Clones

Send in the - Canadian Meat Business

Send in the - Canadian Meat Business

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

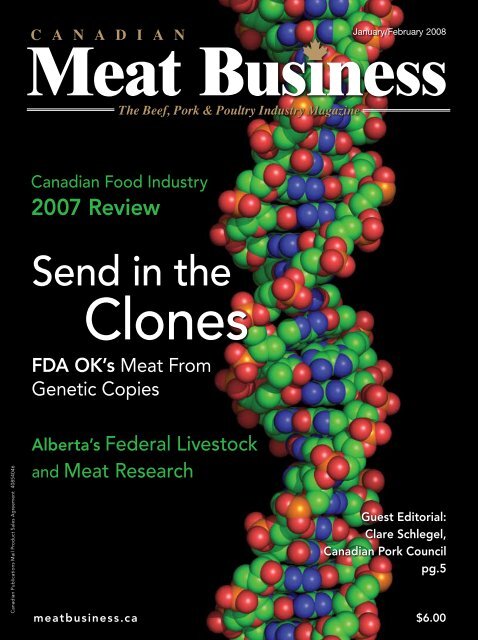

January/February 2008<br />

Canadian Food Industry<br />

2007 Review<br />

Send in the<br />

<strong>Clones</strong><br />

FDA OK’s Meat From<br />

Genetic Copies<br />

Canadian Publications Mail Product Sales Agreement 40854046<br />

Alberta’s Federal Livestock<br />

and Meat Research<br />

meatbusiness.ca<br />

Guest Editorial:<br />

Clare Schlegel,<br />

Canadian Pork Council<br />

pg.5<br />

$6.00

Volume 7, Number 1 January/February 2008<br />

5 Guest Editorial by Clare Schlegel<br />

6 Send in the <strong>Clones</strong> by Alan MacKenzie<br />

8<br />

8 Expanded Canadian Emphasis at NAMP<br />

Conference<br />

10 From Early Pioneers to Current Issues<br />

by Debbie Lockrey-Wessel<br />

12 Canadian Food Industry 2007 Review<br />

by Kevin Grier<br />

14 Cross Country News<br />

16 $12 Million Turnaround by Alan MacKenzie<br />

18 Industry Roundup<br />

20 Meat-Friendly Weight Loss by Alan MacKenzie<br />

21 Events Calendar<br />

22 Ethanol as Public Policy in Canada<br />

by Al Mussell and Larry Martin<br />

24 Assembly Line<br />

20<br />

27 Business Spotlight<br />

28 Product Showcase<br />

30 Meat Industry Business Watch<br />

by James Sbrolla<br />

10<br />

22<br />

meatbusiness.ca<br />

January/February 2008 Canadian Meat Business

| Guest Editorial |<br />

January/February 2008 Volume 7 Number 1<br />

PUBLISHER<br />

Ray Blumenfeld<br />

ray@meatbusiness.ca<br />

MANAGING EDITOR<br />

Alan MacKenzie<br />

alan@meatbusiness.ca<br />

CONTRIBUTING WRITERS<br />

Clare Schlegel, Debbie Lockrey-Wessel,<br />

Kevin Grier, Al Mussell, Larry Martin,<br />

James Sbrolla<br />

ART DIRECTOR & DESIGNER<br />

Donna Endacott<br />

DESIGNER<br />

Correna Saunders<br />

CIRCULATION/ADMINISTRATION<br />

Kerry Freek<br />

kerry@meatbusiness.ca<br />

FINANCE<br />

Jane Addie<br />

Canadian Meat Business is published<br />

six times a year by We Communications Inc.<br />

PRESIDENT<br />

Todd Latham<br />

todd@wecommunications.ca<br />

We Communications Inc.<br />

7-1080 Waverley Street<br />

Winnipeg, MB, Canada R3T 5S4<br />

Phone: 204.985.9502 Fax: 204.582.9800<br />

Toll Free: 1.800.344.7055<br />

We Communications Inc.<br />

11 Prince Andrew Place<br />

Toronto, ON, Canada M3C 2H2<br />

Phone: 416.444.5842 Fax: 416.444.1176<br />

E-mail: publishing@meatbusiness.ca<br />

Website: www.meatbusiness.ca<br />

Canadian Meat Business subscriptions are<br />

available for $33.00/year or $59.00/two years<br />

and includes the annual Buyers Guide issue.<br />

©2008 We Communications Inc. All rights reserved.<br />

The contents of this publication may not be<br />

reproduced by any means in whole or in part,<br />

without prior written consent from the publisher.<br />

Printed in Canada.<br />

Undeliverable mail return to:<br />

7-1080 Waverley Street, Winnipeg, MB, R3T 5S4<br />

ISSN 1715-6726<br />

meatbusiness.ca<br />

Why Canadian Pork Producers<br />

Need Government Support<br />

As part of a fifth generation<br />

farming family, I have seen<br />

many ups and downs in<br />

agriculture. Particularly in the hog<br />

business, highs and lows in the average<br />

four-year price cycle are the norm.<br />

Nothing, however, could have prepared<br />

Canadian pork producers for what we<br />

experienced in 2007.<br />

Over the past twelve months our<br />

export-dependent sector has been<br />

assaulted by “the perfect storm”<br />

– a combination of a high Canadian<br />

dollar, skyrocketing feed costs, and low<br />

market prices for our hogs.<br />

Our industry was also weakened<br />

in 2005/06 by disease challenges,<br />

such as circovirus (PCVAD), for<br />

which producers had no effective<br />

tools. Thankfully, excellent vaccines<br />

have now been developed to combat<br />

PCVAD.<br />

The high cost of grain alone<br />

has caused not only Canadian hog<br />

producers, but also those in other<br />

countries – including Australia, New<br />

Zealand, Britain and France – to<br />

suffer severe losses. Even the U.S. felt<br />

the impact of these increased costs.<br />

This truly is a global reality.<br />

We are seeing serious challenges in<br />

hog production worldwide, but Canada<br />

is particularly vulnerable because of<br />

the record highs of our dollar (which<br />

have increased more than 70 per<br />

cent over four years), thus directly<br />

affecting our competitiveness with the<br />

U.S.. Our producers are now faced with<br />

making extremely difficult business,<br />

financial and family decisions for their<br />

farms.<br />

For months, we have been meeting<br />

with federal politicians, including<br />

Agriculture and Agri-Food Minister<br />

Gerry Ritz, as well as many political<br />

and bureaucratic staff, to create<br />

awareness about the plight facing our<br />

farmers and to look for solutions to get<br />

us through this crisis.<br />

We asked for a repayable loan to<br />

help hog producers transition through<br />

the difficult coming months, as well as<br />

improvements to the present suite of<br />

business risk management programs.<br />

In order to be competitive within<br />

the current reality, costs will have to<br />

be cut dramatically across the supply<br />

chain. This takes time. Not everyone<br />

will be able to accomplish this,<br />

including some of our supply chain<br />

partners. However, over the long term,<br />

the Canadian hog sector cannot afford<br />

to pay more for their inputs than our<br />

competitors and expect to maintain<br />

the current production levels.<br />

In late December, Minister Ritz<br />

announced “help” for producers in<br />

the form of currently existing business<br />

risk management programs. While we<br />

appreciate this, it will not be enough,<br />

soon enough for our producers –<br />

including some of our very best.<br />

The good news is that, with time,<br />

markets will adjust to the new cost<br />

conditions. We are confident that<br />

Canadian producers will be among the<br />

most competitive in the world.<br />

Factors that point to a brighter<br />

future for Canadian pork sales include<br />

growth in Chinese pork consumption<br />

that exceeds China’s ability to increase<br />

hog production, and positive signs that<br />

the WTO negotiations will succeed at<br />

further liberalizing world trade.<br />

There is no doubt some producers<br />

will exit the business. Our proposals<br />

for dealing with the crisis are not<br />

designed to preserve our industry in<br />

its current state. Instead, we need to<br />

provide conditions in which rational<br />

long-run business decisions can be<br />

made. We are fighting to avoid the total<br />

destruction of a viable Canadian pork<br />

production, processing, distribution<br />

and exporting value chain.<br />

But the bottom line is, in order to<br />

succeed in the future, we need to still<br />

be in business when things get better<br />

again for hog production.<br />

We need the support of the federal<br />

government right now to see us through<br />

the tough times we’re facing. We need<br />

a government that supports farmers.<br />

We need them to realize the severity of<br />

our crisis before it’s too late.<br />

- Clare Schlegel, president, Canadian<br />

Pork Council<br />

January/February 2008 Canadian Meat Business

| Cover Stor y |<br />

Send in the<br />

<strong>Clones</strong><br />

The U.S. FDA says eating meat from<br />

cloned animals is safe. Will Canada be<br />

next to say ‘copy that’ to cloned food?<br />

By Alan MacKenzie<br />

It sounds like science fiction. Some<br />

call it unnatural. And it may soon<br />

be on your plate.<br />

Cloning – the process of using DNA<br />

technology to create a genetically<br />

identical copy – was generally<br />

considered the subject matter of<br />

outlandish stories until 1996 when<br />

Scottish scientists gained worldwide<br />

attention by famously cloning a<br />

sheep, Dolly. Now, a little over a<br />

decade later, the U.S. Food and<br />

Drug Administration (FDA) has<br />

announced that consuming meat<br />

and milk from clones of cattle, swine,<br />

and goats – and their offspring – is<br />

as safe as from conventionally bred<br />

animals (interestingly, the FDA said it<br />

needs more time to come to the same<br />

conclusion about sheep).<br />

FDA made its announcement Jan. 15,<br />

