You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE 100-BAGGERS OF THE LAST 50 YEARS 57<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

Sales<br />

Growth (%)<br />

$15.75<br />

$148<br />

838.06%<br />

$609<br />

312.30%<br />

$1,639<br />

189.13%<br />

$2,761<br />

68.45%<br />

$3,122<br />

13.07%<br />

$3,933<br />

25.98%<br />

Operating Income<br />

Operating Income (%)<br />

-6<br />

-38.10%<br />

-32<br />

-21.66%<br />

-109<br />

-17.90%<br />

-605<br />

-36.91%<br />

-863<br />

-31.26%<br />

-412<br />

-13.20%<br />

64<br />

1.63%<br />

Plus: R&D<br />

Adj. EBIT<br />

Adj. Operating Income (%)<br />

2<br />

-4<br />

-25.40%<br />

13<br />

-19<br />

-12.86%<br />

46<br />

-63<br />

-10.34%<br />

159<br />

-446<br />

-27.21%<br />

269<br />

-594<br />

-21.51%<br />

241<br />

-171<br />

-5.46%<br />

215<br />

279<br />

-7.09%<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

Sales<br />

Growth (%)<br />

$5,264<br />

33.84%<br />

$6,921<br />

31.48%<br />

$8,490<br />

22.87%<br />

$10,711<br />

26.18%<br />

$14,835<br />

38.50%<br />

$19,166<br />

29.19%<br />

$24,509<br />

27.88%<br />

Operating Income<br />

Operating Income (%)<br />

270<br />

5.13%<br />

440<br />

6.36%<br />

432<br />

5.09%<br />

389<br />

3.63%<br />

655<br />

4.42%<br />

842<br />

4.39%<br />

1129<br />

4.61%<br />

Plus: R&D<br />

Adj. EBIT<br />

Adj. Operating Income (%)<br />

257<br />

527<br />

10.01%<br />

263<br />

723<br />

10.45%<br />

451<br />

883<br />

10.40%<br />

662<br />

10.51<br />

9.81%<br />

818<br />

1473<br />

9.93%<br />

1033<br />

1875<br />

9.78%<br />

1240<br />

2369<br />

9.67%<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

Sales<br />

Growth (%)<br />

$34,384<br />

40.29%<br />

$48,077<br />

39.82%<br />

$61,093<br />

27.07%<br />

$74,452<br />

21.87%<br />

$88,968<br />

19.52%<br />

Operating Income<br />

Operating Income (%)<br />

1406<br />

4.09%<br />

862<br />

1.79%<br />

676<br />

1.11%<br />

745<br />

1.00%<br />

178<br />

0.20%<br />

Plus: R&D<br />

Adj. EBIT<br />

Adj. Operating Income (%)<br />

1734<br />

3140<br />

9.13%<br />

2909<br />

3771<br />

7.81%<br />

4564<br />

5240<br />

8.58%<br />

6585<br />

7310<br />

9.82%<br />

9275<br />

9453<br />

10.62%<br />

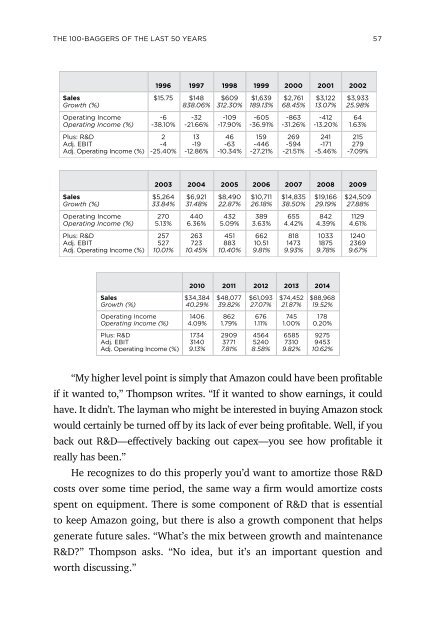

“My higher level point is simply that Amazon could have been profitable<br />

if it wanted to,” Thompson writes. “If it wanted to show earnings, it could<br />

have. It didn’t. The layman who might be interested in buying Amazon stock<br />

would certainly be turned off by its lack of ever being profitable. Well, if you<br />

back out R&D—effectively backing out capex—you see how profitable it<br />

really has been.”<br />

He recognizes to do this properly you’d want to amortize those R&D<br />

costs over some time period, the same way a firm would amortize costs<br />

spent on equipment. There is some component of R&D that is essential<br />

to keep Amazon going, but there is also a growth component that helps<br />

generate future sales. “What’s the mix between growth and maintenance<br />

R&D?” Thompson asks. “No idea, but it’s an important question and<br />

worth discussing.”