Annual Report 2010-11

Annual Report 2010-11 - Kribhco

Annual Report 2010-11 - Kribhco

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong><br />

<strong>2010</strong>-<strong>11</strong><br />

KRISHAK BHARATI COOPERATIVE LIMITED

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

Shri B.D. Sinha, Managing Director receiving the first prize from FAI for its educational film on 'Soil Health Improvement<br />

& Farmers' Prosperity' from Shri M.K. Alagiri, Hon'ble Union Minister for Chemicals & Fertilisers. Other seen are<br />

Shri Srikant Jena, Hon'ble Union Minister of State for Chemicals & Fertilisers.

CONTENTS<br />

Performance Highlights 2<br />

Growth at a Glance 3<br />

Sources and Application of Funds 4<br />

Board of Directors 5<br />

Financials at a Glance 10<br />

Directors' <strong>Report</strong> <strong>11</strong><br />

Auditors' <strong>Report</strong> 34<br />

Financial Statements 35<br />

Cash Flow Statement 38<br />

1

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

PERFORMANCE HIGHLIGHTS<br />

Highest Ammonia Production<br />

(Previous best was <strong>11</strong>28926 MT during 2005-06)<br />

<strong>11</strong>57905 MT<br />

Highest Urea Production<br />

(Previous best was 1806500 MT during 2005-06)<br />

1840856 MT<br />

Highest Argon Production<br />

(Previous best was 4244577 NM³ during 2008-09)<br />

5921616 NM³<br />

Highest Seed Production<br />

(Previous best was 2.29 Lakh Qtls. during 2009-10)<br />

2.48 Lakh Qtls.<br />

Highest Seed Sales<br />

(Previous best was 2.22 Lakh Qtls. during 2009-10)<br />

2.47 Lakh Qtls.<br />

Highest Total Fertilizers Sale<br />

(Previous best was 40.51 Lakh MT during 2009-10)<br />

42.10 Lakh MT<br />

Highest KBSK Turnover<br />

(Previous best was ` 74.79 crore during 2009-10)<br />

` <strong>11</strong>4.46 Crore<br />

Highest Operational Profit of Traded Products<br />

(Previous best was ` 38.77 crore during 2009-10)<br />

` 80.98 Crore<br />

2

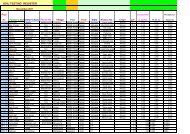

GROWTH AT A GLANCE<br />

( ` incrore)<br />

<strong>2010</strong>-20<strong>11</strong> 2009-<strong>2010</strong> 2008-2009 2007-2008 2006-2007 2005-2006 2004-2005 2003-2004 2002-2003 2001-2002<br />

EARNINGS<br />

Sales 2,027.24 1,637.39 1,512.40 1,385.62 1,343.97 1,257.30 924.22 979.31 800.05 766.08<br />

Concession/Remuneration<br />

from Govt.of India 1,526.85 959.69 1,046.72 844.79 5<strong>11</strong>.59 250.78 215.85 221.65 86.01 215.51<br />

Other Revenue 299.76 304.78 409.75 266.56 248.<strong>11</strong> 255.33 132.01 124.00 152.29 220.49<br />

Accretion/Decretion in<br />

Finished Goods 50.50 (38.20) (58.90) (36.77) 83.21 8.56 28.28 (25.79) (7.87) (12.57)<br />

OUTGOINGS<br />

3,904.35 2,863.66 2,909.97 2,460.20 2,186.88 1,771.97 1,300.36 1,299.17 1,030.48 1,189.51<br />

Raw Material, Packing,<br />

Stores, Power, Fuel, etc. 1,341.60 966.46 1,501.74 1,<strong>11</strong>1.16 825.43 727.54 707.55 687.64 639.47 575.62<br />

Purchases - Fertilisers,<br />

Seeds & Chemicals 1,578.76 916.29 527.07 454.50 627.05 333.49 50.87 28.15 26.92 25.40<br />

Employees' Remuneration<br />

& Benefits 241.31 224.89 169.66 173.40 121.50 <strong>11</strong>7.43 99.16 99.56 87.34 90.17<br />

Other Expenses (including<br />

Net Prior Period 462.71 467.45 404.25 420.89 362.27 293.91 234.48 243.55 214.96 230.37<br />

Income/Expenditure)<br />

Interest Expenses 19.23 5.18 10.38 5.32 1.47 2.30 2.78 0.86 2.26 0.15<br />

Depreciation 30.48 30.62 27.53 22.79 17.63 17.10 19.69 19.90 19.52 19.47<br />

3,674.09 2,610.89 2,640.63 2,188.06 1,955.35 1,491.77 1,<strong>11</strong>4.53 1,079.66 990.47 941.18<br />

PROFIT BEFORE TAX<br />

230.26 252.77 269.34 272.14 231.53 280.20 185.83 219.51 40.01 248.33<br />

Provision for Taxation ( Net ) 29.71 24.60 19.21 62.94 38.29 87.75 45.24 66.81 6.00 61.00<br />

PROFIT AFTER TAX<br />

200.55 228.17 250.13 209.20 193.24 192.45 140.59 152.70 34.01 187.33<br />

Amount Utilised from<br />

Div.Equalisation Fund 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (12.83) 0.00<br />

Dividend Payout 69.29 77.67 71.28 79.20 78.91 78.47 74.50 88.33 34.39 97.92<br />

Contribution to Cooperative<br />

Education Fund 2.00 2.28 2.47 1.84 1.78 1.67 1.24 1.38 0.34 1.87<br />

Donations 0.40 0.40 0.40 0.40 0.25 0.26 1.15 0.15 0.15 0.15<br />

RETAINED PROFIT<br />

128.86 147.82 175.98 127.76 <strong>11</strong>2.30 <strong>11</strong>2.05 63.70 62.84 <strong>11</strong>.96 87.39<br />

3

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

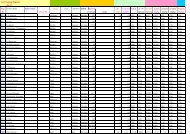

SOURCES AND APPLICATION OF FUNDS<br />

( ` incrore)<br />

<strong>2010</strong>-20<strong>11</strong> 2009-<strong>2010</strong> 2008-2009 2007-2008 2006-2007 2005-2006 2004-2005 2003-2004 2002-2003 2001-2002<br />

SOURCES<br />

Share Capital and Application<br />

Money 390.23 390.67 390.74 396.08 396.<strong>11</strong> 394.67 393.59 491.82 493.<strong>11</strong> 490.01<br />

Reserves and Surplus 2,435.33 2,306.46 2,158.68 1,982.43 1,891.41 1,779.02 1,666.76 1,602.99 1,578.81 1,579.68<br />

Net Worth<br />

2,825.56 2,697.13 2,549.42 2,378.51 2,287.52 2,173.69 2,060.35 2,094.81 2,071.92 2,069.69<br />

Secured Loan from Bank 30.23 0.23 0.23 0.76 0.41<br />

Unsecured Loan from Bank 264.19 0.00 91.91 223.96<br />

Deferred Tax Balance 22.50 16.63 5.03 0.00 24.61 30.32 35.07 37.42 0.00 0.00<br />

FUNDS EMPLOYED 3,142.48 2,713.99 2,646.59 2,603.23 2,312.54 2,204.01 2,095.42 2,132.23 2,071.92 2,069.69<br />

APPLICATION<br />

Fixed Assets<br />

Gross Block(including capital<br />

work in progress) 2,<strong>11</strong>2.33 1,395.36 1,264.13 1,231.58 1,<strong>11</strong>5.10 1,053.69 1,041.26 1,035.42 1,029.84 1,032.34<br />

Less: Depreciation 925.76 896.91 881.17 856.29 844.77 829.<strong>11</strong> 813.70 795.42 775.87 757.24<br />

Net Block (A) 1,186.57 498.45 382.96 375.29 270.33 224.58 227.56 240.00 253.97 275.10<br />

Investments ( B ) 1,355.57 1,406.45 1,203.42 870.56 807.56 855.67 455.64 455.69 288.47 154.91<br />

Deferred Tax assets (C) 0.00 0.00 0.00 4.18<br />

Working Capital:<br />

Current Assets 1,205.20 1,355.14 1,567.97 1,851.78 1,577.00 1,421.00 1,712.05 1,786.48 1,741.98 1,936.47<br />

Less: Current Liabilities and<br />

Provisions 604.86 546.05 507.76 498.58 342.35 297.24 299.83 349.94 212.50 296.79<br />

Net Working Capital (D) 600.34 809.09 1,060.21 1,353.20 1,234.65 1,123.76 1,412.22 1,436.54 1,529.48 1,639.68<br />

NET ASSETS EMPLOYED 3,142.48 2,713.99 2,646.59 2,603.23 2,312.54 2,204.01 2,095.42 2,132.23 2,071.92 2,069.69<br />

(A+B+C+D)<br />

SIGNIFICANT FINANCIAL RATIOS<br />

(RATIOS AFTER APPROPRIATION)<br />

<strong>2010</strong>-20<strong>11</strong> 2009-<strong>2010</strong> 2008-2009 2007-2008 2006-2007 2005-2006<br />

Return on Average Capital Employed (%) 5.35 7.60 1.33 9.69 8.38 17.57<br />

Profit to Average Net Worth (%) 8.34 9.64 10.93 <strong>11</strong>.66 10.38 13.24<br />

Current Ratio 1.99 2.75 3.61 3.71 4.61 4.78<br />

Quick Ratio 1.65 2.49 3.19 3.28 3.87 4.27<br />

Working Capital in terms of Cash Cost of Production (Months) 1.98 3.76 5.21 7.50 7.65 9.14<br />

