Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

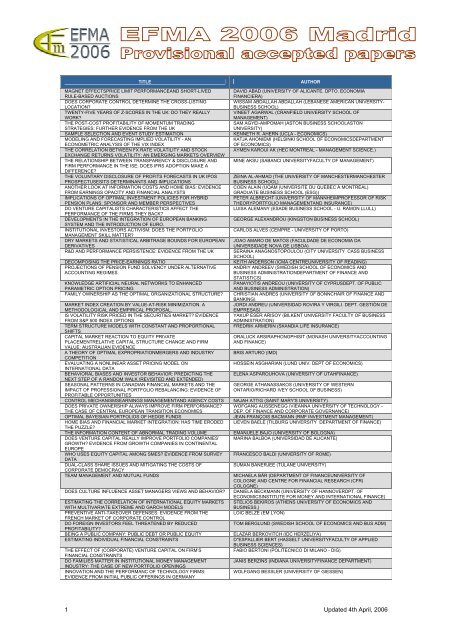

TITLE AUTHOR<br />

MAGNET EFFECTSPRICE LIMIT PERFORMANCEAND SHORT-LIVED DAVID ABAD (UNIVERSITY OF ALICANTE. DPTO. ECONOMÍA<br />

RULE-BASED AUCTIONS<br />

FINANCIERA)<br />

DOES CORPORATE CONTROL DETERMINE THE CROSS-LISTING<br />

WISSAM ABDALLAH ABDALLAH (LEBANESE AMERICAN UNIVERSITY-<br />

LOCATION?<br />

BUSINESS SCHOOL)<br />

TWENTY-FIVE YEARS OF Z-SCORES IN THE UK: DO THEY REALLY<br />

VINEET AGARWAL (CRANFIELD UNIVERSITY SCHOOL OF<br />

WORK?<br />

MANAGEMENT)<br />

THE POST-COST PROFITABILITY OF MOMENTUM TRADING<br />

SAM AGYEI-AMPOMAH (ASTON BUSINESS SCHOOLASTON<br />

STRATEGIES: FURTHER EVIDENCE FROM THE UK<br />

UNIVERSITY)<br />

SAMPLE SELECTION AND EVENT STUDY ESTIMATION KENNETH R. AHERN (UCLA - ECONOMICS)<br />

MODELING AND FORECASTING IMPLIED VOLATILITY - AN<br />

KATJA AHONIEMI (HELSINKI SCHOOL OF ECONOMICSDEPARTMENT<br />

ECONOMETRIC ANALYSIS OF THE VIX INDEX<br />

OF ECONOMICS)<br />

THE CORRELATION BETWEEN FX RATE VOLATILITY AND STOCK<br />

EXCHANGE RETURNS VOLATILITY: AN EMERGING MARKETS OVERVIEW<br />

AYMEN KAROUI AK (HEC MONTRÉAL - MANAGEMENT SCIENCE.)<br />

THE RELATIONSHIP BETWEEN TRANSPARENCY & DISCLOSURE AND<br />

FIRM PERFORMANCE IN THE ISE: DOES IFRS ADOPTION MAKE A<br />

DIFFERENCE?<br />

MINE AKSU (SABANCI UNIVERSITYFACULTY OF MANAGEMENT)<br />

THE VOLUNTARY DISCLOSURE OF PROFITS FORECASTS IN UK IPOS ZEINA AL-AHMAD (THE UNIVERSITY OF MANCHESTERMANCHESTER<br />

PROSPECTUSESITS DETERMINANTS AND IMPLICATIONS<br />

BUSINESS SCHOOL)<br />

ANOTHER LOOK AT INFORMATION COSTS AND HOME BIAS: EVIDENCE COEN ALAIN (UQÀM (UNIVERSITÉ DU QUÉBEC À MONTRÉAL)<br />

FROM EARNINGS OPACITY AND FINANCIAL ANALYSTS<br />

GRADUATE BUSINESS SCHOOL (ESG))<br />

IMPLICATIONS OF OPTIMAL INVESTMENT POLICIES FOR HYBRID<br />

PETER ALBRECHT (UNIVERSITY OF MANNHEIMPROFESSOR OF RISK<br />

PENSION PLANS: SPONSOR AND MEMBER PERSPECTIVES<br />

THEORYPORTFOLIO MANAGEMENTAND INSURANCE)<br />

DO VENTURE CAPITALISTS CHARACTERISTICS AFFECT THE<br />

PERFORMANCE OF THE FIRMS THEY BACK?<br />

LUISA ALEMANY (ESADE BUSINESS SCHOOL - U. RAMON LLULL)<br />

DEVELOPMENTS IN THE INTEGRATION OF EUROPEAN BANKING<br />

SYSTEM AND THE INTRODUCTION OF EURO.<br />

GEORGE ALEXANDROU (KINGSTON BUSINESS SCHOOL)<br />

INSTITUTIONAL INVESTORS ACTIVISM: DOES THE PORTFOLIO<br />

MANAGEMENT SKILL MATTER?<br />

CARLOS ALVES (CEMPRE - UNIVERSITY OF PORTO)<br />

DRY MARKETS AND STATISTICAL ARBITRAGE BOUNDS FOR EUROPEAN JOAO AMARO DE MATOS (FACULDADE DE ECONOMIA DA<br />

DERIVATIVES<br />

UNIVERSIDADE NOVA DE LISBOA)<br />

R&D AND PERFORMANCE PERSISTENCE: EVIDENCE FROM THE UK SERAINA ANAGNOSTOPOULOU (CITY UNIVERSITY CASS BUSINESS<br />

SCHOOL)<br />

DECOMPOSING THE PRICE-EARNINGS RATIO KEITH ANDERSON (ICMA CENTREUNIVERSITY OF READING)<br />

PROJECTIONS OF PENSION FUND SOLVENCY UNDER ALTERNATIVE ANDRIY ANDREEV (SWEDISH SCHOOL OF ECONOMICS AND<br />

ACCOUNTING REGIMES<br />

BUSINESS ADMINISTRATIONDEPARTMENT OF FINANCE AND<br />

STATISTICS)<br />

KNOWLEDGE ARTIFICIAL NEURAL NETWORKS TO ENHANCED<br />

PANAYIOTIS ANDREOU (UNIVERSITY OF CYPRUSDEPT. OF PUBLIC<br />

PARAMETRIC OPTION PRICING<br />

AND BUSINESS ADMINISTRATION)<br />

FAMILY OWNERSHIP AS THE OPTIMAL ORGANIZATIONAL STRUCTURE? CHRISTIAN ANDRES (UNIVERSITY OF BONNCHAIR OF FINANCE AND<br />

BANKING)<br />

MARKET INDEX CREATION BY VALUE-AT-RISK MINIMIZATION. A<br />

JORDI ANDREU (UNIVERSIDAD ROVIRA Y VIRGILI. DEPT. GESTIÓN DE<br />

METHODOLOGICAL AND EMPIRICAL PROPOSAL.<br />

EMPRESAS)<br />

IS VOLATILITY RISK PRICED IN THE SECURITIES MARKET? EVIDENCE YAKUP ESER ARISOY (BILKENT UNIVERSITY FACULTY OF BUSINESS<br />

FROM S&P 500 INDEX OPTIONS<br />

ADMINISTRATION)<br />

TERM STRUCTURE MODELS WITH CONSTANT AND PROPORTIONAL<br />

SHIFTS<br />

FREDRIK ARMERIN (SKANDIA LIFE INSURANCE)<br />

CAPITAL MARKET REACTION TO EQUITY PRIVATE<br />

ORALUCK ARSIRAPHONGPHISIT (MONASH UNIVERSITYACCOUNTING<br />

PLACEMENTRELATIVE CAPITAL STRUCTURE CHANGE AND FIRM<br />

VALUE: AUSTRALIAN EVIDENCE<br />

AND FINANCE)<br />

A THEORY OF OPTIMAL EXPROPRIATIONMERGERS AND INDUSTRY<br />

COMPETITION<br />

BRIS ARTURO (IMD)<br />

EVALUATING A NONLINEAR ASSET PRICING MODEL ON<br />

INTERNATIONAL DATA<br />

HOSSEIN ASGHARIAN (LUND UNIV. DEPT OF ECONOMICS)<br />

BEHAVIORAL BIASES AND INVESTOR BEHAVIOR: PREDICTING THE<br />

NEXT STEP OF A RANDOM WALK (REVISITED AND EXTENDED)<br />

ELENA ASPAROUHOVA (UNIVERSITY OF UTAHFINANCE)<br />

SEASONAL PATTERNS IN CANADIAN FINANCIAL MARKETS AND THE GEORGE ATHANASSAKOS (UNIVERSITY OF WESTERN<br />

IMPACT OF PROFESSIONAL PORTFOLIO REBALANCING: EVIDENCE OF<br />

PROFITABLE OPPORTUNITIES<br />

ONTARIO/RICHARD IVEY SCHOOL OF BUSINESS)<br />

CONTROL MECHANISMSEARNINGS MANAGEMENTAND AGENCY COSTS NAJAH ATTIG (SAINT MARY'S UNIVERSITY)<br />

DOES PRIVATE OWNERSHIP ALWAYS IMPROVE FIRM PERFORMANCE? WOFGANG AUSSENEGG (VIEANNA UNIVERSITY OF TECHNOLOGY -<br />

THE CASE OF CENTRAL EUROPEAN TRANSITION ECONOMIES<br />

DEP. OF FINANCE AND CORPORATE GOVERNANCE)<br />

OPTIMAL BAYESIAN PORTFOLIOS OF HEDGE FUNDS JEAN-FRANÇOIS BACMANN (RMF INVESTMENT MANAGEMENT)<br />

HOME BIAS AND FINANCIAL MARKET INTEGRATION: HAS TIME ERODED<br />

THE PUZZLE?<br />

LIEVEN BAELE (TILBURG UNIVERSITY DEPARTMENT OF FINANCE)<br />

THE INFORMATION CONTENT OF ABNORMAL TRADING VOLUME EMANUELE BAJO (UNIVERSITY OF BOLOGNA)<br />

DOES VENTURE CAPITAL REALLY IMPROVE PORTFOLIO COMPANIES’<br />

GROWTH? EVIDENCE FROM GROWTH COMPANIES IN CONTINENTAL<br />

EUROPE<br />

MARINA BALBOA (UNIVERSIDAD DE ALICANTE)<br />

WHO USES EQUITY CAPITAL AMONG SMES? EVIDENCE FROM SURVEY<br />

DATA<br />

FRANCESCO BALDI (UNIVERSITY OF ROME)<br />

DUAL-CLASS SHARE ISSUES AND MITIGATING THE COSTS OF<br />

CORPORATE DEMOCRACY<br />

SUMAN BANERJEE (TULANE UNIVERSITY)<br />

TEAM MANAGEMENT AND MUTUAL FUNDS MICHAELA BÄR (DEPARTMENT OF FINANCEUNIVERSITY OF<br />

COLOGNE AND CENTRE FOR FINANCIAL RESEARCH (CFR)<br />

COLOGNE)<br />

DOES CULTURE INFLUENCE ASSET MANAGERS VIEWS AND BEHAVIOR? DANIELA BECKMANN (UNIVERSITY OF HANNOVERDPT. OF<br />

ECONOMICSINSTITUTE FOR MONEY AND INTERNATIONAL FINANCE)<br />

ESTIMATING THE CORRELATION OF INTERNATIONAL EQUITY MARKETS STELIOS BEKIROS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

WITH MULTIVARIATE EXTREME AND GARCH MODELS<br />

BUSINESS,)<br />

PREVENTIVE ANTI-TAKEOVER DEFENSES: EVIDENCE FROM THE<br />

FRENCH MARKET OF CORPORATE CONTROL<br />

LOÏC BELZE (EM LYON)<br />

DO FOREIGN INVESTORS FEEL THREATENED BY REDUCED<br />

PROFITABILITY?<br />

TOM BERGLUND (SWEDISH SCHOOL OF ECONOMICS AND BUS ADM)<br />

BEING A PUBLIC COMPANY: PUBLIC DEBT OR PUBLIC EQUITY ELAZAR BERKOVITCH (IDC HERZELIYA)<br />

ESTIMATING INDIVIDUAL FINANCIAL CONSTRAINTS D''ESPALLIER BERT (HASSELT UNIVERSITYFACULTY OF APPLIED<br />

BUSINESS SCIENCES)<br />

THE EFFECT OF (CORPORATE) VENTURE CAPITAL ON FIRM’S<br />

FINANCIAL CONSTRAINTS<br />

FABIO BERTONI (POLITECNICO DI MILANO - DIG)<br />

DO FAMILIES MATTER IN INSTITUTIONAL MONEY MANAGEMENT<br />

INDUSTRY: THE CASE OF NEW PORTFOLIO OPENINGS<br />

JANIS BERZINS (INDIANA UNIVERSITYFINANCE DEPARTMENT)<br />

INNOVATION AND THE PERFORMANC OF TECHNOLOGY FIRMS:<br />

EVIDENCE FROM INITIAL PUBLIC OFFERINGS IN GERMANY<br />

WOLFGANG BESSLER (UNIVERSITY OF GIESSEN)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

