MARKET OVERVIEW

+/24'5&6737)75 - Great Southern Touring Route Australia

+/24'5&6737)75 - Great Southern Touring Route Australia

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MARKET</strong> <strong>OVERVIEW</strong><br />

Germany<br />

As Europe's largest economy and second most populous nation (after Russia), Germany is a key<br />

member of the continent's economic, political, and defence organisations.<br />

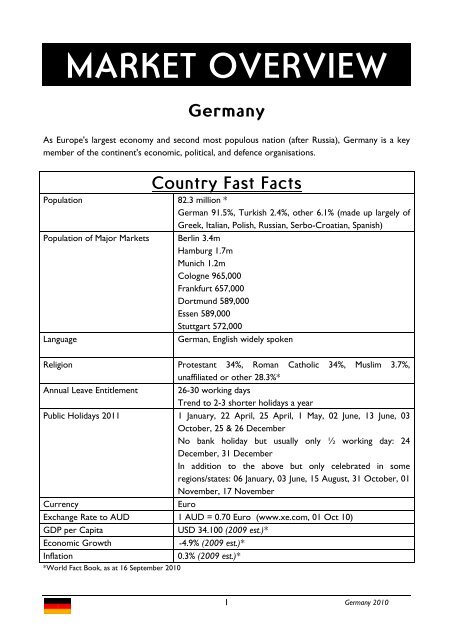

Country Fast Facts<br />

Population 82.3 million *<br />

German 91.5%, Turkish 2.4%, other 6.1% (made up largely of<br />

Greek, Italian, Polish, Russian, Serbo-Croatian, Spanish)<br />

Population of Major Markets Berlin 3.4m<br />

Hamburg 1.7m<br />

Munich 1.2m<br />

Cologne 965,000<br />

Frankfurt 657,000<br />

Dortmund 589,000<br />

Essen 589,000<br />

Stuttgart 572,000<br />

Language<br />

German, English widely spoken<br />

Religion Protestant 34%, Roman Catholic 34%, Muslim 3.7%,<br />

unaffiliated or other 28.3%*<br />

Annual Leave Entitlement 26-30 working days<br />

Trend to 2-3 shorter holidays a year<br />

Public Holidays 2011 1 January, 22 April, 25 April, 1 May, 02 June, 13 June, 03<br />

October, 25 & 26 December<br />

No bank holiday but usually only ½ working day: 24<br />

December, 31 December<br />

In addition to the above but only celebrated in some<br />

regions/states: 06 January, 03 June, 15 August, 31 October, 01<br />

November, 17 November<br />

Currency<br />

Euro<br />

Exchange Rate to AUD 1 AUD = 0.70 Euro (www.xe.com, 01 Oct 10)<br />

GDP per Capita<br />

USD 34.100 (2009 est.)*<br />

Economic Growth<br />

-4.9% (2009 est.)*<br />

Inflation<br />

0.3% (2009 est.)*<br />

*World Fact Book, as at 16 September 2010<br />

1<br />

Germany 2010

ECONOMIC & FINANCIAL <strong>OVERVIEW</strong><br />

The German economy, the fifth largest economy in the world in purchasing power parity terms<br />

and Europe's largest, is a leading exporter of machinery, vehicles, chemicals, and household<br />

equipment and benefits from a highly skilled labor force. Like its western European neighbors,<br />

Germany faces significant demographic challenges to sustained long-term growth. Low fertility<br />

rates and declining net immigration are increasing pressure on the country's social welfare system<br />

and necessitate structural reforms.<br />

Sources: www.cia.gov/library/publications/the-world-factbook<br />

Germany crept out of recession in the second and third quarters of 2009 and is now leading the<br />

euro zone’s economic growth. The Ifo Business Climate for industry and trade in Germany has<br />

reported slight improvement in September with companies more satisfied than they were in the<br />

previous month. In retailing the business climate has brightened for the third consecutive month.<br />

The surveyed retailers<br />

reported their current business<br />

situation as better, with levels<br />

similar to those seen following<br />

the unification boom.<br />

Sources: www.cesifo-group.de<br />

Consumer Confidence<br />

Germany, the Euro region’s<br />

largest economy, posted a<br />

welcomed rebound in quarter<br />

two 2010 with an increase of seven index points to 81, up from 74 index points in quarter one,<br />

the highest increase in the region. In the second quarter, newly confident Germans began to spend<br />

again and were among the world’s top 10 discretionary spenders on clothes and out-of-home<br />

entertainment. In fact, the German job market showed a rather robust upward trend, a possible<br />

sign that consumers now believe that the worst has passed.<br />

Source: Nielsen Global consumer confidence survey, June 2010<br />

The positive economic forecast resulted in German travel agents experiencing a significant<br />

increase in holiday bookings. According to the latest GfK survey of 1,200 agencies, holiday<br />

revenues soared by as much as 22% in August in comparison to the previous year.<br />

There was a surge of last-minute bookings, with 54% of revenue generated by sales for departures<br />

in the summer season. The European summer 2010 is now heading for record revenues with a<br />

cumulative 6.8% rise at the end of last month. August revenues are now 8.7% higher year-on-year,<br />

while September and October (+14%) are also selling well.<br />

2<br />

Germany 2010

Winter holidays are also selling strongly, with a cumulative 15% rise so far and November (+24%)<br />

and December (+21%) generating heavy demand. Last year experienced a very slow start to<br />

winter bookings, with bookings 22.5% lower than at the same time last year.<br />

Sources: www.fvw.com<br />

3<br />

Germany 2010

TOURISM <strong>MARKET</strong><br />

There were 58,000 German visitors to Victoria in the year ending June 2010, a 3.8% decrease<br />

over the previous year. Nationally, German visitation to Australia increased by 3.0% to 157,800.<br />

German visitation to Victoria has increased by an average rate of 1.7% per annum between 2000<br />

and 2010.<br />

Victoria’s market share of visitor nights spent by German travellers in the year ending June 2010<br />

was 14%, behind Queensland (31%) and New South Wales (30%).<br />

Germany is Australia’s third most important international leisure market in terms of regional<br />

dispersal. 54% of German visitor nights are spent outside Sydney, Brisbane, Melbourne or Perth.<br />

This is significantly higher than the 39% average for all inbound leisure visitors to Australia.<br />

43% of German leisure visitors are repeat visitors to Australia (+3%), below the total inbound<br />

repeat rate of 59%.<br />

The 15-29 year old segment is the biggest age segment of the German market, representing 46%<br />

of total arrivals from the market in year ended March 2010.<br />

The 50-59 age group has had the fastest growth in the German market, with a 16% increase for<br />

the year ended March 2010 relative to March 2009. The 30-39 and the 60+ age groups<br />

experienced declines during the same period (down 24% and 6% respectively).<br />

Tourism Outlook<br />

Feedback from German, Swiss and Austrian sellers of Australian tourism product noted the<br />

decreased price competitiveness of Australia relative to North America and Asian destinations.<br />

However, German inbound tourism to Australia is expected to be supported by healthy rates of<br />

growth by Working Holiday Makers and expansions in long haul aviation capacity.<br />

