reactivation of dormant account application form - Alpha Bank ...

reactivation of dormant account application form - Alpha Bank ...

reactivation of dormant account application form - Alpha Bank ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

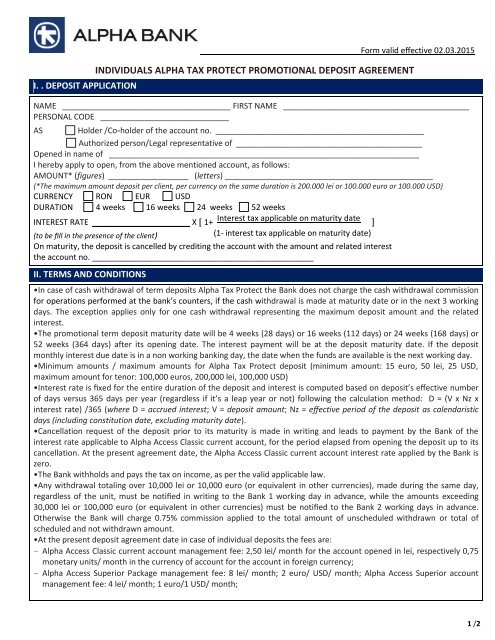

I. . DEPOSIT APPLICATION<br />

INDIVIDUALS ALPHA TAX PROTECT PROMOTIONAL DEPOSIT AGREEMENT<br />

Form valid effective 02.03.2015<br />

NAME ______________________________________ FIRST NAME __________________________________________<br />

PERSONAL CODE _____________________________<br />

AS Holder /Co‐holder <strong>of</strong> the <strong>account</strong> no. _______________________________________________<br />

Authorized person/Legal representative <strong>of</strong> __________________________________________<br />

Opened in name <strong>of</strong> ______________________________________________________________________<br />

I hereby apply to open, from the above mentioned <strong>account</strong>, as follows:<br />

AMOUNT* (figures) __________________ (letters) _______________________________________________<br />

(*The maximum amount deposit per client, per currency on the same duration is 200.000 lei or 100.000 euro or 100.000 USD)<br />

CURRENCY RON EUR USD<br />

DURATION 4 weeks 16 weeks 24 weeks 52 weeks<br />

INTEREST RATE ______________________ X 1+<br />

Interest tax applicable on maturity date<br />

(to be fill in the presence <strong>of</strong> the client)<br />

(1- interest tax applicable on maturity date)<br />

On maturity, the deposit is cancelled by crediting the <strong>account</strong> with the amount and related interest<br />

the <strong>account</strong> no. __________________________________________________<br />

II. TERMS AND CONDITIONS<br />

•In case <strong>of</strong> cash withdrawal <strong>of</strong> term deposits <strong>Alpha</strong> Tax Protect the <strong>Bank</strong> does not charge the cash withdrawal commission<br />

for operations per<strong>form</strong>ed at the bank’s counters, if the cash withdrawal is made at maturity date or in the next 3 working<br />

days. The exception applies only for one cash withdrawal representing the maximum deposit amount and the related<br />

interest.<br />

•The promotional term deposit maturity date will be 4 weeks (28 days) or 16 weeks (112 days) or 24 weeks (168 days) or<br />

52 weeks (364 days) after its opening date. The interest payment will be at the deposit maturity date. If the deposit<br />

monthly interest due date is in a non working banking day, the date when the funds are available is the next working day.<br />

•Minimum amounts / maximum amounts for <strong>Alpha</strong> Tax Protect deposit (minimum amount: 15 euro, 50 lei, 25 USD,<br />

maximum amount for tenor: 100,000 euros, 200,000 lei, 100,000 USD)<br />

•Interest rate is fixed for the entire duration <strong>of</strong> the deposit and interest is computed based on deposit’s effective number<br />

<strong>of</strong> days versus 365 days per year (regardless if it’s a leap year or not) following the calculation method: D = (V x Nz x<br />

interest rate) /365 (where D = accrued interest; V = deposit amount; Nz = effective period <strong>of</strong> the deposit as calendaristic<br />

days (including constitution date, excluding maturity date).<br />

•Cancellation request <strong>of</strong> the deposit prior to its maturity is made in writing and leads to payment by the <strong>Bank</strong> <strong>of</strong> the<br />

interest rate applicable to <strong>Alpha</strong> Access Classic current <strong>account</strong>, for the period elapsed from opening the deposit up to its<br />

cancellation. At the present agreement date, the <strong>Alpha</strong> Access Classic current <strong>account</strong> interest rate applied by the <strong>Bank</strong> is<br />

zero.<br />

•The <strong>Bank</strong> withholds and pays the tax on income, as per the valid applicable law.<br />

