MARKET OVERVIEW

01213+0%*%4+2520+56/87+/9% 2+ - Great Southern Touring ...

01213+0%*%4+2520+56/87+/9% 2+ - Great Southern Touring ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MARKET</strong> <strong>OVERVIEW</strong><br />

United Kingdom & Ireland<br />

The UK remains one of key outbound global markets and currently remains the largest long-haul<br />

source market for visitors to Australia. Australia’s appeal in the UK is supported by the historical<br />

and cultural links shared by the two countries. Generally British travellers tend to be least<br />

affected by worldwide events, and maintain their overseas holidays even in times of severe<br />

economic downturn. The high VFR factor may well be a key influence here. The challenge<br />

remains in the ability of marketing to convert high levels of interest from the UK consumer into<br />

urgency to visit. The market is framed currently by two conflicting trends – excellent increase in<br />

aviation capacity which enables visitation growth, against the current global economic uncertainty<br />

that is dampening this growth prospect.<br />

In terms of total inbound economic value to Australia the UK remains the number one<br />

international market in terms of visitation, yield and dispersal.<br />

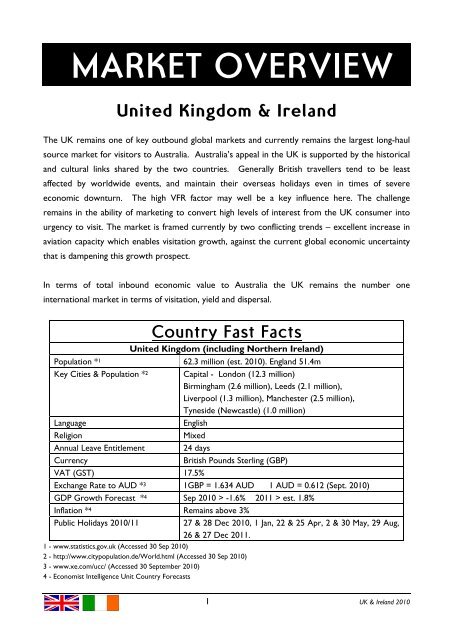

Country Fast Facts<br />

United Kingdom (including Northern Ireland)<br />

Population * 1 62.3 million (est. 2010). England 51.4m<br />

Key Cities & Population * 2 Capital - London (12.3 million)<br />

Birmingham (2.6 million), Leeds (2.1 million),<br />

Liverpool (1.3 million), Manchester (2.5 million),<br />

Tyneside (Newcastle) (1.0 million)<br />

Language<br />

English<br />

Religion<br />

Mixed<br />

Annual Leave Entitlement 24 days<br />

Currency<br />

British Pounds Sterling (GBP)<br />

VAT (GST) 17.5%<br />

Exchange Rate to AUD * 3 1GBP = 1.634 AUD 1 AUD = 0.612 (Sept. 2010)<br />

GDP Growth Forecast * 4 Sep 2010 > -1.6% 2011 > est. 1.8%<br />

Inflation * 4 Remains above 3%<br />

Public Holidays 2010/11<br />

1 - www.statistics.gov.uk (Accessed 30 Sep 2010)<br />

2 - http://www.citypopulation.de/World.html (Accessed 30 Sep 2010)<br />

3 - www.xe.com/ucc/ (Accessed 30 September 2010)<br />

4 - Economist Intelligence Unit Country Forecasts<br />

27 & 28 Dec 2010, 1 Jan, 22 & 25 Apr, 2 & 30 May, 29 Aug,<br />

26 & 27 Dec 2011.<br />

1 UK & Ireland 2010

Country Fast Facts<br />

Ireland<br />

Population * 1<br />

4,203,200 (July 2009 est.)<br />

Key cities & population *2 Capital - Dublin (pop. 1,027,900 – Dublin & Outer Dublin).<br />

Cork (195,400), Galway (71,983), Limerick (85,700),<br />

Waterford, (48,300).<br />

Language<br />

English<br />

Religion<br />

Mixed, strong Catholic predominance<br />

Annual leave entitlement 23 days<br />

Currency<br />

Euro (EUR)<br />

GST 21%<br />

Exchange rate to AUD * 3 1AUD = 0.591839 EUR<br />

GDP growth forecast * 4 2011 = 2.75%<br />

Public Holidays 2010/11<br />

25 & 26 Dec 2010, 1 Jan, 17 Mar, 25 Apr, 2 May, 6 Jun, 1 Aug,<br />

31 Oct, 25 Dec, 26 Dec 2011<br />

1 - https://www.cia.gov/library/publications/the-world-factbook/geos/ei.html (Accessed 30 Sep 2010)<br />

2 - http://www.tageo.com/index-e-ei-cities-IE.htm (Accessed 30 Sep 2010)<br />

3 - http://www.xe.com/ucc (Accessed 30 Sep 2010)<br />

4 - Economist Intelligence Unit Country Forecasts<br />

2 UK & Ireland 2010

ECONOMIC & FINANCIAL <strong>OVERVIEW</strong><br />

UNITED KINGDOM<br />

Government<br />

The UK is a Constitutional monarchy with the key political parties being Conservative, Labour,<br />

and Liberal Democrats. In Scotland the main political party is the Scottish National Party. In Wales<br />

it is the Plaid Cymru (Party of Wales). In Northern Ireland the main political parties include the<br />

Ulster Unionist Party, Social Democratic and Labour Party, the Democratic Unionist Party, Sinn<br />

Fein and the Alliance Party.<br />

The coalition of the right-of-centre Conservative Party and centrist Liberal Democrats has a solid<br />

majority in parliament post the June 2010 elections, but policy compromises will be needed on a<br />

range of issues, while fiscal austerity will provoke ongoing strains. As the junior coalition partner,<br />

the Lib Dems face pressure to defend their identity. A period of low opinion poll ratings and<br />

defeat in an electoral reform referendum in 2011 could lead to the party questioning its role in<br />

government.<br />

UK Economy<br />

The UK was hard hit by the global economic crisis in 2009 and real GDP growth fell by 4.9 per<br />

cent. Figures released by the UK Office for National Statistics on 16 December 2009 measured<br />

unemployment at 2.5 million people, or 7.9% of the workforce. The UK nevertheless remains the<br />

world's sixth largest economy.<br />

Efforts to shrink the UK’s largest-ever peacetime budget deficit will dominate policy debate. A<br />

dramatic five-year fiscal tightening programme will entail tax rises and the deepest sustained<br />

period of public spending cuts since the 1930s. The austerity plan has eased near-term concerns<br />

over fiscal sustainability, but a public backlash and deterioration in industrial relations appear<br />

inevitable.<br />

Fiscal consolidation implies that any monetary tightening will be gradual, but persistent abovetarget<br />

inflation will be a complicating factor for the Bank of England (BoE, the central bank),<br />

particularly if growth remains subdued. Despite rising profits, the banking system will remain<br />

reliant on state support. The banks large refinancing needs in 2011-12 and concerns about<br />

counterparty risk will continue to constrain credit availability to the private sector.<br />

After the largest annual decline in output in 2009 since the Second World War, the economy is<br />

forecast to expand by 1.6% in 2010 and by 1.3% in 2011. An extended period of sub-par growth<br />

and heightened market volatility is likely.<br />

Real GDP growth is forecast at 1.8% for 2011. Inflation remains around 3%.<br />

3 UK & Ireland 2010

Exchange Rates<br />

With the decline of the GBP against the rise in value of the AUD, Australia is now a more<br />

expensive holiday destination proposition for the British. The strength of the dollar is seen to have<br />

had a negative effect on product pricing in key tour operator programmes for 2010/11 particularly<br />

when reviewed against other major destinations which have become more price-competitive.<br />

Current rate of exchange (Google spot rate as at 11 th October 2010) 1 GBP – 0.6171 AUD.<br />

On average by May 2010, the British Pound was buying 32% fewer Australian dollars than in<br />

December 2008.<br />

Sterling has also continued to remain weak against the euro, resulting in an annual average<br />

exchange rate of GBP 1: €1. This however has driven customers away from the more traditional<br />

and mass market holiday in the euro zone, and has added to the growth in visitors to non euro<br />

zone short haul countries such as Egypt which has seen significant growth.<br />

Having appreciated strongly against the US dollar in 2007 providing great value for the UK visitor<br />

to the US with a rate of exchange of around one pound to two US dollars, sterling has now<br />

weakened against the US currency making the US slightly less favourable from an exchange rate<br />

basis.<br />

ECONOMIC & FINANCIAL <strong>OVERVIEW</strong><br />

IRELAND<br />

Ireland is a parliamentary republic with the key political parties being Fianna Fail, Fine Gael,<br />

