Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

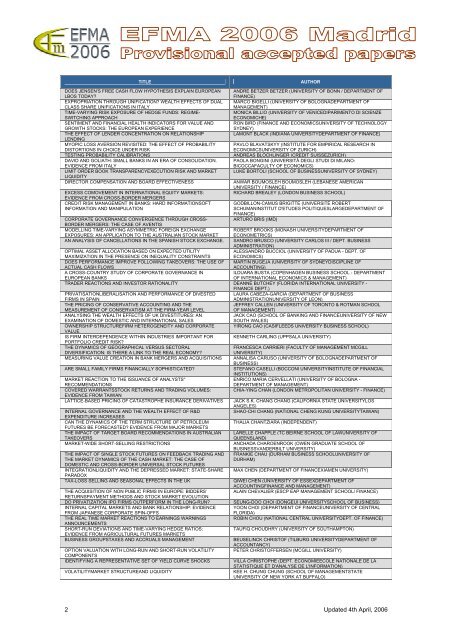

TITLE AUTHOR<br />

DOES JENSEN’S FREE CASH FLOW HYPOTHESIS EXPLAIN EUROPEAN ANDRÉ BETZER BETZER (UNIVERSITY OF BONN / DEPARTMENT OF<br />

LBOS TODAY?<br />

FINANCE)<br />

EXPROPRIATION THROUGH UNIFICATION? WEALTH EFFECTS OF DUAL MARCO BIGELLI (UNIVERSITY OF BOLOGNADEPARTMENT OF<br />

CLASS SHARE UNIFICATIONS IN ITALY<br />

MANAGEMENT)<br />

TIME-VARYING RISK EXPOSURE OF HEDGE FUNDS: REGIME-<br />

MONICA BILLIO (UNIVERSITY OF VENICEDIPARIMENTO DI SCIENZE<br />

SWITCHING APPROACH<br />

ECONOMICHE)<br />

SENTIMENT AND FINANCIAL HEALTH INDICATORS FOR VALUE AND RON BIRD (FINANCE AND ECONOMICSUNIVERSITY OF TECHNOLOGY<br />

GROWTH STOCKS: THE EUROPEAN EXPERIENCE<br />

SYDNEY)<br />

THE EFFECT OF LENDER CONCENTRATION ON RELATIONSHIP<br />

LENDING<br />

LAMONT BLACK (INDIANA UNIVERSITYDEPARTMENT OF FINANCE)<br />

MYOPIC LOSS AVERSION REVISITED: THE EFFECT OF PROBABILITY PAVLO BLAVATSKYY (INSTITUTE FOR EMPIRICAL RESEARCH IN<br />

DISTORTIONS IN CHOICE UNDER RISK<br />

ECONOMICSUNIVERSITY OF ZURICH)<br />

TESTING PROBABILITY CALIBRATIONS ANDREAS BLÖCHLINGER (CREDIT SUISSEZURICH)<br />

DAVID AND GOLIATH: SMALL BANKS IN AN ERA OF CONSOLIDATION. PAOLA BONGINI (UNIVERSITÀ DEGLI STUDI DI MILANO-<br />

EVIDENCE FROM ITALY<br />

BICOCCAFACULTY OF ECONOMICS)<br />

LIMIT ORDER BOOK TRANSPARENCYEXECUTION RISK AND MARKET<br />

LIQUIDITY<br />

LUKE BORTOLI (SCHOOL OF BUSINESSUNIVERSITY OF SYDNEY)<br />

DIRECTOR COMPENSATION AND BOARD EFFECTIVENESS ANWAR BOUMOSLEH BOUMOSLEH (LEBANESE AMERICAN<br />

UNIVERSITY / FINANCE)<br />

EXCESS COMOVEMENT IN INTERNATIONAL EQUITY MARKETS:<br />

EVIDENCE FROM CROSS-BORDER MERGERS<br />

RICHARD BREALEY (LONDON BUSINESS SCHOOL)<br />

CREDIT RISK MANAGEMENT IN BANKS: HARD INFORMATIONSOFT GODBILLON-CAMUS BRIGITTE (UNIVERSITÉ ROBERT<br />

INFORMATION AND MANIPULATION<br />

SCHUMANINSTITUT D'ETUDES POLITIQUESLARGEDEPARTMENT OF<br />

FINANCE)<br />

CORPORATE GOVERNANCE CONVERGENCE THROUGH CROSS-<br />

BORDER MERGERS: THE CASE OF AVENTIS<br />

ARTURO BRIS (IMD)<br />

MODELLING TIME-VARYING ASYMMETRIC FOREIGN EXCHANGE<br />

ROBERT BROOKS (MONASH UNIVERSITYDEPARTMENT OF<br />

EXPOSURES: AN APPLICATION TO THE AUSTRALIAN STOCK MARKET ECONOMETRICS)<br />

AN ANALYSIS OF CANCELLATIONS IN THE SPANISH STOCK EXCHANGE. SANDRO BRUSCO (UNIVERSITY CARLOS III / DEPT. BUSINESS<br />

