FTInsight April/May 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

For Sierra Leone’s entrepreneurs, business<br />

people, policy makers and investors<br />

<strong>April</strong>/<strong>May</strong> <strong>2016</strong><br />

Le 55,000<br />

www.ftinsight.net<br />

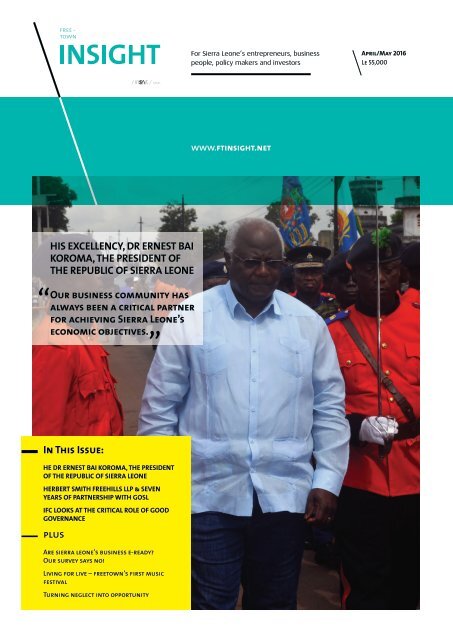

HIS EXCELLENCY, DR ERNEST BAI<br />

KOROMA, THE PRESIDENT OF<br />

THE REPUBLIC OF SIERRA LEONE<br />

Our business community has<br />

always been a critical partner<br />

for achieving Sierra Leone’s<br />

economic objectives.<br />

“<br />

”<br />

In This Issue:<br />

HE DR ERNEST BAI KOROMA, THE PRESIDENT<br />

OF THE REPUBLIC OF SIERRA LEONE<br />

HERBERT SMITH FREEHILLS LLP & SEVEN<br />

YEARS OF PARTNERSHIP WITH GOSL<br />

IFC LOOKS AT THE CRITICAL ROLE OF GOOD<br />

GOVERNANCE<br />

plus<br />

Are sierra leone’s business e-ready?<br />

Our survey says no!<br />

Living for live – freetown’s f irst music<br />

festival<br />

Turning neglect into opportunity

Editor’s Insight<br />

Welcome to the <strong>April</strong>/<strong>May</strong> edition of Freetown Insight – our third. This edition is tremendously significant to<br />

us for three reasons. Firstly, it is the first time we have been honoured to be able to publish a piece by His<br />

Excellency, Dr Ernest Bai Koroma, the President of Sierra Leone. The President’s piece focuses on private sector<br />

investment into the country and ties in with our forthcoming London-based investment forum – Invest Sierra<br />

Leone <strong>2016</strong>. In it he reinforces the importance of the private sector to our recovering economy, and writes:<br />

“Great opportunities and challenges beckon as we embark upon the journey towards forging a win-win<br />

partnership for our country’s enormous investment and trade potential. In a global economy, all our futures are<br />

intertwined and I look forward to building productive relationships with the private sectors of nations across the<br />

world.”<br />

This issue of the magazine also coincides with Sierra Leone’s Independence Day. After more than 150 years of<br />

British colonial rule, Sierra Leone was finally able to celebrate its independence on the 27th <strong>April</strong> 1961. Real<br />

economic independence has been slow to follow, but there is a growing impetus that solutions for African<br />

problems must be developed within Africa and tailored to our particular circumstances. This is not a call for<br />

insularity; it is a suggestion that we appreciate and learn about independence from the achievements of our<br />

private sector and their approach to sustainability.<br />

We count amongst our business leaders, individuals who have steered their companies to success through<br />

great political, economic and social upheaval. In our four months of existence, Freetown Insight magazine has<br />

spoken to a number of Sierra Leone’s most successful business men and women. They repeatedly reference<br />

the significance of hard work, persistence, resilience, team work, and continuous professional and personal<br />

development. They make sacrifices that are often personal as well as professional; and without exception<br />

they have had to struggle to secure the finance they need to set up their business ventures. They have taken<br />

responsibility for their own destiny and show that success necessitates self-belief, self-denial, self-development<br />

and self-reliance. Our entrepreneurs are a wonderful microcosm of the independence that Sierra Leone could<br />

and should achieve.<br />

FT<br />

Insight<br />

3<br />

Invest Sierra Leone <strong>2016</strong>, a collaboration with Herbert Smith Freehills, the leading international law firm, is<br />

scheduled for the 5th <strong>May</strong> and is the only annual forum dedicated to investment in Sierra Leone. The event puts<br />

our country’s investment potential and investment pioneers centre stage. In the pages that follow, it becomes<br />

clear from the experience of existing investors, that Sierra Leone offers substantial opportunities for the farsighted<br />

in a range of areas that haven’t traditionally caught the eye of the international investment community<br />

- agriculture, fisheries, tourism, hotels and hospitality, energy and infrastructure to name a few.<br />

Neglected areas with great potential but as Paddy Docherty of Phoenix Africa says in his piece for Freetown<br />

