Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7<br />

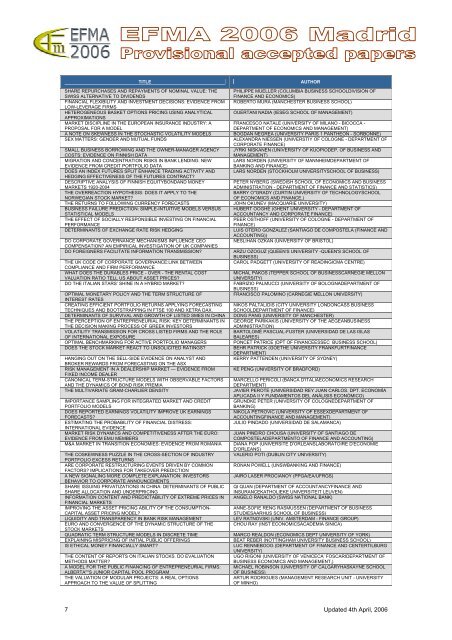

TITLE AUTHOR<br />

SHARE REPURCHASES AND REPAYMENTS OF NOMINAL VALUE: THE PHILIPPE MUELLER (COLUMBIA BUSINESS SCHOOLDIVISION OF<br />

SWISS ALTERNATIVE TO DIVIDENDS<br />

FINANCE AND ECONOMICS)<br />

FINANCIAL FLEXIBILITY AND INVESTMENT DECISIONS: EVIDENCE FROM<br />

LOW-LEVERAGE FIRMS<br />

ROBERTO MURA (MANCHESTER BUSINESS SCHOOL)<br />

HETEROGENEOUS BASKET OPTIONS PRICING USING ANALYTICAL<br />

APPROXIMATIONS<br />

OUERTANI NADIA (IESEG SCHOOL OF MANAGEMENT)<br />

MARKET DISCIPLINE IN THE EUROPEAN INSURANCE INDUSTRY: A FRANCESCO NATALE (UNIVERSITY OF MILANO - BICOCCA -<br />

PROPOSAL FOR A MODEL<br />

DEPARTMENT OF ECONOMICS AND MANAGEMENT)<br />

A NOTE ON SKEWNESS IN THE STOCHASTIC VOLATILITY MODELS BOGDAN NEGREA (UNIVERSITY PARIS 1 PANTHEON - SORBONNE)<br />

SEX MATTERS: GENDER AND MUTUAL FUNDS ALEXANDRA NIESSEN (UNIVERSTIY OF COLOGNE - DEPARTMENT OF<br />

CORPORATE FINANCE)<br />

SMALL BUSINESS BORROWING AND THE OWNER-MANAGER AGENCY JYRKI NISKANEN (UNIVERSITY OF KUOPIODEP. OF BUSINESS AND<br />

COSTS: EVIDENCE ON FINNISH DATA<br />

MANAGEMENT)<br />

MIGRATION AND CONCENTRATION RISKS IN BANK LENDING: NEW LARS NORDEN (UNIVERSITY OF MANNHEIMDEPARTMENT OF<br />

EVIDENCE FROM CREDIT PORTFOLIO DATA<br />

BANKING AND FINANCE)<br />

DOES AN INDEX FUTURES SPLIT ENHANCE TRADING ACTIVITY AND<br />

HEDGING EFFECTIVENESS OF THE FUTURES CONTRACT?<br />

LARS NORDEN (STOCKHOLM UNIVERSITYSCHOOL OF BUSINESS)<br />

DESCRIPTIVE ANALYSIS OF FINNISH EQUITYBONDAND MONEY<br />

PETER NYBERG (SWEDISH SCHOOL OF ECONOMICS AND BUSINESS<br />

MARKETS 1920-2004<br />

ADMINISTRATION - DEPARTMENT OF FINANCE AND STATISTICS)<br />

THE OVERREACTION HYPOTHESIS: DOES IT APPLY TO THE<br />

BARRY O''GRADY (CURTIN UNIVERSITY OF TECHNOLOGYSCHOOL<br />

NORWEGIAN STOCK MARKET?<br />

OF ECONOMICS AND FINANCE,)<br />

THE RETURNS TO FOLLOWING CURRENCY FORECASTS JOHN OKUNEV (MACQUARIE UNIVERSITY)<br />

BUSINESS FAILURE PREDICTION: SIMPLE-INTUITIVE MODELS VERSUS HUBERT OOGHE (GHENT UNIVERSITY - DEPARTMENT OF<br />

STATISTICAL MODELS<br />

ACCOUNTANCY AND CORPORATE FINANCE)<br />

THE EFFECT OF SOCIALLY RESPONSIBLE INVESTING ON FINANCIAL PEER OSTHOFF (UNIVERSITY OF COLOGNE - DEPARTMENT OF<br />

PERFORMANCE<br />

FINANCE)<br />

DETERMINANTS OF EXCHANGE RATE RISK HEDGING LUIS OTERO GONZÁLEZ (SANTIAGO DE COMPOSTELA (FINANCE AND<br />

ACCOUNTING))<br />

DO CORPORATE GOVERNANCE MECHANISMS INFLUENCE CEO<br />

COMPENSATION? AN EMPIRICAL INVESTIGATION OF UK COMPANIES<br />

