You’ve worked hard for your savings Now keep your savings working hard for you

1-888-445-4226 - Login to T. Rowe Price

1-888-445-4226 - Login to T. Rowe Price

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>You’ve</strong> <strong>worked</strong> <strong>hard</strong> <strong>for</strong> <strong><strong>you</strong>r</strong> <strong>savings</strong>.<br />

<strong>Now</strong> <strong>keep</strong> <strong><strong>you</strong>r</strong> <strong>savings</strong> <strong>working</strong> <strong>hard</strong> <strong>for</strong> <strong>you</strong>.<br />

Retire with confidence®<br />

A guide to <strong><strong>you</strong>r</strong><br />

distribution<br />

options.

As <strong>you</strong> reach life’s milestones,<br />

we can help navigate the way ahead.<br />

When changing jobs or retiring, it’s important to take a look at <strong><strong>you</strong>r</strong> <strong>savings</strong> and make<br />

in<strong>for</strong>med decisions about how to <strong>keep</strong> <strong><strong>you</strong>r</strong> money <strong>working</strong> toward <strong><strong>you</strong>r</strong> retirement goals.<br />

As <strong>you</strong> move <strong>for</strong>ward in life, this brochure can help <strong>you</strong> move wisely.<br />

Want help right now?<br />

By phone:<br />

Online:<br />

Call toll free at 1-888-445-4226 business days from 7 a.m. to 10 p.m. eastern<br />

time to speak with a Retirement Specialist. A T. Rowe Price Retirement<br />

Specialist can help <strong>you</strong> assess <strong><strong>you</strong>r</strong> situation, discuss <strong><strong>you</strong>r</strong> options, answer<br />

<strong><strong>you</strong>r</strong> questions, and take action.<br />

Visit the myRetirementPlan Web site at rps.troweprice.com and click on the<br />

Distributions tab <strong>for</strong> more in<strong>for</strong>mation and helpful tools. You’ll also find the<br />

myDistributionGuide, which can help <strong>you</strong> evaluate <strong><strong>you</strong>r</strong> options and create<br />

an action plan.

What are <strong>you</strong> looking <strong>for</strong>?<br />

2 Your distribution options<br />

Staying on track<br />

Deciding what’s right <strong>for</strong> <strong>you</strong><br />

4 About rollovers and IRAs<br />

Traditional versus Roth IRAs<br />

How to select an IRA provider<br />

Consider a T. Rowe Price Rollover IRA<br />

6 Rules of thumb <strong>for</strong> different life stages<br />

Develop a retirement income strategy<br />

A word about company stock and loans<br />

8 Helpful resources from T. Rowe Price<br />

Retirement Specialists<br />

Online tools<br />

Advice and guidance<br />

1

Your distribution options<br />

Staying on track with <strong><strong>you</strong>r</strong> retirement <strong>savings</strong><br />

Your retirement <strong>savings</strong> is part of <strong><strong>you</strong>r</strong> nest egg. Its purpose is to help sustain <strong>you</strong> financially<br />

when <strong>you</strong> retire. You want to preserve <strong><strong>you</strong>r</strong> <strong>savings</strong> and allow the money to <strong>keep</strong> growing<br />

tax-deferred until <strong>you</strong> need it— as <strong>you</strong> need it—throughout retirement. Depending on<br />

which life stage <strong>you</strong> may be facing—whether <strong>you</strong> are changing jobs, nearing retirement, or<br />

retiring—<strong>you</strong> have different decisions to make about how to handle <strong><strong>you</strong>r</strong> retirement account.<br />

This guide is meant to help <strong>you</strong> through those decisions.<br />

Everyone who faces the distribution decision has some common choices to make, such as<br />

how to invest and how to <strong>keep</strong> <strong><strong>you</strong>r</strong> money <strong>working</strong> <strong>for</strong> <strong>you</strong>. Regardless of <strong><strong>you</strong>r</strong> stage in life,<br />

<strong>you</strong>’ve <strong>worked</strong> <strong>hard</strong> to save <strong>for</strong> retirement. It’s important to <strong>keep</strong> <strong><strong>you</strong>r</strong> retirement account<br />