Sundry Debtors to Sales (Months) 1.48 0.93 1.93 3.34 1.32 1.52<br />

Inventory of Finished Goods to Sales (Months) 0.21 0.06 0.24 0.59 1.32 0.61<br />

Debt Equity Ratio 0.75:1 0:1 0:1 0:1 0:1 0:1<br />

4

As on March 31, 20<strong>11</strong><br />

BOARD OF DIRECTORS<br />

CHAIRMAN<br />

Shri Vaghjibhai Rugnathbhai Patel<br />

VICE–CHAIRMAN<br />

Shri Chandra Pal Singh<br />

DIRECTORS<br />

Dr. Bijender Singh<br />

Shri V. Sudhakar Chowdary<br />

Dr. Sunil Kumar Singh<br />

Smt. Shailajadevi D. Nikam<br />

Shri Pareshbhai R. Patel<br />

Shri Bhanwar Singh Shekhawat<br />

Dr. V. Rajagopalan<br />

Shri Deepak Singhal<br />

Shri Ponnam Prabhakar<br />

Shri Bhikhajibhai Zaberbhai Patel<br />

MANAGING DIRECTOR<br />

Shri B.D. Sinha<br />

FINANCE DIRECTOR<br />

Shri R. Kamra<br />

MARKETING DIRECTOR<br />

Shri N. Sambasiva Rao<br />

OPERATIONS DIRECTOR<br />

Shri S. Jaggia<br />

5

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

BOARD OF DIRECTORS<br />

As on March 31, 20<strong>11</strong><br />

Shri V. R. Patel<br />

Chairman<br />

Shri Chandra Pal Singh<br />

Vice-Chairman<br />

Dr. Bijender Singh Shri V. S. Chowdary Dr. Sunil Kumar Singh Smt. Shailajadevi D. Nikam Shri Pareshbhai R. Patel<br />

Shri B. S. Shekhawat Dr. V. Rajagopalan Shri Deepak Singhal Shri Ponnam Prabhakar Shri Bhikhajibhai Z. Patel<br />

