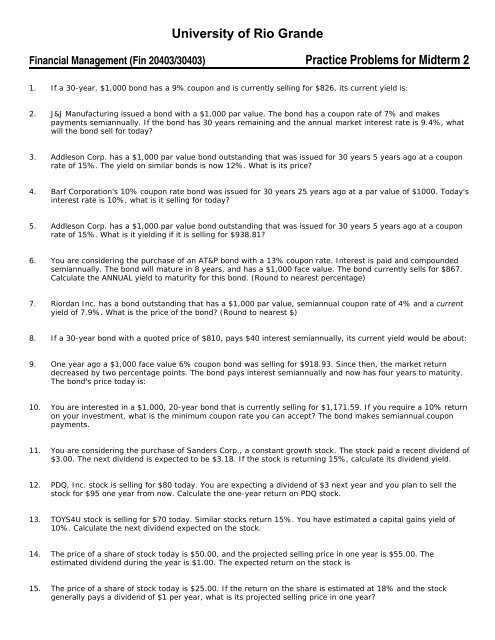

Practice Problems for Midterm 2

University of Rio Grande Practice Problems for Midterm 2

University of Rio Grande Practice Problems for Midterm 2

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

University of Rio Grande<br />

Financial Management (Fin 20403/30403) <strong>Practice</strong> <strong>Problems</strong> <strong>for</strong> <strong>Midterm</strong> 2<br />

1. If a 30-year, $1,000 bond has a 9% coupon and is currently selling <strong>for</strong> $826, its current yield is:<br />

2. J&J Manufacturing issued a bond with a $1,000 par value. The bond has a coupon rate of 7% and makes<br />

payments semiannually. If the bond has 30 years remaining and the annual market interest rate is 9.4%, what<br />

will the bond sell <strong>for</strong> today?<br />

3. Addleson Corp. has a $1,000 par value bond outstanding that was issued <strong>for</strong> 30 years 5 years ago at a coupon<br />

rate of 15%. The yield on similar bonds is now 12%. What is its price?<br />

4. Barf Corporation's 10% coupon rate bond was issued <strong>for</strong> 30 years 25 years ago at a par value of $1000. Today's<br />

interest rate is 10%, what is it selling <strong>for</strong> today?<br />

5. Addleson Corp. has a $1,000 par value bond outstanding that was issued <strong>for</strong> 30 years 5 years ago at a coupon<br />

rate of 15%. What is it yielding if it is selling <strong>for</strong> $938.81?<br />

6. You are considering the purchase of an AT&P bond with a 13% coupon rate. Interest is paid and compounded<br />

semiannually. The bond will mature in 8 years, and has a $1,000 face value. The bond currently sells <strong>for</strong> $867.<br />

Calculate the ANNUAL yield to maturity <strong>for</strong> this bond. (Round to nearest percentage)<br />

7. Riordan Inc. has a bond outstanding that has a $1,000 par value, semiannual coupon rate of 4% and a current<br />

yield of 7.9%. What is the price of the bond? (Round to nearest $)<br />

8. If a 30-year bond with a quoted price of $810, pays $40 interest semiannually, its current yield would be about:<br />

9. One year ago a $1,000 face value 6% coupon bond was selling <strong>for</strong> $918.93. Since then, the market return<br />

decreased by two percentage points. The bond pays interest semiannually and now has four years to maturity.<br />

The bond's price today is:<br />

10. You are interested in a $1,000, 20-year bond that is currently selling <strong>for</strong> $1,171.59. If you require a 10% return<br />

on your investment, what is the minimum coupon rate you can accept? The bond makes semiannual coupon<br />

payments.<br />

11. You are considering the purchase of Sanders Corp., a constant growth stock. The stock paid a recent dividend of<br />

$3.00. The next dividend is expected to be $3.18. If the stock is returning 15%, calculate its dividend yield.<br />

12. PDQ, Inc. stock is selling <strong>for</strong> $80 today. You are expecting a dividend of $3 next year and you plan to sell the<br />

stock <strong>for</strong> $95 one year from now. Calculate the one-year return on PDQ stock.<br />

13. TOYS4U stock is selling <strong>for</strong> $70 today. Similar stocks return 15%. You have estimated a capital gains yield of<br />

10%. Calculate the next dividend expected on the stock.<br />

14. The price of a share of stock today is $50.00, and the projected selling price in one year is $55.00. The<br />

estimated dividend during the year is $1.00. The expected return on the stock is<br />

15. The price of a share of stock today is $25.00. If the return on the share is estimated at 18% and the stock<br />

generally pays a dividend of $1 per year, what is its projected selling price in one year?

