Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

Updated 4th April, 2006 1 - EFMA 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3<br />

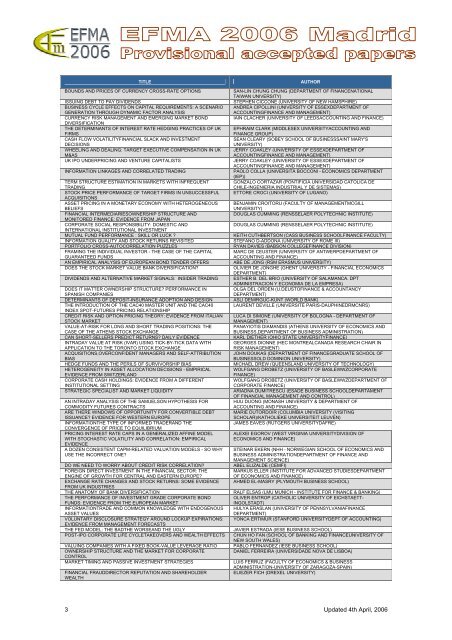

TITLE AUTHOR<br />

BOUNDS AND PRICES OF CURRENCY CROSS-RATE OPTIONS SAN-LIN CHUNG CHUNG (DEPARTMENT OF FINANCENATIONAL<br />

TAIWAN UNIVERSITY)<br />

ISSUING DEBT TO PAY DIVIDENDS STEPHEN CICCONE (UNIVERSITY OF NEW HAMSPHIRE)<br />

BUSINESS CYCLE EFFECTS ON CAPITAL REQUIREMENTS: A SCENARIO ANDREA CIPOLLINI (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

GENERATION THROUGH DYNAMIC FACTOR ANALYSIS<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

CURRENCY RISK MANAGEMENT AND EMERGING MARKET BOND<br />

DIVERSIFICATION<br />

IAIN CLACHER (UNIVERSITY OF LEEDSACCOUNTING AND FINANCE)<br />

THE DETERMINANTS OF INTEREST RATE HEDGING PRACTICES OF UK EPHRAIM CLARK (MIDDLESEX UNIVERSITYACCOUNTING AND<br />

FIRMS<br />

FINANCE GROUP)<br />

CASH FLOW VOLATILITYFINANCIAL SLACK AND INVESTMENT<br />

SEAN CLEARY (SOBEY SCHOOL OF BUSINESSSAINT MARY'S<br />

DECISIONS<br />

UNIVERSITY)<br />

WHEELING AND DEALING: TARGET EXECUTIVE COMPENSATION IN UK JERRY COAKLEY (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