NESLIHAN OZKAN (UNIVERSITY OF BRISTOL)<br />

DO FOREIGNERS FACILITATE INFORMATION TRANSMISSION? ARZU OZOGUZ (QUEEN'S UNIVERSITY -QUEEN'S SCHOOL OF<br />

BUSINESS)<br />

THE UK CODE OF CORPORATE GOVERNANCE:LINK BETWEEN<br />

COMPLIANCE AND FIRM PERFORMANCE<br />

CAROL PADGETT (UNIVERSITY OF READINGICMA CENTRE)<br />

WHAT DOES THE DURABLES PRICE - OVER - THE RENTAL COST<br />

MICHAL PAKOS (TEPPER SCHOOL OF BUSINESSCARNEGIE MELLON<br />

VALUATION RATIO TELL US ABOUT ASSET PRICES?<br />

UNIVERSITY)<br />

DO THE ITALIAN STARS’ SHINE IN A HYBRID MARKET? FABRIZIO PALMUCCI (UNIVERSITY OF BOLOGNADEPARTMENT OF<br />

BUSINESS)<br />

OPTIMAL MONETARY POLICY AND THE TERM STRUCTURE OF<br />

INTEREST RATES<br />

FRANCISCO PALOMINO (CARNEGIE MELLON UNIVERSITY)<br />

CREATING EFFICIENT PORTFOLIO RETURNS APPLYING FORECASTING NIKOS PALTALIDIS (CITY UNIVERSITY LONDONCASS BUSINESS<br />

TECHNIQUES AND BOOTSTRAPPING IN FTSE 100 AND XETRA DAX. SCHOOLDEPARTMENT OF FINANCE)<br />

DETERMINANTS OF SURVIVAL AND GROWTH OF LISTED SMES IN CHINA DONG PANG (UNIVERSITY OF MANCHESTER)<br />

THE PERCEPTION OF ENTREPRENEURIAL RISK: KEY DETERMINANTS IN GEORGE PARIKAKIS (UNIVERSITY OF THE AEGEANBUSINESS<br />

THE DECISION MAKING PROCESS OF GREEK INVESTORS<br />

ADMINISTRATION)<br />

VOLATILITY TRANSMISSION FOR CROSS LISTED FIRMS AND THE ROLE BARTOLOMÉ PASCUAL-FUSTER (UNIVERSIDAD DE LAS ISLAS<br />

OF INTERNATIONAL EXPOSURE<br />

BALEARES)<br />

OPTIMAL BENCHMARKING FOR ACTIVE PORTFOLIO MANAGERS PONCET PATRICE (DPT OF FINANCEESSEC BUSINESS SCHOOL)<br />

DOES THE STOCK MARKET REACT TO UNSOLICITED RATINGS? BEHR PATRICK (GOETHE UNIVERSITY FRANKFURTFINANCE<br />

DEPARTMENT)<br />

HANGING OUT ON THE SELL-SIDE EVIDENCE ON ANALYST AND<br />

BROKER REWARDS FROM FORECASTING ON THE ASX<br />

KERRY PATTENDEN (UNIVERSITY OF SYDNEY)<br />

RISK MANAGEMENT IN A DEALERSHIP MARKET --- EVIDENCE FROM<br />

FIXED INCOME DEALER<br />

KE PENG (UNIVERSITY OF BRADFORD)<br />

CANONICAL TERM-STRUCTURE MODELS WITH OBSERVABLE FACTORS MARCELLO PERICOLI (BANCA D'ITALIAECONOMICS RESEARCH<br />

AND THE DYNAMICS OF BOND RISK PREMIA<br />

DEPARTMENT)<br />

THE MULTIVARIATE GRAM-CHARLIER DENSITY JAVIER PEROTE (UNIVERSIDAD REY JUAN CARLOS. DPT. ECONOMÍA<br />

APLICADA II Y FUNDAMENTOS DEL ANÁLISIS ECONÓMICO)<br />

IMPORTANCE SAMPLING FOR INTEGRATED MARKET AND CREDIT GRUNDKE PETER (UNIVERSITY OF COLOGNEDEPARTMENT OF<br />

PORTFOLIO MODELS<br />

BANKING)<br />

DOES REPORTED EARNINGS VOLATILITY IMPROVE UK EARNINGS NIKOLA PETROVIC (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