2<br />

TITLE AUTHOR<br />

DOES JENSEN’S FREE CASH FLOW HYPOTHESIS EXPLAIN EUROPEAN ANDRÉ BETZER BETZER (UNIVERSITY OF BONN / DEPARTMENT OF<br />

LBOS TODAY?<br />

FINANCE)<br />

EXPROPRIATION THROUGH UNIFICATION? WEALTH EFFECTS OF DUAL MARCO BIGELLI (UNIVERSITY OF BOLOGNADEPARTMENT OF<br />

CLASS SHARE UNIFICATIONS IN ITALY<br />

MANAGEMENT)<br />

TIME-VARYING RISK EXPOSURE OF HEDGE FUNDS: REGIME-<br />

MONICA BILLIO (UNIVERSITY OF VENICEDIPARIMENTO DI SCIENZE<br />

SWITCHING APPROACH<br />

ECONOMICHE)<br />

SENTIMENT AND FINANCIAL HEALTH INDICATORS FOR VALUE AND RON BIRD (FINANCE AND ECONOMICSUNIVERSITY OF TECHNOLOGY<br />

GROWTH STOCKS: THE EUROPEAN EXPERIENCE<br />

SYDNEY)<br />

THE EFFECT OF LENDER CONCENTRATION ON RELATIONSHIP<br />

LENDING<br />

LAMONT BLACK (INDIANA UNIVERSITYDEPARTMENT OF FINANCE)<br />

MYOPIC LOSS AVERSION REVISITED: THE EFFECT OF PROBABILITY PAVLO BLAVATSKYY (INSTITUTE FOR EMPIRICAL RESEARCH IN<br />

DISTORTIONS IN CHOICE UNDER RISK<br />

ECONOMICSUNIVERSITY OF ZURICH)<br />

TESTING PROBABILITY CALIBRATIONS ANDREAS BLÖCHLINGER (CREDIT SUISSEZURICH)<br />

DAVID AND GOLIATH: SMALL BANKS IN AN ERA OF CONSOLIDATION. PAOLA BONGINI (UNIVERSITÀ DEGLI STUDI DI MILANO-<br />

EVIDENCE FROM ITALY<br />

BICOCCAFACULTY OF ECONOMICS)<br />

LIMIT ORDER BOOK TRANSPARENCYEXECUTION RISK AND MARKET<br />

LIQUIDITY<br />

LUKE BORTOLI (SCHOOL OF BUSINESSUNIVERSITY OF SYDNEY)<br />

DIRECTOR COMPENSATION AND BOARD EFFECTIVENESS ANWAR BOUMOSLEH BOUMOSLEH (LEBANESE AMERICAN<br />

UNIVERSITY / FINANCE)<br />

EXCESS COMOVEMENT IN INTERNATIONAL EQUITY MARKETS:<br />

EVIDENCE FROM CROSS-BORDER MERGERS<br />

RICHARD BREALEY (LONDON BUSINESS SCHOOL)<br />

CREDIT RISK MANAGEMENT IN BANKS: HARD INFORMATIONSOFT GODBILLON-CAMUS BRIGITTE (UNIVERSITÉ ROBERT<br />

INFORMATION AND MANIPULATION<br />

SCHUMANINSTITUT D'ETUDES POLITIQUESLARGEDEPARTMENT OF<br />

FINANCE)<br />

CORPORATE GOVERNANCE CONVERGENCE THROUGH CROSS-<br />

BORDER MERGERS: THE CASE OF AVENTIS<br />

ARTURO BRIS (IMD)<br />

MODELLING TIME-VARYING ASYMMETRIC FOREIGN EXCHANGE<br />

ROBERT BROOKS (MONASH UNIVERSITYDEPARTMENT OF<br />

EXPOSURES: AN APPLICATION TO THE AUSTRALIAN STOCK MARKET ECONOMETRICS)<br />

AN ANALYSIS OF CANCELLATIONS IN THE SPANISH STOCK EXCHANGE. SANDRO BRUSCO (UNIVERSITY CARLOS III / DEPT. BUSINESS<br />

ADMINISTRATION)<br />

OPTIMAL ASSET ALLOCATION BASED ON EXPECTED UTILITY<br />

ALESSANDRO BUCCIOL (UNIVERSITY OF PADUA - DEPT. OF<br />

MAXIMIZATION IN THE PRESENCE ON INEQUALITY CONSTRAINTS<br />

ECONOMICS)<br />

DOES PERFORMANCE IMPROVE FOLLOWING TAKEOVERS: THE USE OF MARTIN BUGEJA (UNIVERSITY OF SYDNEYDISCIPLINE OF<br />

ACTUAL CASH FLOWS<br />

ACCOUNTING)<br />

A CROSS-COUNTRY STUDY OF CORPORATE GOVERNANCE IN<br />

ILDUARA BUSTA (COPENHAGEN BUSINESS SCHOOL - DEPARTMENT<br />

EUROPEAN BANKS<br />

OF INTERNATIONAL ECONOMICS & MANAGEMENT)<br />

TRADER REACTIONS AND INVESTOR RATIONALITY DEANNE BUTCHEY (FLORIDA INTERNATIONAL UNIVERSITY -<br />

FINANCE DEPT.)<br />

PRIVATISATIONLIBERALISATION AND PERFORMANCE OF DIVESTED LAURA CABEZA-GARCIA (DEPARTMENT OF BUSINESS<br />

FIRMS IN SPAIN<br />

ADMINISTRATIONUNIVERSITY OF LEON)<br />

THE PRICING OF CONSERVATIVE ACCOUNTING AND THE<br />

JEFFREY CALLEN (UNIVERSITY OF TORONTO & ROTMAN SCHOOL<br />

MEASUREMENT OF CONSERVATISM AT THE FIRM-YEAR LEVEL<br />

OF MANAGEMENT)<br />

ANALYSING THE WEALTH EFFECTS OF UK DIVESTITURES: AN<br />

JACK CAO (SCHOOL OF BANKING AND FINANCEUNIVERSITY OF NEW<br />

EXAMINATION OF DOMESTIC AND INTERNATIONAL SALES<br />

SOUTH WALES)<br />

OWNERSHIP STRUCTUREFIRM HETEROGENEITY AND CORPORATE<br />

VALUE<br />

YIRONG CAO (CASIFLEEDS UNIVERSITY BUSINESS SCHOOL)<br />

IS FIRM INTERDEPENDENCE WITHIN INDUSTRIES IMPORTANT FOR<br />

PORTFOLIO CREDIT RISK?<br />

KENNETH CARLING (UPPSALA UNIVERSITY)<br />

THE DYNAMICS OF GEOGRAPHICAL VERSUS SECTORAL<br />

FRANCESCA CARRIERI (FACULTY OF MANAGEMENT MCGILL<br />

DIVERSIFICATION: IS THERE A LINK TO THE REAL ECONOMY?<br />

UNIVERSITY)<br />

MEASURING VALUE CREATION IN BANK MERGERS AND ACQUISITIONS ANNALISA CARUSO (UNIVERSITY OF BOLOGNADEPARTMENT OF<br />

BUSINESS)<br />

ARE SMALL FAMILY FIRMS FINANCIALLY SOPHISTICATED? STEFANO CASELLI (BOCCONI UNIVERSITYINSTITUTE OF FINANCIAL<br />

INSTITUTIONS)<br />

MARKET REACTION TO THE ISSUANCE OF ANALYSTS''<br />

ENRICO MARIA CERVELLATI (UNIVERSITY OF BOLOGNA -<br />

RECOMMENDATIONS<br />

DEPARTMENT OF MANAGEMENT)<br />

COVERED WARRANTSSTOCK RETURNS AND TRADING VOLUMES:<br />

EVIDENCE FROM TAIWAN<br />

CHIA-YING CHAN (LONDON METROPOLITAN UNIVERSITY - FINANCE)<br />

LATTICE-BASED PRICING OF CATASTROPHE INSURANCE DERIVATIVES JACK S.K. CHANG CHANG (CALIFORNIA STATE UNIVERSITYLOS<br />

ANGELES)<br />

INTERNAL GOVERNANCE AND THE WEALTH EFFECT OF R&D<br />

EXPENDITURE INCREASES<br />

SHAO-CHI CHANG (NATIONAL CHENG KUNG UNIVERSITYTAIWAN)<br />

CAN THE DYNAMICS OF THE TERM STRUCTURE OF PETROLEUM<br />

FUTURES BE FORECASTED? EVIDENCE FROM MAJOR MARKETS<br />

THALIA CHANTZIARA (INDEPENDENT)<br />

THE IMPACT OF TARGET BOARD RECOMMENDATIONS IN AUSTRALIAN LARELLE CHAPPLE (TC BEIRNE SCHOOL OF LAWUNIVERSITY OF<br />

TAKEOVERS<br />

QUEENSLAND)<br />

MARKET-WIDE SHORT-SELLING RESTRICTIONS ANCHADA CHAROENROOK (OWEN GRADUATE SCHOOL OF<br />

BUSINESSVANDERBILT UNIVERSITY)<br />

THE IMPACT OF SINGLE STOCK FUTURES ON FEEDBACK TRADING AND FRANKIE CHAU (DURHAM BUSINESS SCHOOLUNIVERSITY OF<br />

THE MARKET DYNAMICS OF THE CASH MARKET: THE CASE OF<br />

DOMESTIC AND CROSS-BORDER UNIVERSAL STOCK FUTURES<br />

DURHAM)<br />

INTEGRATIONLIQUIDITY AND THE DEPRESSED MARKET: STATE-SHARE<br />

PARADOX<br />

MAX CHEN (DEPARTMENT OF FINANCEXIAMEN UNIVERSITY)<br />

TAX-LOSS SELLING AND SEASONAL EFFECTS IN THE UK QIWEI CHEN (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

THE ACQUISITION OF NON PUBLIC FIRMS IN EUROPE: BIDDERS’<br />

RETURNSPAYMENT METHODS AND STOCK MARKET EVOLUTION<br />

ALAIN CHEVALIER (ESCP EAP MANAGEMENT SCHOOL/ FINANCE)<br />

DO PRIVATIZATION IPO FIRMS OUTPERFORM IN THE LONG-RUN? SEUNG-DOO CHOI (DONGEUI UNIVERSITYSCHOOL OF BUSINESS)<br />

INTERNAL CAPITAL MARKETS AND BANK RELATIONSHIP: EVIDENCE YOON CHOI (DEPARTMENT OF FINANCEUNIVERSITY OF CENTRAL<br />

FROM JAPANESE CORPORATE SPIN-OFFS<br />

FLORIDA)<br />

THE REAL TIME MARKET REACTIONS TO EARNINGS WARNINGS<br />

ANNOUNCEMENTS<br />

ROBIN CHOU (NATIONAL CENTRAL UNIVERSITYDEPT. OF FINANCE)<br />

SHORT-RUN DEVIATIONS AND TIME-VARYING HEDGE RATIOS:<br />

EVIDENCE FROM AGRICULTURAL FUTURES MARKETS<br />

TAUFIQ CHOUDHRY (UNIVERSITY OF SOUTHAMPTON)<br />

BUSINESS GROUPSTAXES AND ACCRUALS MANAGEMENT BEUSELINCK CHRISTOF (TILBURG UNIVERSITYDEPARTMENT OF<br />

ACCOUNTANCY)<br />

OPTION VALUATION WITH LONG-RUN AND SHORT-RUN VOLATILITY<br />

COMPONENTS<br />

PETER CHRISTOFFERSEN (MCGILL UNIVERSITY)<br />

IDENTIFYING A REPRESENTATIVE SET OF YIELD CURVE SHOCKS VILLA CHRISTOPHE (DEPT. ECONOMIEECOLE NATIONALE DE LA<br />

STATISTIQUE ET D'ANALYSE DE L'INFORMATION)<br />

VOLATILITYMARKET STRUCTUREAND LIQUIDITY KEE H. CHUNG CHUNG (SCHOOL OF MANAGEMENTSTATE<br />

UNIVERSITY OF NEW YORK AT BUFFALO)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

3<br />

TITLE AUTHOR<br />

BOUNDS AND PRICES OF CURRENCY CROSS-RATE OPTIONS SAN-LIN CHUNG CHUNG (DEPARTMENT OF FINANCENATIONAL<br />

TAIWAN UNIVERSITY)<br />

ISSUING DEBT TO PAY DIVIDENDS STEPHEN CICCONE (UNIVERSITY OF NEW HAMSPHIRE)<br />

BUSINESS CYCLE EFFECTS ON CAPITAL REQUIREMENTS: A SCENARIO ANDREA CIPOLLINI (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

GENERATION THROUGH DYNAMIC FACTOR ANALYSIS<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

CURRENCY RISK MANAGEMENT AND EMERGING MARKET BOND<br />

DIVERSIFICATION<br />

IAIN CLACHER (UNIVERSITY OF LEEDSACCOUNTING AND FINANCE)<br />

THE DETERMINANTS OF INTEREST RATE HEDGING PRACTICES OF UK EPHRAIM CLARK (MIDDLESEX UNIVERSITYACCOUNTING AND<br />

FIRMS<br />

FINANCE GROUP)<br />

CASH FLOW VOLATILITYFINANCIAL SLACK AND INVESTMENT<br />

SEAN CLEARY (SOBEY SCHOOL OF BUSINESSSAINT MARY'S<br />

DECISIONS<br />

UNIVERSITY)<br />

WHEELING AND DEALING: TARGET EXECUTIVE COMPENSATION IN UK JERRY COAKLEY (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

