Volume 3 Appendix C 1 APPENDIX C 1 COUNTRY/CURRENCY ...

Volume 3 Appendix C 1 APPENDIX C 1 COUNTRY/CURRENCY ...

Volume 3 Appendix C 1 APPENDIX C 1 COUNTRY/CURRENCY ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

VOLUME 3 <strong>APPENDIX</strong> C11<br />

<strong>Volume</strong> 3<br />

<strong>Appendix</strong> C11<br />

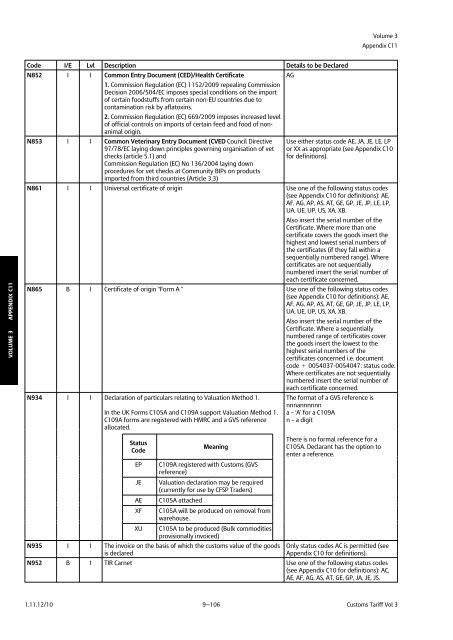

Code I/E Lvl Description Details to be Declared<br />

N852 I I Common Entry Document (CED)/Health Certificate<br />

1. Commission Regulation (EC) 1152/2009 repealing Commission<br />

Decision 2006/504/EC imposes special conditions on the import<br />

of certain foodstuffs from certain non-EU countries due to<br />

contamination risk by aflatoxins.<br />

2. Commission Regulation (EC) 669/2009 imposes increased level<br />

of official controls on imports of certain feed and food of nonanimal<br />

origin.<br />

AG<br />

N853 I I Common Veterinary Entry Document (CVED Council Directive Use either status code AE, JA, JE, LE, LP<br />

97/78/EC laying down principles governing organisation of vet or XX as appropriate (see <strong>Appendix</strong> C10<br />

checks (article 5.1) and<br />

Commission Regulation (EC) No 136/2004 laying down<br />

procedures for vet checks at Community BIPs on products<br />

imported from third countries (Article 3.3)<br />

for definitions).<br />

N861 I I Universal certificate of origin Use one of the following status codes<br />

(see <strong>Appendix</strong> C10 for definitions): AE,<br />

AF, AG, AP, AS, AT, GE, GP, JE, JP, LE, LP,<br />

UA, UE, UP, US, XA, XB.<br />

Also insert the serial number of the<br />

Certificate. Where more than one<br />

certificate covers the goods insert the<br />

highest and lowest serial numbers of<br />

the certificates (if they fall within a<br />

sequentially numbered range). Where<br />

certificates are not sequentially<br />

numbered insert the serial number of<br />

each certificate concerned.<br />

N865 B I Certificate of origin “Form A ” Use one of the following status codes<br />

(see <strong>Appendix</strong> C10 for definitions): AE,<br />

AF, AG, AP, AS, AT, GE, GP, JE, JP, LE, LP,<br />

UA, UE, UP, US, XA, XB.<br />

Also insert the serial number of the<br />

Certificate. Where a sequentially<br />

numbered range of certificates cover<br />

the goods insert the lowest to the<br />

highest serial numbers of the<br />

certificates concerned i.e. document<br />

code ! 0054037-0054047: status code.<br />

Where certificates are not sequentially<br />

numbered insert the serial number of<br />

each certificate concerned.<br />

N934 I I Declaration of particulars relating to Valuation Method 1. The format of a GVS reference is<br />

nnnannnnnn<br />

In the UK Forms C105A and C109A support Valuation Method 1. a – ‘A’ for a C109A<br />

C109A forms are registered with HMRC and a GVS reference<br />

allocated.<br />

n – a digit<br />

Status<br />

Code<br />

There is no formal reference for a<br />

Meaning C105A. Declarant has the option to<br />

enter a reference.<br />

EP C109A registered with Customs (GVS<br />

reference)<br />

JE Valuation declaration may be required<br />

(currently for use by CFSP Traders)<br />

AE C105A attached<br />

XF C105A will be produced on removal from<br />

warehouse.<br />

XU C105A to be produced (Bulk commodities<br />

provisionally invoiced)<br />

N935 I I The invoice on the basis of which the customs value of the goods Only status codes AC is permitted (see<br />

is declared <strong>Appendix</strong> C10 for definitions).<br />

N952 B I TIR Carnet Use one of the following status codes<br />

(see <strong>Appendix</strong> C10 for definitions): AC,<br />

AE, AF, AG, AS, AT, GE, GP, JA, JE, JS.<br />

1.11.12/10 9—106<br />

Customs Tariff Vol 3