16. Analysts expect a stock to be selling <strong>for</strong> $22 in one year. It is also expected to pay a $1 dividend during the<br />

year. If you require a 15% return on this kind of investment, what is the most you can pay <strong>for</strong> the stock today.<br />

17. Assume a dividend today of $2.50 with anticipated growth over the next three years of 10%. The estimated<br />

dividend at the third year is:<br />

18. Sharbaugh Inc.'s most recent dividend was $2.00 per share. The dividend is expected to grow at a rate of 4%<br />

per year <strong>for</strong> the <strong>for</strong>eseeable future. If the market return is 13% on investments with comparable risk, what<br />

should the stock sell <strong>for</strong> today?<br />

19. A stock just paid a $2.00 dividend that is anticipated to grow at 6% indefinitely. Similar stocks are returning<br />

about 13%. The estimated selling price of this stock is:<br />

20. A stock is selling <strong>for</strong> $20.00 (P 0 ). The projected selling price one year from now (P 1 ) is $22.50, and the<br />

projected dividend payment one year from now (D 1 ) is $1.00. What is the expected return on an investment in<br />

the stock made today?<br />

21. A share of stock is currently selling <strong>for</strong> $31.80. If the anticipated constant growth rate <strong>for</strong> dividends is 6% and<br />

investors are seeking a 16% return, what is the dividend just paid?<br />

22. You are considering investing in B & B, Inc.'s stock and your broker has told you that you can purchase it <strong>for</strong><br />

$72. You require a return 12% <strong>for</strong> this type of investment. The last dividend (D 0 ) that B & B paid was $4 and a<br />

6% constant growth rate is anticipated. Should you purchase B & B, Inc.?<br />

23. Fast Wheels, Inc. expects to pay an annual dividend of $0.72 next year. Dividends have been growing at a<br />

compound annual rate of 6 percent and are expected to continue growing at that rate. What is the value of a<br />

share of Fast Wheels if similar stocks return 14 percent?<br />

24. Pace Enterprises' common stock sells <strong>for</strong> $29, and its dividends are expected to grow at a rate of 9 percent<br />

annually. If investors in Pace require a return of 14%, what is the expected dividend next year?<br />

25. Delta Company has some very exciting prospects in the near future. As a result it is expected to grow at a rate<br />

of 20% <strong>for</strong> the next year. After that it will grow at 7% indefinitely. The interest rate is currently 14% and Delta<br />

paid a dividend of $2.60 recently. What should Delta sell <strong>for</strong> today?<br />

26. Genestek Inc. just paid a $5.00 dividend. Due to a new product about to be released, analysts expect the<br />

company to grow at a supernormal rate of 15% <strong>for</strong> three years. After that it is expected to grow at a normal<br />

rate of 4% indefinitely. Stocks similar to Genestek are currently earning shareholders a return of 12%. The<br />

estimated selling price of the stock is:<br />

27. Static Inc. has had a hard time recently. In order to help the firm survive a downturn in the market <strong>for</strong> its<br />

products, management has announced that it doesn't plan to pay dividends <strong>for</strong> the next three years. A modest<br />

dividend of $2.00 is projected <strong>for</strong> the fourth year after which dividends are expected to grow at 5% indefinitely.<br />

Similar stocks return 10%. How much should Static's stock sell <strong>for</strong> today?<br />

28. Sudberry Systems Corp. is launching a new product that analysts expect will propel its growth to 18% <strong>for</strong> about<br />

a year. After that everyone expects the firm to return to a more normal 5% growth rate indefinitely. Sudberry<br />

recently paid an annual dividend of $3.50. Similar stocks are currently returning 9%. What is the most an<br />

investor should be willing to pay <strong>for</strong> a share of Sudberry?<br />

29. Frazier Inc. paid a dividend of $4 last year (D 0 ). The firm is expecting dividends to grow at 21% in years 1-2<br />

and 10% in Year 3. After that growth will be constant at 8% per year. Similar investments return 14%.<br />

Calculate the value of the stock today.