Labour, Progressive Democrats, Green Party, and Sinn Fein. Ireland, after being one of the<br />

strongest economic performers in Europe in recent years, has seen a massive downturn, almost<br />

without precedent.<br />

The Irish banking system remains in a precarious state despite liability guarantees and<br />

recapitalisation by the government. The full nationalisation of all of the banks is possible over the<br />

outlook period.<br />

The unemployment rate averages around 13.25% and is expected to fall marginally to 13 per cent<br />

in 2011. The General Government Deficit is expected to be 11.5 per cent of GDP in 2010.<br />

Including the cost of the bailout monies for Anglo Irish Bank and Irish Nationwide, this figure<br />

would be 19.75 per cent. In 2011, the deficit will fall to 10.5 per cent of GDP. This is based on the<br />

assumption that a full €3bn package of austerity measures is implemented in the 2011 budget. By<br />

the end of 2011 the gross government debt will be equivalent to 94 per cent of GDP, compared<br />

to 44 per cent in 2008. Interest payments (excluding toxic property loans agency NAMA), which<br />

will also increase due to the cost of the bank bailout, will be close to €6bn, or 3.5 per cent of<br />

GDP in 2011.<br />

4 UK & Ireland 2010

Population Structure<br />

The UK and Ireland have rapidly ageing demographic profiles which present a challenge to the<br />

leisure travel industry since older travellers tend to have a lower propensity to travel; however,<br />

there are positive implications for the Australia market. There is good reason to believe that<br />

members of the “baby-boomer” generation, who are currently entering or approaching<br />

retirement and are wealthier, better educated and better-travelled than their forefathers, will<br />

maintain or increase their level of tourism spending. The over-55 segment - typically emptynesters<br />

with mortgages paid off – have the highest discretionary income of any age segment<br />

coupled with maximum leisure time.<br />

Consumer Confidence<br />

The tough economic climate has meant that there is a lack of consumer confidence for spending in<br />

general and in particular, the impact for holiday spending is significant. Consumers have been<br />

waiting for “a deal” and the trend has been towards last minute bookings to ensure they are<br />

getting the best possible price. Anecdotally it is reported that this trend has shown signs of<br />

reverting to as much as three to six month lead time.<br />

With the weaker consumer sentiment for travel in general the tourism sector continues to<br />

compete with other discretionary purchases. The austerity measures being put in place by the new<br />

British Government are providing concerns for the consumer; however, there does appear to be<br />

an improvement in consumer confidence.<br />

That said however, the British market has historically proven to be extremely resilient and the<br />

consumer puts their main holiday high on their spending agenda. Whilst there has been a trend<br />

towards shorter breaks and short haul travel, recent studies challenge this and indicate consumers<br />

may opt for one long haul rather than a number of short holidays. In addition to this the Euro is<br />

very strong against the Pound which is definitely influencing the customer and steering them away<br />

from a European short break towards mid to long haul destinations.<br />

Consumer Booking Patterns<br />

According to Mintel’s UK Holiday Booking Process report, the holiday booking process continues to<br />

evolve, with the major driving force being the ever-changing online environment. UK consumers<br />

report that reviews and other user-generated content are increasingly important in their research<br />

process, and the number of holidays booked entirely online by Mintel’s respondents has grown to<br />

over one in two. Reviews written by strangers on independent websites such as TripAdvisor,<br />

search results on Google and word of mouth advice from family and colleagues are more<br />

influential than brochures, advertising, media reviews and advice from travel agents when it comes<br />

to booking holidays, according to recent studies.<br />

This growth online has led to a number of important changes in the market, influencing the mix of<br />

independent and package holidays, regulation (both UK and pan-Europe), operator engagement<br />

with the ‘amateur’ reviewer, product innovation, when and what type of holidays are booked and<br />

it has even presented opportunities in the offline channel.<br />

5 UK & Ireland 2010

There are strong correlations between both the use of the internet with taking independent<br />

holidays and the use of travel agents with going on package holidays. Almost seven in ten whose<br />

last holiday was independent booked online; one third of package holiday takers used a travel<br />

agent only (way above an overall average of 17 per cent).<br />

Long-term booking trends show a fall in the use of travel agents as consumers look to make their<br />

own arrangements online. Ironically, however, the sheer proliferation of online information is<br />

helping to create a clear role for travel agents and other ‘expert’ intermediaries, and there are<br />

suggestions of a recent bounce back in the percentage using agents. In general there has been a<br />

return to traditional booking methods and visiting travel agencies again because consumers believe<br />

they offer more financial security through their bonding. Telegraph.co.uk reported that according<br />

to travel companies, more British holidaymakers are now booking with high street retailers,<br />

particularly following the collapse of the operator XL two years ago, and other subsequent<br />

failures.<br />

As the travel industry continues to explore areas of revenue opportunities, Australia is important<br />

for wholesalers and travel agents given the revenue potential in selling Australia. The Aussie<br />

Specialist Program continues to be the primary platform for Tourism Australia to train and<br />

develop agents selling Australia through the trade. Aussie Specialist agents are supported through<br />

online training, familiarisation trips, support collateral and a dedicated travel agent helpline.<br />

The recession has not appeared to have triggered an end to the era of taking multiple holidays,<br />

with two holidays per year being the dominant choice in 2009. Of those who took a trip in 2009,<br />

almost one in three holidayed once or twice. Over six in ten (62 per cent) of adults report having<br />

booked a holiday in 2009. This figure has remained remarkably consistent over the years, with<br />

approximately one third of the UK’s adults not going on holiday each year.<br />

The peak booking period is January to March, followed by September to November. July to<br />

August is the British summer holiday and bookings taken during this period are influenced by<br />

weather.<br />

The market became very late booking during the global economic crisis, even for long haul<br />

destinations including Australia, with passengers booking and travelling within three months of<br />

departure or significantly less during 2009, however, a move towards the more traditional three<br />

to six month lead time is returning.<br />

A recent UK passenger study conducted by TNS on behalf of Tourism Australia, gave insight into<br />

which sources UK travellers use when planning and booking their trip to Australia. This research<br />

stated that airline websites are the most used source to plan travel to Australia, and joint second<br />

as the most trusted. Travel agents advice is still the most trusted advice and second most used.<br />

6 UK & Ireland 2010

Source: TNS UK Passenger Conversion Study 2009 (conducted on behalf of Tourism Australia)<br />

41% of travellers said they used a travel agent in planning their trip to Australia. The strong<br />

presence of 18–36 year olds ensures that STA Travel figures highly among the agencies consulted.<br />

Specialists such as Trailfinders are also strong. The researchers also pointed out first-time visitors<br />

to Australia are also more likely to use a travel agent when planning their trip.<br />

For bookings to Australia, travel agents are still the source most frequently used. Of the<br />

respondents, 44% booked over the internet – usually direct with an airline, followed by an online<br />

travel company.<br />

7 UK & Ireland 2010

Online Environment<br />

The UK has one of the highest internet usage and penetration within Europe and is still<br />

demonstrating significant user growth.<br />

Population<br />

est.<br />

Internet<br />

Users<br />

Penetration %<br />

of population<br />

User growth % Users<br />

Europe<br />

UK 62,348,447 51,442,100 82.5% 234% 10.8%<br />

Ireland 4,622,917 3,042,600 65.8% 288.1% 0.6%<br />

Facebook Users (31 Aug 2010) Penetration %<br />

UK 27,806,860 44.6%<br />

Ireland 1,705,460 36.9%<br />

Source: www.internetworldstats.com<br />

The web is widely used as an important information gathering tool. The use of social media has<br />

continued to gain momentum and customers are seeing an array of marketing via traditional online<br />

media and new channels such as via mobile technology and platforms such as Twitter.<br />

8 UK & Ireland 2010

Google remains the strongest search platform in the UK driving approximately 80% of all UK<br />

search engine traffic and dominates online marketing.<br />

Users continue to embrace social media to connect with friends, and over 28 million Brits use<br />

social networking sites. This would seem to indicate that social media will have a role to play in<br />

how friends can influence each other’s travel plans. Facebook, Twitter, LinkedIN, and Flickr are<br />

strong platforms with high usage. The use of social media is highly prevalent in the marketing mix<br />

however advertising spend on social media is still modest compared to search engine optimisation<br />

and paid search.<br />

For a number of years the web has resounded to the phrase “content is king” and more recently<br />

there has been an emphasis on adding content to sites to not only inform and inspire customers<br />

but also to attract them through natural search. Content also plays an important role in the user<br />

experience on websites, which impacts both conversion rates and loyalty.<br />

75% of UK consumers check online comments and opinions from other holiday makers when<br />

choosing a holiday destination, with TripAdvisor being the leading platform.<br />