Shri B. D. Sinha Shri R. Kamra Shri N. Sambasiva Rao Shri S. Jaggia<br />

6

EX - CHAIRMEN<br />

Shri Chandra Pal Singh<br />

July 1999 - May <strong>2010</strong><br />

EX-MANAGING DIRECTORS<br />

June 1986-May 1990<br />

September 1991-January 1992<br />

7

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

EXECUTIVES<br />

As on March 31, 20<strong>11</strong><br />

CHIEF VIGILANCE OFFICER<br />

EXECUTIVE DIRECTORS<br />

Shri A.K. Gupta, IAS<br />

Shri C. P. Singh<br />

Shri Amar Prasad<br />

GENERAL MANAGERS<br />

ShriB.Prasad<br />

Shri S.K. Garg<br />

General Manager (Port Opns.) General Manager ( F&A)<br />

General Manager (F&A)<br />

Shri V.B. Gaur<br />

General Manager (Maint.)<br />

Shri D.B. Shah<br />

General Manager (Commr.)<br />

Shri M.K. Shah<br />

General Manager (Proj.)<br />

Shri J.K. Mathur<br />

General Manager (F&A)<br />

ADDITIONAL GENERAL MANAGERS<br />

Shri H.P. Kataria<br />

Addl. GM (Proj.)<br />

Shri A.S. Awwal<br />

Addl. GM (Proj.)<br />

Shri S.B. Mehta<br />

Addl. GM (Mech.)<br />

Shri A.K. Gupta<br />

Addl. GM (F&S)<br />

Shri G. H. Soni<br />

Addl. GM (Inst.)<br />

Shri S. U. Chaudhari<br />

Addl. GM (Mtls.)<br />

Shri M.D. Thakkar<br />

Addl. GM (Civil)<br />

Shri M. Pailoor<br />

Addl. GM (MS)<br />

Shri A.A. Shah<br />

Addl. GM (F&A)<br />

Shri P.K. Mathew<br />

Addl. GM (F&A)<br />

Dr. W.S. Guleria<br />

Addl. GM (MS)<br />

8

EXECUTIVES<br />

As on March 31, 20<strong>11</strong><br />

CORPORATE OFFICE<br />

Shri Deepak Kushwaha<br />

Dy. General Manager (MIS)<br />

Shri G.P. Rao<br />

Dy. General Manager (F&A)<br />

Shri G.S. Pearlson<br />

Dy. General Manager (F&A)<br />

Shri A.K. Singh<br />

Dy. General Manager (MS)<br />

Shri Virendra Singh<br />

Dy. General Manager (Mtls.)<br />

Shri Anand Padalia<br />

Dy. General Manager (HR)<br />

Shri M.C. Bansal<br />

Dy. General Manager (F&A)<br />

HAZIRA COMPLEX<br />

Shri Jasbir Singh<br />

Dy. General Manager (Tptn.)<br />

Shri C. Venkateswarulu<br />

Dy. General Manager (Elect.)<br />

Shri A.K. Nayak<br />

Dy. General Manager (Mech.)<br />

Shri S.R. Ahmed<br />

Dy. General Manager (Prodn.)<br />

Shri N K Gurjar<br />

Dy. General Manager (Mech.)<br />

Shri U.C. Sharma<br />

Dy. General Manager (Mech.)<br />

Shri R.N. Shah<br />

Dy. General Manager (Civil)<br />

Shri H.B. Trivedi<br />

Dy. General Manager (Elect.)<br />

Shri B.M. Rao<br />

Dy. General Manager (Prodn.)<br />

Shri S L Pandya<br />

Dy. General Manager (Proj.)<br />

Shri Kuldeep Singh<br />

Dy. General Manager (Prodn.)<br />

Dr. S.R. Poundarik<br />

Chief Medical Officer<br />

Shri S.B. Neogi<br />

Dy. General Manager (Prodn.)<br />

Shri J. P. Verma<br />

Dy. General Manager (Prodn.)<br />

Shri Rishipal Singh<br />

Dy. General Manager (Elect.)<br />

Shri J.P. Patel<br />

Dy. General Manager (Mech.)<br />

Shri A.S. Singh<br />

Dy. General Manager (Prodn.)<br />

Shri R L Shukla<br />

Dy. General Manager (Proj.)<br />

Shri S. Banerjee<br />

Dy. General Manager (Prodn.)<br />

Shri J J Dalwadi<br />

Dy. General Manager (Inst.)<br />

Shri B. Mitra<br />

Dy. General Manager (Prodn.)<br />

Shri B.R. Patel<br />

Dy. General Manager (Mtls.)<br />

Shri D.K. Mandal<br />

Dy. General Manager (Tech.)<br />

Shri K. Srihari<br />

Dy. General Manager (Mech.)<br />

Shri C J Shah<br />

Dy. General Manager (Inst.)<br />

Shri M.R. Sharma<br />

Dy. General Manager (Prodn.)<br />

Shri K.M. Patel<br />

Dy. General Manager (Mech.)<br />

Shri I.A. Khan<br />

Dy. General Manager (Tech.)<br />

Shri R K Tiwari<br />

Dy. General Manager (Mech.)<br />

Shri P S Gandhi<br />

Dy. General Manager (Inst.)<br />

Shri A.B. De<br />

Dy. General Manager (Tech.)<br />

Shri V.K. Sareen<br />

Dy. General Manager (Mtls.)<br />

Shri Amarjeet Singh<br />

Dy. General Manager (Trg.)<br />

Shri V K Singh<br />

Dy. General Manager (Mech.)<br />

Shri Raveen Nagi<br />

Dy. General Manager (MS)<br />

Shri A. K. Das<br />

Dy. General Manager (Prodn.)<br />

Shri N. K. Gupta<br />

Dy. General Manager (Prodn.)<br />

Shri S.S. Johar<br />

Dy. General Manager (Prodn.)<br />

Shri G Srinavas<br />

Dy. General Manager (Mech.)<br />

MARKETING DIVISION<br />

Shri R.K. Jain<br />

Dy. General Manager (Mktg.)<br />

Shri S.S. Khare<br />

Dy. General Manager (Mktg.)<br />

Shri J.S. Sandhu<br />

Dy. General Manager (Mktg.)<br />

Shri R.K. Bansal<br />

Dy. General Manager (F&A)<br />

Dr. S. Maheshwari<br />

Dy. General Manager (Mktg.)<br />

Shri M.S. Rathore<br />

Dy. General Manager (Mktg.)<br />

Shri A.K. Gupta<br />

Dy. General Manager (F&A)<br />

JOINT STATUTORY AUDITORS<br />

M/s G. S. Mathur & Co.<br />

Chartered Accountants<br />

A-160 Defence Colony,<br />

New Delhi - <strong>11</strong>0024<br />

M/sS.K.Mehta&Co.<br />

Chartered Accountants<br />

2682/2, Beadon Pura,<br />

Ajmal Khan Market, Karol Bagh,<br />

New Delhi-<strong>11</strong>0005<br />

M/s G. K. Choksi & Co.<br />

Chartered Accountants<br />

Madhuban, Near Madalpur<br />

underbridge, Ellisbridge,<br />

Ahmedabad - 380006<br />

MAIN BANKERS<br />

ICICI Bank Ltd.<br />

Indian Overseas Bank<br />

Axis Bank<br />

HDFC Bank Ltd.<br />

State Bank of India<br />

State Bank of Patiala<br />

REGISTERED OFFICE<br />

Red Rose House,<br />

49-50, Nehru Place,<br />

New Delhi-<strong>11</strong>0019<br />

CORPORATE OFFICE<br />

KRIBHCO Bhawan,<br />

A8-10, Sector-1, NOIDA-201 301,<br />

Distt. Gautam Budh Nagar (U.P.)<br />

PLANT OFFICE<br />

P.O.KRIBHCO Nagar,<br />

Distt. Surat-394 515,<br />

Gujarat<br />

9

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

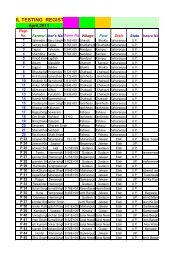

FINANCIALS AT A GLANCE<br />

3000<br />

2500<br />

2000<br />

2,549.42<br />

2,158.68<br />

NET WORTH<br />

2,697.13<br />

2,306.46<br />

( ` incrore)<br />

2,825.56<br />

2,435.33<br />

300.00<br />

250.00<br />

200.00<br />

269.34<br />

250.13<br />

PROFIT<br />

252.77<br />

228.17<br />

230.26<br />

( ` incrore)<br />

200.55<br />

1500<br />

150.00<br />

1000<br />

100.00<br />

500<br />

390.74<br />

390.67<br />

390.23<br />

50.00<br />

31.03.2009 31.03.<strong>2010</strong> 31.03.20<strong>11</strong><br />

2008 - 2009 2009 - <strong>2010</strong> <strong>2010</strong> - 20<strong>11</strong><br />

EQUITY RESERVES NET WORTH<br />

PROFIT BEFORE TAX<br />

PROFIT AFTER TAX<br />

SOURCES OF INCOME<br />

for the year ended 31.03.20<strong>11</strong><br />

350.26 (9%)<br />

( ` in crore)<br />

1,526.85 (39%)<br />

2,027.24 (52%)<br />

SALES (NET) CONCESSION / REMUNERATION FROM GOVT. OF INDIA OTHER REVENUE<br />

DISTRIBUTION OF INCOME<br />

for the year ended 31.03.20<strong>11</strong> ( ` incrore)<br />

481.94 (12%)<br />

241.31(6%)<br />

30.48 (1%)<br />

29.71 (1%)<br />

200.55 (5%)<br />

1341.60 (34%)<br />

1578.76 (41%)<br />

CONSUMPTION - MATERIALS & STORES<br />

PURCHASES - SEEDS, CHEMICALS & OTHER FERTILISERS<br />

EMPLOYEES REMUNERATION AND BENEFITS EXPENSES - MANUFACTURING, ADMINISTRATION,<br />

DEPRECIATION<br />

DISTRIBUTION & INTEREST<br />

PROFIT AFTER TAX<br />

TAXATION (NET)<br />

10

DIRECTORS' REPORT<br />

Dear Cooperators,<br />

The year <strong>2010</strong>-20<strong>11</strong>, has been particularly good<br />

for Indian Agriculture due to favourable weather<br />

conditions in most parts of the country. The country is<br />

expected to reap record food grains production of<br />

over 241 million tonnes for the year. The year also<br />

marked important initiative in fertilizer sector on<br />

introduction of several pragmatic policy initiatives<br />

especially the Nutrient Based Subsidy (NBS).<br />

There was an overall improvement in the<br />

availability of various fertilizer products. In near<br />

future several other positive policy initiatives for<br />

accelerating the growth of domestic urea industry<br />

are also expected.<br />

In this scenario, Your Directors have pleasure to<br />

present Thirty first <strong>Annual</strong> <strong>Report</strong> together with<br />

Audited Accounts of your Society for the Financial<br />

Year <strong>2010</strong>-20<strong>11</strong>.<br />

The Society endeavored to accomplish its goal<br />

with Participatory Planning and Strategic Management<br />

for fulfilling the aspirations of all stakeholders.<br />

Several milestones have been achieved<br />

such as all time high sales record, increased<br />

production, dedicated services to farming<br />

community etc. Your Society has maintained its<br />

unique position on marketing front by selling<br />

42.10 Lakh MT of total fertilizers during the year<br />

<strong>2010</strong>-20<strong>11</strong>, which is the highest ever sales of<br />

fertilizers achieved by the Society. The product<br />

basket has been enlarged by adding DAP, Hybrid<br />

Seeds, Compost, and Liquid bio-fertilizers, which<br />

has yielded positive contribution.<br />

Shri Chandra Pal Singh, the then Chairman KRIBHCO addressing the delegates of the Society in the 30<br />

Body Meeting. Sitting on the dias are the Board of Directors and other dignitaries.<br />

th<br />

<strong>Annual</strong> General<br />

<strong>11</strong>

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

Board of Directors visiting KRIBHCO Jetty at Hazira, Surat.<br />

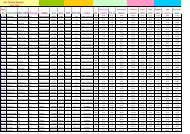

2. FINANCIAL PERFORMANCE<br />

Your society has achieved good financial results<br />

for the Financial Year <strong>2010</strong>-20<strong>11</strong>. The Society has<br />

posted Pre-Tax Profit of `230.26 crore during the year<br />

and Profit after Tax is `200.55 crore. The net worth of<br />

the Society has increased from `2697.13 crore to<br />

`2825.56 crore as on March 31, 20<strong>11</strong>. The financial<br />

results of the Society for the year are summarized<br />

hereunder:<br />

( ` in crore)<br />

TABLE -1 <strong>2010</strong>-20<strong>11</strong> 2009-<strong>2010</strong><br />

Sales including 3554.09 2597.07<br />

subsidies<br />

Other Revenue 299.76 304.78<br />

Increase/(Decrease) in Stock 50.50 (38.19)<br />

Income 3904.35 2863.66<br />

Profit before Tax 230.26 252.77<br />

Provision for Taxation(Net) 29.71 24.60<br />

Profit after Tax 200.55 228.17<br />

3. FOREIGN EXCHANGE RISK<br />

MANAGEMENT<br />

During the year, the huge import of phosphatic<br />

fertilisers and capital goods for Revamp involved<br />

payments in foreign currency. The Society managed its<br />

foreign currency payments competitively by availing<br />

buyers credit and entering into forward contracts for<br />

hedging the foreign exchange exposure. The Exchange<br />

Risk management resulted in earning a profit of<br />

approximately `21 crore during the year.<br />

4. APPROPRIATIONS<br />

Contribution towards Capital Repatriation<br />

Fund of `0.40 crore is reduced from the Profit after Tax<br />

for the purpose of arriving at the Net Profit in<br />

accordance with provisions of Section 62 of the Multi-<br />

State Cooperative Societies (MSCS) Act 2002.<br />

Accordingly, the Net Allocable Profit works out to<br />

`200.15 crore, which has been proposed for<br />

appropriation as under:<br />

12

Shri Vaghjibhai Rugnathbhai Patel, Chairman KRIBHCO addressing KRIBHCO employees during the felicitation<br />

function at Hazira Plant. Shri B.D. Sinha, Managing Director; Shri N. Sambasiva Rao, Marketing Director;<br />

Shri R. Kamra, Finance Director; Dr. Bijender Singh, Director; Shri Bhikhajibhai Zaberbhai Patel, Director and<br />

Shri S. Jaggia, Operations Director KRIBHCO are also seen.<br />

TABLE-2 <strong>2010</strong>-20<strong>11</strong> 2009-<strong>2010</strong><br />

Net profit as per the 200.15 228.03<br />

MSCS Act 2002<br />

Appropriations<br />

Reserve Fund as per 50.04 57.01<br />

Bye-Law 58(i) of the<br />

Society<br />

Provision for 2.00 2.28<br />

Cooperative<br />

Education Fund<br />

Reserve Fund for 20.01 22.80<br />

Contingency<br />

Reserve for 0.40 0.40<br />

donations<br />

( ` incrore)<br />

Proposed Dividend 69.29 141.74 77.67 160.16<br />

@20%<br />

Balance transferred 58.41 67.87<br />

to General Reserve<br />

5. DIVIDEND<br />

Hon'ble Members will be pleased to know that<br />

the Board of Directors of your Society have recommended<br />

for the seventh consecutive year, the maximum<br />

permissible dividend of 20% on the paid-up share<br />

capital.<br />

The proposed dividend would be paid on pro-rata<br />

basis to the eligible shareholders whose names stood<br />

in the Membership Register of the Society as on March<br />

31, 20<strong>11</strong>. Accordingly, the amount of proposed dividend<br />

outgo will be `69.29 crore.<br />

60.00<br />

50.00<br />

40.00<br />

30.00<br />

20.00<br />

10.00<br />

39.46<br />

31.82<br />

DIVIDEND PAYOUT<br />

2008-2009 (20%) 2009-<strong>2010</strong> (20%) <strong>2010</strong>-20<strong>11</strong> (20%)<br />

GOI<br />

39.89<br />

37.78<br />

OTHERS<br />

( ` incrore)<br />

48.99<br />

20.30<br />

13

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

KRIBHCO Township children showing their talent by performing dance programme during Independence Day<br />

celebrations at Hazira Plant.<br />

6. MEMBERSHIP AND SHARE CAPITAL<br />

A cooperative thrives on the trust of its members.<br />

The total membership in KRIBHCO as on March 31,<br />

20<strong>11</strong> was 7356 cooperative societies, institutions and<br />

Government of India, as against 6546 on March 31,<br />

<strong>2010</strong>. Phenomenal progress made by the Society<br />

bears testimony of increasing faith reposed in the<br />

Society. This has resulted in increasing membership<br />

over the years. The paid up share capital of the Society<br />

was `390.18 crore as on March 31, 20<strong>11</strong>.<br />

7. PRODUCTION PERFORMANCE<br />

The year being the 25th year of commercial<br />

operation, Plant achieved highly commendable performance<br />

creating 31 new records during the Financial<br />

Year <strong>2010</strong>-20<strong>11</strong>. The highest ever yearly production of<br />

