Korea

SSmsV

SSmsV

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Country starter pack<br />

Business practicalities in <strong>Korea</strong><br />

63<br />

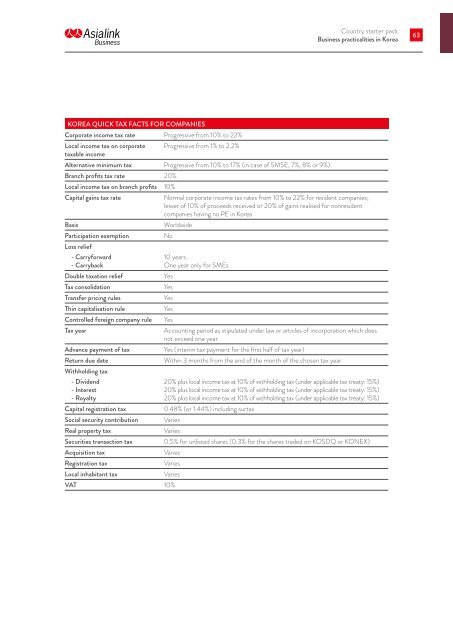

KOREA QUICK TAX FACTS FOR COMPANIES<br />

Corporate income tax rate Progressive from 10% to 22%<br />

Local income tax on corporate Progressive from 1% to 2.2%<br />

taxable income<br />

Alternative minimum tax Progressive from 10% to 17% (in case of SMSE, 7%, 8% or 9%)<br />

Branch profits tax rate 20%<br />

Local income tax on branch profits 10%<br />

Capital gains tax rate<br />

Normal corporate income tax rates from 10% to 22% for resident companies;<br />

lesser of 10% of proceeds received or 20% of gains realised for nonresident<br />

companies having no PE in <strong>Korea</strong><br />

Basis<br />

Worldwide<br />

Participation exemption<br />

No<br />

Loss relief<br />

- Carryforward<br />

- Carryback<br />

Double taxation relief<br />

Tax consolidation<br />

Transfer pricing rules<br />

Thin capitalisation rule<br />

Controlled foreign company rule<br />

Tax year<br />

10 years<br />

One year only for SMEs<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Accounting period as stipulated under law or articles of incorporation which does<br />

not exceed one year<br />

Yes (interim tax payment for the first half of tax year)<br />

Within 3 months from the end of the month of the chosen tax year<br />

Advance payment of tax<br />

Return due date<br />

Withholding tax<br />

- Dividend<br />

20% plus local income tax at 10% of withholding tax (under applicable tax treaty: 15%)<br />

- Interest<br />

20% plus local income tax at 10% of withholding tax (under applicable tax treaty: 15%)<br />

- Royalty<br />

20% plus local income tax at 10% of withholding tax (under applicable tax treaty: 15%)<br />

Capital registration tax<br />

0.48% (or 1.44%) including surtax<br />

Social security contribution Varies<br />

Real property tax<br />

Varies<br />

Securities transaction tax<br />

0.5% for unlisted shares (0.3% for the shares traded on KOSDQ or KONEX)<br />

Acquisition tax<br />

Varies<br />

Registration tax<br />

Varies<br />

Local inhabitant tax<br />

Varies<br />

VAT 10%