Volume 3 Appendix C 1 APPENDIX C 1 COUNTRY/CURRENCY ...

Volume 3 Appendix C 1 APPENDIX C 1 COUNTRY/CURRENCY ...

Volume 3 Appendix C 1 APPENDIX C 1 COUNTRY/CURRENCY ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Volume</strong> 3<br />

<strong>Appendix</strong> C11<br />

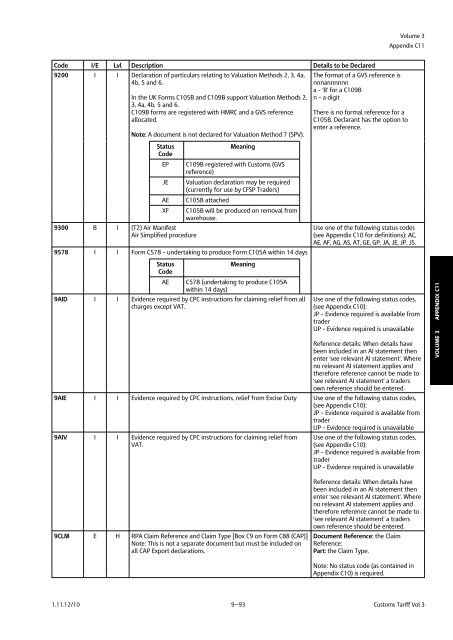

Code I/E Lvl Description Details to be Declared<br />

9200 I I Declaration of particulars relating to Valuation Methods 2, 3, 4a, The format of a GVS reference is<br />

4b, 5 and 6. nnnannnnnn<br />

a – ‘B’ for a C109B<br />

In the UK Forms C105B and C109B support Valuation Methods 2,<br />

3, 4a, 4b, 5 and 6.<br />

n – a digit<br />

C109B forms are registered with HMRC and a GVS reference There is no formal reference for a<br />

allocated.<br />

Note: A document is not declared for Valuation Method 7 (SPV).<br />

C105B. Declarant has the option to<br />

enter a reference.<br />

Status<br />

Code<br />

Meaning<br />

EP C109B registered with Customs (GVS<br />

reference)<br />

JE Valuation declaration may be required<br />

(currently for use by CFSP Traders)<br />

AE C105B attached<br />

XF C105B will be produced on removal from<br />

warehouse.<br />

9300 B I (T2) Air Manifest Use one of the following status codes<br />

Air Simplified procedure (see <strong>Appendix</strong> C10 for definitions): AC,<br />

AE, AF, AG, AS, AT, GE, GP, JA, JE, JP, JS.<br />

9578 I I Form C578 – undertaking to produce Form C105A within 14 days<br />

Status<br />

Code<br />

Meaning<br />

AE C578 (undertaking to produce C105A<br />

within 14 days)<br />

9AID I I Evidence required by CPC instructions for claiming relief from all Use one of the following status codes,<br />

charges except VAT. (see <strong>Appendix</strong> C10):<br />

JP – Evidence required is available from<br />

trader<br />

UP – Evidence required is unavailable<br />

9AIE I I Evidence required by CPC instructions, relief from Excise Duty<br />

Reference details: When details have<br />

been included in an AI statement then<br />

enter ‘see relevant AI statement’. Where<br />

no relevant AI statement applies and<br />

therefore reference cannot be made to<br />

‘see relevant AI statement’ a traders<br />

own reference should be entered.<br />

Use one of the following status codes,<br />

(see <strong>Appendix</strong> C10):<br />

JP – Evidence required is available from<br />

trader<br />

UP – Evidence required is unavailable<br />

9AIV I I Evidence required by CPC instructions for claiming relief from Use one of the following status codes,<br />

VAT. (see <strong>Appendix</strong> C10):<br />

JP – Evidence required is available from<br />

trader<br />

UP – Evidence required is unavailable<br />

9CLM E H RPA Claim Reference and Claim Type [Box C9 on Form C88 (CAP)]<br />

Reference details: When details have<br />

been included in an AI statement then<br />

enter ‘see relevant AI statement’. Where<br />

no relevant AI statement applies and<br />

therefore reference cannot be made to<br />

‘see relevant AI statement’ a traders<br />

own reference should be entered.<br />

Document Reference: the Claim<br />

Note: This is not a separate document but must be included on Reference;<br />

all CAP Export declarations. Part: the Claim Type.<br />

Note: No status code (as contained in<br />

<strong>Appendix</strong> C10) is required.<br />

1.11.12/10 9—93<br />

Customs Tariff Vol 3<br />

VOLUME 3 <strong>APPENDIX</strong> C11