Title IV funds) for that same period.Aid may be recalculated and any adjusted award canbe found at My.maricopa.edu under the student’saccount. Calculation examples are available fromthe school’s Office of Student Financial Assistance.Students are referred to the Maricopa <strong>Community</strong><strong>College</strong>s’ withdrawal policy concerning procedures forwithdrawal.I. DefinitionsA. Calculations are based upon the percentage ofaid earned. For students who officiallywithdraw from school, the percentage of aidearned is based upon the number of dayscompleted during the semester. For studentswho unofficially withdraw from school, themid-point of the semester is used forcalculation purposes.B. Amount of aid earned by the student isdetermined by taking the aid disbursed (plusaid that could have been disbursed) andmultiplying by the percentage of aid earned.C. Amount of Title IV aid to be returned is thedifference between the total aid disbursed andthe amount of aid earned by the student.D. Amount of unearned Title IV aid due from theschool is calculated by taking the totalinstitutional costs multiplied by the percentageof unearned Title IV aid. If loan funds wereincluded in the disbursement, unearned TitleIV aid due from the school would first bereturned to the loan program(s).E. Amount of unearned Title IV aid due fromthe student is calculated by taking thepreviously calculated Title IV aid to bereturned and subtracting the amount ofunearned aid returned by the school. TitleIV loans are reimbursed first. Since loanrepayment is subject to the terms of thepromissory note, the student is not requiredto make immediate repayment. The schoolwill bill the student for amounts requiringimmediate repayment. Student may pay infull or make satisfactory repaymentarrangements. Failure by the student torepay or make satisfactory repaymentarrangements will result in the reporting ofthe debt to the U.S. Department of Educationand the student will be ineligible for furtherTitle IV assistance. Funds owed back to<strong>GateWay</strong> <strong>Community</strong> <strong>College</strong>, by the student,will be reported for collection to the State ofArizona Department of Revenue and mayresult in the garnishment of the student’sArizona State income tax returns.II. Funds must be returned to the source(s) fromwhich they were paid.A. School return of funds must be distributed inthe following order:1. Unsubsidized Direct Loan2. Subsidized Direct Loan3. Federal Perkins Loan4. Direct PLUS Loan5. Federal Pell Grant6. Federal Supplemental EducationalOpportunity Grant (FSEOG)7. Other Title IV programsB. Student return of funds must be distributed inthe following order:1. Unsubsidized Direct Loan*2. Subsidized Direct Loan*3. Federal Perkins Loan*4. Direct PLUS Loan*5. Federal Pell Grant6. Federal Supplemental EducationalOpportunity Grant (FSEOG)7. Other Title IV programs*Loan amounts are returned in accordance with the terms ofthe promissory note.