A number of factors will influence this recovery:<br />

The value of the Australian dollar against the major world currencies<br />

Airline seat capacity and price discounting on Australia international routes<br />

German air tax to be introduced 01 Jan 2011 (€45 one way for long haul flights)<br />

Global consumer consent<br />

4<br />

Germany 2010

Forecast Germany (Tourism Forecasting Committee)<br />

Exchange rate<br />

The currently weak Euro may cause difficulties for Australia as a travel destination. Reports from<br />

the European travel industry suggest that the impact of increased exchange rates on Australian<br />

holidays is now more visible to the consumer given it has flowed through to product pricing in the<br />

latest 2010 travel brochures.<br />

5<br />

Germany 2010

FAST FACTS<br />

Germany<br />

Brochures Production The main period of brochure production is from September-<br />

November<br />

Validity<br />

Most of the wholesale brochures are valid for 1 year with a<br />

few of the bigger operators publishing a second brochure with<br />

price updates for the summer season<br />

Rates Validity At least 12 months, 18 months preferable<br />

Setting Rates<br />

Between July – October<br />

Commission Wholesalers Minimum 20-25%<br />

Key Source Cities<br />

Retailers<br />

Minimum10%<br />

Well spread across Germany (more in former West and a<br />

gradient fall from north to south)<br />

Major Consumer Shows Cologne, Leipzig, Stuttgart, Hamburg, Munich (November –<br />

February)<br />

ITB Berlin – March (two days for consumers)<br />

Major Trade Fairs<br />

Peak Booking Time<br />

Peak Travel Period<br />

Best Time For Sales Calls<br />

ITB Berlin – March<br />

January – March, September – November<br />

Trend to short term bookings increasing strongly<br />

October – December, February- March<br />

July – August for families<br />

June – August (post ATE and before brochure production);<br />

March to May; Sales calls should be planned well in advance<br />

with a minimum of 4 weeks notice<br />

Best Time For Sales Training<br />

February – March, July – September (ideal to combine<br />

products to visit at same time)<br />

6<br />

Germany 2010

INDUSTRY INFRASTRUCTURE<br />

Distribution Overview - Change<br />

The internet is now nearly twice as important as an information source to consumers as visiting a<br />

travel agent, although ultimately the travel trade is still very important in terms of travel<br />

distribution. Prepackaged holidays remain an extremely important product in Europe, and tour<br />

operators still generate more than double the bookings of online travel agents (OTAs). Dynamic<br />

packaging is continuing to grow its share, both through the efforts of OTAs as well as tour<br />

operators who recognise the importance of offering consumers control over package<br />

components.<br />

Retail agents<br />

The number of high street travel agencies continues to decline. Ten years ago there were more<br />

than 19,000 travel agencies in Germany. Today only approximately 11,000 registered retail travel<br />

offices are left. More than 95% of these retail agencies are “allied”, i.e. franchised, chains and/or<br />

members of a consortium.<br />

Unfortunately “allied” also means that retailers aren't necessarily free to sell what's best for the<br />

customer. The four large tour operators who control over 70% of the total leisure market have<br />

increased their minimum turnover conditions. To achieve commission levels to ensure<br />

profitability, travel agencies find they have to concentrate their sales efforts on the products of<br />

one of the four large tour operators, in other words: to survive, they have to be agents/advocates<br />

for TUI, DER, COOK or FTI. Obviously this influences the choice of tour or hotel that agencies<br />

are offering clients. DERTOUR operates the largest agency network and is the most popular<br />

specialist for modular long haul travel arrangements.<br />

Aussie Specialists<br />

In September 2010 there was a total of 1646 qualified Aussie Specialists throughout Germany. 858<br />

agents were also Victorian Specialists, which is an increase of 18% compared to the same time last<br />

year.<br />

With the introduction of the Premium Aussie Specialist Programme in Germany last year, Tourism<br />

Australia has created a pool of 130 VIP agents.<br />

Wholesalers<br />

There are approximately 70-80 tour operators selling Australia in Germany, distributing product<br />

via wholesale/retail agencies. The major companies selling Australia include DERTOUR, FTI,<br />

Meier’s Weltreisen, TUI and STA Travel.<br />

7<br />

Germany 2010

Direct Sellers<br />

Direct sellers are a very important feature of the German market, producing a good share of the<br />

outbound travellers to Australia. Key direct sellers include Best of Travel Group, Explorer<br />

Fernreisen and Boomerang Reisen. Several direct sell operators are actively growing their agency<br />

network throughout Germany and into neighbouring countries including the Netherlands,<br />

Switzerland and Austria.<br />

Student/Youth:<br />

STA is the largest operator for youth travel in Germany. They have rebranded their operations as<br />

they no longer want to be seen as a student operator and would prefer to cater for the younger,<br />

open minded traveller. Due to the increase in working holiday visa travellers, other operators like<br />

Step-in and Travelworks are reporting growth in travel to Australia and are actively promoting<br />

Australia.<br />

Niche Operators:<br />

There are a couple of operators which service specialised market segments such as luxury travel,<br />

honeymoon or adventure. One of the major operators in the luxury segment is Airtours (part of<br />

TUI) which produces an Australian, Asia and South Pacific brochure. Windrose and Art of Travel<br />

are also specialised in this segment. Design Reisen is a new player in the Australian market and<br />

have just produced their first design travel flyer in conjunction with Etihad. FTI and DERTOUR<br />

have now also introduced a global luxury brochure.<br />

There are several operators specialised on trekking, mountain biking or other outdoor activities.<br />

Diamir, Chamaeleon, Wikinger and Globetrotter are just three of the key players, however they<br />

are global and don’t have a large emphasis on Australia.<br />

Online travel agents<br />

Online travel agents (OTAs) such as Expedia and Opodo have been star performers in the<br />

European travel market – both contributing to and benefiting from growing consumer use of the<br />

Internet for travel planning and booking. While OTA growth has slowed from the marked doubledigit<br />

figures earlier in the decade (the segment grew 26% in 2007), OTAs continue to outperform<br />

the broader European travel market. OTAs grew an impressive 17% in 2008 while the total travel<br />

market was essentially flat. They recorded 6% growth in 2009, a remarkable performance<br />

considering the recession forced a 10% contraction in the travel market overall (Sources: PhoCusWright,<br />

ETTSA study, Sep 10).<br />

OTAs will continue to gain overall market share. Their share of all travel sales will double to 11%<br />

by 2011, versus 6% in 2006. Total OTA gross bookings are expected to reach €29 billion by 2011,<br />

up from €24 billion in 2009 and €15 billion in 2006.<br />

8<br />

Germany 2010

Sources: PhoCusWright, ETTSA study, Sep 10<br />

OTAs are clearly a preferred channel for online travel shopping. PhoCusWright’s European<br />

Consumer Travel Report (2010) reveals that European online travel buyers are significantly more<br />

likely to shop for travel via an OTA versus any other type of website (excluding general search<br />

engines).<br />

More than 40% of French travellers and 50% of German and UK travellers cite OTAs as the type<br />

of website they typically use.<br />

Online Environment<br />

The Internet has become a popular shopping channel for Germans, and remains the fastest<br />

growing sales channel. E-commerce sales rose significantly once again in 2009, bucking the general<br />

trend for non-food products.<br />

Sources: the Nielsen Company<br />

Globally social networks and blogs are the most popular online category when ranked by average<br />

time spent, followed by online games and instant messaging. With 206.9 million unique visitors,<br />