M&AS<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

UK IPO UNDERPRICING AND VENTURE CAPITALISTS JERRY COAKLEY (UNIVERSITY OF ESSEXDEPARTMENT OF<br />

ACCOUNTINGFINANCE AND MANAGEMENT)<br />

INFORMATION LINKAGES AND CORRELATED TRADING PAOLO COLLA (UNIVERSITÀ BOCCONI - ECONOMICS DEPARTMENT<br />

(IEP))<br />

TERM STRUCTURE ESTIMATION IN MARKETS WITH INFREQUENT<br />

GONZALO CORTAZAR (PONTIFICIA UNIVERSIDAD CATOLICA DE<br />

TRADING<br />

CHILE-INGENIERIA INDUSTRIAL Y DE SISTEMAS)<br />

STOCK PRICE PERFORMANCE OF TARGET FIRMS IN UNSUCCESSFUL<br />

ACQUISITIONS<br />

ETTORE CROCI (UNIVERSITY OF LUGANO)<br />

ASSET PRICING IN A MONETARY ECONOMY WITH HETEROGENEOUS BENJAMIN CROITORU (FACULTY OF MANAGEMENTMCGILL<br />

BELIEFS<br />

UNIVERSITY)<br />

FINANCIAL INTERMEDIARIESOWNERSHIP STRUCTURE AND<br />

MONITORED FINANCE: EVIDENCE FROM JAPAN<br />

DOUGLAS CUMMING (RENSSELAER POLYTECHNIC INSTITUTE)<br />

CORPORATE SOCIAL RESPONSIBILITY: DOMESTIC AND<br />

INTERNATIONAL INSTITUTIONAL INVESTMENT<br />

DOUGLAS CUMMING (RENSSELAER POLYTECHNIC INSTITUTE)<br />

MUTUAL FUND PERFORMANCE : SKILL OR LUCK ? KEITH CUTHBERTSON (CASS BUSINESS SCHOOLFINANCE FACULTY)<br />

INFORMATION QUALITY AND STOCK RETURNS REVISITED STEFANO D-ADDONA (UNIVERSITY OF ROME III)<br />

PORTFOLIO CROSS-AUTOCORRELATION PUZZLES RYAN DAVIES (BABSON COLLEGEFINANCE DIVISION)<br />

FRAMING THE INDIVIDUAL INVESTOR - THE CASE OF THE CAPITAL MARC DE CEUSTER (UNIVERSITY OF ANTWERPDEPARTMENT OF<br />

GUARANTEED FUNDS<br />

ACCOUNTING AND FINANCE)<br />

AN EMPIRICAL ANALYSIS OF EUROPEAN BOND TENDER OFFERS ABE DE JONG (RSM ERASMUS UNIVERSITY)<br />

DOES THE STOCK MARKET VALUE BANK DIVERSIFICATION? OLIVIER DE JONGHE (GHENT UNIVERSITY - FINANCIAL ECONOMICS<br />

DEPARTMENT)<br />

DIVIDENDS AND ALTERNATIVE MARKET SIGNALS: INSIDER TRADING ESTHER B. DEL BRIO (UNIVERSITY OF SALAMANCA. DPT<br />

ADMINISTRACION Y ECONOMIA DE LA EMPRESA)<br />

DOES IT MATTER OWNERSHIP STRUCTURE? PERFORMANCE IN<br />

OLGA DEL ORDEN (U.DEUSTOFINANCE & ACCOUNTANCY<br />

SPANISH COMPANIES<br />

DEPARTMENT)<br />

DETERMINANTS OF DEPOSIT-INSURANCE ADOPTION AND DESIGN ASLI DEMIRGUC-KUNT (WORLD BANK)<br />

THE INTRODUCTION OF THE CAC40 MASTER UNIT AND THE CAC40<br />

INDEX SPOT-FUTURES PRICING RELATIONSHIP<br />

LAURENT DEVILLE (UNIVERSITÉ PARIS-DAUPHINEDRMCNRS)<br />

CREDIT RISK AND OPTION PRICING THEORY: EVIDENCE FROM ITALIAN LUCA DI SIMONE (UNIVERSITY OF BOLOGNA - DEPARTMENT OF<br />

STOCK MARKET<br />

MANAGEMENT)<br />

VALUE-AT-RISK FOR LONG AND SHORT TRADING POSITIONS: THE PANAYIOTIS DIAMANDIS (ATHENS UNIVERSITY OF ECONOMICS AND<br />

CASE OF THE ATHENS STOCK EXCHANGE<br />

BUSINESS,DEPARTMENT OF BUSINESS ADMINISTRATION)<br />

CAN SHORT-SELLERS PREDICT RETURNS? DAILY EVIDENCE KARL DIETHER (OHIO STATE UNIVERSITYFINANCE)<br />

INTRADAY VALUE AT RISK (IVAR) USING TICK-BY-TICK DATA WITH GEORGES DIONNE (HEC MONTREALCANADA RESEARCH CHAIR IN<br />

APPLICATION TO THE TORONTO STOCK EXCHANGE<br />

RISK MANAGEMENT)<br />

ACQUISITIONS,OVERCONFIDENT MANAGERS AND SELF-ATTRIBUTION JOHN DOUKAS (DEPARTMENT OF FINANCEGRADUATE SCHOOL OF<br />

BIAS<br />

BUSINESSOLD DOMINION UNIVERSITY)<br />

HEDGE FUNDS AND THE PERILS OF SURVIVORSHIP BIAS MICHAEL DREW (QUEENSLAND UNIVERSITY OF TECHNOLOGY)<br />