making three documents – a “risk<br />

assessment,” a “risk management plan”<br />

and “guidance for industry” – available<br />

on its website. They were originally<br />

released in draft form in December<br />

2006.<br />

“After reviewing additional data and<br />

the public comments in the intervening<br />

year since the release of our draft<br />

documents on cloning, we conclude<br />

that meat and milk from cattle, swine,<br />

and goat clones are as safe as food we<br />

eat every day,” said Stephen F. Sundlof,<br />

director of FDA's Center for Food<br />

Safety and Applied Nutrition.<br />

The controversial announcement<br />

was quickly followed by statements<br />

from leading U.S. meat processors<br />

– including Smithfield Foods and<br />

Tyson Foods – that they do not plan<br />

to produce products from cloned<br />

animals. U.S. consumer and animal<br />

protection groups were also quick<br />

to criticize, noting that the science<br />

remains insufficient and that many<br />

consumers are against cloning for<br />

religious or ethical reasons.<br />

Although cloning has been approved<br />

by the FDA, it doesn’t necessarily mean<br />

it will be widely used to produce food<br />

in America any time soon. The United<br />

States Department of Agriculture<br />

(USDA) undersecretary for marketing<br />

and regulatory programs, Bruce I.<br />

Knight stated the department “fully<br />

supports and agrees with” the FDA's<br />

findings, but asked for a “voluntary<br />

moratorium” on letting product from<br />

cloned animals enter the market,<br />

noting the domestic agriculture and<br />

international trade implications of using<br />

cloned food needs to be studied first.<br />

But the FDA is not alone in its<br />

stance. A week prior to its statements,<br />

the European Food Safety Authority<br />

released a draft scientific report<br />

stating, “healthy clones, their offspring<br />

and products from them do not show<br />

any significant differences from their<br />

conventional counterparts.”<br />

So can Canada be far behind?<br />

According to Health Canada spokesperson<br />

Paul Duchesse, there are<br />

currently no foods from cloned<br />

animals approved for sale in Canada.<br />

He noted the release of the FDA<br />

documents “does not necessarily mean<br />

there will be a change” in Canada’s<br />

existing policy towards foods derived<br />

from clones.<br />

“While the U.S documents provide<br />

some important information that<br />

fills gaps in current knowledge about<br />

cloned animals, Health Canada must<br />

still do its own evaluation of new<br />

information considered by the U.S. FDA<br />

before a Canadian policy specifically<br />

related to foods from cloned animals<br />

can be developed,” Duchesse said.<br />

“Fundamentally the cloned animal is no different – it’s just<br />

a copy. There’s nothing sinister in what’s been done to<br />

its genetic material.”<br />

- Gary Crow, associate professor, University of Manitoba<br />

Department of Animal Science.<br />

“Before a policy on how these<br />

products will be regulated in Canada<br />

can be finalized, work must first be done<br />

to assess all of the science available,”<br />

he added, noting that Health Canada<br />

is looking to have a policy in place “as<br />

soon as possible.”<br />

He urged that developers wishing<br />

to produce cloned animals for human<br />

food withhold submissions to Health<br />

Canada until scientific requirements<br />

are determined and the required<br />

guidance is published.<br />

Bruce Cran, president of the<br />

Consumers Association of Canada<br />

(CAC) said that when the time comes<br />

for food from clones to make its<br />

Canadian Meat Business January/February 2008<br />

meatbusiness.ca

| Cover Stor y |<br />

way into Canadian grocery stores,<br />

consumers should have the opportunity<br />

of choosing whether they want to use<br />

the product – something that may not<br />

happen south of the border/(the FDA<br />

already stated labels will not be required<br />

on food derived from clones).<br />

“If they don’t label the food, people<br />

could stop eating meat altogether<br />

and become vegetarians,” Cran said.<br />

“That’s one of the things that’s come<br />

up in conversations I’ve had in the last<br />

year on this particular issue. There are<br />

people who would rather eat no meat<br />

than think they’re eating cloned meat.”<br />

He added the CAC has lost a few<br />

battles for food labelling in recent<br />

years, particularly for labels on<br />

genetically modified foods. But, he<br />

said, the issue of cloning may be<br />

upsetting to enough people to make<br />

a difference, noting that concerned<br />

consumers should contact their local<br />

member of parliament or the CAC.<br />

“In the case of genetically modified<br />

food, the request for labelling was in<br />

the 90 percentile range on many polls,<br />

and I would expect cloned animal<br />

products would be somewhere around<br />

the same level,” he said.<br />

But Gary Crow, an associate professor<br />

with the University of Manitoba’s<br />

Department of Animal Science, said<br />

people shouldn’t let sci-fi associations<br />

with the word “clone” scare them<br />

off. He said meat from cloned cattle,<br />

for example, would be the same as<br />

if it came from the original cow that<br />

provided the DNA.<br />

“A cloned animal is not much<br />

different from an identical twin, in<br />

the sense that they have equal genetic<br />

material to some other animal,” he<br />

said. “Fundamentally the cloned<br />

animal is no different – it’s just a copy.<br />

There’s nothing sinister in what’s been<br />

done to its genetic material.”<br />

He noted he is not familiar with<br />

the studies the FDA conducted, but<br />

said there is nothing in the cloning<br />

process that would make a genetic<br />

copy something that shouldn’t be<br />

consumed.<br />

“The process, as it stands now, is just<br />

the insertion of DNA from the sister<br />

animal into a new embryo and having<br />

that embryo develop and grow in a<br />

surrogate mother,” he explained.<br />

He added, however, that sometimes<br />

the genes are “expressed differently” in<br />

clones, resulting in accelerated growth.<br />

“There’s a pattern of imprinting that<br />

tells which genes should come in at<br />

which times,” he said. “Some of that is<br />

lost in cloned animals.”<br />

He said this does not change the<br />

animal’s genetic make-up and doesn’t<br />

make it any less safe to eat, but admitted<br />

consumers might still find the idea<br />

hard to swallow.<br />

Crow added he doesn’t expect to see<br />

a huge impact on the meat market in<br />

the near future. Because of the expense<br />

“If they don’t label the food,<br />

people could stop eating meat<br />

altogether and<br />

become vegetarians.”<br />

- Bruce Cran, president,<br />

Consumers Association<br />

of Canada.<br />

of making a cloned animal – some<br />

reports peg the cost of a cloned cow at<br />

US$15,000 to US$20,000 – meat from<br />

genetic copies will not likely be sold to<br />

consumers, at least not in a large-scale<br />

way. Instead the animals would be used<br />

for breeding and their offspring would<br />

be used in food production.<br />

Crow said a way in which cloning<br />

could become an advantage for the<br />

industry is in the creation of “specialized”<br />

animals, pointing to Nexia Biotechnologies<br />

Inc., a Montreal-based<br />

company that spliced the genes of a<br />

spider and a goat to create a goat that<br />

can secrete spider silk through its milk.<br />

“Once you have this specialized<br />

animal, cloning can be used to create<br />

more of them,” he said, noting that, in<br />

theory, an animal could be created to<br />

make an especially tender source of<br />

meat. “That’s where cloning might be<br />

valuable. But my feeling is that using<br />

animals that have genes transferred<br />

from other species isn’t something that<br />

is going to happen in the short term.”<br />

How do you feel about meat from cloned<br />

animals making its way onto store shelves?<br />

Should the products be labelled? Would<br />

you eat it? Tell us your opinion. Contact<br />

alan@meatbusiness.ca.<br />

meatbusiness.ca<br />

January/February 2008 Canadian Meat Business

North American Meat Processors Association<br />

Chicago’s historic<br />

Drake Hotel.<br />

Expanded<br />