M&AS<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

UK IPO UNDERPRICING AND VENTURE CAPITALISTS JERRY COAKLEY (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

INFORMATION LINKAGES AND CORRELATED TRADING PAOLO COLLA (UNIVERSITÀ BOCCONI - ECONOMICS DEPARTMENT<br />

(IEP))<br />

TERM STRUCTURE ESTIMATION IN MARKETS WITH INFREQUENT<br />

GONZALO CORTAZAR (PONTIFICIA UNIVERSIDAD CATOLICA DE<br />

TRADING<br />

CHILE-INGENIERIA INDUSTRIAL Y DE SISTEMAS)<br />

STOCK PRICE PERFORMANCE OF TARGET FIRMS IN UNSUCCESSFUL<br />

ACQUISITIONS<br />

ETTORE CROCI (UNIVERSITY OF LUGANO)<br />

ASSET PRICING IN A MONETARY ECONOMY WITH HETEROGENEOUS BENJAMIN CROITORU (FACULTY OF MANAGEMENTMCGILL<br />

BELIEFS<br />

UNIVERSITY)<br />

FINANCIAL INTERMEDIARIESOWNERSHIP STRUCTURE AND<br />

MONITORED FINANCE: EVIDENCE FROM JAPAN<br />

DOUGLAS CUMMING (RENSSELAER POLYTECHNIC INSTITUTE)<br />

CORPORATE SOCIAL RESPONSIBILITY: DOMESTIC AND<br />

INTERNATIONAL INSTITUTIONAL INVESTMENT<br />

DOUGLAS CUMMING (RENSSELAER POLYTECHNIC INSTITUTE)<br />

MUTUAL FUND PERFORMANCE : SKILL OR LUCK ? KEITH CUTHBERTSON (CASS BUSINESS SCHOOLFINANCE FACULTY)<br />

INFORMATION QUALITY AND STOCK RETURNS REVISITED STEFANO D-ADDONA (UNIVERSITY OF ROME III)<br />

PORTFOLIO CROSS-AUTOCORRELATION PUZZLES RYAN DAVIES (BABSON COLLEGEFINANCE DIVISION)<br />

FRAMING THE INDIVIDUAL INVESTOR - THE CASE OF THE CAPITAL MARC DE CEUSTER (UNIVERSITY OF ANTWERPDEPARTMENT OF<br />

GUARANTEED FUNDS<br />

ACCOUNTING AND FINANCE)<br />

AN EMPIRICAL ANALYSIS OF EUROPEAN BOND TENDER OFFERS ABE DE JONG (RSM ERASMUS UNIVERSITY)<br />

DOES THE STOCK MARKET VALUE BANK DIVERSIFICATION? OLIVIER DE JONGHE (GHENT UNIVERSITY - FINANCIAL ECONOMICS<br />

DEPARTMENT)<br />

DIVIDENDS AND ALTERNATIVE MARKET SIGNALS: INSIDER TRADING ESTHER B. DEL BRIO (UNIVERSITY OF SALAMANCA. DPT<br />

ADMINISTRACION Y ECONOMIA DE LA EMPRESA)<br />

DOES IT MATTER OWNERSHIP STRUCTURE? PERFORMANCE IN<br />

OLGA DEL ORDEN (U.DEUSTOFINANCE & ACCOUNTANCY<br />

SPANISH COMPANIES<br />

DEPARTMENT)<br />

DETERMINANTS OF DEPOSIT-INSURANCE ADOPTION AND DESIGN ASLI DEMIRGUC-KUNT (WORLD BANK)<br />

THE INTRODUCTION OF THE CAC40 MASTER UNIT AND THE CAC40<br />

INDEX SPOT-FUTURES PRICING RELATIONSHIP<br />

LAURENT DEVILLE (UNIVERSITÉ PARIS-DAUPHINEDRMCNRS)<br />

CREDIT RISK AND OPTION PRICING THEORY: EVIDENCE FROM ITALIAN LUCA DI SIMONE (UNIVERSITY OF BOLOGNA - DEPARTMENT OF<br />

STOCK MARKET<br />

MANAGEMENT)<br />

VALUE-AT-RISK FOR LONG AND SHORT TRADING POSITIONS: THE PANAYIOTIS DIAMANDIS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

CASE OF THE ATHENS STOCK EXCHANGE<br />

BUSINESS,DEPARTMENT OF BUSINESS ADMINISTRATION)<br />

CAN SHORT-SELLERS PREDICT RETURNS? DAILY EVIDENCE KARL DIETHER (OHIO STATE UNIVERSITYFINANCE)<br />

INTRADAY VALUE AT RISK (IVAR) USING TICK-BY-TICK DATA WITH GEORGES DIONNE (HEC MONTREALCANADA RESEARCH CHAIR IN<br />

APPLICATION TO THE TORONTO STOCK EXCHANGE<br />

RISK MANAGEMENT)<br />

ACQUISITIONS,OVERCONFIDENT MANAGERS AND SELF-ATTRIBUTION JOHN DOUKAS (DEPARTMENT OF FINANCEGRADUATE SCHOOL OF<br />

BIAS<br />

BUSINESSOLD DOMINION UNIVERSITY)<br />

HEDGE FUNDS AND THE PERILS OF SURVIVORSHIP BIAS MICHAEL DREW (QUEENSLAND UNIVERSITY OF TECHNOLOGY)<br />

HETEROGENEITY IN ASSET ALLOCATION DECISIONS - EMPIRICAL WOLFGANG DROBETZ (UNIVERSITY OF BASLEWWZCORPORATE<br />

EVIDENCE FROM SWITZERLAND<br />

FINANCE)<br />

CORPORATE CASH HOLDINGS: EVIDENCE FROM A DIFFERENT<br />

WOLFGANG DROBETZ (UNIVERSITY OF BASLEWWZDEPARTMENT OF<br />

INSTITUTIONAL SETTING<br />

CORPORATE FINANCE)<br />

STRATEGIC SPECIALIST AND MARKET LIQUIDITY ARIADNA DUMITRESCU (ESADE BUSINESS SCHOOLDEPARTAMENT<br />

OF FINANCIAL MANAGEMENT AND CONTROL)<br />

AN INTRADAY ANALYSIS OF THE SAMUELSON HYPOTHESIS FOR<br />

HUU DUONG (MONASH UNIVERSITY & DEPARTMENT OF<br />

COMMODITY FUTURES CONTRACTS<br />

ACCOUNTING AND FINANCE)<br />

ARE THERE WINDOWS OF OPPORTUNITY FOR CONVERTIBLE DEBT MARIE DUTORDOIR (COLUMBIA UNIVERSITY (VISITING<br />

ISSUANCE? EVIDENCE FOR WESTERN EUROPE<br />

SCHOLAR)/KATHOLIEKE UNIVERSITEIT LEUVEN)<br />

INFORMATIONTHE TYPE OF INFORMED TRADERAND THE<br />

CONVERGENCE OF PRICE TO EQUILIBRIUM<br />

JAMES EAVES (RUTGERS UNIVERSITYDAFRE)<br />

PRICING INTEREST RATE CAPS IN A GENERALIZED AFFINE MODEL<br />

WITH STOCHASTIC VOLATILITY AND CORRELATION: EMPIRICAL<br />

EVIDENCE<br />

A DOZEN CONSISTENT CAPM-RELATED VALUATION MODELS - SO WHY<br />

USE THE INCORRECT ONE?<br />

ALEXEI EGOROV (WEST VIRGINIA UNIVERSITYDIVISION OF<br />

ECONOMICS AND FINANCE)<br />

STEINAR EKERN (NHH - NORWEGIAN SCHOOL OF ECONOMICS AND<br />

BUSINESS ADMINISTRATIONDEPARTMENT OF FINANCE AND<br />

MANAGEMENT SCIENCE)<br />

DO WE NEED TO WORRY ABOUT CREDIT RISK CORRELATION? ABEL ELIZALDE (CEMFI)<br />

FOREIGN DIRECT INVESTMENT IN THE FINANCIAL SECTOR: THE<br />

MARKUS ELLER (INSTITUTE FOR ADVANCED STUDIESDEPARTMENT<br />

ENGINE OF GROWTH FOR CENTRAL AND EASTERN EUROPE?<br />

OF ECONOMICS AND FINANCE)<br />

EXCHANGE RATE CHANGES AND STOCK RETURNS: SOME EVIDENCE<br />

FROM UK INDUSTRIES<br />

AHMED EL-MASRY (PLYMOUTH BUSINESS SCHOOL)<br />

THE ANATOMY OF BANK DIVERSIFICATION RALF ELSAS (LMU MUNICH - INSTITUTE FOR FINANCE & BANKING)<br />

THE PERFORMANCE OF INVESTMENT GRADE CORPORATE BOND OLIVER ENTROP (CATHOLIC UNIVERSITY OF EICHSTAETT-<br />

FUNDS: EVIDENCE FROM THE EUROPEAN MARKET<br />

INGOLSTADT)<br />

INFORMATIONTRADE AND COMMON KNOWLEDGE WITH ENDOGENOUS HULYA ERASLAN (UNIVERSITY OF PENNSYLVANIAFINANCE<br />

ASSET VALUES<br />

DEPARTMENT)<br />

VOLUNTARY DISCLOSURE STRATEGY AROUND LOCKUP EXPIRATIONS:<br />

EVIDENCE FROM MANAGEMENT FORECASTS<br />

YONCA ERTIMUR (STANFORD UNIVERSITYDEPT OF ACCOUNTING)<br />

THE FED MODEL: THE BADTHE WORSEAND THE UGLY JAVIER ESTRADA (IESE BUSINESS SCHOOL)<br />

POST-IPO CORPORATE LIFE CYCLETAKEOVERS AND WEALTH EFFECTS CHUN HO FAN (SCHOOL OF BANKING AND FINANCEUNIVERSITY OF<br />

NEW SOUTH WALES)<br />

VALUING COMPANIES WITH A FIXED BOOK-VALUE LEVERAGE RATIO PABLO FERNANDEZ (IESE BUSINESS SCHOOL)<br />

OWNERSHIP STRUCTURE AND THE MARKET FOR CORPORATE<br />

CONTROL<br />

DANIEL FERREIRA (UNIVERSIDADE NOVA DE LISBOA)<br />

MARKET TIMING AND PASSIVE INVESTMENT STRATEGIES LUIS FERRUZ (FACULTY OF ECONOMICS & BUSINESS<br />

ADMINISTRATION-UNIVERSITY OF ZARAGOZA-SPAIN)<br />

FINANCIAL FRAUDDIRECTOR REPUTATION AND SHAREHOLDER<br />

WEALTH<br />

ELIEZER FICH (DREXEL UNIVERSITY)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

4<br />

TITLE AUTHOR<br />

A PANIC REPORT ON THE PASS-THROUGH OF MONETARY POLICY TO<br />

INTEREST RATES IN THE EURO AREA<br />

MICHAEL FLAD (JOHANN WOLFGANG GOETHE-UNIVERSITÄT<br />

FRANKFURT/MAINGERMANY - GRADUATE PROGRAM "FINANCE AND<br />

MONETARY ECONOMICS")<br />

CHRISOSTOMOS FLORACKIS (UNIVERSITY OF YORKDEPARTMENT<br />

OF ECONOMICS AND RELATED STUDIES)<br />

WHAT REDUCES THE IMPACT OF MANAGERIAL ENTRENCHMENT ON<br />

AGENCY COSTS? EVIDENCE FOR UK FIRMS<br />

POST-EARNINGS ANOUNCEMENT DRIFT: SPANISH EVIDENCE CARLOS FORNER (UNIVERSITY OF ALICANTEDPT. ECONOMÍA<br />

FINANCIERACONTABILIDAD Y MARKETING)<br />

CREDIT SPREADS: THEORY AND EVIDENCE ABOUT THE INFORMATION<br />

CONTENT OF STOCKSBONDS AND CDSS<br />

SANTIAGO FORTE (ESADE BUSINESS SCHOOL)<br />

THE ACTIVE MANAGEMENT OF DISTRESSED DEBT MORAUX FRANCK (UNIVERSITÉ DU MAINE)<br />

BID-ASK SPREADS UNDER AUCTION AND SPECIALIST MARKET<br />

STRUCTURES: EVIDENCE FROM THE ITALIAN BOURSE<br />

ALEX FRINO (FINANCE DISCIPLINEUNIVERSITY OF SYDNEY)<br />

THE RISK MICROSTRUCTURE OF CORPORATE BONDS: A BAYESIAN<br />

ANALYSIS<br />

MANFRED FRUHWIRTH (HARVARD UNIVERSITY)<br />

COMPETITIONCORPORATE GOVERNANCE AND EQUITY CARVE-OUTS –<br />

THE EUROPEAN CASE<br />

DANIEL FUCKS (UNIVERSITY OF BONN)<br />

RELATIONSHIP BETWEEN DOWNSIDE BETA AND CAPM BETA DON GALAGEDERA (MONASH UNIVERSITYDEPARTMENT OF<br />

ECONOMETRICS AND BUSINESS STATISTICS)<br />

INTEGRATION OF THE MONETARY MARKET. A GRAVITATIONAL MODEL FERNANDO GARCIA GARCIA (UNIVERSIDAD POLITECNICA DE<br />

VIA TARGET<br />

VALENCIA. DEPARTAMENTO DE ECONOMIA Y CIENCIAS SOCIALES)<br />

LEADING THE HERD TO GREENER PASTURES: WHEN TRADE IMITATION<br />

IS THE MOST ‘PROFITABLE’ FORM OF FLATTERY<br />

PETER GARDNER (UNIVERSITY OF NEW SOUTH WALESFINANCE)<br />

PORTFOLIO CHOICE AND PRICING IN ILLIQUID MARKETS NICOLAE GARLEANU (UNIVERSITY OF PENNSYLVANIAWHARTON<br />

SCHOOL)<br />

THE INTERACTION BETWEEN LATIN AMERICAN STOCK MARKETS AND IAN GARRETT (MANCHESTER BUSINESS SCHOOLUNIVERSITY OF<br />

THE US<br />

MANCHESTER)<br />

USING OPTIONS DATA TO OPTIMALLY REBALANCE AN EQUITY<br />

JOHN GARVEY (DEPARTMENT OF ACCOUNTING AND<br />

PORTFOLIO.<br />

FINANCEUNIVERSITY OF LIMERICK)<br />

THE ROLE OF OPERATING CONTRACTS IN INFLUENCING LOAN<br />

SPREADS AND LEVERAGE IN PROJECT FINANCE DEALS<br />

STEFANO GATTI (UNIVERSITÀ BOCCONI)<br />

ASSET PRICING IN DYNAMIC STOCHASTIC GENERAL EQUILIBRIUM NATALIA GERSHUN (DEPARTMENT OF FINANCELUBIN SCHOOL OF<br />

MODELS WITH INDETERMINACY<br />

BUSINESSPACE UNIVERSITY)<br />

DETERMINANTS OF EARNINGS PERFORMANCE SUBSEQUENT TO<br />

DIMITRIOS GHICAS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

INITIAL PUBLIC OFFERINGS<br />

BUSINESSDEPARTMENT OF ACCOUNTING AND FINANCE)<br />

ROLE OF COMPETITION IN CAPITAL ALLOCATION FOR R&D<br />

CHINMOY GHOSH GHOSH (FINANCE DEPARTMENTUNIVERSITY OF<br />

EXPENDITURE<br />

CONNECTICUT)<br />

STRATEGIC TRADING IN THE WRONG DIRECTION BY A LARGE<br />

ERASMO GIAMBONA (GABELLI SCHOOL OF BUSINESS - ROGER<br />

INSTITUTIONAL INVESTOR<br />

WILLIAMS UNIVERSITY)<br />

HEDGE FUND PORTFOLIO CONSTRUCTION: A COMPARISON OF STATIC DANIEL GIAMOURIDIS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