ADMINISTRATION)<br />

OPTIMAL ASSET ALLOCATION BASED ON EXPECTED UTILITY<br />

ALESSANDRO BUCCIOL (UNIVERSITY OF PADUA - DEPT. OF<br />

MAXIMIZATION IN THE PRESENCE ON INEQUALITY CONSTRAINTS<br />

ECONOMICS)<br />

DOES PERFORMANCE IMPROVE FOLLOWING TAKEOVERS: THE USE OF MARTIN BUGEJA (UNIVERSITY OF SYDNEYDISCIPLINE OF<br />

ACTUAL CASH FLOWS<br />

ACCOUNTING)<br />

A CROSS-COUNTRY STUDY OF CORPORATE GOVERNANCE IN<br />

ILDUARA BUSTA (COPENHAGEN BUSINESS SCHOOL - DEPARTMENT<br />

EUROPEAN BANKS<br />

OF INTERNATIONAL ECONOMICS & MANAGEMENT)<br />

TRADER REACTIONS AND INVESTOR RATIONALITY DEANNE BUTCHEY (FLORIDA INTERNATIONAL UNIVERSITY -<br />

FINANCE DEPT.)<br />

PRIVATISATIONLIBERALISATION AND PERFORMANCE OF DIVESTED LAURA CABEZA-GARCIA (DEPARTMENT OF BUSINESS<br />

FIRMS IN SPAIN<br />

ADMINISTRATIONUNIVERSITY OF LEON)<br />

THE PRICING OF CONSERVATIVE ACCOUNTING AND THE<br />

JEFFREY CALLEN (UNIVERSITY OF TORONTO & ROTMAN SCHOOL<br />

MEASUREMENT OF CONSERVATISM AT THE FIRM-YEAR LEVEL<br />

OF MANAGEMENT)<br />

ANALYSING THE WEALTH EFFECTS OF UK DIVESTITURES: AN<br />

JACK CAO (SCHOOL OF BANKING AND FINANCEUNIVERSITY OF NEW<br />

EXAMINATION OF DOMESTIC AND INTERNATIONAL SALES<br />

SOUTH WALES)<br />

OWNERSHIP STRUCTUREFIRM HETEROGENEITY AND CORPORATE<br />

VALUE<br />

YIRONG CAO (CASIFLEEDS UNIVERSITY BUSINESS SCHOOL)<br />

IS FIRM INTERDEPENDENCE WITHIN INDUSTRIES IMPORTANT FOR<br />

PORTFOLIO CREDIT RISK?<br />

KENNETH CARLING (UPPSALA UNIVERSITY)<br />

THE DYNAMICS OF GEOGRAPHICAL VERSUS SECTORAL<br />

FRANCESCA CARRIERI (FACULTY OF MANAGEMENT MCGILL<br />

DIVERSIFICATION: IS THERE A LINK TO THE REAL ECONOMY?<br />

UNIVERSITY)<br />

MEASURING VALUE CREATION IN BANK MERGERS AND ACQUISITIONS ANNALISA CARUSO (UNIVERSITY OF BOLOGNADEPARTMENT OF<br />

BUSINESS)<br />

ARE SMALL FAMILY FIRMS FINANCIALLY SOPHISTICATED? STEFANO CASELLI (BOCCONI UNIVERSITYINSTITUTE OF FINANCIAL<br />

INSTITUTIONS)<br />

MARKET REACTION TO THE ISSUANCE OF ANALYSTS''<br />

ENRICO MARIA CERVELLATI (UNIVERSITY OF BOLOGNA -<br />

RECOMMENDATIONS<br />

DEPARTMENT OF MANAGEMENT)<br />

COVERED WARRANTSSTOCK RETURNS AND TRADING VOLUMES:<br />

EVIDENCE FROM TAIWAN<br />

CHIA-YING CHAN (LONDON METROPOLITAN UNIVERSITY - FINANCE)<br />

LATTICE-BASED PRICING OF CATASTROPHE INSURANCE DERIVATIVES JACK S.K. CHANG CHANG (CALIFORNIA STATE UNIVERSITYLOS<br />

ANGELES)<br />

