- Page 2 and 3:

100 BAGGERS STOCKS THAT RETURN 100-

- Page 4 and 5:

In memory of Thomas W. Phelps, auth

- Page 6 and 7:

CONTENTS Chapter 1: Introducing 100

- Page 8 and 9:

2 100-BAGGERS You should read this

- Page 10 and 11:

4 100-BAGGERS year by year—that m

- Page 12 and 13:

6 100-BAGGERS of compounding, to fo

- Page 14 and 15:

8 100-BAGGERS some new insights, si

- Page 16 and 17:

10 100-BAGGERS These principles I w

- Page 18 and 19:

12 100-BAGGERS I have had my share

- Page 20 and 21:

14 100-BAGGERS fears. The list of r

- Page 22 and 23:

16 100-BAGGERS The idea is simple:

- Page 24 and 25:

18 100-BAGGERS Here’s Kerber: The

- Page 26 and 27:

20 100-BAGGERS (Lowenstein is also

- Page 28 and 29:

22 100-BAGGERS only when you are in

- Page 30 and 31:

24 100-BAGGERS earned around $21 mi

- Page 32 and 33:

26 100-BAGGERS But Biggs was someth

- Page 34 and 35:

28 100-BAGGERS unlikely, given all

- Page 36 and 37:

30 100-BAGGERS It seems to me a bet

- Page 38 and 39:

32 100-BAGGERS He looked at 19 such

- Page 40 and 41:

34 100-BAGGERS MTY’s path to cove

- Page 42 and 43:

36 100-BAGGERS Years it takes for 1

- Page 44 and 45:

38 100-BAGGERS Martelli’s study,

- Page 46 and 47:

40 100-BAGGERS Another trap is that

- Page 48 and 49:

CHAPTER 5: THE 100-BAGGERS OF THE L

- Page 50 and 51:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 52 and 53:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 54 and 55:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 56 and 57:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 58 and 59:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 60 and 61:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 62 and 63:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 64 and 65:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 66 and 67:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 68 and 69:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 70 and 71:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 72 and 73:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 74 and 75:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 76 and 77:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 78 and 79:

THE 100-BAGGERS OF THE LAST 50 YEAR

- Page 80 and 81:

76 100-BAGGERS about $80 per share.

- Page 82 and 83:

78 100-BAGGERS “That’s exactly

- Page 84 and 85:

80 100-BAGGERS But he has no intere

- Page 86 and 87:

CHAPTER 7: OWNER-OPERATORS: SKIN IN

- Page 88 and 89:

OWNER-OPERATORS: SKIN IN THE GAME 8

- Page 90 and 91:

OWNER-OPERATORS: SKIN IN THE GAME 8

- Page 92 and 93:

OWNER-OPERATORS: SKIN IN THE GAME 8

- Page 94 and 95:

OWNER-OPERATORS: SKIN IN THE GAME 9

- Page 96 and 97:

CHAPTER 8: THE OUTSIDERS: THE BEST

- Page 98 and 99:

THE OUTSIDERS: THE BEST CEOS 95 Eac

- Page 100 and 101:

THE OUTSIDERS: THE BEST CEOS 97 bou

- Page 102 and 103:

THE OUTSIDERS: THE BEST CEOS 99 •

- Page 104 and 105:

THE OUTSIDERS: THE BEST CEOS 101 Le

- Page 106 and 107:

104 100-BAGGERS “The amount of le

- Page 108 and 109:

106 100-BAGGERS The Berkshire Hatha

- Page 110 and 111:

108 100-BAGGERS Next was Canadian f

- Page 112 and 113:

CHAPTER 10: KELLY’S HEROES: BET B

- Page 114 and 115:

KELLY’S HEROES: BET BIG 113 The f

- Page 116 and 117: CHAPTER 11: STOCK BUYBACKS: ACCELER

- Page 118 and 119: STOCK BUYBACKS: ACCELERATE RETURNS

- Page 120 and 121: STOCK BUYBACKS: ACCELERATE RETURNS

- Page 122 and 123: 122 100-BAGGERS houses, items that

- Page 124 and 125: 124 100-BAGGERS has no moat. See wh

- Page 126 and 127: 126 100-BAGGERS The beverage indust

- Page 128 and 129: 128 100-BAGGERS gross margin. “Am

- Page 130 and 131: 130 100-BAGGERS It seems to me a bo

- Page 132 and 133: 132 100-BAGGERS The problem with th

- Page 134 and 135: 134 100-BAGGERS “Boredom”—as

- Page 136 and 137: 136 100-BAGGERS The same kind of ar

- Page 138 and 139: 138 100-BAGGERS How can you deal wi

- Page 140 and 141: 140 100-BAGGERS Market-Research Fir

- Page 142 and 143: 142 100-BAGGERS Many investors watc

- Page 144 and 145: 144 100-BAGGERS Note how the consen

- Page 146 and 147: 146 100-BAGGERS The results showed

- Page 148 and 149: 148 100-BAGGERS ideas often come fr

- Page 150 and 151: 150 100-BAGGERS A similar compariso

- Page 152 and 153: 152 100-BAGGERS this investment is

- Page 154 and 155: CHAPTER 14: IN CASE OF THE NEXT GRE

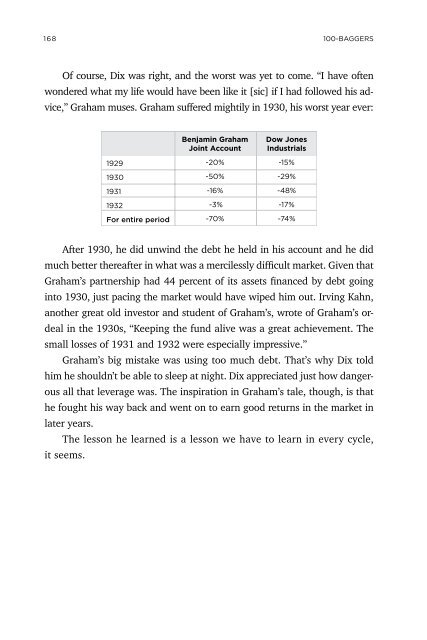

- Page 156 and 157: IN CASE OF THE NEXT GREAT DEPRESSIO

- Page 158 and 159: IN CASE OF THE NEXT GREAT DEPRESSIO

- Page 160 and 161: IN CASE OF THE NEXT GREAT DEPRESSIO

- Page 162 and 163: IN CASE OF THE NEXT GREAT DEPRESSIO

- Page 164 and 165: IN CASE OF THE NEXT GREAT DEPRESSIO

- Page 168 and 169: CHAPTER 15: 100-BAGGERS DISTILLED:

- Page 170 and 171: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 172 and 173: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 174 and 175: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 176 and 177: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 178 and 179: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 180 and 181: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 182 and 183: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 184 and 185: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 186 and 187: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 188 and 189: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 190 and 191: 100-BAGGERS DISTILLED: ESSENTIAL PR

- Page 192 and 193: APPENDIX THE 100-BAGGERS (1962-2014

- Page 194 and 195: APPENDIX: THE 100-BAGGERS (1962-201

- Page 196 and 197: APPENDIX: THE 100-BAGGERS (1962-201

- Page 198 and 199: APPENDIX: THE 100-BAGGERS (1962-201

- Page 200 and 201: APPENDIX: THE 100-BAGGERS (1962-201

- Page 202: APPENDIX: THE 100-BAGGERS (1962-201