ISLAMIC (MICRO)FINANCE

TrYIw

TrYIw

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

which had formal schedules, payout terms, and restrictions. 71 Clients often held multiple<br />

microfinance accounts, a fact they often concealed from providers.<br />

For clients, the economic benefits of their local Islamic microfinance program (low fees, suitable<br />

payment structures, quick access to funds) were more important than the Sunnah principle of<br />

riba-free financing because the economic benefits were, in and of themselves, seen as<br />

expressions of Islamic compassion toward the poor (see chart below). Respect and compassion<br />

shown to clients during their encounter with IMF staff was, for the clients, Islam manifest.<br />

Respect and compassion for poor clients becomes particularly critical regarding late payments.<br />

Microfinance is unsustainable without acceptance of periodically late payments—particularly for<br />

weekly rather than monthly repayment schemes. Official acceptance of late payments would set<br />

a negative precedent, but providers tacitly accept them in order to secure their typically high<br />

repayment statistics.<br />

Conventional MFIs have been scrutinized for subjecting clients to harassment, house-breaking,<br />

asset seizures, or entrapment in expanding debt cycles when clients feel pressured to take on new<br />

debts to pay down outstanding loans. The ethical orientation of IMFIs, by contrast, tends to<br />

motivate a more compassionate approach to late repayments, working with clients to informally<br />

readjust payment schedules. Accordingly, the microfinance ‘Portfolio at risk’ 30-day benchmark<br />

indicator is less reliable than a 60-day or 90-day indicator, to accommodate institutions with<br />

formal or informal leeway for late payments.<br />

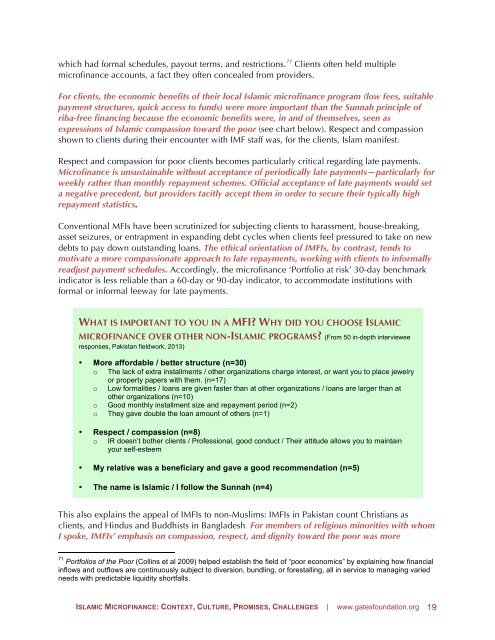

WHAT IS IMPORTANT TO YOU IN A MFI? WHY DID YOU CHOOSE <strong>ISLAMIC</strong><br />

<strong>MICRO</strong><strong>FINANCE</strong> OVER OTHER NON-<strong>ISLAMIC</strong> PROGRAMS? (From 50 in-depth interviewee<br />

responses, Pakistan fieldwork, 2013)<br />

• More affordable / better structure (n=30)<br />

o The lack of extra installments / other organizations charge interest, or want you to place jewelry<br />

or property papers with them. (n=17)<br />

o Low formalities / loans are given faster than at other organizations / loans are larger than at<br />

other organizations (n=10)<br />

o Good monthly installment size and repayment period (n=2)<br />

o They gave double the loan amount of others (n=1)<br />

• Respect / compassion (n=8)<br />

o IR doesn’t bother clients / Professional, good conduct / Their attitude allows you to maintain<br />

your self-esteem<br />

• My relative was a beneficiary and gave a good recommendation (n=5)<br />

• The name is Islamic / I follow the Sunnah (n=4)<br />

This also explains the appeal of IMFIs to non-Muslims: IMFIs in Pakistan count Christians as<br />

clients, and Hindus and Buddhists in Bangladesh. For members of religious minorities with whom<br />

I spoke, IMFIs’ emphasis on compassion, respect, and dignity toward the poor was more<br />

71 Portfolios of the Poor (Collins et al 2009) helped establish the field of “poor economics” by explaining how financial<br />

inflows and outflows are continuously subject to diversion, bundling, or forestalling, all in service to managing varied<br />

needs with predictable liquidity shortfalls.<br />

<strong>ISLAMIC</strong> <strong>MICRO</strong><strong>FINANCE</strong>: CONTEXT, CULTURE, PROMISES, CHALLENGES | www.gatesfoundation.org 19