18.41 Lakh MT of Urea and <strong>11</strong>.58 Lakh MT of Ammonia<br />

were achieved which corresponds to a capacity<br />

utilisation of 106.5% and <strong>11</strong>5.4% respectively, breaking<br />

the previous highest production records achieved<br />

during the financial year 2005-2006.<br />

The cumulative Urea and Ammonia production<br />

achieved since inception has been 41.78 million MT<br />

and 25.49 million MT respectively as on March 31,<br />

20<strong>11</strong>. The Urea despatch from the plant during the<br />

Financial Year <strong>2010</strong>-20<strong>11</strong> was 18.41 Lakh MT which is<br />

the highest record achieved so far.<br />

The record production of Argon of 5921.62<br />

thousand NM³ was achieved during the year. Also<br />

several records were achieved in Bio-Fertiliser<br />

production and despatch.<br />

• PRODUCTION PLAN 20<strong>11</strong>-2012<br />

The production plan target for the Financial Year<br />

20<strong>11</strong>-2012 has been 17.30 Lakh MT of Urea and 10.31<br />

Lakh MT of Ammonia. The targets have been fixed considering<br />

the expected shutdown of plants for Revamp jobs.<br />

CAP UTLN (%)<br />

KRIBHCO AMMONIA & UREA CAPACITY UTILISATION<br />

120<br />

<strong>11</strong>5<br />

<strong>11</strong>0<br />

105<br />

100<br />

95<br />

90<br />

108.<strong>11</strong><br />

100.83<br />

<strong>11</strong>0.65<br />

102.94<br />

<strong>11</strong>5.42<br />

106.46<br />

2008-2009 2009-<strong>2010</strong> <strong>2010</strong>-20<strong>11</strong><br />

YEARS<br />

AMMONIA UREA<br />

14

8. SCHEMES IMPLEMENTED, UNDER<br />

IMPLEMENTATION & TO BE IMPLEMENTED<br />

• Revamp Project<br />

The revamp of existing Ammonia and Urea Plants<br />

at Hazira is under progress. On completion of revamp,<br />

the production capacity of the plants will increase<br />

from 17.29 Lakh MT to 21.94 Lakh MT of Urea per<br />

annum i.e. an increase of 4.65 Lakh MT Urea annually.<br />

The total estimated cost of revamp is `1301 crore.<br />

Apart from the increase in production capacities there<br />

will be considerable savings in energy, resulting into<br />

lower production costs. The project work is in progress<br />

and many of the major equipments have already<br />

arrived at Plant.<br />

• New Gas Turbine based Power Plant<br />

The Society is in the process of setting up a new<br />

gas turbine based Captive Power Plant of 72 MW<br />

capacity at estimated cost of approximately `400 crore<br />

to meet requirement of additional power after revamp.<br />

Surplus power will be sold in the open market.<br />

• Use of Cooling Tower Blow Down water<br />

for Township Horticulture<br />

CT blow down water, which is currently used for<br />

horticulture purposes around Administration Building<br />

Lawns in Plant, is proposed to be extended for use for<br />

Township Horticulture by laying around 2500 meters<br />

of 10'' HDPE Header at a cost of `60 Lakh with proper<br />

isolation for the existing header from drinking water<br />

network. This will help in using 1500 M³ CT blow down<br />

water which is otherwise discharged in Balancing<br />

Pond, thus saving cost on costly drinking water. The<br />

scheme is under implementation.<br />

• Jetty at Hazira<br />

The Society has revived the Jetty at Hazira to<br />

handle part of OMIFCO Urea in view of better rail/road<br />

connectivity for evacuation of the material at a total<br />

cost of ` 34.03 Crore. Jetty has become operational<br />

since December <strong>2010</strong>.<br />

The first consignment of OMIFCO Urea arrived at<br />

Jetty on 29th December, <strong>2010</strong>. Till end April, 20<strong>11</strong> we<br />

have handled 80,905 MT of imported Urea from<br />

OMIFCO at this Jetty.<br />

• Construction of Building for Registered<br />

Office<br />

The Society has commenced the construction of<br />

building for Registered Office at the land acquired in<br />

New Delhi.<br />

• Zinc Sulphate Project<br />

Zinc is a vital micronutrient for plant. There is<br />

growing demand for Zinc fertilisers in the country as<br />

Indian soils are almost 50% zinc deficient. Zinc<br />

Sulphate Monohydrate is a preferred composition by<br />

farmers due to non-caking, free flowing nature and<br />

higher zinc percentage. As there is ample opportunity<br />

in terms of growing demand and your Society is<br />

exploring the possibilities for setting up of plant for<br />

production of Zinc Sulphate Monohydrate.<br />

• Hazira Expansion Project<br />

Your Society is exploring the possibilities for<br />

setting up another mega Ammonia-Urea Plant at its<br />

existing fertilizer complex at Hazira. Environmental<br />

Clearance has already been received from Ministry of<br />

Environment and Forest. The Society has already<br />

approached Department of Fertilizers/Ministry of<br />

Petroleum and Natural Gas for allocation of Natural<br />

Gas on long term basis. The Society will initiate actions<br />

to set up Hazira Expansion Project after allocation of<br />

Natural Gas and availability of conducive policy for<br />

investment.<br />

9. SAFETY MANAGEMENT<br />

The safety setup of KRIBHCO Hazira Plant has<br />

been established with a vision to achieve its slogan of<br />

"SAFETY FIRST- PRODUCTION MUST." Safety management<br />

involves creation of safe, efficient and pleasant<br />

working environment in the plant, continual<br />

enrichment of safety culture of the plant, high level of<br />

emergency preparedness at all the time and<br />

extending support to the neighbouring villages,<br />

industries and Government agencies in case urgent<br />

need for any emergency mitigation beyond plant<br />

boundaries.<br />

State of the art safety systems and infrastructures<br />

have been set up, which are audited by the internal<br />

safety committees as well as by the external experts<br />

15

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

Shri Chandra Pal Singh, Vice Chairman KRIBHCO inaugurating warehouse at KRIBHCO Jetty Hazira. Other dignitaries in<br />

the picture are Shri Vaghjibhai Rugnathbhai Patel, Chairman KRIBHCO; Shri B.D. Sinha, Managing Director;<br />

and other Board of Directors.<br />

under the OHSAS implementation programme, apart<br />

from a comprehensive risk assessment study of the<br />

entire fertilizer complex undertaken through an<br />

external specialist agency.<br />

Safety training and awareness is given top<br />

priority. During the year, not a single dangerous<br />

occurrence took place. Your Society also received<br />

around 20 requests from Government agencies for<br />

rendering emergency services in neighbouring areas<br />

which were honoured. An off-site mock drill was<br />

conducted jointly by the District Administration and<br />

KRIBHCO to test the emergency preparedness of<br />

various Government institutions and neighbouring<br />

industries.<br />

10. ENVIRONMENTAL PROTECTION<br />

Care for environment has always been of<br />

paramount importance for the Society. Your Society<br />

recognizes its responsibility to protect environment<br />

and is committed to regulate all its activities using best<br />

available technology to mitigate adverse environmental<br />

impact, if any that may arise out of its operations.<br />

A comprehensive environmental protection<br />

plan based on principle of "Reduce, Re-cycle & Re-<br />

use" has been adopted to conserve scarce natural<br />

resources.<br />

Various treatment schemes have been implemented<br />

since commissioning of the plant, which have<br />

resulted in reduction of water consumption by<br />

approximately 40%, and achieved Zero effluent<br />

discharge from final outlet. Efforts are being made to<br />

further reduce water consumption. Tertiary treated<br />

sewage water is being used as cooling water make up.<br />

Deep hydrolyser is installed in the Urea plant to reuse<br />

the effluent as boiler feed water after treatment.<br />

Emission of pollutants to air from the various<br />

stacks is far below the limits specified by regulatory<br />

bodies. Six ambient air quality monitoring stations<br />

have been set up within a radius of 10 km for periodic<br />

monitoring of air quality in surrounding area.<br />

Wet de-dusting system at Prilling tower top has<br />

been installed and emission of the Urea dust and<br />

Ammonia in the atmosphere is well below the<br />

specified limits.<br />

To ensure clean and green environment, the<br />

Society has created a green belt by planting more than<br />

one lakh trees of different species based on Air<br />

Pollution Tolerance Index. Thus helping to improve the<br />

16

ambient air quality within the complex. Lush green<br />

lawns are also developed and maintained in an area of<br />

100 acres. A demonstration farm in an area of 41<br />

acres has been developed.<br />

Integrated Management System (IMS) of the<br />

Society has been certified as in-line with international<br />

standard ISO 14001 and OHSAS 18001. The proactive<br />

steps ensure that the Society conforms to regulations<br />

governing emission and other environmental<br />

considerations. Internal and External Audits are<br />

conducted periodically for checking efficacy of the<br />

system which has expressed satisfaction with the<br />

environmental procedure compliance.<br />

<strong>11</strong>. FERTILIZER POLICY<br />

During the year <strong>2010</strong>-20<strong>11</strong>, the NBS Policy was<br />

