Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4<br />

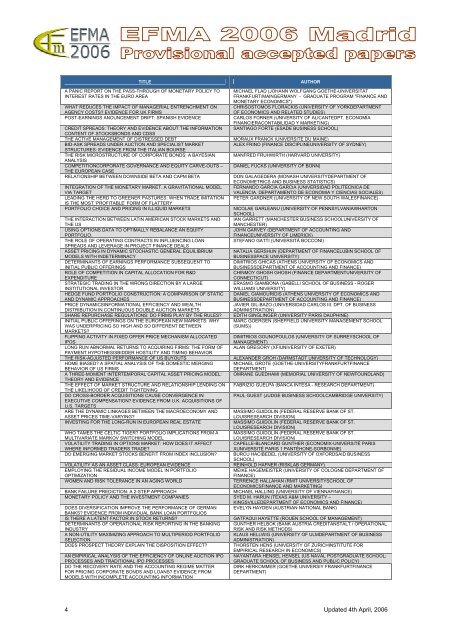

TITLE AUTHOR<br />

A PANIC REPORT ON THE PASS-THROUGH OF MONETARY POLICY TO<br />

INTEREST RATES IN THE EURO AREA<br />

MICHAEL FLAD (JOHANN WOLFGANG GOETHE-UNIVERSITÄT<br />

FRANKFURT/MAINGERMANY - GRADUATE PROGRAM "FINANCE AND<br />

MONETARY ECONOMICS")<br />

CHRISOSTOMOS FLORACKIS (UNIVERSITY OF YORKDEPARTMENT<br />

OF ECONOMICS AND RELATED STUDIES)<br />

WHAT REDUCES THE IMPACT OF MANAGERIAL ENTRENCHMENT ON<br />

AGENCY COSTS? EVIDENCE FOR UK FIRMS<br />

POST-EARNINGS ANOUNCEMENT DRIFT: SPANISH EVIDENCE CARLOS FORNER (UNIVERSITY OF ALICANTEDPT. ECONOMÍA<br />

FINANCIERACONTABILIDAD Y MARKETING)<br />

CREDIT SPREADS: THEORY AND EVIDENCE ABOUT THE INFORMATION<br />

CONTENT OF STOCKSBONDS AND CDSS<br />

SANTIAGO FORTE (ESADE BUSINESS SCHOOL)<br />

THE ACTIVE MANAGEMENT OF DISTRESSED DEBT MORAUX FRANCK (UNIVERSITÉ DU MAINE)<br />

BID-ASK SPREADS UNDER AUCTION AND SPECIALIST MARKET<br />

STRUCTURES: EVIDENCE FROM THE ITALIAN BOURSE<br />

ALEX FRINO (FINANCE DISCIPLINEUNIVERSITY OF SYDNEY)<br />

THE RISK MICROSTRUCTURE OF CORPORATE BONDS: A BAYESIAN<br />

ANALYSIS<br />

MANFRED FRUHWIRTH (HARVARD UNIVERSITY)<br />

COMPETITIONCORPORATE GOVERNANCE AND EQUITY CARVE-OUTS –<br />

THE EUROPEAN CASE<br />

DANIEL FUCKS (UNIVERSITY OF BONN)<br />

RELATIONSHIP BETWEEN DOWNSIDE BETA AND CAPM BETA DON GALAGEDERA (MONASH UNIVERSITYDEPARTMENT OF<br />

ECONOMETRICS AND BUSINESS STATISTICS)<br />

INTEGRATION OF THE MONETARY MARKET. A GRAVITATIONAL MODEL FERNANDO GARCIA GARCIA (UNIVERSIDAD POLITECNICA DE<br />

VIA TARGET<br />

VALENCIA. DEPARTAMENTO DE ECONOMIA Y CIENCIAS SOCIALES)<br />

LEADING THE HERD TO GREENER PASTURES: WHEN TRADE IMITATION<br />

IS THE MOST ‘PROFITABLE’ FORM OF FLATTERY<br />

PETER GARDNER (UNIVERSITY OF NEW SOUTH WALESFINANCE)<br />

PORTFOLIO CHOICE AND PRICING IN ILLIQUID MARKETS NICOLAE GARLEANU (UNIVERSITY OF PENNSYLVANIAWHARTON<br />

SCHOOL)<br />

THE INTERACTION BETWEEN LATIN AMERICAN STOCK MARKETS AND IAN GARRETT (MANCHESTER BUSINESS SCHOOLUNIVERSITY OF<br />

THE US<br />

MANCHESTER)<br />

USING OPTIONS DATA TO OPTIMALLY REBALANCE AN EQUITY<br />

JOHN GARVEY (DEPARTMENT OF ACCOUNTING AND<br />

PORTFOLIO.<br />

FINANCEUNIVERSITY OF LIMERICK)<br />

THE ROLE OF OPERATING CONTRACTS IN INFLUENCING LOAN<br />

SPREADS AND LEVERAGE IN PROJECT FINANCE DEALS<br />

STEFANO GATTI (UNIVERSITÀ BOCCONI)<br />

ASSET PRICING IN DYNAMIC STOCHASTIC GENERAL EQUILIBRIUM NATALIA GERSHUN (DEPARTMENT OF FINANCELUBIN SCHOOL OF<br />

MODELS WITH INDETERMINACY<br />

BUSINESSPACE UNIVERSITY)<br />

DETERMINANTS OF EARNINGS PERFORMANCE SUBSEQUENT TO<br />

DIMITRIOS GHICAS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

INITIAL PUBLIC OFFERINGS<br />

BUSINESSDEPARTMENT OF ACCOUNTING AND FINANCE)<br />

ROLE OF COMPETITION IN CAPITAL ALLOCATION FOR R&D<br />

CHINMOY GHOSH GHOSH (FINANCE DEPARTMENTUNIVERSITY OF<br />

EXPENDITURE<br />

CONNECTICUT)<br />

STRATEGIC TRADING IN THE WRONG DIRECTION BY A LARGE<br />

ERASMO GIAMBONA (GABELLI SCHOOL OF BUSINESS - ROGER<br />

INSTITUTIONAL INVESTOR<br />

WILLIAMS UNIVERSITY)<br />

HEDGE FUND PORTFOLIO CONSTRUCTION: A COMPARISON OF STATIC DANIEL GIAMOURIDIS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