Facebook was the number one global social networking destination in December 2009 and 67% of<br />

9<br />

Germany 2010

global social media users visited the site during the month. Time spent on Facebook has also<br />

increased, with global users spending nearly six hours per month on the site.<br />

While some organisations may remain skeptical about the ability to use social media to drive<br />

transaction revenues, maintaining and monitoring a brand presence wherever consumers choose<br />

to discuss travel has important value. Word of mouth has tremendous power in consumer travel<br />

decisions, and social media applications like Twitter allow companies to essentially “eavesdrop” on<br />

conversations and interact with consumers directly. The value of social networks for public<br />

relations and customer service are reason enough to build a branded presence in popular<br />

networks. Interaction with consumers outside of a website adds a new facet to brand identity to<br />

allow a company to become more than just a URL, and drives new touch points and higher levels<br />

of engagement.<br />

10<br />

Germany 2010

ARRIVALS TO VICTORIA & AUSTRALIA<br />

Arrivals from Germany have been constant over the last few years – despite the global recession.<br />

For Germans, travelling is an essential part of their lives and they would rather save their spending<br />

on clothes and consumer goods than on travel. It is no surprise that Germany is the biggest<br />

outbound travel market in Europe. However, only 7% of all German travels are long haul - the<br />

majority of trips stay within Germany or Europe.<br />

For the year ending June 2010 Australia showed a slight increase in visitor numbers whereas<br />

German visitors to Victoria have decreased by 4 percent.<br />

Germany<br />

Visitors<br />

Y/E June 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 AAG % change<br />

Complete 09/10<br />

Australia 111,619 113,278 118,128 122,174 125,216 125,596 142,900 142,920 131,959 130,161 136,642 137,889 145,188 143,614 149,689 153,264 157,818 2% 3%<br />

New South Wales 80,859 83,928 89,526 85,490 91,741 90,427 97,804 96,289 97,647 92,171 92,434 96,815 97,529 99,569 105,974 104,923 107,777 2% 3%<br />

Queensland 67,981 63,032 65,767 68,206 75,258 69,646 74,646 71,358 78,284 64,615 70,852 71,802 75,931 74,851 73,617 79,625 81,291 1% 2%<br />

Victoria 44,488 53,047 48,849 51,064 53,814 46,588 53,819 55,302 54,371 51,196 54,033 55,518 57,330 55,272 62,893 60,312 58,043 2% -4%<br />

Victoria Mkt Share 40% 47% 41% 42% 43% 37% 38% 39% 41% 39% 40% 40% 39% 38% 42% 39% 37%<br />

Source: International Visitor Survey 1994-2010, Tourism Research Australia<br />

Visitors<br />

175,000<br />

50%<br />

150,000<br />

45%<br />

40%<br />

125,000<br />

35%<br />

Visitors<br />

100,000<br />

75,000<br />

30%<br />

25%<br />

20%<br />

Market Share<br />

50,000<br />

15%<br />

10%<br />

25,000<br />

5%<br />

0<br />

0%<br />

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Year Ending June<br />

Australia New South Wales Queensland Victoria Victoria Mkt Share<br />

Visitor Forecasts 2019<br />

Places Visited - Overnight Visit or Daytrip (% of all Visitors to Victoria)<br />

Australia 201,129 Great Ocean Road 59%<br />

Victoria 76,061 Phillip Island, penguin parade 29%<br />

Ballarat, Sovereign Hill 13%<br />

Yarra Valley 12%<br />

Source: Tourism Forecasting Committee,<br />

Forecast 2010 Issue 1, Tourism Research<br />

Dandenongs, Puffing Billy, Healesville 12%<br />

Australia, Canberra.<br />

Mornington Peninsula 10%<br />

(Tourism Victoria estimates for Visitor<br />

Source: International Visitor Survey, Tourism Research Australia (year ending December 2009)<br />

Forecasts 2019 based on Year Ending<br />

December 2009 International Visitor Survey<br />

data).<br />

11<br />

Germany 2010

Nights ('000)<br />

Y/E June 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 AAG % change<br />

Complete 09/10<br />

Australia 3,904 3,830 4,123 3,814 4,257 4,066 4,266 4,562 5,352 4,688 6,320 5,517 6,490 6,672 6,770 7,482 7,115 4% -5%<br />

New South Wales 1,044 1,055 1,095 1,354 1,091 1,139 1,183 1,346 1,543 1,590 1,746 1,413 1,807 1,967 1,993 2,009 2,170 5% 8%<br />

Queensland 1,118 976 970 953 1,117 949 967 974 1,219 1,097 1,627 1,548 1,793 1,886 1,839 2,237 2,174 4% -3%<br />

Victoria 471 648 863 414 632 800 617 598 1,074 658 1,220 924 1,168 1,052 902 1,216 969 5% -20%<br />

Victoria Mkt Share 12% 17% 21% 11% 15% 20% 14% 13% 20% 14% 19% 17% 18% 16% 13% 16% 14%<br />

Source: International Visitor Survey 1994-2010, Tourism Research Australia<br />

Nights<br />

8,000<br />

25%<br />

7,000<br />

6,000<br />

20%<br />

Nights ('000)<br />

5,000<br />

4,000<br />

3,000<br />

15%<br />

10%<br />

Market Share<br />

2,000<br />

5%<br />

1,000<br />

0<br />

0%<br />

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Year Ending June<br />

Australia New South Wales Queensland Victoria Victoria Mkt Share<br />

Main Reason for Trip<br />

Visitors (%) Nights (%)<br />

Aus Vic Aus Vic<br />

Holiday 64% 72% 63% 54%<br />

Visiting friends and relatives 14% 6% 7% 5%<br />

Business 10% 11% 4% 9%<br />

Education 6% 6% 16% 23%<br />

Employment 2% 2% 5% 7%<br />

Other reason 4% 2% 5% 1%<br />

Source: International Visitor Survey - Year ending June 10, Tourism Research Australia<br />

Note: The figures which appear in red are subject to sampling variability that is too high for practical purposes and should be used with caution, as they have a large margin of error.<br />

Prepared by Tourism Victoria Research Unit<br />

12<br />

Germany 2010

AIR ACCESS TO VICTORIA & AUSTRALIA<br />

The main growth from Europe into Australia is via the Middle Eastern carriers. Emirates are<br />

adding aircraft with more seat capacity, Etihad is increasing flight capacity out of Frankfurt, and<br />

Qatar came online to Australia last year. These carriers also have the advantage of regional uplift<br />

since they depart from a variety of different airports in Germany - Qatar will soon add four flights<br />

a week from Stuttgart to Doha. Singapore Airlines has recognised the regional advantage of the<br />

Middle Eastern carriers and has introduced daily flights from Munich starting March 2010.<br />