successfully implemented for all fertilisers except urea<br />

and was well received by all the stakeholders. The<br />

stage-III of New Pricing Scheme (NPS), applicable to<br />

the indigenous urea industry was effective up to<br />

March 31, <strong>2010</strong>. This scheme has been extended until<br />

the new policy for urea industry is introduced. The<br />

new policy for urea is under active consideration of<br />

Government of India. Under the proposed policy, gas<br />

based urea manufacturers are likely to get fixed<br />

subsidy PMT of urea produced. Gas price pooling up<br />

to "cut off quantity" is also proposed under this new<br />

policy. The Society hopes that this policy will be a step<br />

towards the NBS.<br />

Amendments in the policy for new investments in<br />

urea sector dated September 4, 2008 is also under<br />

active consideration of Government of India. The<br />

Society is hopeful that the new policy of investments<br />

would be advantageous so as to attract investments in<br />

fertilizer industry.<br />

the country as a whole received 2% more rainfall<br />

during South West Monsoon (June-Sept.<strong>2010</strong>) and<br />

21% above normal rainfall during Post-Monsoon<br />

Season (October-December <strong>2010</strong>). This created<br />

favourable conditions for Agriculture operations in<br />

most parts of the country barring Bihar, Eastern U.P,<br />

Orissa and Chhattisgarh.<br />

As per the latest estimate of Agriculture Ministry,<br />

total food grains production in the country may be<br />

around 241.58 million tonnes during <strong>2010</strong>-20<strong>11</strong> as<br />

against 218.20 million tonnes of last year.<br />

12.2 Marketing Infrastructure<br />

Marketing channel of KRIBHCO includes<br />

Cooperative Apex Federations, Institutional Agencies<br />

and Grass Root Level Primary Agriculture Societies.<br />

The Society's cooperative development programmes<br />

help its channel partners, especially PACS to acquire<br />

marketing skills and other agriculture practices for<br />

inclusive development of the cooperatives. The direct<br />

supplies to Primary Agricultural Cooperative Society<br />

(PACS) help these societies immensely as the timely<br />

supplies enable them to increase fertilizer<br />

consumption and agriculture productivity as well as to<br />

draw maximum financial benefits.<br />

Your Society's commitment towards farming<br />

community for providing quality services has paid rich<br />

dividend in terms of strong Brand image for its<br />

products. The interdisciplinary team of marketing and<br />

extension experts spread all over the major States<br />

20.00<br />

KRIBHCO UREA SALES<br />

18.<strong>11</strong> 18.00<br />

18.40<br />

12. MARKETING<br />

12.1 Overall Agricultural Scenario<br />

Rainfall was fairly good mainly due to near<br />

normal rains during South-West and Post Monsoon<br />

seasons. In comparison to Long Period Average (LPA)<br />

rainfall, the country as a whole received 44% less<br />

rainfall during winter (Jan-Feb, <strong>2010</strong>) and <strong>11</strong>% less<br />

during pre-monsoon (March-May, <strong>2010</strong>). However,<br />

(QTY. LAKH MT)<br />

15.00<br />

10.00<br />

5.00<br />

0.00<br />

2008-2009 2009-<strong>2010</strong> <strong>2010</strong>-20<strong>11</strong><br />

YEARS<br />

17

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

have worked extensively to reach farming community<br />

in all crop production systems. The Society has pan<br />

India presence. KRIBHCO Urea is an established brand<br />

in the key market territories across the length and<br />

breadth of the country. The major marketing territory<br />

consists of Andhra Pradesh, Bihar, Chhattisgarh,<br />

Gujarat, Haryana, Jharkhand, Karnataka, Kerala,<br />

Madhya Pradesh, Maharashtra, Orissa, Puducherry,<br />

Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh,<br />

Uttrakhand and West Bengal<br />

(QTY. LAKH MT)<br />

40.00<br />

30.00<br />

20.00<br />

10.00<br />

0.00<br />

TOTAL UREA SALES<br />

37.76<br />

38.47<br />

38.23<br />

2008-2009 2009-<strong>2010</strong> <strong>2010</strong>-20<strong>11</strong><br />

YEARS<br />

12.3 Marketing Business Plan<br />

An initiative has been taken to develop Marketing<br />

Business Plan for the whole year with "Participatory<br />

Approach" involving key marketing officials, keeping<br />

into view Financial, Process, Customer and Capacity<br />

Building Perspectives. The Business Plan exercise<br />

involved all field force in understanding the issues and<br />

challenges which resulted in enhanced performance.<br />

Similar exercise is being done in 20<strong>11</strong>-2012.<br />

While preparing the business plan, attempt has<br />

been made to analyse the impact of environmental<br />

factors like Agricultural and Fertilisers scenario of the<br />

country, likely policy environment, situational analysis<br />

of individual products, future thrust areas and<br />

resources have been taken into consideration.<br />

12.4 Infrastructure at Ports<br />

Development of own infrastructure at various<br />

ports is considered essential to add efficiency in<br />

operations. In this direction, the Society completed<br />

the construction of another warehousing complex<br />

with storage capacity of 15000 MT, at Tuticorin port<br />

with bagging capacity of 4000 MT per day.<br />

The Society's Jetty at Hazira became operational<br />

during the year <strong>2010</strong>-20<strong>11</strong>. The facility at Jetty<br />

includes a warehouse for storage of 15000 MT<br />

imported fertilizers and a conveyor belt from Jetty to<br />

warehouse.<br />

12.5. Handling of Imported Fertilisers<br />

• OMIFCO Urea<br />

The Society successfully completed the 6th<br />

consecutive year of Handling and Marketing of<br />

OMIFCO urea under the agreement with Department<br />

of Fertilizers, Government of India. During the year<br />

<strong>2010</strong>-20<strong>11</strong>, the Society imported a record quantity of<br />

10.62 Lakh MT granular urea from OMIFCO, Oman in<br />

33 vessels. This Urea was handled at 9 Indian ports i.e.<br />

Visakhapatnam, Kakinada Deep Water, Krishnapatnam,<br />

Chennai, Tuticorin, New Mangalore,<br />

Magdalla (Hazira Jetty), Mundra and Kandla Ports. The<br />

Society has so far, imported 55.45 Lakh MT OMIFCO<br />

Urea in 186 vessels since inception of imports from<br />

OMIFCO, Oman.<br />

The overall physical and financial performance on<br />

handling of OMIFCO Urea has improved during the<br />

year and there has been a significant positive<br />

contribution on this account. This could be achieved<br />

mainly by way of judicious despatches, checking cargo<br />

loss, close monitoring and prompt sales and<br />

realisation.<br />

12.6 Import of DAP<br />

During the year <strong>2010</strong>-20<strong>11</strong>, the Society also<br />

imported and handled 12 vessels containing 3.87Lakh<br />

MT DAP at Viskhapatnam, Kakinada, Krishnapatnam,<br />

Tuticorin and Mundra Ports. The entire quantity of<br />

imported DAP was marketed through Society's own<br />

marketing network. The import and marketing of DAP<br />

has also made a significant contribution to the<br />

Society's profit.<br />

12.7 Sales and Distribution<br />

• Urea<br />

The Business plan and close monitoring<br />

18

KRIL container being handled.<br />

facilitated the Society to make timely despatches of its<br />

Urea, as per ECA and for de-regulated quantity from<br />

Plant site to various destinations. Depending upon<br />

the Movement Order and Supply Plan, the Society<br />

despatched the material by optimizing the Rail and<br />

Road mix. During the year, a quantity of 18.41 Lakh<br />

MT of own urea was despatched to different<br />

destinations in 12 States.<br />

The Society has sold 18.40 Lakh MT of KRIBHCO<br />

Urea, 9.54 Lakh MT of OMIFCO urea and 10.29 Lakh<br />

MT of KSFL Urea during the year.<br />

The entire imported OMIFCO urea during <strong>2010</strong>-<br />

<strong>11</strong> was allocated under ECA and marketed throughout<br />

the country i.e. in the states of Gujarat, Rajasthan,<br />

Punjab, Haryana, Uttar Pradesh, Bihar, West Bengal,<br />

Madhya Pradesh, Andhra Pradesh, Puducherry, Tamil<br />

Nadu, Kerala, Karnataka and Maharashtra.<br />

• DAP<br />

In order to promote balanced fertilization, the<br />

Society further strengthened its product range to<br />

cover DAP. The Society sold 3.87 Lakh MT of Imported<br />

DAP as against 1.14 Lakh MT in the previous year.<br />

The Society has made significant achievements<br />

on marketing fronts and has achieved the highest ever<br />

sales of fertilizers of 42.10 Lakh MT during the year<br />

<strong>2010</strong>-20<strong>11</strong>.<br />

• Other Products<br />

Apart from Urea, the Society also sold 99917 MT<br />

of Surplus Ammonia during <strong>2010</strong>-20<strong>11</strong> as against<br />