A summary of the key findings of an Online Travel Content and User Experience 2009 survey<br />

undertaken by Frommer’s Unlimited (the B2B division of Frommer’s Travel, a branded imprint of<br />

Wiley – a trusted source of travel information) provides an interesting insight into global online<br />

travel consumers. Findings show:<br />

- Consumers are still primarily influenced by price when deciding on a holiday/vacation.<br />

However, they also have additional information needs that change at each stage of the<br />

booking cycle.<br />

- At the planning stage, images of the accommodation and a written description of the<br />

destination proved to be the most important factor in the process, closely followed by<br />

information on activities and events and maps.<br />

- When booking, three pieces of information ranked as almost equally crucial, with airport<br />

and transportation information on a par with pictures of the room and a guide to the city<br />

or resort.<br />

- Finally, post-booking, a map of the destination was the essential item of content, with<br />

travel, weather, events and activities information and local dining also ranked as<br />

important.<br />

9 UK & Ireland 2010

The survey also revealed:<br />

What influences people’s decisions when planning where to go?<br />

When are they looking for destination information?<br />

10 UK & Ireland 2010

How influential are the following factors to you when deciding on a holiday destination?<br />

11 UK & Ireland 2010

TOURISM <strong>MARKET</strong><br />

Tourism Overview<br />

The UK is Australia’s second largest market by visitor arrivals 614,600 but is the largest in terms<br />

of economic value ($3.3 billion in 2009). However, the value of this market to Australia fell 8% in<br />

2009 while arrival numbers declined 0.7% year ending June 2010, impacted by the global financial<br />

crisis and other factors.<br />

The prospects for significant growth in arrivals from the UK remain poor given the lingering<br />

effects of the GFC and the weak outlook for household spending. Visitor arrivals were not<br />

assisted by the Icelandic volcanic ash cloud which led to a 20% reduction in arrivals in the month<br />

of April.<br />

In the year ending June 2010, Victoria received 32.1% of total UK arrivals, around 197,300 visitors.<br />

Victoria’s market share of visitors increased by 0.1% points on the previous year despite the flat<br />

market. On average UK visitors spend around $5,482 on their trip to Australia. There is a high<br />

level of repeat business with the level currently sitting around 57%.<br />

The UK also has the highest number of visitor nights out of all international markets and accounts<br />

for 13% of all visitor nights. The average stay in Australia is 36 days compared to the average 34<br />

day stay and dispersal is high with 42% of nights spent away from the major gateways. Victoria’s<br />

visitor night performance showed a significant growth year ending June 2010 of 13.4%, or<br />

3,895,000 visitor nights. This reflected a market share growth of +1% to 17% of the market.<br />

Tourism Outlook<br />

Despite the negative outlook for consumer spending and uncertainty regarding aviation duties and<br />

taxes, seat capacity between the UK and Australia is expected to increase during 2010, mainly<br />

because of the expansion plans of the Gulf based carriers. Arrivals to Australia are also likely to be<br />

supported by the Ashes cricket series to be played in Australia across late 2010 and early 2011,<br />

expected numbers circa 15,000 from the UK.<br />

On balance, visitor arrivals from the UK are forecast to decline 0.4% to 661,000 in 2010. Over the<br />

ten year period to 2019, arrivals to Australia are forecast to grow at an average annual rate of<br />

1.8% to reach 794,000, valued at $4.1 billion in real terms<br />

Tourism Forecasting Committee – Forecasts (year-on-year growth %)<br />

2007 2008 2009 2010<br />

(F1)<br />

2010<br />

(F2)<br />

2011<br />

(F1)<br />

2011<br />

(F2)<br />

UK -6.2 -2.4 -1.2 +3.3 -0.4 +3.4 +2.7<br />

Ireland 13.9 1.2 -8.2 -3.3 -7.1 +2.3 +2.6<br />

12 UK & Ireland 2010

Ireland remains significantly impacted by the market conditions and remains a declining market in<br />

the short to medium term.<br />

The UK remains the largest backpacker market to Australia (just ahead of Korea) and this<br />

segment will help support total arrivals from the UK. In the UK, 37,459 WHM visas were granted<br />

between July 2008 and May 2009, representing a 20% increase on the same period of the previous<br />

year.<br />

Source: Department of Immigration and Citizenship, August 2009<br />

13 UK & Ireland 2010

FAST FACTS<br />

United Kingdom & Ireland<br />

Brochures Production Varies<br />

Research Feb-Jun, production Jul-Dec, launch Nov-Jan<br />

Validity<br />

1 year<br />

Rates Validity Minimum 1 year, working up to 18 months ahead<br />

Setting Rates June-Aug<br />

Currently looking for rates for 2010/11 rates and onwards to 2012<br />

Commissions Wholesalers &<br />

Retailers<br />

Main ITO players<br />

Key Source Cities<br />

Major Consumer Shows<br />

Major Trade Fairs<br />

Peak Travel Period<br />

Best Time For Sales Calls<br />

Minimum 20% off rack/gross rates for both wholesalers<br />

and retailers, and up to 30% subject to targeted<br />

performance<br />

AOT, Goway, ATS, Australia One and Southern<br />

Crossings<br />

UK – London, Manchester, Leeds, Birmingham,<br />

Newcastle, Glasgow, Edinburgh<br />

Ireland – Dublin, Cork<br />

International Travellers World<br />

The Daily Telegraph Adventure Show<br />

ATE, World Travel Market, Dublin Holiday World<br />

Sep-Mar<br />

Mar-Jun, early Sep – avoid Nov/Dec & Jan/Feb<br />

Tourism Victoria encourages products to visit the market once or twice a year to meet with both<br />

the tour operator product teams and include some front line sales consultant training if their<br />

product is brochured with that operator. The best time to visit the market is end Mar-Jun and<br />

Sep-Oct. It is better to avoid Jan/Feb and August.<br />

Operators look for value added offers to market and differentiate their product offering from that<br />

of their competitors on a regular basis. Some operators will solicit for brochure inclusion via<br />

financial support.<br />

14 UK & Ireland 2010

INDUSTRY INFRASTRUCTURE<br />

Distribution Overview<br />

The travel industry in the UK has continued to see significant changes in distribution. The<br />

vertically integrated tour operator model has focused concentration on a smaller number of<br />

businesses and the continued “globalisation” of business continues to be an important trend in the<br />

retail travel sector.<br />

For destination Australia, this continued consolidation of the traditional trade distribution channels<br />

has provided a challenging environment in which to market itself, with Australia being just one of<br />

many long-haul destinations sold by these larger organisations.<br />

The continued consolidation within the travel industry has remained an area of concern and has<br />

seen a weakening of tour operator brands that traditionally had been key producers for Australia.<br />

With key Australia specialist brands being absorbed into larger travel organisations such as TUI<br />

and Thomas Cook, the larger parent companies’ continual business rationalisation and<br />

restructures have continued to impact the smaller brands. The closure of all Austravel retail shops<br />

is one example, as this brand is now call centre driven with brochures racked in Thomson retail<br />

shops rather than in their own outlets, and Austravel’s core business substantially reduced.<br />

What is interesting is the return to growth in sales from the high street travel agent. Traditional<br />

operators have faced a growing challenge from a number of online firms (OTAs) and online bed<br />

banks which had previously benefited from trends such as the growing propensity for travellers to<br />

book holidays at shorter notice and to build their own holiday packages. However, the recent<br />

collapses of travel providers, for example XL Leisure Group, a number of low cost carriers and<br />

other unlicensed (ATOL bonded) travel providers, have forced consumers to review their<br />

purchasing habits. This has resulted in a greater number of high street travel agencies receiving<br />

enquiries for Australia and whilst a high percentage of research is conducted online the final<br />

transaction is taken through a travel agent or licensed travel provider. The consumer is looking<br />

for financial protection for their holiday dollar investment and this can only be provided through a<br />

bonded agent or tour operator. Consumers were also negatively affected by the flight disruption<br />

and cancellation of air services due to the volcanic ash from Iceland in April/May 2010 costing<br />

many customers, who had booked flights and accommodation independently, thousands of dollars<br />

in repatriation costs and insurance claims.<br />

The Irish market is structured in a similar way to the UK, and there is cross over in terms of<br />

distribution with a number of UK based operators including outlets and various tour operator<br />

brands in Ireland. The two most prominent UK based operators are Trailfinders and now<br />

