OE News Special Edition June 2014

OE News Special Edition June 2014

OE News Special Edition June 2014

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

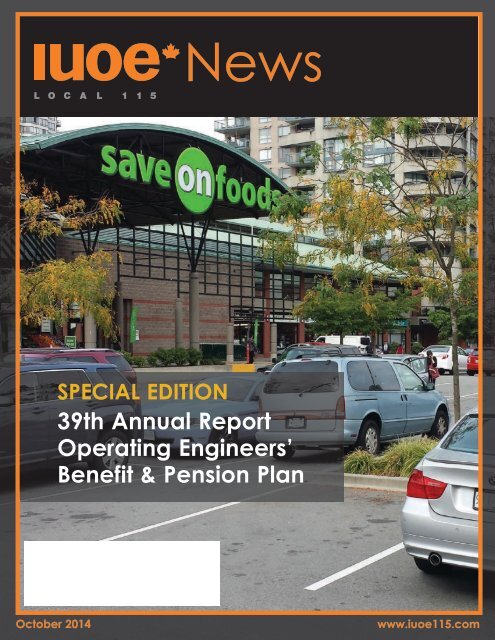

IU<strong>OE</strong> <strong>News</strong> is the officialpublication of the InternationalUnion of Operating EngineersLocal 115.ON THE COVER <strong>OE</strong>PP Owned Columbia SquarePlaza welcomes new tenant – Save On Foods onAugust 1st, <strong>2014</strong>.Local Executive BoardBusiness ManagerBrian CochranePresidentWayne E. MillsVice-PresidentBrad RandallRecording SecretaryBrian LefebvreFinancial SecretaryDon SwerdanTreasurerFrank CarrGuardEverett CummingsConductorDoug FisherTrusteesBrett ChapmanCurtis WrightAuditorsChip DhaliwalGoretti GuibaultCraig McIntoshDistrict Executive Board1 - Al Cooper2 - Curtis Harold3 - Brad Gerow4 - Herb Conat5 - Mike Spiruda6 - Rob FoskettPublication CommitteeBrian CochraneWayne MillsLynda ArlandDon SwerdanEditorial ServicesSarita Stad, COPE 378Design and Layoutwww.workingdesign.netContact Details4333 Ledger Avenue,Burnaby, B.C., V5G 3T3Telephone: 604-291-8831Fax: 604-473-5235Website: www.iuoe115.comE-mail: iuoe@iuoe115.comPensioners enjoying the September 2013 Annual Pension Social.REPORTSInvestment strategy proving successfulBrian Cochrane, Chairman.................................................................................................. 1Preparing for a challenging year aheadTrustees................................................................................................................................ 3Letter from Income Security ConsultantStrategic Income Security Services..................................................................................... 4Letter from ActuaryMorneau Shepell................................................................................................................. 5Administrator’s ReportShawn Hatch, Administrator............................................................................................... 6Operating Engineers’ Pension Plan Summarized Financial Statements............. 18Operating Engineers’ Benefits Plan Summarized Financial Statements ............ 28FEATURERetirees’ Social Evening September 2013.................................................................. 23PleaseRecycle

Message from the ChairmanInvestmentstrategy isproving successfulBrian Cochrane,Business ManagerDear Brothers and Sisters,In keeping with our proud traditions, I ampleased to present this 39th Annual Report, onbehalf of the Board of Trustees and the Staff ofthe Operating Engineers’ Benefits & PensionPlans.Pension PlanManagement of the pension funds you rely onfor your retirement is a tremendously importantresponsibility, and often a challenging one. Aftermany years of historically consistent low interestrates, this past year saw a volatile rise and subsequentfall in interest rates.Your Board of Trustees’ primary objective isto ensure the greatest certainty possible withrespect to the payment of the benefits that thePlan has promised to provide. I am thereforepleased to report that the investment strategyadopted by the Board is proving successful inachieving this goal during times of volatility.Throughout the past year, the Board hasreceived many reports and presentations fromeconomists, investment managers and otherprofessional advisors. Based on this informationthe Board has concluded that only minor adjustmentsto its investment strategy are required.Our investment portfolios are heavily weightedtowards fixed-income assets. This strategy isin-line with the conservative approach requiredin the management of a mature pension plansuch as ours. However, we will continue to seekalternative investments which meet our risk toleranceand investment return requirements.Given the particular assets we have selectedtheir value continues to respond to interest ratechanges in the same way as the value of our liabilitiesdo. Declines in interest rates have been anissue for pension plans. Our investment strategyhas, by design, largely protected us from thisissue.Benefits PlanThe past year saw significant increases in thecost of providing benefits.This is due in part to yet another 3% increasein MSP premiums and increased drug claimcosts due to point of purchase drug claim reimbursementthrough the Pacific Blue Cross drugcard. Overall, in 2013 Extended Health Benefitclaims rose by 22%.Your Board of Trustees continue to monitorbenefit plan costs closely so that the plan willcontinue to be able toprovide quality coverageMembership growth leads tofor our members andincreased market share whichtheir families.The good news is that in turn builds the Union’sfor 2013, contributions strength for the future.to the benefits plan roseby over $1,000,000 representing an 8% increase.This is a sign of an improved work picture andthe organizing efforts of our Union.In ClosingIn closing it is important to note that the prudentinvestment strategies and fiscal management ofthe benefits plan can only go so far in securingthe long-term stability of the <strong>OE</strong>BPP. The otherkey factor is membership which drives increasedhours of covered employment.Membership growth leads to increased marketshare which in turn builds the Union’sstrength for the future. We also need to maintaina constant influx of new and younger membersto provide a balance to an aging demographic.The Local Union Executive Board is very committedto these values which will keep our mem-<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 1