83900 MT in the previous year. The Society has also<br />

sold 59,04,774 NM³ Liquid Argon in the year <strong>2010</strong>-<br />

20<strong>11</strong> and the cumulative total quantity sold is<br />

1,47,13,653 NM³ since commencement of Argon<br />

Plant unit in year 2007-2008.<br />

12.8 Plan for Import of Fertilisers 20<strong>11</strong>-2012<br />

During the year 20<strong>11</strong>-2012, the Society plans to<br />

import 50% of OMIFCO Urea produced apart from<br />

importing DAP/MOP/Complex fertilizers. It is<br />

expected that with optimum utilization of the<br />

infrastructure developed by the Society at<br />

Visakhapatnam, Tuticorin Ports and Hazira Jetty, the<br />

efficiency will improve further thereby having more<br />

positive impact on Society's profitability.<br />

19

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

12.9 Seed Multiplication Programme and<br />

Marketing of Hybrid Seeds<br />

• Certified Seeds<br />

Seed is one of the major inputs in increasing<br />

agriculture production. Timely availability of seed<br />

in adequate quantity at consuming point at<br />

affordable price is essential to increase foodgrains<br />

production.<br />

Your Society initiated seed production<br />

programme in 1990-1991 to provide quality<br />

certified seeds of main crops to the farmers.<br />

Encouraging response of farmers towards KRIBHCO<br />

seeds inspired us to increase the seed production<br />

activity. The Society has produced 2,48,015 quintals<br />

in <strong>2010</strong>-<strong>11</strong>. The seeds produced were made<br />

available to the farmers through Krishak Bharati<br />

Sewa Kendras, Co-operative Societies and State Cooperative<br />

Marketing Federations in the state of<br />

Gujarat, Haryana, Madhya Pradesh, Punjab,<br />

Rajasthan and Uttar Pradesh. The main crops under<br />

seed production are:- Cereals- Paddy ,Wheat.,<br />

Barley and Maize; Pulses - Gram, Pea, Moong, Arhar<br />

and Lentil; Oilseeds- Mustard, Soybean, Groundnut<br />

and Caster. Fodder- Guar.<br />

To ensure the quality, seeds are being<br />

processed at 13 modern seed processing plants<br />

located at Abohar (Punjab), Aligarh (U.P.),<br />

Bulandshahar (U.P.), Dewas (M.P.), Gajraula (U.P.),<br />

Gorakhpur (U.P.) Himmatnagar (Gujarat), Hissar<br />

(Haryana), Jungipur (U.P.),Ludhiana(Punjab) Kota<br />

(Rajasthan) Moth (U.P.) and. Shahjahanpur (U.P.)<br />

The total production capacity of these plants is<br />

2.70 lakh quintal. The Society is planning to<br />

establish 2 new seed grading units, one in Bihar<br />

(Arrah, Distt- Bhojpur) and another in Rajasthan<br />

(Hanumangarh). After commencement of these<br />

units the total installed capacity of the Society will<br />

be 3.00 lakh quintal per annum.<br />

In order to develop further infrastructure for<br />

seed multiplication, your Society has purchased<br />

land at Hissar in Haryana, Kota and Hanumangarh in<br />

Rajasthan for establishment of Seed Grading Units.<br />

During the year under review, the Society sold<br />

2,47,157 quintals of certified seeds of various crops<br />

and varieties and plans to produce 3.80 lakh<br />

quintals of seeds during 20<strong>11</strong>-2012.<br />

(QTY. LAKH QTLS)<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

SEED PRODUCTION AND SALES<br />

1.98<br />

1.96<br />

2.29 2.22<br />

2008-2009 2009-<strong>2010</strong> <strong>2010</strong>-20<strong>11</strong><br />

YEARS<br />

2.48 2.47<br />

PRODUCTION<br />

SALES<br />

• Hybrid Seeds<br />

The growth of seed industry is expected to<br />

reach `12000 Crore during 2014 from `5200<br />

Crore<br />

during 2008. Hybrid Seeds have replaced the public<br />

varieties ranging from 3% to 100% in various crops.<br />

The area covered under different Hybrid Crops in<br />

the country is Rice (3%), Jowar (60%), Bajra (90%),<br />

Maize (95%), Cotton (97%) and Sunflower (100%).<br />

During <strong>2010</strong>, the Society entered into a MOU<br />

with a renowned Hybrid Seed company for marketing<br />

of their seeds through Society`s Marketing network in<br />

KRIBHCO's own brand. Accordingly, during the year,<br />

Society marketed 1,48,686 packets of Bt. Cotton,<br />

290.54 quintals of Paddy Hybrid, 3041.08 quintals of<br />

Paddy Research, 1677.57 quintals of Maize Hybrid and<br />

7.74 quintals of Hybrid Sunflower Seeds.<br />

In view of popularity and Crop Performance of<br />

KRIBHCO's Hybrid Seed among the progressive<br />

farmers of the country and rapid increase in<br />

demand in market, the Society, plans to sale 5.10<br />

Lakh packets of Bt. Cotton, 344 quintals of Paddy<br />

Hybrid, 7885 quintals of Paddy Research, 5557<br />

quintals Hybrid Maize, 600 quintals of Hybrid Bajra<br />

and 17 quintals of Hybrid Sunflower Seed during the<br />

year 20<strong>11</strong>-2012.<br />

20

KRIBHCO Raja variety of Bt. Cotton bearing more than 300 balls at village Hokwala in distt. Ferozepur, Punjab.<br />

12.10 Organic Fertilizer<br />

Agriculture is going through a major<br />

transformation across the world and India is no<br />

exception. Organic Agriculture has emerged as a<br />

feasible option related to land degradation and<br />

increasing contamination in food. Organic Manure /<br />

Compost use in the fields help in producing food of<br />

high nutritional value and reduce the health risks by<br />

keeping harmful chemicals and pesticides out. It<br />

also preserves long term fertility of the soil through<br />

sustainable production system.<br />

Your Society took initiative to co-market the<br />

Compost made from City Garbage since December<br />

2009. During the year <strong>2010</strong>-20<strong>11</strong>, the Society Comarketed<br />

about 17,350 MT of compost in <strong>11</strong> states<br />

and plans to sell 30,000 MT during next financial year.<br />

12.<strong>11</strong> Bio-Fertilizers<br />

Your Society initiated producing and marketing<br />

five bacterial strains of Bio-fertilizers in three Plants<br />

at Hazira (Gujarat), Lanjha (Maharashtra) and<br />

Varanasi (U.P.) with combined capacity of 550 MT.<br />

During the year <strong>2010</strong>-20<strong>11</strong>, the Society produced<br />

965 MT and sold 944 MT of 5 bacterial strains of<br />

Bio-fertilizers i.e. Rhizobium, Azotobacter,<br />

Acetobacter, Azospirillium and PSM (Phosphate<br />

Solubilising Micro-organism). Initiative has also<br />

been taken to produce liquid Bio-fertilizers in view<br />

of meeting the need of increased shelf life for better<br />

marketability and farmers benefit. The Society's<br />

Bio-fertilizer Plants are ISO certified.<br />

Your Society has been continuously promoting<br />

the use of Bio-fertilizers by educating farmers and<br />

making them aware about its benefits through various<br />

promotional and educational programmes, which has<br />

been duly recognized through awards by FAI.<br />

(QTY. MT)<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

BIO-FERTILIZERS PRODUCTION AND SALES<br />

865<br />

867 953 922 965 944<br />

2008-2009 2009-<strong>2010</strong> <strong>2010</strong>-20<strong>11</strong><br />

YEARS<br />

PRODUCTION SALE<br />

21

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

Shri N. Sambasiva Rao, Marketing Director visiting Krishak Bharati Sewa Kendra, Bulandshahr, U.P.<br />

12.12 Krishak Bharati Sewa Kendra<br />

The Society is operating its 63 own outlets<br />

known as Krishak Bharati Sewa Kendra (KBSKs) in<br />

the states of Uttar Pradesh, Haryana and Punjab to<br />

provide all agriculture inputs and technical knowhow<br />

under Single Window Concept. This concept<br />

has gained a permanent place in the hearts of the<br />

farmers in these areas.<br />

During the year <strong>2010</strong>-20<strong>11</strong>, the total turnover<br />

achieved was ` <strong>11</strong>4.46 crore, as compared to `<br />

74.97 crore, an increase of 53% over previous year.<br />

The Society recognizes the role of these Kendras in<br />

establishing the strong image of the Society<br />

amongst the farming community.<br />

12.13 Marketing Coordination System<br />

The Society's web based software KRIBHCO<br />

Marketing Coordination System (KRIBHCO MCS) has<br />

been running successfully for the fourth<br />

consecutive year. It helps in collecting requisite<br />

data from field for further consolidation and<br />

uploading the same to the Fertilizer Monitoring<br />

System (FMS) Web Site of Department of Fertilizers<br />

(DOF), Government of India in prescribed time limit.<br />

It has also enabled the Society to update its data<br />

base quickly and to enable faster monitoring and<br />

decision making process.<br />

13. INVESTMENTS<br />

13.1 Joint Ventures and Subsidiaries<br />

• Oman India Fertiliser Company SAOC<br />

(OMIFCO)<br />

Your Society is a lead sponsor of Oman India<br />

Fertilizer Company (OMIFCO) with an investment of<br />

US$ 69.5 Million (Equivalent to INR ` 328.53 Crore) as<br />

equity representing 25% of paid up equity capital of<br />

OMIFCO.<br />

The capacity of OMIFCO plant is 16.52 Lakh MT<br />

per annum of granular Urea and <strong>11</strong>.9 Lakh MT per<br />

annum of Ammonia.<br />

Year <strong>2010</strong> (Jan10 - Dec10) was fifth complete year<br />

of the Commercial Production of OMIFCO. In this<br />

period, OMIFCO produced 20.77 Lakh MT of urea<br />

which is 125% of the rated capacity and 13.47 lakh MT<br />

of Ammonia being <strong>11</strong>3% of the rated capacity.<br />

OMIFCO sold 21.13 Lakh MT of Urea and 1.38 Lakh MT<br />

of surplus Ammonia.<br />

22

Capt. Ajay Singh Yadav, Hon'ble Finance Minister, Govt. of Haryana inaugurating KRIL Inland Container Depot, Rewari.<br />

