Practice Problems for Midterm 2

University of Rio Grande Practice Problems for Midterm 2

University of Rio Grande Practice Problems for Midterm 2

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

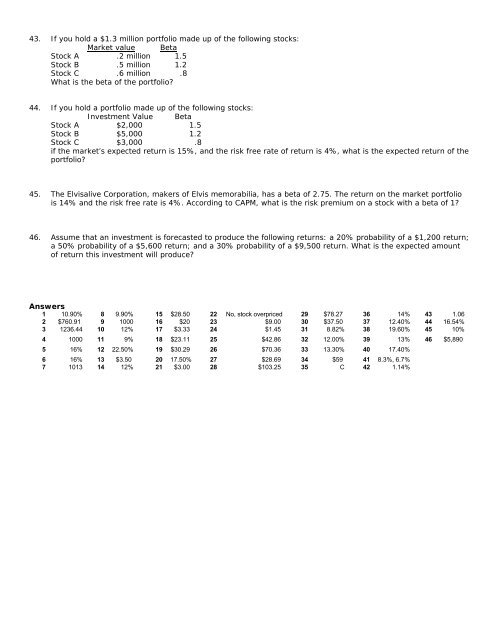

43. If you hold a $1.3 million portfolio made up of the following stocks:<br />

Market value Beta<br />

Stock A .2 million 1.5<br />

Stock B .5 million 1.2<br />

Stock C .6 million .8<br />

What is the beta of the portfolio?<br />

44. If you hold a portfolio made up of the following stocks:<br />

Investment Value Beta<br />

Stock A $2,000 1.5<br />

Stock B $5,000 1.2<br />

Stock C $3,000 .8<br />

if the market’s expected return is 15%, and the risk free rate of return is 4%, what is the expected return of the<br />

portfolio?<br />

45. The Elvisalive Corporation, makers of Elvis memorabilia, has a beta of 2.75. The return on the market portfolio<br />

is 14% and the risk free rate is 4%. According to CAPM, what is the risk premium on a stock with a beta of 1?<br />

46. Assume that an investment is <strong>for</strong>ecasted to produce the following returns: a 20% probability of a $1,200 return;<br />

a 50% probability of a $5,600 return; and a 30% probability of a $9,500 return. What is the expected amount<br />

of return this investment will produce?<br />

Answers<br />

1 10.90% 8 9.90% 15 $28.50 22 No, stock overpriced 29 $78.27 36 14% 43 1.06<br />

2 $760.91 9 1000 16 $20 23 $9.00 30 $37.50 37 12.40% 44 16.54%<br />

3 1236.44 10 12% 17 $3.33 24 $1.45 31 8.82% 38 19.60% 45 10%<br />

4 1000 11 9% 18 $23.11 25 $42.86 32 12.00% 39 13% 46 $5,890<br />

5 16% 12 22.50% 19 $30.29 26 $70.36 33 13.30% 40 17.40%<br />

6 16% 13 $3.50 20 17.50% 27 $28.69 34 $59 41 8.3%, 6.7%<br />

7 1013 14 12% 21 $3.00 28 $103.25 35 C 42 1.14%