Travelmood (formerly the Austravel brand presence).<br />

15 UK & Ireland 2010

Retailers<br />

The UK currently has around 6,200 travel agencies. The number of high street travel agencies is<br />

set to fall further, particularly with the expected rationalisation of the multiples retail outlets.<br />

Travel agents generally have a basic knowledge of Australia, largely due to the Commonwealth,<br />

sporting and historical ties that Australia shares with the British, and the regular, general coverage<br />

of Australia in the media, but they still lack the detailed knowledge and confidence to proactively<br />

sell Australia.<br />

ABTA membership has fallen steadily over the past decade. Ten years ago the association boasted<br />

2,800 agency members, but this has fallen to 1,700 with 7,000 branches. The decline is attributed<br />

to the consolidation in the travel industry and growth in online distribution.<br />

Ireland has around 365 ITAA travel agency members and 130 other agencies selling travel<br />

packages. The majority of agencies are family owned although there is a trend towards franchising.<br />

Travel agents generally work on a base commission level of 10%.<br />

Aussie Specialists<br />

The Aussie Specialist Program (ASP) is Tourism Australia’s global online training program, run<br />

with the cooperation of the State and Territory tourism organisations. The program is designed to<br />

provide travel agents and distributors with the knowledge and skills to sell Australia more<br />

effectively. As at June 2010 there were 1,789 qualified ASP’s in the UK.<br />

UK<br />

Premier<br />

ASP<br />

Qualified Training NT SA NSW QLD VIC WA TAS<br />

127 1789 1143 603 547 656 620 573 573 554<br />

Ireland n/a 101 25 33 30 34 35 33 39 44<br />

Victoria Specialists<br />

The Victoria specialist module is an advanced module which can be completed once an agent has<br />

qualified as an ASP. It remains Tourism Victoria’s primary training tool for the wider retail<br />

distribution network. There are 573 qualified Victoria specialists in the UK and 33 in Ireland.<br />

Homeworkers<br />

The UK and Ireland have both seen growth in the number of “homeworkers”, with organisations<br />

such as Travel Counsellors being the largest home based travel company in Europe and continuing<br />

to grow rapidly. Other organisations include Future Travel, Personal Travel Advisors network and<br />

Hays Travel in the UK.<br />

16 UK & Ireland 2010

Wholesalers/Direct Sell Operators<br />

There are over 100 tour operators selling Australia in their programs throughout the UK, and the<br />

top 10 account for some 80% of the leisure travel market to Australia. There are a number of<br />

wholesalers who sell Australia through a traditional distribution system relying on retail agencies,<br />

either their own branded agencies or independents, to sell the product contained in their<br />

brochures. Direct sell operators and brands are a key feature of the UK market and are still an<br />

important part of Australia distribution although the actual number of specialists is dwindling as a<br />

result of industry consolidation.<br />

Top 10 UK Agents/Operators<br />

Company Presence Latest Market Intelligence<br />

TUI<br />

Austravel &<br />

Travelmood<br />

brands<br />

Moved from direct sell to<br />

wholesale only brand<br />

Closed all retail outlets which were re-branded<br />

as Travelmood, and during 2010 are closing all<br />

Travelmood outlets completely. Austravel<br />

product now wholesaled through TUI high street<br />

retail shops. Travelmood will remain a brand<br />

with a retail outlet in Ireland only. ITOs -AOT &<br />

direct.<br />

Flight<br />

Centre<br />

Retailer - c100 shops, head<br />

office New Malden, Surrey<br />

FC has consolidated its position further in the<br />

UK market as one of the leading specialist<br />

retailers for Australia. Now operating a number<br />

of sub brands including Round the World Travel<br />

Experts, Infinity (wholesaler) and Flight Centre.<br />

ITOs - Infinity & ATS.<br />

Gold Medal National wholesaler based<br />

in Preston (NW England),<br />

with direct sell online<br />

brand Netflights<br />

Now fully owned by Thomas Cook. Gold Medal<br />

has taken over responsibility for TC’s Flight<br />

Savers unit. Expect further integration with TC.<br />

ITOs –global product buy.<br />

17 UK & Ireland 2010

Top 10 UK Agents/Operators<br />

Company Presence Latest Market Intelligence<br />

STA Travel c45 shops nationally, youth<br />

focused, head office<br />

London<br />

Leading youth operator, strong online and digital<br />

marketing opportunity.<br />

ITOs – STA/AOT<br />

Bridge The<br />

World<br />

Retailer/direct sell<br />

specialist. Brand name<br />

bought by STA, set to<br />

become a strong retail<br />

presence with focus on<br />

Australia.<br />

STA is developing a totally separate brand to<br />

focus on the older market segment and provide<br />

a vehicle to ensure customer retention post<br />

“youth”. Opened first retail outlet in<br />

Bournemouth in October 2010 (old Austravel<br />

premises), and is currently purchasing the<br />

remaining Austravel/Travelmood shops from<br />

TUI, re-opening as BTW by the end of<br />

December 2010. ITO s- AOT & direct.<br />

The Lotus National direct seller, Independent operator - worldwide low cost<br />

Group London based<br />

specialist<br />

Qantas<br />

Holidays<br />

National wholesaler based<br />

in London<br />

Qantas Airways subsidiary company, focused<br />

predominantly on wholesale activity.<br />

Escape (part of<br />

Cooperative<br />

Travel)<br />

Previously branded Flight<br />

Desk.<br />

Escape provides all air and independent packages<br />

for Co-operative Travel distribution (strong<br />

northern presence). White label brochure with<br />

ATS.<br />

Thomas<br />

Cook<br />

c1,000 shops, head office<br />

Peterborough<br />

Now owns Gold Medal Travel (Gold Medal<br />

Travel, Netflights & Pure Luxury brands). The<br />

Gold Medal team are responsible for all schedule<br />

air and ground product buy for all brands across<br />

The TC group. ITO is ATS.<br />

Trailfinders 22 retail shops in most<br />

major cities including 2<br />

Remains the leading independent retailer, and<br />

receives high brand recognition.<br />

shops in Ireland.<br />

Travel 2 National wholesaler, based<br />

in London (Stella) with<br />

main call centre in<br />

Part of Stella Group – remains a traditional<br />

wholesaler for Australia competing<br />

predominantly with Gold Medal Holidays.<br />

Glasgow.<br />

Travelbag Direct sell - 8 retail shops<br />

nationally, based on<br />

London (Stella)<br />

Part of Stella Group – direct sell only<br />

18 UK & Ireland 2010

Luxury specialists who promote Australia include Audley Travel, Abercrombie and Kent, Bridge &<br />

Wickers, Cox and Kings, Turquoise Holidays and Tailor Made Travel. There are a number of<br />

comparatively new players in this segment that are actively now including Australia in their<br />

portfolio and these include Scott Dunn, Bailey Robinson and Steppes Travel.<br />

Online Travel Agents (OTAs)<br />

Key OTAs are Expedia, Travelocity and lastminute.com. Online and niche operators<br />

Key2Holidays, Dreamticket.com, Black Tomato and Isango! provide an opportunity for broader<br />

product exposure as they have no brochure overheads.<br />

With increasing global concern for sustainable tourism a number of new responsible tour<br />

operators are emerging including Hands Up Holidays and Responsible Travel.<br />

Inbound Tour Operators<br />

There are several inbound tour operators active in the UK market and working with a variety<br />

of mainstream wholesalers through and specialist operators. Key players are AOT and ATS,<br />

both have sales staff based in the UK. Commission Level: Up to 30 per cent<br />

Refer to the tour operator appendix at the end of this report for more detail on individual operators.<br />

19 UK & Ireland 2010

ARRIVALS TO VICTORIA & AUSTRALIA<br />

UK<br />

Visitors<br />

Y/E June 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 AAG % change<br />

Complete 09/10<br />

Australia 309,038 344,602 327,076 352,156 419,525 466,256 534,418 577,192 589,999 605,908 644,456 652,283 660,685 684,722 643,046 618,847 614,624 4% -1%<br />

New South Wales 188,090 229,988 208,787 236,407 270,133 296,444 356,662 371,279 386,401 398,824 409,624 423,077 425,505 440,051 393,969 374,541 366,636 4% -2%<br />

