Babcock & Brown

24 08 06 interim result 2006 presentation.pdf - Astrojapanproperty.com

24 08 06 interim result 2006 presentation.pdf - Astrojapanproperty.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

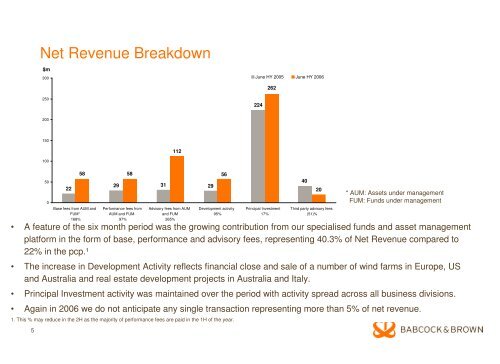

Net Revenue Breakdown<br />

$m<br />

300<br />

June HY 2005 June HY 2006<br />

262<br />

250<br />

224<br />

200<br />

150<br />

112<br />

100<br />

• A feature of the six month period was the growing contribution from our specialised funds and asset management<br />

platform in the form of base, performance and advisory fees, representing 40.3% of Net Revenue compared to<br />

22% in the pcp.¹<br />

• The increase in Development Activity reflects financial close and sale of a number of wind farms in Europe, US<br />

and Australia and real estate development projects in Australia and Italy.<br />

• Principal Investment activity was maintained over the period with activity spread across all business divisions.<br />

• Again in 2006 we do not anticipate any single transaction representing more than 5% of net revenue.<br />

1. This % may reduce in the 2H as the majority of performance fees are paid in the 1H of the year.<br />

5<br />

50<br />

0<br />

22<br />

Base fees from AUM and<br />

FUM*<br />

168%<br />

58 58<br />

29 31 29<br />

Performance fees from<br />

AUM and FUM<br />

97%<br />

Advisory fees from AUM<br />

and FUM<br />

265%<br />

56<br />

Development activity<br />

95%<br />

Principal Investment<br />

17%<br />

40<br />

20<br />

Third party advisory fees<br />

(51)%<br />

* AUM: Assets under management<br />

FUM: Funds under management