<strong>working</strong> <strong>for</strong> <strong>you</strong>.<br />

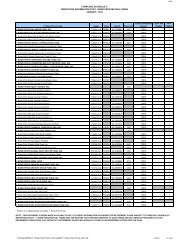

The table below shows the potential impact that taking a withdrawal could have on <strong><strong>you</strong>r</strong><br />

<strong>savings</strong>—in this example, a difference of more than $110,000 after 20 years.<br />

Consequences of Withdrawing Your Savings<br />

If <strong>you</strong> take a distribution, <strong>you</strong> will pay taxes now, and<br />

<strong>you</strong> also risk having less money <strong>for</strong> retirement if <strong>you</strong><br />

place <strong><strong>you</strong>r</strong> balance in a taxable account.<br />

Your total account balance $40,000<br />

20% withholding 1 -$8,000<br />

Additional current federal and state tax 1 -$3,500<br />

10% early withdrawal penalty 2 -$4,000<br />

Account balance after taxes and penalty $24,500<br />

Potential account value in 20 years 3 $76,236<br />

Advantages of Staying Invested Tax-Deferred<br />

If <strong>you</strong> <strong>keep</strong> <strong><strong>you</strong>r</strong> account tax-deferred—by rolling over<br />

<strong><strong>you</strong>r</strong> money into a Traditional IRA or <strong>keep</strong>ing it in an<br />

eligible plan—<strong>you</strong> avoid paying taxes now and give <strong><strong>you</strong>r</strong><br />

money the opportunity to grow tax-deferred.<br />

$40,000<br />

-$0<br />

-$0<br />

-$0<br />

$40,000<br />

$186,438 4<br />

1<br />

Assumes a tax rate of 28.75% (federal and state) in the year of distribution. 20% withholding at time of<br />

distribution. Additional taxes payable by April 15 the year following a distribution.<br />

2<br />

If <strong>you</strong> are under age 59 1 /2, a 10% penalty may apply.<br />

3<br />

Assumes a hypothetical 5.85% annual rate of return and no early withdrawal penalty at the end of<br />

20 years. This is <strong>for</strong> illustrative purposes only and is not intended to demonstrate the past per<strong>for</strong>mance or<br />

future results of any investment. Your results may vary.<br />

4<br />

Taxes are payable when money is withdrawn from the account.<br />

Remember that retirement investing is a long-term process, and although resources are<br />

available to help, it is up to <strong>you</strong> to take an active role in <strong><strong>you</strong>r</strong> future. If <strong>you</strong> ever have<br />

questions or need help getting on the right track, feel free to call T. Rowe Price at<br />

1-888-445-4226. Representatives are available on business days from 7 a.m. to 10 p.m. eastern<br />

time.<br />

Call 1-888-445-4226 to request a prospectus, which includes investment objectives, risks, fees,<br />

expenses, and other in<strong>for</strong>mation that <strong>you</strong> should read and consider carefully be<strong>for</strong>e investing.<br />

2

Deciding what’s right <strong>for</strong> <strong>you</strong><br />

Considerations and questions to help <strong>you</strong> with <strong><strong>you</strong>r</strong> decision<br />

A good way to <strong>keep</strong> <strong><strong>you</strong>r</strong> retirement <strong>savings</strong> tax-deferred is to stay in <strong><strong>you</strong>r</strong><br />

current plan or roll over to an IRA (see “Consider a T. Rowe Price Rollover<br />

IRA,” p. 5). This table can help <strong>you</strong> weigh the pros and cons of each option:<br />

You’re not alone—<br />

Help is at hand<br />

See page 8 to learn how a T. Rowe Price<br />

Retirement Specialist can help <strong>you</strong><br />

understand <strong><strong>you</strong>r</strong> options and what<br />

steps may be right <strong>for</strong> <strong>you</strong>.<br />

Considerations<br />

Considerations<br />

Stay in the plan<br />

Stay tax-deferred<br />

Avoid current taxes and penalties<br />

Continue to enjoy the same tools, services, and<br />

investments <strong>you</strong>’ve come to know<br />

Continue with a low-cost provider<br />

Distributions and investments are based on <strong><strong>you</strong>r</strong><br />

plan’s provisions<br />

Could be <strong><strong>you</strong>r</strong> easiest option<br />

Ask <strong><strong>you</strong>r</strong>self<br />

Ask <strong><strong>you</strong>r</strong>self<br />

Do I want to continue investing with my current<br />

provider?<br />

Am I satisfied with my plan’s investment choices?<br />

Am I satisfied with my plan’s distribution policies?<br />

What to do<br />

What to do<br />

No action required<br />

If or when <strong><strong>you</strong>r</strong> needs change or to talk through<br />