Insight: “To an entrepreneur, neglect naturally means opportunity.”<br />

Freetown Insight<br />

+44 771 722 1023<br />

info@ftinsight.net<br />

Editor:<br />

Memuna Forna<br />

Art Director:<br />

Erika Perez-Leon<br />

Contributors:<br />

HE Dr Ernest Bai Koroma, President<br />

of the Republic of Sierra Leone<br />

Chinyere Almona, Africa Corporate<br />

Governance Programme<br />

Ishmael Beah, Sierra WiFi<br />

Paddy Docherty, Phoenix Africa<br />

Advertising Enquiries:<br />

info@ftinsight.net<br />

+44 771 722 1023 / +232 7879 9999<br />

TABLE OF CONTENTS<br />

Land of great potential & untapped opportunities.<br />

By H.E. Dr Ernest Bai Koroma . . . . . . . . . . . . . . . . . 8<br />

High taxes or high investment?<br />

FT Insight poll results . . . . . . . . . . . . . . . . . . . . . 14<br />

To an entrepreneur, neglect naturally means opportunity<br />

By Paddy Docherty . . . . . . . . . . . . . . . . . . . . . . 16<br />

Seizing the corporate governance opportunity<br />

By Chinyere Almona . . . . . . . . . . . . . . . . . . . . . 18<br />

Digital content for socio-economic growth<br />

By Ishmael Bull . . . . . . . . . . . . . . . . . . . . . . . . 21<br />

E-ready for e-commerce? Sierra Leone’s<br />

businesses have some way to go . . . . . . . . . . . . . 22<br />

Are small solar systems, the way to light<br />

up Sierra Leone? . . . . . . . . . . . . . . . . . . . . . . . 26<br />

www.ftinsight.net

Insightful<br />

Remittances - the money migrants send to their countries of<br />

origin from their host countries, are increasingly significant<br />

for West Africa. In 2014, the amount sent home totaled US<br />

$26 billion (of which US $20.9 billion was sent to Nigeria)<br />

and amounted to 3.2% of the region’s GDP. The magnitude of<br />

these transfers, which make West Africa the second recipient<br />

subregion on the continent, ref lects the size of the West African<br />

diaspora, estimated at 9.1 million people in 2011, or 2.6% of the<br />

population of the region.<br />

A remittance is a transfer of money by a foreign worker to an individual<br />

in his or her home country. Money sent home by migrants competes with<br />

international aid as one of the largest f inancial inf lows to developing<br />

countries. Workers’ remittances are a signif icant part of international<br />

capital f lows, especially with regard to labour-exporting countries.<br />

in Sierra Leone remittances increased by<br />

over 50% between 2013 and 2014 with<br />

the Ebola virus disease outbreak.<br />

Remittance f lows to and<br />

within Africa approach<br />

US$40 billion.<br />

Countries in Northern Africa (for example,<br />

Morocco, Algeria and Egypt) are the<br />

major receivers in the continent. Eastern<br />

African countries depend heavily on<br />

these flows, with Somalia standing out<br />

as particularly remittance dependent.<br />

The $600bn global remittance<br />

market is becoming more<br />

fragmented, as regulators<br />

scramble to keep up with<br />

a surge in digital-only<br />

platforms and increased<br />

demand for money transfers<br />

from a growing number of<br />

international migrants.<br />

(Financial Times 29 December 2015)<br />

For the entire region, annual average<br />

remittances per migrant reach almost<br />

US$1,200 and on a country-by-country<br />

average represent 5 per cent of GDP and 27<br />

per cent of exports.<br />

African and European leaders in<br />

November pledged to cut money<br />

transfer costs below 3 per cent by<br />

2030 in an attempt to ease the burden<br />

on migrants who emigrate for<br />

work and send money home to their<br />

families. (Financial Times 29 December 2015)<br />

South-South migration is larger than South-North<br />

migration. Over 38 percent of the international<br />

migrants in 2013 migrated from developing<br />

countries to other developing countries, compared<br />

to 34 percent that moved from developing<br />

countries to advanced countries.<br />

Remittances are private flows of<br />

resources mostly intended for<br />

direct consumption and household<br />

support.

international migrants will send $601 billion to their families in their<br />

home countries this year, with developing countries receiving $441<br />

billion, says the Migration and Remittances.<br />

Factbook <strong>2016</strong><br />

Currently, no uniform and authoritative historical data on<br />

informal f lows exist. Given the widespread use of informal<br />

remittance channels, the data should be regarded as<br />

underestimates of total f lows.<br />

The United States was the largest remittance source country, with an estimated $56 billion in<br />

outward flows in 2014, followed by Saudi Arabia ($37 billion), and Russia ($33 billion). India<br />

was the largest remittance receiving country, with an estimated $72 billion in 2015, followed<br />

by China ($64 billion), and the Philippines ($30 billion).<br />

The top destination countries<br />

for Sierra Leonean emigrants are<br />

Guinea, the United States, the United<br />

Kingdom, Liberia, Senegal, Germany,<br />

the Netherlands, Australia, Nigeria,<br />

Canada.<br />

The African Institute for Remittances was<br />

launched on 28th November, 2014 to<br />

build the capacity of the Member States<br />

of the African Union, remittance senders<br />

and recipients and other stakeholders<br />

to develop and implement concrete<br />

strategies and operational instruments<br />

to use remittances as development tools<br />

for poverty reduction.<br />

Remittances to sub-Saharan<br />

Africa cost the most. Sub-<br />

Saharan Africa also has the<br />

least eff icient retail payment<br />

systems and regulation that<br />

creates high barriers to entry.<br />

Globally, sending remittances costs an average of 7.37<br />

percent of the amount sent. This figure is used to monitor<br />

the progress of the global effort for reduction of remittance<br />

prices.<br />

South Africa remains the most costly G20 country<br />

to send remittances from, and this is despite a<br />

decline of about 5 percentage points in the last<br />

two years, when the cost of sending from South<br />

Africa was in excess of 20 percent. The cost of<br />

sending from the second most expensive G20<br />

sending country – Japan – was recorded at 11.95<br />

percent, falling below 12 percent for the first<br />

time in the history of RPW. Russia remains the<br />

least expensive G20 sending country, followed by<br />

Saudi Arabia (5.05 percent). Korea (5.54 percent)<br />

and the USA (5.93 percent).<br />

Location, Location, Location! Remittance<br />

costs vary widely between different service<br />

providers. Commercial banks, at 13 percent,<br />

remain the most expensive option for<br />

sending money unless they have dedicated<br />

remittance services. At 7 percent, specialised<br />

money transfer operators are the cheapest<br />

option.<br />

FT<br />

Insight<br />

5<br />

If the cost of sending remittances could be reduced by 5 percentage points, remittance<br />

recipients could receive over $16 billion more each year.<br />

www.ftinsight.net

the only annual forum dedicated to<br />

investment in Sierra Leone<br />

5 <strong>May</strong> <strong>2016</strong><br />

http://www.ftinsight.net/invest-sierraleone-<strong>2016</strong>.html

Invest Sierra Leone <strong>2016</strong><br />

Special<br />

Sierra Leone’s only annual<br />

investment forum returns<br />

on 5 <strong>May</strong> <strong>2016</strong><br />

Invest Sierra Leone, the only annual forum dedicated<br />

to encouraging investment into Sierra Leone, returns<br />

to London on 5 <strong>May</strong> <strong>2016</strong>. Endorsed by the Sierra Leone<br />

Investment and Export Promotion Agency (SLIEPA), Invest<br />

Sierra Leone is a not-for-prof it collaboration between<br />

leading global law f irm - Herbert Smith Freehills LLP<br />

and Freetown Insight magazine, Sierra Leone’s only<br />

business journal. It follows on from last year’s successful<br />

inaugural event - Post Ebola economic renaissance in<br />

Sierra Leone and the role of the private sector - which was<br />

held in the House of Commons.<br />

The forum follows a panel debate format intended to identify innovative approaches to investment in Sierra<br />

Leone and gives interested investors the opportunity for in-depth discussion with government ministers, CEOs,<br />

financiers and the country’s most successful business and investment pioneers.<br />

FT<br />

Insight<br />

7<br />

It is chaired once again by the Rt Hon David Lammy MP. Confirmed panellists include Dr Samura Kamara, Sierra<br />

Leone’s Minister of Foreign Affairs and International Cooperation; Dr Kaifala Marah, Governor Designate of the<br />

Bank of Sierra Leone; Guy Warrington, High Commissioner Sierra Leone Designate; Amara Kuyateh, Deputy<br />

Director General of Sierra Leone’s National Social Security and Investment Trust; Paddy Docherty, Chief Executive<br />

of Phoenix Africa Development Company; and Tom Cairnes, founder of ManoCap – the Africa focused private<br />

investment firm.<br />

The context for this year’s event is provided by Sierra Leone: An Investor Guide. Produced by Herbert Smith<br />

Freehills, Standard Chartered and Prudential plc and launched by H.E. Dr. Ernest Bai Koroma, President of the<br />

Republic of Sierra Leone, the guide outlines the opportunities the country offers, and resources that potential<br />

investors can draw on.<br />

Invest Sierra Leone <strong>2016</strong> will be followed by an exclusive screening of the trailer for ‘Sierra Leone’, a major<br />

feature documentary from an Oscar, Emmy and Grammy award winning team. Due to be released in 2017, the<br />

film tells the story of Charlie Haffner, Sierra Leone’s most beloved theatre director, and his mission to create<br />

a play to galvanise his people and unite them around a better vision of the future. The film’s award winning<br />

producer, Sorious Samura, will be on hand to give a short talk about the project.<br />