FORECASTS?<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

ESTIMATING THE PROBABILITY OF FINANCIAL DISTRESS:<br />

INTERNATIONAL EVIDENCE<br />

JULIO PINDADO (UNIVERSIDAD DE SALAMANCA)<br />

MARKET RISK DYNAMICS AND COMPETITIVENESS AFTER THE EURO: JUAN PIÑEIRO CHOUSA (UNIVERSITY OF SANTIAGO DE<br />

EVIDENCE FROM EMU MEMBERS<br />

COMPOSTELADEPARTMENTO OF FINANCE AND ACCOUNTING)<br />

M&A MARKET IN TRANSITION ECONOMIES: EVIDENCE FROM ROMANIA DIANA POP (UNIVERSITÉ D'ORLÉANSLABORATOIRE D'ECONOMIE<br />

D'ORLEANS)<br />

THE COSKEWNESS PUZZLE IN THE CROSS-SECTION OF INDUSTRY<br />

PORTFOLIO EXCESS RETURNS<br />

VALERIO POTI (DUBLIN CITY UNIVERSITY)<br />

ARE CORPORATE RESTRUCTURING EVENTS DRIVEN BY COMMON<br />

FACTORS? IMPLICATIONS FOR TAKEOVER PREDICTION<br />

RONAN POWELL (UNSWBANKING AND FINANCE)<br />

A NEW SIGNALING MORE COMPLETE EXPLANATION: INVESTORS<br />

BEHAVIOR TO CORPORATE ANNOUNCEMENTS<br />

JAIRO LASER PROCIANOY (PPGA/EA/UFRGS)<br />

SHARE ISSUING PRIVATIZATIONS IN CHINA: DETERMINANTS OF PUBLIC QI QUAN (DEPARTMENT OF ACCOUNTANCYFINANCE AND<br />

SHARE ALLOCATION AND UNDERPRICING<br />

INSURANCEKATHOLIEKE UNIVERSITEIT LEUVEN)<br />

INFORMATION CONTENT AND PREDICTABILITY OF EXTREME PRICES IN<br />

FINANCIAL MARKETS<br />

ANGELO RANALDO (SWISS NATIONAL BANK)<br />

IMPROVING THE ASSET PRICING ABILITY OF THE CONSUMPTION- ANNE-SOFIE RENG RASMUSSEN (DEPARTMENT OF BUSINESS<br />

CAPITAL ASSET PRICING MODEL?<br />

STUDIESAARHUS SCHOOL OF BUSINESS)<br />

LIQUIDITY AND TRANSPARENCY IN BANK RISK MANAGEMENT LEV RATNOVSKI (UNIV. AMSTERDAM - FINANCE GROUP)<br />

EURO AND CONVERGENCE OF THE DYNAMIC STRUCTURE OF THE<br />

STOCK MARKETS<br />

CHOU RAY (INST ECONOMICSACADEMIA SINICA)<br />

QUADRATIC TERM STRUCTURE MODELS IN DISCRETE TIME MARCO REALDON (ECONOMICS DEPT UNIVERSITY OF YORK)<br />

EXPLAINING MISPRICING OF INITIAL PUBLIC OFFERINGS BEAT REBER (NOTTINGHAM UNIVERSITY BUSINESS SCHOOL)<br />

IS ETHICAL MONEY FINANCIALLY SMART? LUC RENNEBOOG (DEPARTMENT OF FINANCE AND CENTERTILBURG<br />

UNIVERSITY)<br />

THE CONTENT OF REPORTS ON ITALIAN STOCKS. DO EVALUATION UGO RIGONI (UNIVERSITY OF VENICECA’ FOSCARIDEPARTMENT OF<br />

METHODS MATTER?<br />

BUSINESS ECONOMICS AND MANAGEMENT,)<br />

A MODEL FOR THE PUBLIC FINANCING OF ENTREPRENEURIAL FIRMS: MICHAEL ROBINSON (UNIVERSITY OF CALGARYHASKAYNE SCHOOL<br />

ALBERTA''''S JUNIOR CAPITAL POOL PROGRAM<br />

OF BUSINESS)<br />

THE VALUATION OF MODULAR PROJECTS: A REAL OPTIONS<br />

ARTUR RODRIGUES (MANAGEMENT RESEARCH UNIT - UNIVERSITY<br />

APPROACH TO THE VALUE OF SPLITTING<br />

OF MINHO)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>