Login to T. Rowe Price

Login to T. Rowe Price

Login to T. Rowe Price

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

T. <strong>Rowe</strong> <strong>Price</strong><br />

Retirement Funds Investment Review<br />

Presented by:<br />

Jerome Clark, CFA<br />

Portfolio Manager<br />

February 11, 2009<br />

Wyatt Lee, CFA<br />

Investment Analyst<br />

Webinar Dial-In: 1-877-407-6910<br />

Passcode: T. <strong>Rowe</strong> <strong>Price</strong><br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Today’s Agenda<br />

I. Introduction<br />

II.<br />

T. <strong>Rowe</strong> <strong>Price</strong> Target Date Overview<br />

III. Case for Target Date Equity Exposure<br />

IV.<br />

2008 Retirement Fund Performance and Attribution<br />

V. Questions<br />

2<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Biographical Backgrounds<br />

Jerome A. Clark, CFA<br />

Jerome Clark is a vice president of T. <strong>Rowe</strong> <strong>Price</strong> Group, Inc., T. <strong>Rowe</strong> <strong>Price</strong> Associates, Inc., and a<br />

portfolio manager in the Asset Allocation Group. He manages the Program for Charitable Giving<br />

portfolios, College Savings Plan portfolios, and the T. <strong>Rowe</strong> <strong>Price</strong> Retirement Funds. Jerome is a<br />

vice president of the Personal Strategy Funds and an Investment Advisory Committee member of<br />

the Spectrum Funds. He is also a member of the Asset Allocation Committee. Prior <strong>to</strong> joining the<br />

firm in 1992, Jerome was a Captain in the United States Marine Corps and spent three years as a<br />

mathematics instruc<strong>to</strong>r at the U.S. Naval Academy. He earned a B.S. in mathematics from the<br />

U.S. Naval Academy, an M.S. in operations research from the Naval Postgraduate School, and an<br />

M.B.A. in finance from Johns Hopkins University. Jerome has also achieved the Chartered<br />

Financial Analyst accreditation.<br />

Wyatt A. Lee, CFA<br />

Wyatt Lee is a vice president of T. <strong>Rowe</strong> <strong>Price</strong> Associates, Inc. and is an investment analyst in the<br />

Asset Allocation Group. Previously, Wyatt was based in T. <strong>Rowe</strong> <strong>Price</strong>’s London office and was<br />

responsible for developing a portfolio and performance analysis function <strong>to</strong> focus on non-U.S.<br />

equity strategies. He has also managed a team of investment performance analysts in the Equity<br />

Division. Prior <strong>to</strong> joining the firm in 1999, he was a research analyst for Summit Strategies<br />

Group, an institutional investment consultant. He earned a B.Sc. in mathematics and political<br />

science, cum laude, from Vanderbilt University and an M.B.A. in finance from the Olin School of<br />

Business at Washing<strong>to</strong>n University, where he was a Charles F. Knight Scholar. Wyatt has also<br />

achieved the Chartered Financial Analyst accreditation.<br />

3<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

T. <strong>Rowe</strong> <strong>Price</strong> Target Date Overview<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

T. <strong>Rowe</strong> <strong>Price</strong> Asset Allocation Snapshot<br />

Asset Allocation Assets Under Management: $46.2 Billion 1<br />

As of December 31, 2008<br />

1 The combined asset allocation assets under management of the T. <strong>Rowe</strong> <strong>Price</strong> group of companies. The t. <strong>Rowe</strong> <strong>Price</strong> group of<br />

companies includes T. <strong>Rowe</strong> <strong>Price</strong> Associates, Inc., T. <strong>Rowe</strong> <strong>Price</strong> international, Inc., T. <strong>Rowe</strong> <strong>Price</strong> Global Investment Services<br />

Limited, and T. <strong>Rowe</strong> <strong>Price</strong> (Canada), Inc.<br />

5<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Retirement Funds Investment Philosophy<br />

6<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Retirement Funds Glidepath<br />

7<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Retirement Funds Performance<br />

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal<br />

value, and return will vary, and you may have a gain or loss when you sell your shares. To obtain the most recent month-end performance, call<br />

