Illicit Financial Flows

Illicit Financial Flows and the Problem of Net Resource Transfers ...

Illicit Financial Flows and the Problem of Net Resource Transfers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ormalized <br />

25 30 35 <br />

countries are under pressure as a result of the global economic as well as the subsequent European<br />

Morocco <br />

crisis, and the ensuing lack of fiscal space implies that they may be unable to significantly expand<br />

ODA in the foreseeable future. Developing countries would need to curtail illicit flows if they are to<br />

Cote d'Ivoire <br />

reduce their offsetting effects on economic development (see Box 5).<br />

Ethiopia <br />

In 2009, illicit financial flows out of Africa were over three times the amount of ODA received. Hence,<br />

curtailing illicit financial flows from African countries through improvements in governance and the<br />

Botswana <br />

business climate can improve the productivity of both domestic and foreign capital needed to boost<br />

economic growth.<br />

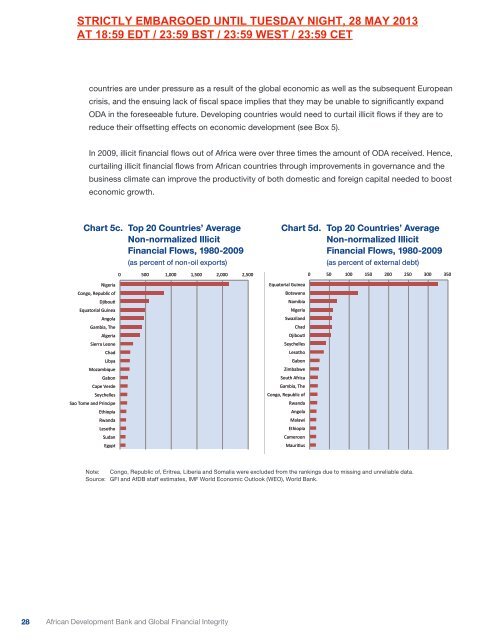

Chart 5c. Top 20 Countries’ Average<br />

Non-normalized <strong>Illicit</strong><br />

Chart 5c. Top 20<br />

<strong>Financial</strong><br />

Countries' Average<br />

<strong>Flows</strong>,<br />

Non-‐normalized<br />

1980-2009<br />

<br />

<strong>Illicit</strong> <strong>Financial</strong> <strong>Flows</strong>, 1980-‐2009 <br />

(as percent of non-oil exports)<br />

(as percent of non-‐oil exports) <br />

(in millions of U.S. dollars) <br />

0 50,000 100,000 150,000 200,000 250,000 <br />

Nigeria <br />

South Africa <br />

Egypt <br />

Algeria <br />

Libya <br />

Angola <br />

Congo, Republic of <br />

Cameroon <br />

Liberia <br />

Gabon <br />

Zimbabwe <br />

Sudan <br />

Chad <br />

Tunisia <br />

Zambia <br />

Equatorial Guinea <br />

Chart 5a. Top 20 Countries' Cumula6ve <br />

Non-‐normalized <strong>Illicit</strong> <strong>Financial</strong> <strong>Flows</strong>, <br />

2000-‐2009 <br />

STRICTLY EMBARGOED UNTIL TUESDAY NIGHT, 28 MAY 2013<br />

AT 18:59 EDT / 23:59 BST / 23:59 WEST / 23:59 CET<br />

Chart 5d. Top 20 Countries’ Average<br />

Non-normalized <strong>Illicit</strong><br />

<strong>Financial</strong> <strong>Flows</strong>, 1980-2009<br />

Chart 5d. Top 20 Countries' Average Non-‐normalized <br />

<strong>Illicit</strong> <strong>Financial</strong> <strong>Flows</strong>, 1980-‐2009 <br />

(as percent of external of external debt) debt)<br />

0 500 1,000 1,500 2,000 2,500 <br />

0 50 100 150 200 250 300 350 <br />

Nigeria <br />

Congo, Republic of <br />

DjibouN <br />

Equatorial Guinea <br />

Angola <br />

Gambia, The <br />

Algeria <br />

Sierra Leone <br />

Chad <br />

Libya <br />

Mozambique <br />

Gabon <br />

Cape Verde <br />

Seychelles <br />

Sao Tome and Principe <br />

Ethiopia <br />

Rwanda <br />

Lesotho <br />

Sudan <br />

Egypt <br />

Equatorial Guinea <br />

Botswana <br />

Namibia <br />

Nigeria <br />

Swaziland <br />

Chad <br />

DjibouN <br />

Seychelles <br />

Lesotho <br />

Gabon <br />

Zimbabwe <br />

South Africa <br />

Gambia, The <br />

Congo, Republic of <br />

Rwanda <br />

Angola <br />

Malawi <br />

Ethiopia <br />

Cameroon <br />

MauriNus <br />

C<br />

Congo<br />

Equa<br />

Sao Tome<br />

C<br />

Equatoria<br />

Sou<br />

Congo, Re<br />

B<br />

S<br />

S<br />

Cot<br />

M<br />

Z<br />

C<br />

Note: Congo, Republic of, Eritrea, Liberia and Somalia were excluded from the rankings due to missing and unreliable data.<br />

ormalized <br />

Chart 5f. Top 20 Countries' Average Non-‐normalized <br />

Source: GFI and AfDB staff estimates, IMF World Economic Outlook (WEO), World Bank.<br />

<strong>Illicit</strong> <strong>Financial</strong> <strong>Flows</strong> per capita, 1980-‐2009 <br />

(in U.S. dollars) 1/ <br />

ce) 1/ 0 200 400 600 800 1,000 1,200 1,400 1,600 <br />

,000 14,000 16,000 <br />

Seychelles <br />

Equatorial Guinea <br />

Gabon <br />

Libya <br />

Botswana <br />

Congo, Republic of <br />

Namibia <br />

DjibouN <br />

Swaziland <br />

South Africa <br />

MauriNus <br />

Angola <br />

Sao Tome and Principe <br />

28 African Development Algeria Bank and Global <strong>Financial</strong> Integrity<br />

Gambia, The