Message from the Chairmanbership and finances on very stable footing. Withyour assistance, we will be successful in reachingthese goals which will in turn, over time, increaseour market share, increase our bargainingstrength, and continue to provide strength to ourbenefits and pension plans.Our organizing efforts continue to focus onbuilding the Union. Your organizers cannot dothis in isolation, we all have a large stake in thisand we all need to play a role. The best contributionyou can make is to be informed and engagedwith the growth of the Union by helping to signup new members.Anti-worker groups continually try to discreditthe rights of our members who benefitfrom plans such as ours. We at the IU<strong>OE</strong> believeworkers have the right to “Rise Above” and thatthe best way to reach that goal is a sound definedbenefit pension plan and a well-designed benefitsplan such as ours.Friday August 1st Save On Food held itsFriends and Family opening celebration forits new store located in Columbia SquarePlaza (<strong>OE</strong>PP Owned). Save On Foodscorporate and store management were inattendance, as was New Westminster CityCouncillor Jaimie McEvoy. However, themost notable attendees were Darrell Jones,President of the Overwaitea Food Group,Glen Clark, former BC premier and nowPresident of The Jim Pattison Group, and,Jimmy Pattison himself!Jimmy Pattison and Columbia Square PlazaProperty Manager Roy Hamilton.Jimmy Pattison and Dennis Van denHooff, IU<strong>OE</strong> Local 115 Controller.Save On Foods store and corporate management ribbon cutting ceremony.2 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Message from the TrusteesPreparing for a challenging year aheadBrian CochraneTrustee/ChairmanWayne KempBrad RandallTrustee/SecretaryFrank CarrBrian LefebvreBrian SavageSince the last report to members of the OperatingEngineers’ Benefits and Pension PlansTrustee Tim Cullen has retired. We thank Timfor his continued commitment and dedicationover the past years. Wayne Kemp has beenappointed to fill the position left by BrotherCullen. Welcome Brother Kemp.This past year there have been 6 meetings ofthe Pension Plan trustees and 3 meetings of theBenefits Plan trustees. In addition, the Trusteesattended several educational presentationsregarding plan governance, the economy andinvestment strategy.A great deal of time was devoted to monitoringthe performance of the Pension Plan investmentsand considering whether any changes tothe overall investment policy were necessary.At this time the Trustees aresatisfied that the investment For the time being theportfolio is performing well Trustees are satisfied that theand that no major changes are investment portfolio isrequired. Looking ahead, the performing well and that noTrustees will continue to reviewmajor changes are required.the investment strategy andconsider whether a shift in strategy is required,especially if we continue to see prolonged periodsof low interest rates.The Trustees are also satisfied with theinvestment returns of the Benefits Plan trustfund.During the year, the Benefits Plan claimsincreased by 22% due largely to several benefitimprovements including long term disability,group life and the Pacific Blue Cross drug cardintroduced at the beginning of the year.The Trustees are preparing for a challengingyear ahead and are committed to working hardto continue to do the very best we can for ourmembers.Don Swerdan<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 3

4 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 5

Administrator’s ReportPension Plan maintainsstability and looksforward to a strong futureShawn Hatch,AdministratorI am pleased to present the 39th Annual Financial Statements of the Operating Engineers’Benefits and Pension Plans (<strong>OE</strong>BPP). The Auditor has prepared these statements for thereview of Plan members, and they reflect the stewardship of the Plan’s assets by yourTrustees.With the continuing and unprecedented turmoil in the world’s financial markets, your Boardof Trustees believes the move in 2002 to an Asset-Liability Matching Policy has provided yourpension plan stability during these difficult times. As described in previous editions of this<strong>Special</strong> <strong>Edition</strong> your Trustees approved this investment strategy to ensure the long-term stabilityof your pension plan.As you will read, the Plan’s basic investment strategy is unchanged from the previous year. Thisstrategy is intended to give you, the Plan members, a higher level of certainty with respect tothe benefits you are relying on for your retirement. This conservative strategy is consistentwith what a large majority of participants told us they prefer.2013 proved to be a year which saw a rapid rise in interest rates and a quick fall downwards.Our investment strategy maintained stability despite this rather unexpected volatility.Investment policy providing greater certaintyDue DiligenceThe Trustees approved the investment strategy after intensive assessment, on the basis ofextensive professional advice, and with the involvement of provincial regulators.The process began with computer modeling through which the performances of differenttypes of assets were assessed – relative to the liabilities of the plan, and in light of possiblechanges in interest rates and stock market performance. The strategy has been accepetd by theprovincial Superintendent of Pensions, who has responsibility for overseeing pension planmanagement.The strategy was scrutinized by five different actuaries: the <strong>OE</strong>PP’s own actuary, a special consultantengaged to develop the strategy, and three independent actuaries (two engaged by the<strong>OE</strong>PP, and one by the Superintendent of Pensions).This strategy isintended to giveyou, the Planmembers, a higherlevel of certaintywith respect to thebenefits you arerelying on for yourretirement.6 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Administrator’s ReportAsset-Liability Matching: The Basic PrincipleOur strategy involves both a significant adjustment in the mix and nature of assets we hold, aswell as a plan specific long term discounted cash flow assessment of the value of some of thoseassets (particularly real estate). The anticipated level of future returns will be much more certain,and the plan will be better protected from the potentially negative impact of changes ininterest rates and stock market performance.The basic principle behind an Asset-Liability Matching Policy is simple, and is summed upin the name. The policy requires us to hold assets that we expect will deliver an income streamcoming as close as possible to matching the estimated liabilities of the Plan (the promises topay benefits to members), over a given time period – regardless of what may happen to interestrates and the stock markets.The Interest Rate ImpactThe following is an example of interest rate impacts. If I want to pay you a certain amount ofmoney now, in return for your promise to pay me $1 per year indefinitely, the amount I’ll haveto pay depends on current interest rates. If rates are high, I’ll be able to pay you less, becauseyou’ll have the opportunity to invest the money I pay you at a high rate of return.In other words, I need fewer assets now to secure certain future payments when interestrates are high. And I need more assets when interest rates are low.A pension plan works the same way. The plan has assets now and needs to make certain paymentsin the future. The current value of a pension plan’s future liabilities (and therefore theassets it needs now to meet those liabilities) goes down as interest rates rise, and goes up asinterest rates drop.In other words, a pension plan needs fewer assets to make the same future payments wheninterest rates are high than when interest rates are low.This has been a growing problem in recent years as interest rates have steadily declined, resultingin an increasing level of liability for the <strong>OE</strong>PP and other pension plans. By shifting to a differentmix of assets, the Trustees believe we can protect our plan against the impact of lowinterest rates, and of interest rate changes generally.Interest Rates andPromises to PayCost of a promise of a$1/year indefinitely, atdifferent ratesCost Interest Rate$10.00 10%$16.67 6%$20.00 5%$25.00 4%$33.33 3%$50.00 2%Interest Ratesand PensionPlan LiabilitiesAsinterestratesdrop....... thevalue ofpensionplanliabilitiesrises.<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 7