AND DYNAMIC APPROACHES<br />

BUSINESSDEPARTMENT OF ACCOUNTING AND FINANCE)<br />

PRICE DYNAMICSINFORMATIONAL EFFICIENCY AND WEALTH<br />

JAVIER GIL-BAZO (UNIVERSIDAD CARLOS III. DPT. OF BUSINESS<br />

DISTRIBUTION IN CONTINUOUS DOUBLE AUCTION MARKETS<br />

ADMINISTRATION)<br />

SHARE REPURCHASE REGULATIONS: DO FIRMS PLAY BY THE RULES? EDITH GINGLINGER (UNIVERSITY PARIS DAUPHINE)<br />

INITIAL PUBLIC OFFERINGS ON THE EUROPEAN NEW MARKETS: WHY MARC GOERGEN (SHEFFIELD UNIVERSITY MANAGEMENT SCHOOL<br />

WAS UNDERPRICING SO HIGH AND SO DIFFERENT BETWEEN<br />

MARKETS?<br />

(SUMS))<br />

FLIPPING ACTIVITY IN FIXED OFFER PRICE MECHANISM ALLOCATED DIMITRIOS GOUNOPOULOS (UNIVERSITY OF SURREYSCHOOL OF<br />

IPOS<br />

MANAGEMENT)<br />

LONG RUN ABNORMAL RETURNS TO ACQUIRING FIRMS: THE FORM OF<br />

PAYMENT HYPOTHESISBIDDER HOSTILITY AND TIMING BEHAVIOR<br />

ALAN GREGORY (XFIUNIVERSITY OF EXETER)<br />

THE RISK-ADJUSTED PERFORMANCE OF US BUYOUTS ALEXANDER GROH (DARMSTADT UNIVERSITY OF TECHNOLOGY)<br />

HOME BIASED? A SPATIAL ANALYSIS OF THE DOMESTIC MERGING MICHAEL GROTE (GOETHE-UNIVERSITYFRANKFURTFINANCE<br />

BEHAVIOR OF US FIRMS<br />

DEPARTMENT)<br />

A THREE-MOMENT INTERTEMPORAL CAPITAL ASSET PRICING MODEL:<br />

THEORY AND EVIDENCE<br />

OMRANE GUEDHAMI (MEMORIAL UNIVERSITY OF NEWFOUNDLAND)<br />

THE EFFECT OF MARKET STRUCTURE AND RELATIONSHIP LENDING ON<br />

THE LIKELIHOOD OF CREDIT TIGHTENING<br />

FABRIZIO GUELPA (BANCA INTESA - RESEARCH DEPARTMENT)<br />

DO CROSS-BORDER ACQUISITIONS CAUSE CONVERGENCE IN<br />

EXECUTIVE COMPENSATION? EVIDENCE FROM U.K. ACQUISITIONS OF<br />

U.S. TARGETS<br />

PAUL GUEST (JUDGE BUSINESS SCHOOLCAMBRIDGE UNIVERSITY)<br />

ARE THE DYNAMIC LINKAGES BETWEEN THE MACROECONOMY AND MASSIMO GUIDOLIN (FEDERAL RESERVE BANK OF ST.<br />

ASSET PRICES TIME-VARYING?<br />

LOUISRESEARCH DIVISION)<br />

INVESTING FOR THE LONG-RUN IN EUROPEAN REAL ESTATE MASSIMO GUIDOLIN (FEDERAL RESERVE BANK OF ST.<br />

LOUISRESEARCH DIVISION)<br />

WHO TAMES THE CELTIC TIGER? PORTFOLIO IMPLICATIONS FROM A MASSIMO GUIDOLIN (FEDERAL RESERVE BANK OF ST.<br />

MULTIVARIATE MARKOV SWITCHING MODEL<br />

LOUISRESEARCH DIVISION)<br />