1-800-638-7890.<br />

Request a prospectus, which includes investment objectives, risks, fees, expenses, and other information that you should read and consider<br />

carefully before investing<br />

Effective May 31, 2008, the broad weighted index for each fund changed <strong>to</strong> include the Russell 3000 Index, MSCI All Country World Ex U.S.<br />

Index, the Barclays Capital U.S. Aggregate Index, and the Citigroup 3-Month Treasury Bill Index. Prior <strong>to</strong> this change, the broad weighted<br />

index for each fund was comprised of the Dow Jones Wilshire 5000 Composite Index, the MSCI EAFE Index, the Barclays Capital U.S.<br />

Aggregate Index, and the Citigroup 3-Month Treasury Bill Index. Each index is weighted at the appropriate strategic neutral allocation of<br />

its respective asset class, which is predetermined and changes over time. His<strong>to</strong>rical benchmark representations have not been restated.<br />

The most recent mix of underlying indices as of December 31, 2008 can be found on page 29.<br />

Figures include changes in principal value, reinvested dividends, and capital gain distributions.<br />

8<br />

T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc., Distribu<strong>to</strong>r.<br />

For Institutional Inves<strong>to</strong>r Use Only<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.

Peer Group Performance Comparison<br />

9<br />

Fund Returns have been affected by market volatility and are negative for certain periods.<br />

Results will vary for other periods, and all funds are subject <strong>to</strong> market risk. Past performance cannot guarantee future results.<br />

Lipper rankings are based on cumulative <strong>to</strong>tal return.<br />

Source: Lipper, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.

Peer Group Comparison<br />

Fund Returns have been affected by market volatility and are negative for certain periods.<br />

Results will vary for other periods, and all funds are subject <strong>to</strong> market risk. Past performance cannot guarantee future results.<br />

Lipper rankings are based on cumulative <strong>to</strong>tal return.<br />

10<br />

Source: Lipper, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.

Case for Target Date Equity Exposure<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Case for Target Date Equity Exposure<br />

• Target-date products are designed for inves<strong>to</strong>rs with a very diverse set of<br />

retirement needs.<br />

• T. <strong>Rowe</strong> <strong>Price</strong> target-date products are designed <strong>to</strong> provide assets from which <strong>to</strong><br />

draw retirement income over a long horizon. We recognize few inves<strong>to</strong>rs need all<br />

their assets at retirement.<br />

• Under conservative retirement assumptions, most asset allocation strategies result<br />

in successful retirement outcomes.<br />

• Higher equity allocation is especially important <strong>to</strong> compensate for under-saving and<br />

over-withdrawing behavior seen among plan participants.<br />

• An extended glidepath design maintains the potential benefits of equity exposure in<br />

retirement while re-distributing risk across the lifetime of the fund.<br />

We believe adequate equity exposure and an extended glidepath best position<br />

inves<strong>to</strong>rs for a successful retirement.<br />

12<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Plan Participant Behavior<br />

Savings Rate<br />

Withdrawal Rate<br />

>15%<br />

8.8%<br />

9-10%<br />

3.2% - Employer<br />

Contribution 2<br />

5.6% - Employee<br />

Contribution 3<br />

4%<br />

Recommended Actual 1<br />

Recommended Actual 4<br />

1 Profit sharing/401(k) Council of America 51 st annual series (9/2008).<br />

2 Non-highly compensated workers.<br />

3 401(k) plan only.<br />

4 T. <strong>Rowe</strong> <strong>Price</strong> plans (60-69 years old with installment sales).<br />

Participant behavior is typically <strong>to</strong> under-save and over-withdraw.<br />

13<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Longevity: Underlying Driver of Retirement Risk<br />

Odds of at Least One Member of a 65-Year-Old Couple Living <strong>to</strong> Age….<br />

Retirees face an increasing risk of “living <strong>to</strong>o long” rather than “dying <strong>to</strong> soon.”<br />

14<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Importance of Equity Exposure <strong>to</strong> Minimize Risk of Outliving Assets<br />