Emirates and Etihad have also reacted to the fact that they do not have a domestic airline<br />

connection in Australia. Emirates have introduced the Australia airpass in cooperation with Virgin<br />

Blue, and Etihad has recently signed an agreement with Virgin Blue which includes a code share<br />

agreement on the V-Australia flights ex Abu Dhabi.<br />

There are currently no direct flights from German ports into Melbourne.<br />

13<br />

Germany 2010

<strong>MARKET</strong> S.W.O.T<br />

Strengths<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Melbourne and Victoria offers contrasting experiences to those found in Europe; fantastic<br />

landscapes, wildlife and coastal lifestyle, easily accessible and in close proximity to Melbourne.<br />

The self-drive and touring experience continues to be popular, with 69% of Germans<br />

participating in a self driving experience whilst on holidays in Australia (Jan-Sep09, IVS).<br />

Great Ocean Road has been named one of the best coastal drives in the world and a ‘not to<br />

be missed’ inclusion on an Australian self drive itinerary.<br />

Australia is considered a relatively safe destination to visit with low threats of terrorism,<br />

political stability and low crime rate.<br />

There is a high desirability across Europe to visit Australia.<br />

Aussie Specialist Program is recognised as an industry leader in retail trade engagement<br />

globally.<br />

Australia offers Working Holiday visas to German citizens aged 18-30 providing the<br />

opportunity to leverage the youth segment.<br />

Weakness<br />

Distance, time of travel, cost and the perception of the time required for an Australian holiday<br />

remain barriers to travel.<br />

The value proposition of Australia compared to other long-haul destinations (e.g. Asia and US)<br />

remains a challenge as the AUD strengthens and airfares to Australia remain high<br />

comparatively.<br />

Australia struggles to compete with the all-inclusive package holiday destinations due to the<br />

higher airfare component of a packaged holiday.<br />

Lack of urgency to travel to Australia – perceived as a ‘once in a lifetime’ holiday dream trip –<br />

continues to be a core barrier for conversion of travel to Australia.<br />

Victoria doesn’t belong to three “have to see” experiences for a first time visitor (Sydney, Reef<br />

& Rock)<br />

Lack of luxury resorts and products in Victoria.<br />

Opportunities<br />

<br />

<br />

German leisure visitors to Australia have the fifth highest rate of dispersal globally (54% YE<br />

Dec 09) and an above average and growing length of stay (43 nights Vs 23 nights on average).<br />

Their preference for extended stays, self-drive and campervan touring represents an ongoing<br />

opportunity to promote touring holidays in regional Victoria.<br />

Germany is Europe’s largest outbound travel market, representing a large pool of potential<br />

travellers for the Australian market.<br />

14<br />

Germany 2010

Holidays are considered a basic necessity by Germans, taking advantage of their long annual<br />

leave entitlement (5-6 weeks per annum), providing the opportunity to maximise German<br />

length of stay in Australia.<br />

With a growing luxury market (1% of German population are high income earners, net<br />

monthly HHI >€4000), Australian luxury products and experiences are increasingly being<br />

brochured by German operators and receiving improved media coverage.<br />

The choice and frequency of airline services to Australia has increased from this market with<br />

Singapore Airlines launching flights from Munich in March 2010 and Middle Eastern carriers<br />

boosting frequencies.<br />

Digital opportunities within the social networking sites and blogosphere provide cost effective<br />

ways to reach consumers (esp. youth) and engage consumers.<br />

Engage with the Aussie Specialists and promote the Victorian Specialist programme.<br />

Threats<br />

<br />

<br />

<br />

<br />

<br />

Media consolidation and cutbacks have resulted in redundancies and reluctance from<br />

journalists to take extended leave due to concerns over job security. This, in conjunction with<br />

smaller budgets, limits media famils opportunities.<br />

The short- to mid-haul destinations are taking advantage of the last minute booking trend of<br />

all-inclusive deals, and are consequentially increasing their marketing investment.<br />

Airlines are looking to re-coup some of the money lost from low pricing in 2008/09. Coupled<br />

with the newly introduced air tax from 01 January 2011, Australia runs the risk of looking<br />

more expensive again in the future.<br />

The majority of competitor destinations (e.g. South Africa, Morocco, Thailand) boosted<br />

marketing spend in 2009 and are expected to maintain this increased investment. This<br />

resulting increased their share of voice in the market means that Australia will have increased<br />

competition for share of voice.<br />

Australia’s share of Germany’s outbound market has changed very little since 2000, fluctuating<br />

between 0.7% and 0.8%. In 2008, Australia represented 0.7% of Germany’s outbound market<br />

to destinations outside of Western Europe. As at 2008, Germany’s top destinations (outside<br />

Western Europe) include the United States, with Australia ranked 30 th .<br />

15<br />

Germany 2010

<strong>MARKET</strong>ING OPPORTUNITIES<br />

UK/Europe New Product Workshop, February 2011<br />

This workshop has proved a popular and over subscribed event. In its 4 th year the event will run<br />

with the objective of increasing awareness of Australia’s new product and continued development<br />

and strengthening of Australia’s key travel experiences and highlighting the diversity of Australia’s<br />

tourism experiences. The mission will facilitate business opportunities for participating delegates<br />

and provide a forum that is conducive to establishing new contacts and potential business.<br />

Applications have closed for 2011, however this event is planned to be repeated annually.<br />

Corroboree Europe, Darwin, May 2011<br />

This annual retail training and mega famil event will be hosted in Darwin on 3-5 June 2011<br />

(workshop dates) following on from Melbourne’s successful hosting of the event in May 2010.<br />

Corroboree includes a 3-day training workshop followed by a series of famils across Australia.<br />

This event allows participating Australian sellers to train over 300 Aussie Specialists from across<br />

Europe in one location during one event. Agents from the German-speaking regions are involved<br />

in Corroboree.<br />

Tourism Victoria will host a total of 4 famils from Europe and South Africa post the 2011<br />

workshops to showcase Melbourne and regional Victoria product/regions.<br />

Australian Tourism Exchange (ATE), Sydney, April 2011<br />

ATE remains the prime forum to showcase Victorian product. This is a key event and product<br />

should continue to be “seen” and contract with operators.<br />

Regional Sales Mission, September/October 2011<br />

The Melbourne and Regional Victoria Sales Mission is planned to run again in September 2011.<br />

The formula is based on key market relevant regions attending, which allows the opportunity to<br />

access and train a wider mix of retailers, ASPs, and key wholesalers regardless of their preferred<br />

individual product choice. It is anticipated that the 2011 mission will incorporate cities within the<br />

UK and Germany and also include countries not visited in 2010, for example The Netherlands, the<br />

Nordic Region and Italy. A strong product manager meeting schedule will also be incorporated<br />

into this event.<br />

DERTOUR Laenderspecial, May 2011<br />

Together with DERTOUR and South Australia, Tourism Victoria is planning a training event in<br />

Victoria for 100 travel agents from the DERTOUR group. A workshop will be held in Melbourne<br />

with famil options to different regions. The visit will take place from 1 – 17 May 2011, and<br />

represents an excellent opportunity for Victorian product to be showcased to a large number of<br />

influential German travel agents from the country’s biggest wholesaler. Please advise Tourism<br />