Queensland 134,779 150,832 130,811 156,313 179,365 206,177 264,772 249,051 274,326 261,267 280,218 279,222 285,461 289,418 256,370 250,288 240,362 4% -4%<br />

Victoria 95,206 105,907 92,345 104,281 124,114 147,458 161,977 184,693 201,095 206,787 211,926 203,107 213,129 237,459 209,529 199,958 197,296 5% -1%<br />

Victoria Mkt Share 31% 31% 28% 30% 30% 32% 30% 32% 34% 34% 33% 31% 32% 35% 33% 32% 32%<br />

Source: International Visitor Survey 1994-2010, Tourism Research Australia<br />

Visitors<br />

700,000<br />

650,000<br />

600,000<br />

550,000<br />

500,000<br />

450,000<br />

400,000<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

Visitors<br />

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Year Ending June<br />

Australia New South Wales Queensland Victoria Victoria Mkt Share<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Market Share<br />

Visitor Forecasts 2019<br />

Places Visited - Overnight Visit or Daytrip (% of all Visitors to Victoria)<br />

Australia 747,838 Great Ocean Road 39%<br />

Victoria 240,889 Phillip Island, penguin parade 20%<br />

Yarra Valley 17%<br />

Source: Tourism Forecasting Committee,<br />

Mornington Peninsula 16%<br />

Forecast 2010 Issue 1, Tourism Research<br />

Dandenongs, Puffing Billy, Healesville 16%<br />

Australia, Canberra.<br />

Ballarat, Sovereign Hill 11%<br />

(Tourism Victoria estimates for Visitor<br />

Bendigo 5%<br />

Forecasts 2019 based on Year Ending<br />

December 2009 International Visitor Survey<br />

Daylesford, Hepburn Springs, Mt. Macedon 3%<br />

data).<br />

Source: International Visitor Survey, Tourism Research Australia (year ending December 2009)<br />

Prepared by Tourism Victoria Research Unit<br />

20 UK & Ireland 2010

Nights ('000)<br />

Y/E June 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 AAG % change<br />

Complete 09/10<br />

Australia 12,538 15,771 13,701 12,975 15,357 17,029 19,713 24,697 22,131 22,497 26,602 21,556 21,950 22,826 20,681 22,104 22,445 4% 2%<br />

New South Wales 4,433 6,202 5,457 5,099 5,382 5,846 7,050 9,699 8,083 7,977 8,673 7,047 7,411 7,767 6,673 7,170 7,159 3% 0%<br />

Queensland 3,064 3,377 2,825 2,693 3,533 4,120 4,707 5,682 4,780 5,103 5,772 5,382 5,006 5,386 4,783 5,386 5,485 4% 2%<br />

Victoria 1,385 1,917 1,941 1,759 2,255 2,447 2,539 2,704 3,367 3,734 5,831 3,521 3,654 3,932 3,539 3,436 3,895 7% 13%<br />

Victoria Mkt Share 11% 12% 14% 14% 15% 14% 13% 11% 15% 17% 22% 16% 17% 17% 17% 16% 17%<br />

Source: International Visitor Survey 1994-2010, Tourism Research Australia<br />

Nights<br />

30%<br />

25,000<br />

25%<br />

20,000<br />

20%<br />

Nights ('000)<br />

15,000<br />

15%<br />

Market Share<br />

10,000<br />

10%<br />

5,000<br />

5%<br />

0<br />

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Year Ending June<br />

0%<br />

Australia New South Wales Queensland Victoria Victoria Mkt Share<br />

Main Reason for Trip<br />

Visitors (%) Nights (%)<br />

Aus Vic Aus Vic<br />

Holiday 46% 56% 54% 48%<br />

Visiting friends and relatives 40% 32% 29% 31%<br />

Business 8% 8% 4% 6%<br />

Education 1% 1% 2% 3%<br />

Employment 3% 3% 9% 11%<br />

Other reason 2% 1% 1% 1%<br />

Source: International Visitor Survey - Year ending June 10, Tourism Research Australia<br />

Note: Figures in red are subject to sampling variability and should be used with caution.<br />

Prepared by Tourism Victoria Research Unit<br />

21 UK & Ireland 2010

Ireland<br />

Visitors<br />

Y/E June 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Av Annual % change<br />

% change 09-10<br />

Australia 16,400 18,600 22,900 28,000 34,100 44,100 49,600 50,600 47,200 54,300 56,600 59,500 63,300 69,300 67,200 58,900 9% -12%<br />

Victoria's Market Share* for the Year Ending June 2010: 41%<br />

Source: Overseas Arrivals & Departures 1995-2010, Australian Bureau of Statistics<br />

* NB: Tourism Victoria estimate for Victoria's Market Share is indicative only. Based on unpublished data from the International Visitor Survey, Year Ending June 2010, Tourism Research Australia<br />

Visitors to Australia<br />

80,000<br />

70,000<br />

60,000<br />

50,000<br />

Visitors<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Year Ending June<br />

Source: Overseas Arrivals & Departures 1995-2010, Australian Bureau of Statistics<br />

Visitor Forecasts 2019<br />

Australia 1 77,348<br />

Victoria 2 31,550<br />

Source: Tourism Forecasting Committee, Forecast 2010<br />

Issue 1, Tourism Research Australia, Canberra.<br />

1. Estimates for Visitor Forecasts 2019 to<br />

Australia based on Year Ending December<br />

2009 International Visitors Survey data.<br />

2. Tourism Victoria estimates for Visitor<br />

Forecasts 2019 to Victoria based on<br />

estimated Market Share (indicative only).<br />

22 UK & Ireland 2010

AIR ACCESS TO AUSTRALIA & VICTORIA<br />

London is a key aviation hub for inbound arrivals to Australia, with a significant number of<br />

European tourists travelling via London (Heathrow) to Australia due to the Kangaroo route (UK-<br />

Australia) being so highly competitive both in terms of airline choice, price and connectivity.<br />

Capacity ex the UK has continued to grow on the back of substantial increases in capacity and<br />

services from the Middle Eastern carriers (Emirates, Etihad and Qatar Airways), which more than<br />

off-set any capacity reductions by end-point carriers. New opportunities have continued to<br />

emerge as bi-lateral agreements are expanded (e.g. the UAE-Australia bilateral agreement<br />

February 2010), new product is introduced (e.g. Qantas/Singapore/Emirates A380 upgrades plus<br />

Air Asia X’s business class flatbeds), new markets serviced (e.g. Emirates regional ports) and<br />

collaboration continues (e.g. the renewal of the Qantas/BA Joint Service Agreement).<br />

Risks have emerged however that will require monitoring such as rising fuel prices, the UK’s<br />

Government policy on aviation and aviation taxes and volcanoes closing airspace.<br />

The top three performing airlines in terms of passenger numbers ex the UK to Australia are<br />

1) Qantas, 2) Emirates and 3) Singapore Airlines. Emirates has particular strength with its strong<br />

passenger capacity over key regional departure points which Qantas and Singapore Airlines do not<br />

serve (serving via interline agreements or a code share in the case of Qantas with British Airways),<br />

and has increased its market share to the detriment of Qantas. Etihad’s recent announcement of a<br />

tie up with Virgin Blue will provide solid growth opportunity for both carriers.<br />

Etihad Airways is currently the only airline that flies one-stop from Dublin to Melbourne.<br />

However, code share partnerships between BA and Qantas offer connections via London<br />