The Organisers<br />

Herbert Smith Freehills is now in the seventh year of its ground-breaking partnership with the Government<br />

of Sierra Leone (GoSL), providing GoSL with legal assistance on a pro bono basis to help build its capacity to<br />

manage inward investment into Sierra Leone.<br />

Freetown Insight is Sierra Leone’s only magazine dedicated to business and investment in the country. It was<br />

launched in December 2015 and is published six times a year.<br />

The Sierra Leone Investment and Export Promotion Agency is responsible for the promotion and facilitation<br />

of private sector investments into Sierra Leone. It works with the Government of Sierra Leone and the private<br />

sector to develop a globally competitive business environment, and acts as the first point of contact for foreign<br />

investors, providing information and support on setting up a business. http://www.investsierraleone.biz

Change Maker<br />

Sierra Leone – land of<br />

great potential and<br />

untapped opportunities<br />

By H.E. Dr. Ernest Bai Koroma,<br />

President of the Republic of<br />

Sierra Leone<br />

In February last year, our battle against the Ebola epidemic was beginning to<br />

yield dividends, when I was asked to write the programme foreword for the<br />

inaugural ‘Invest Sierra Leone’ forum which was held in the House of Commons.<br />

Several months later, as we approached victory against the virus, I contributed the<br />

foreword for Herbert Smith Freehills’ ‘Sierra Leone: An Investor’s Guide’. While the<br />

primary tragedy of the outbreak was the terrible devastation and human suffering<br />

it caused; these two initiatives, aimed at increasing investment into the country,<br />

were both reflective of the urgent need to address the catastrophic economic<br />

consequences of the epidemic and the private sector’s continuing commitment to<br />

the economic development of Sierra Leone.<br />

Our business community has always been a critical partner for achieving Sierra Leone’s economic objectives.<br />

From my first term’s ‘Agenda for Change’, to the ‘Agenda for Prosperity’, Sierra Leone has pursued the vision of<br />

an inclusive economy, with reduced poverty and greater opportunities for all people; and before we were struck<br />

by Ebola, ours was one of the world’s fastest growing economies. Political stability and sound macroeconomic<br />

fundamentals had led to increased FDI (net) inflows totaling US$2bn over 2010-14, up steeply from US$402mn<br />

on the previous five-year period.<br />

We have now defeated the Ebola outbreak and completed the<br />

f irst phase of our recovery programme. This underpins our<br />

determination and ability to rediscover that economic success<br />

by strengthening entrepreneurship, by continuous economic<br />

diversif ication and innovation; by growing our trade relations<br />

and by upgrading our industrial sector.<br />

Already, this March, the International Monetary Fund has confirmed that “Sierra Leone’s economy is recovering<br />

from the twin shocks of the Ebola virus epidemic and the halt in iron-ore mining. Economic momentum is<br />

building again, and GDP is expected to grow by 4.3 percent this year from a contraction of 21 percent in 2015.…”<br />

We are still not at pre - Ebola levels even though we are on course to achieve our objective of full economic<br />

recovery. But we cannot do it alone; the private sector – both national and international - has to be at the very<br />

heart of our recovery plan.<br />

As a business man before I become President, I have direct personal experience of the workings and challenges<br />

of Sierra Leone’s business environment; and I am fully aware that creating trust in our systems and processes is<br />

key to attracting international investment and improving private sector confidence. Investors, both national and<br />

international, will want to know how we intend to improve on the favourable investment climate. Questions<br />

about the stability of foreign investments in the country, the application of the rule of law for business and the<br />

right policies to attract foreign investment without undermining internal revenue generation will be asked.<br />

Frank and objective dialogue between the private sector and the Government of Sierra Leone is an important<br />

step in the journey forward, and independent initiatives such as ‘Invest Sierra Leone’, ‘Freetown Insight’<br />

magazine and ‘Sierra Leone: An Investor’s Guide’ make an important contribution to that process.

FT<br />

Insight<br />

9<br />

There have been real lessons learned about the need for economic diversification, and our priorities align with<br />

a diverse range of opportunities across various sectors – amongst them are infrastructure, health, education,<br />

agriculture, construction, electrification and ICT.<br />

For example, only about one-fifth of our 5.4 million hectares of available farmland is presently used for crop<br />

growing. Our immediate priority is to increase production and productivity, focusing on rice and cassava and cash<br />

crops such as cocoa and oil palm. Additionally, we should be able to add value to our wide range of crops by<br />

processing them in country. We are also fortunate to be home to the third largest natural harbour in the world;<br />

and our strategic location adjacent to European market shipping lanes has long made Sierra Leone a popular<br />

trading and refueling location. The Government is devising an extended programme to develop Freetown as<br />

a trans-shipment global trade hub by improving the management and renovation of the port. This will create<br />

demand for port services equipment, management expertise and rehabilitation engineering. The ecotourism<br />

potential of our diverse landscape of islands, rivers, mountains, spectacular beaches and lush vegetation is barely<br />

tapped. Hotels, tours and other leisure gateways are exciting possibilities in a country that is only about six hours<br />

from Europe.<br />

These are just a few of the investment possibilities we have on offer. The collaboration between Freetown<br />

Insight magazine and Herbert Smith Freehills that has resulted in an annual commitment to the ‘Invest Sierra<br />

Leone’ forum will encourage potential investors to explore many more. This is a dynamic and transformational<br />

moment for Sierra Leone. Great opportunities and challenges beckon as we embark upon the journey towards<br />

forging a win-win partnership for our country’s enormous investment and trade potential. In a global economy,<br />

all our futures are intertwined and I look forward to building productive relationships with the private sectors of<br />

nations across the world.<br />

www.ftinsight.net

38 Spur Road, Freetown | Tel: +232 77 399399 | Website: www.swissspirithotels.com/freetown<br />

38 Spur Road, Freetown | Tel: +232 77 399399 | www.swissspirithotels.com/freetown

Invest Sierra Leone <strong>2016</strong><br />

Special<br />

Seven years of a groundbreaking<br />

partnership - Herbert<br />

Smith Freehills and the GoSL<br />

Leading international law f irm, Herbert Smith Freehills (HSF) is<br />

now in the seventh year of Fair Deal Sierra Leone - its ground<br />

breaking partnership with the Government of Sierra Leone<br />

(GoSL), providing legal assistance on a pro bono basis to help<br />

build Sierra Leone’s capacity to manage inward investment.<br />

The firm offers its services to GoSL for free, where it does not have sufficient financial, legal and human<br />

resources to achieve the best results for the country, but where it can benefit from world class legal assistance<br />

on supporting deal negotiation with international investors, helping bridge skills gaps to redress the balance<br />

when negotiating with large well-advised international investors.<br />

HSF works across a range of Government departments and bodies, including the President’s office, the Ministries<br />

of Energy, Health, Trade and Agriculture, the Attorney General’s office, the Law Officers’ Department and the<br />

investment promotions and PPP agencies; and coordinates with other development partners of GoSL (including<br />

