FINANCIAL

Financial report 2005/2006 (PDF) - Vision Australia

Financial report 2005/2006 (PDF) - Vision Australia

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE <strong>FINANCIAL</strong> STATEMENTS<br />

FOR THE <strong>FINANCIAL</strong> YEAR ENDED 30 JUNE 2006<br />

Note 29: Impacts of the adoption of Australian equivalents to<br />

International Financial Reporting Standards (continued)<br />

service leave provision was classified as non-current. Under A-IFRS, all long service<br />

leave that an employee is entitled to be paid should they cease their employment<br />

with Vision Australia this classified as current, with remaining long service leave<br />

provision classified as non-current.<br />

Note 30: Prior Period Adjustment<br />

At merger date (July 2004) Vision Australia brought its land and buildings to account at<br />

fair value. These values were determined by valuations undertaken by independent<br />

valuers contracted by the individual merging agencies.<br />

In early 2006 the Vision Australia Board engaged property advisors, Ernst & Young to<br />

assist with a review of property. Ernst & Young’s task was to recommend the best use for<br />

a selected number of Vision Australia’s properties. Interim reports produced by Ernst &<br />

Young indicated current values may not match the amounts recorded at merger date.<br />

Acting on this information the Vision Australia Board engaged a firm of independent<br />

valuers, Charter Keck Cramer (CKC) to review the fair value of Land and Buildings as at<br />

June 2004, 2005 and 2006.<br />

Whilst the total value of land and buildings as determined by CKC varies by only 4%<br />

from the values as at merger date, there are significant differences in values for certain<br />

properties, and for both land and buildings at the same property as at merger date.<br />

Vision Australia’s directors believe that the values determined by CKC more truly reflect<br />

the fair values of both land and buildings at merger date. This is based upon more<br />

substantial documentation provided by CKC, validated by Ernst & Young in a number of<br />

instances. Consequently the Board resolved to adopt the value of land and buildings as<br />

at merger date as calculated by CKC. The effect of this change is summarised in the<br />

table below.<br />

Consolidated<br />

Company<br />

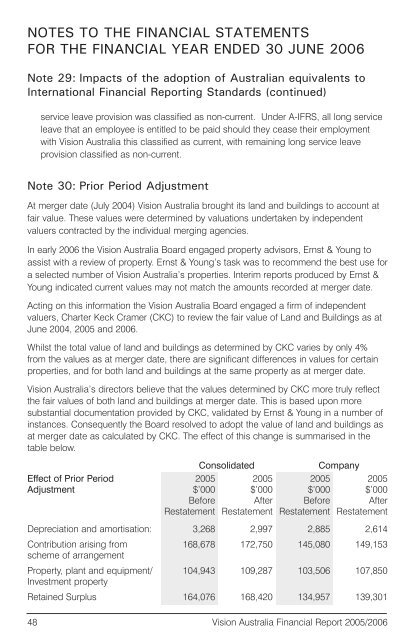

Effect of Prior Period 2005 2005 2005 2005<br />

Adjustment $’000 $’000 $’000 $’000<br />

Before After Before After<br />

Restatement Restatement Restatement Restatement<br />

Depreciation and amortisation: 3,268 2,997 2,885 2,614<br />

Contribution arising from 168,678 172,750 145,080 149,153<br />

scheme of arrangement<br />

Property, plant and equipment/ 104,943 109,287 103,506 107,850<br />

Investment property<br />

Retained Surplus 164,076 168,420 134,957 139,301<br />

48 Vision Australia Financial Report 2005/2006