•Any withdrawal totaling over 10,000 lei or 10,000 euro (or equivalent in other currencies), made during the same day,<br />

regardless <strong>of</strong> the unit, must be notified in writing to the <strong>Bank</strong> 1 working day in advance, while the amounts exceeding<br />

30,000 lei or 100,000 euro (or equivalent in other currencies) must be notified to the <strong>Bank</strong> 2 working days in advance.<br />

Otherwise the <strong>Bank</strong> will charge 0.75% commission applied to the total amount <strong>of</strong> unscheduled withdrawn or total <strong>of</strong><br />

scheduled and not withdrawn amount.<br />

•At the present deposit agreement date in case <strong>of</strong> individual deposits the fees are:<br />

<strong>Alpha</strong> Access Classic current <strong>account</strong> management fee: 2,50 lei/ month for the <strong>account</strong> opened in lei, respectively 0,75<br />

monetary units/ month in the currency <strong>of</strong> <strong>account</strong> for the <strong>account</strong> in foreign currency;<br />

<strong>Alpha</strong> Access Superior Package management fee: 8 lei/ month; 2 euro/ USD/ month; <strong>Alpha</strong> Access Superior <strong>account</strong><br />

management fee: 4 lei/ month; 1 euro/1 USD/ month;<br />

1 /2

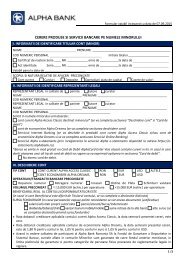

Form valid effective 02.03.2015<br />

<strong>Alpha</strong> Student Package management fee: 1 Leu/ month; management fee for one optional current <strong>account</strong> in foreign<br />

currency, 0.38 monetary units (EUR/ USD/ GBP/ CHF)/ month;<br />

<strong>Alpha</strong> Premier <strong>account</strong> management fee: 4 lei/ month; 1 euro/ month;<br />

<strong>Alpha</strong> Access Package management fee: 4 lei/ month;<br />

<strong>Alpha</strong> Connect Package management fee: 8 lei/ luna; 2 EUR/USD/GBP/CHF / month;<br />

<strong>Alpha</strong> Explore Package management fee: 12 lei/ luna; 3 EUR/USD/GBP/CHF / month;<br />

withdrawal fee: 0,40% min. 3 lei for withdrawals in lei/ 0,50% min. 1 euro for withdrawals in foreign currency;<br />

cash deposit fee: zero.<br />

•The <strong>account</strong> holder undertakes to in<strong>form</strong> the <strong>Bank</strong> in writing, at latest on the date <strong>of</strong> the present contract termination,<br />

with regard to his/her option to close the current <strong>account</strong> opened in the <strong>Bank</strong>’s records, taking into <strong>account</strong> that this<br />

represents another financial service <strong>of</strong>fered by the <strong>Bank</strong>. Following the holder’s written request, the <strong>Bank</strong> will close the<br />

current <strong>account</strong> without additional costs, but only after all specific banking financial service commissions/charges are paid,<br />

these being due to the <strong>Bank</strong> prior to the sending <strong>of</strong> the current <strong>account</strong> termination request.<br />

•Taking into <strong>account</strong> that <strong>Alpha</strong> <strong>Bank</strong> Romania participates to <strong>Bank</strong>ing System Deposits Guarantee Fund, the amounts<br />

existing in <strong>account</strong>s are guaranteed by the before ‐mentioned fund, in accordance with the guarantee limits and for<br />

individual clients foreseen by the legislation in force.<br />

The Terms and Conditions together with the deposit <strong>application</strong> represent the contract between the parties. I am aware<br />

and agree with the terms and conditions <strong>of</strong> the deposit, which I understand and accept unconditionally.<br />

Date _____________________<br />

Authorized signatures ___________________________<br />

TO BE FILLED BY THE BANK<br />

CIF ________________________<br />

Sucursala/Agentie ____________________________<br />

REFERINTA DEPOZIT ___________________________ GARANTAT NEGARANTAT<br />

DATA SCADENTEI _____________________________<br />

Data _______________________<br />

Semnatura autorizata_____________________________(L.S.)<br />

2 /2