Activity Report 2015

Activity Report 2015 - Federal Audit Oversight Authority FAOA

Activity Report 2015 - Federal Audit Oversight Authority FAOA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

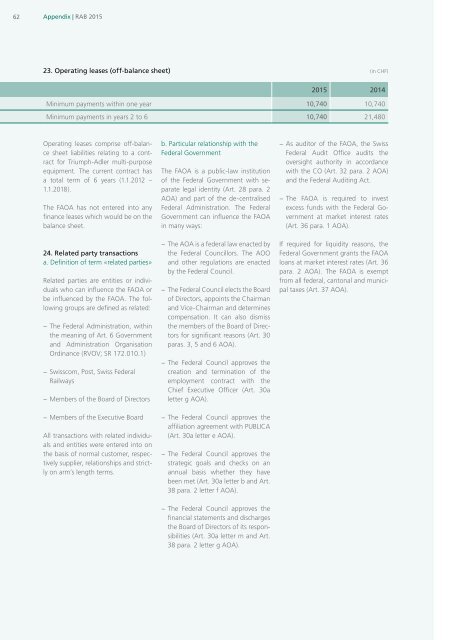

62 Appendix | RAB <strong>2015</strong><br />

23. Operating leases (off-balance sheet)<br />

(in CHF)<br />

<strong>2015</strong> 2014<br />

Minimum payments within one year 10,740 10,740<br />

Minimum payments in years 2 to 6 10,740 21,480<br />

Operating leases comprise off-balance<br />

sheet liabilities relating to a contract<br />

for Triumph-Adler multi-purpose<br />

equipment. The current contract has<br />

a total term of 6 years (1.1.2012 –<br />

1.1.2018).<br />

The FAOA has not entered into any<br />

finance leases which would be on the<br />

balance sheet.<br />

24. Related party transactions<br />

a. Definition of term «related parties»<br />

Related parties are entities or individuals<br />

who can influence the FAOA or<br />

be influenced by the FAOA. The following<br />

groups are defined as related:<br />

− The Federal Administration, within<br />

the meaning of Art. 6 Government<br />

and Administration Organisation<br />

Ordinance (RVOV; SR 172.010.1)<br />

− Swisscom, Post, Swiss Federal<br />

Railways<br />

− Members of the Board of Directors<br />

− Members of the Executive Board<br />

All transactions with related individuals<br />

and entities were entered into on<br />

the basis of normal customer, respectively<br />

supplier, relationships and strictly<br />

on arm’s length terms.<br />

b. Particular relationship with the<br />

Federal Government<br />

The FAOA is a public-law institution<br />

of the Federal Government with separate<br />

legal identity (Art. 28 para. 2<br />

AOA) and part of the de-centralised<br />

Federal Administration. The Federal<br />

Government can influence the FAOA<br />

in many ways:<br />

− The AOA is a federal law enacted by<br />

the Federal Councillors. The AOO<br />

and other regulations are enacted<br />

by the Federal Council.<br />

− The Federal Council elects the Board<br />

of Directors, appoints the Chairman<br />

and Vice-Chairman and determines<br />

compensation. It can also dismiss<br />

the members of the Board of Directors<br />

for significant reasons (Art. 30<br />

paras. 3, 5 and 6 AOA).<br />

− The Federal Council approves the<br />

creation and termination of the<br />

employment contract with the<br />

Chief Executive Officer (Art. 30a<br />

letter g AOA).<br />

− The Federal Council approves the<br />

affiliation agreement with PUBLICA<br />

(Art. 30a letter e AOA).<br />

− The Federal Council approves the<br />

strategic goals and checks on an<br />

annual basis whether they have<br />

been met (Art. 30a letter b and Art.<br />

38 para. 2 letter f AOA).<br />

− The Federal Council approves the<br />

financial statements and discharges<br />

the Board of Directors of its responsibilities<br />

(Art. 30a letter m and Art.<br />

38 para. 2 letter g AOA).<br />

− As auditor of the FAOA, the Swiss<br />

Federal Audit Office audits the<br />

oversight authority in accordance<br />

with the CO (Art. 32 para. 2 AOA)<br />

and the Federal Auditing Act.<br />

− The FAOA is required to invest<br />

excess funds with the Federal Government<br />

at market interest rates<br />

(Art. 36 para. 1 AOA).<br />

If required for liquidity reasons, the<br />

Federal Government grants the FAOA<br />

loans at market interest rates (Art. 36<br />

para. 2 AOA). The FAOA is exempt<br />

from all federal, cantonal and municipal<br />

taxes (Art. 37 AOA).