<strong><strong>you</strong>r</strong> options in more detail, call T. Rowe Price at<br />

1-888-445-4226<br />

Roll over<br />

Stay tax-deferred<br />

Avoid current taxes and penalties<br />

Additional investment options available<br />

Consolidate <strong><strong>you</strong>r</strong> retirement <strong>savings</strong><br />

IRA<br />

Flexible IRA withdrawal options<br />

Continue with a low-cost provider<br />

New plan<br />

Loans may be available<br />

Should I roll over to an IRA or my new plan?<br />

How do I want to invest?<br />

Does a Rollover IRA meet my needs? (See p. 5)<br />

How do I choose an IRA provider? (See p. 4)<br />

How do I decide between a Roth and Traditional IRA?<br />

(See p. 4)<br />

Do I need an investment advisor? (See p. 5)<br />

Can I continue investing in my new account?<br />

Have I made Roth contributions to my plan?<br />

Does my new plan accept rollovers?<br />

Call T. Rowe Price at 1-888-445-4226<br />

Or<br />

Go online to rps.troweprice.com and click on the<br />

Distributions tab<br />

Cash out<br />

Tax consequences: Most distributions subject<br />

to 20% withholding<br />

Penalties: 10% early withdrawal penalty may<br />

apply to those under age 59½<br />

Provides immediate access to <strong>savings</strong><br />

Can roll over balance within 60 days<br />

Account balance, including any outstanding loans,<br />

taxed as current income in year of distribution<br />

Do I need my retirement <strong>savings</strong> now?<br />

How much money will I get?<br />

How will I be affected by taxes and potential penalties?<br />

Call T. Rowe Price at 1-888-445-4226<br />

3

About rollovers and IRAs<br />

What is a rollover?<br />

A rollover is when <strong><strong>you</strong>r</strong> retirement <strong>savings</strong> account is moved from <strong><strong>you</strong>r</strong> employer’s retirement<br />

plan to a Traditional IRA, Roth IRA, or another retirement plan.<br />

Here are some rollover considerations and guidelines:<br />

• An IRA (individual retirement account) is separate from <strong><strong>you</strong>r</strong> employer-sponsored plan.<br />

The fees, investment options, and distribution options are related to the plan or IRA that<br />

<strong>you</strong> choose.<br />

How to select an<br />

IRA provider<br />

Choosing an IRA provider may require some<br />

research. Consider these questions as <strong>you</strong><br />

evaluate providers:<br />

• What fees will I pay?<br />

• What will I get <strong>for</strong> those fees?<br />

• What types of investments are available?<br />

• What types of education and service<br />

are available?<br />

• What is the reputation of the provider?<br />

• How do the provider’s investments<br />

and services rate against other<br />

providers?<br />

• A rollover to a Traditional IRA or a new employer plan allows <strong>you</strong> to continue deferring<br />

taxes on <strong><strong>you</strong>r</strong> account and avoid current taxes and potential penalties.<br />

• You may consolidate <strong><strong>you</strong>r</strong> IRA and <strong><strong>you</strong>r</strong> previous employer retirement plan balance into<br />

one account and possibly continue contributing.<br />

• Your outstanding loan balance cannot be rolled into an IRA, nor may <strong>you</strong> take a new loan<br />

from an IRA. You may be able to take a loan from <strong><strong>you</strong>r</strong> new employer-sponsored plan,<br />

depending on the plan rules.<br />

What is the difference between a Traditional IRA and a Roth IRA?<br />

A Roth IRA is similar to a Traditional IRA but has some important tax differences. As a result,<br />

