FINANCIAL

Financial report 2005/2006 (PDF) - Vision Australia

Financial report 2005/2006 (PDF) - Vision Australia

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

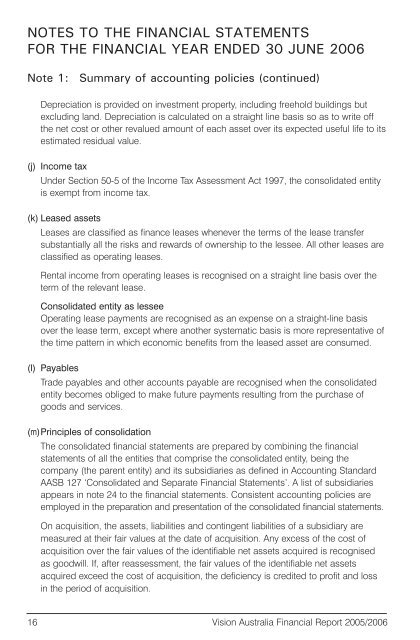

NOTES TO THE <strong>FINANCIAL</strong> STATEMENTS<br />

FOR THE <strong>FINANCIAL</strong> YEAR ENDED 30 JUNE 2006<br />

Note 1:<br />

Summary of accounting policies (continued)<br />

Depreciation is provided on investment property, including freehold buildings but<br />

excluding land. Depreciation is calculated on a straight line basis so as to write off<br />

the net cost or other revalued amount of each asset over its expected useful life to its<br />

estimated residual value.<br />

(j) Income tax<br />

Under Section 50-5 of the Income Tax Assessment Act 1997, the consolidated entity<br />

is exempt from income tax.<br />

(k) Leased assets<br />

Leases are classified as finance leases whenever the terms of the lease transfer<br />

substantially all the risks and rewards of ownership to the lessee. All other leases are<br />

classified as operating leases.<br />

Rental income from operating leases is recognised on a straight line basis over the<br />

term of the relevant lease.<br />

Consolidated entity as lessee<br />

Operating lease payments are recognised as an expense on a straight-line basis<br />

over the lease term, except where another systematic basis is more representative of<br />

the time pattern in which economic benefits from the leased asset are consumed.<br />

(l) Payables<br />

Trade payables and other accounts payable are recognised when the consolidated<br />

entity becomes obliged to make future payments resulting from the purchase of<br />

goods and services.<br />

(m)Principles of consolidation<br />

The consolidated financial statements are prepared by combining the financial<br />

statements of all the entities that comprise the consolidated entity, being the<br />

company (the parent entity) and its subsidiaries as defined in Accounting Standard<br />

AASB 127 ‘Consolidated and Separate Financial Statements’. A list of subsidiaries<br />

appears in note 24 to the financial statements. Consistent accounting policies are<br />

employed in the preparation and presentation of the consolidated financial statements.<br />

On acquisition, the assets, liabilities and contingent liabilities of a subsidiary are<br />

measured at their fair values at the date of acquisition. Any excess of the cost of<br />

acquisition over the fair values of the identifiable net assets acquired is recognised<br />

as goodwill. If, after reassessment, the fair values of the identifiable net assets<br />

acquired exceed the cost of acquisition, the deficiency is credited to profit and loss<br />

in the period of acquisition.<br />

16 Vision Australia Financial Report 2005/2006