DFID, UNDP, the World Bank, and the Africa Governance Initiative).<br />

Since its involvement with GoSL began in 2010, over 100 people<br />

across HSF have delivered over £2m worth of support, in what is<br />

believed to be the f irst pro bono facility focused by a law f irm on this<br />

scale in support of one country’s development efforts.<br />

FT<br />

Insight<br />

11<br />

In one example HSF was asked by the Ministry of Health to assist with the establishment of the National<br />

Pharmaceutical Procurement Agency, and the negotiation of its key supply contract. A team of HSF’s outsourcing<br />

specialists worked with GoSL for over a year alongside UNICEF and other international development agencies, to<br />

coordinate and support negotiation of the contract and creation of the requisite new legislation. On completion<br />

of the process, Zainab Hawa Bangura, Minister of GoSL, wrote: On behalf of the Government and people of<br />

Sierra Leone, I would like to extend my deepest thanks to Herbert Smith […] for your time, insights and hard<br />

work in assisting the Ministry of Health… and its partners in developing a final agreement to establish the …NPPU<br />

in Sierra Leone. […] I am deeply grateful for your invaluable help.<br />

HSF’s M&A partner Gavin Davies spent three months on his sabbatical living in Freetown in 2010, supporting<br />

the Government on deal negotiation and capacity building. Disputes associate Dan Hoyle was seconded to the<br />

Attorney General in 2011-2012 for seven months. He was followed by corporate associate Richard Woods, who<br />

spent two months of his sabbatical working with the Law Officers’ Department and the PPP unit in Freetown<br />

during the summer of 2013, and corporate associate Rebecca Perlman who was seconded to the PPP unit during<br />

February and March 2014.<br />

Rebecca Perlman of HSF says of the partnership and her experience working with the PPP Unit: “Fair Deal<br />

Sierra Leone was established by Herbert Smith Freehills to help the Government of Sierra Leone respond<br />

more effectively to growing volumes of foreign investment as part of its programme of recovery, growth and<br />

sustained development. We treat the Government of Sierra Leone like any other key global client, with a full<br />

relationship team and access to all of our expertise. We believe that Fair Deal Sierra Leone is a truly innovative<br />

project that demonstrates how lawyers can support and influence development outcomes at the highest levels,<br />

www.ftinsight.net

Invest Sierra Leone <strong>2016</strong><br />

Special<br />

CONTINUED<br />

focusing on capacity building to achieve sustainable change. We are now taking a central part in the debate<br />

with the international development community as to how lawyers can use their expertise to assist developing<br />

countries in this way.<br />

“The project also offers Herbert Smith Freehills’ team the chance to fulfil their international pro bono ambitions,<br />

to support their personal development beyond their usual working environments, and to gain unique experience<br />

of working on African matters. This is one of our global firm’s most significant and prestigious pro bono projects,<br />

fully aligned with our CSR programme, with many of our clients’ focus on Africa as a key growth market, and<br />

with our commitment to continuous innovation in our pro bono programme. Most of all, we are all enjoying this<br />

project enormously and are excited about the many ideas we have to build it further.”<br />

Herbert Smith Freehills:<br />

• Recognised as one of the world’s leading law f irms<br />

• A full service law f irm, expert in transactional,<br />

dispute and f inance work<br />

• Global experience across all key sectors including<br />

agribusiness, energy, government and public sector,<br />

infrastructure, international trade, PPP, project<br />

f inance, mining and transport work<br />

• A leading Africa practice<br />

• Award winning global pro bono projects

Herbert Smith Freehills<br />

in numbers<br />

• 25 off ices across Asia- Pacif ic, EMEA and North America<br />

• More than 3,000 lawyers worldwide<br />

• 470 partners<br />

• Eighth largest law f irm in the world by lawyers<br />

• Ranked f irst across the legal professional directories across a full<br />

range of practice areas<br />

Ernest Bai Koroma, President of Sierra Leone, The Times CEO Summit Africa, March 2012:<br />

[O]ur governments need help getting the best deal. As president, it is disheartening to get to the negotiating<br />

table and find yourself confronted by a phalanx of lawyers and accountants on one side of the table<br />

outnumbering your own side ten to one. In Sierra Leone, we have benefited immensely from generous pro-bono<br />

support from the London law firm, Herbert Smith.<br />

Rt Hon Dominic Grieve QC MP, UK Attorney General in a speech at Chatham House, July 2013:<br />

…there is clearly a lot of good work going on among British law firms. In terms of international pro bono work,<br />

Herbert Smith Freehills have been identified among the market leaders in London, in offering more than £1<br />

million of billable time to the government of Sierra Leone, in what must be one of the most laudable examples of<br />

international pro bono work in the City today.<br />

FT<br />

Insight<br />

13<br />

Tony Blair, Founder of the Africa Governance Initiative, August 2012:<br />

I was delighted that Herbert Smith established this programme with GoSL. I know that their support is proving<br />

to be a powerful tool in helping GoSL deliver the kind of sustainable, broad-based economic growth that will lift<br />

people out of poverty.<br />

Invest Sierra Leone, Sierra Leone’s only annual investment forum, is a collaboration between Herbert Smith Freehills, Freetown Insight and the<br />

Sierra Leone Investment and Export Promotion Agency (SLIEPA).<br />

www.ftinsight.net

Freetown Insight<br />

online Poll<br />

We asked:<br />

High taxes or high investment?<br />

Which would do more to reduce the gap<br />

between rich and poor in Sierra Leone?<br />

3<br />

2<br />

1<br />

1 High taxes on the wealthy and<br />

corporations to fund programmes<br />

that help the poor<br />

2 Low taxes on the wealthy and<br />

corporations to encourage investment<br />

and economic growth<br />

3 Other<br />

RESPONDENTS TO THE ONLINE POLL SAID:<br />

“Taxes are already very high in Sierra Leone and we need to encourage more investment especially among<br />

indigenous Sierra Leoneans, to expand employment opportunities for Sierra Leoneans.”<br />

“High taxes on the wealthy and corporations to fund programmes that help the poor? This is the logical thing to<br />

do, the reason that the wealthy and corporations have the money is due to them taking advantage of the poor,<br />

basically that is how they made their money, so they should be the ones to finance programmes for the poor. The<br />

more money one has, the more taxes the wealthy/corporations should pay.”<br />

“If taxes are increased this increase will then be passed down to the consumer which will not bridge the gap<br />

between the rich and poor, it will only make the situation worse. Tax incentives need to be developed to<br />

encourage investment in Sierra Leone from foreign business. Additional investment will encourage new business<br />

and employment opportunities for all of Sierra Leone, thus improving the GDP and the quality of life.”<br />

“The Government of Sierra Leone needs to improve the foreign investment incentives for the mining sector. Mining<br />

creates significant training and employment opportunities and often the contribution to the SL fiscus from PAYE<br />

payments is overlooked as are the indirect employment opportunities which result. The process for obtaining<br />

Mine Development Agreements is unclear. Much could be done in this regard but in the absence of internationally<br />

competitive fiscal terms, investors will pursue opportunities elsewhere. The lack of grid power is a major negative<br />

versus other countries as generating power at mine site is very costly, reducing the attraction for investors. These<br />

are serious issues which SL needs to address.”<br />

“The authorities seem to think that taxing imports at punitive rates is raising money, but it actually encourages<br />

businesses to bribe customs officials into under-valuing imports. Those that pay the high prices correspondingly<br />

charge more for their goods which affects everyone.”<br />

“Collect taxes!”<br />

“Get Companies to commit to Community Development Action Plans, and see that they honour their<br />

commitments. Already over the past 12 months nearly all Government of Sierra Leone Departments have<br />

doubled their charges, be it for Visas etc. Mining related application fees etc. Enforcing the collection of GST would<br />

also go a long way towards having money to spend on the poor. But unless corruption is rooted out/reduced, the<br />

gap between rich and poor will only widen. Don’t waste money on showcase projects like a new airport, rather<br />

put that money into a new hydroelectric scheme. There are many examples out there of how to grow a middle<br />

class, it just needs a willingness to do so and the commitment.”