Likelihood that payment stream duration exceeds 30 years<br />

100<br />

Stimulation Success Rate (%)<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

4% annual withdrawal<br />

5% annual withdrawal<br />

6% annual withdrawal<br />

8% annual withdrawal<br />

1<br />

1<br />

1<br />

1<br />

0<br />

100% Fixed Income 20% Equity/ 80%<br />

Fixed Income<br />

40% Equity/ 60%<br />

Fixed Income<br />

60% Equity/ 40%<br />

Fixed Income<br />

80% Equity/ 20%<br />

Fixed Income<br />

100% Equity<br />

• Virtually all asset allocations support a recommended 4% withdrawal rate with 90% success.<br />

• Higher (5% and above) withdrawal rates benefit from higher equity allocations.<br />

Adequate equity exposure is necessary <strong>to</strong> successfully fund long retirement horizons.<br />

15<br />

1 Withdrawal increases annually by 3%.<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Importance of Equity Exposure for Balances Late in Retirement<br />

250<br />

Purchasing Power Remaining 30 Years Post-Retirement<br />

Purchasing Power Remaining (%)<br />

200<br />

150<br />

100<br />

50<br />

0<br />

100% Fixed<br />

Income<br />

20% Equity/<br />

80% Fixed<br />

Income<br />

40% Equity/<br />

60% Fixed<br />

Income<br />

60% Equity/<br />

40% Fixed<br />

Income<br />

80% Equity/<br />

20% Fixed<br />

Income<br />

100% Equity<br />

Median Purchasing Power Remaining,<br />

4% initial withdrawal1<br />

25th percentile Purchasing Power<br />

Remaining, 4% initial withdrawal<br />

1<br />

Median Purchasing Power Remaining,<br />

6% initial withdrawal1<br />

25th percentile Purchasing Power<br />

Remaining, 6% initial withdrawal 1<br />

• Purchasing power remaining is an indication of the cushion provided.<br />

• Remaining purchasing power universally increases with equity.<br />

Equity exposure in retirement can help provide a cushion against unplanned events.<br />

16<br />

1 Withdrawal increases annually by 3%.<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Consideration of Downside at Retirement<br />

Likelihood of Annual Return Less Than<br />

20<br />

Probability (%)<br />

16<br />

12<br />

8<br />

100% Fixed Income<br />

20% Equity/80% Fixed Income<br />

40% Equity/60% Fixed Income<br />

60% Equity/40% Fixed Income<br />

80% Equity/20% Fixed Income<br />

100% Equity<br />

4<br />

0<br />

-5%<br />

-10%<br />

The risk of significant negative market returns should be taken in<strong>to</strong> consideration.<br />

17<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Distribution<br />

A glidepath design maintains potential benefits of equity in retirement,<br />

while re-distributing the risk.<br />

1 55-20 Glidepath represents a 55% Equity/45% Fixed Income allocation at retirement that linearly decreases<br />

equity exposure over 30 years. The final allocation is 20% Equity/80% Fixed Income.<br />

18<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

His<strong>to</strong>rical Analysis of Alternative Glidepaths<br />

$10,000,000<br />

Resulting Value of $1MM Investment at Retirement 1<br />

30-Year Horizon, 4% Initial Withdrawal, Inflation Adjusted 2<br />

$8,000,000<br />

$6,000,000<br />

$4,000,000<br />

$2,000,000<br />

$0<br />

-$2,000,000<br />

12/55 12/60 12/65 12/70 12/75 12/80 12/85 12/90 12/95 12/00 12/05<br />

12/08<br />

T. <strong>Rowe</strong> <strong>Price</strong> Glidepath Balance 10% Equity <strong>to</strong> Fixed Income Balance 20% Equity <strong>to</strong> Fixed Income Balance<br />

3 4 5<br />

19<br />

Equity = S&P 500 Index, Fixed Income = 1926-1972 U.S. IT Gov’t Index; 1973-1975 LB Gov’t/Corp Index; 1976-Present Barclays U.S. Aggregate Index<br />

(formerly Lehman Brothers U.S. Aggregate Index), Cash = U.S. 30 Day T-Bills.<br />