Heathrow and other European hubs.<br />

With a wide choice of international departures from the UK there is a wide range of flight options<br />

with a multitude of connection possibilities. The following table demonstrates the key airline<br />

players with direct or one-stop capacity to Melbourne.<br />

23 UK & Ireland 2010

Airline Routing Flight #<br />

Flights<br />

PW<br />

Aircraft<br />

Type<br />

Qantas LHR-SIN-MEL QF10 7 A380<br />

Qantas LHR-HKG-MEL QF030 7 B744<br />

Singapore LHR-SIN/SIN-MEL SQ317/SQ217 7 A380/B777<br />

Singapore LHR-SIN/SIN-MEL SQ317/SQ227 7 A380/A380<br />

Singapore LHR-SIN/SIN-MEL SQ317/SQ237 7 A380/B777<br />

Singapore LHR-SIN/SIN-MEL SQ319/SQ227 7 B777/A380<br />

Singapore LHR-SIN/SIN-MEL SQ319/SQ237 7 B777/B777<br />

Singapore MAN-SIN/SIN-MEL SQ327/SQ217 7 B777/B777<br />

Singapore LHR-SIN/SIN-MEL SQ321 /SQ227 7 A380/A380<br />

Emirates LHR-DXB-SIN-MEL EK004/EK404 7 A380/B777<br />

Emirates LHR-DXB-SIN-MEL EK004/EK404 7 B777/B777<br />

Emirates LHR-DXB/DXB-MEL EK008/EK408 7 B777/B777<br />

Emirates LHR-DXB-KUL-MEL EK002/EK408 7 A380/B777<br />

Emirates LHR-DXB/DXB-MEL EK030 /EK404-406 7 B777/B777<br />

Emirates LGW-DXB-MEL EK010/EK406 7 B777/B777<br />

Emirates LGW-DXB-KUL-MEL EK016/EK408 7 B777/B777<br />

Emirates LGW-DXB-KUL-MEL EK012/EK408 7 B777/B777<br />

Emirates MAN-DXB/DXB-MEL EK020/EK404 7 B777/B777<br />

Emirates MAN-DXB/DXB-MEL EK020/EK408 7 A380/B777<br />

Emirates MAN-DXB/DXB-MEL EK018/EK406 7 B777/A340<br />

Emirates BHX-DXB/DXB-SIN-MEL EK038/EK404 7 B777/B777<br />

Emirates BHX-DXB/DXB-MEL EK040/EK408 7 B777/B777<br />

Emirates NCL-DXB/DXB-MEL EK036/EK408 7 A330/B777<br />

Emirates GLA-DXB/DXB-MEL EK028/EK408 7 B777/B777<br />

Malaysia LHR-KUL/KUL-MEL MH003/MH129 7 B744/B772<br />

Malaysia LHR-KUL/KUL-MEL MH001/MH149 7 B744/B772<br />

Cathay LHR-HKG/HKG-MEL CX254/CX105 7 B747/A330<br />

Cathay LHR-HKG/HKG-MEL CX252/CX163 7 B747/A330<br />

Cathay LHR-HKG/HKG-MEL CX256/CX135 7 A340/A330<br />

Etihad LHR-AUH/AUH-MEL EY012/EY460 7 A330/A340<br />

Etihad LHR-AUH-SYD-MEL EY018/EY450 7 A340/A340<br />

Etihad DUB-DOH/DOH-MEL EY042/EY460 6 A330/A340<br />

Etihad DUB-AUH-SYD-MEL EY048/EY450 4 A330/A340<br />

Qatar<br />

LHR/DOH/DOH-MEL<br />

QR002-006-008-012-<br />

018/QR030<br />

7 A330/B777<br />

Qatar LGW/DOH/DOH-MEL QR076-QR030 7 A330/B777<br />

24 UK & Ireland 2010

Strengths<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<strong>MARKET</strong> S.W.O.T<br />

The UK market is generally resilient and has historically had the ability to bounce back from<br />

global issues. The market expects a quicker market recovery / opportunity from the global<br />

downturn due to high repeat visitor numbers and historic / cultural links mid to longer term.<br />

Strong relationships with key industry and media partners and stakeholders.<br />

Australia continues to rank high in the table of “aspirational” destinations although<br />

competition from other countries has increased in the “must see” stakes.<br />

Australia is still perceived as a “safe” destination during times of continued uncertainty.<br />

Victoria has strong VFR links which provide a strong reason to travel, catch up with friends<br />

and family, and take a holiday.<br />

The state is compact, with diverse and easily accessible regions and attractions, and presents<br />

excellent touring opportunities, as strong as or stronger than the touring proposition in other<br />

regions of Australia.<br />

Ongoing activity & relationship with student/youth market leader STA Travel and ability to<br />

work this performing segment harder in partnership.<br />

Development of multi-channel strategies to ensure competitiveness in the online environment<br />

supported by the growth in web usage, online price transparency, self-selection/do-it-yourself<br />

packaging, and direct booking facilities with key service providers, e.g. activity with<br />

OTAs/Expedia, TripAdvisor, MSN<br />

Tourism Victoria has an excellent level of online video content to further develop and<br />

distribute.<br />

Extensive ASP network across the UK<br />

Tourism Victoria’s Discover the Other Oz (DTOZ) partnership with the NT and SA remains<br />

the only committed and consistent STO marketing partnership with trade partnerships still<br />

keen to invest in partnership marketing.<br />

The implementation of the Nature Based Tourism Strategy provides opportunity with the<br />

development and awareness of nature based and eco-friendly products which are becoming<br />

more important to the traveller.<br />

Weaknesses<br />

<br />

<br />

<br />

The strong Australian dollar resulting in perceived lack of “value” proposition, increase in<br />

ground product costs in tour operator programmes compared to previous year and versus<br />

other competing destinations.<br />

Global exchange rate fluctuations will potentially negatively impact the investment made by<br />

the Australian industry marketing in the UK.<br />

Business arrivals – no fast recovery predicted<br />

25 UK & Ireland 2010

Lack of urgency to travel to Australia together with the rational barriers of time and distance.<br />

Reduced take up rate of and opportunity for Victorian products making it to market as<br />

operators consolidate their consumer offering.<br />

The current economic climate is impacting on the operators’ marketing spend in the UK and<br />

Tourism Victoria needs to continue to ensure strong business relationships and consistency to<br />

ensure those funds invested are done so promoting destination Australia and including<br />

Melbourne and Victoria.<br />

Lack of motivational content particularly in the digital space and with particular relevance for<br />

the youth, nature based and luxury segments.<br />

Lack of specific WHV and Luxury segment modules on the ASP.<br />

Australia is sometimes perceived as one dimensional - a hot place with lots of beaches and a<br />

huge desert - and perceptions of climatic diversity, sub-continental characteristics, seasonal<br />

variations and opportunities do not feature in the findings of various research undertaken.<br />

However, through Tourism Australia’s marketing of “experiences” a deeper dimension is<br />

being positioned to entice potential visitors to dig deeper into what Australia has to offer in a<br />

competitive world.<br />

There are misconceptions about the weather in Melbourne and Victoria versus weather in the<br />

rest of Australia.<br />

Sydney continues to be the “must see” iconic Australia city.<br />

Melbourne and Victoria are often perceived as a second time visitor market only.<br />

Lack of awareness on what lies beyond Melbourne, and the diversity and compactness of the<br />

state and its attributes of nature and wildlife, food and wine etc.<br />

Booking accessibility of the smaller and unique products, especially with the growing strength<br />

of the ITOs in market.<br />

Lack of “signature” status product for the luxury traveller in comparison to other regions of<br />

Australia e.g. Southern Ocean Lodge (Kangaroo Island) and Longitude (NT).<br />

Opportunities<br />

<br />

<br />

<br />

<br />

Continued growth of air capacity, particularly outside London / regional airports (introduction<br />

of A380s on the Melbourne route by Singapore Airlines, and Emirates, Etihad and Qatar<br />

Airways adding services to Melbourne)<br />

The number of airline and industry partners interested in working and investing with Tourism<br />

Australia provides potential opportunity to participate in or leverage off activity, and raise<br />

Melbourne’s destination profile.<br />

Timing of Tourism Victoria’s marketing activity to coincide and leverage off Tourism<br />

Australia’s activity e.g. January 2011 co-operative activity with Emirates and February 2011 cooperative<br />

activity with Singapore Airlines, to maximise exposure under the core brand.<br />

Opportunity to develop Victoria’s nature and natural attractions positioning off the back of<br />

the Nature Based Programme, e.g. UK’s activity with www.responsibletravel.com<br />

26 UK & Ireland 2010

Australialive event Sep 2011, opportunity to work across Victorian Government Departments<br />

and in partnership with Victoria product.<br />

Opportunity to develop affinity partnerships with the food and wine industry.<br />

Opportunity to promote Hallmark events and Victoria’s festivals programme.<br />

Industry consolidation enables access to a greater number of consumers through one<br />

organisation i.e. integrated partnership with big players. There is also a drive back to the<br />

traditional trusted high street brand to book travel due to the uncertainty of these financial<br />

times, which reflects the importance of the Aussie Specialist Programme.<br />

Research shows that the desire and importance of a holiday remains strong for the UK<br />

population.<br />

The high internet penetration, the importance of word of mouth and growing use of social<br />

media.<br />

Further grow the youth segment; in particular the Working Holiday Visa Program in response<br />

to the decline in graduate/employment opportunities (this sector has increased by 20% in the<br />