Administrator’s ReportThe Plan’s Asset MixThe large majority of our assets continue to be made up of bonds. A bond is simply a promiseto re-pay a certain amount of money at a specified date, with interest payments in the interimbased on a fixed rate. It is a “fixed-income asset”, meaning that there is no doubt as to the rateof return it will deliver. The only risk relates to the survival of the bond issuer. Although thiscan be an issue with corporate bonds, it is much less of an issue with government bonds. Thepie charts below show all of the Operating Engineers’ Pension Plan assets by class and whateach manager holdsBY ASSET CLASS0.4% Real Estate –(Internal Mortgages)0.8 % Fengate CapitalManagement2.6 % Fiera Capital4.8% ACMMortgage Fund II0.3% Realcor MortgageFund (External Mortgages)Real Estate –RevenueProducing19.9%Philips Hager & North61.1%0.2% Real Estate –Non-Revenue Producing5.6% PrepaidLeases3.2% ConcertProperties1% Short-termBY INVESTMENT MANAGERPension PlanAdministrator9.8%Realty InvDivision (Total)20.5%0.3% Realcor MortgageFund (external)0.8% Fengate CapitalManagement2.6% Fiera Capital Management4.8% ACM - MortgageFund IIPhilips Hagar & North61.1% PHN –Bond Fund60.7%8 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Administrator’s ReportThe following table illustrates the investment returns of each investment manager over thepast two years:RATE OF RETURN BY ASSET MANAGER AS AT APRIL 30, 2013Total Manager ResultsJan. - Apr. 4Mths %Sep - Dec. 4Mths %May - Aug. 4Mths % 1 Year% 2 Year %Phillips Hager & North - Bond Fund 1.50% 1.20% 6.20% 9.20% 17.30%Mortgage Fund Two 2.60% 1.20% 4.40% 8.20% 11.50%Fengate Capital Management -0.60% - - - -Fiera Capital 2.80% 1.40% 6.50% 11.10% -Realty Investment Division / Realcor Mortgage Fund -3.00% 15.70% -12.50% -1.90% 7.40%Pension Plan Administrator -1.00% 8.30% -6.30% 0.60% 5.30%TOTAL FUND 0.40% 4.80% 0.60% 5.70% 13.40%The most important point, however, is what bonds do in response to interest rate changes.If interest rates are high, the value of a bond will be less than when interest rates are low. Thesame principles are at work as in the example above. The promise of fixed future payments isworth more in a low interest rate world because alternative investment opportunities are lessattractive.In other words, the current value of bonds goes down as interest rates rise, and goes up asinterest rates drop.Greater Certainty in All Investment ClimatesSince our plan’s assets continue to be heavily focused on bonds, the value of our assets andliabilities will largely move in tandem in response to future interest rate changes. If interestrates were to rise, the current value of both our liabilities and our assets would go down. Similarly,if the trend towards lower interest rates continues, both values will increase.This is the most important part of the “match” that an Asset-Liability Matching Policy requires.When there’s a match between asset and liability income streams, there’s certainty thatfuture payments can be made.In moving to bonds, we have moved away from stock market or equity assets. Equities have nofixed rate of return, and therefore cannot be reliably matched against anticipated liabilities.Also they do not respond in a predictable way to interest rate changes.As interest rates dcline, we know that the value of our future liabilities will increase. But wedon’t know what will happen to the value of the equities – it may stay the same, it may decrease,or it may increase (although the rate of increase may or may not match the rate of increase inliabilities). These multiple possible outcomes – most of which result in a mismatch betweenassets and liabilities – reduce the certainty that the plan will be able to meet its futureobligations.Because of their unpredictability, equities create inherent challenges for Trustees in the managementof pension plans. What has made matters particularly difficult in recent times is thefluctuation of asset values in the stock markets, coupled with increases in plan liabilities as aresult of declining interest rates.Interest Rates,Pension PlanLiabilities and BondsAsinterestratesdrop …... and sodoes thevalue ofbonds.... thevalue ofpensionplanliabilitiesrises …<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 9