Canadian<br />

Emphasis<br />

NAMP 51st Management Conference<br />

offers timely E. coli session, greater<br />

Canadian perspective.<br />

An increased Canadian focus will be among the<br />

highlights of the North American Meat Processors<br />

Association's (NAMP) 51st Management Conference,<br />

March 28 to 30, at the Drake Hotel in Chicago, Illinois –<br />

the most ambitious program NAMP has ever put together.<br />

Always an intense, fact-filled event, the conference has been<br />

expanded with additional sessions, topics and speakers to fit<br />

four separate special interest tracks designed to appeal to a<br />

meat processing company’s entire management team.<br />

An important and timely session bringing new information<br />

and perspective on E. coli O157:H7, the industry's rapidly<br />

changing number one food safety issue, will be aimed at top<br />

management and quality control experts.<br />

Featured speakers include the USDA's top policy maker,<br />

Dr. Dan Engeljohn, and the Canadian Food Inspection<br />

Agency's (CFIA) Dr. Bill Anderson, who heads its recently<br />

established E. coli Working Group.<br />

A blue ribbon roundtable panel features respected experts<br />

on E. coli, including:<br />

• Dr. Kerri Harris, associate professor of meat science, Texas<br />

A & M University, and president & CEO of the International<br />

HACCP Alliance;<br />

• Bob Hibbert, partner, Kilpatrick & Lockhart Preston<br />

Gates Ellis LLP and a USDA regulatory expert attorney;<br />

• Ann Wells, NAMP director of scientific and regulatory<br />

affairs;<br />

• Dr. Jim Marsden, NAMP senior science advisor, Kansas<br />

State University;<br />

• Dr. "Reddi" Thippareddi, NAMP science advisor, University<br />

of Nebraska;<br />

• Robert de Valk, NAMP Canadian government<br />

representative.<br />

The conference also will focus on what slaughterers are<br />

doing to combat this pathogen before it reaches further<br />

processors – and how to manage a recall.<br />

NAMP also will introduce seven noted authorities as<br />

members of the association's recently formed College of<br />

Experts. On hand for the forums and for private one-onone,<br />

members-only consultations will be Dr. Kerri Harris,<br />

Bob Hibbert, Dr. Jim Marsden, Dr. "Reddi" Thipareddi,<br />

as long with Dr. Melvin Hunt (professor of meat science,<br />

Kansas State University), Dr. Chance Brooks (assistant<br />

professor of meat science, Texas Tech University), and<br />

Dr. Rich Mancini (assistant professor of meat science,<br />

University of Connecticut).<br />

NAMP is also expanding the conference's emphasis on<br />

Canadian issues with a special forum designed to address<br />

specific Canadian food safety issues with Dr. Bill Anderson<br />

and Robert de Valk.<br />

The conference also will focus on what<br />

slaughterers are doing to combat this<br />

pathogen before it reaches further processors<br />

– and how to manage a recall.<br />

Human resources professionals will learn how to avoid<br />

costly mistakes by hearing about changes to the U.S. Fair<br />

Labor Standards Act directly from Jim Kessler of the U.S.<br />

Labor Department. Topics will include the controversial<br />

“donning and doffing” rule.<br />

Sales professionals will hear Merit Gest talk about how to<br />

generate more sales by blending effective selling techniques<br />

with the principles of human potential.<br />

Marketing pros will hear case histories of companies<br />

that have succeeded by differentiating their business from<br />

the competition. Industry leaders like Corey Check of<br />

Smithfield Beef, Charlie Moore of Maverick Ranch, and<br />

Mike Satzow of North Country Smokehouse will talk about<br />

how their companies stepped ahead of the pack through<br />

savvy marketing.<br />

The keynote speaker will be Notre Dame Football Hero<br />

“Rudy” Reuttiger, immortalized in the 1993 movie Rudy.<br />

A highly sought after speaker, he brings a message of<br />

achievement through determination that comes from his<br />

personal experiences with overcoming adversity.<br />

For more information, visit namp.com.<br />

Canadian Meat Business January/February 2008<br />

meatbusiness.ca

AAFC’s Lacombe centre is internationally<br />

recognized for its red meat research.<br />

Agriculture and Agri-Food Canada<br />

From Early Pioneers<br />

to Current Issues<br />

The evolution of federal livestock and meat research in Alberta.<br />

By Debbie Lockrey-Wessel<br />

From pioneer times to modern day, livestock has<br />

been an important part of agriculture and a key<br />

component of federal research in Alberta. Recent<br />

centennial celebrations at two of Agriculture and Agri-Food<br />

Canada’s (AAFC) research centres provide an opportunity<br />

to recall the history of livestock and meat research in this<br />

prairie province.<br />

One hundred years ago, research centres were established<br />

in Lethbridge and Lacombe, Alta. to develop farming<br />

practices and help farmers produce crops and animals in a<br />

relatively harsh environment with a somewhat short growing<br />

season. Early research was closely aligned with the farming<br />

community and dealt with pioneer problems such as wind<br />

erosion, livestock, irrigation, and selecting crop varieties<br />

suitable to the region.<br />

Over the years these centres made significant contributions<br />

in crop research and the research on animals evolved into<br />

animal breeding and genetics, meat quality and safety.<br />

Today, animal-related research at these two AAFC centres<br />

has moved past the local farm gate and now provides valuable<br />

information to the national livestock and meat industry.<br />

Researchers in Lethbridge have developed range<br />

management and cross-breeding systems to increase beef<br />

production. Today the centre has facilities for sheep and<br />

beef cattle, including a research feedlot that is supported by<br />

a commercial-sized feed mill for preparing and optimizing<br />

animal rations.<br />

Specialized facilities and equipment allow scientists to<br />

study animal nutrition and disease prevention, and look<br />

inside the rumen stomach and closely examine metabolic<br />

systems, digestion and nutrition.<br />

Scientists in Lethbridge are tackling issues such as<br />

E.coli, the behaviour and welfare of cattle, working with<br />

the Canadian Food Inspection Agency to find a way to<br />

safely dispose of/compost dead livestock, and finding new<br />

strategies and techniques to preserve and enhance beef<br />

quality. Research is also developing new technologies to<br />

advance the efficiency, profitability and environmental<br />

sustainability of beef production. Several environmental<br />

projects focus on the impact of manure on soil and ground<br />

water quality and the impact of feedlot industry greenhouse<br />

gas production.<br />

Today, animal-related research at these two<br />

AAFC centres has moved past the local farm<br />

gate and now provides valuable information<br />

to the national livestock and meat industry.<br />

While research at Lethbridge concentrates on the live<br />

animal, Lacombe is internationally recognized for research<br />

on ante- and post-mortem factors that influence red meat:<br />

yield, quality, safety and preservation.<br />

Notable achievements from Lacombe include the<br />

development in the 1950s of non-destructive, electronic and<br />

physiological techniques to estimate carcass lean and fat in<br />

live animals, and collaboration with the industry to develop<br />

and revise national grading standards for beef (1972) and<br />

pork (1968) including the design and testing of novel<br />

instrumental grading technologies.<br />

Scientists at Lacombe also developed methods to detect<br />

and treat antemortem stress, ante- and post-mortem methods<br />

to evaluate and improve meat yield, colour, tenderness and<br />

eating quality, and hygienic processing procedures and<br />

preservation strategies to help the industry improve the safety<br />

10 Canadian Meat Business January/February 2008 meatbusiness.ca

and storage life of meats. A patented<br />

hot water hog carcass pasteurizer,<br />

now an integral component of swine<br />

processing, helped facilitate a 100-<br />

fold reduction in bacterial numbers,<br />

including E. coli.<br />

Today the centre at Lacombe contains<br />

a federally inspected slaughter and<br />

processing facility and meat research<br />

laboratories, 400-head beef herd and<br />