UK from Jul 08 - Feb 09).<br />

Target a growing sector of professionals who have been made redundant due to the<br />

economic crisis and who are using the opportunity to take a career break.<br />

Historical high number of repeat visitors and relevant opinion formers in this market can act<br />

as advocates via Word Of Mouth to their peers.<br />

The luxury/upmarket segment has continued to show signs of resilience in this tough<br />

economic environment.<br />

The reduction in the price of oil has made Australia more affordable from an aviation<br />

perspective in the short term versus the increase in passenger taxes.<br />

The historic, cultural and sporting ties between the UK and Australia continues to create high<br />

media noise and consequently generates a high level of desire and keeps Australia front of<br />

mind amongst consumers e.g. The Ashes Series 2010<br />

Digital opportunities within the social media sites and blogosphere provide cost effective ways<br />

to reach consumers (esp. youth) and engage consumers through storytelling and range of<br />

experiences.<br />

Australia’s diversity provides us with a wealth of stories to use as media hooks and stimulate<br />

interest and depth of message.<br />

Increased focus by trade on long-haul/higher revenue destinations versus short haul.<br />

Increase in niche tour operators selling experience-based modular holidays.<br />

27 UK & Ireland 2010

Threats<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Credit crunch creating tough economic environment generally, and the planned austerity<br />

measures leave consumers unsure.<br />

The strong Australia dollar making an Australia holiday more expensive, less perceived value<br />

for money.<br />

Whilst consumer confidence is improving the general lack of consumer confidence for<br />

spending in general and in particular, the impact for holiday spending is significant. Consumers<br />

are waiting for a deal and there has been a trend towards last minute bookings to ensure they<br />

are getting the best possible price.<br />

Weaker consumer sentiment for travel in general – tourism competing with other<br />

discretionary purchases.<br />

Continued negative media coverage of the economic situation is impacting general consumer<br />

attitude.<br />

Tourism New South Wales recent launch of their new brand campaign in the UK and across<br />

Europe with a profile on Sydney.<br />

There has been a trend towards shorter breaks / short haul travel; although recent studies<br />

challenge this & indicate consumers may opt for one long haul rather than multiple short haul<br />

holidays.<br />

Competition for the UK Pound is fierce for domestic, European and long haul competitor<br />

destinations. Low cost airlines to Europe introducing very low fares, aggressive pricing for<br />

holidays to Asia and all inclusive long haul holidays.<br />

Continued consolidation of the travel distribution network and an emphasis on other long<br />

haul destinations that are perceived as less complex and labour intensive to sell and produce a<br />

higher margin (e.g. island destinations, cruise packages).<br />

Environmental sustainability issues impacting on travel planning, but to lesser extent due to<br />

the focus on the economic downturn.<br />

Risks that will require monitoring such as rising fuel prices longer term, the UK’s Government<br />

policy on aviation and aviation taxes and volcano’s closing airspace.<br />

Increase in Air Passenger Duty (additional £15 to £55 as of 1 Nov 2009 and additional £45 to<br />

£85 as of 1 Nov 2010 for economy passengers).<br />

Increased media proliferation and shifts in how the consumer can most effectively be reached.<br />

TA’s activity in a more tactical market reducing opportunity for STOs to leverage $ as<br />

effectively with major trade players. Consolidation of trade players also means reduced<br />

available marketing spend.<br />

28 UK & Ireland 2010

<strong>MARKET</strong>ING OPPORTUNITIES<br />

UK/Europe New Product Workshop, February 2011<br />

This workshop has proved a popular and over subscribed event. In its 4 th year the event will run<br />

with the objective of increasing awareness of Australia’s new product and continued development<br />

and strengthening of Australia’s key travel experiences and highlighting the diversity of Australia’s<br />

tourism experiences. The mission will facilitate business opportunities for participating delegates<br />

and provide a forum that is conducive to establishing new contacts and potential business.<br />

Applications have closed for 2011, however, this event is planned to be repeated annually.<br />

Corroboree Europe, Darwin, May 2011<br />

This annual retail training and mega famil event will be hosted in Darwin 3-5 June 2011 (workshop<br />

dates) following Melbourne’s successful hosting of the event in May 2010. Corroboree includes a<br />

3-day training workshop followed by a series of famils across Australia. This event allows<br />

participating Australian sellers to train over 300 Aussie Specialists from across Europe in one<br />

location during one event, including agents from the United Kingdom and Ireland.<br />

Tourism Victoria will host a total of 4 famils from Europe and South Africa post the 2011<br />

workshops and will showcase Melbourne and regional Victoria product/regions.<br />

Australian Tourism Exchange (ATE), Sydney, April 2011<br />

ATE remains the prime forum to showcase Victorian product. This is without doubt the key event<br />

and product should continue to be “seen” and contract with operators.<br />

Regional Sales Mission, September/October 2011<br />

The Melbourne and Regional Victoria Sales Mission is planned to run again in September 2011.<br />

The formula is based on key market relevant regions attending which allows the opportunity to<br />

access and train a wider mix of retailers, ASPs, and key wholesalers regardless of their preferred<br />

individual product choice. It is anticipated that the 2011 mission will incorporate cities within the<br />

UK and Germany, but for 2011 will also include cities in countries not visited in 2010 e.g. The<br />

Netherlands, the Nordic Region, and Italy. A strong product manager meeting schedule will also<br />

be incorporated into this event.<br />

The Aussie Specialist Program www.specialist.australia.com<br />

The Aussie Specialist Program is a comprehensive online four module training program with a final<br />

exam, teaching the trade how to sell generic Australia, and developing their knowledge on all<br />

elements of the Australian product offering. There are three tiers. The first is the core Australia<br />

module, followed by individual modules for each of the states & territories.<br />

A quarterly email blast is distributed to both Aussie Specialists and Victoria Specialists. Suppliers<br />

can take advantage of this opportunity to update the specialists with product information and new<br />

29 UK & Ireland 2010

developments through the online newsletter. Costs start from around A$25 inclusive of VAT per<br />

100 emails.<br />

There is an Aussie Specialist Travel Club offering special deals to encourage the specialists to try<br />

the product at an industry rate. You can provide a special trade offer to experience your product,<br />

and the specialists are advised to contact you directly for bookings. There are no participation<br />

costs, to register your company’s offer go to www.specialist.australia.com/travelcluboffers.<br />

Destination Australia Partnership - Trade Helpline<br />

Tourism Victoria contributes to the running and costs of the Trade Helpline. Suppliers should<br />

ensure that any visit to London includes a training session with the helpline team at Tourism<br />

Australia. Remember that London is the centralised European base for Tourism Australia and<br />

therefore supports agents across Europe via phone and email.<br />

Trade and Media Familiarisations<br />

Suppliers are encouraged to assist with Tourism Victoria’s media visits and sales consultant famils<br />

with key operators which are an integral part of developing and maintaining product awareness,<br />

and enable consultants to sell Victoria with confidence. Please also see ‘Corroboree Europe 2011’<br />

trade famils.<br />

Consumer Media and PR<br />

Tourism Victoria welcomes direct contact from Victoria’s products to Tourism Victoria’s PR<br />

company and recommends that any newsworthy developments, regular newsletters or PR<br />

releases, and any “quirky” stories that the media might pick up on, be communicated to account<br />

manager Lucy Pennington at LPennington@bgb.co.uk for possible exposure in Tourism Victoria’s<br />

media communications.<br />

Independent Market Visits<br />

Visits to market by product are welcomed, and the Tourism Victoria London office is happy to<br />

assist with advice on meetings, suggested timings and schedules.<br />

Online Sales Manual<br />

The Destination Australia Partnership (DAP) launched an online Sales Call Manual in June 07<br />

which is available at www.destinationaustralia.uk.com. The site has been designed specifically for<br />

the Australian tourism industry, to ensure product suppliers have access to up-to-date operator<br />

details, location maps and market information when planning their visit to the UK. The site also<br />

includes links to assist industry contacts when planning their itinerary – everything from transport<br />

options to weather and restaurant reviews. Product suppliers can also use the site to access online<br />

copies of many of the UK operator brochures, eliminating the need to send off for original copies<br />

when researching training appointment schedules.<br />

30 UK & Ireland 2010

KEY STRATEGIC ACTIVITIES<br />

Ultimately Tourism Victoria’s core objective in the UK remains to defend and further develop<br />

Melbourne and Victoria’s market position, particularly in the tough trading environment,<br />

continuing to grow Victoria’s share of arrivals and length of stay through a strategy of improved<br />

trade exposure and increased consumer awareness using a multi channel marketing approach with<br />

a strong digital component.<br />

Consumer Marketing<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Work closely with Tourism Australia on their Country Media Programme to maximise the<br />

number of media visits and exposure for Melbourne.<br />

Through Tourism Victoria’s appointed PR company for the UK and Ireland, Bgb<br />