AND DYNAMIC APPROACHES<br />

BUSINESSDEPARTMENT OF ACCOUNTING AND FINANCE)<br />

PRICE DYNAMICSINFORMATIONAL EFFICIENCY AND WEALTH<br />

JAVIER GIL-BAZO (UNIVERSIDAD CARLOS III. DPT. OF BUSINESS<br />

DISTRIBUTION IN CONTINUOUS DOUBLE AUCTION MARKETS<br />

ADMINISTRATION)<br />

SHARE REPURCHASE REGULATIONS: DO FIRMS PLAY BY THE RULES? EDITH GINGLINGER (UNIVERSITY PARIS DAUPHINE)<br />

INITIAL PUBLIC OFFERINGS ON THE EUROPEAN NEW MARKETS: WHY MARC GOERGEN (SHEFFIELD UNIVERSITY MANAGEMENT SCHOOL<br />

WAS UNDERPRICING SO HIGH AND SO DIFFERENT BETWEEN<br />

MARKETS?<br />

(SUMS))<br />

FLIPPING ACTIVITY IN FIXED OFFER PRICE MECHANISM ALLOCATED DIMITRIOS GOUNOPOULOS (UNIVERSITY OF SURREYSCHOOL OF<br />

IPOS<br />

MANAGEMENT)<br />

LONG RUN ABNORMAL RETURNS TO ACQUIRING FIRMS: THE FORM OF<br />

PAYMENT HYPOTHESISBIDDER HOSTILITY AND TIMING BEHAVIOR<br />

ALAN GREGORY (XFIUNIVERSITY OF EXETER)<br />

THE RISK-ADJUSTED PERFORMANCE OF US BUYOUTS ALEXANDER GROH (DARMSTADT UNIVERSITY OF TECHNOLOGY)<br />

HOME BIASED? A SPATIAL ANALYSIS OF THE DOMESTIC MERGING MICHAEL GROTE (GOETHE-UNIVERSITYFRANKFURTFINANCE<br />

BEHAVIOR OF US FIRMS<br />

DEPARTMENT)<br />

A THREE-MOMENT INTERTEMPORAL CAPITAL ASSET PRICING MODEL:<br />

THEORY AND EVIDENCE<br />

OMRANE GUEDHAMI (MEMORIAL UNIVERSITY OF NEWFOUNDLAND)<br />

THE EFFECT OF MARKET STRUCTURE AND RELATIONSHIP LENDING ON<br />

THE LIKELIHOOD OF CREDIT TIGHTENING<br />

FABRIZIO GUELPA (BANCA INTESA - RESEARCH DEPARTMENT)<br />

DO CROSS-BORDER ACQUISITIONS CAUSE CONVERGENCE IN<br />

EXECUTIVE COMPENSATION? EVIDENCE FROM U.K. ACQUISITIONS OF<br />

U.S. TARGETS<br />

PAUL GUEST (JUDGE BUSINESS SCHOOLCAMBRIDGE UNIVERSITY)<br />

ARE THE DYNAMIC LINKAGES BETWEEN THE MACROECONOMY AND MASSIMO GUIDOLIN (FEDERAL RESERVE BANK OF ST.<br />

ASSET PRICES TIME-VARYING?<br />

LOUISRESEARCH DIVISION)<br />

INVESTING FOR THE LONG-RUN IN EUROPEAN REAL ESTATE MASSIMO GUIDOLIN (FEDERAL RESERVE BANK OF ST.<br />

LOUISRESEARCH DIVISION)<br />

WHO TAMES THE CELTIC TIGER? PORTFOLIO IMPLICATIONS FROM A MASSIMO GUIDOLIN (FEDERAL RESERVE BANK OF ST.<br />

MULTIVARIATE MARKOV SWITCHING MODEL<br />

LOUISRESEARCH DIVISION)<br />

VOLATILITY TRADING IN OPTIONS MARKET: HOW DOES IT AFFECT CAPELLE-BLANCARD GUNTHER (ECONOMIX-UNIVERSITÉ PARIS<br />

WHERE INFORMED TRADERS TRADE?<br />

XUNIVERSITÉ PARIS 1 PANTÉHONE-SORBONNE)<br />

DO EMERGING MARKET STOCKS BENEFIT FROM INDEX INCLUSION? BURCU HACIBEDEL (UNIVERSITY OF OXFORDSAID BUSINESS<br />

SCHOOL)<br />

VOLATILITY AS AN ASSET CLASS: EUROPEAN EVIDENCE REINHOLD HAFNER (RISKLAB GERMANY)<br />

EMPLOYING THE RESIDUAL INCOME MODEL IN PORTFOLIO<br />

MEIKE HAGEMEISTER (UNIVERSITY OF COLOGNE DEPARTMENT OF<br />

OPTIMIZATION<br />

FINANCE)<br />

WOMEN AND RISK TOLERANCE IN AN AGING WORLD TERRENCE HALLAHAN (RMIT UNIVERSITYSCHOOL OF<br />

ECONOMICSFINANCE AND MARKETING)<br />

BANK FAILURE PREDICTION: A 2-STEP APPROACH MICHAEL HALLING (UNIVERSITY OF VIENNAFINANCE)<br />

MONETARY POLICY AND THE INVESTMENT COMPANIES SYED M. HARUN (TEXAS A&M UNIVERSITY –<br />

KINGSVILLEDEPARTMENT OF ECONOMICS AND FINANCE)<br />

DOES DIVERSIFICATION IMPROVE THE PERFORMANCE OF GERMAN<br />

BANKS? EVIDENCE FROM INDIVIDUAL BANK LOAN PORTFOLIOS<br />

EVELYN HAYDEN (AUSTRIAN NATIONAL BANK)<br />

IS THERE A LATENT FACTOR IN STOCK RETURNS? GATFAOUI HAYETTE (ROUEN SCHOOL OF MANAGEMENT)<br />

DETERMINANTS OF OPERATIONAL RISK REPORTING IN THE BANKING GÜNTHER HELBOK (BANK AUSTRIA CREDITANSTALT / OPERATIONAL<br />

INDUSTRY<br />

RISK AND RISK METHODS)<br />

A NON-UTILITY MAXIMIZING APPROACH TO MULTIPERIOD PORTFOLIO KLAUS HELLWIG (UNIVERSITY OF ULMDEPARTMENT OF BUSINESS<br />

SELECTION<br />

ADMINISTRATION)<br />

DOES PROSPECT THEORY EXPLAIN THE DISPOSITION EFFECT? THORSTEN HENS (UNIVERSITY OF ZURICHINSTITUTE FOR<br />

EMPIRICAL RESEARCH IN ECONOMICS)<br />

AN EMPIRICAL ANALYSIS OF THE EFFICIENCY OF ONLINE AUCTION IPO NAYANTARA HENSEL HENSEL (US NAVAL POSTGRADUATE SCHOOL;<br />

PROCESSES AND TRADITIONAL IPO PROCESSES<br />

GRADUATE SCHOOL OF BUSINESS AND PUBLIC POLICY)<br />

DO THE RECOVERY RATE AND THE ACCOUNTING REGIME MATTER DIRK HERKOMMER (GOETHE UNIVERSIY FRANKFURTFINANCE<br />

FOR PRICING CORPORATE BONDS AND LOANS? EVIDENCE FROM<br />

MODELS WITH INCOMPLETE ACCOUNTING INFORMATION<br />

DEPARTMENT)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

DEBT MATURITY AND RELATIONSHIP LENDING: AN ANALYSIS OF<br />

EUROPEAN SMES<br />

5<br />

TITLE AUTHOR<br />

GINÉS HERNÁNDEZ CÁNOVAS (POLYTECHNIC UNIVERSITY OF<br />

CARTAGENA - DEPARTMENT OF FINANCIAL ECONOMICS AND<br />

ACCOUNTING)<br />

CHRISTOPH HEUMANN (UNIVERSITY OF MANNHEIM)<br />

ON THE NONCOMPENSATION FOR ILLIQUIDITY IN EQUILIBRIUM ASSET<br />

RETURNS<br />

COMPANY PERFORMANCE SURROUNDING CEO TURNOVER: EVIDENCE<br />

FROM THE UK<br />

DAVID HILLIER (UNIVERSITY OF LEEDSBUSINESS SCHOOL)<br />

FIRM PERFORMANCEENTRENCHMENT AND CEO SUCCESSION IN<br />

DAVID HILLIER (UNIVERSITY OF LEEDSLEEDS UNIVERSITY<br />

FAMILY-MANAGED FIRMS<br />

BUSINESS SCHOOL)<br />

REQUIRED RATES OF RETURN FOR CORPORATE INVESTMENT<br />

APPRAISAL IN THE PRESENCE OF GROWTH OPPORTUNITIES<br />

IAN HIRST (HERIOT-WATT UNIVERSITY)<br />

AN ANALYSIS OF FLIPPING ACTIVITY IN EARLY AFTERMARKET TRADING LE HOA TRAN (MONASH UNIVERSITY)<br />

TRADING THE FORWARD BIAS: ARE THERE LIMITS TO SPECULATION? MARKUS HOCHRADL (NEW YORK UNIVERSITYLEONARD N. STERN<br />

SCHOOL OF BUSINESSDEPARTMENT OF FINANCE)<br />

CAPITAL BUDGETING AND POLITICAL RISK: EMPIRICAL EVIDENCE MARTIN HOLMEN (UPPSALA UNIVERSITYDEPARTMENT OF<br />

ECONOMICS)<br />

RETURN UNCERTAINTY AND THE APPEARANCE OF BIASES IN<br />

DONG HONG (SINGAPORE MANAGEMENT UNIVERSITYLKC SCHOOL<br />

EXPECTED RETURNS<br />

OF BUSINESS)<br />

LIFE-CYCLE ASSET ALLOCATION WITH ANNUITY MARKETS: IS<br />

WOLFRAM HORNEFF (GOETHE UNIVERSITYDEPARTMENT OF<br />

LONGEVITY INSURANCE A GOOD DEAL?<br />

FINANCE)<br />

VALIDATION OF CREDIT RATING SYSTEMS USING MULTI-RATER<br />

KURT HORNIK (VIENNA UNIVERSITY OF ECONOMICS AND BUSINESS<br />

INFORMATION<br />

ADMINISTRATIONDEPARTMENT OF STATISTICS AND MATHEMATICS)<br />

THE LAST ISSUES PUZZLE ARMEN HOVAKIMIAN (BARUCH COLLEGEDEPARTMENT OF<br />

ECONOMICS AND FINANCE)<br />

MULTILATERAL EXCHANGE RATE CHANGES AND INTERNATIONAL CHIN-WEN HSIN HSIN (YUAN ZE UNIVERSITYDEPARTMENT OF<br />

INDUSTRY EFFECTS<br />

FINANCE)<br />

DEVELOPING FINANCIAL DISTRESS PREDICTION MODELS: A STUDY OF YU-CHIANG HU (MANAGEMENT SCHOOL AND<br />

USEUROPE AND JAPAN RETAIL PERFORMANCE<br />

ECONOMICSUNIVERSITY OF EDINBURGH)<br />

TRADING VOLUMEPRICE AUTO CORRELATION AND VOLATILITY UNDER CHENG HUA (DEPARTMENT OF ECONOMICSUNIVERSITY OF PARIS<br />

PROPORTIONAL TRANSACTION COSTS<br />

DAUPHINE)<br />

CONTROLLING SHAREHOLDERSPRIVATE BENEFITS AND DEBT DE LA BRUSLERIE HUBERT (UNIVERSITY PARIS I SORBONNE)<br />

SKEWNESSKURTOSIS AND CONVERTIBLE ARBITRAGE HEDGE FUND MARK HUTCHINSON (UNIVERSITY COLLEGE CORKDEPARTMENT OF<br />

PERFORMANCE<br />

ACCOUNTING AND FINANCE)<br />

OWNERSHIP STRUCTURERISK AND PERFORMANCE IN THE EUROPEAN GIULIANO IANNOTTA (UNIVERSITÀ COMMERCIALE “LUIGI BOCCONI” -<br />