research feedlot, a 100-sow farrowfinish<br />

swine unit, kitchen and taste<br />

panel area for sensory analysis. These<br />

specialized facilities allow scientists to<br />

conduct research on factors affecting<br />

meat quality throughout the entirety of<br />

the meat production continuum from<br />

animal conception to consumption.<br />

Researchers continue to provide<br />

information to the production and<br />

processing sector on systems for<br />

producing meat of predictable and<br />

consistent quality and safety for the<br />

benefit of the meat industry, Canadian<br />

consumers and international trade<br />

partners.<br />

Current projects include research<br />

on the ways in which meat and meat<br />

products are processed, produced,<br />

packaged and distributed, and how<br />

these factors influence consumer<br />

acceptance for taste, flavour and<br />

appearance. Strategies are being<br />

developed to improve the safety and<br />

extend the storage life of meat, and<br />

prevent meat contamination during<br />

processing and distribution.<br />

Always striving to improve meat<br />

quality, scientists in Lacombe continue<br />

the tradition of finding new ways to<br />

estimate carcass yields and grading,<br />

evaluate and control variations in the<br />

composition and quality of carcasses<br />

and meat, and look for ways to reduce<br />

livestock stress and the resulting effects<br />

on the quality and yield of meat and<br />

meat products.<br />

Research from these two centres<br />

will continue to strengthen the<br />

Canadian meat industry and move<br />

Canada forward into another century<br />

of cutting-edge livestock and meat<br />

research in Alberta.<br />

Debbie Lockrey-Wessel is a<br />

communications advisor<br />

at Agriculture and<br />

Agri-Food Canada.<br />

meatbusiness.ca<br />

January/February 2008 Canadian Meat Business 11

Canadian Food Industry<br />

2007 Review<br />

Food manufacturer profits<br />

up 10 per cent over 2006.<br />

According to Statistics Canada’s<br />

Quarterly Financial Statistics<br />

for Enterprises, food manufacturer<br />

profits were up 10 per cent by<br />

the end of the third quarter of 2007,<br />

compared to same time in 2006. A<br />

special statistical run for the George<br />

Morris Centre by StatsCan shows that<br />

operating margins (operating profits/<br />

revenues) were just over six per cent,<br />

compared to a five per cent average<br />

between 1999 and 2006.<br />

While the final fourth-quarter<br />

Statistics Canada profit reports were<br />

not available at the time of printing,<br />

the first three quarters of the year<br />

provide an adequate perspective of<br />

performance.<br />

Food manufacturer margins over<br />

the past eight to nine years have seen<br />

a gradual improvement. Sales for 2007<br />

should increase by about three per<br />

cent to settle over $74 billion. That<br />

expected three per cent sales increase<br />

is right around the five-year average.<br />

In contrast, total manufacturing sales<br />

will likely only increase by one per<br />

cent. Food manufacturer sales as a<br />

share of total manufacturer sales have<br />

held steady at around 12 per cent for<br />

the last few years.<br />

Perhaps surprisingly, given the difficulties<br />

imposed by the Canadian dollar,<br />

it appears that food manufacturers<br />

enjoyed a relatively good year in<br />

By Kevin Grier<br />

2007. From a sales and marketing<br />

perspective the 2007 performance will<br />

be average or better than recent years.<br />

Another relatively positive sign is that<br />

the industry is continuing to actively<br />

invest in capital expenditures. In fact,<br />

investment actually soared in the third<br />

quarter, likely made easier by the<br />

appreciation of the Canadian dollar.<br />

Supermarkets are gradually losing food sales to general<br />

merchandisers, such as Wal-Mart and Costco.<br />

Food retailer margins are telling a<br />

different story, undergoing a not-sogradual<br />

reduction. The once strong<br />

spread of food over total retail is<br />

diminishing. Food retailing margins<br />

from 2005 to 2007 averaged three per<br />

cent, compared to four per cent from<br />

1999 to 2006.<br />

Supermarket sales were above yearago<br />

levels for almost every month in<br />

2007 through September. Based on<br />

sales during the first nine months of<br />

the year, total 2007 sales are likely to<br />

increase by three per cent to around<br />

$65.4 billion.<br />

While total supermarket sales<br />

increased, the share of supermarket<br />

sales as a percentage of total retail<br />

sales (not counting motor vehicle<br />

sales) continues to decline. In 2007,<br />

supermarket sales will likely amount<br />

to less than 21 per cent of total retail<br />

sales, which compares to more than<br />

21 per cent last year and nearly 25 per<br />

cent in 1997.<br />

Perhaps more worrisome from the<br />

grocer’s perspective is data published<br />

in Grocery Trade Review that showed<br />

supermarkets are gradually losing<br />

food sales to general merchandisers,<br />

such as Wal-Mart and Costco. While<br />

supermarkets still have the lion’s share<br />

of food sales, at about 88 per cent, that<br />

share has declined by two per cent<br />

since 2002, representing about $400<br />

million in sales each quarter.<br />

Clearly, the food retail industry in<br />

Canada is under margin and sales<br />

stress. Nowhere is the stress greater<br />

than in Ontario. Leading grocers<br />

have called Ontario a “blood bath,”<br />

and a “battle ground.” The difficulties<br />

are spreading across the rest of the<br />

country. Retailers are squeezed at both<br />

pricing and cost ends of the picture.<br />

On the cost side, manufacturers are<br />

pushing for pricing increases. Hardly<br />

a week goes by in the financial press,<br />

particularly in the U.S., without some<br />

leading manufacturer announcing or<br />

planning a price increase.<br />

Of course grocers are pushing back<br />

on the manufacturers. CIBC World<br />

Markets notes that, as reported in<br />

early October, Loblaw is asking for<br />

substantial incremental discounts from<br />

its suppliers, suggesting an overall 1.5<br />

per cent reduction in costs of goods in<br />

order to fund promotional campaigns.<br />

This comes on the heels of its 2007<br />

“cost freeze” edict issued back in<br />

February. CIBC World Markets notes<br />

this is another example of blanket<br />

attempts by management to mitigate<br />

the margin damage from its campaign<br />

to lower prices. The analysts go on to<br />

say that grocers are usually fooling<br />

themselves if they believe that suppliers<br />

will instantly fork over an extra 1.5 per<br />

cent just because they are ordered to.<br />

This is similar to how grocers<br />

sometimes fool themselves into<br />

thinking that a “cost freeze” really<br />

freezes costs. Some suppliers have<br />

made modest gains on the Canadian<br />

dollar, and Loblaw is right to focus on<br />

those. But even if Loblaw just deducts<br />

the targeted discounts off invoice,<br />

suppliers have plenty of ways to make<br />

this back. Reduced promotional<br />

support, substituted offerings, modest<br />

participation in events, a pullback on<br />

discretional trade spending or other<br />

types of effective cost increases will<br />

be implemented to claw back dollars.<br />

With commodity and input costs rising<br />

12 Canadian Meat Business January/February 2008 meatbusiness.ca

all year, suppliers are compelled to<br />

concoct methods to ease the pain.<br />

The Industry Price Index shows there<br />

was clearly some upward pressure on<br />

food pricing in late 2006 and early<br />

2007. Pricing undoubtedly stabilized<br />

for most of the year and in fact, began<br />

to decrease in the summer and fall.<br />

Looking at the specific commodity<br />

price indexes, there were three main<br />

areas that helped push pricing higher<br />

- meats, grain milling and dairy.<br />

Dairy generally exhibits a relatively<br />

steady year-over-year increase, so it is<br />

not the major influence of any change.<br />

Meats, on the other hand, showed a<br />

strong upward momentum in the latter<br />

half of 2006 and into 2007, but began<br />

a steady decline in the summer, which<br />

continued through October. Oilseeds,<br />

as well as flour, however, have been<br />

