Practice Problems for Midterm 2

University of Rio Grande Practice Problems for Midterm 2

University of Rio Grande Practice Problems for Midterm 2

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

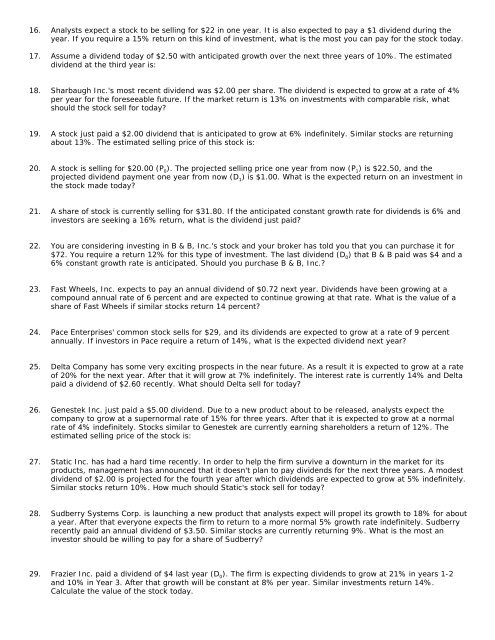

16. Analysts expect a stock to be selling <strong>for</strong> $22 in one year. It is also expected to pay a $1 dividend during the<br />

year. If you require a 15% return on this kind of investment, what is the most you can pay <strong>for</strong> the stock today.<br />

17. Assume a dividend today of $2.50 with anticipated growth over the next three years of 10%. The estimated<br />

dividend at the third year is:<br />

18. Sharbaugh Inc.'s most recent dividend was $2.00 per share. The dividend is expected to grow at a rate of 4%<br />

per year <strong>for</strong> the <strong>for</strong>eseeable future. If the market return is 13% on investments with comparable risk, what<br />

should the stock sell <strong>for</strong> today?<br />

19. A stock just paid a $2.00 dividend that is anticipated to grow at 6% indefinitely. Similar stocks are returning<br />

about 13%. The estimated selling price of this stock is:<br />

20. A stock is selling <strong>for</strong> $20.00 (P 0 ). The projected selling price one year from now (P 1 ) is $22.50, and the<br />

projected dividend payment one year from now (D 1 ) is $1.00. What is the expected return on an investment in<br />

the stock made today?<br />

21. A share of stock is currently selling <strong>for</strong> $31.80. If the anticipated constant growth rate <strong>for</strong> dividends is 6% and<br />

investors are seeking a 16% return, what is the dividend just paid?<br />

22. You are considering investing in B & B, Inc.'s stock and your broker has told you that you can purchase it <strong>for</strong><br />

$72. You require a return 12% <strong>for</strong> this type of investment. The last dividend (D 0 ) that B & B paid was $4 and a<br />

6% constant growth rate is anticipated. Should you purchase B & B, Inc.?<br />

23. Fast Wheels, Inc. expects to pay an annual dividend of $0.72 next year. Dividends have been growing at a<br />

compound annual rate of 6 percent and are expected to continue growing at that rate. What is the value of a<br />

share of Fast Wheels if similar stocks return 14 percent?<br />

24. Pace Enterprises' common stock sells <strong>for</strong> $29, and its dividends are expected to grow at a rate of 9 percent<br />

annually. If investors in Pace require a return of 14%, what is the expected dividend next year?<br />

25. Delta Company has some very exciting prospects in the near future. As a result it is expected to grow at a rate<br />

of 20% <strong>for</strong> the next year. After that it will grow at 7% indefinitely. The interest rate is currently 14% and Delta<br />

paid a dividend of $2.60 recently. What should Delta sell <strong>for</strong> today?<br />

26. Genestek Inc. just paid a $5.00 dividend. Due to a new product about to be released, analysts expect the<br />

company to grow at a supernormal rate of 15% <strong>for</strong> three years. After that it is expected to grow at a normal<br />

rate of 4% indefinitely. Stocks similar to Genestek are currently earning shareholders a return of 12%. The<br />

estimated selling price of the stock is:<br />

27. Static Inc. has had a hard time recently. In order to help the firm survive a downturn in the market <strong>for</strong> its<br />

products, management has announced that it doesn't plan to pay dividends <strong>for</strong> the next three years. A modest<br />

dividend of $2.00 is projected <strong>for</strong> the fourth year after which dividends are expected to grow at 5% indefinitely.<br />

Similar stocks return 10%. How much should Static's stock sell <strong>for</strong> today?<br />

28. Sudberry Systems Corp. is launching a new product that analysts expect will propel its growth to 18% <strong>for</strong> about<br />

a year. After that everyone expects the firm to return to a more normal 5% growth rate indefinitely. Sudberry<br />

recently paid an annual dividend of $3.50. Similar stocks are currently returning 9%. What is the most an<br />

investor should be willing to pay <strong>for</strong> a share of Sudberry?<br />

29. Frazier Inc. paid a dividend of $4 last year (D 0 ). The firm is expecting dividends to grow at 21% in years 1-2<br />

and 10% in Year 3. After that growth will be constant at 8% per year. Similar investments return 14%.<br />

Calculate the value of the stock today.