BANKING INDUSTRY<br />

INSTITUTE OF FINANCIAL MARKETS AND INSTITUTIONS)<br />

WHICH FACTORS AFFECT BOND UNDERWRITER SPREAD? THE ROLE GIULIANO IANNOTTA (BOCCONI UNIVERSITY - FINANCIAL MARKETS<br />

OF BANKING RELATIONSHIPS<br />

AND INSTITUTIONS INSTITUTE)<br />

ACCOUNTING DISCLOSURE AND FIRMS’ FINANCIAL ATTRIBUTES;<br />

GEORGE IATRIDIS (UNIVERSITY OF THESSALYDEPARTMENT OF<br />

EVIDENCE FROM THE UK STOCK MARKET<br />

ECONOMICS)<br />

PRIVATE EQUITY RETURNS: IS THERE REALLY A BENEFIT OF LOW CO-<br />

MOVEMENT WITH PUBLIC EQUITY MARKETS?<br />

MATTHIAS ICK (UNIVERSITY OF LUGANO)<br />

THE VALUATION OF DEFAULTABLE PENSION LIABILITIES JOACHIM INKMANN (TILBURG UNIVERSITYDEPARTMENT OF<br />

FINANCE)<br />

PORTFOLIO CHOICE UNDER CONVEX TRANSACTION COSTS SERGEI ISAENKO (CONCORDIA UNIVERSITYFINANCE DEPARTMENT)<br />

REPURCHASING SHARES ON A SECOND TRADING LINE DUSAN ISAKOV (UNIVERSITY OF FRIBOURG)<br />

EMPLOYEE STOCK OPTIONS: MUCH MORE VALUABLE THAN YOU<br />

JENS CARSTEN JACKWERTH (UNIVERSITY OF KONSTANZFINANCE<br />

THOUGHT<br />

DEPARTMENT)<br />

INFLATION NEWS AND STOCK RETURNS: A SECTORIAL ANALYSIS IN FRANCISCO JAREÑO (UNIVERSIDAD DE CASTILLA-LA<br />

THE SPANISH CASE<br />

MANCHADEPARTAMENTO DE ANÁLISIS ECONÓMICO Y FINANZAS)<br />

THE POLITICAL ECONOMY OF CURRENT ACCOUNT REVERSALS: AN JUAN MANUEL JAUREGUI (UCLA ANDERSON SCHOOL OF<br />

EMPIRICAL STUDY<br />

MANAGEMENT)<br />

IPO UNDERPRICING ACROSS THE WORLD: DOES THE COUNTRY RISK NGUEMA JEAN-FERNAND (UNIVERSITY MONTPELLIER I - SUP DE CO<br />

MATTER?<br />

MONTPELLIER)<br />

AN EXPERIMENTAL STUDY OF TRADING VOLUME AND DIVERGENCE OF GAJEWSKI JEAN-FRANÇOIS (UNIVERSITY OF PARIS 12 VAL-DE-<br />

EXPECTATIONS AROUND EARNINGS ANNOUNCEMENT<br />

MARNEIRG)<br />

INFORMATION ASYMMETRY AND INVESTMENT-CASH FLOW<br />

SENSITIVITY<br />

MCDERMOTT JOHN (FAIRFIELD UNIVERSITY)<br />

BASEL-2 REVISED STANDARD APPROACH AND BEYOND: CREDIT RISK CHATEAU JOHN PETER (ROUEN GRADUATE SCHOOL OF<br />

VALUATION OF SHORT-TERM LOAN COMMITMENTS<br />

MANAGEMENT)<br />

THE ROLE OF HETEROGENEITY IN EARLY WARNING SYSTEMS FOR ELENA KALOTYCHOU (CASS BUSINESS SCHOOLFACULTY OF<br />

SOVEREIGN DEBT CRISES<br />

FINANCE)<br />

FACTORS UNDERLYING THE CREDIT RISK EXPOSURE OF SOVEREIGN<br />

LOANS<br />

ELENA KALOTYCHOU (CASS BUSINESS SCHOOLFINANCE)<br />

DOES ADAPTIVE EPS FORECASTING MAKE ANALYSTS FORECASTS<br />

REDUNDANT?<br />

DMITRI KANTSYREV (USC)<br />

MODELING THE TERM STRUCTURE OF DEFAULTABLE BONDS UNDER<br />

RECOVERY RISK<br />

LOTFI KAROUI (MCGILL UNIVERSITYFACULTY OF MANAGEMENT)<br />

WHO NEEDS HEDGE FUNDS? A COPULA-BASED APPROACH TO HEDGE<br />

FUND RETURN REPLICATION<br />

HARRY KAT (CASS BUSINESS SCHOOL - FACULTY OF FINANCE)<br />

OWNERSHIPFOREIGN LISTINGSAND MARKET VALUATION ADITYA KAUL (UNIVERSITY OF ALBERTA)<br />

TESTING BEHAVIORAL FINANCE MODELS OF MARKET UNDER- AND<br />

OVERREACTION: DO THEY REALLY WORK?<br />

ASAD KAUSAR (UNIVERSITY OF MANCHESTER)<br />

MERGER ANNOUNCEMENTS AND INSIDER TRADING ACTIVITY: AN MANOLIS KAVUSSANOS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

EMPIRICAL COMPARATIVE INVESTIGATION IN LSE AND ASE<br />

BUSINESS)<br />

INSIDER TRADING RULES AND PRICE FORMATION IN SECURITIES<br />

KARL LUDWIG KEIBER (WHU OTTO BEISHEIM SCHOOL OF<br />

MARKETS - AN ENTROPY ANALYSIS OF STRATEGIC TRADING<br />

MANAGEMENT)<br />

CAN EXCHANGE RATE VOLATILITY EXPLAIN PERSISTENCE IN THE NEIL KELLARD (UNIVERSITY OF ESSEX; DEPT. OF<br />

FORWARD PREMIUM?<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

OPTION PRICING AND CORPORATE REPORT DISCLOSURES:<br />

MANAGERIAL INCENTIVES TO UNDERVALUE<br />

ELISHA J KELLY (MONASH UNIVERSITYACCOUNTING AND FINANCE)<br />

A MODEL TO MEASURE PORTFOLIO RISKS IN VENTURE CAPITAL ANDREAS KEMMERER (GOETHE UNIVERSITY FRANKFURT)<br />

THE DAY OF THE WEEK EFFECT PATTERNS ON STOCK MARKET<br />

DIMITRIS KENOURGIOS (UNIVERSITY OF ATHENSFACULTY OF<br />

RETURN AND VOLATILITY: EVIDENCE FOR THE ATHENS STOCK<br />

EXCHANGE<br />

ECONOMICS)<br />

MARKET RESPONSES TO BUY RECOMMENDATIONS ISSUED BY<br />

GERMAN PERSONAL FINANCE MAGAZINES: EFFECTS OF<br />

INFORMATIONPRICE-PRESSUREAND COMPANY CHARACTERISTICS<br />

ALEXANDER KERL (UNIVERSITY OF TUEBINGEN)<br />

DIRECTORS'''' AND OFFICERS'''' INSURANCE AND OPPORTUNISM IN<br />

ACCOUNTING CHOICE<br />

IRENE KIM (DUKE UNIVERSITYACCOUNTING)<br />

MEASURING BUSINESS SECTOR CONCENTRATION BY AN INFECTION<br />

MODEL<br />

DUELLMANN KLAUS (DEUTSCHE BUNDESBANK)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

