You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

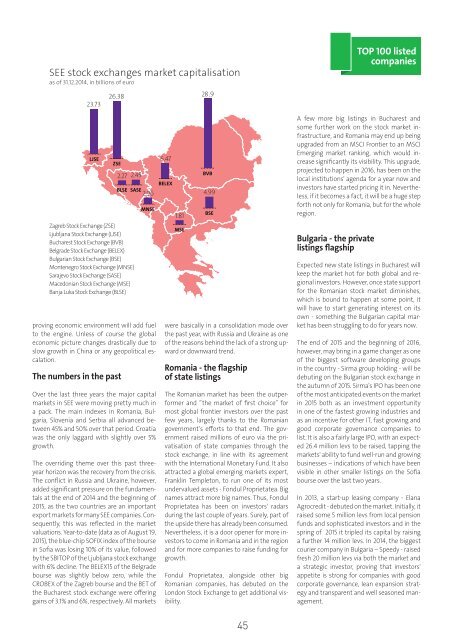

SEE stock exchanges market capitalisation<br />

as of 31.12.2014, in billions of euro<br />

23.73<br />

LJSE<br />

26.38<br />

ZSE<br />

proving economic environment will add fuel<br />

to the engine. Unless of course the global<br />

economic picture changes drastically due to<br />

slow growth in China or any geopolitical escalation.<br />

The numbers in the past<br />

2.27 2.45<br />

BLSE SASE<br />

2.96<br />

Zagreb Stock Exchange (ZSE)<br />

Ljubljana Stock Exchange (LJSE)<br />

Bucharest Stock Exchange (BVB)<br />

Belgrade Stock Exchange (BELEX)<br />

Bulgarian Stock Exchange (BSE)<br />

Montenegro Stock Exchange (MNSE)<br />

Sarajevo Stock Exchange (SASE)<br />

Macedonian Stock Exchange (MSE)<br />

Banja Luka Stock Exchange (BLSE)<br />

MNSE<br />

Over the last three years the major capital<br />

markets in SEE were moving pretty much in<br />

a pack. The main indexes in Romania, Bulgaria,<br />

Slovenia and Serbia аll advanced between<br />

45% and 50% over that period. Croatia<br />

was the only laggard with slightly over 5%<br />

growth.<br />

The overriding theme over this past threeyear<br />

horizon was the recovery from the crisis.<br />

The conflict in Russia and Ukraine, however,<br />

added significant pressure on the fundamentals<br />

at the end of 2014 and the beginning of<br />

2015, as the two countries are an important<br />

export markets for many SEE companies. Consequently,<br />

this was reflected in the market<br />

valuations. Year-to-date (data as of August 19,<br />

2015), the blue-chip SOFIX index of the bourse<br />

in Sofia was losing 10% of its value, followed<br />

by the SBITOP of the Ljubljana stock exchange<br />

with 6% decline. The BELEX15 of the Belgrade<br />

bourse was slightly below zero, while the<br />

CROBEX of the Zagreb bourse and the BET of<br />

the Bucharest stock exchange were offering<br />

gains of 3.1% and 6%, respectively. All markets<br />

6.47<br />

BELEX<br />

1.81<br />

MSE<br />

28 .9<br />

BVB<br />

4.99<br />

BSE<br />

were basically in a consolidation mode over<br />

the past year, with Russia and Ukraine as one<br />

of the reasons behind the lack of a strong upward<br />

or downward trend.<br />

Romania - the flagship<br />

of state listings<br />

The Romanian market has been the outperformer<br />

and ”the market of first choice” for<br />

most global frontier investors over the past<br />

few years, largely thanks to the Romanian<br />

government’s efforts to that end. The government<br />

raised millions of euro via the privatisation<br />

of state companies through the<br />

stock exchange, in line with its agreement<br />

with the International Monetary Fund. It also<br />

attracted a global emerging markets expert,<br />

Franklin Templeton, to run one of its most<br />

undervalued assets - Fondul Proprietatea. Big<br />

names attract more big names. Thus, Fondul<br />

Proprietatea has been on investors' radars<br />

during the last couple of years. Surely, part of<br />

the upside there has already been consumed.<br />

Nevertheless, it is a door opener for more investors<br />

to come in Romania and in the region<br />

and for more companies to raise funding for<br />

growth.<br />

Fondul Proprietatea, alongside other big<br />

Romanian companies, has debuted on the<br />

London Stock Exchange to get additional visibility.<br />

TOP 100 listed<br />

companies<br />

A few more big listings in Bucharest and<br />

some further work on the stock market infrastructure,<br />

and Romania may end up being<br />

upgraded from an MSCI Frontier to an MSCI<br />

Emerging market ranking, which would increase<br />

significantly its visibility. This upgrade,<br />

projected to happen in 2016, has been on the<br />

local institutions' agenda for a year now and<br />

investors have started pricing it in. Nevertheless,<br />

if it becomes a fact, it will be a huge step<br />

forth not only for Romania, but for the whole<br />

region.<br />

Bulgaria - the private<br />

listings flagship<br />

Expected new state listings in Bucharest will<br />

keep the market hot for both global and regional<br />

investors. However, once state support<br />

for the Romanian stock market diminishes,<br />

which is bound to happen at some point, it<br />

will have to start generating interest on its<br />

own - something the Bulgarian capital market<br />

has been struggling to do for years now.<br />

The end of 2015 and the beginning of 2016,<br />

however, may bring in a game changer as one<br />

of the biggest software developing groups<br />

in the country - Sirma group holding - will be<br />

debuting on the Bulgarian stock exchange in<br />

the autumn of 2015. Sirma’s IPO has been one<br />

of the most anticipated events on the market<br />

in 2015 both as an investment opportunity<br />

in one of the fastest growing industries and<br />

as an incentive for other IT, fast growing and<br />

good corporate governance companies to<br />

list. It is also a fairly large IPO, with an expected<br />

26.4 million levs to be raised, tapping the<br />

markets' ability to fund well-run and growing<br />

businesses – indications of which have been<br />

visible in other smaller listings on the Sofia<br />

bourse over the last two years.<br />

In 2013, a start-up leasing company - Elana<br />

Agrocredit - debuted on the market. Initially, it<br />

raised some 5 million levs from local pension<br />

funds and sophisticated investors and in the<br />

spring of 2015 it tripled its capital by raising<br />

a further 14 million levs. In 2014, the biggest<br />

courier company in Bulgaria – Speedy - raised<br />

fresh 20 million levs via both the market and<br />

a strategic investor, proving that investors'<br />

appetite is strong for companies with good<br />

corporate governance, lean expansion strategy<br />

and transparent and well seasoned management.<br />

45