NEWHORIZON

NEWHORIZON - Institute of Islamic Banking and Insurance

NEWHORIZON - Institute of Islamic Banking and Insurance

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>NEWHORIZON</strong> April to June 2013<br />

IIBI Lectures<br />

IIBI Monthly Lecture Series – February and March 2013<br />

February: The Tax Treatment of Islamic<br />

Finance in the MENA Region<br />

Mohammed Amin’s lecture was<br />

based on a study of taxation<br />

practices relating to Islamic finance<br />

in the MENA region. The study<br />

was sponsored by the Qatar<br />

Financial Centre Authority region<br />

working with the Washingtonbased<br />

International Tax and<br />

Investment Centre and Ernst &<br />

Young (E&Y). It was designed<br />

to establish how common Islamic<br />

finance structures were treated in<br />

the region, with a particular focus<br />

on cross-border transactions, to<br />

identify tax obstacles and to make<br />

policy recommendations. The<br />

study also looked at Malaysian<br />

practices to provide a comparison<br />

with the MENA region.<br />

Mr Amin began the lecture with<br />

a disclaimer, pointing out that tax<br />

was a complex subject and the<br />

contents of the lecture did not<br />

constitute professional advice.<br />

consumption taxes and zakat were<br />

excluded. The study focussed on<br />

four structures commonly used<br />

in Islamic finance – commodity<br />

murabaha/tawarruq, which are<br />

equivalent to conventional loans;<br />

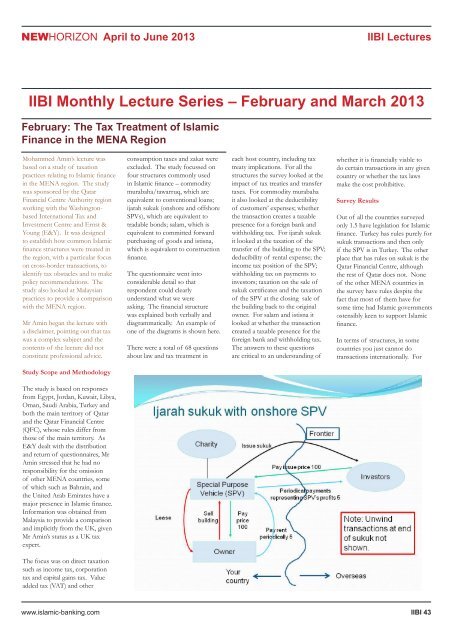

ijarah sukuk (onshore and offshore<br />

SPVs), which are equivalent to<br />

tradable bonds; salam, which is<br />

equivalent to committed forward<br />

purchasing of goods and istisna,<br />

which is equivalent to construction<br />

finance.<br />

The questionnaire went into<br />

considerable detail so that<br />

respondent could clearly<br />

understand what we were<br />

asking. The financial structure<br />

was explained both verbally and<br />

diagrammatically. An example of<br />

one of the diagrams is shown here.<br />

There were a total of 68 questions<br />

about law and tax treatment in<br />

each host country, including tax<br />

treaty implications. For all the<br />

structures the survey looked at the<br />

impact of tax treaties and transfer<br />

taxes. For commodity murabaha<br />

it also looked at the deductibility<br />

of customers’ expenses; whether<br />

the transaction creates a taxable<br />

presence for a foreign bank and<br />

withholding tax. For ijarah sukuk<br />

it looked at the taxation of the<br />

transfer of the building to the SPV;<br />

deducibility of rental expense; the<br />

income tax position of the SPV;<br />

withholding tax on payments to<br />

investors; taxation on the sale of<br />

sukuk certificates and the taxation<br />

of the SPV at the closing sale of<br />

the building back to the original<br />

owner. For salam and istisna it<br />

looked at whether the transaction<br />

created a taxable presence for the<br />

foreign bank and withholding tax.<br />

The answers to these questions<br />

are critical to an understanding of<br />

whether it is financially viable to<br />

do certain transactions in any given<br />

country or whether the tax laws<br />

make the cost prohibitive.<br />

Survey Results<br />

Out of all the countries surveyed<br />

only 1.5 have legislation for Islamic<br />

finance. Turkey has rules purely for<br />

sukuk transactions and then only<br />

if the SPV is in Turkey. The other<br />

place that has rules on sukuk is the<br />

Qatar Financial Centre, although<br />

the rest of Qatar does not. None<br />

of the other MENA countries in<br />

the survey have rules despite the<br />

fact that most of them have for<br />

some time had Islamic governments<br />

ostensibly keen to support Islamic<br />

finance.<br />

In terms of structures, in some<br />

countries you just cannot do<br />

transactions internationally. For<br />

Study Scope and Methodology<br />

The study is based on responses<br />

from Egypt, Jordan, Kuwait, Libya,<br />

Oman, Saudi Arabia, Turkey and<br />

both the main territory of Qatar<br />

and the Qatar Financial Centre<br />

(QFC), whose rules differ from<br />

those of the main territory. As<br />

E&Y dealt with the distribution<br />

and return of questionnaires, Mr<br />

Amin stressed that he had no<br />

responsibility for the omission<br />

of other MENA countries, some<br />

of which such as Bahrain, and<br />

the United Arab Emirates have a<br />

major presence in Islamic finance.<br />

Information was obtained from<br />

Malaysia to provide a comparison<br />

and implicitly from the UK, given<br />

Mr Amin’s status as a UK tax<br />

expert.<br />

The focus was on direct taxation<br />

such as income tax, corporation<br />

tax and capital gains tax. Value<br />

added tax (VAT) and other<br />

www.islamic-banking.com IIBI 43