6<br />

TITLE AUTHOR<br />

RETURN PERFORMANCE SURROUNDING REVERSE STOCK SPLITS:<br />

CAN INVESTORS PROFIT?<br />

APRIL KLEIN (NEW YORK UNIVERSITYSTERN SCHOOL OF BUSINESS)<br />

ABNORMAL RETURNS IN THE VICINITY OF INSIDER TRANSACTIONS:<br />

UNBIASED ESTIMATES FOR GERMANY<br />

MARCO KLINGE (ROLAND BERGER STRATEGY CONSULTANTS)<br />

INSIDER TRADING AND INTERNATIONAL CROSS-LISTING ADRIANA KORCZAK (CASS BUSINESS SCHOOLDEPARTMENT OF<br />

FINANCE)<br />

BEHAVIORAL BIAS OF TRADERS: EVIDENCE FOR THE DISPOSITION AND ANDREAS KRAUSE (UNIVERSITY OF BATHSCHOOL OF<br />

REVERSE DISPOSITION EFFECT<br />

MANAGEMENT)<br />

DERIVATIVE CREDIT RISK DIFFERENTIAL – AN ANALYSIS OF EUR<br />

SWAPS<br />

VAIDYANATHAN KRISHNAMURTHY (IIT BOMBAY)<br />

SOCIAL NETWORKSCORPORATE GOVERNANCE AND CONTRACTING IN<br />

THE MUTUAL FUND INDUSTRY<br />

CAMELIA KUHNEN (STANFORD GRADUATE SCHOOL OF BUSINESS)<br />

OWNERSHIP CONCENTRATION AND COMPETITION IN BANKING<br />

MARKETS<br />

ALEXANDRA LAI (BANK OF CANADA)<br />

PROJECT FINANCED INVESTMENTSDEBT MATURITY AND CREDIT<br />

INSURANCE<br />

VAN SON LAI (LAVAL UNIVERSITY)<br />

ACTIVE FUND MANAGEMENT: THE CASE OF GLOBAL ASSET<br />

ALLOCATION FUNDS<br />

NORRIS LARRYMORE (QUINNIPIAC UNIVERSITY)<br />

MARKET BEHAVIOUR OF FOREIGN VERSUS DOMESTIC INVESTORS<br />

FOLLOWING A PERIOD OF STRESSFUL CIRCUMSTANCES<br />

MEZIANE LASFER (CASS BUSINESS SCHOOLCITY UNIVERSITY)<br />

LIQUIDITY SUPPLY IN MULTIPLE MARKETS LESCOURRET LAURENCE (ESSEC BUSINESS SCHOOL)<br />

LEARNING AND ASSET PRICES UNDER AMBIGUOUS INFORMATION MARKUS LEIPPOLD (SWISS BANKING INSTITUTE)<br />

PARAMETRIC PROPERTIES OF SEMI-NONPARAMETRIC<br />

ANGEL LEÓN (UNIVERSIDAD DE ALICANTEDPTO. ECONOMÍA<br />

DISTRIBUTIONSWITH APPLICATIONS TO OPTION VALUATION<br />

FINANCIERA)<br />

DO STOCK SPLITS REALLY SIGNAL? TAK YAN LEUNG (DEPARTMENT OF ACCOUNTANCYCITY UNIVERSITY<br />

OF HONG KONG)<br />

FOREIGN EXCHANGE EXPOSURE: EVIDENCE FROM THE UNITED<br />

DONGHUI LI (UNIVERSITY OF NEW SOUTH WALESSCHOOL OF<br />

STATES INSURANCE INDUSTRY<br />

BANKING AND FINANCE)<br />

AN EMPIRICAL ANALYSIS OF YIELD CURVES ACROSS EURO AND NON-<br />

EURO COUNTRIES USING INTERBANK INTEREST RATES<br />

HONGZHU LI (HANKENSWEDISH SCHOOL OF ECONOMICS)<br />

CCAPMWEALTH SHOCKAND STOCK MARKET ANOMALIES SAMUEL XIN LIANG LIANG (HONG KONG UNIVERSITY OF SCIENCE<br />

AND TECHNOLOGY)<br />

STRUCTURAL VERSUS TEMPORARY FACTORS IN COUNTRY AND<br />

INDUSTRY RISK<br />

BAELE LIEVEN (TILBURG UNIVERSITY)<br />

RECOVERING RISK-NEUTRAL DENSITIES OF SPOT AND OPTION<br />

YUEH-NENG LIN LIN (DEPARTMENT OF FINANCENATIONAL CHUNG<br />

MARKETS UNDER STOCHASTIC VOLATILITY AND PRICE JUMPS<br />

HSING UNIVERSITY)<br />

RISK WEIGHTS AND CAPITAL SAVING/ADDITION USING THE INTERNAL MEI-YING LIU (DEPARTMENT OF BUSINESS<br />

(VAR) MODEL BASED ON THE BASEL ACCORD<br />

ADMINISTRATIONSOOCHOW UNIVERSITY)<br />

CONVERTIBLE DEBT ISSUES AND CONVERTIBLE ARBITRAGE – ISSUE<br />

CHARACTERISTICSUNDERPRICING AND SHORT SALES<br />

IGOR LONCARSKI (TILBURG UNIVERSITYFINANCE DEPARTMENT)<br />

COULD INVESTORS OBTAIN POSITIVE RETURNS USING SECURITY GERMAN LOPEZ-ESPINOSA (UNIVERSITY OF NAVARRADEPARTMENT<br />

ANALYST RECOMMENDATIONS?<br />

OF BUSINESS)<br />

BADGOOD AND EXCELLENT: AN ICAPM WITH BOND RISK PREMIA PAULO MAIO (NEW UNIVERSITY OF LISBONFACULDADE DE<br />

ECONOMIA)<br />

CASH HOLDING POLICY AND ABILITY TO INVEST: HOW DO FIRMS<br />

MARIA-TERESA MARCHICA (MANCHESTER ACCOUNTING AND<br />

DETERMINE THEIR CAPITAL EXPENDITURES? NEW EVIDENCE FROM<br />

THE UK MARKET<br />

FINANCE GROUP MANCHESTER BUSINESS SCHOOL)<br />

THE INFORMATION CONTENT OF HEDGE FUND INVESTMENT STYLES –<br />

A RETURN-BASED ANALYSIS WITH SELF-ORGANIZING MAPS<br />

SCHWAIGER MARKUS (AUSTRIAN CENTRAL BANKOENB)<br />

CAN MARKET COMPETITION COMPLEMENT THE USUAL MECHANISMS JUAN A. MAROTO (UNIVERSIDAD COMPLUTENSE DE MADRIDDEPT.<br />

OF CORPORATE GOVERNANCE?<br />

DE ECONOMÍA FINANCIERA Y CONTABILIDAD III)<br />

THE ACCURACY OF TIME-VARYING BETAS AND THE CROSS-SECTION<br />

OF STOCK RETURNS<br />

DIDIER MARTI (UNIVERSITY OF FRIBOURG / MANAGEMENT)<br />

TAKEOVERS AND THE CROSS-SECTION OF RETURNS CREMERS MARTIJN (YALE SCHOOL OF MANAGEMENT)<br />

USING MARKET VALUES VERSUS ACCOUNTING DATA IN CREDIT RISK JOSÉ LUIS MARTÍN MARÍN (PABLO DE OLAVIDE UNIVERSITY.<br />

MODELS: A COMPARATIVE ANALYSIS<br />

DEPARTAMENTO DE DIRECCIÓN DE EMPRESAS.)<br />

SOURCES OF TRANSACTION FINANCING AND MEANS OF PAYMENT IN MARINA MARTYNOVA (TILBURG UNIVERSITY - DEPARTMENT OF<br />

CORPORATE TAKEOVERS<br />

FINANCE)<br />

SMALL CAPS IN INTERNATIONAL EQUITY PORTFOLIOS: THE EFFECTS<br />

OF VARIANCE RISK<br />

GUIDOLIN MASSIMO (FEDERAL RESERVE BANK OF ST. LOUIS)<br />

TAXES AND CORPORATE DEBT POLICY : EVIDENCE FOR UNLISTED CESARIO MATEUS (AARHUS SCHOOL OF BUSINESS - DEPARTMENT<br />

FIRMS OF SIXTEEN EUROPEAN COUNTRIES<br />

OF ACCOUNTINGFINANCE AND LOGISTICS)<br />

TECHNICAL TRADING RULES IN EMERGING MARKETS AND THE 1997 MICHAEL D. MCKENZIE (RMIT UNIVERSITYSCHOOL OF<br />

ASIAN CURRENCY CRISES<br />

ECONOMICSFINANCE AND MARKETING)<br />

FINANCIAL VISIBILITY AND THE DECISION TO GO PRIVATE HAMID MEHRAN (FEDERAL RESERVE BANK OF NEW YORK)<br />

CORPORATE INVESTMENT DECISION PRACTICES AND THE HURDLE<br />

RATE PREMIUM PUZZLE<br />

IWAN MEIER (HEC MONTREALDEPARTMENT OF FINANCE)<br />

THE ADVANTAGES OF INTRODUCING AN EXCHANGE RATE TARGET IN<br />

THE STATUTES OF THE EUROPEAN CENTRAL BANK<br />

SÉVERINE MENGUY (UNIVERSITÉ PARIS X NANTERREECONOMIX)<br />

HIGHLY LEVERAGED FIRMS AND CORPORATE PERFORMANCE IN<br />

ANNA MERIKA (THE AMERICAN COLLEGE OF GREECEDEREE<br />

DISTRESSED INDUSTRIES<br />

COLLEGE)<br />

AN EFFECTIVE INDEX OF MANAGEMENT COMPETENCE ANDREAS MERIKAS (UNIVERSITY OF PIRAEUS)<br />

THE INFORMATION CONTENT OF VOLATILITIES IMPLIED FROM<br />

CURRENCY OPTIONS: EMPIRICAL EVIDENCE FROM EMERGING MARKET<br />

COUNTRIES<br />

MARIAN MICU (BANK FOR INTERNATIONAL SETTLEMENTS)<br />

BASEL REQUIREMENT OF DOWNTURN LGD: MODELING AND<br />

PETER MIU (DEGROOTE SCHOOL OF BUSINESSMCMASTER<br />

ESTIMATING PD & LGD CORRELATIONS<br />

UNIVERSITY)<br />

CALLABLE RISKY PERPETUAL DEBT: OPTIONSPRICING AND<br />

AKSEL MJOS (NORWEGIAN SCHOOL OF ECONOMICS AND BUSINESS<br />

BANKRUPTCY IMPLICATIONS.<br />

ADMINISTRATIONINSTITUTE OF FINANCE AND MANAGEMENT<br />

SCIENCE)<br />

BOARD STRUCTUREOWNERSHIP STRUCTUREAND FIRM<br />

BELKHIR MOHAMED (UNIVERSITY OF ORLEANS - DEPARTMENT OF<br />

PERFORMANCE: EVIDENCE FROM BANKING<br />

ECONOMICS)<br />

INSIDER OWNERSHIP AND CORPORATE PERFORMANCE EVIDENCE BENJAMIN MOLDENHAUER (TECHNISCHE UNIVERSITÄT MÜNCHEN<br />

FROM GERMANY<br />

CEFS)<br />

LONG-HORIZON REGRESSIONS WHEN THE PREDICTOR IS SLOWLY<br />

VARYING<br />

ROGER MOON (UNIVERSITY OF SOUTH CALIFORNIA)<br />

THE COSKEWNESS FACTOR:IMPLICATIONS FOR PERFORMANCE<br />

EVALUATION<br />

DAVID MORENO (UNIVERSIDAD CARLOS III)<br />

FINANCING THROUGH BOND ISSUES AND THE NEXUS WITH ECONOMIC ULRIKE MOSER (VIENNA UNIVERSITY OF ECONOMICS AND<br />

GROWTH<br />

BUSINESS ADMINISTRATION / DEPARTMENT OF ENGLISH BUSINESS<br />

COMMUNICATION)<br />

THE PRICING OF TURBO CERTIFICATES IN THE PRESENCE OF<br />

MATTHIAS MUCK (WHU - OTTO BEISHEIM SCHOOL OF<br />

STOCHASTIC JUMPSINTEREST RATESAND VOLATILITY<br />

MANAGEMENT)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

7<br />

TITLE AUTHOR<br />

SHARE REPURCHASES AND REPAYMENTS OF NOMINAL VALUE: THE PHILIPPE MUELLER (COLUMBIA BUSINESS SCHOOLDIVISION OF<br />

SWISS ALTERNATIVE TO DIVIDENDS<br />

FINANCE AND ECONOMICS)<br />

FINANCIAL FLEXIBILITY AND INVESTMENT DECISIONS: EVIDENCE FROM<br />

LOW-LEVERAGE FIRMS<br />

ROBERTO MURA (MANCHESTER BUSINESS SCHOOL)<br />

HETEROGENEOUS BASKET OPTIONS PRICING USING ANALYTICAL<br />

APPROXIMATIONS<br />

OUERTANI NADIA (IESEG SCHOOL OF MANAGEMENT)<br />

MARKET DISCIPLINE IN THE EUROPEAN INSURANCE INDUSTRY: A FRANCESCO NATALE (UNIVERSITY OF MILANO - BICOCCA -<br />

PROPOSAL FOR A MODEL<br />

DEPARTMENT OF ECONOMICS AND MANAGEMENT)<br />

A NOTE ON SKEWNESS IN THE STOCHASTIC VOLATILITY MODELS BOGDAN NEGREA (UNIVERSITY PARIS 1 PANTHEON - SORBONNE)<br />

SEX MATTERS: GENDER AND MUTUAL FUNDS ALEXANDRA NIESSEN (UNIVERSTIY OF COLOGNE - DEPARTMENT OF<br />

CORPORATE FINANCE)<br />

SMALL BUSINESS BORROWING AND THE OWNER-MANAGER AGENCY JYRKI NISKANEN (UNIVERSITY OF KUOPIODEP. OF BUSINESS AND<br />

COSTS: EVIDENCE ON FINNISH DATA<br />

MANAGEMENT)<br />

MIGRATION AND CONCENTRATION RISKS IN BANK LENDING: NEW LARS NORDEN (UNIVERSITY OF MANNHEIMDEPARTMENT OF<br />

EVIDENCE FROM CREDIT PORTFOLIO DATA<br />

BANKING AND FINANCE)<br />

DOES AN INDEX FUTURES SPLIT ENHANCE TRADING ACTIVITY AND<br />

HEDGING EFFECTIVENESS OF THE FUTURES CONTRACT?<br />

LARS NORDEN (STOCKHOLM UNIVERSITYSCHOOL OF BUSINESS)<br />

DESCRIPTIVE ANALYSIS OF FINNISH EQUITYBONDAND MONEY<br />

PETER NYBERG (SWEDISH SCHOOL OF ECONOMICS AND BUSINESS<br />

MARKETS 1920-2004<br />

ADMINISTRATION - DEPARTMENT OF FINANCE AND STATISTICS)<br />

THE OVERREACTION HYPOTHESIS: DOES IT APPLY TO THE<br />

BARRY O''GRADY (CURTIN UNIVERSITY OF TECHNOLOGYSCHOOL<br />

NORWEGIAN STOCK MARKET?<br />

OF ECONOMICS AND FINANCE,)<br />

THE RETURNS TO FOLLOWING CURRENCY FORECASTS JOHN OKUNEV (MACQUARIE UNIVERSITY)<br />

BUSINESS FAILURE PREDICTION: SIMPLE-INTUITIVE MODELS VERSUS HUBERT OOGHE (GHENT UNIVERSITY - DEPARTMENT OF<br />

STATISTICAL MODELS<br />

ACCOUNTANCY AND CORPORATE FINANCE)<br />

THE EFFECT OF SOCIALLY RESPONSIBLE INVESTING ON FINANCIAL PEER OSTHOFF (UNIVERSITY OF COLOGNE - DEPARTMENT OF<br />

PERFORMANCE<br />

FINANCE)<br />

DETERMINANTS OF EXCHANGE RATE RISK HEDGING LUIS OTERO GONZÁLEZ (SANTIAGO DE COMPOSTELA (FINANCE AND<br />

ACCOUNTING))<br />

DO CORPORATE GOVERNANCE MECHANISMS INFLUENCE CEO<br />

COMPENSATION? AN EMPIRICAL INVESTIGATION OF UK COMPANIES<br />

NESLIHAN OZKAN (UNIVERSITY OF BRISTOL)<br />

DO FOREIGNERS FACILITATE INFORMATION TRANSMISSION? ARZU OZOGUZ (QUEEN'S UNIVERSITY -QUEEN'S SCHOOL OF<br />

BUSINESS)<br />

THE UK CODE OF CORPORATE GOVERNANCE:LINK BETWEEN<br />

COMPLIANCE AND FIRM PERFORMANCE<br />

CAROL PADGETT (UNIVERSITY OF READINGICMA CENTRE)<br />

WHAT DOES THE DURABLES PRICE - OVER - THE RENTAL COST<br />

MICHAL PAKOS (TEPPER SCHOOL OF BUSINESSCARNEGIE MELLON<br />

VALUATION RATIO TELL US ABOUT ASSET PRICES?<br />

UNIVERSITY)<br />

DO THE ITALIAN STARS’ SHINE IN A HYBRID MARKET? FABRIZIO PALMUCCI (UNIVERSITY OF BOLOGNADEPARTMENT OF<br />

BUSINESS)<br />

OPTIMAL MONETARY POLICY AND THE TERM STRUCTURE OF<br />

INTEREST RATES<br />

FRANCISCO PALOMINO (CARNEGIE MELLON UNIVERSITY)<br />

CREATING EFFICIENT PORTFOLIO RETURNS APPLYING FORECASTING NIKOS PALTALIDIS (CITY UNIVERSITY LONDONCASS BUSINESS<br />

TECHNIQUES AND BOOTSTRAPPING IN FTSE 100 AND XETRA DAX. SCHOOLDEPARTMENT OF FINANCE)<br />

DETERMINANTS OF SURVIVAL AND GROWTH OF LISTED SMES IN CHINA DONG PANG (UNIVERSITY OF MANCHESTER)<br />

THE PERCEPTION OF ENTREPRENEURIAL RISK: KEY DETERMINANTS IN GEORGE PARIKAKIS (UNIVERSITY OF THE AEGEANBUSINESS<br />

THE DECISION MAKING PROCESS OF GREEK INVESTORS<br />

ADMINISTRATION)<br />

VOLATILITY TRANSMISSION FOR CROSS LISTED FIRMS AND THE ROLE BARTOLOMÉ PASCUAL-FUSTER (UNIVERSIDAD DE LAS ISLAS<br />

OF INTERNATIONAL EXPOSURE<br />

BALEARES)<br />

OPTIMAL BENCHMARKING FOR ACTIVE PORTFOLIO MANAGERS PONCET PATRICE (DPT OF FINANCEESSEC BUSINESS SCHOOL)<br />

DOES THE STOCK MARKET REACT TO UNSOLICITED RATINGS? BEHR PATRICK (GOETHE UNIVERSITY FRANKFURTFINANCE<br />

DEPARTMENT)<br />

HANGING OUT ON THE SELL-SIDE EVIDENCE ON ANALYST AND<br />

BROKER REWARDS FROM FORECASTING ON THE ASX<br />

KERRY PATTENDEN (UNIVERSITY OF SYDNEY)<br />

RISK MANAGEMENT IN A DEALERSHIP MARKET --- EVIDENCE FROM<br />

FIXED INCOME DEALER<br />

KE PENG (UNIVERSITY OF BRADFORD)<br />

CANONICAL TERM-STRUCTURE MODELS WITH OBSERVABLE FACTORS MARCELLO PERICOLI (BANCA D'ITALIAECONOMICS RESEARCH<br />

AND THE DYNAMICS OF BOND RISK PREMIA<br />

DEPARTMENT)<br />

THE MULTIVARIATE GRAM-CHARLIER DENSITY JAVIER PEROTE (UNIVERSIDAD REY JUAN CARLOS. DPT. ECONOMÍA<br />

APLICADA II Y FUNDAMENTOS DEL ANÁLISIS ECONÓMICO)<br />

IMPORTANCE SAMPLING FOR INTEGRATED MARKET AND CREDIT GRUNDKE PETER (UNIVERSITY OF COLOGNEDEPARTMENT OF<br />

PORTFOLIO MODELS<br />

BANKING)<br />

DOES REPORTED EARNINGS VOLATILITY IMPROVE UK EARNINGS NIKOLA PETROVIC (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