INTERNAL GOVERNANCE AND THE WEALTH EFFECT OF R&D<br />

EXPENDITURE INCREASES<br />

SHAO-CHI CHANG (NATIONAL CHENG KUNG UNIVERSITYTAIWAN)<br />

CAN THE DYNAMICS OF THE TERM STRUCTURE OF PETROLEUM<br />

FUTURES BE FORECASTED? EVIDENCE FROM MAJOR MARKETS<br />

THALIA CHANTZIARA (INDEPENDENT)<br />

THE IMPACT OF TARGET BOARD RECOMMENDATIONS IN AUSTRALIAN LARELLE CHAPPLE (TC BEIRNE SCHOOL OF LAWUNIVERSITY OF<br />

TAKEOVERS<br />

QUEENSLAND)<br />

MARKET-WIDE SHORT-SELLING RESTRICTIONS ANCHADA CHAROENROOK (OWEN GRADUATE SCHOOL OF<br />

BUSINESSVANDERBILT UNIVERSITY)<br />

THE IMPACT OF SINGLE STOCK FUTURES ON FEEDBACK TRADING AND FRANKIE CHAU (DURHAM BUSINESS SCHOOLUNIVERSITY OF<br />

THE MARKET DYNAMICS OF THE CASH MARKET: THE CASE OF<br />

DOMESTIC AND CROSS-BORDER UNIVERSAL STOCK FUTURES<br />

DURHAM)<br />

INTEGRATIONLIQUIDITY AND THE DEPRESSED MARKET: STATE-SHARE<br />

PARADOX<br />

MAX CHEN (DEPARTMENT OF FINANCEXIAMEN UNIVERSITY)<br />

TAX-LOSS SELLING AND SEASONAL EFFECTS IN THE UK QIWEI CHEN (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

THE ACQUISITION OF NON PUBLIC FIRMS IN EUROPE: BIDDERS’<br />

RETURNSPAYMENT METHODS AND STOCK MARKET EVOLUTION<br />

ALAIN CHEVALIER (ESCP EAP MANAGEMENT SCHOOL/ FINANCE)<br />

DO PRIVATIZATION IPO FIRMS OUTPERFORM IN THE LONG-RUN? SEUNG-DOO CHOI (DONGEUI UNIVERSITYSCHOOL OF BUSINESS)<br />

INTERNAL CAPITAL MARKETS AND BANK RELATIONSHIP: EVIDENCE YOON CHOI (DEPARTMENT OF FINANCEUNIVERSITY OF CENTRAL<br />

FROM JAPANESE CORPORATE SPIN-OFFS<br />

FLORIDA)<br />

THE REAL TIME MARKET REACTIONS TO EARNINGS WARNINGS<br />

ANNOUNCEMENTS<br />

ROBIN CHOU (NATIONAL CENTRAL UNIVERSITYDEPT. OF FINANCE)<br />

SHORT-RUN DEVIATIONS AND TIME-VARYING HEDGE RATIOS:<br />

EVIDENCE FROM AGRICULTURAL FUTURES MARKETS<br />

TAUFIQ CHOUDHRY (UNIVERSITY OF SOUTHAMPTON)<br />

BUSINESS GROUPSTAXES AND ACCRUALS MANAGEMENT BEUSELINCK CHRISTOF (TILBURG UNIVERSITYDEPARTMENT OF<br />

ACCOUNTANCY)<br />

OPTION VALUATION WITH LONG-RUN AND SHORT-RUN VOLATILITY<br />

COMPONENTS<br />

PETER CHRISTOFFERSEN (MCGILL UNIVERSITY)<br />

IDENTIFYING A REPRESENTATIVE SET OF YIELD CURVE SHOCKS VILLA CHRISTOPHE (DEPT. ECONOMIEECOLE NATIONALE DE LA<br />

STATISTIQUE ET D'ANALYSE DE L'INFORMATION)<br />

VOLATILITYMARKET STRUCTUREAND LIQUIDITY KEE H. CHUNG CHUNG (SCHOOL OF MANAGEMENTSTATE<br />

UNIVERSITY OF NEW YORK AT BUFFALO)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>