rising fairly steadily since mid 2006.<br />

Those are the items that have been<br />

most rapidly taking the brunt of grain<br />

and wheat cost increases. It will be<br />

important to see whether the increases<br />

there manage to flow through to further<br />

processed items such as breads, cereals<br />

and other goods. With those noted<br />

exceptions, at this point the key to note<br />

is that food manufacturing items have<br />

not generally moved higher in price by<br />

the end of the third quarter.<br />

On the consumer side, once again,<br />

pricing has not been favorable to<br />

retailers.<br />

After some fairly dramatic increases<br />

late in 2006 and early 2007, pricing<br />

stabilized and then backed off. Most<br />

of the increase, however, was due to<br />

big increases in fresh vegetables and,<br />

to a lesser extent, fruit. Those prices<br />

were related to winter freezes and have<br />

quickly fallen through the year.<br />

The key message is that the pricing<br />

of food purchased from stores is<br />

decreasing, not increasing.<br />

The primary reason for these<br />

decreases is the strong competition<br />

at the supermarket level. Wal-Mart’s<br />

influence in that area is likely the<br />

predominant reason. Wal-Mart has<br />

made 2007 the year of the rollback and<br />

has taken price focus to a whole new<br />

level. Furthermore, the gradual growth<br />

and spread of the “supercenter” format<br />

has all grocers on edge with regard to<br />

price. For its part, Loblaw has publicly<br />

stated that it needs to get its prices<br />

down. Other market share and square<br />

footage factors are also at play. The<br />

rapid appreciation of the Canadian<br />

dollar has forced retailers to lower<br />

prices, as consumers are increasingly<br />

aware of values and options in the U.S.<br />

There is no doubt that the retail pricing<br />

performance is due to competitive<br />

forces in Canada.<br />

One way to demonstrate that it is<br />

domestic competition, as opposed to<br />

overall pricing levels, is to compare<br />

performance in Canada and the<br />

U.S. From January 2006 through<br />

October 2007, Canadian food prices<br />

have increased about one per cent.<br />

U.S. food prices, on the other hand,<br />

have increased by nearly six per cent.<br />

Canada has clearly broken away from<br />

the U.S., and if you are a Canadian<br />

grocer that is not a good thing.<br />

Kevin Grier is a senior market analyst with<br />

the George Morris Centre.<br />

meatbusiness.ca<br />

January/February 2008 Canadian Meat Business 13

| Cross Countr y News |<br />

North-Central B.C. Meat Processing Plant<br />

Gets $4K in Funding<br />

Northwest Premium Meats Co-op in Telkwa recently<br />

received over $400,000 in funding.<br />

Northern Development Initiative Trust is providing a<br />

$433,000 loan guarantee to facilitate local financing by<br />

agricultural producers, investors and the Bulkley Valley<br />

Credit Union for the $1.6-million project.<br />

The facility will handle 3,000 animals per year starting<br />

in early 2008, with chill coolers, meat processing and<br />

custom packaging for local restaurants, retail outlets and<br />

consumers. The plant will create 13 jobs initially, with two<br />

more expected in the next two years.<br />

The project is the 100th for the trust in just over two<br />

years.<br />

opinion250.com<br />

Calgary Trims Trans Fats<br />

Calgary became the first city in Canada to regulate trans<br />

fats on New Year’s Day.<br />

Trans fats have become a top target of health advocates in<br />

recent years, but Calgary is the first Canadian municipality<br />

to set limits – following the example of Chicago and New<br />

York, which put similar regulations in place last year.<br />

The city launched a two-phase plan, the first phase<br />

requiring the use of oils and spreads that contain less than<br />

two per cent trans fat.<br />

Phase two, will require that all processed or manufactured<br />

foods contain less than five per cent of their total fat content<br />

as trans fats and should be effective by mid-January, 2009.<br />

Restaurants in the city are given a five-month grace<br />

period to institute the changes before risking health code<br />

violations and having their operating permits pulled.<br />

According to the Heart and Stroke Foundation of Canada,<br />

the consumption of trans fats accounts for between 3,000<br />

and 5,000 deaths every year in Canada alone.<br />

ctv.ca<br />

Livestock Industry Legislation<br />

Streamlined<br />

Alberta has taken a step toward a more effective and<br />

efficient livestock industry with the introduction of Bill 47,<br />

the Livestock Commerce and Animal Inspection Statutes<br />

Amendment Act.<br />

The proposed legislation clarifies the requirements and<br />

refines the legal language of the Livestock Identification<br />

and Commerce Act (LICA) regarding security interest<br />

disclosure and payment for the sale of livestock. It also<br />

adds inspection authority over livestock market facilities<br />

and provides for regulation-making authority for facilities<br />

licensed under the Animal Health Act.<br />

The LICA, developed with extensive industry consultation<br />

to address industry concerns and issues, consolidates<br />

and revises three existing acts – the Brand Act, the Livestock<br />

Identification and Brand Inspection Act and the Livestock<br />

and Livestock Products Act. LICA received Royal Assent on<br />

May 24, 2006.<br />

Upon proclamation, the livestock industry will see such<br />

changes as mandatory livestock security interest disclosures,<br />

greater protection for personal property in livestock,<br />

streamlined documentation, and enhanced consumer<br />

protection.<br />

Alberta Agriculture and Food and Livestock Identification<br />

Services (LIS) jointly developed LICA and<br />

the Livestock Commerce and Animal Inspection Statutes<br />

Amendment Act.<br />

LIS is a not-for-profit company established in 1998 as the<br />

delegated authority for provincial livestock identification<br />

and inspection legislation. It is governed by a board of<br />

directors comprised of livestock industry representatives<br />

from various Alberta cattle and horse associations.<br />

peacecountrysun.com<br />

Province Announces Programs to Aid Hog<br />

and Cattle Producers<br />

Saskatchewan Agriculture Minister Bob Bjornerud<br />

14 Canadian Meat Business January/February 2008 meatbusiness.ca

announced a new program to provide<br />

financial assistance to Saskatchewan<br />

hog and cattle producers.<br />

The Saskatchewan Short-Term Hog<br />

Loan Program and the Saskatchewan<br />

Short-Term Cattle Loan Program will<br />

provide an estimated $90 million in<br />

funding to those who are struggling<br />

during this current price downturn,<br />

the province announced in a press<br />

release.<br />

It is estimated the hog industry will<br />

access about $30 million in loans,<br />

while $60 million will be accessed by<br />

the cattle industry. Both sectors have<br />

been suffering from low prices brought<br />

on by an increase in the value of the<br />

Canadian dollar and very high feed<br />

grain prices.<br />

The province also announced it has<br />

signed onto the national AgriInvest<br />

and AgriStability programs, providing<br />

further assistance to livestock<br />

producers.<br />

Applications for the Saskatchewan<br />

Short-Term Hog Loan Program and<br />

Cattle Loan Program will be made<br />

available to producers early in the New<br />

Year. Deadline for applications is June<br />

10 for the hog program, and March 31<br />

for the cattle program.<br />

agriculture.gov.sk.ca<br />

Restaurant Chain to Cut<br />

Trans Fats<br />

As of Jan. 15, Manitoba restaurant<br />

chain Salisbury House has cut trans<br />

fats from its menu, according to a CBC<br />

News report.<br />

Salisbury House owner Earl Barrish<br />

said his restaurants spent two months<br />

testing new products to determine<br />

what could be used as an alternative. So<br />

far, he's had trouble finding a suitable<br />

replacement for the fats used in baked<br />

goods. It could take some time before<br />

those products are trans fat-free, he<br />

said.<br />

Winnipeg has not made a move<br />

to ban the compound, although the<br />

provincial government plans to ban<br />

the sale of any food containing trans<br />

fats in schools.<br />

cbc.ca<br />

NAMP Offers Center of the<br />