Mano River Union<br />

The Mano River Union is an Intergovernmental Institution made up of Sierra Leone, Liberia,<br />

Guinea and Cote d’Ivoire. It aims to strengthen the capacity of Member States to integrate<br />

their economies and coordinate development programmes.<br />

Republic of Sierra Leone<br />

Capital: Freetown<br />

Population: 7,075,641 (49.1% men and 50.9% women)<br />

Area: 71,740 sq km (27,699 sq miles)<br />

Languages: English, Krio, Temne, Mende and a range of other indigenous languages<br />

Life expectancy: 48 years (men), 49 years (women)<br />

Currency: Leone<br />

Republic of Liberia<br />

Capital: Monrovia<br />

Population: 4.2 million<br />

Area: 99,067 sq km (38,250 sq miles)<br />

Languages: English, 29 African languages belonging to the Mande, Kwa<br />

or Mel linguistic groups<br />

Life expectancy: 56 years (men), 59 years (women)<br />

Currency: Liberian dollar<br />

FT<br />

Insight<br />

15<br />

The Republic of Guinea<br />

Capital: Conakry<br />

Population: 10.5 million<br />

Area: 245,857 sq km (94,926 sq miles)<br />

Languages: French, Susu, Fulani, Mandingo<br />

Life expectancy: 53 years (men), 56 years (women)<br />

Currency: Guinean franc<br />

The Republic of Ivory Coast<br />

Capital: Yamoussoukro<br />

Population: 20.6 million<br />

Area: 322,462 sq km (124,503 sq miles)<br />

Major languages: French, indigenous languages<br />

Life expectancy: 55 years (men), 58 years (women)<br />

Currency: CFA (Communaute Financiere Africaine) franc<br />

www.ftinsight.net

Invest Sierra Leone <strong>2016</strong><br />

Special<br />

Opinion<br />

To an entrepreneur,<br />

neglect naturally<br />

means opportunity<br />

By Paddy Docherty,<br />

Phoenix Africa<br />

I founded Phoenix Africa several years ago to build<br />

a series of social-impact businesses in post-con f lict<br />

countries in Africa. The business model is based on<br />

the realisation that countries recovering from civil<br />

war or armed insurgency are very often nothing like<br />

as dangerous and risky as one would imagine from<br />

a casual glance at the newspapers or TV; at the same<br />

time, because of the generally negative press (and an<br />

unhealthy dose of assumption), these countries are very<br />

badly neglected by most investors around the world,<br />

and suffer from a lack of inward capital f lows. To an<br />

entrepreneur, neglect naturally means opportunity,<br />

and my hunch was that post-conf lict Africa – as almost<br />

certainly the most forgotten group of countries on the<br />

planet – would offer plentiful business opportunities.<br />

In the early days of the company, I travelled to many countries on the continent, all at various stages of<br />

emerging from conflict, to research where we might go and precisely what we might do. We spent some time<br />

on a plan to establish a microfinance bank in South Sudan, before rightly deciding that the politics in the country<br />

were too unstable. From a list of other potential investment destinations, Sierra Leone stood out as the clear<br />

choice for our first project, and a very attractive place to begin work. It is the perfect fit for the Phoenix Africa<br />

model, being both highly neglected by international investors (thus offering plentiful opportunity) and at the<br />

same time being politically very stable and wonderfully peaceful and quiet.<br />

This is how Lion Mountains Agrico Ltd came into being. From my research trip around the country, the agriculture<br />

sector evidently offered much scope for development, especially when considering the enormous amounts that<br />

Sierra Leone spends on importing rice, the staple diet. We therefore began planning Lion Mountains with the aim<br />

of growing rice for domestic sale: a commercial undertaking that would simultaneously deliver a profound social<br />

impact to the local community and go some way to redressing the food security problem that Sierra Leone<br />

faces.<br />

From my perspective, the single biggest challenge in establishing the company was not to be found in Sierra<br />

Leone itself. The most difficult obstacle to overcome is the perception problem – the negative assumptions<br />

that many people make about the country, based on dim recollections of news reports from the worst days<br />

of the rebel war. Risk analysts sitting in London (who have typically never visited Sierra Leone, of course) are<br />

fond of declaring it a high-risk country, and this general perception has retarded investment. It is a tough task<br />

to raise money for a Sierra Leonean project. Happily, however, we managed to raise enough money to launch<br />

pilot phase operations in October 2014 – during the worst of the Ebola crisis – and are now firmly established<br />

as one of the key players in food production and processing, with our headquarters in Bo. We closed our Series<br />

A finance in August 2015, and are now working on finalising Series B, an investment that will provide for<br />

expansion to large-scale commercial farming.<br />

While it is the goal of Lion Mountains to farm rice at scale, the focus of the operation in the first 18 months has<br />

been the milling of rice that we buy in from a network of approximately 2,000 outgrowers around Bo District.

By going into the countryside and providing market linkage to many small farmers who have no other route to<br />

market, we have been able to both build a business and deliver a valuable social impact: most of our outgrowers<br />

are subsistence farmers with no other cash income. Even as we move to large-scale commercial farming over<br />

the next year, our Outgrower Programme will expand, and this year we expect to buy husked rice from about<br />

3,000 local smallholders. Besides the milling operation, we have been growing rice, soy beans and black-eyed<br />

beans at a small pilot farm in Lugbu Chiefdom, which in the last harvest delivered fully 2.73t of rice per hectare,<br />

a very healthy yield for the first full year of operation.<br />

While there are of course challenges to operating in Sierra Leone, we are very excited about the enormous<br />

potential. Few countries around the world offer the opportunity to go from a standing start to being the<br />

dominant player in a sector, but that is what we have under way with Lion Mountains. A key factor in this is our<br />

people. Managing Director Mike Gericke – surely one of the most highly experienced farmers working in Africa –<br />

has performed miracles on a regular basis to establish operations and make them successful. We are very lucky<br />

to have not only Paramount Chief Komrabai, Peter Penfold but also Dr Joe Demby on our board of directors,<br />

which has offered us great protection from corruption and helped us to get things done in good time.<br />

