Charges applied to the main banking operations of ... - ING Belgium

Charges applied to the main banking operations of ... - ING Belgium

Charges applied to the main banking operations of ... - ING Belgium

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Valid as from 1 January 2011<br />

Valid as from 1 January 2011<br />

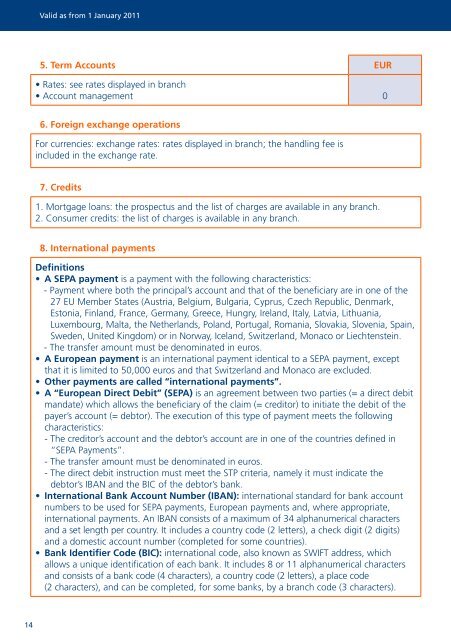

5. Term Accounts EUR<br />

• Rates: see rates displayed in branch<br />

• Account management 0<br />

6. Foreign exchange <strong>operations</strong><br />

For currencies: exchange rates: rates displayed in branch; <strong>the</strong> handling fee is<br />

included in <strong>the</strong> exchange rate.<br />

7. Credits<br />

1. Mortgage loans: <strong>the</strong> prospectus and <strong>the</strong> list <strong>of</strong> charges are available in any branch.<br />

2. Consumer credits: <strong>the</strong> list <strong>of</strong> charges is available in any branch.<br />

8. International payments<br />

Definitions<br />

• A SEPA payment is a payment with <strong>the</strong> following characteristics:<br />

- Payment where both <strong>the</strong> principal’s account and that <strong>of</strong> <strong>the</strong> beneficiary are in one <strong>of</strong> <strong>the</strong><br />

27 EU Member States (Austria, <strong>Belgium</strong>, Bulgaria, Cyprus, Czech Republic, Denmark,<br />

Es<strong>to</strong>nia, Finland, France, Germany, Greece, Hungry, Ireland, Italy, Latvia, Lithuania,<br />

Luxembourg, Malta, <strong>the</strong> Ne<strong>the</strong>rlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain,<br />

Sweden, United Kingdom) or in Norway, Iceland, Switzerland, Monaco or Liechtenstein.<br />

- The transfer amount must be denominated in euros.<br />

• A European payment is an international payment identical <strong>to</strong> a SEPA payment, except<br />

that it is limited <strong>to</strong> 50,000 euros and that Switzerland and Monaco are excluded.<br />

• O<strong>the</strong>r payments are called “international payments”.<br />

• A “European Direct Debit” (SEPA) is an agreement between two parties (= a direct debit<br />

mandate) which allows <strong>the</strong> beneficiary <strong>of</strong> <strong>the</strong> claim (= credi<strong>to</strong>r) <strong>to</strong> initiate <strong>the</strong> debit <strong>of</strong> <strong>the</strong><br />

payer’s account (= deb<strong>to</strong>r). The execution <strong>of</strong> this type <strong>of</strong> payment meets <strong>the</strong> following<br />

characteristics:<br />

- The credi<strong>to</strong>r’s account and <strong>the</strong> deb<strong>to</strong>r’s account are in one <strong>of</strong> <strong>the</strong> countries defined in<br />

“SEPA Payments”.<br />

- The transfer amount must be denominated in euros.<br />

- The direct debit instruction must meet <strong>the</strong> STP criteria, namely it must indicate <strong>the</strong><br />

deb<strong>to</strong>r’s IBAN and <strong>the</strong> BIC <strong>of</strong> <strong>the</strong> deb<strong>to</strong>r’s bank.<br />

• International Bank Account Number (IBAN): international standard for bank account<br />

numbers <strong>to</strong> be used for SEPA payments, European payments and, where appropriate,<br />

international payments. An IBAN consists <strong>of</strong> a maximum <strong>of</strong> 34 alphanumerical characters<br />

and a set length per country. It includes a country code (2 letters), a check digit (2 digits)<br />

and a domestic account number (completed for some countries).<br />

• Bank Identifier Code (BIC): international code, also known as SWIFT address, which<br />

allows a unique identification <strong>of</strong> each bank. It includes 8 or 11 alphanumerical characters<br />

and consists <strong>of</strong> a bank code (4 characters), a country code (2 letters), a place code<br />

(2 characters), and can be completed, for some banks, by a branch code (3 characters).<br />

• Straight Through Processing (STP):<br />

- In <strong>the</strong> case <strong>of</strong> SEPA and European payments: payment which indicates <strong>the</strong> correct account<br />

numbers (IBAN) <strong>of</strong> <strong>the</strong> payer and <strong>the</strong> payee, <strong>the</strong> BIC (Swift address) <strong>of</strong> <strong>the</strong> payee’s bank.<br />