Plate Training in Guelph<br />

For the first time, the North American<br />

Meat Processors Association (NAMP)<br />

is offering its popular Centre of the<br />

Plate Training course in Canada. The<br />

course takes place Feb. 19 to 21 at the<br />

University of Guelph in Guelph, Ont.,<br />

and covers all the major center of the<br />

plate protein items: beef, veal, lamb,<br />

pork, and poultry.<br />

NAMP’s Center of the Plate training<br />

is a first-hand look at how carcasses<br />

are converted into portioned items<br />

commonly traded in the foodservice<br />

business, covering all the major center<br />

of the plate protein items – beef, veal,<br />

lamb, pork, seafood and poultry.<br />

Participants will learn:<br />

• The international trading numbering<br />

system (IMPS/NAMP), purchase<br />

specified options, and standards<br />

common to the industry<br />

• A knowledge of meat items as<br />

described by IMPS and by NAMP's<br />

Meat Buyer's Guide<br />

• Where meat products originate and<br />

how this affects their use<br />

• Current trends in the food service<br />

industry including new menu ideas<br />

and options<br />

• How value is determined for different<br />

meat products and how this is affected<br />

by quality parameters.<br />

Course presentations will be made<br />

| Cross Countr y News |<br />

primarily by Steve Olson, meat<br />

marketing specialist at USDA's<br />

Agricultural Marketing Service (AMS).<br />

One of the main objectives in the<br />

course, according to Olson, is to teach<br />

people how to “identify variations in<br />

quality and eliminate them.”<br />

namp.com<br />

Aylmer Meat Packer Fined<br />

$125K<br />

Butch Clare of Aylmer Meat Products<br />

was convicted Dec. 14 of selling meat<br />

unfit for human consumption and fined<br />

$125,000, according to local news reports.<br />

Appearing in a London courtroom,<br />

Clare admitted to selling meat that<br />

hadn't been inspected and agreed to<br />

a statement that outlined evidence the<br />

meat came from cows that died before<br />

reaching the slaughterhouse.<br />

But despite his guilty pleas, Clare<br />

insisted the meat was safe, telling the<br />

judge, “I never, ever sold a piece of<br />

meat I wouldn't eat myself.”<br />

As part of his conviction, Clare<br />

was ordered not to take any role in a<br />

slaughterhouse for a year. Charges<br />

against his sons, who helped run<br />

Aylmer Meat, were dropped.<br />

Aylmer Meat Packers was shut down<br />

Aug. 21, 2003, after a probe by Ontario's<br />

Natural Resources Ministry. Meat<br />

inspectors said there were rampant<br />

abuses in meat inspection in Ontario<br />

and pressure by regulators to look the<br />

other way.<br />

lfpress.ca<br />

meatbusiness.ca<br />

January/February 2008 Canadian Meat Business 15

$12 Million<br />

Turnaround<br />

Government funding saves Atlantic<br />

Beef Products.<br />

By Alan MacKenzie<br />

Atlantic Canada’s only federally inspected beef<br />

processing plant received a much needed boost<br />

in December as the federal government and<br />

three provincial governments announced a $12 million<br />

investment in the facility.<br />

Atlantic Beef Products (ABP), located in Albany, P.E.I.,<br />

opened its doors in December 2004 and has struggled<br />

“It’s fair to say we struggled from a financial standpoint<br />

pretty well from the time we opened our doors,” Baglole<br />

said of the plant. “With the three provincial governments<br />

coming together and then being able to access some dollars<br />

through ACOA, we believe it’s going to have the cash<br />

infusion it needs to put it on the right path.”<br />

ABP is owned by the Atlantic Beef Producers Co-operative,<br />

a group of 200 beef producers from across the region, and<br />

minority shareholder Co-op Atlantic of Moncton, N.B., for<br />

which ABP supplies product for the Atlantic Tender Beef<br />

Classic brand.<br />

Baglole noted the Atlantic Beef Producers Co-operative<br />

was formed after Maple Leaf Foods bought the Hub Meat<br />

Packers plant in Moncton – which processed both beef and<br />

pork products – in 2002.<br />

“Maple Leaf bought it for the hog side, because that’s the<br />

business they’re in, and then exited the beef business, which<br />

left the industry down here without a federally inspected<br />

plant,” Baglole said.<br />

ABP, he noted, was originally designed to process 500<br />

cattle a week on a single shift, five days a week, a goal that<br />

was met – and slightly exceeded – by last spring, before<br />

increased financial pressure caused the plant to scale back<br />

to only 100 cattle per week. Now, with the new support, the<br />

business is on its way to meeting its goal once again by the<br />

end of January.<br />

Atlantic Beef Products<br />

financially, losing approximately $10 million since.<br />

According to interim general manager Dean Baglole, the<br />

funding came at the right time.<br />

“The plant was in a crisis mode and there was a very real<br />

possibility that we’d have to shut it down,” he said.<br />

The federal government made a $6 million investment<br />

through the Atlantic Canada Opportunities Agency<br />

(ACOA), an outfit that aims to improve the economy of<br />

communities in Atlantic Canada through the development<br />

of business and job opportunities. The ACOA funding will<br />

assist the company to undertake marketing initiatives for<br />

diversified and value-added products, purchase specialized<br />

equipment and provide advanced training.<br />

“This one-time investment will help the Maritimes’ only<br />

federally inspected beef plant improve efficiency and<br />

expand capacity and markets,” Peter MacKay, Minister of<br />

ACOA and of National Defence, said at a press conference<br />

on Dec. 9.<br />

The remaining funds come from the three Atlantic<br />

provinces, which will each contribute $2 million. Previous to<br />

the funding announcement, P.E.I. was the only government<br />

that had invested in the plant. In June the province provided<br />

$1.5 million and said it would be its last subsidy until other<br />

governments also contribute.<br />

The company boasts a state-of-the-art European-designed<br />

traceability system that can track each piece of meat back to<br />

the animal it came from, making for increased food safety.<br />

Part of the role of the funding, Baglole said, is to develop<br />

a new business and marketing plan to better position the<br />

company within the industry and take advantage of the<br />

right opportunities, including more value-adding from the<br />

plant side.<br />

“We’re a small enough company that we feel we can<br />

potentially offer niche products or something that a larger<br />

plant would have trouble doing,” he said.<br />

Baglole noted ABP has gone through several management<br />

and operational changes in 2007, but with the new funds<br />

the company is now in the right position to move forward.<br />

Baglole and Shane Murphy have been interim managers<br />

since general manager Lance Warmington left his position,<br />

prior to the funding announcement, to return to his native<br />

New Zealand.<br />

“Because we didn’t have the comfort level that we were<br />

going to secure funding, we felt it wasn’t fair to find a new<br />

GM and put him in here when the funding was not in<br />

place,” Baglole said.<br />

Atlantic Beef Products currently employs about 80 staff<br />

and has an annual payroll of $3 million.<br />

16 Canadian Meat Business January/February 2008 meatbusiness.ca

Let BEACON customize<br />

our standard designs for you<br />

STAINLESS STEEL PROCESSING TRUCKS<br />

All Trucks, Racks & Cages are manufactured from<br />

heavy-duty T-304 Stainless Steel. We can engineer<br />

to your exact specifications, and whatever product<br />

you are processing - BEACON has the right product<br />

for you.<br />

The Nesting design allows the<br />

processor greater versatility,<br />

by providing a heavy-duty<br />

Truck that can save on storage<br />

space when not in use.<br />

BEACON also manufactures<br />

the Stainless Steel SCREENS<br />

& SHELVES for all Truck<br />

designs.<br />

CALL US FOR A<br />

QUOTATION!!!<br />

BEACON has many designs for many products!!!<br />

• Four-upright design • Nesting Trucks • Bacon Racks<br />

• Trucks for Smokesticks • Bologna trucks<br />

...and many more designs.<br />

BEACON, Inc. 12223 S. Laramie Ave, Alsip, IL 60803 (708) 544-9900 Fax (708) 544-9999<br />