1 Positive balances reflect surplus assets at the end of a 30-year retirement horizon. Negative balances reflect the shortfall amount needed <strong>to</strong> fund the<br />

specified withdrawals.<br />

2 Assumes withdrawal increases annually by the % change in the Consumer <strong>Price</strong> Index for all Urban Consumers (CPI-U), not seasonally adjusted (if<br />

greater than 0% (if annual % change of CPI-U is negative).<br />

3 See p. 7 for T. <strong>Rowe</strong> <strong>Price</strong> Glidepath.<br />

4 T. <strong>Rowe</strong> <strong>Price</strong> Glidepath with equity allocation reduced by 10% and fixed-income allocation increased by 10%, with minimum equity allocation of 20%.<br />

5 T. <strong>Rowe</strong> <strong>Price</strong> Glidepath with equity allocation reduced by 20% and fixed-income allocation increased by 20%, with minimum equity<br />

allocation of 20%.<br />

Source: Ibbotson Associates, T. <strong>Rowe</strong> <strong>Price</strong>.<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

His<strong>to</strong>rical Analysis of Alternative Glidepaths<br />

$3,500,000<br />

$3,000,000<br />

$2,500,000<br />

$2,000,000<br />

$1,500,000<br />

$1,000,000<br />

$500,000<br />

$0<br />

-$500,000<br />

Difference in Resulting Value of $1MM Investment at Retirement 1<br />

30-Year Horizon, 4% Initial Withdrawal, Inflation Adjusted 2<br />

12/55 12/60 12/65 12/70 12/75 12/80 12/85 12/90 12/95 12/00 12/05 12/08<br />

T. <strong>Rowe</strong> <strong>Price</strong> Glidepath Balance vs. 10% Equity <strong>to</strong> Fixed Income Balance<br />

T. <strong>Rowe</strong> <strong>Price</strong> Glidepath Balance vs. 20% Equity <strong>to</strong> Fixed Income Balance<br />

1 Positive differences reflect higher ending assets in T. <strong>Rowe</strong> <strong>Price</strong> Glidepath. Negative differences reflect<br />

lower ending assets in T. <strong>Rowe</strong> <strong>Price</strong> Glidepath.<br />

2 Assumes withdrawal increases annually by the %change in the Consumer <strong>Price</strong> Index for all Urban Consumers (CPI-U),<br />

not seasonally adjusted (if greater than 0% (if annual % change of CPI-U is negative).<br />

Source: Ibbotson Associates, T. <strong>Rowe</strong> <strong>Price</strong>.<br />

20<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Accumulation<br />

Equity = S&P 500 Index, Fixed Income = 1968-1972 U.S. IT Gov’t Index; 1973-1975 LB Gov’t/Corp Index; 1976-Present Barclays U.S.<br />

Aggregate Index (formerly Lehman Brothers U.S. Aggregate Index).<br />

Source: Ibbotson Associates, T. <strong>Rowe</strong> <strong>Price</strong>.<br />

Assuming contribution rate = 9%, starting salary = $50,000, and final salary = $50,000*1.03^39.<br />

21<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

2008 Retirement Fund Performance & Attribution<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Retirement Funds Performance Relative <strong>to</strong> Benchmark<br />

Effective May 31, 2008, the broad weighted index for each fund changed <strong>to</strong> include the Russell 3000 Index, MSCI All Country World Ex U.S. Index, the Barclays<br />

Capital U.S. Aggregate Index, and the Citigroup 3-Month Treasury Bill Index. Prior <strong>to</strong> this change, the broad weighted index for each fund was comprised of the<br />

Dow Jones Wilshire 5000 Composite Index, the MSCI EAFE Index, the Barclays Capital U.S. Aggregate Index, and the Citigroup 3-Month Treasury Bill Index.<br />

Each index is weighted at the appropriate strategic neutral allocation of its respective asset class, which is predetermined and changes over time. His<strong>to</strong>rical<br />

benchmark representations have not been restated.<br />

The most recent mix of underlying indices as of December 31, 2008 can be found on page 29.<br />