<strong>for</strong> some, a Roth IRA may be more advantageous than a Traditional IRA. For more in<strong>for</strong>mation,<br />

contact T. Rowe Price at 1-888-445-4226.<br />

Rollovers<br />

Traditional IRA<br />

• Standard contributions (non-Roth<br />

contributions) in <strong><strong>you</strong>r</strong> employersponsored<br />

plan can be rolled over<br />

to a Traditional IRA<br />

Roth IRA<br />

• Your total account balance in <strong><strong>you</strong>r</strong> employersponsored<br />

plan can be rolled over to a Roth IRA<br />

• There are income level requirements <strong>for</strong> rolling<br />

<strong><strong>you</strong>r</strong> non-Roth contribution account to a Roth IRA<br />

• If <strong>you</strong> wish to roll over non-Roth assets to a Roth<br />

IRA, <strong>you</strong> will have to pay taxes on that amount in<br />

the year <strong>you</strong> roll over to the Roth IRA<br />

Distributions •<br />

•<br />

Typically, withdrawals can begin<br />

penalty-free at age 59½<br />

Taxed at <strong><strong>you</strong>r</strong> ordinary income rate<br />

• Qualified withdrawals are tax-free if <strong>you</strong><br />

withdraw at least five years after <strong><strong>you</strong>r</strong> first<br />

Roth IRA contribution and reach other<br />

qualifying events (e.g., age 59½)<br />

upon withdrawal<br />

• Nondeductible contributions are<br />

typically withdrawn tax-free<br />

• Distributions are typically required<br />

to begin at age 70½<br />

• Nonqualified distributions may be subject to<br />

a penalty upon withdrawal<br />

4

Consider a T. Rowe Price<br />

Rollover IRA<br />

In times of change, sticking with who and what <strong>you</strong> know can be<br />

beneficial. By participating in <strong><strong>you</strong>r</strong> employer’s retirement plan, <strong>you</strong><br />

already know T. Rowe Price. So, if <strong>you</strong>’re thinking about rolling <strong><strong>you</strong>r</strong><br />

retirement <strong>savings</strong> into an IRA (individual retirement account),<br />

consider a T. Rowe Price IRA.<br />

It’s easy to roll over<br />

Initiate <strong><strong>you</strong>r</strong> rollover by phone with a Retirement Specialist<br />

at 1-888-445-4226. Or initiate a rollover online using the<br />

myRetirementPlan Web site. Go to rps.troweprice.com and<br />

click on the Distributions tab.<br />

If <strong>you</strong> want to continue saving <strong>for</strong> retirement in a tax-advantaged<br />

account, consider an IRA or Roth IRA at T. Rowe Price, and enjoy the<br />

following benefits:<br />

• Stay invested with a low-cost provider.<br />

• Maintain a similar investment lineup—or create a new one—<br />

with access to stocks, bonds, and mutual funds, including most<br />

company stock.<br />

• If <strong>you</strong> prefer, choose a one-step investment solution with a<br />

pre-assembled T. Rowe Price Retirement Fund that is<br />

professionally managed and adjusted over time <strong>for</strong> <strong>you</strong>—<br />

automatically. These funds invest in many underlying funds,<br />

which means they are exposed to the risks of different areas<br />

of the market.<br />

• Enjoy world-class service, investment management excellence,<br />

knowledgeable service representatives, and easy account access.<br />

• Get individualized guidance and advice including T. Rowe Price<br />

Advisory Planning Services (See p. 8).<br />

* Minimum balance to open a T. Rowe Price IRA is $1,000.<br />

Is an investment advisor or financial<br />

planner right <strong>for</strong> <strong>you</strong>?<br />

An investment advisor is paid to give advice on investing in stocks,<br />

bonds, or mutual funds. On the other hand, financial planners will<br />

help <strong>you</strong> assess other aspects of <strong><strong>you</strong>r</strong> financial life, including<br />

insurance, taxes, retirement, and estate planning.<br />

Once <strong>you</strong>’ve determined what kind of help <strong>you</strong> need, it’s important<br />

that <strong>you</strong> are com<strong>for</strong>table with a particular advisor or planner.<br />

