Customs Regulations 1986. - Fiji Revenue & Customs Authority

Customs Regulations 1986. - Fiji Revenue & Customs Authority

Customs Regulations 1986. - Fiji Revenue & Customs Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Customs</strong> Act No.11 of 1986 Rev. 2010<br />

Subsidiary Legislation<br />

The <strong>Customs</strong><br />

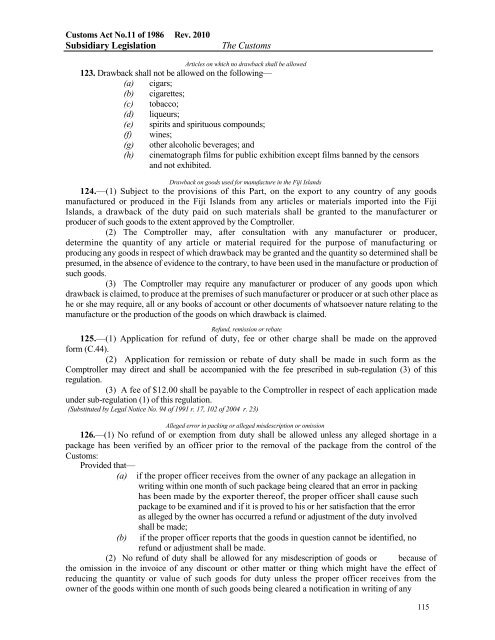

Articles on which no drawback shall be allowed<br />

123. Drawback shall not be allowed on the following—<br />

(a) cigars;<br />

(b) cigarettes;<br />

(c) tobacco;<br />

(d) liqueurs;<br />

(e) spirits and spirituous compounds;<br />

(f) wines;<br />

(g) other alcoholic beverages; and<br />

(h) cinematograph films for public exhibition except films banned by the censors<br />

and not exhibited.<br />

Drawback on goods used for manufacture in the <strong>Fiji</strong> Islands<br />

124.—(1) Subject to the provisions of this Part, on the export to any country of any goods<br />

manufactured or produced in the <strong>Fiji</strong> Islands from any articles or materials imported into the <strong>Fiji</strong><br />

Islands, a drawback of the duty paid on such materials shall be granted to the manufacturer or<br />

producer of such goods to the extent approved by the Comptroller.<br />

(2) The Comptroller may, after consultation with any manufacturer or producer,<br />

determine the quantity of any article or material required for the purpose of manufacturing or<br />

producing any goods in respect of which drawback may be granted and the quantity so determined shall be<br />

presumed, in the absence of evidence to the contrary, to have been used in the manufacture or production of<br />

such goods.<br />

(3) The Comptroller may require any manufacturer or producer of any goods upon which<br />

drawback is claimed, to produce at the premises of such manufacturer or producer or at such other place as<br />

he or she may require, all or any books of account or other documents of whatsoever nature relating to the<br />

manufacture or the production of the goods on which drawback is claimed.<br />

Refund, remission or rebate<br />

125.—(1) Application for refund of duty, fee or other charge shall be made on the approved<br />

form (C.44).<br />

(2) Application for remission or rebate of duty shall be made in such form as the<br />

Comptroller may direct and shall be accompanied with the fee prescribed in sub-regulation (3) of this<br />

regulation.<br />

(3) A fee of $12.00 shall be payable to the Comptroller in respect of each application made<br />

under sub-regulation (1) of this regulation.<br />

(Substituted by Legal Notice No. 94 of 1991 r. 17, 102 of 2004 r. 23)<br />

Alleged error in packing or alleged misdescription or omission<br />

126.—(1) No refund of or exemption from duty shall be allowed unless any alleged shortage in a<br />

package has been verified by an officer prior to the removal of the package from the control of the<br />

<strong>Customs</strong>:<br />

Provided that—<br />

(a) if the proper officer receives from the owner of any package an allegation in<br />

writing within one month of such package being cleared that an error in packing<br />

has been made by the exporter thereof, the proper officer shall cause such<br />

package to be examined and if it is proved to his or her satisfaction that the error<br />

as alleged by the owner has occurred a refund or adjustment of the duty involved<br />

(b)<br />

shall be made;<br />

if the proper officer reports that the goods in question cannot be identified, no<br />

refund or adjustment shall be made.<br />

(2) No refund of duty shall be allowed for any misdescription of goods or because of<br />

the omission in the invoice of any discount or other matter or thing which might have the effect of<br />

reducing the quantity or value of such goods for duty unless the proper officer receives from the<br />

owner of the goods within one month of such goods being cleared a notification in writing of any<br />

115