- In <strong>the</strong> case <strong>of</strong> international payments: payment which indicates <strong>the</strong> correct account<br />

numbers (IBAN, BBAN or o<strong>the</strong>r) <strong>of</strong> <strong>the</strong> payer and <strong>the</strong> payee, <strong>the</strong> BIC (Swift address) <strong>of</strong> <strong>the</strong><br />

payee’s bank, and <strong>the</strong> full name and address <strong>of</strong> <strong>the</strong> payee.<br />

• Cost instruction - BEN/SHA/OUR<br />

The payer can indicate how <strong>the</strong> costs are distributed. There are three options:<br />

- Shared Costs (SHA): <strong>the</strong> payer pays <strong>the</strong> costs charged by his/her bank; <strong>the</strong> costs charged<br />

by <strong>the</strong> payee’s bank are borne by <strong>the</strong> payee.<br />

- Our Costs (OUR – costs for <strong>the</strong> payer): <strong>the</strong> payer pays <strong>the</strong> costs charged by his/her bank<br />

and <strong>the</strong> costs charged by <strong>the</strong> payee’s bank.<br />

- Beneficiary Costs (BEN – costs for <strong>the</strong> payee): <strong>the</strong> payer does not pay any costs. Both <strong>the</strong><br />

costs charged by <strong>ING</strong> and <strong>the</strong> costs <strong>of</strong> <strong>the</strong> payee’s bank are borne by <strong>the</strong> payee.<br />

In <strong>the</strong> case <strong>of</strong> SEPA payments and outgoing international payments in a currency <strong>of</strong> <strong>the</strong><br />

EEA 1 and in <strong>the</strong> EEA zone, only SHA is accepted. If ano<strong>the</strong>r instruction is given, it will<br />

au<strong>to</strong>matically be changed <strong>to</strong> SHA. In <strong>the</strong> case <strong>of</strong> any o<strong>the</strong>r international payment, SHA,<br />

BEN or OUR can be chosen.<br />

What will you be charged for an outgoing international payment?<br />

- With a SHA instruction: <strong>ING</strong>’s payment commission (see point 8.1)<br />

- With an OUR instruction: <strong>ING</strong>’s payment commission + OUR costs (see points 8.1 and 8.4)<br />

- With a BEN instruction: no charges for <strong>the</strong> cus<strong>to</strong>mer. <strong>ING</strong> au<strong>to</strong>matically deducts <strong>the</strong><br />

commission from <strong>the</strong> amount transferred.<br />

What will you be charged for an incoming international payment?<br />

- With a SHA instruction: <strong>ING</strong>’s payment commission (see point 8.1)<br />

- With an OUR instruction: no charges for <strong>the</strong> <strong>ING</strong> cus<strong>to</strong>mer (payee).<br />

- With a BEN instruction: <strong>ING</strong>’s payment commission + <strong>the</strong> correspondent banks’ charges<br />

• “Full amount” principle: <strong>the</strong> full amount must be transferred <strong>to</strong> <strong>the</strong> payee’s account.<br />

Any charges possibly applicable are debited by <strong>the</strong> bank separately. This principle applies<br />

<strong>to</strong> both SEPA and European payments.<br />

• The European Economic Area (EEA) includes <strong>the</strong> 27 Member States <strong>of</strong> <strong>the</strong> European<br />

Union, as well as Norway, Iceland and Liechtenstein.<br />

8.1 Charge for payments from and <strong>to</strong> o<strong>the</strong>r countries (including<br />

postage)<br />

• SEPA and European payments <strong>to</strong> and from an account held abroad up<br />

<strong>to</strong> 50,000 euros<br />

• SEPA payments <strong>to</strong> and from an account held abroad<br />

above 50,000 euros<br />

• Payments in euros outside <strong>the</strong> EEA or payments in o<strong>the</strong>r currencies:<br />

- Payment commission: 0.1% (+ V.A.T.) <strong>of</strong> <strong>the</strong> amount<br />

• Transfers <strong>to</strong> and from an account held in <strong>Belgium</strong> in ano<strong>the</strong>r currency<br />

than <strong>the</strong> euro, or transfers <strong>to</strong> and from an account in <strong>the</strong> EEA in Swedish<br />

kronor (free between <strong>ING</strong> <strong>Belgium</strong> accounts):<br />

- Currency equivalent up <strong>to</strong> 50,000 euros<br />

- Currency equivalent above 50,000 euros<br />

EUR<br />

0<br />

10.89<br />

min. 9.08<br />

max. 121<br />

9.08<br />

10.89<br />

14<br />

1 The EEA currencies are <strong>the</strong> following: euro, Bulgarian lev, Czech koruna, Danish krone, Hungarian forint, Latvian lat, Lithuanian litas, zloty,<br />

Romanian leu, Swedish krona, pound sterling, Swiss franc, Norwegian krone, Icelandic krona.<br />

15