FORECASTS?<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

ESTIMATING THE PROBABILITY OF FINANCIAL DISTRESS:<br />

INTERNATIONAL EVIDENCE<br />

JULIO PINDADO (UNIVERSIDAD DE SALAMANCA)<br />

MARKET RISK DYNAMICS AND COMPETITIVENESS AFTER THE EURO: JUAN PIÑEIRO CHOUSA (UNIVERSITY OF SANTIAGO DE<br />

EVIDENCE FROM EMU MEMBERS<br />

COMPOSTELADEPARTMENTO OF FINANCE AND ACCOUNTING)<br />

M&A MARKET IN TRANSITION ECONOMIES: EVIDENCE FROM ROMANIA DIANA POP (UNIVERSITÉ D'ORLÉANSLABORATOIRE D'ECONOMIE<br />

D'ORLEANS)<br />

THE COSKEWNESS PUZZLE IN THE CROSS-SECTION OF INDUSTRY<br />

PORTFOLIO EXCESS RETURNS<br />

VALERIO POTI (DUBLIN CITY UNIVERSITY)<br />

ARE CORPORATE RESTRUCTURING EVENTS DRIVEN BY COMMON<br />

FACTORS? IMPLICATIONS FOR TAKEOVER PREDICTION<br />

RONAN POWELL (UNSWBANKING AND FINANCE)<br />

A NEW SIGNALING MORE COMPLETE EXPLANATION: INVESTORS<br />

BEHAVIOR TO CORPORATE ANNOUNCEMENTS<br />

JAIRO LASER PROCIANOY (PPGA/EA/UFRGS)<br />

SHARE ISSUING PRIVATIZATIONS IN CHINA: DETERMINANTS OF PUBLIC QI QUAN (DEPARTMENT OF ACCOUNTANCYFINANCE AND<br />

SHARE ALLOCATION AND UNDERPRICING<br />

INSURANCEKATHOLIEKE UNIVERSITEIT LEUVEN)<br />

INFORMATION CONTENT AND PREDICTABILITY OF EXTREME PRICES IN<br />

FINANCIAL MARKETS<br />

ANGELO RANALDO (SWISS NATIONAL BANK)<br />

IMPROVING THE ASSET PRICING ABILITY OF THE CONSUMPTION- ANNE-SOFIE RENG RASMUSSEN (DEPARTMENT OF BUSINESS<br />

CAPITAL ASSET PRICING MODEL?<br />

STUDIESAARHUS SCHOOL OF BUSINESS)<br />

LIQUIDITY AND TRANSPARENCY IN BANK RISK MANAGEMENT LEV RATNOVSKI (UNIV. AMSTERDAM - FINANCE GROUP)<br />

EURO AND CONVERGENCE OF THE DYNAMIC STRUCTURE OF THE<br />

STOCK MARKETS<br />

CHOU RAY (INST ECONOMICSACADEMIA SINICA)<br />

QUADRATIC TERM STRUCTURE MODELS IN DISCRETE TIME MARCO REALDON (ECONOMICS DEPT UNIVERSITY OF YORK)<br />

EXPLAINING MISPRICING OF INITIAL PUBLIC OFFERINGS BEAT REBER (NOTTINGHAM UNIVERSITY BUSINESS SCHOOL)<br />

IS ETHICAL MONEY FINANCIALLY SMART? LUC RENNEBOOG (DEPARTMENT OF FINANCE AND CENTERTILBURG<br />

UNIVERSITY)<br />

THE CONTENT OF REPORTS ON ITALIAN STOCKS. DO EVALUATION UGO RIGONI (UNIVERSITY OF VENICECA’ FOSCARIDEPARTMENT OF<br />

METHODS MATTER?<br />

BUSINESS ECONOMICS AND MANAGEMENT,)<br />

A MODEL FOR THE PUBLIC FINANCING OF ENTREPRENEURIAL FIRMS: MICHAEL ROBINSON (UNIVERSITY OF CALGARYHASKAYNE SCHOOL<br />

ALBERTA''''S JUNIOR CAPITAL POOL PROGRAM<br />

OF BUSINESS)<br />

THE VALUATION OF MODULAR PROJECTS: A REAL OPTIONS<br />

ARTUR RODRIGUES (MANAGEMENT RESEARCH UNIT - UNIVERSITY<br />

APPROACH TO THE VALUE OF SPLITTING<br />

OF MINHO)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

8<br />

TITLE AUTHOR<br />

UNDERSTANDING AND FORECASTING STOCK PRICE CHANGES PEDRO RODRIGUEZ (UNIVERSIDAD COMPLUTENSE DE<br />

MADRID;FACULTAD DE CIENCIAS ECONÓMICAS Y<br />

EMPRESARIALESDEPARTAMENTO DE ESTADÍSTICA E<br />

INVESTIGACIÓN OPERATIVA II)<br />

REVISITING STATIC PORTFOLIO THEORY FOR HARA INVESTORS IÑAKI RODRÍGUEZ LONGARELA (STOCKHOLM SCHOOL OF<br />

ECONOMICS DEPARTMENT OF FINANCE)<br />

TOTAL VENTURE CAPITAL DIVESTMENTS AS ABANDONMENT OPTIONS JAVIER ROJO SUÁREZ (UNIVERSIDAD REY JUAN CARLOSBUSINESS<br />

AND ASYMMETRIC INFORMATION<br />

ADMINISTRATION DEPARTMENT)<br />

AN INTRADAY PRICING MODEL OF FOREIGN EXCHANGE MARKETS RAFAEL ROMEU (INTERNATIONAL MONETARY FUND)<br />

A NEW MEASURE OF CROSS-SECTIONAL RISK: THEORY AND<br />

ANDREA RONCORONI (ESSEC BUSINESS SCHOOL)<br />

APPLICATIONS.<br />

INTERTEMPORAL CAPITAL ALLOCATION AND CORPORATE<br />

ANDREW ROPER (UNIVERSITY OF WISCONSIN-MADISONSCHOOL OF<br />

INVESTMENT<br />

BUSINESS)<br />

LIMITED LIABILITY IN BUSINESS GROUPS EVA ROPERO MORIONES (DEPARTMENT OF BUSINESS<br />

ADMINISTRATIONUNIV. CARLOS III DE MADRID)<br />

PRE-BID ACQUISITIONS OF TARGET STOCK AND MANAGEMENT-<br />

BRUCE A ROSSER (UNIVERSITY OF ADELAIDE)<br />

CONTROLLED EQUITY<br />

STRATEGIC MARKET MAKING AND RISK SHARING FABRICE ROUSSEAU (NATIONAL UNIVERSITY OF<br />

IRELANDMAYNOOTHDEPARTMENT OF ECONOMICS)<br />

OPTION-IMPLIED PREFERENCES ADJUSTMENTSDENSITY<br />

FORECASTSAND THE EQUITY RISK PREMIUM<br />

GONZALO RUBIO (DEPARTAMENT OF ECONOMICSUNIVERSITY OF<br />

THE BASQUE COUNTRY AND DEPARTAMENT OF FINANCE AND<br />

ECONOMICSUNIVERSITY OF CASTILLA LA MANCHA)<br />

DELPHINE SABOURIN (CREST AND UNIVERSITY OF PARIS<br />

DAUPHINE)<br />

SALIM CHAHINE SALIM (AMERICAN UNIVERSITY OF BEIRUT -<br />

SCHOOL OF BUSINESS - FINANCE)<br />

SALIM CHAHINE SALIM (AMERICAN UNIVERSITY OF BEIRUT -<br />

SCHOOL OF BUSINESS - FINANCE)<br />

ARE DESIGNATED MARKET MAKERS NECESSARY IN CENTRALIZED<br />

LIMIT ORDER MARKETS?<br />

PREMIUMMERGER FEES AND THE CHOICE OF INVESTMENT BANKS: A<br />

SIMULTANEOUS ANALYSIS<br />

VENTURE CAPITALISTSBUSINESS ANGELSAND PERFORMANCE OF<br />

ENTREPRENEURIAL IPOS IN THE UK AND FRANCE.<br />

A STOCHASTIC VOLATILITY SWAP MARKET MODEL ATTAOUI SAMI (UNIVERSITY OF PARIS 1 PANTHEON-SORBONNE<br />

DEPARTEMENT OF MANAGEMENT (OSES))<br />

TARGET BONDHOLDER WEALTH AND SHAREHOLDER POWER DURING ANTHONY SANDERS (THE OHIO STATE UNIVERSITY; FACULTY OF<br />

MERGERS AND ACQUISITIONS<br />

FINANCE)<br />

EXCHANGE RATE RESPONSE TO MACRO NEWS: THROUGH THE LENS TANSELI SAVASER (BRANDEIS UNIVERSITY INTERNATIONAL<br />

OF MICROSTRUCTURE<br />

BUSINESS SCHOOL)<br />

THE FIRM-SPECIFIC DETERMINANTS OF CORPORATE CAPITAL<br />

GÜVEN SAYÝLGAN (BUSINESS ADMINISTRATIONFACULTY OF<br />

STRUCTURE: EVIDENCE FROM TURKISH DYNAMIC PANEL DATA<br />

POLITICAL SCIENCESANKARA UNIVERSITY)<br />

A MULTI-FACTOR APPROACH FOR SYSTEMATIC DEFAULT AND<br />

HARALD SCHEULE (UNIVERSITY OF MELBOURNEDEPARTMENT OF<br />

RECOVERY RISK<br />

FINANCE)<br />

WHY DO LATIN AMERICAN FIRMS MANAGE CURRENCY RISK? RAFAEL SCHIOZER (FUNDACAO GETULIO VARGAS / EAESP -<br />

ACCOUNTING AND FINANCE DEPT.)<br />

THE IMPACT OF BASEL I REGULATION ON BANK DEPOSITS AND LOANS: BIRGIT SCHMITZ (UNIVERSITY OF BONNIIW INSTITUTE FOR<br />

EMPIRICAL EVIDENCE FOR EUROPE<br />

INTERNATIONAL ECONOMICS)<br />

THE SHARPE RATI S MARKET CLIMATE BIAS THEORETICAL AND HENDRIK SCHOLZ (CATHOLIC UNIVERSITY EICHSTAETT-<br />

EMPIRICAL EVIDENCE FROM US EQUITY MUTUAL FUNDS<br />

INGOLSTADTINGOLSTADT SCHOOL OF MANAGEMENT)<br />

CROSS-SECTIONAL TESTS OF CONDITIONAL ASSET PRICING MODELS: ANDREAS SCHRIMPF (CENTRE FOR EUROPEAN ECONOMIC<br />

EVIDENCE FROM THE GERMAN STOCK MARKET<br />

RESEARCH (ZEW)MANNHEIM. DEPT. INTERNATIONAL FINANCE AND<br />

FINANCIAL MANAGEMENT)<br />

IMPLIED COST OF CAPITAL BASED INVESTMENT STRATEGIES -<br />

EVIDENCE FROM INTERNATIONAL STOCK MARKETS<br />

DAVID SCHROEDER (CREST)<br />

THE INTERNATIONAL EVIDENCE ON THE PECKING ORDER HYPOTHESIS BRUCE SEIFERT (DEPARTMENT OF BUSINESS ADMINISTRATIONOLD<br />

DOMINION UNIVERSITY)<br />

RISK FACTOR BETA CONDITIONAL VALUE-AT-RISK ANDREI SEMENOV (YORK UNIVERSITYECONOMICS)<br />

ESTIMATING THE COSTS OF INTERNATIONAL EQUITY INVESTMENTS PIET SERCU (KATHOLIEKE UNIVERSITEIT LEUVEN - INTERNATIONAL<br />

