You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

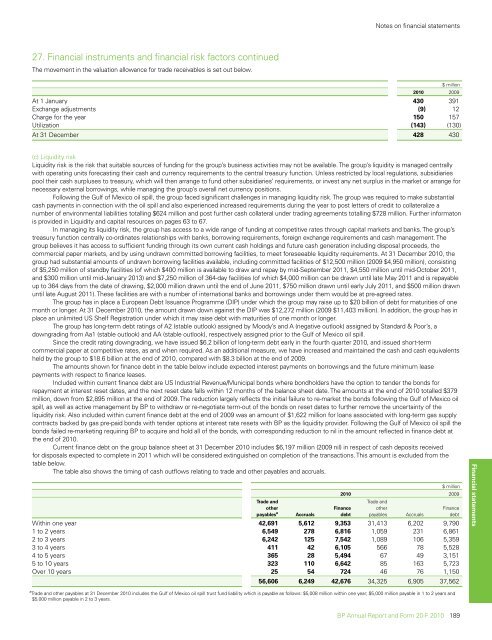

27. Financial instruments <strong>and</strong> financial risk factors continued<br />

The movement in the valuation allowance for trade receivables is set out below.<br />

Notes on financial statements<br />

$ million<br />

<strong>20</strong>10 <strong>20</strong>09<br />

At 1 January 430 391<br />

Exchange adjustments (9) 12<br />

Charge for the year 150 157<br />

Utilization (143) (130)<br />

At 31 December 428 430<br />

(c) Liquidity risk<br />

Liquidity risk is the risk that suitable sources of funding for the group’s business activities may not be available. The group’s liquidity is managed centrally<br />

with operating units forecasting their cash <strong>and</strong> currency requirements to the central treasury function. Unless restricted by local regulations, subsidiaries<br />

pool their cash surpluses to treasury, which will then arrange to fund other subsidiaries’ requirements, or invest any net surplus in the market or arrange for<br />

necessary external borrowings, while managing the group’s overall net currency positions.<br />

Following the Gulf of Mexico oil spill, the group faced significant challenges in managing liquidity risk. The group was required to make substantial<br />

cash payments in connection with the oil spill <strong>and</strong> also experienced increased requirements during the year to post letters of credit to collateralize a<br />

number of environmental liabilities totalling $624 million <strong>and</strong> post further cash collateral under trading agreements totalling $728 million. Further informaton<br />

is provided in Liquidity <strong>and</strong> capital resources on pages 63 to 67.<br />

In managing its liquidity risk, the group has access to a wide range of funding at competitive rates through capital markets <strong>and</strong> banks. The group’s<br />

treasury function centrally co-ordinates relationships with banks, borrowing requirements, foreign exchange requirements <strong>and</strong> cash management. The<br />

group believes it has access to sufficient funding through its own current cash holdings <strong>and</strong> future cash generation including disposal proceeds, the<br />

commercial paper markets, <strong>and</strong> by using undrawn committed borrowing facilities, to meet foreseeable liquidity requirements. At 31 December <strong>20</strong>10, the<br />

group had substantial amounts of undrawn borrowing facilities available, including committed facilities of $12,500 million (<strong>20</strong>09 $4,950 million), consisting<br />

of $5,250 million of st<strong>and</strong>by facilities (of which $400 million is available to draw <strong>and</strong> repay by mid-September <strong>20</strong>11, $4,550 million until mid-October <strong>20</strong>11,<br />

<strong>and</strong> $300 million until mid-January <strong>20</strong>13) <strong>and</strong> $7,250 million of 364-day facilities (of which $4,000 million can be drawn until late May <strong>20</strong>11 <strong>and</strong> is repayable<br />

up to 364 days from the date of drawing, $2,000 million drawn until the end of June <strong>20</strong>11, $750 million drawn until early July <strong>20</strong>11, <strong>and</strong> $500 million drawn<br />

until late August <strong>20</strong>11). These facilities are with a number of international banks <strong>and</strong> borrowings under them would be at pre-agreed rates.<br />