Lion Mountains has also benefitted from the strong support of the Ministry of Agriculture, including the direct<br />

backing of the Hon Minister Professor Monty Jones and Deputy Minister Marie Jalloh. Though the day-to-day<br />

challenges remain (power cuts, lack of readily available inputs, poor roads), such support helps us overcome<br />

them, and we look forward to collaborating further with the Ministry in the pursuit of our joint goal of food<br />

security for Sierra Leone.<br />

In the view of Phoenix Africa, Sierra Leone is a highly attractive place to do business. The perception problem<br />

and its negative effect on investors has provided us with an exceptional opportunity to become a key player<br />

in the agricultural sector. This is available to other entrants too. For those companies that can overcome the<br />

financing obstacles and assemble a team that can handle the daily challenges, the country offers plentiful<br />

opportunities in several other sectors. With Lion Mountains a key part of our portfolio, Phoenix Africa is<br />

committed to Sierra Leone for the long term. We would like to see many other investors seize this chance as<br />

well, and work with us to drive the development of this most excellent country.<br />

FT<br />

Insight<br />

17<br />

Paddy Doherty has two degrees in history from Oxford University, where he also won a Blue for boxing. He was in the oil & gas corporate finance<br />

team at PricewaterhouseCoopers in London, before joining the boutique investment bank Global Union (based in Bahrain) as a Director. After<br />

leaving the Middle East, he returned to PricewaterhouseCoopers to take up a role as Manager of the regional CEE & CIS energy corporate finance<br />

team, based in Prague; before leaving to establish Phoenix Africa. He was on the UK board of Millennium Promise 2010-2015 and a member of<br />

the World Economic Forum Global Agenda Council on Fragile States 2012-14. He is currently Chairman of Lion Mountains in Sierra Leone, the first<br />

Phoenix Africa business, and a Member of the Private Sector Delegation to the Committee on World Food Security at the UN FAO.<br />

www.ftinsight.net

Invest Sierra Leone <strong>2016</strong><br />

Special<br />

Seizing the<br />

corporate<br />

governance<br />

opportunity is<br />

essential if Sierra<br />

Leone is to secure<br />

investor conf idence<br />

By Chinyere Almona,<br />

Regional Program<br />

Manager, Africa<br />

Corporate<br />

Governance<br />

Program<br />

In its Agenda for Prosperity (2013-18), Sierra Leone laid<br />

out the ambitious goals of becoming an inclusive,<br />

green, middle income country by 2035, with specif ic<br />

targets of only 5% unemployment, and lifting 80% of<br />

its citizens above the poverty line. Governance and<br />

public sector reform is one of the eight agenda pillars<br />

intended to help the country achieve its goals. As one<br />

of the seven key areas, Governance is also a critical<br />

component of the President’s Recovery Priorities.<br />

Clearly, Sierra Leone’s government and its private sector recognise the importance of corporate governance,<br />

especially as a driver of overall economic health and growth. But what practical steps are being taken to<br />

improve standards on the ground? To be clear about what’s involved, corporate governance is defined as<br />

the structures and processes by which companies are directed and controlled. Good corporate governance<br />

helps companies operate more efficiently, improve access to capital, mitigate risk and safeguard against<br />

mismanagement. It makes companies more accountable and transparent to investors and gives them the tools<br />

to respond to stakeholder concerns. Corporate governance also contributes to development by helping facilitate<br />

new investment, access to capital, and long-term sustainability for firms, leading to economic growth and<br />

increased employment opportunities across markets.<br />

With support from the International Finance Corporation (IFC), a member of the World Bank Group, Sierra<br />

Leone is strengthening its financial sector, making it safer, sounder, and better positioned to attract the foreign<br />

investment it needs to grow.<br />

The IFC and Sierra Leone’s government are collaborating on providing training on governance related issues<br />

for the board directors and senior executives of the country’s leading banks and institutions. The training<br />

programme is targeting at least 100 organisations in Sierra Leone. It explains the roles of directors and<br />

committees, and introduces global best practices of corporate governance, including how to meet the<br />

expectations of markets and investors.<br />

IFC is also working directly with Sierra Leone’s Central Bank and its Corporate Affairs Commission to make<br />

information on corporate governance more widely available to those in the banking sector and beyond, and<br />

to develop a code of conduct for private sector businesses across Sierra Leone. These efforts are helping Sierra<br />

Leone’s private sector better understand the importance of corporate governance, and how to incorporate its<br />

guiding principles into its structures.

In the aftermath of the 2008 global financial crisis, the pitfalls of failing to promote sound corporate governance<br />

became shockingly clear. Increasingly, companies must be able to respond to fast-changing conditions, and to<br />

meet the needs of investors and partners in a timely and transparent manner.<br />

Businesses and banks in Sierra Leone are no exception. The country cannot fully develop by counting entirely on<br />

its natural resources, stunning scenery, and young and growing population of entrepreneurs, as valuable as these<br />

assets are.<br />

Good corporate governance – good governance in general –<br />

is an essential ingredient that every bank or business needs<br />

in order to secure trust, conf idence, and investment from its<br />

partners. Conversely, a weak corporate governance framework<br />

will severely impede all stages of the investment process and<br />

hence the economy’s overall prospects to build a strong private<br />

sector basis for economic growth. Poor corporate governance<br />

will damage the capacity to mobilise savings, it will hinder<br />

eff icient allocation of f inancial resources, and it will prevent<br />

proper monitoring of corporate assets.<br />

Perhaps most importantly, corporate governance is about delivering long-term sustainability. One of the<br />

most salient relationships in economic life is the positive link between investment and economic growth.<br />

In this regard, any economic strategy that looks 20, 10, or even five years into the future must consider the<br />

fundamental role that corporate governance will play in creating an enabling environment for that relationship<br />

to flourish.<br />

FT<br />

Insight<br />

19<br />

For IFC, which is the largest global development institution focused exclusively on the private sector in<br />

developing countries, corporate governance is part of broader strategy to support growth in Sierra Leone. IFC<br />

also invests directly in Sierra Leone, and has supported business reform efforts, gender initiatives, and a wide<br />

ranging World Bank Group response to the Ebola crisis.<br />

Going forward, IFC will remain a strong partner with Sierra Leone, helping the country realise its ‘Agenda for<br />

Prosperity’. We’re confident that the public and private sector institutions will adapt good corporate governance<br />

practices that have the potential to make them highly attractive to investors and make Sierra Leone the next<br />

investment destination in Africa.<br />

www.ftinsight.net

Visitors to FT Insight’s<br />

website www.ftinsight.net<br />

Sierra<br />

Ghana<br />

Leone<br />

Guinea<br />

Kenya<br />

Costa Rica<br />

France<br />

Netherlands<br />

UKRussia<br />

USA<br />

Norway<br />

Brazil<br />

Canada<br />

Switzerland<br />

Nigeria<br />

China<br />

Belgium<br />

Germany<br />

Spain

Tech Talk<br />

Utilising and managing<br />

digital content for<br />

socio-economic growth<br />

By Ishmael Bull,<br />

Sierra WiFi<br />

Sierra Leone, like many developing countries, continues to struggle with its economic development. Underlying<br />

problems with education, health and poverty still compound the nation’s growth. Numerous studies have<br />

identified inexpensive and fast internet as a factor that can boost economic growth and Sierra Leone’s<br />

connection to the African Coast to Europe (ACE) submarine communications cable offers the country the very<br />

high bandwidth necessary to catch up with the new global information age, and take advantage of its associated<br />

benefits.<br />

In his keynote delivered early 2013 on the commissioning of the ACE Fibre Optic, His Excellency the President<br />