Past performance cannot guarantee future results.<br />

23<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Retirement Funds 1 Sources of Value Added – Total Fund<br />

1 The funds’ investment in many underlying funds means that they will be exposed <strong>to</strong> the risks of different areas of the market. Inves<strong>to</strong>rs should note that the higher the fund’s<br />

allocation <strong>to</strong> s<strong>to</strong>cks, the greater the risk.<br />

Value Added: the performance difference between the portfolio and its cus<strong>to</strong>m benchmark.<br />

Structural Effect: the impact of any differences between the portfolio's strategic neutral design and its benchmark, including the use of investment sec<strong>to</strong>rs that are not<br />

represented in the benchmark, and the performance differences between an asset class and the underlying investment sec<strong>to</strong>rs chosen <strong>to</strong> represent it.<br />

Allocation Effect: the aggregate performance impact of differences in the portfolio asset classes & sec<strong>to</strong>r weights relative <strong>to</strong> their blended sec<strong>to</strong>r benchmarks.<br />

Selection Effect: the aggregate impact of the performance difference between the underlying sec<strong>to</strong>r portfolios and their respective sec<strong>to</strong>r indices.<br />

Cash Flow & Rebalancing: the impact of intra-month cash flows and rebalancing transactions.<br />

Performance used in calculations are net of fees.<br />

Numbers may not add <strong>to</strong> 100% due <strong>to</strong> rounding; all numbers are percentages.<br />

Analysis represents the <strong>to</strong>tal fund performance of each fund relative <strong>to</strong> its respective broad weighted benchmark as calculated by T. <strong>Rowe</strong> <strong>Price</strong>’s proprietary attribution<br />

model, and includes all underlying mutual funds.<br />

Figures shown are net of fees.<br />

24 Past performance cannot guarantee future results.<br />

For Institutional Inves<strong>to</strong>r Use Only<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.

Retirement Funds Major Contribu<strong>to</strong>rs & Detrac<strong>to</strong>rs<br />

Structural Effect and Allocation Effect<br />

One Year Ending December 31, 2008<br />

25<br />

Totals for each effect may not be equivalent <strong>to</strong> underlying component pieces due <strong>to</strong> the exclusion of component effects that can be<br />

considered immaterial in size.<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Retirement Funds Major Contribu<strong>to</strong>rs & Detrac<strong>to</strong>rs<br />

Security Selection Effect<br />

One Year Ending December 31, 2008<br />

1 Represents International S<strong>to</strong>ck Fund, International Growth & Income Fund, and Overseas S<strong>to</strong>ck Fund.<br />

Totals for each effect may not be equivalent <strong>to</strong> underlying component pieces due <strong>to</strong> the exclusion of component effects that can<br />

26<br />

be considered immaterial in size.<br />

For Institutional Inves<strong>to</strong>r Use Only<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.

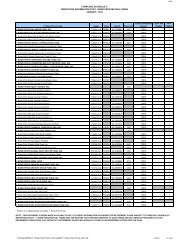

Retirement Funds Benchmark Allocations<br />

27<br />

Effective May 31, 2008, the broad weighted index for each fund changed <strong>to</strong> include the Russell 3000 Index, MSCI All Country World Ex U.S. Index, the Barclays<br />

Capital U.S. Aggregate Index, and the Citigroup 3-Month Treasury Bill Index. Prior <strong>to</strong> this change, the broad weighted index for each fund was comprised of the<br />

Dow Jones Wilshire 5000 Composite Index, the MSCI EAFE Index, the Barclays Capital U.S. Aggregate Index, and the Citigroup 3-Month Treasury Bill Index. Each<br />

index is weighted at the appropriate strategic neutral allocation of its respective asset class, which is predetermined and changes over time. His<strong>to</strong>rical benchmark<br />

representations have not been restated.<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Overview of Monte Carlo Analysis<br />

28<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only

Overview of Monte Carlo Analysis<br />

29<br />

82288 2/09<br />

Copyright 2009. T. <strong>Rowe</strong> <strong>Price</strong> Investment Services, Inc.<br />

For Institutional Inves<strong>to</strong>r Use Only