Ask questions:<br />

• What are the person’s educational and professional credentials?<br />

• How many years has he or she been doing business in the<br />

community?<br />

• Can the person recommend a full range of financial products—<br />

or only those of a single company?<br />

• What—exactly—are the payment terms? Hourly? Annual<br />

management fee? Commission on services? A combination?<br />

Understand the arrangement up front, and feel com<strong>for</strong>table<br />

with it.<br />

Can T. Rowe Price meet <strong><strong>you</strong>r</strong> needs?<br />

Some IRA providers offer services that meet <strong><strong>you</strong>r</strong> needs at no<br />

additional cost to <strong>you</strong>. Contact T. Rowe Price to learn more about<br />

the services and assistance that are available.<br />

5

Rules of thumb <strong>for</strong> different<br />

Life Stages<br />

Depending on which life stage <strong>you</strong> may be facing, <strong>you</strong> have different<br />

decisions to make about how to handle <strong><strong>you</strong>r</strong> retirement account.<br />

Your decisions now could have a significant impact on the quality<br />

of <strong><strong>you</strong>r</strong> retirement. Here are some tips <strong>for</strong> each stage of <strong><strong>you</strong>r</strong><br />

retirement planning.<br />

Life Stage: You’re Changing Jobs<br />

Stay tax-deferred and <strong>keep</strong> saving!<br />

• Keep <strong><strong>you</strong>r</strong> retirement account tax-deferred<br />

• Continue saving <strong>for</strong> retirement, in an IRA or a new employer’s plan<br />

• Consider consolidating <strong><strong>you</strong>r</strong> <strong>savings</strong> into one IRA<br />

• Consider investing <strong>for</strong> growth to allow <strong><strong>you</strong>r</strong> account to build<br />

be<strong>for</strong>e <strong>you</strong> need to tap into it<br />

Life Stage: You’re Changing Jobs and Nearing<br />

Retirement (age 50+)<br />

Stay on course!<br />

• Calculate <strong><strong>you</strong>r</strong> income sources and needs at retirement<br />

• Save more, making additional catch-up or IRA contributions,<br />

if needed<br />

• Develop an investment strategy based on <strong><strong>you</strong>r</strong> time horizon<br />

• Pay down <strong><strong>you</strong>r</strong> debts<br />

Develop a retirement income<br />

strategy<br />

Your retirement <strong>savings</strong> will become <strong><strong>you</strong>r</strong><br />

retirement income<br />

It’s helpful to think about <strong><strong>you</strong>r</strong> retirement <strong>savings</strong> in terms of being<br />

the money <strong>you</strong>’ll need to replace the regular paycheck <strong>you</strong>’ve always<br />

relied on. This is known as <strong><strong>you</strong>r</strong> retirement income.<br />

To maintain a familiar lifestyle in <strong><strong>you</strong>r</strong> retirement, financial experts<br />

estimate that <strong>you</strong>’ll need to replace approximately 75% of <strong><strong>you</strong>r</strong> preretirement<br />

income each year.<br />

For example, if <strong>you</strong>’re earning $50,000 the day be<strong>for</strong>e <strong>you</strong> retire,<br />

it’s estimated that <strong>you</strong>’ll need approximately $37,500 from various<br />

income sources (e.g., retirement <strong>savings</strong>, Social Security, other income)<br />

during the first year of <strong><strong>you</strong>r</strong> retirement to live the way <strong>you</strong>’re used to.<br />

When <strong>you</strong> retire, follow a careful<br />

withdrawal strategy<br />

Your retirement could last up to 30 years or longer. That’s a long time<br />

to stretch <strong><strong>you</strong>r</strong> retirement <strong>savings</strong>. Financial experts generally recommend<br />

<strong>you</strong> base <strong><strong>you</strong>r</strong> first year’s withdrawal on <strong><strong>you</strong>r</strong> age, increasing<br />

that dollar amount by 3% every year to account <strong>for</strong> inflation. For<br />

example, if <strong>you</strong> are age 65 and <strong><strong>you</strong>r</strong> combined assets total $500,000,<br />

<strong>you</strong> could withdraw 4%, or $20,000, in <strong><strong>you</strong>r</strong> first year of retirement,<br />

$20,600 in <strong><strong>you</strong>r</strong> second year (a 3% increase over $20,000), $21,218 in<br />

<strong><strong>you</strong>r</strong> third year, and so on.<br />

Age<br />

60-64<br />

Initial withdrawal amount<br />

(% of ending balance)<br />

3.5%<br />

• Know <strong><strong>you</strong>r</strong> distribution options<br />

• Think about when to begin taking benefits<br />

Life Stage: You’re Retiring<br />

65-69<br />

70-74<br />

75-79<br />

4%<br />

5%<br />

6%<br />

Congratulations! Make it last.<br />

• Establish a withdrawal strategy<br />

• Revisit <strong><strong>you</strong>r</strong> investment allocation regularly<br />