Dr. Ernest Bai Koroma stated: “The essence of this project is to develop applications for the use of this huge<br />

bandwidth. Examples of these applications are e-education, e-health, e-tourism, e-commerce, e-banking, and<br />

e-government to name but a few.”<br />

Still in its early stages, the great socio-economic potential of this information superhighway is not readily<br />

accessible to the average Sierra Leonean. And while mobile penetration is on the increase with 70% penetration,<br />

expensive costs keep internet penetration in the country below 10%.<br />

This limited internet penetration can definitely be problematic. For example, during the recent Ebola crisis, I was<br />

part of a team that developed a customised ‘Open Data Kit’ – a mapping tool that could provide timely feedback<br />

on district response activities. Using skip logic on android phones, field workers collected and uploaded key data<br />

from their districts to an open source platform whenever internet connectivity was available, to be fed into a<br />

mapping tool displaying activities by region or district. However, a major constraint to the usefulness of the<br />

‘Open Data Kit’ was the lack of internet connectivity in rural areas and thus heavy funding was critically needed<br />

to set up (satellite) systems.<br />

FT<br />

Insight<br />

21<br />

Improved connectivity therefore, is undoubtedly important. Yet with 60% of the nation under the poverty line<br />

and a 41 % adult literacy rate, how do we ensure we make the internet productive and useful in the context<br />

of our developing economy, as well as accessible? The answer lies in following His Excellency the President’s<br />

advice and focusing on how we can utilise and manage digital content for socio-economic growth by developing<br />

applications that will help enhance sectors including health, agriculture and education.<br />

As a private sector Internet Service Provider, we at Sierra WiFi see it as a paramount responsibility to help<br />

develop sectors within the economy rather than simply providing internet services to end users. Our primary<br />

corporate mandate is to provide schools with e-learning facilities. To deliver this, a tripartite partnership was<br />

formed between Sierra WiFi, the Ministry of Education and Ministry of Information & Communication to launch<br />

the Government Intranet Virtual Education (GiVE) Portal which gives schools free computers and provides<br />

students and teachers with access to digitised educational tools and resources. To date we have installed GiVE<br />

in 90 schools and aim to do 75 schools yearly. Communities can use the same platform to supply information to<br />

farmers thus aiding agricultural development; and health centres can supply health information and education.<br />

Subsidising the provision of internet access for its own sake has limited value and is mainly of interest to an<br />

educated elite. Similar to how bus companies carry passengers to different locations for reasons of education,<br />

employment, research, relationships; the internet’s end use has to be considered up front, otherwise it becomes<br />

as meaningless as a fleet of empty buses driving back and forth.<br />

www.ftinsight.net

Tech Talk<br />

Survey results show the Internet is<br />

not an essential part of the economic<br />

infrastructure in Sierra Leone<br />

The internet is a fact of international business life and Sierra Leonean businesses could benefit enormously<br />

from an e-presence. Yet a recent FT Insight survey on the e-readiness of Sierra Leone’s business sector, showed<br />

that the internet is not yet an essential part of the economic infrastructure in Sierra Leone, with almost 45% of<br />

business respondents admitting that they do not have a website.<br />

Yes<br />

No<br />

10 20 30 40 50 60 70 80 90 100<br />

The development of e-commerce in Sierra<br />

Leone has admittedly been hobbled by the<br />

limitations of our financial, legal and physical<br />

infrastructure. But even if a firm’s goods and<br />

services don’t lend themselves to online<br />

purchases, a business website offers other<br />

useful ways of connecting with customers –<br />

online booking, promotions, newsletters and<br />

24/7 two-way communication to name just a few. We asked Sierra Leonean businesses what was keeping them<br />

from maximising the value of commercial connectivity?<br />

If you are in business in Sierra Leone but do not have a business website, what are the reasons?<br />

The two most common reasons given by respondents is that e-commerce does not fit with their business model<br />

(37%) and that Sierra Leone’s telecoms and tech infrastructure isn’t ready for e-commerce (37%). Almost 32%<br />

said that e-commerce did not fit with their goods and services.<br />

Twenty-six percent said that unreliable access to the internet would prevent them from maintaining their<br />

website. Lack of technical know-how and the high costs of building and maintaining a website are an<br />

impediment to 21%. Almost 16% hadn’t got round to building a business website, but it was in their plans.<br />

Business benef its of an online presence:<br />

• The cost of running an e-business can be less than a physical one<br />

• Easier cross-border trading in Sub Sahara Africa<br />

• Transparency<br />

• Information sharing<br />

• Customer service<br />

• Establish yourself as a thought leader<br />

• Marketing<br />

• Communication with clients and customers<br />

• Showcase your goods and services

E-commerce<br />

doesn’t fit<br />

Answer choices<br />

Responses<br />

E-commerce<br />

doesn’t fit<br />

E-commerce<br />

doesn’t fit<br />

We don’t see<br />

the advantag...<br />

Lack of<br />

technical...<br />

We are<br />

concerned ab...<br />

The costs are<br />

too high...<br />

We do not have<br />

the right...<br />

We do not know<br />

what equipme....<br />

We plan to<br />

build a...<br />

I don’t have<br />

reliable acc...<br />

Sierra Leone’s<br />

telecommunic...<br />

E-commerce doesn’t fit with<br />

our products/services . . . . . . . . . . . . . . . .31.58%<br />

E-commerce doesn’t fit with<br />

the way we do business . . . . . . . . . . . . . .36.84%<br />

E-commerce doesn’t fit the<br />

way our customers work . . . . . . . . . . . . . .10.53%<br />

We don’t see the advantage<br />

of using E-commerce . . . . . . . . . . . . . . . .10.53%<br />

Lack of technical know-how . . . . . . . . . . . .21.05%<br />

We are concerned about security risks . . . . . . . 5.26%<br />

The costs are too high . . . . . . . . . . . . . . .21.05%<br />

We do not have the right equipment . . . . . . . 5.26%<br />

We do not know what equipment<br />

we need . . . . . . . . . . . . . . . . . . . . . . . 5.26%<br />

We plan to build a business website,<br />

but just haven’t got round to it yet . . . . . . . . .15.79%<br />

I don’t have reliable access to the internet and<br />

would not be able to maintain my platform . . . 26.32%<br />

Sierra Leone’s telecommunications and technical<br />

infrastructure isn’t ready for e-commerce . . . . 36.84%<br />

FT FT<br />

Insight<br />

23<br />

10 20 30 40 50<br />

A substantial number of businesses with an online presence found that their website wasn’t particularly helpful<br />

for generating work, reporting that they receive less than 10% of their business through the internet. However,<br />

an encouraging 15% receive over 50% of their business via the web.<br />

If you do have a business website, how much business or potential business do you<br />