www.beaconmetals.com

| Industr y Roundup |<br />

Bison Meat Exports Double<br />

Over Five Years<br />

According to a Statistics Canada,<br />

the number of bison on Canadian<br />

farms has increased over a third in the<br />

last five years, and exports of bison<br />

meat have doubled in the same time<br />

period.<br />

The study, titled “Bison on the<br />

comeback trail” and based on Census<br />

of Agriculture data, says that nearly<br />

2,000 farms reported they had a<br />

total of 195,728 head of bison on<br />

their operations on May 16, 2006, an<br />

increase of 34.9 per cent since the<br />

previous census in 2001.<br />

The number of farms raising bison<br />

increased more than 6.5 times since<br />

1991. The number of bison continues<br />

to increase, responding to the rise of<br />

consumer demand both domestically<br />

and internationally, the report says.<br />

The number of bison slaughtered in<br />

federally and provincially inspected<br />

establishments in Canada climbed<br />

from 11,168 in 2001 to 25,613 in 2006.<br />

Exports of bison meat totalled over<br />

2,075,000 kilograms in 2006. Live<br />

bison exports also increased, peaking<br />

at 13,255 in 2006.<br />

The report outlines some of the<br />

advantages bison have over other<br />

livestock. As an indigenous species,<br />

bison are naturally adapted to the<br />

climate and able to survive blustery<br />

winter storms and sweltering summer<br />

heat.<br />

It also notes that the number of<br />

bison in Canada is on the rise “partly<br />

because health-conscious consumers<br />

perceive bison as being a more natural<br />

food product" and that bison tends<br />

to "yield a meat that is low in fat and<br />

calories and high in iron.”<br />

Canadian bison producers are<br />

concentrated in British Columbia,<br />

Alberta, Saskatchewan and Manitoba<br />

– areas that are the traditional home<br />

for the animal.<br />

Meat Cutters Included in<br />

Expansion of Temporary<br />

Foreign Worker Program<br />

Twenty-one new occupations were<br />

added to the Expedited Labour<br />

Market Opinion pilot project, a<br />

temporary program designed to speed<br />

up the process for employers in British<br />

Columbia and Alberta to hire foreign<br />

workers, including industrial meat<br />

cutters and food service supervisors.<br />

“The 33 occupations now included<br />

in this pilot represent 50 per cent of<br />

the total volume of labour market<br />

opinion applications from employers<br />

in B.C. and Alberta,” said Federal<br />

Minister of Human Resources and<br />

Social Development Monte Solberg.<br />

The program will continue to run<br />

in B.C. and Alberta until September.<br />

It will allow eligible employers needing<br />

workers in the 33 specific occupations<br />

to receive their Labour Market<br />

Opinions much faster than in the past.<br />

The pilot project originally covered 12<br />

specific occupations.<br />

hrsdc.gc.ca<br />

VC999 Packaging Systems<br />

Opens New Canada<br />

Logistics Centre and<br />

Offices<br />

VC999 Packaging Systems, a<br />

leading international packaging<br />

equipment manufacturer, has<br />

announced the completion of a new<br />

20,000 square foot logistics centre in<br />

St-Germain de Grantham, Que., just<br />

outside Montreal, that will house its<br />

Canada location.<br />

The new building is equipped to<br />

handle international customs shipping<br />

and inspection. VC999 plans on using<br />

the warehouse to handle much of its<br />

international shipping.<br />

The warehouse was specifically<br />

designed to meet LEED (Leadership<br />

in Energy and Environmental Design)<br />

criteria. The company said it chose the<br />

finest materials for the project in order<br />

to ensure better air quality for the<br />

warehouse. The building also meets<br />

CT-Pat standards and HACCP rules for<br />

warehousing.<br />

The centre will formally open on<br />

Feb. 22 and will employ 12 people.<br />

vc999.com<br />

New Western Canadian<br />

Value Chain Initiative<br />

Agriculture councils across Western<br />

Canada have joined forces to form<br />

a new initiative designed to encourage<br />

the development of inter-provincial<br />

value chains.<br />

The Agriculture Council of<br />

Saskatchewan, the British Columbia<br />

Investment Agriculture Foundation,<br />

the Alberta Agriculture and Food<br />

Council, the Manitoba Rural<br />

Adaptation Council and the provincial<br />

governments of all four western<br />

provinces will form the Western<br />

Canadian Value Chain Initiative.<br />

The organizations recognized a<br />

need for a collaborative approach in<br />

promoting the value chain model,<br />

delivering a consistent series of<br />

workshops across Western Canada that<br />

will encourage more inter-provincial<br />

value chains to develop.<br />

The initiative will be based on the<br />

Saskatchewan Agri-Food Value Chain<br />

Initiative.<br />

U.S. Actress Launches<br />

Campaign Against Horse<br />

Meat in Canada<br />

American actress and one-time<br />

Playboy model Bo Derek launched<br />

a campaign against the slaughter of<br />

horses for meat in Canada, saying<br />

that Canada needs to modernize and<br />

toughen its 115-year old animal cruelty<br />

laws.<br />

A press release issued by Derek said<br />

there is no law specifically protecting<br />

wild horses in Canada, though the U.S.<br />

has offered legal protection for its wild<br />

horses since 1971.<br />

The closure of major American<br />

slaughter operations in the face of an<br />

impending ban has meant an increase<br />

of over 40 per cent in the number<br />

of horses crossing the border to be<br />

slaughtered in Canada. She said the<br />

U.S. ban on horse slaughter could<br />

result in 100,000 horses being killed<br />

here in the next year.<br />

“I was surprised to discover that<br />

Canada has cruelty laws that were<br />

18 Canadian Meat Business January/February 2008 meatbusiness.ca

| Industr y Roundup |<br />

written a century ago, that there is no protection at all<br />

here for wild horses and that 300 horses a day could face<br />

death in a trade most Canadians would want no part of,”<br />

Derek said.<br />

Foodservice Suppliers Embrace Canada's<br />

Largest-Ever Hospitality Event<br />

More than 700 exhibitors are now expected to welcome<br />

a record-breaking audience of Canadian chefs,<br />

restaurateurs, bar experts and foodservice professionals<br />

during the CRFA Show's three-day run, March 2 to 4 at the<br />

Direct Energy Centre in downtown Toronto.<br />

The original plan for 1,442 exhibit booths at the CRFA<br />

Show has been expanded to more than 1,600, thanks largely<br />

to the return of many former exhibitors from the HostEx<br />

and Food & Beverage shows.<br />

To meet strong demand, a limited number of exhibit<br />

booths are being made available in the Direct Energy<br />

Centre's Heritage Court, adjacent to the main building.<br />

crfa.ca<br />

Silliker Acquires JR Laboratories<br />

Silliker, a world leader in food safety and quality services,<br />

has acquired 70 per cent of the Burnaby, B.C.-based food<br />

testing and technical consulting company JR Laboratories.<br />

Founded in 1988 by Ray Cheung and Jimmy Chang,<br />

JR Laboratories serves many of the country's major food,<br />

beverage, natural health, and pharmaceutical companies.<br />

Under terms of the acquisition, Ray Cheung and Jimmy<br />

Chang will assume the roles of division president and<br />

division vice president, respectively, in the renamed Silliker<br />

JR Laboratories, ULC.<br />

The expertise and capabilities of Silliker JR Laboratories<br />

and Silliker Markham in Ontario, are complementary,<br />

and will ensure full testing services in Canada while also<br />

covering the Northwest United States region.<br />

silliker.com<br />

Maple Leaf Foods Completes Strategic<br />

Review of Rendering Operations<br />

Maple Leaf Foods Inc. announced it will retain its<br />

Rothsay rendering operations. Rothsay recycles<br />

inedible animal by-products, generated by Maple Leaf<br />

operations or collected from other customers, into valueadded<br />

products including animal feed, amino acid<br />

supplements, biodiesel and other industrial uses.<br />

In October 2006, Maple Leaf announced a change in its<br />

strategy to focus on growth in its value added meat, meals<br />

and bakery businesses. At that time, management indicated<br />

the role of its rendering operations was under review.<br />

Management has since concluded that the business is an<br />

integral part of managing the disposition of by-products<br />

from its remaining primary processing operations.<br />

investor.mapleleaf.ca<br />

BSE Case Confirmed in Alberta<br />

The Canadian Food Inspection Agency (CFIA) confirmed<br />

the diagnosis of bovine spongiform encephalopathy<br />

(BSE) in a 13-year-old beef cow from Alberta on Dec. 18.<br />