VOLATILITY TRADING IN OPTIONS MARKET: HOW DOES IT AFFECT CAPELLE-BLANCARD GUNTHER (ECONOMIX-UNIVERSITÉ PARIS<br />

WHERE INFORMED TRADERS TRADE?<br />

XUNIVERSITÉ PARIS 1 PANTÉHONE-SORBONNE)<br />

DO EMERGING MARKET STOCKS BENEFIT FROM INDEX INCLUSION? BURCU HACIBEDEL (UNIVERSITY OF OXFORDSAID BUSINESS<br />

SCHOOL)<br />

VOLATILITY AS AN ASSET CLASS: EUROPEAN EVIDENCE REINHOLD HAFNER (RISKLAB GERMANY)<br />

EMPLOYING THE RESIDUAL INCOME MODEL IN PORTFOLIO<br />

MEIKE HAGEMEISTER (UNIVERSITY OF COLOGNE DEPARTMENT OF<br />

OPTIMIZATION<br />

FINANCE)<br />

WOMEN AND RISK TOLERANCE IN AN AGING WORLD TERRENCE HALLAHAN (RMIT UNIVERSITYSCHOOL OF<br />

ECONOMICSFINANCE AND MARKETING)<br />

BANK FAILURE PREDICTION: A 2-STEP APPROACH MICHAEL HALLING (UNIVERSITY OF VIENNAFINANCE)<br />

MONETARY POLICY AND THE INVESTMENT COMPANIES SYED M. HARUN (TEXAS A&M UNIVERSITY –<br />

KINGSVILLEDEPARTMENT OF ECONOMICS AND FINANCE)<br />

DOES DIVERSIFICATION IMPROVE THE PERFORMANCE OF GERMAN<br />

BANKS? EVIDENCE FROM INDIVIDUAL BANK LOAN PORTFOLIOS<br />

EVELYN HAYDEN (AUSTRIAN NATIONAL BANK)<br />

IS THERE A LATENT FACTOR IN STOCK RETURNS? GATFAOUI HAYETTE (ROUEN SCHOOL OF MANAGEMENT)<br />

DETERMINANTS OF OPERATIONAL RISK REPORTING IN THE BANKING GÜNTHER HELBOK (BANK AUSTRIA CREDITANSTALT / OPERATIONAL<br />

INDUSTRY<br />

RISK AND RISK METHODS)<br />

A NON-UTILITY MAXIMIZING APPROACH TO MULTIPERIOD PORTFOLIO KLAUS HELLWIG (UNIVERSITY OF ULMDEPARTMENT OF BUSINESS<br />

SELECTION<br />

ADMINISTRATION)<br />

DOES PROSPECT THEORY EXPLAIN THE DISPOSITION EFFECT? THORSTEN HENS (UNIVERSITY OF ZURICHINSTITUTE FOR<br />

EMPIRICAL RESEARCH IN ECONOMICS)<br />

AN EMPIRICAL ANALYSIS OF THE EFFICIENCY OF ONLINE AUCTION IPO NAYANTARA HENSEL HENSEL (US NAVAL POSTGRADUATE SCHOOL;<br />

PROCESSES AND TRADITIONAL IPO PROCESSES<br />

GRADUATE SCHOOL OF BUSINESS AND PUBLIC POLICY)<br />

DO THE RECOVERY RATE AND THE ACCOUNTING REGIME MATTER DIRK HERKOMMER (GOETHE UNIVERSIY FRANKFURTFINANCE<br />

FOR PRICING CORPORATE BONDS AND LOANS? EVIDENCE FROM<br />

MODELS WITH INCOMPLETE ACCOUNTING INFORMATION<br />

DEPARTMENT)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>