Administrator’s ReportBetter ValuationsInherent in the <strong>OE</strong>PP’s investment strategy, and in the Asset-Liability Matching Policy thatgoverns it, is a careful and consistent assessment of the current value of both our assets andliabilities.On the liability side, we are concerned with future cash payments to members, in the years anddecades ahead. On the asset side, we therefore also need to be concerned with the long-termcash flows that will be generated.As the investment policy of the Plan is to hold revenue producing properties indefinitely andto not sell any of these properties unless an investment of better value can be obtained, thePlan values these properties using an assigned value method. The assigned value method isbased on the present value of the net future cash flows using a discounted cash flow method.The cash flows are discounted at an interest rate equal to the actuarial assumption rate used todetermine the value of the liabilities of the Plan.Greater Certainty, But Not CompleteThe Trustees believe they have achieved the most advantageous match possible between thePlan’s existing assets and liabilities.It is important to note, however, that our plan is not completely protected from the negativeeffect of interest rate changes. Our asset pool is simply not large enough, even in light of thevaluation of our real estate holdings, to put us in that position.We continue to rely on a portion of future contributions from members to pay for benefitsalready earned, a situation common to many pension plans, and largely a function of theimpact that interest rate declines and stock market volatility have already had on our plan.Looking AheadYour Trustees have determined that our investment strategy is prudent and appropriate forour plan at this point in time. They will continue to closely monitor economic and financialtrends, and the health of the Plan so that any necessary adjustments can be made in a timelyfashion.The Trusteesbelieve they haveachieved the mostadvantageous matchpossibly between thePlan’s existing assetsand liabilities.Implications of Low Interest RatesThere have been a number of articles in the media about the funded status of pension plans.Many pension plans have gotten into trouble for a variety of reasons. Most of these reasons canbe traced back to the lack of adequate investment performance based on the investment policiesbeing followed by many plans. This has resulted in plans having insufficient assets to covertheir liabilities for benefits earned to date by plan members.We are pleased to report that based on the most recent actuarial valuation of the OperatingEngineers’ Pension Plan, the total assets of the Plan are more than sufficient to cover the liabilitiesfor all benefits currently being paid and benefits earned to date by active members.Your Board of Trustees adopted an investment strategy that was designed to select assets of thePlan which would be sufficient to provide all benefits earned to date with a high degree of certainty,no matter if long term interest rates went up or down or stayed the same. The strategyinvolved investing a large portion of the Plan’s assets in a portfolio of long duration bonds.In recent years, long term interest rates have fallen significantly. However, because of ourinvestment strategy, the value of the Plan’s assets has increased at a faster rate than the value ofthe earned pension benefits. The strategy has worked well and has provided for the reductionand over time the elimination of our past under funding.10 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Administrator’s ReportBecause we are unable to invest future contributions until we receive them and because wecannot predict what interest rate levels will be when we do receive the contributions, it is notpossible to fully protect future service benefit levels against the possibility of lower interestrates. When we adopted our current investment strategy we were advised and understood thestrategy might not be able to protect future service benefit levels in a dropping interest rateenvironment, particularly where long term interest rates stay at low levels for a long period oftime as they have done recently.When most of us joined the Plan, we typically expected investment returns of 7% per annum,and this was the basis used to establish pension benefit levels. Higher long-term investmentreturns would provide for higher future benefits, all other things being equal. With that beingsaid, over the last decade the long term interest rates have fallen steadily. This means that thecost to finance benefits earned in the future has risen while the contributions made today andin the future will earn lower rates of return than expected when the benefit levels were established.The only way to offset this increased cost is to continually monitor and if necessaryamend the level of future benefits to reflect the lower interest rate environment we are currentlyliving in.To illustrate the impact of future investment returns falling from 7% per annum to 4.5% perannum, consider an active plan member, with a contribution rate of $2.45 per hour with 1,600hours of annual contributions accruing a monthly pension benefit of $70.56 per year of membership.The cost of this pension at 7% is $1.95 per hour vs. $3.12 per hour at 4.5%.You can see that if investment returns are only 4.5% per annum, the pension benefit that canbe provided is 37% lower than if the investment returns are 7% per annum. For the same pensionbenefit rate to be provided when only 4.5% per annum returns are available, contributionrates would have to be increased by 60%. To put this more simply, if we were starting a newpension plan today with the same level of contributions, we could not support the same levelof benefit for the future. A simple rule of thumb for determining the reduction needed in benefitlevels is this: for every 1% drop in long term interest rates, the required reduction in benefitlevels would be 20%. This situation affects all pension plans in our current economicenvironment.The purpose of this communication is to alert the membership that if long term interest ratesstay at present levels or continue to fall it may be necessary to adjust future service benefitslevels for accruing pension members.It is also important to note that the long-term health of our pension plan continues to dependon a strong membership, and in particular on the recruitment of new members. As the BusinessManager notes elsewhere in this report, all members have a responsibility to contribute torecruitment – and this is the best way you can support your Trustees’ ongoing work to ensurethe stability of the pension plan you rely on.<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 11

Administrator’s ReportActuarial Report (Executive Summary)Operating Engineers’ Pension PlanThe following tables are from Plan’s Actuarial Report as at April 30, 2013, prepared by Ellement& Ellement. They summarize the results of the going concern valuation, solvency valuation,and the normal actuarial cost calculation made. As the tables confirm the Board is proud toverify your Pension Plan continues to satisfy the going concern and solvency funding requirementsdespite the global economic situation we are currently living through.GOING CONCERN VALUATION 30-Apr-13 30-Apr-12Invested Assets at market value $1,057,885,340 $1,013,752,735Liabilities -1,040,326,700 -964,630,000Going Concern Excess/(Unfunded Liability) $17,558,640 $49,122,735Funded Ratio 101.70% 105.10%SOLVENCY VALUATION 30-Apr-13 30-Apr-12Invested Assets at market value less expenses $1,056,585,340 $1,012,452,735Liabilities -1,043,623,800 -991,836,800Solvency Excess/(Deficiency) before allowance for the excess of expectedcontributions over the normal cost $12,961,540 $20,615,935Present value of the excess of expected contributions over the normalcost - next 5 years -12,650,546 -11,300,486Solvency Excess/(Deficiency) after allowance for the excess of expectedcontributions over the normal cost $310,994 $9,315,449Solvency Ratio 101.20% 102.10%CONTRIBUTION REQUIREMENTS 30-Apr-13 30-Apr-12Annual Amount Amount Per Hour Annual Amount Amount Per Hour<strong>2014</strong> Plan Year 2013 Plan YearNormal Cost * $23,874,000 $3.46 $23,667,000 $3.43Going Concern minimum payment - - - -Additional amount to satisfy funding of solvency deficiency - - - -Total Required Contributions $23,874,000 $3.46 $23,667,000 $3.43Expected Contributions 20,700,000 3.00 20,700,000 3.00Excess/(Shortfall) of expected contributions over totalrequired contributions ($3,174,000) ($0.46) ($2,967,000) ($0.43)12 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Administrator’s ReportGOING CONCERN VALUATION BALANCE SHEET30-Apr-1330-Apr-12ASSETSInvested Assets at market value (Appendix I) $1,057,885,340 $1,013,752,735LIABILITIESValue of future benefits accrued to date(a) pensioners (2013: 4,667 / 2012: 4,585)- healthy & disabled $445,228,500 $418,301,700- survivors 46,568,200 42,783,000(b) present members (2013: 6,480 / 2012: 6,383)$491,796,700 $461,084,700- retirement pensions $444,077,700 $404,521,300- disability pensions 29,800 34,500- termination benefits 42,767,000 38,560,300- death benefits 10,551,600 11,265,800$497,426,100 $454,381,900(c) paid-up pensions / transfers to another union (2013: 2431 / 2012: 2,555) 51,103,900 49,163,400TOTAL LIABILITIES $1,040,326,700 $964,630,000GOING CONCERN EXCESS/(UNFUNDED LIABILITY) $17,558,640 $49,122,735FUNDED RATIO 101.70% 105.10%<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 13

