OE News Special Edition June 2014

OE News Special Edition June 2014

OE News Special Edition June 2014

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

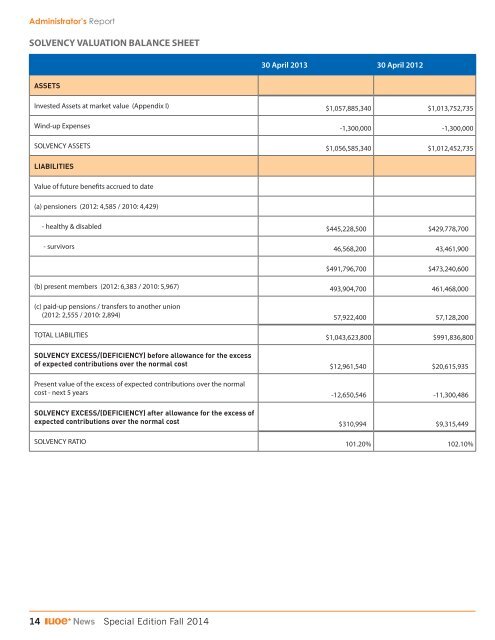

Administrator’s ReportSOLVENCY VALUATION BALANCE SHEET30 April 2013 30 April 2012ASSETSInvested Assets at market value (Appendix I) $1,057,885,340 $1,013,752,735Wind-up Expenses -1,300,000 -1,300,000SOLVENCY ASSETS $1,056,585,340 $1,012,452,735LIABILITIESValue of future benefits accrued to date(a) pensioners (2012: 4,585 / 2010: 4,429)- healthy & disabled $445,228,500 $429,778,700- survivors 46,568,200 43,461,900$491,796,700 $473,240,600(b) present members (2012: 6,383 / 2010: 5,967) 493,904,700 461,468,000(c) paid-up pensions / transfers to another union(2012: 2,555 / 2010: 2,894) 57,922,400 57,128,200TOTAL LIABILITIES $1,043,623,800 $991,836,800SOLVENCY EXCESS/(DEFICIENCY) before allowance for the excessof expected contributions over the normal cost $12,961,540 $20,615,935Present value of the excess of expected contributions over the normalcost - next 5 years -12,650,546 -11,300,486SOLVENCY EXCESS/(DEFICIENCY) after allowance for the excess ofexpected contributions over the normal cost $310,994 $9,315,449SOLVENCY RATIO 101.20% 102.10%14 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>