• Decide what age to start collecting Social Security<br />

• Begin taking required minimum distributions at age 70½<br />

• Set aside a portion of <strong><strong>you</strong>r</strong> total <strong>savings</strong> <strong>for</strong> emergencies<br />

80-84<br />

85+<br />

7%<br />

10%<br />

Of course, don’t tap into <strong><strong>you</strong>r</strong> retirement <strong>savings</strong> until <strong>you</strong> need to—<br />

even if that is years after <strong>you</strong> retire. Your initial withdrawal amount is<br />

based on the age when <strong>you</strong> start withdrawing, not necessarily the<br />

age in which <strong>you</strong> retire.<br />

And remember, things come up. Plan on putting aside at least three<br />

to six months of living expenses <strong>for</strong> un<strong>for</strong>eseen emergencies.<br />

6

Distribution order matters<br />

In general, it may be best to withdraw from taxable accounts first.<br />

That way the money in tax-deferred accounts has a chance to<br />

continue growing without being taxed. Go about <strong><strong>you</strong>r</strong> withdrawals<br />

in this order (after any required minimum distributions):<br />

• Taxable accounts<br />

• Tax-deferred account, such as <strong><strong>you</strong>r</strong> retirement plan<br />

• Tax-free accounts, such as after-tax contributions in an IRA,<br />

a Roth 401(k), or a Roth IRA<br />

Keep a substantial amount invested in stocks<br />

Even in retirement, <strong>you</strong> should maintain a mix of investments that<br />

is based on <strong><strong>you</strong>r</strong> time horizon. Retirement could last a long time, and<br />

it’s important to <strong>keep</strong> <strong><strong>you</strong>r</strong> money growing so that <strong>you</strong> can <strong>keep</strong> pace<br />

with inflation as well as expenses like health care.<br />

The T. Rowe Price Retirement Funds can help <strong>you</strong> stay invested in<br />

stocks and shift toward less aggressive investments automatically<br />

over time. Consider them as part of <strong><strong>you</strong>r</strong> investment strategy—either<br />

within <strong><strong>you</strong>r</strong> plan (if available), or as part of an IRA Rollover<br />

with T. Rowe Price.<br />

A word about company stock<br />

If <strong>you</strong> own company stock as part of <strong><strong>you</strong>r</strong> retirement <strong>savings</strong>,<br />

consider this: Company stock is one of the most potentially volatile<br />

investments. You don’t want too much of <strong><strong>you</strong>r</strong> retirement nest egg<br />

riding on one investment. As a rule of thumb, company stock should<br />

not make up more than 10% of <strong><strong>you</strong>r</strong> retirement <strong>savings</strong>.<br />

If company stock is part of <strong><strong>you</strong>r</strong> retirement <strong>savings</strong>, and <strong>you</strong>’re<br />

considering taking a distribution, <strong>you</strong> may have additional options.<br />

Be<strong>for</strong>e making a decision concerning any company stock in <strong><strong>you</strong>r</strong><br />

employer plan, we recommend <strong>you</strong> get professional advice.<br />

A word about loans<br />

If <strong>you</strong> have an outstanding loan, <strong>you</strong> need to understand how the<br />

loan impacts <strong><strong>you</strong>r</strong> distribution decision. The loan is considered part of<br />

<strong><strong>you</strong>r</strong> account balance, so if <strong>you</strong> take a distribution from the plan, the<br />

amount of the loan will be treated as income.<br />

Here are some considerations on how to handle <strong><strong>you</strong>r</strong> outstanding<br />

loan, depending on <strong><strong>you</strong>r</strong> plan’s provisions:<br />

• You may be able to stay in the plan, and determine how and if<br />

<strong>you</strong> can continue paying off the loan.<br />

• If <strong>you</strong> would like to roll over or take a distribution, consider paying<br />

off the loan first to avoid taxes and penalties on the loan amount.<br />

7

Helpful resources from<br />

T. Rowe Price<br />

Let a T. Rowe Price Retirement Specialist<br />

help <strong>you</strong><br />

You don’t have to make <strong><strong>you</strong>r</strong> decisions alone. We understand <strong><strong>you</strong>r</strong> needs and can help <strong>you</strong> make<br />

in<strong>for</strong>med choices. Here’s what an experienced Retirement Specialist can do <strong>for</strong> <strong>you</strong>:<br />