Administrator’s ReportSOLVENCY VALUATION BALANCE SHEET30 April 2013 30 April 2012ASSETSInvested Assets at market value (Appendix I) $1,057,885,340 $1,013,752,735Wind-up Expenses -1,300,000 -1,300,000SOLVENCY ASSETS $1,056,585,340 $1,012,452,735LIABILITIESValue of future benefits accrued to date(a) pensioners (2012: 4,585 / 2010: 4,429)- healthy & disabled $445,228,500 $429,778,700- survivors 46,568,200 43,461,900$491,796,700 $473,240,600(b) present members (2012: 6,383 / 2010: 5,967) 493,904,700 461,468,000(c) paid-up pensions / transfers to another union(2012: 2,555 / 2010: 2,894) 57,922,400 57,128,200TOTAL LIABILITIES $1,043,623,800 $991,836,800SOLVENCY EXCESS/(DEFICIENCY) before allowance for the excessof expected contributions over the normal cost $12,961,540 $20,615,935Present value of the excess of expected contributions over the normalcost - next 5 years -12,650,546 -11,300,486SOLVENCY EXCESS/(DEFICIENCY) after allowance for the excess ofexpected contributions over the normal cost $310,994 $9,315,449SOLVENCY RATIO 101.20% 102.10%14 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Administrator’s ReportBenefits PlanCost Analysis for 2013 vs 2012As the tables below show, total benefit costs continue to increase year over year. Total costs forthe fiscal year ended December 31, 2013 were $20,718,252 as compared to $17,005,281 in 2012amounting to an increase of $3,712,971 or 21.83%. The cost of providing all benefits per memberper month was $373.78 in 2013 versus $309.84 in 2012. The hourly cost rose from $2.48 to$2.98.The one constant: your Plan continues to subsidize members’ benefits.2013 Cost Breakdown Audited 2013 costsAverage EligibleMembersCost per Memberper MonthCost per HourMedical $6,139,639 4,630 $110.50 $0.88Extended Health $5,951,062 5,274 $94.03 $0.75Dental $4,706,772 4,465 $87.85 $0.70Long-term Disability $1,297,364 3,498 $30.91 $0.25Life Insurance $1,288,851 5,257 $20.43 $0.16Weekly Disability $1,098,885 3,547 $25.82 $0.21AD&D Insurance $128,090 4,196 $2.54 $0.02Family Assistance $107,589 5,274 $1.70 $0.01$20,718,252 $373.78 $2.982012 Cost Breakdown Audited 2012 costsAverage EligibleMembersCost per Memberper MonthCost per HourMedical $5,820,815 4,522 $107.27 $0.86Dental $4,628,679 4,338 $88.92 $0.71Extended Health $4,576,920 5,173 $73.73 $0.59Life Insurance $844,963 5,154 $13.66 $0.11Weekly Disability $800,104 3,443 $19.37 $0.15Long-term Disability $132,259 3,392 $3.25 $0.03Family Assistance $125,090 5,173 $2.02 $0.02AD&D Insurance $76,451 3,940 $1.62 $0.01$17,005,281 $309.84 $2.48<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 15

Administrator’s ReportThe graph below includes the costs for all benefit categories dating back to 2000. Whilesome benefit costs have been rather flat, the graph clearly shows how dramatically costs haverisen in the Medical, Dental and Extended Health categories. Benefit Costs can be determinedusing the left (black) vertical axis of the graph.Not all increases are bad; membership has risen as well, tipping 5,277 at the end of 2013. Membershipnumbers can be determined using the right (red) vertical axis of the graph.16 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Administrator’s ReportAdministration ExpensesThe following tables give a breakdown of administrative disbursements for the period commencing in 2000.Operating Engineers’ Pension PlanYear Ending Assets Contributions ExpensesExpenses asa % of AssetsExpensesas a % ofContributionsTotal PlanParticipantsExpensesper PlanParticipant,per yearApril 30, 2000 $412,784,657 $18,644,501 $702,151 0.17% 3.77% 12,447 $56.41April 30, 2001 $416,350,954 $22,790,835 $678,916 0.16% 2.98% 12,654 $53.65April 30, 2002 $485,414,220 $17,144,904 $660,816 0.14% 3.85% 12,739 $51.87April 30, 2003 $490,087,308 $17,889,602 $811,192 0.17% 4.53% 12,836 $63.20April 30, 2004 $531,062,657 $18,511,783 $698,680 0.13% 3.77% 12,836 $54.43April 30, 2005 $611,447,912 $21,344,139 $685,298 0.11% 3.21% 12,836 $53.39April 30, 2006 $661,907,384 $26,948,233 $1,146,822 0.17% 4.26% 12,611 $90.94April 30, 2007 $727,512,372 $28,377,553 $980,418 0.13% 3.45% 12,870 $76.18April 30, 2008 $732,913,398 $31,418,564 $810,319 0.11% 2.58% 13,322 $60.83April 30, 2009 $713,473,674 $30,060,633 $1,065,027 0.15% 3.54% 13,450 $79.18April 30, 2010 $782,235,346 $26,235,516 $935,082 0.12% 3.56% 13,290 $70.36April 30, 2011 $844,956,804 $28,509,186 $1,015,967 0.12% 3.56% 13,274 $76.54April 30, 2012 $1,013,752,735 $35,479,577 $1,141,079 0.11% 3.22% 13,523 $84.38April 30, 2013 $1,057,885,340 $36,780,111 $900,340 0.09% 2.45% 13,578 $66.31Operating Engineers’ Benefits PlanYear Ending Assets Contributions ExpensesExpenses as a% of AssetsExpensesas a % ofContributionsTotal PlanParticipantsExpensesper PlanParticipant,per yearDec. 31, 2000 $25,930,085 $10,619,468 $723,469 2.79% 6.81% 11,406 $63.43Dec. 31, 2001 $24,181,086 $8,521,071 $722,317 2.99% 8.48% 11,118 $64.97Dec. 31, 2002 $24,494,360 $9,462,127 $604,709 2.47% 6.39% 10,448 $57.88Dec. 31, 2003 $24,853,971 $10,274,224 $523,110 2.10% 5.09% 10,108 $51.75Dec. 31, 2004 $26,374,356 $11,389,921 $593,624 2.25% 5.21% 10,249 $57.92Dec. 31, 2005 $29,643,824 $13,038,803 $711,203 2.40% 5.45% 10,712 $66.39Dec. 31, 2006 $32,057,915 $13,664,782 $799,280 2.49% 5.85% 11,116 $71.90Dec. 31, 2007 $32,345,223 $15,118,433 $847,359 2.62% 5.60% 11,719 $72.31Dec. 31, 2008 $31,073,300 $15,569,742 $772,521 2.49% 4.96% 11,994 $64.41Dec. 31, 2009 $34,303,853 $13,712,670 $810,404 2.36% 5.91% 11,660 $69.50Dec. 31, 2010 $34,216,220 $13,377,710 $837,022 2.45% 6.26% 11,016 $75.98Dec. 31, 2011 $36,414,701 $15,442,009 $980,032 2.69% 6.35% 11,943 $82.06Dec. 31, 2012 $37,493,408 $17,210,628 $987,513 2.63% 5.74% 11,958 $82.58Dec. 31, 2013 $38,047,271 $18,437,103 $942,128 2.48% 5.11% 12,224 $77.07<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 17

