czech pavilion at 2010 expo - MZV ÄŒR

czech pavilion at 2010 expo - MZV ÄŒR

czech pavilion at 2010 expo - MZV ÄŒR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

| 22<br />

SERVICES<br />

Industrial Real Est<strong>at</strong>e Market Stabilised Between Supply and Demand<br />

The industrial real est<strong>at</strong>e market<br />

experienced a robust development<br />

in the past years and has reached<br />

the line between a developing<br />

market and a s<strong>at</strong>ur<strong>at</strong>ed one. The<br />

massive specul<strong>at</strong>ive construction<br />

of the past years, when developers<br />

were building warehouses without<br />

a secured lease, was gre<strong>at</strong>ly slowed<br />

down by the global economic crisis<br />

in 2009. Paradoxically, this situ<strong>at</strong>ion<br />

has brought market stabilis<strong>at</strong>ion<br />

in the supply-demand rel<strong>at</strong>ion<br />

in this country.<br />

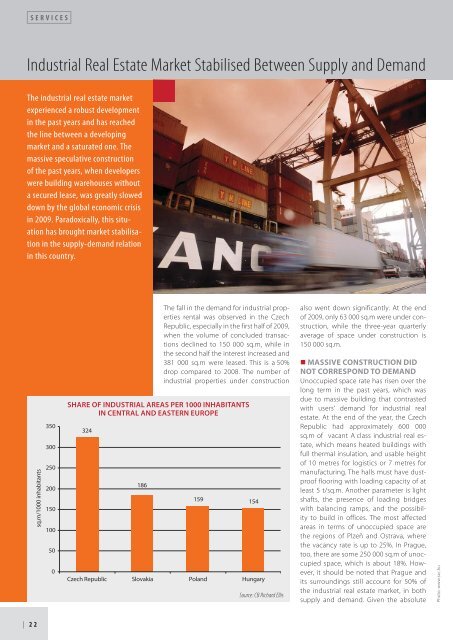

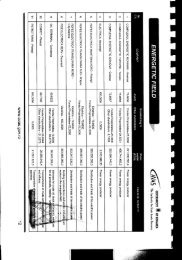

sq.m/1000 inhabitants<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

The fall in the demand for industrial properties<br />

rental was observed in the Czech<br />

Republic, especially in the first half of 2009,<br />

when the volume of concluded transactions<br />

declined to 150 000 sq.m, while in<br />

the second half the interest increased and<br />

381 000 sq.m were leased. This is a 50%<br />

drop compared to 2008. The number of<br />

industrial properties under construction<br />

SHARE OF INDUSTRIAL AREAS PER 1000 INHABITANTS<br />

IN CENTRAL AND EASTERN EUROPE<br />

324<br />

186<br />

159 154<br />

Czech Republic Slovakia Poland Hungary<br />

Source: CB Richard Ellis<br />

also went down significantly. At the end<br />

of 2009, only 63 000 sq.m were under construction,<br />

while the three-year quarterly<br />

average of space under construction is<br />

150 000 sq.m.<br />

� MASSIVE CONSTRUCTION DID<br />

NOT CORRESPOND TO DEMAND<br />

Unoccupied space r<strong>at</strong>e has risen over the<br />

long term in the past years, which was<br />

due to massive building th<strong>at</strong> contrasted<br />

with users‘ demand for industrial real<br />

est<strong>at</strong>e. At the end of the year, the Czech<br />

Republic had approxim<strong>at</strong>ely 600 000<br />

sq.m of vacant A class industrial real est<strong>at</strong>e,<br />

which means he<strong>at</strong>ed buildings with<br />

full thermal insul<strong>at</strong>ion, and usable height<br />

of 10 metres for logistics or 7 metres for<br />

manufacturing. The halls must have dustproof<br />

flooring with loading capacity of <strong>at</strong><br />

least 5 t/sq.m. Another parameter is light<br />

shafts, the presence of loading bridges<br />

with balancing ramps, and the possibility<br />

to build in offices. The most affected<br />

areas in terms of unoccupied space are<br />

the regions of Plzeň and Ostrava, where<br />

the vacancy r<strong>at</strong>e is up to 25%. In Prague,<br />

too, there are some 250 000 sq.m of unoccupied<br />

space, which is about 18%. However,<br />

it should be noted th<strong>at</strong> Prague and<br />

its surroundings still account for 50% of<br />

the industrial real est<strong>at</strong>e market, in both<br />

supply and demand. Given the absolute<br />

Photo: www.sxc.hu