HETEROGENEITY IN ASSET ALLOCATION DECISIONS - EMPIRICAL WOLFGANG DROBETZ (UNIVERSITY OF BASLEWWZCORPORATE<br />

EVIDENCE FROM SWITZERLAND<br />

FINANCE)<br />

CORPORATE CASH HOLDINGS: EVIDENCE FROM A DIFFERENT<br />

WOLFGANG DROBETZ (UNIVERSITY OF BASLEWWZDEPARTMENT OF<br />

INSTITUTIONAL SETTING<br />

CORPORATE FINANCE)<br />

STRATEGIC SPECIALIST AND MARKET LIQUIDITY ARIADNA DUMITRESCU (ESADE BUSINESS SCHOOLDEPARTAMENT<br />

OF FINANCIAL MANAGEMENT AND CONTROL)<br />

AN INTRADAY ANALYSIS OF THE SAMUELSON HYPOTHESIS FOR<br />

HUU DUONG (MONASH UNIVERSITY & DEPARTMENT OF<br />

COMMODITY FUTURES CONTRACTS<br />

ACCOUNTING AND FINANCE)<br />

ARE THERE WINDOWS OF OPPORTUNITY FOR CONVERTIBLE DEBT MARIE DUTORDOIR (COLUMBIA UNIVERSITY (VISITING<br />

ISSUANCE? EVIDENCE FOR WESTERN EUROPE<br />

SCHOLAR)/KATHOLIEKE UNIVERSITEIT LEUVEN)<br />

INFORMATIONTHE TYPE OF INFORMED TRADERAND THE<br />

CONVERGENCE OF PRICE TO EQUILIBRIUM<br />

JAMES EAVES (RUTGERS UNIVERSITYDAFRE)<br />

PRICING INTEREST RATE CAPS IN A GENERALIZED AFFINE MODEL<br />

WITH STOCHASTIC VOLATILITY AND CORRELATION: EMPIRICAL<br />

EVIDENCE<br />

A DOZEN CONSISTENT CAPM-RELATED VALUATION MODELS - SO WHY<br />

USE THE INCORRECT ONE?<br />

ALEXEI EGOROV (WEST VIRGINIA UNIVERSITYDIVISION OF<br />

ECONOMICS AND FINANCE)<br />

STEINAR EKERN (NHH - NORWEGIAN SCHOOL OF ECONOMICS AND<br />

BUSINESS ADMINISTRATIONDEPARTMENT OF FINANCE AND<br />

MANAGEMENT SCIENCE)<br />

DO WE NEED TO WORRY ABOUT CREDIT RISK CORRELATION? ABEL ELIZALDE (CEMFI)<br />

FOREIGN DIRECT INVESTMENT IN THE FINANCIAL SECTOR: THE<br />

MARKUS ELLER (INSTITUTE FOR ADVANCED STUDIESDEPARTMENT<br />

ENGINE OF GROWTH FOR CENTRAL AND EASTERN EUROPE?<br />

OF ECONOMICS AND FINANCE)<br />

EXCHANGE RATE CHANGES AND STOCK RETURNS: SOME EVIDENCE<br />

FROM UK INDUSTRIES<br />

AHMED EL-MASRY (PLYMOUTH BUSINESS SCHOOL)<br />

THE ANATOMY OF BANK DIVERSIFICATION RALF ELSAS (LMU MUNICH - INSTITUTE FOR FINANCE & BANKING)<br />

THE PERFORMANCE OF INVESTMENT GRADE CORPORATE BOND OLIVER ENTROP (CATHOLIC UNIVERSITY OF EICHSTAETT-<br />

FUNDS: EVIDENCE FROM THE EUROPEAN MARKET<br />

INGOLSTADT)<br />

INFORMATIONTRADE AND COMMON KNOWLEDGE WITH ENDOGENOUS HULYA ERASLAN (UNIVERSITY OF PENNSYLVANIAFINANCE<br />

ASSET VALUES<br />

DEPARTMENT)<br />

VOLUNTARY DISCLOSURE STRATEGY AROUND LOCKUP EXPIRATIONS:<br />

EVIDENCE FROM MANAGEMENT FORECASTS<br />

YONCA ERTIMUR (STANFORD UNIVERSITYDEPT OF ACCOUNTING)<br />

THE FED MODEL: THE BADTHE WORSEAND THE UGLY JAVIER ESTRADA (IESE BUSINESS SCHOOL)<br />

POST-IPO CORPORATE LIFE CYCLETAKEOVERS AND WEALTH EFFECTS CHUN HO FAN (SCHOOL OF BANKING AND FINANCEUNIVERSITY OF<br />

NEW SOUTH WALES)<br />

VALUING COMPANIES WITH A FIXED BOOK-VALUE LEVERAGE RATIO PABLO FERNANDEZ (IESE BUSINESS SCHOOL)<br />

OWNERSHIP STRUCTURE AND THE MARKET FOR CORPORATE<br />

CONTROL<br />

DANIEL FERREIRA (UNIVERSIDADE NOVA DE LISBOA)<br />

MARKET TIMING AND PASSIVE INVESTMENT STRATEGIES LUIS FERRUZ (FACULTY OF ECONOMICS & BUSINESS<br />

ADMINISTRATION-UNIVERSITY OF ZARAGOZA-SPAIN)<br />

FINANCIAL FRAUDDIRECTOR REPUTATION AND SHAREHOLDER<br />

WEALTH<br />

ELIEZER FICH (DREXEL UNIVERSITY)<br />

<strong>Updated</strong> <strong>4th</strong> <strong>April</strong>, <strong>2006</strong>