Pensionsworkingfor youOperating Engineers’ Pension PlanSummarized Financial Statementsfor the years ended April 30, 2013 and 201218 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Independent Auditors' ReportTo the Members of Operating Engineers’ Pension Plan:The accompanying summary financial statements, which comprise the summary Statements of Net AssetsAvailable for Benefits as at April 30, 2013 and 2012, the summary Statements of Changes in Net Assets Availablefor Benefits, and the summary Statement of Expenses for the years then ended, are derived from the auditedfinancial statements of the Operating Engineers’ Pension Plan for the years ended April 30, 2013 and 2012. Weexpressed a qualified opinion on those financial statements in our report dated October 23, 2013. Those financialstatements, and the summary financial statements, do not reflect the effects of events that occurred subsequent tothe date of our report on those financial statements.The summary financial statements do not contain all the disclosures required by Section 9(7) of the PensionBenefits Standards Act of British Columbia. Reading the summary financial statements, therefore, is not asubstitute for reading the audited financial statements of Operating Engineers’ Pension Plan.Administration's Responsibility for the Summary Financial StatementsThe administration and the Plan’s trustees are responsible for the preparation and fair presentation of a summary ofthe audited financial statements in accordance with Section 9(7) of the Pension Benefits Standards Act of BritishColumbia.Auditors' ResponsibilityOur responsibility is to express an opinion on the summary financial statements based on our procedures which wereconducted in accordance with Canadian Auditing Standard (CAS) 810, “Engagements to Report on Summary FinancialStatements.”Except as described in the Basis for Qualified Opinion paragraph, we conducted our audit in accordance withCanadian Auditing Standards. Those standards require that we comply with ethical requirements and plan andperform the audit to obtain reasonable assurance about whether the financial statements are free from materialmisstatement.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our qualifiedaudit opinion.Basis for Qualified OpinionWe did not review the accounting records of the participating employers to ascertain whether remittances made bythem were in accordance with the requirements of the Plan. Accordingly, our work in respect of remittances fromemployers was limited to the amounts recorded in the books of the Plan.Qualified OpinionIn our opinion, except for the possible effects of the matter described in the Basis for Qualified Opinionparagraph, the summary financial statements present fairly in all material respects the net assets available forbenefits of the Plan as at April 30, 2013 and 2012 and the results of its operations and changes in net assetsavailable for benefits for the years then ended in accordance with Section 9(7) of the Pension Benefits Standards Actof British Columbia.Vancouver, British Columbia<strong>June</strong> 3, <strong>2014</strong>Chartered AccountantsACCOUNTING › CONSULTING › TAX2300, 1055 DUNSMUIR STREET, PO BOX 49148; VANCOUVER BC; V7X 1J11-877-688-8408 P: 604-685-8408 F: 604-685-8594 www.MNP.ca<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 19

20 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

OPERATING ENGINEERS’ PENSION PLANStatement of Changes in Net Assets Available for BenefitsFor the Year Ended April 30, 2013 and 20122013 2012────────────────────────────────────────────────────────────Increase in Book Value of Assets:Contributions $ 36,780,111 $ 35,479,577Cooperative housing income 176,094 176,094Dividends, gains on sale of securities, and interest -Investments managed under contract) 95,218,984 52,871,856Other 285,931 267,742Real estate income 5,722,586 5,437,390────────────────────────────────────────────────────────────138,183,706 94,232,659────────────────────────────────────────────────────────────Decrease in Book Value of Assets:Benefit Payments -Cash terminations 7,668,853 4,774,039Death 438,417 228,634Pension 41,778,716 40,215,596────────────────────────────────────────────────────────────49,885,986 45,218,269────────────────────────────────────────────────────────────Expenses -Administrative (Appendix A) 900,340 1,141,079Investments managed under contract 975,524 935,138Other (11,639) 1,450────────────────────────────────────────────────────────────1,864,225 2,077,666────────────────────────────────────────────────────────────Increase in book value of assets 86,433,494 46,936,724Assigned and fair value adjustment(Decrease) increase in fair value adjustment (32,491,789) 83,946,740(Decrease) increase in assigned value adjustment (9,809,101) 37,912,468────────────────────────────────────────────────────────────(42,300,890) 121,859,208Increase in Net Assets available for benefits 44,132,605 168,795,931Net Assets Available for Benefits, beginning 1,013,752,735 844,956,804────────────────────────────────────────────────────────────Net Assets Available for Benefits, ending $1,057,885,340 $1,013,752,735════════════════════════════════════════════════════════════These summarized financial statements are not complete and do not contain all of thedisclosures required under Canadian generally accepted accounting principles. A complete setof financial statements, and notes thereto, are available upon request from the OperatingEngineers Local 115 Pension Plan Administrator3<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 21

OPERATING ENGINEERS’ PENSION PLANStatement of ExpensesFor the Year Ended April 30, 2013 and 2012Appendix A2013 2012────────────────────────────────────────────────────────────Administrative:Actuarial and appraisals $ 169,311 $ 134,166Amortization 23,364 25,119Bank charges 6,779 6,600Consulting 259,939 229,250Education 6,436 8,332Insurance 44,346 50,522Labour 863,783 1,035,457Material and supplies 35,287 31,056Miscellaneous 101,589 100,273Postage and courier 59,731 49,019Professional fees 83,444 95,664Public relations 21,933 114,498Rent 71,369 71,369Telecommunications 10,834 12,219Trustees 18,442 53,815────────────────────────────────────────────────────────────1,776,587 2,017,359────────────────────────────────────────────────────────────Cost Recoveries:Administration fees 24,247 24,281Shared costs 852,000 852,000────────────────────────────────────────────────────────────876,247 876,281────────────────────────────────────────────────────────────Totals $ 900,340 $1,141,079════════════════════════════════════════════════════════════These summarized financial statements are not complete and do not contain all of thedisclosures required under Canadian generally accepted accounting principles. A complete setof financial statements, and notes thereto, are available upon request from the OperatingEngineers Local 115 Pension Plan Administrator422 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