30. Find the value of a share of preferred stock that pays $6.00 per year given a return of 16%.<br />

31. What is the rate of return on a preferred stock that has a par value of $50, a market price of $46.50, and a<br />

dividend of $4.10?<br />

32. If a share of preferred stock pays a quarterly dividend of $1.50, has a $40 par value, and is currently selling <strong>for</strong><br />

$50.00, it is earning an annual return of:<br />

33. A share of Jones Inc. preferred stock pays a dividend of $1.25 each quarter. You are willing to pay $37.50 <strong>for</strong><br />

this stock. Your annual return on the investment is:<br />

34. You have invested in a project that has the following payoff schedule:<br />

Payoff Probability of Occurrence<br />

$40 .15<br />

$50 .20<br />

$60 .30<br />

$70 .30<br />

$80 .05<br />

What is the expected value of the investment's payoff? (Round to the nearest $1)<br />

35. Which of the following investments is clearly preferred to the others?<br />

Investment<br />

A 18% 20%<br />

B 20% 20%<br />

C 20% 18%<br />

k<br />

F<br />

36. Sibling Incorporated has a beta of 1.0. If the expected return on the market is 14%, what is the expected<br />

return on Sibling Incorporated's stock?<br />

37. PDQ Company's common stock has a beta of 1.2. If the expected risk free return is 4% and the market offers a<br />

risk premium of 7% over the risk free rate, what is the expected return on PDQ's common stock?<br />

38. Car Buff, Inc. common stock has a beta of 1.3. If the expected risk free return is 4% and the expected market<br />

risk premium is 12%, what is the expected return on Car Buff’s stock?<br />

39. If there is a 20% chance we will get a 16% return, a 30% chance of getting a 14% return, a 40% chance of<br />

getting a 12% return, and a 10% chance of getting an 8% return, what is the expected rate of return?<br />

40. According to the capital asset pricing model, if the risk free rate is 5.5%, and the market return is 14%, a<br />

security with a beta of 1.4 should return what?<br />

41. You are considering investing in a project with the following possible outcomes:<br />

States Probability of Occurrence Investment Returns<br />

State 1: Economic boom 15% 16%<br />

State 2: Economic growth 45% 12%<br />

State 3: Economic decline 25% 5%<br />

State 4: Depression 15% -5%<br />

Calculate the expected rate of return and standard deviation of returns <strong>for</strong> this investment, respectively.<br />

42. If you hold a portfolio made up of the following stocks:<br />

Investment Value Beta<br />

Stock A $2,000 1.5<br />

Stock B $5,000 1.2<br />

Stock C $3,000 .8<br />

What is the beta of the portfolio?

43. If you hold a $1.3 million portfolio made up of the following stocks:<br />

Market value Beta<br />

Stock A .2 million 1.5<br />

Stock B .5 million 1.2<br />

Stock C .6 million .8<br />

What is the beta of the portfolio?<br />

44. If you hold a portfolio made up of the following stocks:<br />

Investment Value Beta<br />

Stock A $2,000 1.5<br />

Stock B $5,000 1.2<br />

Stock C $3,000 .8<br />

if the market’s expected return is 15%, and the risk free rate of return is 4%, what is the expected return of the<br />

portfolio?<br />

45. The Elvisalive Corporation, makers of Elvis memorabilia, has a beta of 2.75. The return on the market portfolio<br />

is 14% and the risk free rate is 4%. According to CAPM, what is the risk premium on a stock with a beta of 1?<br />

46. Assume that an investment is <strong>for</strong>ecasted to produce the following returns: a 20% probability of a $1,200 return;<br />

a 50% probability of a $5,600 return; and a 30% probability of a $9,500 return. What is the expected amount<br />

of return this investment will produce?<br />

Answers<br />

1 10.90% 8 9.90% 15 $28.50 22 No, stock overpriced 29 $78.27 36 14% 43 1.06<br />

2 $760.91 9 1000 16 $20 23 $9.00 30 $37.50 37 12.40% 44 16.54%<br />

3 1236.44 10 12% 17 $3.33 24 $1.45 31 8.82% 38 19.60% 45 10%<br />

4 1000 11 9% 18 $23.11 25 $42.86 32 12.00% 39 13% 46 $5,890<br />

5 16% 12 22.50% 19 $30.29 26 $70.36 33 13.30% 40 17.40%<br />

6 16% 13 $3.50 20 17.50% 27 $28.69 34 $59 41 8.3%, 6.7%<br />

7 1013 14 12% 21 $3.00 28 $103.25 35 C 42 1.14%