Victoria’s Melbourne office (Diana Morgan) if you are interested in supporting this event.<br />

16<br />

Germany 2010

Tourism Victoria quarterly trade newsletter<br />

Tourism Victoria sends out a quarterly trade newsletter to a database of over 10,000 travel agents<br />

across the German speaking markets, Italy and France. Please keep Tourism Victoria updated with<br />

any news to be featured.<br />

Aussie Specialist Program<br />

The Aussie Specialist Program (ASP) provides suppliers with the opportunity to advertise their<br />

product to the increasing number of Aussie Specialist members across Europe. Currently there<br />

are about 5,000 Aussie Specialists across Europe with another 5,000 agents in training. The exact<br />

reach of from the ASP database will be confirmed on booking of newsletter advertising.<br />

Shared<br />

Exclusive<br />

AUD $25 inc GST per 100 emails<br />

AUD $40 inc GST per 100 emails<br />

UK £10 inc VAT per 100 emails<br />

UK £17 inc VAT per 100 emails<br />

Consumer & Trade Shows<br />

Destination Australia Partnership and Tourism Australia will participate in ITB, the largest trade<br />

and consumer travel show in Germany. It will be held from 9-13 March 2011 in Berlin.<br />

Destination Australia Partnership – Trade Trainer<br />

As part of the DAP agreement between Tourism Australia and the STOs, Tourism Victoria has a<br />

dedicated training resource in the Frankfurt office, covering Germany, Switzerland & Austria. All<br />

products conducting in-market training should contact Alexandra Anger, DAP Trainer,<br />

(aanger@tourism.australia.com) and ensure she is aware of and updated on your individual<br />

product.<br />

Trade and Media Familiarisations<br />

Suppliers are encouraged to assist with Tourism Victoria’s series of sales consultant famils and<br />

media visits. These are an integral part of developing and maintaining product awareness, and<br />

enable consultants to sell Victoria with confidence.<br />

Consumer Media and PR<br />

Tourism Victoria welcomes direct contact from Victoria’s products to Tourism Victoria’s PR<br />

Company and recommends that any newsworthy developments, regular newsletters or PR<br />

releases, and any “quirky” stories for the media, be communicated to account manager Caroline<br />

Zimmermann at cz@liebl.-pr.de, for possible use in Tourism Victoria’s media communications.<br />

17<br />

Germany 2010

Tourism Victoria Overview<br />

Objectives<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

KEY STRATEGIC ACTIVITIES<br />

Tourism Victoria’s core objective in the German speaking markets is to protect, maintain and<br />

increase Melbourne and Victoria’s market share.<br />

Maximise international visitation through the development of innovative online and cross<br />

media consumer promotions.<br />

Increase visitation to regional Victoria and increase yield through increasing length of stay and<br />

visitor expenditure.<br />

Improve destination awareness through fresh images, video and podcast content in both print<br />

and online environments.<br />

Drive visitation to www.melbourne.com/de.<br />

Increase the use of online media to communicate directly with the consumer.<br />

Embrace the surge in online travel bookings through innovative online campaigns that include<br />

both awareness and tactical/sales elements, for example special offers.<br />

Support the Nature Based Tourism Strategy.<br />

Educate and motivate the German travel trade on selling Melbourne and Victoria.<br />

Provide Victorian stakeholders with market knowledge and create opportunities for<br />

involvement in trade and consumer campaigns, press and trade famils, in-market visits and<br />

training.<br />

Maximise Melbourne and Victoria’s position with Tourism Australia’s local marketing activity,<br />

including maximising Victoria’s inclusion in their new “There’s nothing like Australia”<br />

campaign.<br />

Consumer Marketing Strategy<br />

<br />

<br />

<br />

<br />

Media and public relations are the core of Tourism Victoria’s consumer marketing strategy in<br />

Europe. Tourism Victoria’s priority is to maximize media exposure through targeted media<br />

outlets using the services of Tourism Victoria’s dedicated PR company Uschi Liebl PR. Key<br />

messages are nature & wildlife, outdoor activities, journeys (self drive routes), Melbourne (as<br />

the trendy gateway) and food & wine (niche market).<br />

Maximise awareness of Melbourne and Victoria through a close working relationship with<br />

Tourism Australia’s in market PR Company, Faktor 3, and through the Country Media<br />

Programme.<br />

Together with Tourism Victoria’s airline partners work on individual media familiarisations to<br />

Melbourne & Victoria.<br />

With social networking and online shopping still on the rise, Tourism Victoria will penetrate<br />

this communication platform and aim to spread destination messages throughout the<br />

consumer buying cycle, for example during the information search and decision making<br />

process and conversion through special package deals and air fares.<br />

18<br />

Germany 2010

Run online advertising campaigns to spread content as well as to drive visitation to<br />

www.visitmelbourne.com/de. Provide relevant, accurate and updated content to market and<br />

review imagery regularly<br />

With the youth market being identified as Tourism Victoria’s second priority target group,<br />

continue to work on online or print campaigns for the youth market including social media<br />

channels like Facebook or Youtube.<br />

Development of a consumer newsletter on www.visitmelbourne.com/de<br />

Trade Marketing Strategy<br />

Training and support are the keys to broadening the product knowledge of agents. One of<br />

Tourism Victoria’s major tasks is to train and inform the Aussie Specialists, the regular travel<br />

agents and the direct selling travel agencies.<br />

Work with the German trade press in order to increase coverage of Melbourne & Victoria<br />

Tourism Victoria will conduct regular face to face meetings with product managers in order<br />

to discuss product development possibilities. Introducing new products to the operators is a<br />

critical part of this relationship management.<br />

Tourism Victoria is considering developing a training kit including a selling guide and useful<br />

information on the destination to maximise the effectiveness of agent training.<br />

Distribute quarterly e-newsletter to product managers and key travel agents including<br />

product updates, event information and other relevant STO news.<br />

Hold the agent event “DERTOUR Laenderspecial” in Melbourne.<br />

Plan and participate in Corroboree 2011.<br />

Participation in ITB in March 2011, Berlin<br />

Special interest/niche strategy<br />

Nature/Walking<br />

Nature and outdoor activities are important in the German market and Tourism Victoria will<br />

therefore support the nature based tourism strategy.<br />

<br />

<br />

<br />

Work with selected hiking and walking tour operators to promote the Great Ocean Walk<br />

and other walks in Victoria.<br />

Engage with outdoor magazines in order to spread the word about the different nature<br />

activities to be found in Victoria.<br />

Produce a walking and hiking booklet for Victoria.<br />

Food & Wine<br />

Support food & wine connoisseur media famils in order to boost coverage in relevant outlets.<br />