35th Annual Retirees’ Social Evening35th ANNUAL PENSION SOCIALRetirees gather for annual eveningThe 2013 Operating Engineers’ 35th annual Pension Social Eveningattracted approximately 345 retirees and spouses to the VancouverItalian Cultural Centre for an enjoyable evening of dinner andentertainment.This most popular event provides an opportunty for retiredmembers and their spouses/guests to renew old friendships,reminisce on numerous shared projects during their careers and toexchange ideas and events pertaining to the enjoyment of their welldeservedretirement years.Those in attendance enjoyed a delectable buffet subsequentlyfollowed by entertainment and dancing.A special “Thanks” to all the Staff in the Benefits and Pension Planoffice for their continued assistance and effort in ensuring the event’ssuccess.<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 23

35th Annual Retirees’ Social Evening24 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

35th Annual Retirees’ Social Evening<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 25

35th Annual Retirees’ Social Evening26 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

35th Annual Retirees’ Social Evening<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 27

Benefitsworkingfor youOperating Engineers’ Benefits PlanSummarized Financial Statementsfor the years ended December 31, 2013 and 201228 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

REPORT OF THE INDEPENDENT AUDITOR ON THE SUMMARY FINANCIALSTATEMENTSTo the Members of Operating Engineers’ Benefits Plan:The accompanying summary financial statements, which comprise the summary Statements of Net AssetsAvailable for Benefits as at December 31, 2013 and 2012, the summary Statements of Changes in Net AssetsAvailable for Benefits, and the summary Statement of Expenses for the years then ended, are derived from theaudited financial statements of the Operating Engineers’ Benefits Plan for the years ended December 31, 2013 and2012. We expressed a qualified opinion on those financial statements in our report dated April 3, <strong>2014</strong>. Thosefinancial statements, and the summary financial statements, do not reflect the effects of events that occurredsubsequent to the date of our report on those financial statements.The summary financial statements do not contain all the disclosures required by Canadian generally acceptedaccounting principles. Reading the summary financial statements, therefore, is not a substitute for reading theaudited financial statements of Operating Engineers’ Benefits Plan.Administration's Responsibility for the Summary Financial StatementsThe administration and the Plan’s trustees are responsible for the preparation and fair presentation of a summary ofthe audited financial statements in accordance with Canadian generally accepted accounting principles.Auditors' ResponsibilityOur responsibility is to express an opinion on the summary financial statements based on our procedures which wereconducted in accordance with Canadian Auditing Standard (CAS) 810, “Engagements to Report on Summary FinancialStatements.”Except as described in the Basis for Qualified Opinion paragraph, we conducted our audit in accordance with CanadianAuditing Standards. Those standards require that we comply with ethical requirements and plan and perform theaudit to obtain reasonable assurance about whether the financial statements are free from material misstatement.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our qualifiedaudit opinion.Basis for Qualified OpinionWe were unable to review the accounting records of participating employers to determine whether contributions werein accordance with the requirements of the Agreement and Declaration of Trust. Accordingly, our verification ofemployer contributions was limited to verifying that contributions received were properly recorded.Qualified OpinionIn our opinion, except for the effect of adjustments, if any, which we might have determined to be necessary had therebeen no limitations in the scope of our examination of employer contributions as described in the preceding paragraph,these financial statements present fairly, in all material respects, the financial position of the Plan as at December 31,2013 and 2012, and the results of its operations and its cash flows for the years then ended in accordance withCanadian generally accepted accounting principles.Vancouver, British ColumbiaAugust 12, <strong>2014</strong>Chartered AccountantsACCOUNTING › CONSULTING › TAX2300, 1055 DUNSMUIR STREET, PO BOX 49148; VANCOUVER BC; V7X 1J11-877-688-8408 P: 604-685-8408 F: 604-685-8594 www.MNP.ca<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 29

OPERATING ENGINEERS' BENEFITS PLANStatement of Net Assets Available for BenefitsDecember 31, 2013 and 2012Assets 2013 2012Current:Cash and savings $ 3,166,921 $ 5,270,356Accounts receivables 1,267,893 1,302,530Prepaid expenses - 1,099,8724,434,814 7,672,759Investments 33,612,457 29,820,649$ 38,047,271 $ 37,493,408LiabilitiesCurrent:Accounts payable and accrued liabilities $ 828,390 $ 1,043,502Contributions payable to other plans 129,440 109,746Due to Operating Engineers' Pension Plan 3,739,631 3,553,9524,697,460 4,707,200Reserve for members' future benefits 14,484,941 13,583,09819,040,102 18,290,298Members' ReservesAppropriated:Contingency reserve fund 300,000 300,000Unappropriated:Reserve for present and future benefits 18,564,869 18,903,10918,864,869 19,203,109$ 38,047,271 $ 37,493,408Approved on behalf of the Trustees:──────────────────────────────────────────────────────These summarized financial statements are not complete and do not contain all of the disclosuresrequired under Canadian generally accepted accounting principles. A complete set of financialstatements, and notes thereto, are available upon request from the Operating Engineers Local 115Benefits Plan Administrator.30 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

OPERATING ENGINEERS' BENEFITS PLANStatement of Changes in Net Assets Available for BenefitsFor the Year Ended December 31, 2013 and 2012% 2013 % 2012Receipts:Contributions 100.0 $ 18,437,103 100.0 $ 17,210,628Members' Benefits:Accidental death and dismemberment insurance 0.7 128,090 0.4 76,451Dental 25.5 4,706,772 26.9 4,628,679Extended health and member family assistance 32.9 6,058,651 27.3 4,702,010Life insurance 7.0 1,288,851 4.9 844,963Long-term disability 7.0 1,297,364 0.8 132,259Medical premiums 33.3 6,139,639 33.8 5,820,815Weekly disability 6.0 1,098,885 4.6 800,105112.4 20,718,252 98.8 17,005,281Increase (decrease) in reserve for members' futurebenefits4.9 901,843 (27.7) (4,766,087)117.3 21,620,095 71.1 12,239,195Gross funds available (17.3) (3,182,992) 28.9 4,971,434Administrative expenses, per Schedule "1" 5.1 942,128 5.7 987,513Excess (deficiency) of receipts over disbursementsbefore investment income(9.8) (4,125,120) 23.1 3,983,921Investment income 8.0 1,468,892 9.0 1,550,776Other income 12.6 2,317,989 - -Excess (deficiency) of receipts over disbursements (1.8) 2,317,989 34.9 5,534,697Reserve for present and future benefits, beginning 18,903,109 13,368,413Reserve for present and future benefits, ending $ 18,564,869 $ 18,903,109These summarized financial statements are not complete and do not contain all of the disclosuresrequired under Canadian generally accepted accounting principles. A complete set of financialstatements, and notes thereto, are available upon request from the Operating Engineers Local 115Benefits Plan Administrator.<strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong> <strong>News</strong> 31