FINANCE)<br />

A MODEL OF THE COMPONENTS OF THE BID-ASK SPREAD ALEXEY SEREDNYAKOV (UNIVERSITY OF MINNESOTA/ FINANCE<br />

DEPARTMENT)<br />

DEMUTUALIZATIONOUTSIDER OWNERSHIP AND STOCK EXCHANGE BARIS SERIFSOY (GOETHE UNIVERSITY FRANKFURT / WHARTON<br />

PERFORMANCE - EMPIRICAL EVIDENCE<br />

SCHOOLFINANCE DEPARTMENT)<br />

A MULTI-HORIZON COMPARISON OF DENSITY FORECASTS FOR THE MARK SHACKLETON (ACCOUNTING & FINANCELANCASTER<br />

S&P 500 USING INDEX RETURNS AND OPTION PRICES<br />

UNIVERSITYENGLAND)<br />

INFORMATIONAL RELEASES IN DIVERSIFYING TAKEOVERS HUSAYN SHAHRUR (BENTLEY COLLEGEFINANCE DEPARTMENT)<br />

WARRANT VALUATION AND STRATEGIC EXERCISE IN CONTINUOUS ROY SHALEM (TEL-AVIV UNIVERSITYISRAEL - THE EITAN BERGLAS<br />

TIME AND IMPERFECT COMPETITION<br />

SCHOOL OF ECONOMICS)<br />

THE PRICING OF FINITE MATURITY CORPORATE COUPON BONDS WITH SÉRGIO SILVA (PORTUCALENSE UNIVERSITYECONOMICS<br />

RATING-BASED COVENANTS<br />

DEPARTMENT)<br />

OVERPRICING IN EMERGING MARKET CREDIT DEFAULT SWAP<br />

CONTRACTS--SOME EVIDENCE FROM RECENT DISTRESS CASES.<br />

MANMOHAN SINGH (INTERNATIONAL MONETARY FUND)<br />

EQUITY HOME BIAS AND REGRET: AN INTERNATIONAL EQUILIBRIUM<br />

MODEL<br />

BRUNO SOLNIK (HEC-PARIS SCHOOL OF MANAGEMENT)<br />

HIDDEN ORDERS AND LIQUIDITY IN LIMIT ORDER MARKETS MOINAS SOPHIE (TOULOUSE BUSINESS SCHOOL)<br />

VOLATILITY COMPONENTS: EVIDENCE OF THE BEHAVIOUR OF THE SÓNIA SOUSA (FACULDADE DE ECONOMIA DA UNIVERSIDADE DO<br />

PORTUGUESE STOCK MARKET<br />

PORTO,)<br />

SEPARATING THE STOCK MARKET''S REACTION TO SIMULTANEOUS CARINA SPONHOLTZ (UNIVERSITY OF AARHUSDEPARTMENT OF<br />

DIVIDEND AND EARNINGS ANNOUNCEMENTS<br />

MANAGEMENT)<br />

THE EFFECT OF BOARD SIZE AND COMPOSITION ON EUROPEAN BANK CHRISTOS STAIKOURAS (DEPARTMENT OF ACCOUNTING AND<br />

PERFORMANCE<br />

FINANCEATHENS UNIVERSITY OF ECONOMICS AND BUSINESS)<br />

RISK-RETURN ISSUES IN DEREGULATING THE BANKING FIRM SOTIRIS K STAIKOURAS (CASS BUSINESS SCHOOLFINANCE)<br />

THE INTERACTION BETWEEN TECHNICAL CURRENCY TRADING AND SCHULMEISTER STEPHAN (AUSTRIAN INSTITUTE OF ECONOMIC<br />

EXCHANGE RATE FLUCTUATIONS<br />

RESEARCH)<br />

MANAGERIAL INCENTIVESOVERCONFIDENCERISK-TAKINGAND<br />

SUDI SUDARSANAM (SCHOOL OF MANAGEMENTCRANFIELD<br />

ACQUIRER SHAREHOLDER VALUE CREATION IN MERGERS AND<br />

ACQUISITIONS<br />

UNIVERSITY)<br />

SPANNING TESTS FOR REPLICABLE SMALL CAP INDEXES AS<br />

SEPARATE ASSET CLASSES: INTERNATIONAL EVIDENCE<br />

LORNE SWITZER (CONCORDIA UNIVERSITYFINANCE DEPARTMENT)<br />

SMALL CAP FIRM PERFORMANCE AND CORPORATE GOVERNANCE: A<br />

SIMULTANEOUS EQUATIONS APPROACH<br />

LORNE SWITZER (CONCORDIA UNIVERSITYFINANCE DEPARTMENT)<br />

CONSUMPTION RISK AND EXPECTED FUTURES RETURNS MARTA SZYMANOWSKA (TILBURG UNIVERSTITYDEPARTMENT OF<br />

FINANCE)<br />

THE IMPACT OF REORGANIZATION FILING AND RESOLUTION ON<br />

TSENG-CHUNG TANG (NATIONAL FORMOSA<br />

DISTRESSED-STOCK RETURNS<br />

UNIVERSITYDEPARTMENT OF BUSINESS ADMINISTRATION)<br />

INFORMATION CONTENT OF IMPLIED VOLATILITIES AND MODEL-FREE STEPHEN J. TAYLOR TAYLOR (DEPARTMENT OF ACCOUNTING AND<br />

VOLATILITY EXPECTATIONS: EVIDENCE FROM OPTIONS WRITTEN ON<br />

INDIVIDUAL STOCKS<br />

FINANCELANCASTER UNIVERSITY)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>

9<br />

TITLE AUTHOR<br />

HOW DO INVESTMENT PATTERNS OF INDEPENDENT AND CAPTIVE<br />

PRIVATE EQUITY FUNDS DIFFER? EVIDENCE FROM GERMANY<br />

TYKVOVA TEREZA (ZEW MANNHEIM)<br />

PRICE DISCOVERY IN SPOT AND FUTURES MARKETS: A<br />

RECONSIDERATION<br />

ERIK THEISSEN (UNIVERSITY OF BONN)<br />

EXTREME UNDERPRICING: DETERMINANTS OF CHINESE IPO INITIAL LIHUI TIAN (GUANGHUA SCHOOL OF MANAGEMENTPEKING<br />

RETURNS<br />

UNIVERSITY)<br />

VALUE-AT-RISK AND EXTREME VALUE DISTRIBUTIONS FOR FINANCIAL KONSTANTINOS TOLIKAS (CARDIFF UNIVERSITYCARDIFF BUSINESS<br />

RETURNS OF FRENCH FIRMS<br />

SCHOOL)<br />

THE INFLUENCE OF THE TYPE AND NUMBER OF BLOCKHOLDERS ON<br />

R&D INVESTMENTS<br />

JOSE ANTONIO TRIBO (CARLOS III. BUSINESS DEPARTMENT)<br />

INVESTMENT FRICTIONS AND LEVERAGE DYNAMICS SERGEY TSYPLAKOV (UNIVERSITY OF SOUTH CAROLINADEPT OF<br />

FINANCE)<br />

ACQUIRING FIRM PERFORMANCE: THE IMPACT OF<br />

CHRISTIAN TUCH (UNIVERSITY OF SHEFFIELD MANAGEMENT<br />

GOVERNANCEMARKET MOMENTUM AND METHOD OF PAYMENT<br />

SCHOOL)<br />

ACCOUNTING FRAUD AND THE PRICING OF CORPORATE LIABILITIES:<br />

STRUCTURAL MODELS WITH GARBLING<br />

CHERUBINI UMBERTO (UNIVERSITY OF BOLOGNA MATEMATES)<br />

PRICING OF LIQUIDITY RISK: EMPIRICAL EVIDENCE FROM FINLAND MIKA VAIHEKOSKI VAIHEKOSKI (LAPPEENRANTA UNIVERSITY OF<br />

TECHNOLOGYDEP. OF BUS. ADM.)<br />

BROAD-BASED EMPLOYEE STOCK OPTIONS GRANTS AND IPO FIRMS TJALLING VAN DER GOOT (UNIVERSITY OF AMSTERDAM / DPT.<br />

BUSINESS STUDIES)<br />

MANAGERS IN THE FAMILIAR AND THEIR DIVESTMENT DECISIONS MARIEKE VAN DER POEL (RSM ERASMUS UNIVERSITYDEPARTMENT<br />

FINANCIAL MANAGEMENT)<br />

THE CAUSES OF INTERNATIONAL DIVERSIFICATION IN THE STOCK AND<br />

EUROBOND MARKETS<br />

SIMONE VAROTTO (UN. OF READINGICMA CENTRE)<br />

THE NATURE AND PERSISTENCE OF BUYBACK ANOMALIES THEO VERMAELEN (INSEAD)<br />

THE ECONOMIC CONSEQUENCES OF IFRS: THE VANISHING OF<br />

PATRICK VERWIJMEREN (RSM ERASMUS UNIVERSITYFINANCIAL<br />

PREFERENCE SHARES IN THE NETHERLANDS<br />

MANAGEMENT)<br />

DO FIRMS HAVE FINANCING PREFERENCES ALONG THEIR LIFE<br />

GABRIELA VIDAL TEIXEIRA (UNIVERSIDADE CATÓLICA PORTUGUESA<br />

CYCLES? THEORYAND EVIDENCE FROM IBERIA<br />

- FEG)<br />

VALUATION OF ELECTRICITY FORWARD CONTRACTS: THE ROLE OF PABLO VILLAPLANA (POMPEU FABRA UNIVERSITY; DEPARTMENT OF<br />

DEMAND AND CAPACITY<br />

ECONOMICS AND BUSINESS)<br />

BEATING THE ODDS: ARBITRAGE AND WINING STRATEGIES IN THE NIKOLAOS VLASTAKIS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

FOOTBALL BETTING MARKET<br />

BUSINESS - DEPARTMENT OF MANAGEMENT SCIENCE AND<br />

TECHNOLOGY)<br />

WEALTH AND RISK EFFECTS OF ADOPTING DEPOSIT INSURANCE IN<br />

CANADA: EVIDENCE OF RISK SHIFTING BY BANKS AND TRUST<br />

COMPANIES<br />

JOHN WAGSTER (WAYNE STATE UNIVERSITY - FINANCE)<br />

ASSET PRICING UNDER ALTERNATIVE INVESTMENT HORIZONS KATHLEEN WALSH (UNIVERSITY OF NSW)<br />

CROSS-AUTOCORRELATION OF DUAL-LISTED STOCK PORTFOLIO<br />

RETURNS<br />

DAXUE WANG (IESE BUSINESS SCHOOLFINANCE DEPARTMENT)<br />

DOES SKIN IN THE GAME MATTER? DIRECTOR INCENTIVES AND<br />

GOVERNANCE IN THE MUTUAL FUND INDUSTRY<br />

DAVID WEINBAUM (CORNELL UNIVERSITY)<br />

GOVERNANCE AND TAKEOVERS: ARE PUBLIC TO PRIVATE<br />

CHARLIE WEIR (ABERDEEN BUSINESS SCHOOLTHE ROBERT<br />

TRANSACTIONS DIFFERENT?<br />

GORDON UNIVERSITY)<br />

SHOULD EXECUTIVES HEDGE THEIR STOCK OPTIONS ANDIF SOHOW? A. ELIZABETH WHALLEY (WARWICK BUSINESS SCHOOLUNIVERSITY<br />

OF WARWICK)<br />

COMMENCEMENT OF ELECTRONIC TRADING: IMPACT ON<br />

J. WICKRAMANAYAKE (MONASH UNIVERSITYDEPT OF ACCOUNTING<br />

LIQUIDITYPRICE DISCOVERY AND MARKET EFFICIENCY - AUSTRALIAN<br />

EVIDENCE FROM SYDNEY FUTURES EXCHANGE<br />

AND FINANCE)<br />

THE IMPACT OF CORPORATE DERIVATIVE USAGE ON FOREIGN<br />

VERSCHOOR WILLEM F. C. (RADBOUD UNIVERSITY NIJMEGEN /<br />

EXCHANGE RISK EXPOSURE<br />

FINANCE DEPARTMENT)<br />

DIVIDENDSPRICES AND THE PRESENT VALUE MODEL:FIRM-LEVEL<br />

EVIDENCE<br />

JOHN O.S. WILSON (SCHOOL OF MANAGEMENT)<br />

CORPORATE GOVERNANCE AND THE INFORMATIVENESS OF<br />

TRACIE WOIDTKE (DEPARTMENT OF FINANCE AND CORPORATE<br />

ACCOUNTING EARNINGS: THE ROLE OF THE AUDIT COMMITTEE<br />

GOVERNANCE CENTERUNIVERSITY OF TENNESSEEU.S.A.)<br />

CONFLICTS OF INTEREST AND RESEARCH QUALITY OF AFFILIATED<br />

ANALYSTS: EVIDENCE FROM IPO UNDERWRITING<br />

BESSLER WOLFGANG (UNIVERSITY OF GIESSEN)<br />

WHAT MAKES A BANK MISBEHAVE? THE ROLE OF THE BOARD SIBEL YAMAK (GALATASARAY UNIVERSITYDEPARTMENT OF<br />

MANAGEMENT)<br />

MARKET TIMING IN M&AS: ANALYST SENTIMENT AROUND<br />

ANNOUNCEMENTS<br />

AN YAN (FORDHAM UNIVERSITYSCHOOL OF BUSINESS)<br />

HEDGING WITH CHINESE METAL FUTURES LI YANG YANG (SCHOOL OF BANKING & FINANCEUNIVERSITY OF<br />

NEW SOUTH WALES)<br />

THE REAL DETERMINANTS OF ASSET SALES LIU YANG (UNIVERSITY OF MARYLANDDEPARTMENT OF FINANCE)<br />

RESTRUCTURINGCONSOLIDATION AND COMPETITION IN LATIN<br />

SEMIH YILDIRIM (YORK UNIVERSITYSCHOOL OF ADMINISTRATIVE<br />

AMERICAN BANKING MARKETS<br />

STUDIES)<br />

MARKET LIQUIDITYCAPITALIZATION AND THE RANDOM WALK<br />

BEHAVIOR OF STOCK PRICES<br />

KAMIL YILMAZ (KOC UNIVERSITY)<br />

DECOMPOSING THE BID-ASK SPREAD: A CROSS-MARKET MODEL<br />

HENRY YIP (UNIVERSITY OF NEW SOUTH WALESSCHOOL OF<br />

USING OPTIONS DATA<br />

BANKING AND FINANCE)<br />

CYCLES IN THE IPO MARKET CHRIS YUNG (LEEDS SCHOOL OF BUSINESS)<br />

NEWSTRADINGAND STOCK RETURN VOLATILITY VLADIMIR ZDOROVTSOV (STATE STREET GLOBAL ADVISORS -<br />

ADVANCED RESEARCH CENTER)<br />

DETERMINANTS OF FLOWS INTO RETAIL INTERNATIONAL EQUITY<br />

FUNDS<br />

XINGE ZHAO (CHINA EUROPE INTERNATIONAL BUSINESS SCHOOL)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>