Jaarverslag 2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

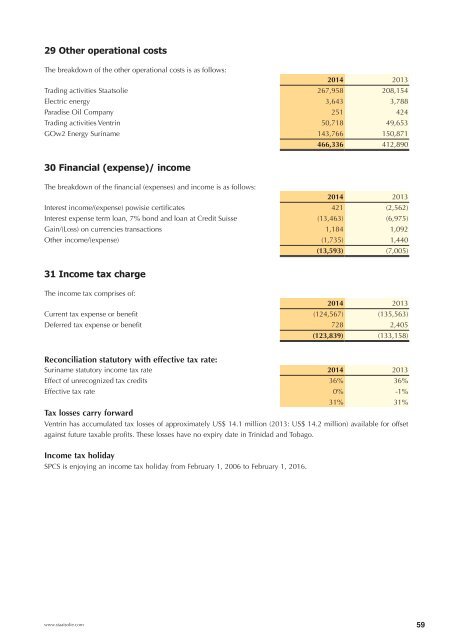

29 Other operational costs<br />

The breakdown of the other operational costs is as follows:<br />

<strong>2014</strong> 2013<br />

Trading activities Staatsolie 267,958 208,154<br />

Electric energy 3,643 3,788<br />

Paradise Oil Company 251 424<br />

Trading activities Ventrin 50,718 49,653<br />

GOw2 Energy Suriname 143,766 150,871<br />

466,336 412,890<br />

30 Financial (expense)/ income<br />

The breakdown of the financial (expenses) and income is as follows:<br />

<strong>2014</strong> 2013<br />

Interest income/(expense) powisie certificates 421 (2,562)<br />

Interest expense term loan, 7% bond and loan at Credit Suisse (13,463) (6,975)<br />

Gain/(Loss) on currencies transactions 1,184 1,092<br />

Other income/(expense) (1,735) 1,440<br />

(13,593) (7,005)<br />

31 Income tax charge<br />

The income tax comprises of:<br />

<strong>2014</strong> 2013<br />

Current tax expense or benefit (124,567) (135,563)<br />

Deferred tax expense or benefit 728 2,405<br />

(123,839) (133,158)<br />

Reconciliation statutory with effective tax rate:<br />

Suriname statutory income tax rate <strong>2014</strong> 2013<br />

Effect of unrecognized tax credits 36% 36%<br />

Effective tax rate 0% -1%<br />

31% 31%<br />

Tax losses carry forward<br />

Ventrin has accumulated tax losses of approximately US$ 14.1 million (2013: US$ 14.2 million) available for offset<br />

against future taxable profits. These losses have no expiry date in Trinidad and Tobago.<br />

Income tax holiday<br />

SPCS is enjoying an income tax holiday from February 1, 2006 to February 1, 2016.<br />

www.staatsolie.com<br />

59