OPERATING ENGINEERS' BENEFITS PLANStatement of Administrative ExpensesFor the Years Ended December 31, 2013 and 20122013 2012Actuarial $ 38,181 $ 93,118Bank charges 1,500 1,678Miscellaneous 20,458 3,093Professional fees 30,001 34,120Legal fees - 3,153Management fees 852,000 852,000Other (12) 351Totals, to Exhibit “B” $ 942,128 $ 987,513These summarized financial statements are not complete and do not contain all of the disclosuresrequired under Canadian generally accepted accounting principles. A complete set of financialstatements, and notes thereto, are available upon request from the Operating Engineers Local 115Benefits Plan Administrator.32 <strong>News</strong> <strong>Special</strong> <strong>Edition</strong> Fall <strong>2014</strong>

Contact DetailsLocal 115 District OfficesDistrict 1 and Main Office4333 Ledger Ave., Burnaby, B.C. V5G 3T3Phone: 604-291-8831 Toll Free: 1-888-486-3115 Fax: 604-473-5235E-mail: iuoe@iuoe115.com Online: www.iuoe115.comBusiness Manager: Brian CochranePresident: Wayne E. MillsMgr. Administration & <strong>Special</strong> Projects: Lynda ArlandOffice Manager: Arlene LindsayBusiness RepresentativesFrank Carr Brett Chapman Everett CummingsChip Dhaliwal Craig McIntosh Don SwerdanDispatcherJim Flynn: 604-473-5231Director of OrganizingBrian LefebvreOrganizing RepresentativesRob Duff: 604-473-5206John Munro: 604-473-5272Bryan Railton: 250-320-4840Benefits and Pension PlansShawn Hatch, AdministratorDirect line: 604-299-8341 Fax: 604-473-5236Training AssociationBrad Randall, AdministratorDirect line: 604-299-7764 E-mail: oetp@iuoe115.comDistrict 2Vancouver Island:Curtis Harold, Business Representative35 Wharf Street, Nanaimo, B.C. V9R 2X3Mailing Address: PO Box 213 Stn A, Nanaimo, B.C. V9R 5K9Phone: 250-754-4022 Fax: 250-754-5513District 3Kamloops-Revelstoke-Okanagan:Brad Gerow, Business Representative785 Tranquille RoadKamloops, B.C. V2B 3J3Phone: 250-554-2278 Fax: 250-554-1766District 4Central Interior-Yellowhead:Herb Conat & Wayne Kemp, Business RepresentativesUnit B, 3339 8th AvenuePrince George, B.C. V2M 3R8Phone: 250-563-3669 Fax: 250-563-3603District 5Peace River and Yukon Territory:Mike Spiruda, Business Representative & OrganizerSite 20, Comp 19 SS2Fort St. John, B.C. V1J 4M7Phone: 250-787-9594 Fax: 250-787-9491Tumbler Ridge Mining Office:220 Main Street, Tumbler Ridge, B.C. V0C 2W0Phone: 250-242-3888 Fax: 250-242-3881District 6East and West Kootenays:Rob Foskett, Business Representative103 Centennial Square, Sparwood, B.C V0B 2G0Mailing Address: PO Box 1567, Sparwood, B.C. V0B 2G0Phone: 250-425-2161 Toll Free: 1-888-605-9955 Fax: 250-425-2166Meeting NoticesDistrict 1BURNABY: 1st Thursday of every month7:30p.m. at 4333 Ledger Ave., BurnabyExcept March & September (due to General Membership Meeting)District 2Monthly meeting locations alternate:NANAIMO: 2nd Monday of odd months6:00p.m at the Coast Bastion Inn, 11 Bastion St.VICTORIA: 2nd Wednesday of even months7:30p.m. at the Pro Pat Legion Branch 31, #292 - 411 Gorge Rd. E.CAMPBELL RIVER/COURTENAY:Members will be advised of meeting date, time and place.District 3Monthly meeting locations alternate:KAMLOOPS: 2nd Thursday of even months7:30p.m. at the Union Hall, 785 Tranquille Rd.KELOWNA: 2nd Tuesday of odd months7:00p.m. at the Teamsters Hall, 185 Froelich Rd.District 4PRINCE GEORGE: 2nd Wednesday of each month8:00p.m. at Coast Inn of the North, 770 Brunswick St.PRINCE RUPERT, TERRACE, KITIMAT, SMITHERS:Members will be advised of meeting dates and times.District 5Monthly meeting locations alternate:FORT ST. JOHN: 2nd Tuesday of odd months7:30p.m. at the Masonic Hall, 10441 100th Ave.DAWSON CREEK: 2nd Tuesday of even months7:30p.m. at the George Dawson Inn, 11705 8th St.TUMBLER RIDGE/PEACE RIVER COAL:Members will be advised of meeting date, time and place.WHITEHORSE:Teamsters Hall, 407 Black St.Members will be advised of meeting dates and times.District 6Monthly meeting locations alternate:CASTLEGAR—1st Wednesday of odd months7:00p.m. at the Super 8 Inn, 651 18th St.CRANBROOK—1st Tuesday of even months7:00p.m. at the Labour Centre (Boardroom), 105 9th Ave. SouthELK VALLEY COAL CORP:Line Creek MineMembers will be advised of meeting dates and times.

We’re working to help you get themost out of your benefitsStart saving today!• Compare pill prices at BC pharmacies• View generic and brand name drugs• Save on pharmacy dispensing feesCreate your secureaccount today!Submit online claims for faster paymentCheck your dependent coverageTrack health expenses and limitsPrint your ID card• Download claim formsDRAFT® Pacific Blue Cross, the registered trade-name of PBC Health Benefits Society, is an independent licensee of the Canadian Association of Blue Cross Plans. BC Life is the registered trade-name of British Columbia Life &Casualty Company, a wholly-owned subsidiary of Pacific Blue Cross. CARESnet is the registered trade-mark of the Canadian Association of Blue Cross Plans, an association of independent Blue Cross Plans, and is used under licenseto Pacific Blue Cross. Pharmacy Compass is a trade-mark of Pacific Blue Cross. 0640.007.05 07/14 CUPE 1816