19<br />

Germany 2010

KEY INDUSTRY CONTACTS<br />

TOURISM AUSTRALIA<br />

Neue Mainzer Str. 22<br />

D-60311 Frankfurt / Main<br />

T: +49 69 2740 0622<br />

www.australia.com<br />

Ms Katherine Droga<br />

Regional Manager Central Europe<br />

kdroga@tourism.australia.com<br />

FAKTOR3 (PR Agency for Tourism Australia)<br />

Kattunbleiche 35<br />

D-22041 Hamburg<br />

T: +49 40 679446-0<br />

www.faktor3.de<br />

Mr Vanessa Lengert<br />

Account Director<br />

v.lengert@faktor3.de<br />

Mr Johannes Falck<br />

Trade Manager Germany, Switzerland, Austria<br />

falck@tourism.australia.com<br />

TOURISM VICTORIA<br />

Neue Mainzer Str. 22<br />

D-60311 Frankfurt / Main<br />

T: +49 69 2740 0677/15<br />

tvic.frankfurt@tvic.australia.com<br />

www.visitmelbourne.com/de<br />

Susanne Stellberg<br />

Marketing Manager German speaking countries, Italy,<br />

France<br />

sstellberg@tvic.australia.com<br />

Sarah Kemsat<br />

Marketing Executive German speaking markets, Italy,<br />

France<br />

skemsat@tvic.australia.com<br />

Uschi liebl pr<br />

(PR Agency for Tourism Victoria)<br />

Emil Geiss -Str 1<br />

D-8137 München<br />

T: +49 89 72402920<br />

www.liebl-pr.de<br />

Mrs Uschi Liebl-Wickstead<br />

General Manager<br />

ul@liebl-pr.de<br />

Ms Caroline Zimmermann<br />

Account Manager<br />

cz@liebl-pr.de<br />

20<br />

Germany 2010

EMBASSY / AUSTRADE / INVEST VICTORIA<br />

AUSTRALIAN EMBASSY – GERMANY<br />

Wallstr. 76-79<br />

D-10179 Berlin<br />

T: +49 30 8800 88357<br />

presse@australian-embassy.de<br />

Mr Günter Schlothauer<br />

PR<br />

guenter.schlothauer@dfat.gov.au<br />

STATE OF VICTORIA – EUROPEAN OFFICE<br />

Grüneburgweg 58-62<br />

D-60322 Frankfurt<br />

T: +49 69 668074-11<br />

frankfurt@invest.vic.gov.au<br />

Mr Andre Haermeyer<br />

Commissioner for Europe<br />

AUSTRADE GERMAN OFFICE<br />

Main Tower, 28 th Floor<br />

Neue Mainzer Str. 52-58<br />

D-60311 Frankfurt<br />

T: + 49 69 90558 116<br />

www.austrade.gov.au<br />

Mr Nicola Watkinson<br />

Consul General Federal Republic Germany<br />

nicola.watkinson@austrade.gov.au<br />

21<br />

Germany 2010

AIRLINES<br />

CATHAY PACIFIC<br />

Lyoner Strasse 15<br />

D-60528 Frankfurt<br />

EMIRATES<br />

Eschersheimer Landstr. 55<br />

D-60322 Frankfurt<br />

T: +49 69-71008-262<br />

www.cathaypacific.com<br />

T: +49 69 9596 8824<br />

www.emirates.com<br />

Mrs Regina Hornbostel<br />

Sales Executive Leisure<br />

regina_hornbostel@cathaypacific.com<br />

Ms Stephanie Krinner<br />

Marketing Executive<br />

Stephanie.krinner@emirates.com<br />

ETIHAD AIRWAYS<br />

Oberanger 34-36<br />

D-80331 Munich<br />

MALAYSIA AIRLINES<br />

Wilhelm-Leuschner Str. 23<br />

D-60329 Frankfurt<br />

T: +49 89 44238893<br />

www.etihadairways.com<br />

T: +49 69 1387 1923<br />

www.malaysiaairlines.de<br />

Ms Isabel Steigauf<br />

Marketing Officer<br />

isteigauf@etihad.ae<br />

QANTAS AIRWAYS<br />

Lyoner Str. 9<br />

D-60528 Frankfurt<br />

Mr Thomas Trass<br />

Sales Manager<br />

Thomas.trass@malaysiaairlines.de<br />

QATAR AIRWAYS<br />

Schillerstrasse 18-20<br />

D-60313 Frankfurt<br />

T: +49 69 6958 5623<br />

www.qantas.com.au<br />

T: +49 69 505057210<br />

www.qatarairways.com<br />

Mr Paul Yankson<br />

Regional Manager Central & Eastern Europe<br />

paulyankson@qantas.com.au<br />

Ms Claudia Erb<br />

Marketing Executive<br />

cerb@de.qatarairways.com<br />

Ms Kiki Loukas<br />

Marketing Manager<br />

kloukas@qantas.com.au<br />

SINGAPORE AIRLINES<br />

(Germany & Austria)<br />

Kettenhofweg 51<br />

D-60325 Frankfurt<br />

T: +49 69 7199 5123<br />

www.singaporeairlines.com.sg<br />

Mr Norbert Hofmann<br />

Marketing<br />

norbert_hofmann@singaporeair.com.sg<br />

THAI AIRWAYS<br />

Zeil 127<br />

D-60313 Frankfurt<br />

T: +49 69 92 87 41 36<br />

www.thai-airways.<br />

Mr Matthias Horn<br />

District Sales Manager Germany, Australia & Eastern<br />

Europe<br />

matthias.horn@thai-airways.de<br />

Mr Thomas Rosenbrock<br />

Sales<br />

thomas_rosenbrock@singaporeair.com.sg<br />

22<br />

Germany 2010

TRADE MEDIA<br />

FVW INTERNATIONAL<br />

(fortnightly trade paper)<br />

Wandsbeker Allee 1<br />

D-22041 Hamburg<br />

T: +49 40 4144 8244<br />

www.fvw.de<br />

Mr Klaus Hildebrandt<br />

Editor in Chief<br />

kh@fvw.de<br />

TRAVEL ONE (weekly trade paper)<br />

Stefanstr. 3<br />

D-64295 Darmstadt<br />

T: +49 6151 390 700<br />

www.travel-one.net<br />

Mr Christian Schmidtke<br />

Editor in Chief<br />

redaktion@travel-one.net<br />

TOURISTIK AKTUELL (weekly trade paper)<br />

(EuBuCo Verlag GmbH)<br />

Osting 13<br />

D-65205 Wiesbaden<br />

T: +49 6122 770 9215<br />

www.touristikaktuell.de<br />

Mr Wilfried Geipert<br />

Editor<br />

w.geipert@touristik-aktuell.de<br />

23<br />

Germany 2010

GERMAN TOUR OPERATOR CONTACT DETAILS<br />

COMPANY HEAD OFFICE COMPANY <strong>OVERVIEW</strong> ANNUAL<br />

PAX TO<br />

AUST.<br />

KEY PERSONNEL<br />

GETTING THERE / TIPS<br />

Australia Tours<br />

Dieselstr. 3<br />

87437 Kempten/Allgäu<br />

T: +49 (0) 831 254 0347<br />

www.australiatours.de<br />

Art of Travel<br />

Tal 26<br />

80331 Munich<br />

T: +49 (0) 89 2110 7610<br />

www.artoftravel.de<br />

Australia Tours has been an Australian Specialist<br />

for almost 20 years. Small direct seller with 11<br />

offices in Germany. Very active with lots of<br />

marketing ideas.<br />

Operating since 1993 and specialising in FIT travel<br />

to Australia, NZ and South Pacific. Main focus on<br />

upmarket products for the discerning traveller. All<br />

itineraries are tailor made and direct mailings are<br />

sent on a regular basis. Good contact for high end<br />

products.<br />

Ca 1500<br />

Managing Director/Owner<br />

Mr German Diethei<br />

german@australiatours.de<br />

Product Manager Australia<br />

Ms Bettina Boettcher<br />

info@artoftravel.de<br />

Kempten is located south of<br />

Munich. The best way to get<br />

