You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

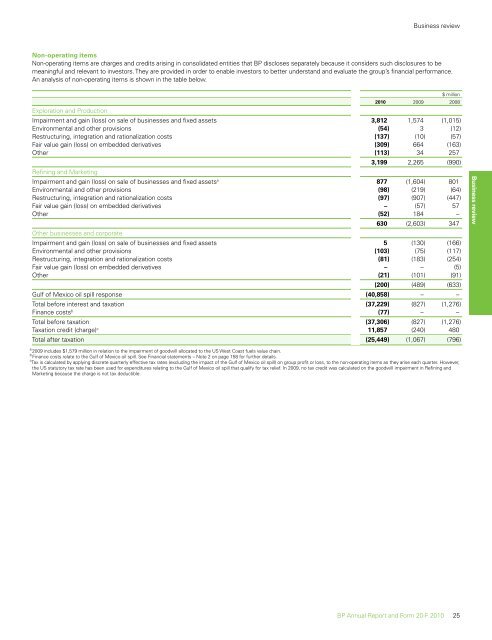

Business review<br />

Non-operating items<br />

Non-operating items are charges <strong>and</strong> credits arising in consolidated entities that <strong>BP</strong> discloses separately because it considers such disclosures to be<br />

meaningful <strong>and</strong> relevant to investors. They are provided in order to enable investors to better underst<strong>and</strong> <strong>and</strong> evaluate the group’s financial performance.<br />

An analysis of non-operating items is shown in the table below.<br />

<strong>20</strong>10 <strong>20</strong>09<br />

$ million<br />

<strong>20</strong>08<br />

Exploration <strong>and</strong> Production<br />

Impairment <strong>and</strong> gain (loss) on sale of businesses <strong>and</strong> fixed assets 3,812 1,574 (1,015)<br />

Environmental <strong>and</strong> other provisions (54) 3 (12)<br />

Restructuring, integration <strong>and</strong> rationalization costs (137) (10) (57)<br />

Fair value gain (loss) on embedded derivatives (309) 664 (163)<br />

Other (113) 34 257<br />

Refining <strong>and</strong> Marketing<br />

3,199 2,265 (990)<br />

Impairment <strong>and</strong> gain (loss) on sale of businesses <strong>and</strong> fixed assetsa 877 (1,604) 801<br />

Environmental <strong>and</strong> other provisions (98) (219) (64)<br />

Restructuring, integration <strong>and</strong> rationalization costs (97) (907) (447)<br />

Fair value gain (loss) on embedded derivatives – (57) 57<br />

Other (52) 184 –<br />

Other businesses <strong>and</strong> corporate<br />

630 (2,603) 347<br />

Impairment <strong>and</strong> gain (loss) on sale of businesses <strong>and</strong> fixed assets 5 (130) (166)<br />

Environmental <strong>and</strong> other provisions (103) (75) (117)<br />

Restructuring, integration <strong>and</strong> rationalization costs (81) (183) (254)<br />

Fair value gain (loss) on embedded derivatives – – (5)<br />

Other (21) (101) (91)<br />

(<strong>20</strong>0) (489) (633)<br />

Gulf of Mexico oil spill response (40,858) – –<br />

Total before interest <strong>and</strong> taxation (37,229) (827) (1,276)<br />

Finance costsb (77) – –<br />

Total before taxation (37,306) (827) (1,276)<br />

Taxation credit (charge) c 11,857 (240) 480<br />

Total after taxation (25,449) (1,067) (796)<br />

a <strong>20</strong>09 includes $1,579 million in relation to the impairment of goodwill allocated to the US West Coast fuels value chain.<br />

b Finance costs relate to the Gulf of Mexico oil spill. See Financial statements – Note 2 on page 158 for further details.<br />

c Tax is calculated by applying discrete quarterly effective tax rates (excluding the impact of the Gulf of Mexico oil spill) on group profit or loss, to the non-operating items as they arise each quarter. However,<br />

the US statutory tax rate has been used for expenditures relating to the Gulf of Mexico oil spill that qualify for tax relief. In <strong>20</strong>09, no tax credit was calculated on the goodwill impairment in Refining <strong>and</strong><br />

Marketing because the charge is not tax deductible.<br />

<strong>BP</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>20</strong>10 25<br />

Business review

![[PDF] Deepwater Horizon: Accident Investigation Report - BP](https://img.yumpu.com/51697031/1/190x245/pdf-deepwater-horizon-accident-investigation-report-bp.jpg?quality=85)