Also seen Shri Rao Dan Singh, Chief Parliamentary Secretary, Haryana; Shri Chandra Pal Singh, Chairman KRIL;<br />

Shri Vaghjibhai Rugnathbhai Patel, Chairman KRIBHCO; Shri B.D. Sinha, Managing Director KRIBHCO and<br />

Shri N. Sambasiva Rao, Marketing Director KRIBHCO on the occasion.<br />

KRIBHCO is handling and marketing 50% of the<br />

urea produced by OMIFCO. For the calendar year<br />

<strong>2010</strong>, OMIFCO paid a dividend of 45.5% on paid up<br />

capital. KRIBHCO received US$ 31.62 Million as<br />

dividend income from OMIFCO during the year.<br />

• KRIBHCO Shyam Fertilizers Limited (KSFL)<br />

KRIBHCO Shyam Fertilizers Limited (KSFL), a joint<br />

venture company of KRIBHCO and M/s STL Fertilizers<br />

Pvt. Ltd., operates the Shahjahanpur Fertilizer<br />

Complex. The Society holds 85% of the total<br />

shareholding of KSFL<br />

On operational parameters, the year <strong>2010</strong>-20<strong>11</strong><br />

was a landmark year in the history of the Shahjahanpur<br />

plant ever since it commenced commercial<br />

production in December 1995. During the year, KSFL<br />

achieved highest ever Urea production of 10.28 Lakh<br />

MT with capacity utilization of <strong>11</strong>9% and Ammonia<br />

production of 6.08 Lakh MT with capacity utilization<br />

of 121%.<br />

KSFL has constructed a new 132KV switchyard for<br />

export of Surplus Power, proposed to be generated<br />

from standby gas turbine. The transmission line of<br />

about 15 km is being constructed to connect the<br />

Captive Power Plant to UPPCL Grid. The operation of<br />

both the GTs simultaneously will not only enable to<br />

produce about 24 MW Surplus Power but also will<br />

bring in energy efficiency in production of high<br />

pressure steam for the plant.<br />

• KRIBHCO Infrastructure Limited (KRIL)<br />

"KRIBHCO Infrastructure Limited" (KRIL) is wholly<br />

owned subsidiary of KRIBHCO for undertaking total<br />

Logistic Business including allied activities. KRIL is<br />

presently operating six container trains on various<br />

sectors and is in the process of procuring additional<br />

Rakes and Containers.<br />

KRIL is maintaining and operating Rail Linked<br />

Terminal at Hazira under Leave and Licence<br />

Agreement with KRIBHCO. KRIL is exploring the<br />

possibilities to set up Logistics Parks/Inland Container<br />

Depots (ICDs)/Container Freight Stations (CFS)/Free<br />

Trade Warehousing Zones/ Domestic Container<br />

Terminals/ Private Freight Terminals (PFT)/<br />

Warehouses preferably with Railway siding at various<br />

strategic locations either individually or in Joint<br />

Venture with Strategic partners in the country.<br />

Majority of land required for setting up Rail<br />

Linked Inland Container Depot (ICD) at Rewari<br />

(Haryana) has already been acquired. Construction<br />

23

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

Promotional Programme organized on Hybrid Maize at Tajewala Village in distt. Hoshiarpur, Punjab.<br />

work has commenced. All statutory approvals for<br />

setting up ICD at Modinagar (Uttar Pradesh) are in<br />

advanced stage. Initiative has been taken for setting<br />

up of Rail Linked ICD / Logistic Park at Hindaun City<br />

(Rajasthan) and Shahjahanpur (Uttar Pradesh).<br />

KRIL holds 10% equity in the Continental<br />

Multimodal Terminals Limited (CMTL). Rail linked ICD<br />

at Hyderabad is likely to be completed shortly. CMTL is<br />

in advanced stage of setting up rail linked ICD at<br />

Tuticorin. KRIL along with GIDC are exploring the<br />

possibilities to set up Rail linked Logistics Park<br />

ICD/PFT/CFS at Dahej and other suitable locations.<br />

• Gujarat State Energy Generation (GSEG)<br />

GSEG is a joint venture between Gujarat State<br />

Petroleum Corporation Ltd (GSPC), other Government<br />

of Gujarat Companies, KRIBHCO and GAIL (India) Ltd. In<br />

addition, IFCI and SBI are strategic partners. It is<br />

operating a 156 MW Gas based Combined Cycle Power<br />

Plant at Mora, in Surat (Gujarat) since June 2002. Plant is<br />

consistently operating satisfactorily. KRIBHCO holds<br />

26.77% equity in GSEG i.e. ` 93.04 crore.<br />

GSEG is implementing a 350 MW Combined Cycle<br />

Gas Based Expansion Project at its existing Site at an<br />

estimated cost of ` <strong>11</strong>60 crore. Erection work is in<br />

progress and the Project is likely to be completed in<br />

August, 20<strong>11</strong>. After implementation of this 350 MW,<br />

the total installed capacity of the Company would go<br />

up from 156 MW to 506 MW.<br />

GSEG has declared a dividend of 3% for the<br />

Financial Year 2009-<strong>2010</strong>.<br />

13.2 Others<br />

• Indian Commodity Exchange Limited (ICEX)<br />

The Society had acquired an equity of `5.00 crore<br />

(5% of total equity) at par in the Financial Year 2009-<br />

<strong>2010</strong>. The exchange is a national level multi<br />

commodity exchange and has started its operations<br />

w.e.f. 27.<strong>11</strong>.2009. The Exchange has been successful<br />

in acquiring over four hundred members reflecting<br />

the confidence reposed in the Exchange by market<br />

participants. Further, the Exchange expanded its<br />

product portfolio by launching contracts in Iron Ore,<br />

Mustard Seeds, Mentha Oil and Raw Jute.<br />

14. SERVICES TO FARMERS, COOPER-<br />

ATIVES AND RURAL DEVELOPMENT<br />

Sustainable rural development through effective<br />

farm services has been a focus area for the Society.<br />

24

Your Society, having a dedicated team of agricultural<br />

professionals, continued its efforts towards transfer of<br />

latest farm technology to the farming community and<br />

has undertaken rural welfare schemes for improving<br />

their livelihood. The Society organized 2669<br />

programmes such as Farmers Meetings, Kisan Melas,<br />

Field Demonstrations, Field Days, Cooperative<br />

Conferences, Group Discussion etc. benefiting 9.97<br />

Lakh farmers and cooperative officials across the<br />

nation. The Society also made available 5.64 lakh<br />

technical folders on various crops to farmers and<br />

cooperatives as back-up knowledge.<br />

'KRIBHCO Krishi Pramarsh Kendra' continues to<br />

provide free consultancy on farm-related issues,<br />

propagate efficient and balanced use of fertilizer by<br />

testing 5622 soil samples for micro-nutrients, 1545<br />

samples for macro-nutrients collected from 15 states<br />

and 71 farmers visited the Kendra. The State Directors<br />

of Agriculture across the nation were apprised about<br />

educational programmes conducted and district-wise<br />

deficiency noticed in soil samples tested from their<br />

states. This year KRIBHCO Krishi Pramarsh Kendra,<br />

NOIDA was visited by many dignatories including Shri<br />

S. Krishnan Secretary (DoF) and Shri S.L. Goyal Jt.<br />

Secretary (DoF), Govt. of India and Mr. Farid Hateen<br />

DG (Agriculture) Govt. Of Afghanistan. The services<br />

provided by KRIBHCO to farmers and cooperatives<br />

was highly appreciated.<br />

Your Society promoted Information Communication<br />

Technology (ICT) and sent the soil profile<br />

results along with the recommendations to the<br />

farmers at their door-steps through KRIBHCO field e-<br />

mails, besides using the KRIBHCO website for display<br />

of results as well as monthly farm operations. The<br />

'Pramarsh Kendra' as well as "KRIBHCO Kisan<br />

Helpline" continued to provide latest information on<br />

weather to farmers enabling them to plan farm<br />

operations and mid-term corrections in case of crop<br />

failures. Kisan helpline is also used for follow-up with<br />

farmers for adopting soil testing results and other<br />

farm-related services.<br />

For inclusive development of cooperatives, the<br />

Society adopted 107 cooperative societies, trained 24,940<br />

cooperative managers in 208 cooperative conferences.<br />

The Society also organized 50 health campaigns for<br />

human and livestock, and rural sports for integrated rural<br />

development. A state Consultative Committee meeting<br />

was organized for the state of Gujarat.<br />

15. FINANCIAL RATINGS<br />

The Society's excellent financials and its core<br />

strength have been recognized by CRISIL by awarding<br />

the highest rating P1+ for accessing short term<br />

borrowings and Letters of Credits. This rating indicates<br />

that the degree of safety regarding timely payment on<br />

the instruments is very strong. On the long term,<br />

CRISIL has rated the Society as AA-/ Stable which<br />

means high degree of safety with regard to timely<br />

payment of financial obligations. The outlook is<br />

indicated to be "stable".<br />

16. CORPORATE GOVERNANCE<br />

A Sound Governance process consists of a<br />

combination of business practices, which result in<br />

enhancement of shareholder's value and enable the<br />

Society to fulfill its obligations to farmers, employees,<br />

shareholders, Lenders, government and the general<br />

public at large.<br />

The constituents of corporate governance in the<br />

Society are the Board of Directors, Shareholders and<br />

the Management.<br />

The Thirtieth <strong>Annual</strong> General Body Meeting<br />

(AGM) of KRIBHCO was held on 20th May, <strong>2010</strong>.<br />

In the 30th AGM, nine Directors were elected as<br />

per Bye-law 38(i) of the Society. Thus, with the<br />

election of nine Directors, the seventh elected Board<br />

of Directors was reconstituted on May 20, <strong>2010</strong>. The<br />

members of the newly constituted Board, unanimously<br />

elected Shri Vaghjibhai Rugnathbhai Patel and<br />

Shri Chandra Pal Singh as Chairman and Vice-<br />

Chairman of the Society, respectively.<br />

Twelve Meetings of the Board of Directors, <strong>11</strong><br />

Meetings of the Executive Committee, 2 Meetings of<br />

the Sub Committee on Marketing and 2 Meetings of<br />

the Audit Committee were held during the year. The<br />

observations/ recommendations of the members are<br />

taken into account while formulating the future<br />

strategies and planning of the Society.<br />

25

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

Shri Chandra Pal Singh, the then Chairman KRIBHCO, presenting KRIBHCO Sahakarita Shiromani Award to<br />