there is either by train via<br />

Ulm or by car via Ulm and<br />

then on to<br />

Memmingen/Kempten.<br />

Can easily be included in a day<br />

of sales calls in Munich.<br />

Best of Travel Group<br />

Ostwall 30<br />

47608 Geldern<br />

T: +49 (0) 2831 133209<br />

www.botg.de<br />

14 independent and experienced tour operators in<br />

Europe – Germany, Austria, Switzerland,<br />

Netherlands and Belgium. The strategic aim is<br />

common product management as well as sales and<br />

marketing. All members are represented in the<br />

market by the same corporate brochure. Australia<br />

is presented in its own brochure and there is a<br />

good spread of Victorian product. BOTG aims to<br />

be the largest direct travel provider to the South<br />

Pacific region out of Continental Europe.<br />

Ca 18,000<br />

across the<br />

group<br />

General Manager<br />

Mr Bernd Roesner<br />

bernd.roesner@botg.de<br />

Assistant Manager<br />

Mrs Inka van Baal<br />

inka.vanbaal@vbotg.de<br />

Geldern is located north west<br />

of Düsseldorf. Good to<br />

combine with a visit at<br />

Explorer. Car is the best way<br />

to get there. Otherwise<br />

regular train connections are<br />

available. Sales staff training at<br />

each of the operators is<br />

recommended.<br />

24<br />

Germany 2010

COMPANY HEAD OFFICE COMPANY <strong>OVERVIEW</strong> ANNUAL<br />

PAX TO<br />

AUST.<br />

KEY PERSONNEL<br />

GETTING THERE / TIPS<br />

Boomerang Reisen<br />

Biewerer Str. 15<br />

54293 Trier<br />

T: +49 (0) 651 966 8000<br />

www.australien.com<br />

Specialist selling Australia, NZ and the South Pacific<br />

through 12 offices in Germany and one each in the<br />

Netherlands, Switzerland and Austria. Active with<br />

marketing campaigns and present at all German<br />

consumer shows. TUI has just bought 49% of<br />

Boomerang which enables Boomernag access to a<br />

bigger distribution network.<br />

Ca 3500<br />

Managing Director<br />

Mr Andreas Macherey<br />

a.macherey@boomerang-reisen.de<br />

Product Manager<br />

Mrs Sabine Schamburger<br />

s.schamburger@boomerang-reisen.de<br />

Trier is quite a stretch from<br />

everywhere. By car from<br />

Frankfurt it approx. takes 2.5<br />

hours. It is also good to visit<br />

the agencies and train the<br />

front line staff.<br />

DER TOUR<br />

Emil-von-Behring Str. 6<br />

50354 Frankfurt<br />

T: + 49 (0) 69 9588 3261<br />

www.dertour.de<br />

Largest wholesaler for long haul destinations. Part<br />

of the REWE group. The brochure is distributed to<br />

approx. 11,000 retail offices. DERTOUR offers<br />

customised, individual holiday arrangements where<br />

clients can choose different combinable modular<br />

systems.<br />

Australia is part of the DER Tour road show every<br />

year. They also conduct the DERTOUR<br />

Reiseakademie every year which is the biggest tool<br />

to train the sales staff (around 700 staff attending).<br />

Sells only through travel agents and relies on<br />

product in brochure.<br />

Ca 35,000<br />

Product Manager<br />

Mr Peter Just<br />

peter.just@dertour.de<br />

Director Division Africa/Asia<br />

Ms Petra Fraatz<br />

petra.fraatz@dertour.de<br />

DER Tour is a bit out of town<br />

but easy to reach by tram<br />

from TVI office, Taxi or car.<br />

Good to combine with a visit<br />

to Meier’s since they are in<br />

the same building.<br />

25<br />

Germany 2010

COMPANY HEAD OFFICE COMPANY <strong>OVERVIEW</strong> ANNUAL<br />

PAX TO<br />

AUST.<br />

KEY PERSONNEL GETTING THERE /<br />

TIPS<br />

Explorer Fernreisen<br />

Huettenstr. 17<br />

40215 Duesseldorf<br />

T: +49 (0) 211 9949 200<br />

www.exlorer-fernreisen.com<br />

Direct seller with 11 (just opened Munich) offices<br />

located in major German cities. 122 well educated<br />

employees are selling products of 88 contracted<br />

airlines and out of 4 comprehensive brochures to<br />

direct costumers and more than 2500 travel<br />

agencies. Owner Rolf Bienert sold the company to<br />

a consolidator – Brand will continue but sales also<br />

via travel agencies not only Explorer offices.<br />

Ca 17,000<br />

Product Manager<br />

Sabine Besken<br />

sabine.besken@explorer-fernreisen.com<br />

General Manager<br />

Andreas Neumann<br />

Andreas.neumann@explorerfernreisen.com<br />

Easy to get to once in<br />

Düsseldorf. Very much in<br />

the city centre.<br />

FTI Frosch Touristik<br />

Friedensstr. 30-32<br />

81671 Muenchen<br />

T: +49 (0) 89 2525 8175<br />

www.fti.de<br />

Leading tour operator in Germany and Austria for<br />

modular holidays. Products are distributed through<br />

10,000 travel agents in Germany and Austria.<br />

Largest selection of product. Open to new<br />

product if seen as sellable. Books only via<br />

inbounder AOT.<br />

Ca 25,000<br />

Senior Product Manager<br />

Mr Dietmar P. Schulz<br />

dietmar.schulz@fti.de<br />

Easy to get to once in<br />

Munich. The best way is by<br />

Taxi or car.<br />

Gebeco<br />

Holzkoppelweg19<br />

24118 Kiel<br />

T: +49 (0) 431 5446 390<br />

www.gebeco.de<br />

Increasing Australia program with more FIT<br />

building blocks. Strong for group tours and one-off<br />

groups.<br />

Ca 3,000<br />

Product Manager<br />

Mr David Kaiser<br />

dka@gebeco.de<br />

Kiel is in the very North of<br />

Germany. Good to<br />

combine with sales calls in<br />

Hamburg.<br />

26<br />

Germany 2010

COMPANY HEAD OFFICE COMPANY <strong>OVERVIEW</strong> ANNUAL<br />

PAX TO<br />

AUST.<br />

KEY PERSONNEL GETTING THERE /<br />

TIPS<br />

Kiwi Tours<br />

Franziskaner Str. 15<br />

81669 Muenchen<br />

T: +49 (0) 89 7466 250<br />

www.kiwitours.com<br />

Small specialised tour operator to Australia & New<br />

Zealand. Mainly groups and special interest. Group<br />

sizes vary from minimum 60-80 pax.<br />

Ca 2,500<br />

Product Manager<br />

Ms Isolde Stengel<br />

i.stengel@kiwitours.de<br />