The group has in place a European Debt Issuance Programme (DIP) under which the group may raise up to $<strong>20</strong> billion of debt for maturities of one<br />

month or longer. At 31 December <strong>20</strong>10, the amount drawn down against the DIP was $12,272 million (<strong>20</strong>09 $11,403 million). In addition, the group has in<br />

place an unlimited US Shelf Registration under which it may raise debt with maturities of one month or longer.<br />

The group has long-term debt ratings of A2 (stable outlook) assigned by Moody’s <strong>and</strong> A (negative outlook) assigned by St<strong>and</strong>ard & Poor’s, a<br />

downgrading from Aa1 (stable outlook) <strong>and</strong> AA (stable outlook), respectively assigned prior to the Gulf of Mexico oil spill.<br />

Since the credit rating downgrading, we have issued $6.2 billion of long-term debt early in the fourth quarter <strong>20</strong>10, <strong>and</strong> issued short-term<br />

commercial paper at competitive rates, as <strong>and</strong> when required. As an additional measure, we have increased <strong>and</strong> maintained the cash <strong>and</strong> cash equivalents<br />

held by the group to $18.6 billion at the end of <strong>20</strong>10, compared with $8.3 billion at the end of <strong>20</strong>09.<br />

The amounts shown for finance debt in the table below include expected interest payments on borrowings <strong>and</strong> the future minimum lease<br />

payments with respect to finance leases.<br />

Included within current finance debt are US Industrial Revenue/Municipal bonds where bondholders have the option to tender the bonds for<br />

repayment at interest reset dates, <strong>and</strong> the next reset date falls within 12 months of the balance sheet date. The amounts at the end of <strong>20</strong>10 totalled $379<br />

million, down from $2,895 million at the end of <strong>20</strong>09. The reduction largely reflects the initial failure to re-market the bonds following the Gulf of Mexico oil<br />

spill, as well as active management by <strong>BP</strong> to withdraw or re-negotiate term-out of the bonds on reset dates to further remove the uncertainty of the<br />

liquidity risk. Also included within current finance debt at the end of <strong>20</strong>09 was an amount of $1,622 million for loans associated with long-term gas supply<br />

contracts backed by gas pre-paid bonds with tender options at interest rate resets with <strong>BP</strong> as the liquidity provider. Following the Gulf of Mexico oil spill the<br />

bonds failed re-marketing requiring <strong>BP</strong> to acquire <strong>and</strong> hold all of the bonds, with corresponding reduction to nil in the amount reflected in finance debt at<br />

the end of <strong>20</strong>10.<br />

Current finance debt on the group balance sheet at 31 December <strong>20</strong>10 includes $6,197 million (<strong>20</strong>09 nil) in respect of cash deposits received<br />

for disposals expected to complete in <strong>20</strong>11 which will be considered extinguished on completion of the transactions. This amount is excluded from the<br />

table below.<br />

The table also shows the timing of cash outflows relating to trade <strong>and</strong> other payables <strong>and</strong> accruals.<br />

<strong>20</strong>10<br />

$ million<br />

<strong>20</strong>09<br />

Trade <strong>and</strong> Trade <strong>and</strong><br />

other Finance other Finance<br />

payables a<br />

Accruals debt payables Accruals debt<br />

Within one year 42,691 5,612 9,353 31,413 6,<strong>20</strong>2 9,790<br />

1 to 2 years 6,549 278 6,816 1,059 231 6,861<br />

2 to 3 years 6,242 125 7,542 1,089 106 5,359<br />

3 to 4 years 411 42 6,105 566 78 5,528<br />

4 to 5 years 365 28 5,494 67 49 3,151<br />

5 to 10 years 323 110 6,642 85 163 5,723<br />

Over 10 years 25 54 724 46 76 1,150<br />

56,606 6,249 42,676 34,325 6,905 37,562<br />

a<br />

Trade <strong>and</strong> other payables at 31 December <strong>20</strong>10 includes the Gulf of Mexico oil spill trust fund liability which is payable as follows: $5,008 million within one year; $5,000 million payable in 1 to 2 years <strong>and</strong><br />

$5,000 million payable in 2 to 3 years.<br />

<strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>10 189<br />

Financial statements

![[PDF] Deepwater Horizon: Accident Investigation Report - BP](https://img.yumpu.com/51697031/1/190x245/pdf-deepwater-horizon-accident-investigation-report-bp.jpg?quality=85)