The animal's carcass is under CFIA control, and no part of<br />

it entered the human food or animal feed systems.<br />

The age of the infected animal falls within the age range<br />

of previous cases detected in Canada under the national<br />

BSE surveillance program. The animal was born before the<br />

implementation of Canada's feed ban in 1997.<br />

The CFIA stated this case will not affect Canada's status as<br />

a controlled risk country for BSE.<br />

inspection.gc.ca<br />

PM Announces New Food and Consumer<br />

Safety Action Plan<br />

Prime Minister Stephen Harper recently announced the<br />

Food and Consumer Safety Action Plan, a set of proposed<br />

new measures that will legislate tougher federal regulation of<br />

food, health, and consumer products.<br />

The proposed legislation will transform the government's<br />

approach to regulating product safety. New measures will<br />

include:<br />

• Mandatory product recalls when companies fail to act on<br />

legitimate safety concerns<br />

• Making importers responsible for the safety of goods they<br />

bring into Canada<br />

• Increasing maximum fines under the Food and Drug Act<br />

from $5,000 up to current international standards<br />

• Better safety information for consumers and guidance<br />

to industries on building safety throughout their supply<br />

chains.<br />

meatbusiness.ca<br />

January/February 2008 Canadian Meat Business 19

Meat-Friendly<br />

Weight Loss<br />

High protein diet developed by Toronto<br />

doctor treats metabolic syndrome,<br />

Type 2 diabetes.<br />

By Alan MacKenzie<br />

When Keith Young visited<br />

his doctor on the day after<br />

his 72nd birthday, the Yes<br />

Group chairman and CEO found out<br />

the number 72 had more significance<br />

than just his age – it was also the amount<br />

of weight he’d lost since starting a new<br />

high-protein, low-carb diet just five<br />

months earlier.<br />

On the recommendation of a<br />

physician he was seeing for high blood<br />

pressure, Young met with Torontobased<br />

doctor Pat Poon and started<br />

following his specialized metabolic<br />

diet on July 28. At the time Young<br />

weighed 284 pounds. Within two weeks<br />

the meat industry veteran lost over 13<br />

pounds, and as of Dec. 28 he weighed<br />

211 pounds – just 11 pounds away from<br />

the target weight initially set out by Dr.<br />

Poon.<br />

But the weight loss was not the most<br />

dramatic change Young saw as a result<br />

of the diet. “Prior to the start I was<br />

taking 78 units of insulin a day, and<br />

for the last couple of months I’ve taken<br />

none – absolutely zero,” says Young,<br />

who was diagnosed with type 2 diabetes<br />

15 years ago. He also now takes about<br />

half the amount of high blood pressure<br />

medication that he used to.<br />

Poon has been running his diet<br />

program since 2000. The doctor says<br />

the diet was designed to treat metabolic<br />

syndrome and type 2 diabetes, not just<br />

weight loss. Poon notes that metabolic<br />

syndrome is a cluster of three of<br />

the following five signs: abdominal<br />

obesity, high blood sugar, high serum<br />

triglycerides, low HDL cholesterol<br />

and high blood pressure. His book,<br />

Dr. Poon’s Metabolic Diet, says that,<br />

according to a study, men aged 42 to<br />

60 that suffer from the syndrome are<br />

2.9 to 4.2 times more likely to die from<br />

a heart attack than those who don’t.<br />

According to the American<br />

Heart Association, 47 million U.S.<br />

residents have metabolic syndrome.<br />

While current Canadian data on the<br />

syndrome is not available, the Heart<br />

and Stroke Foundation of Canada says<br />

the prevalence rate for the syndrome<br />

in 2004 was 25.8 per cent, noting that<br />

thousands of Canadians are affected.<br />

People over the age of 50 are more<br />

at risk, as are certain ethnic groups<br />

(Heart and Stroke said the prevalence<br />

rate among First Nations people is 41.6<br />

per cent, compared to 11 per cent for<br />

Chinese).<br />

“If you’re just overweight you can go<br />

on any diet and you will lose weight, but<br />

not every diet is for certain conditions,”<br />

“If someone has high<br />

cholesterol it is because they<br />

are eating too much starch, not<br />

too much meat. People have<br />

to understand that – then they<br />

won’t be scared of eating meat<br />

anymore.” – Dr. Pat Poon.<br />

Poon says, noting that many commercial<br />

low-fat diets emphasize eating very little<br />

meat. “What happens if you go on that<br />

kind of diet? The patient loses muscle<br />

as well as fat. That is the big difference<br />

between this diet and any other– it has<br />

a high protein content so you gain the<br />

muscle that you have lost.”<br />

That makes Poon’s diet very meatfriendly.<br />

In fact, Young says he is able<br />

to eat an “almost unlimited” amount of<br />

meat. However, the doctor stresses that<br />

the emphasis is on lean meats, such as<br />

chicken, sirloin steak and beef or pork<br />

tenderloin – unlike other low-carb<br />

diets that allow salty items like bacon.<br />

“This is not just a low-carb diet,” Poon<br />

says, noting the difference compared<br />

to popular programs such as the<br />

Atkins and South Beach diets. “It is a<br />

low-carb, low-fat and low-sodium diet<br />

– all three things at the same time.”<br />

Dr. Poon holds regular seminars for<br />

individuals and medical professionals<br />

wanting to learn more about the<br />

program, but notes that there is a<br />

three-month waiting list to see him or<br />

any of the other eight doctors working<br />

at his two clinics (one in Toronto, the<br />

second in Richmond Hill). Among the<br />

topics covered in his seminar is the<br />

“misconception” that beef is high in<br />

cholesterol.<br />

“If you go for a piece of fatty meat,<br />

of course (the cholesterol) is high, but<br />

try to eat lean,” he says, noting that,<br />

according to data obtained by the U.S.<br />

Food and Drug Administration, lean<br />

red meat is actually lower in cholesterol<br />

than in fish, which he notes many see<br />

as a healthier alternative to red meat.<br />

“If someone has high cholesterol it<br />

is because they are eating too much<br />

starch, not too much meat,” he says.<br />

“People have to understand that – then<br />

they won’t be scared of eating meat<br />

anymore.”<br />

Poon’s book is available exclusively<br />

through his website, poondiet.com.<br />

Much of its content is written for<br />

medical professionals, he notes, but<br />

the section on how to follow the three<br />

phases of the diet is easy for all patients<br />

to understand.<br />

The amount of time spent on each<br />

phase of the diet will differ from<br />

individual to individual, Poon notes. In<br />

the first phase a patient’s metabolism<br />

is changed from “fat forming” to “fat<br />

burning” – then they determine how<br />

much carbohydrate they can tolerate<br />

while still burning fat. The final phase<br />

is a life-long program that allows<br />

patients to eat a variety of foods, but<br />

still emphasizes that too many carbs<br />

can be problematic.<br />

Young, who is about to enter the third<br />

stage of the diet – notes the weight loss<br />

has made him more active, adding<br />

that he recently joined a gym to work<br />

out. “Obviously after you lose all that<br />

weight you need to tone yourself up,”<br />

he says.<br />

An increased level of energy is a good<br />

thing for Young, who still works full<br />

days at the meat processing supplies<br />

company he founded in 1987. “I should<br />

be retired but I still come in here at<br />

6:30 in the morning,” he says.<br />

20 Canadian Meat Business January/February 2008 meatbusiness.ca

events calendar<br />

February<br />

14 - 15 AMI Animal Care and<br />

Handling Conference<br />

Westin Crown Center, Kansas<br />

City, Missouri<br />

meatami.com<br />

anuttall@meatami.com<br />

15 - 17 Ontario Independent<br />

Meat Processors Conference<br />

Niagra Falls, Ont. oimp.ca<br />

19 - 21 NAMP Center of the<br />

Plate Training<br />

University of Guelph, Guelph, Ont.<br />

namp.com<br />

20 Canadian Council of Grocery<br />

Distributors 2008 Atlantic<br />

Conference<br />

Halifax, N.S. ccgd.ca<br />

23 – 27 American Frozen Food<br />

Institute Convention<br />

San Diego, California affi.com<br />

25 Food Safety 2008 Forum<br />

Toronto, Ont. foodsafetyforum.ca<br />

March<br />

2 - 4 CFRA Show<br />

Toronto, Ont. crfa.ca<br />

9 - 11 AMI Annual Meat<br />

Conference<br />

Gaylord Opryland Resort and<br />

Convention Center, Nashville,<br />

Tennesse meatconference.com<br />

anuttall@meatami.com<br />

10 – 14 Canadian Cattlemen’s<br />

Association Annual General<br />

Meeting<br />

Ottawa, Ont. cattle.ca<br />

12 Ontario Pork Producers<br />

Annual Meeting<br />

London Convention Centre,<br />

London, Ont. ontariopork.on.ca<br />

28 - 30 North American Meat<br />