Shri Shivajirao G. Patil from Maharashtra. Also seen are Dr. Bijender Singh, Director; Shri V. Sudhakar Chowdary, Director<br />

and other dignitaries.<br />

Shri Vaghjibhai Rugnathbhai Patel, Chairman KRIBHCO and Shri Chandra Pal Singh, the then Chairman KRIBHCO<br />

presenting KRIBHCO Sahakarita Vibhushan Award to Shri Dalsangbhai J Patel from Gujarat. Also seen on the occasion<br />

are Shri B.D. Sinha, Managing Director and other dignitaries.<br />

26

Shri S. Jaggia, Operations Director receiving the first Prize of FAI for 'Bio-fertilisers Production, Promotion & Marketing'<br />

from Shri M.K. Alagiri, Hon'ble Union Minister for Chemicals & Fertilisers. Shri Srikant Jena, Hon'ble Union Minster of<br />

State for Chemicals & Fertilizers is also seen.<br />

Shri L.S. Bharambe, the then Sr. SMM Maharashtra receiving the FAI (Western Region) Mahadhan Trophy from<br />

Shri U.S. Jha, the then CMD RCF.<br />

27

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

GVT officials seen alongwith villagers in Krishi Vikas Pariyojna in tribal distt. Jhabua, M.P.<br />

17. INFORMATION TECHNOLOGY<br />

The Society's business processes and operations<br />

rely on vast amount of information repository spread<br />

across its various functional units. The Information<br />

Technology and Communication facilities such as<br />

Local and Wide Area Networks, INTRANET based<br />

information exchanges; electronic mail, internet<br />

access, web site etc. have been continuously<br />

maintained and the security concerns are addressed<br />

from time to time. New applications for intra<br />

organizational information exchange have been<br />

developed to reduce paper work.<br />

18.CORPORATE SOCIAL RESPONSIBILITY<br />

As a CSR initiative, the Society through GVT, has<br />

taken up a project on Mangroves plantation on 100<br />

hectares at village Kantiyajal (Distt.Bharuch) by<br />

signing a MoU with Gujarat Ecology Commission<br />

(GEC). The restoration project involves coastal<br />

communities for the development and management<br />

of mangroves, to give them livelihood and<br />

employment opportunities. Society has taken CSR<br />

initiatives to improve the livelihood of the rural<br />

marginalized communities for their betterment in<br />

the rainfed areas through GVT. Your society is also<br />

contributing in improving socio-economic conditions<br />

by enhancing seed replacement ratio at farmers' field<br />

through hybrid seeds, Bt. cotton and encouraging use<br />

of eco-friendly products like Bio-fertilisers and<br />

Compost.<br />

19. COMMUNITY DEVELOPMENT<br />

Your society is playing a significant role in<br />

community development and committed for<br />

improving the quality of life of the farmers, better<br />

Health, Education, Infrastructure support, Safe<br />

drinking water, Income generation, Environment<br />

protection, Family welfare, Institution building etc.<br />

The Society has taken initiative for upliftment of rural<br />

community through construction of storage-cumcommunity<br />

centres since 1977 under Golden Jubilee<br />

celebrations of India's Independence. So far, 136 such<br />

centres have been constructed throughout the<br />

country. These centres are meeting the dual needs of<br />

timely stocking of agro-inputs / farm produce and<br />

social gathering in rural areas. These centres have<br />

proved helpful in reducing expenses of rural people on<br />

account of tents etc. during social functions and on<br />

storage during crop seasons. Farmers training, health<br />

28

Shri N. Sambasiva Rao, Marketing Director KRIBHCO alongwith Chinese delegates visited KRIBHCO stall at KIPO Trade<br />

Centre, Bangaluru.<br />

check-ups for human beings and livestock, rural sports<br />

and meetings etc. are also conducted occasionally in<br />

these centres. The Society has immensely benefited<br />

on account of long term publicity for its products<br />

through these centres in the heart of our market<br />

areas.<br />

Besides above, some of the community<br />

development activities carried out in the surrounding<br />

villages of Hazira Plant during the year include<br />

Drinking water facilities extended to Kavas Group<br />

Gram Panchayat, Distribution of Text books, study<br />

materials and uniform to school students, provision of<br />

computers, printers, LCD projector, sports items,<br />

benches and fans to schools, provision of ambulance<br />

van, construction of water tank, financial aid to<br />

Viklang Kalyan Society Surat, organising blood<br />

donation camps, created an Institution called<br />

"Ashirwad" for senior citizens and carried out fogging<br />

operation for malaria control.<br />

20. KRIBHCO SAHAKARITA AWARDS<br />

KRIBHCO Sahakarita Awards for the year 2009-<br />

<strong>2010</strong> were presented to two eminent cooperators in<br />

its 30th AGM held on May 20, <strong>2010</strong>. KRIBHCO<br />

Sahakarita Shiromani Award was conferred on Shri<br />

Shivajirao G. Patil from Maharashtra and KRIBHCO<br />

Sahakarita Vibhushan Award on Shri Dalsangbhai J.<br />

Patel (Chaudhary) from Gujarat for their dedicated<br />

efforts for development of the Co-operative<br />

Movement.<br />

21. PUBLICITY<br />

In order to build a corporate Image the publicity<br />

activities were reoriented. The Society focussed on<br />

making the new/potential customers aware of<br />

KRIBHCO's existing as well as new products, on creating<br />

awareness on the CSR roles performed by the Society.<br />

The efforts have not only improved the Society's<br />

visibility in the field, encouraged farmers to buy new<br />

products but also impacted the credibility of the<br />

organisation/brand consciousness among farmers<br />

and other stakeholders. Some of the activities<br />

undertaken related to provision of name boards for<br />

cooperatives selling our products, wall paintings/<br />

tractor trolley paintings, distribution of kisan carry<br />

bags, caps, key chains, distribution of corporate<br />

brochure for potential partners/visitors, distribution<br />

of product posters for display etc. The In-house<br />

magazine - 'KRIBHCO NEWS' was re-oriented which<br />

received award from Public Relation Society of India.<br />

29

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>-<strong>11</strong><br />

State Consultative Committee Meeting of Gujarat in progress at Shirdi, Maharashtra. Shri Vaghjibhai Rugnathbhai Patel<br />

Chairman and Shri Chandra Pal Singh Vice Chairman and other KRIBHCO Directors are seen interacting with delegates.<br />

The short film on "Soil health improvement &<br />

farmer's prosperity" of your Society received 1st prize<br />

from FAI.<br />

Your Society participated in International Trade<br />

Fair at New Delhi, International Co-operative Alliance<br />

(ICA) Expo at Bengaluru and several Kisan Melas in<br />

Agriculture Universities, ICAR Institutes and<br />

Agriculture Department.<br />

Your Society also developed KRIBHCO theme<br />

song in Hindi and Gujarati and TV Advertisement for<br />

telecasting during Doordarshan serial "Aahar".<br />

The relations with Print and Electronic media<br />

were cordial and the Society's events were covered by<br />

them judiciously.<br />

22. HUMAN RESOURCE DEVELOPMENT<br />

In order to update the skill and develop human<br />

resource of the Society, various programmes/<br />

trainings were conducted involving wide range of<br />

lectures by eminent faculty were arranged on various<br />

topics. Students from various Management Institutes<br />

were given training in their respective fields. The<br />

Society has also taken initiative for development of<br />

dependants of employees for better life quality. The<br />

Society also celebrated "National Productivity Week"<br />

wherein various competitions like Essay, Slogan<br />

Writing, Painting and Quiz etc. were organised<br />

23. INDUSTRIAL RELATIONS<br />

Employees' Relations in the Society remained<br />

cordial and peaceful. An atmosphere of mutual trust,<br />

confidence and goodwill prevailed between the<br />

Management and the employees represented by their<br />

Unions and Associations. Management maintained<br />

an open-door policy with fair and transparent<br />

approach while dealing with the employees and their<br />

Unions and Associations. As a result, not a single manday<br />

was lost during the year due to Industrial Relations<br />

Problems.<br />

Your Society recognises its employees as a<br />

valuable asset and assign paramount importance to<br />

Employees Relations. Continuous and untiring efforts<br />

towards maintaining cordial and harmonious interpersonal<br />

relations have been key factor(s) in achieving<br />

all round better performance of the Society.<br />

24. PROGRESSIVE USE OF HINDI<br />