ACCT 434 Midterm Exam (Updated)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

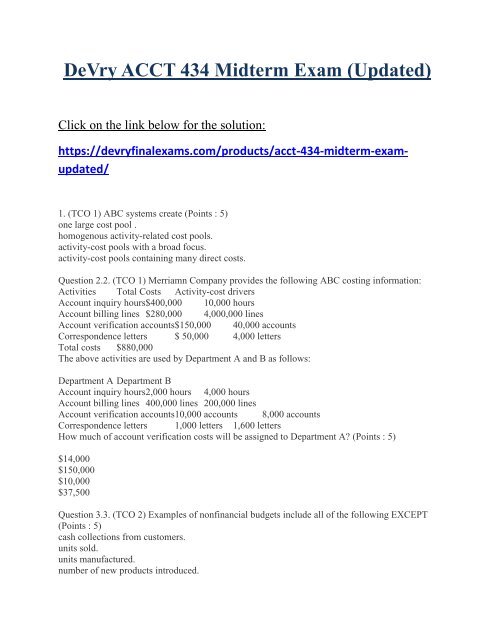

DeVry <strong>ACCT</strong> <strong>434</strong> <strong>Midterm</strong> <strong>Exam</strong> (<strong>Updated</strong>)<br />

Click on the link below for the solution:<br />

https://devryfinalexams.com/products/acct-<strong>434</strong>-midterm-examupdated/<br />

1. (TCO 1) ABC systems create (Points : 5)<br />

one large cost pool .<br />

homogenous activity-related cost pools.<br />

activity-cost pools with a broad focus.<br />

activity-cost pools containing many direct costs.<br />

Question 2.2. (TCO 1) Merriamn Company provides the following ABC costing information:<br />

Activities Total Costs Activity-cost drivers<br />

Account inquiry hours$400,000 10,000 hours<br />

Account billing lines $280,000 4,000,000 lines<br />

Account verification accounts$150,000 40,000 accounts<br />

Correspondence letters $ 50,000 4,000 letters<br />

Total costs $880,000<br />

The above activities are used by Department A and B as follows:<br />

Department A Department B<br />

Account inquiry hours2,000 hours 4,000 hours<br />

Account billing lines 400,000 lines 200,000 lines<br />

Account verification accounts10,000 accounts 8,000 accounts<br />

Correspondence letters 1,000 letters 1,600 letters<br />

How much of account verification costs will be assigned to Department A? (Points : 5)<br />

$14,000<br />

$150,000<br />

$10,000<br />

$37,500<br />

Question 3.3. (TCO 2) <strong>Exam</strong>ples of nonfinancial budgets include all of the following EXCEPT<br />

(Points : 5)<br />

cash collections from customers.<br />

units sold.<br />

units manufactured.<br />

number of new products introduced.

Question 4.4. (TCO 2) Dalyrymple Company produces a special spray nozzle. The budgeted<br />

indirect total cost of inserting the spray nozzle is $80,000. The budgeted number of nozzles to<br />

be inserted is 40,000. What is the budgeted indirect cost allocation rate for this activity? (Points<br />

: 5)<br />

$.50<br />

$1.00<br />

$1.50<br />

$2.00<br />

Question 5.5. (TCO 3) The conference method estimates cost functions (Points : 5)<br />

by mathematically analyzing the relationship between inputs and outputs in physical terms.<br />

using quantitative methods that can be very time consuming and costly.<br />

based on analysis and opinions gathered from various departments.<br />

using time-and-motion studies.<br />

Question 6.6. (TCO 4) Relevant costs of a make-or-buy decision include all of the following<br />

EXCEPT (Points : 5)<br />

fixed salaries that will not be incurred if the part is outsourced.<br />

current direct material costs of the part.<br />

special machinery for the part that has no resale value.<br />

material-handling costs that can be eliminated.<br />

Question 7.7. (TCO 5) One-time-only special orders should only be accepted if ________.<br />

(Points : 5)<br />

incremental revenues exceed incremental costs<br />

differential revenues exceed variable costs<br />

incremental revenues exceed fixed costs<br />

total revenues exceed total costs<br />

Question 8.8. (TCO 5) Konrade’s Engine Company manufactures part TE456 used in several of<br />

its engine models. Monthly production costs for 1,000 units are as follows:<br />

Direct materials $40,000<br />

Direct labor 10,000<br />

Variable overhead costs 30,000<br />

Fixed overhead costs 20,000<br />

Total costs $100,000<br />

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred<br />

if the company purchases TE456 from the outside supplier. Konrade’s Engine Company has the<br />

option of purchasing the part from an outside supplier at $85 per unit.<br />

If Konrade’s Engine Company accepts the offer from the outside supplier, the monthly avoidable<br />

costs (costs that will no longer be incurred) total (Points : 5)<br />

$82,000<br />

$98,000<br />

$50,000<br />

$100,000

Question 9.9. (TCO 3) The cost function y = 100 + 10X (Points : 5)<br />

has a slope coefficient of 100.<br />

is a nonlinear.<br />

has an intercept of 100.<br />

represents a fixed cost.<br />

Question 10.10. (TCO 4) Sunk costs (Points : 5)<br />

are future costs.<br />

are past costs.<br />

have future implications<br />

(TCO 1) For each of the following drivers identify an appropriate activity.<br />

# of machines<br />

# of setups<br />

# of inspections<br />

# of orders<br />

# of runs<br />

# of bins or aisles<br />

# of engineers<br />

(TCO 2) Favata Company has the following information<br />

Month Budgeted Sales<br />

June $60,000<br />

July 51,000<br />

August 40,000<br />

September 70,000<br />

October 72,000<br />

In addition, the cost of goods sold rate is 70% and the desired inventory level is 30% of next<br />

month’s cost of sales.<br />

Prepare a purchases budget for July through September. (Points : 30)<br />

(TCO 5) Kirkland Company manufactures a part for use in its production of hats. When 10,000<br />

items are produced, the costs per unit are:<br />

Direct materials $0.60<br />

Direct manufacturing labor 3.00<br />

Variable manufacturing overhead 1.20<br />

Fixed manufacturing overhead 1.60<br />

Total $6.40<br />

Mike Company has offered to sell to Kirkland Company 10,000 units of the part for $6.00 per<br />

unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if

Kirkland accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the<br />

original item would be eliminated.<br />

What is the relevant per unit cost for the original part<br />

Which alternative is best for Kirkland Company? By how much?<br />

(TCO 3) The Wildcat Company has provided the following information:<br />

Units of Output 30,000 Units 42,000 Units<br />

Direct materials $180,000 $252,000<br />

Workers’ wages 1,080,000 1,512,000<br />

Supervisors’ salaries 312,000 312,000<br />

Equipment depreciation 151,200 151,200<br />

Maintenance 81,600 110,400<br />

Utilities 384,000 528,000<br />

Total $2,188,800 $2,865,600<br />

Using the high-low method and the information provided above, identify the linear cost function<br />

equation. (Points : 30)<br />

DeVry <strong>ACCT</strong> 324 <strong>Midterm</strong> <strong>Exam</strong> (<strong>Updated</strong>)<br />

Click on the link below for the solution:<br />

https://devryfinalexams.com/products/acct-<strong>434</strong>-midterm-examupdated/