ACCT 312 Midterm Exam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

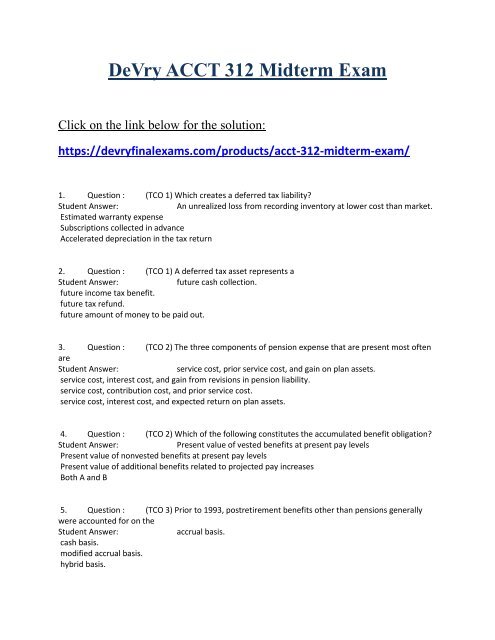

DeVry <strong>ACCT</strong> <strong>312</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

Click on the link below for the solution:<br />

https://devryfinalexams.com/products/acct-<strong>312</strong>-midterm-exam/<br />

1. Question : (TCO 1) Which creates a deferred tax liability?<br />

Student Answer:<br />

An unrealized loss from recording inventory at lower cost than market.<br />

Estimated warranty expense<br />

Subscriptions collected in advance<br />

Accelerated depreciation in the tax return<br />

2. Question : (TCO 1) A deferred tax asset represents a<br />

Student Answer:<br />

future cash collection.<br />

future income tax benefit.<br />

future tax refund.<br />

future amount of money to be paid out.<br />

3. Question : (TCO 2) The three components of pension expense that are present most often<br />

are<br />

Student Answer:<br />

service cost, prior service cost, and gain on plan assets.<br />

service cost, interest cost, and gain from revisions in pension liability.<br />

service cost, contribution cost, and prior service cost.<br />

service cost, interest cost, and expected return on plan assets.<br />

4. Question : (TCO 2) Which of the following constitutes the accumulated benefit obligation?<br />

Student Answer:<br />

Present value of vested benefits at present pay levels<br />

Present value of nonvested benefits at present pay levels<br />

Present value of additional benefits related to projected pay increases<br />

Both A and B<br />

5. Question : (TCO 3) Prior to 1993, postretirement benefits other than pensions generally<br />

were accounted for on the<br />

Student Answer:<br />

accrual basis.<br />

cash basis.<br />

modified accrual basis.<br />

hybrid basis.

6. Question : (TCO 4) Which of the following transactions decreases retained earnings?<br />

Student Answer:<br />

A property dividend<br />

A stock dividend<br />

A cash dividend<br />

All of the above<br />

7. Question : (TCO 4) When a property dividend is declared, the reduction in retained<br />

earnings is for<br />

Student Answer:<br />

the book value of the property on the date of declaration.<br />

the book value of the property on the date of distribution.<br />

the fair value of the property on the date of declaration.<br />

the fair value of the property on the date of distribution.<br />

8. Question : (TCO 5) Executive stock options should be reported as compensation expense<br />

Student Answer:<br />

using the intrinsic value method.<br />

using the fair value method.<br />

using either the fair value method or the intrinsic value method.<br />

only on rare occasions.<br />

9. Question : (TCO 5) Our company granted options for 2 million shares of its $1 par common<br />

stock at the beginning of the current year. The exercise price is $35 per share, which was also the<br />

market value of the stock on the grant date. The fair value of the options was estimated at $9 per<br />

option. If the options have a vesting period of 5 years, which would be the balance in Paid-in Capital –<br />

Stock Options 3 years after the grant date?<br />

Student Answer:<br />

A credit of $10.8 million<br />

A credit of $18 million<br />

A debit of $70 million<br />

A debit of $3.6 million<br />

10. Question : (TCO 6) Which of the following is not a potential common stock?<br />

Student Answer:<br />

Convertible preferred stock<br />

Convertible bonds<br />

Stock rights<br />

Participating preferred stock<br />

11. Question : (TCO 6) When computing diluted earnings per share, which of the following will<br />

be omitted from the calculation?<br />

Student Answer:<br />

The weighted average common shares<br />

The effect of stock splits<br />

Dividends paid on common stock<br />

The number of common shares represented by stock purchase warrants<br />

12. Question : (TCO 1) Please describe permanent differences and provide three examples.

13. Question : (TCO 2) Please describe defined-contribution plans. What is an example? Who<br />

bears the risk? Who typically contributes to these plans?<br />

14. Question : (TCO 4) What are the two ways for a company to reacquire stock? Please also<br />

discuss when a company reacquires stock and whether there is a difference between the amount the<br />

shares were originally sold for and the cash paid to buy the shares back.<br />

15. Question : (TCO 5) What is FASB’s stance on companies recording compensation expense<br />

for stock option plans? What method is preferable? What is the journal entry to record compensation<br />

expense?<br />

DeVry <strong>ACCT</strong> <strong>312</strong> <strong>Midterm</strong> <strong>Exam</strong><br />

Click on the link below for the solution:<br />

https://devryfinalexams.com/products/acct-<strong>312</strong>-midterm-exam/