• Help <strong>you</strong> move <strong><strong>you</strong>r</strong> plan account balance from <strong><strong>you</strong>r</strong> employer’s plan to a T. Rowe Price<br />

Rollover IRA<br />

• Provide assistance with <strong><strong>you</strong>r</strong> investment choices<br />

• Answer questions about our many no-load mutual funds, products, and services<br />

• Direct <strong>you</strong> to our free online calculators and planning tools<br />

• Help make every step of <strong><strong>you</strong>r</strong> investing experience easier<br />

Help <strong><strong>you</strong>r</strong>self with our online tools<br />

Visit the T. Rowe Price myRetirementPlan Web site at rps.troweprice.com <strong>for</strong> tips, calculators,<br />

worksheets, analyzers, and much more. You’ll also find free Morningstar tools that can help <strong>you</strong><br />

choose and track <strong><strong>you</strong>r</strong> investments.<br />

Click on the Distributions tab to find:<br />

• T. Rowe Price myDistributionGuide—a step-by-step, interactive guide lets <strong>you</strong> evaluate <strong><strong>you</strong>r</strong><br />

distribution options. You can even create an action plan that’s based on <strong><strong>you</strong>r</strong> answers to a<br />

few basic questions.<br />

• How to start the rollover process online—follow the steps to establish a T. Rowe Price<br />

Rollover IRA.<br />

Click on the Advice and Tools tabs to find:<br />

• Retirement income estimator—estimate of how much <strong>you</strong> may receive each month in<br />

retirement based on current retirement balances, <strong>savings</strong> rates, age, and Social Security<br />

estimates.<br />

• Distribution calculator—the cost of taking an immediate cash distribution versus <strong>keep</strong>ing<br />

<strong><strong>you</strong>r</strong> money in a tax-deferred account.<br />

• Retirement budget calculator—walks <strong>you</strong> through a step-by-step analysis of <strong><strong>you</strong>r</strong> current<br />

budget, and then, with the help of some current retirees, helps <strong>you</strong> estimate how each of<br />

<strong><strong>you</strong>r</strong> expenses might change in retirement.<br />

Advice and guidance<br />

T. Rowe Price has many tools to help <strong>you</strong> select the appropriate investment strategy <strong>for</strong> <strong>you</strong>. Our<br />

Retirement Specialists and online tools can assist <strong>you</strong>. In addition, T. Rowe Price Advisory Planning<br />

Services* provide helpful investment planning, including a complimentary portfolio analysis and<br />

investment guidance <strong>for</strong> IRA shareholders. Call a Retirement Specialist at 1-888-445-4226 <strong>for</strong> more<br />

in<strong>for</strong>mation or to determine what type of assistance meets <strong><strong>you</strong>r</strong> needs.<br />

*Services of T. Rowe Price Associates, Inc., a federally registered investment advisor. There may be costs<br />

associated with these services.<br />

8

Let T. Rowe Price help <strong>keep</strong><br />

<strong><strong>you</strong>r</strong> money <strong>working</strong> <strong>for</strong> <strong>you</strong><br />

By phone: Call toll-free at 1-888-445-4226. You can speak with an<br />

experienced Retirement Specialist during business days<br />

from 7 a.m. to 10 p.m. eastern time.<br />

Online:<br />

Visit the myRetirementPlan Web site at rps.troweprice.com.<br />

Click on the Distributions tab <strong>for</strong> more in<strong>for</strong>mation and helpful tools.<br />

T. Rowe Price Retirement Plan Services, Inc., its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this brochure is not intended or<br />

written to be used, and cannot be used, <strong>for</strong> the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter<br />

addressed herein. Please consult <strong><strong>you</strong>r</strong> independent legal counsel and/or professional tax advisor regarding any legal or tax issues raised in this brochure.

T. Rowe Price Investment Services, Inc., distributor, T. Rowe Price mutual funds.<br />

06181-282 DMB260-DIST 1/09<br />

74279