Illicit Financial Flows

Illicit Financial Flows and the Problem of Net Resource Transfers ...

Illicit Financial Flows and the Problem of Net Resource Transfers ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRICTLY EMBARGOED UNTIL TUESDAY NIGHT, 28 MAY 2013<br />

AT 18:59 EDT / 23:59 BST / 23:59 WEST / 23:59 CET<br />

Ghana’s Balance of Payments Accounts<br />

According to Stern (1973), “the balance of payments is a summary of all economic transactions<br />

between the residents of one country and the rest of the world, covering some given period of<br />

time.” The IMF’s more detailed definition is: “The balance of payments is a statistical statement<br />

that summarizes transactions between residents and nonresidents during a period. It consists of<br />

the goods and services account, the primary income account, the secondary income account, the<br />

capital account, and the financial account. Together, these accounts balance in the sense that the<br />

sum of the entries is conceptually zero.” 11<br />

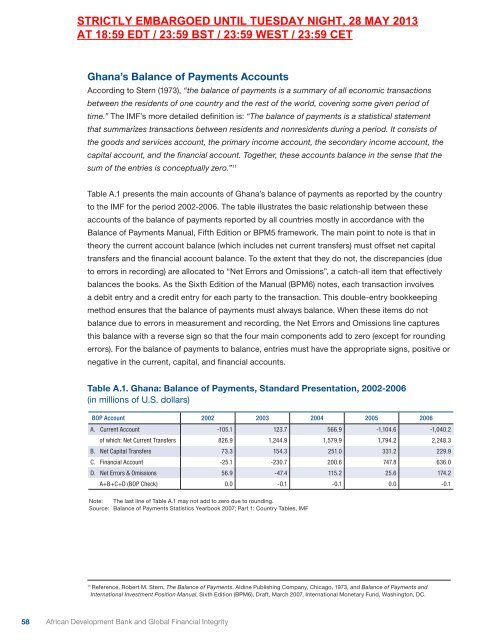

Table A.1 presents the main accounts of Ghana’s balance of payments as reported by the country<br />

to the IMF for the period 2002-2006. The table illustrates the basic relationship between these<br />

accounts of the balance of payments reported by all countries mostly in accordance with the<br />

Balance of Payments Manual, Fifth Edition or BPM5 framework. The main point to note is that in<br />

theory the current account balance (which includes net current transfers) must offset net capital<br />

transfers and the financial account balance. To the extent that they do not, the discrepancies (due<br />

to errors in recording) are allocated to “Net Errors and Omissions”, a catch-all item that effectively<br />

balances the books. As the Sixth Edition of the Manual (BPM6) notes, each transaction involves<br />

a debit entry and a credit entry for each party to the transaction. This double-entry bookkeeping<br />

method ensures that the balance of payments must always balance. When these items do not<br />

balance due to errors in measurement and recording, the Net Errors and Omissions line captures<br />

this balance with a reverse sign so that the four main components add to zero (except for rounding<br />

errors). For the balance of payments to balance, entries must have the appropriate signs, positive or<br />

negative in the current, capital, and financial accounts.<br />

Table A.1. Ghana: Balance of Payments, Standard Presentation, 2002-2006<br />

(in millions of U.S. dollars)<br />

BOP Account 2002 2003 2004 2005 2006<br />

A. Current Account -105.1 123.7 566.9 -1,104.6 -1,040.2<br />

of which: Net Current Transfers 826.9 1,244.9 1,579.9 1,794.2 2,248.3<br />

B. Net Capital Transfers 73.3 154.3 251.0 331.2 229.9<br />

C. <strong>Financial</strong> Account -25.1 -230.7 200.6 747.8 636.0<br />

D. Net Errors & Omissions 56.9 -47.4 115.2 25.6 174.2<br />

A+B+C+D (BOP Check) 0.0 -0.1 -0.1 0.0 -0.1<br />

Note: The last line of Table A.1 may not add to zero due to rounding.<br />

Source: Balance of Payments Statistics Yearbook 2007; Part 1: Country Tables, IMF<br />

11<br />

Reference, Robert M. Stern, The Balance of Payments, Aldine Publishing Company, Chicago, 1973, and Balance of Payments and<br />

International Investment Position Manual, Sixth Edition (BPM6), Draft, March 2007, International Monetary Fund, Washington, DC.<br />

58 African Development Bank and Global <strong>Financial</strong> Integrity