Managing Director<br />

Mr Guenter Wrede<br />

g.wrede@kiwitours.de<br />

Product Manager<br />

Mr Joachim Voss<br />

joachim.voss@meiers-weltreisen.de<br />

Good contact to include<br />

while in Munich anyway.<br />

Very much in the city<br />

centre. Easy to get to by<br />

taxi or car.<br />

Meier’s Weltreisen<br />

Emil-von-Behring Str. 6<br />

60439 Frankfurt<br />

T: +49 (0) 69 9588 3744<br />

www.meiers.-weltreisen.de<br />

Part of the REWE Touristik and one of the top<br />

three tour operators in Germany.<br />

In the classic roundtrips and beach holiday<br />

segments Meier’s is the leader in the German longdistance<br />

market with high brand awareness. They<br />

are interested in niche products like Food & Wine.<br />

Ca 7,500<br />

See DER Tour<br />

Pacific Travelhouse<br />

Bayerstr. 95<br />

80335 Muenchen<br />

T: +49 (0) 89 5432 180<br />

F: +49 (0) 89 5432 1822<br />

www.pacific-travel-house.de<br />

Small specialised wholesaler for South Pacific.<br />

Good product selection in their brochure.<br />

Special interest in scuba diving.<br />

Managing Director<br />

Mr Joerg Poppen<br />

j.poppen@pacific-travel-house.de<br />

The office is in walking<br />

distance of the main train<br />

station in Munich. Just use<br />

the exit “Bayerstrasse”<br />

when getting off the train<br />

and turn right.<br />

STA Travel<br />

Praunheimer Landstr. 50<br />

60488 Frankfurt<br />

T: +49 (0) 69 97907260<br />

www.statravel.de<br />

Worldwide the biggest operator for youth travel.<br />

They are great promoters for Australia and focus<br />

very much on the WHM. Good opportunities for<br />

products which are geared to this market.<br />

However with the recent brand update they now<br />

also target the older travel segment.<br />

Managing Director<br />

Mr Andreas Siegmann<br />

Andreas.Siegmann@statravel.de<br />

Product Manager<br />

Mr Michael Schmidtke<br />

Michael.schmidtke@statravel.de<br />

Located in Frankfurt. Best<br />

to get there by taxi or<br />

tram.<br />

27<br />

Germany 2010

COMPANY HEAD OFFICE COMPANY <strong>OVERVIEW</strong> ANNUAL<br />

PAX TO<br />

AUST.<br />

KEY PERSONNEL GETTING THERE /<br />

TIPS<br />

Step-In<br />

Beethoven Allee 21<br />

53173 Bonn<br />

T: +49 (0) 228 956 9515<br />

www.step-in.de<br />

Also a good agency contact for youth products and<br />

once again very focused on WHM in Australia/NZ.<br />

Worthwhile contact for products geared to the<br />

youth market.<br />

Product Manager<br />

Ms Verena Hanneken<br />

Verena.hanneken@step-in.de<br />

Bonn is close to Cologne<br />

and Düsseldorf. Sales calls<br />

could be combined with<br />

Explorer in Düsseldorf.<br />

Studiosus Reisen<br />

Riesstrasse 25<br />

80992 Muenchen<br />

T: +49 (0) 89 500 60277<br />

www.studiosus.com<br />

Europe’s leading cultural group-tour operator.<br />

They distribute 14 different brochures through<br />

approx. 9000 travel agencies throughout Germany,<br />

Austria and Switzerland. Tours range from hiking<br />

and cycling cultural tours to cultural tours with a<br />

high level of comfort.<br />

Ca 1000<br />

Product Manager<br />

Thomas Graune<br />

thomas.graune@studiosusreisen.de<br />

Thomas Cook Reisen<br />

Zimmersmuehlenweg 55<br />

61440 Oberursel<br />

T: +49 (0) 6171 652050<br />

www.thomascook.de<br />

Major wholesaler in Germany but small product<br />

range for Australia.<br />

Product Manager Australia<br />

Florian Werzinger<br />

florian.werzinger@thomascookag.com<br />

Oberursel is close to<br />

Frankfurt. Can be<br />

combined with a visit to<br />

DERTOUR/Meier’s since<br />

they are located in the<br />

same direction.<br />

Travelworks<br />

Muensterstr. 111<br />

48155 Muenster<br />

T: +49 (0) 2506 304721<br />

www.travelworks.de<br />

Another travel agent geared to the WHM. The<br />

only WHV operator delivering significant numbers<br />

for Melbouerne as arrival city.<br />

Very active in online marketing<br />

PR/Marketing Manager<br />

Tanja Kuntz<br />

tkuntz@travelworks.de<br />

Muenster is north of<br />

Düsseldorf. Approx. 150<br />

km. Difficult to combine a<br />

visit there with anything<br />

else.<br />

28<br />

Germany 2010

COMPANY HEAD OFFICE COMPANY <strong>OVERVIEW</strong> ANNUAL<br />

PAX TO<br />

AUST.<br />

KEY PERSONNEL GETTING THERE /<br />

TIPS<br />

TUI Deutschland<br />

Branch: Airtours<br />

Karl-Wiechert Allee 25<br />

30171 Hannover<br />

T: +49 (0) 511 5676427<br />

www.airtours.de<br />

The company Airtours has merged with the TUI<br />

Deutschland GmbH. Airtours is also working<br />

exclusively with APTC.<br />

Airtours is concentrating on upmarket products<br />

only – no dedicated Australia brochure.<br />

Product Manager<br />

Majken Müller<br />

Majken.mueller@tui.de<br />

Hannover is in the<br />

northern part of Germany.<br />

Good to combine with<br />

sales calls in Hamburg<br />

(approx. 2 hours).<br />

TUI Deutschland<br />

Karl-Wiechert-Allee 23<br />

30171 Hannover<br />

T: +49 (0) 511 5676427<br />

www.tui.de<br />

TUI is producing an Oceania brochure with<br />

approx. 200 pages, under the TUI brand -<br />

Weltentdecker. Product range is mainly 3-4 star<br />

category. Exclusive Inbounder – APTC<br />

We just ran a TUI famil with excellent feedback<br />

Product Manager Australia<br />

Jesko Krengel<br />

jesko.krengel@tui.de<br />

Hannover is in the<br />

northern part of Germany.<br />

Good to combine with<br />

sales calls in Hamburg<br />

(approx. 2 hours).<br />

Windrose Fernreisen<br />

Neue Grünstrasse 28<br />

10926 Berlin<br />

Very exclusive wholesaler. Only 5 star travel<br />

brochure. No extra Australia brochure but part of<br />

the Asia brochure.<br />

Area Manager Asia & Australia<br />

Meinhard Hiller<br />

hiller@windrose.de<br />

The office is just around<br />

the corner of the German<br />

Embassy.<br />

T: +49 (0) 30 2017 2121<br />

www.windrose.de<br />

29<br />

Germany 2010