Communications, actively seek targeted opportunities in order to position Melbourne and<br />

Victoria in selected consumer media and maintain strong media relationships.<br />

Focus on key target segments and Hallmark Events to leverage consumer opportunity.<br />

Develop the usage of the new Brand Victoria destination brand in all consumer activity, and<br />

present strong and consistent imagery of Melbourne and Victoria.<br />

Increase the level of consumer promotions undertaken, utilizing a mix of media - traditional<br />

print and radio, and increasing the use of new media such as pod casts and vod casts, and<br />

Tourism Victoria’s video content.<br />

Maximise e-commerce opportunities by developing www.visitmelbourne.com/uk (UK variant)<br />

as a consumer tool that reflects Tourism Victoria’s market activity and assists in directing the<br />

consumer towards conversion via trade partners. Continue to provide and refresh the site<br />

with relevant and accurate content.<br />

Develop opportunities to provide the consumer with options for conversion through the<br />

development of special offers and packages, providing a call to action via key tour operator<br />

partners.<br />

Growth awareness and motivate the consumer through targeted activity on social media sites<br />

such as Trip Advisor UK.<br />

Develop consumer promotions and third party affiliate relationship marketing to establish and<br />

grow a consumer database through email acquisition. Tourism Victoria’s UK opted in database<br />

has reached 60,000+ email addresses.<br />

Provide market content for the UK’s quarterly consumer eNewsletter created to provide a<br />

tool to build online relationships with existing and prospective visitors, and provide a platform<br />

for a tactical approach with selected trade partners.<br />

Tourism Victoria’s UK dedicated Video Room is found at www.visitmelbourne.com/uk-tv.<br />

2011 will continue to see Tourism Victoria’s focus on the distribution of video content to<br />

other URLs with links back to www.visitmelbourne.com/uk-tv. The success of this distribution<br />

31 UK & Ireland 2010

will be monitored where possible to quantify the exposure and brand recognition gained from<br />

this activity.<br />

Plan and execute search engine marketing activity (SEM) in order to increase visitation<br />

targeting specific keywords on Google to build awareness and drive visitation to<br />

www.visitmelbourne.com/uk.<br />

Trade Marketing<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Position Melbourne as the gateway to Australia, “Your Australia holiday starts here”.<br />

Continue to develop length of stay in Melbourne, showcasing the quality and variety of<br />

accommodation the city has to offer and the mix of experiences that can be found within<br />

Melbourne.<br />

Support and further develop regional tourism through the positioning and development of our<br />

touring routes. The Great Ocean Road has been successfully marketed to the trade and UK<br />

consumer together with the Great Southern Touring Route as an extension of the GOR, and<br />

has increased regional dispersion of room nights and length of stay within the State. This route<br />

will continue to be a key priority.<br />

Incorporate and consolidate the positioning of Sydney-Melbourne Touring including the<br />

Sydney-Melbourne Coastal Drive, and the recently launched Gippsland itinerary including<br />

Wilsons Promontory, Lakes Entrance and Walhalla. Further development and positioning of<br />

the South-East Touring Triangle (the Yarra Valley, Phillip Island and the Mornington Peninsula)<br />

is planned including its link to the Great Ocean Road/GSTR.<br />

Develop regional length of stay though promotion of one/two night package options in key<br />

operator programmes in key regions including the Great Ocean Road, Grampians, Goldfields,<br />

Spa Country, Yarra Valley, Phillip Island, and the Mornington Peninsula.<br />

Continue to improve and refresh the visual imagery of Melbourne and Victoria within tour<br />

operators’ programmes providing consistency with Tourism Victoria’s own marketing<br />

programmes through the production of an updated Image CD-Rom selection to be reproduced<br />

in late 2010.<br />

Plan and undertake a number of major marketing promotions via key wholesalers and direct<br />

sellers including Expedia, Flight Centre UK, Gold Medal Travel, STA Travel, Bridge the World<br />

and Bridge & Wickers.<br />

In order to access more targeted databases of those customers with a predisposition to visit<br />

Australia, Tourism Victoria will place a number of advertorials in key trade partners’ customer<br />

magazines e.g. Trailfinders’ Trailfinder Magazine. These pages provide an excellent opportunity<br />

to position new product ideas and deepen Victoria’s messages and product offering directly to<br />

the long-haul travel customer.<br />

Undertake regular face to face communication with key product managers to ensure Victoria’s<br />

core product is maintained and refreshed, and to encourage new product development. Over<br />

the past few years the UK market has seen excellent growth in the level of pagination<br />

dedicated to Victoria in the traditional tour operator brochures however many of the<br />

32 UK & Ireland 2010

specialist Australia operators are now looking to reduce their paper brochure size and cost of<br />

distribution. This will inevitably have an impact on Victoria content. Online inventory and the<br />

marketing activity of these specialists are increasing in importance and will provide the<br />

platform for further product growth and development.<br />

Enhance the support of key tour operators and agency chains through trade training. The<br />

Aussie Specialist Programme (ASP) and dedicated Victoria Specialist Programme (VSP) will<br />

remain Tourism Victoria’s primary destination training tool and will continue to be supported<br />

with agent/operator training conducted by Tourism Victoria, with priority given to trade<br />

marketing partners.<br />

Manage and develop the current Victoria content in the Aussie Specialist Programme and<br />

Victoria Specialist Programme. This programme is the core of Tourism Victoria’s training<br />

efforts and augments Tourism Victoria’s “reach” to include the front line travel consultants of<br />

high street retail travel agents as well as those consultants working for the specialist operators.<br />

Tourism Victoria is currently working on refreshing the content and functionality for the ASP<br />

re-launched in January 2010.<br />

Trade familiarisations – a programme of continued famils is planned to include a product<br />

managers’ famil, four famils to support Corroboree, and front line travel consultant famils to<br />

support key trade partner activity with operators such as Flight Centre in the UK, and mixed<br />

trade in the Nordic and Netherlands.<br />

Attend Corroboree Europe 2011 in Darwin. This event provides a motivational platform to<br />

continue the training programme for front line consultants/travel agents.<br />

Attend the key trade events and maximize networking opportunities. World Travel Market<br />

(London) Nov 2010 and ATE (Sydney) April 2011.<br />

Youth focus – Tourism Victoria will engage in a major joint activity with leading youth<br />

specialist STA Travel, including positioning of Melbourne and Victoria as the preferred<br />

Australasia destination in their Round the World programme in early 2011.<br />

Trade Partners and Stakeholders<br />

<br />

<br />

<br />

<br />

Maintain close relationships with other state and territory partners and actively position and<br />

promote Victoria as an integral part of the South East Australia experience and key gateway.<br />

Develop joint marketing opportunities with state partners to maximize tactical trade activity<br />

and reach e.g. Discover the Other Oz partnership with the NT and SA, Sydney Melbourne<br />

Touring with NSW.<br />

Maintain relationships with all key airline partners, with emphasis on Emirates, Etihad, Qatar<br />

and Singapore Airlines.<br />

Maintain and develop relationships with other Government bodies including Invest Victoria,<br />

Austrade and Tourism Australia.<br />

33 UK & Ireland 2010

KEY INDUSTRY CONTACTS<br />

TOURISM AUSTRALIA<br />

6th Floor, Australia Centre<br />

Melbourne Place<br />

Strand<br />

London WC2B 4LG<br />

TOURISM VICTORIA<br />

6th Floor, Australia Centre<br />

Melbourne Place<br />

Strand<br />

London WC2B 4LG<br />

T: +44 20 7438 4600<br />

Rodney Harrex<br />

General Manager<br />

rharrex@tourism.australia.com<br />

Ben Janeczko<br />

UK Distribution Development Manager<br />

bjaneczko@tourism.australia.com<br />

Emma Humphreys<br />

PR Manager<br />

ehumphreys@tourism.australia.com<br />

Nadine Christiansen<br />

Team Leader (Aussie Helpline)<br />

nchristiansen@tourism.australia.com<br />

BGB<br />

(TOURISM VICTORIA PR AGENCY)<br />

91 Waterloo Rd<br />

London SE1 8RT<br />

T: +44 20 7438 4645/6<br />

tvic.london@tvic.australia.com<br />

Claire Golding<br />

Regional Manager UK and Europe<br />

cgolding@tvic.australia.com<br />

Sarah Dean<br />

Marketing Executive UK, Ireland, Nordic & Benelux<br />

Regions<br />