get through your website?<br />

Less<br />

than 10%<br />

Answer choices<br />

Responses<br />

From<br />

10% - 25%<br />

From<br />

25% - 50%<br />

From<br />

50% - 75%<br />

From<br />

75% - 100%<br />

Others<br />

(please specify)<br />

Less than 10% . . . . . . . . . . . . . . . . . . . 42.42%<br />

From 10%-25% . . . . . . . . . . . . . . . . . . 15.15%<br />

From 25%-50% . . . . . . . . . . . . . . . . . . . 3.03%<br />

From 50%-75% . . . . . . . . . . . . . . . . . . . 9.09%<br />

LFrom 75%-100% . . . . . . . . . . . . . . . . . . 6.06%<br />

Others (please specify) . . . . . . . . . . . . . . 24.24%<br />

10 20 30 40 50<br />

www.ftinsight.net

FT Insight readers prefer<br />

iPhones!<br />

www.ftinsight.net<br />

iPhone<br />

iPad<br />

Samsung GT1930II<br />

Galaxy S III Neo+<br />

Not Set<br />

iPhone 6<br />

Google Nexus 5<br />

Samsung SM-G925F<br />

Galaxy S6 Edge<br />

Apple iPad 2<br />

Apple iPhone 5s<br />

Apple iPhone<br />

6s Plus<br />

The rest<br />

5 10 15 20 25 30 35

In Digest<br />

The British High Commission in collaboration with the Public Private<br />

Partnership (PPP) Unit ran a two-day PPP workshop for policy makers, legal<br />

practitioners, procurement specialists, and key actors within the private and<br />

public sectors at the Sierra Light House Hotel in Aberdeen, Freetown.<br />

Sierra Rutile announced that it has<br />

extended the maturity dates on its<br />

existing US$20 million working capital<br />

facility and US$15 million standby loan<br />

facility with Nedbank Limited, acting<br />

through its London Branch, for a further<br />

14 months until 30 <strong>May</strong> 2017.<br />

On 25th February, Developing Markets<br />

Associates welcomed the Government of<br />

Sierra Leone to London, for the UK/Sierra<br />

Leone Trade & Investment Forum. Organised<br />

by DMA in partnership with SLIEPA, and led<br />

by Hon Samura Kamara, Minister of Foreign<br />

Affairs and Cooperation, the forum provided<br />

in-depth knowledge of Sierra Leone to<br />

potential investors.<br />

Sierra Leone commenced work on a<br />

6 MW PV park backed by IRENA. The PV<br />

project in Sierra Leone has received<br />

part funding of $9 million from the<br />

Abu Dhabi Fund for Development<br />

(ADFD), which has partnered with<br />

International Renewable Energy<br />

Agency (IRENA) to support clean<br />

power generation in Africa.<br />

International competitive football<br />

returns to Sierra Leone for the<br />

f irst time since 2014, with an AFCON<br />

qualif ier against Gabon on 28 March,<br />

which Sierra Leone won 1-0.<br />

Citigate Commodities Trading Limited<br />

announced the acquisition of a kimberlite<br />

diamond concession in Sierra Leone. Located<br />

adjacent to one of the country’s largest diamond<br />

reserves, Citigate’s extraction and mineral rights<br />

are spread over an area of 79 square kilometres<br />

to explore diamonds.<br />

President Koroma launched the Small<br />

and Medium Enterprise Development<br />

Association to provide credit facilities to<br />

micro, small and medium enterprises.<br />

The Sierra Leone Chamber of Commerce,<br />

Industry and Agriculture holds its annual trade<br />

fair at the Siaka Stevens Stadium, attracting<br />

businesses from Nigeria, Ghana, Benin, Senegal,<br />

Liberia and Guinea.<br />

FT<br />

Insight<br />

25<br />

Sierra Leone’s President Ernest Bai Koroma announced a major cabinet<br />

reshuff le involving a total of 40 appointments to ministerial and<br />

ambassadorial positions.<br />

International power project developer Joule Africa has bought out its co-developer, Endeavor Energy,<br />

giving it 100 per cent ownership of the Bumbuna II HPP. Bumbuna II is the 202MW expansion of the<br />

50MW Bumbuna HPP commissioned in 2009 by H.E. Dr Ernest Bai Koroma, President of Sierra Leone. The<br />

project has been in development since 2011.<br />

Stellar Diamonds will be focusing on moving the Tongo project in Sierra Leone into funding<br />

and development this year.<br />

www.ftinsight.net

Freetown Insight<br />

Contributor<br />

Are small solar home<br />

systems the way to<br />

light up Sierra Leone?<br />

Less than 1% of Sierra Leoneans living in rural areas have access to energy. Around the country, lack of energy is<br />

a major challenge across all sectors including: private sector, health, and education.<br />

Energy is one of the key priorities in the “Agenda for Prosperity” and also one of the country’s key socio<br />

economic post-Ebola recovery priorities. The UK’s Department for International Development (DFID) is supporting<br />

the Government and people of Sierra Leone to deliver on this challenge.<br />

Early in <strong>April</strong>, the Ministry of Energy (MoE) and DFID hosted an unprecedented meeting with all 149 Paramount<br />

Chiefs, District Council Chairmen, and City <strong>May</strong>ors in Sierra Leone to discuss providing power for all Sierra<br />

Leoneans. The one-day event was intended to engage attendees in a conversation about the current energy<br />

challenges in rural communities and the solutions and opportunities available through renewable energy, with an<br />

emphasis on small solar home systems (SHSs). The MoE hopes to inspire leaders to champion renewable energy<br />

in their chiefdoms.<br />

Designed to be both an informative and interactive session, the community leaders had the chance to learn<br />

about the opportunities the Government of Sierra Leone (GoSL), donor partners, and the private sector can offer

FT<br />

Insight<br />

27<br />

in fostering renewable energy businesses in their chiefdoms. Following that, a roundtable conversation discussed<br />

lessons learned among chiefdoms which have been early adopters of renewable energy. Local private sector<br />

companies attended to showcase the technologies and services they can provide.<br />

This event is the fourth and final meeting leading up the Sierra Leone Energy Revolution launch event on the<br />

10th of <strong>May</strong> in Freetown. Three previous roundtable meetings were held over the past several weeks to engage<br />

the private sector; Ministries, Departments, and Agencies (MDAs); and financial institutions, in discussions about<br />

the obstacles, challenges, and opportunities in running a renewable energy business in Sierra Leone and to<br />

identify incentives and policy shifts that would enable off-grid renewable energy sector growth.<br />

All three roundtables were successful in identifying key challenges and the solutions needed to overcome<br />

them. Some of the major outcomes include: the creation of the Renewable Energy Association, the adoption of<br />

international quality standards and duty free status for qualifying imports.<br />

“We are really happy with the outcomes of the previous<br />

roundtables and we feel conf ident that this event will be a<br />

success. If community leaders can embrace renewable energy in<br />

their communities, we will be on track to provide power for Sierra<br />

Leoneans,” said Patrick Tarawalli, Technical Advisor Ministry of<br />

Energy.<br />

www.ftinsight.net

Music<br />

Living for Live - Sierra<br />

Leone’s f irst major live<br />

music festival targets<br />

10,000 fans a day<br />

Three years ago a small group of young Sierra<br />

Leonean musicians formed a not-for-profit<br />

organisation to encourage live music in Sierra Leone,<br />

where it is more common for artists to mime or sing<br />

over CDs. They called themselves Freetown Uncut<br />

and started their campaign by organising occasional<br />

live performances in bars and clubs around Freetown.<br />

This year, they are planning the biggest live music<br />

spectacular Sierra Leone has ever experienced – a<br />

two-day event on the 23rd and 24th <strong>April</strong>, which will<br />

attract over 10,000 people a day.<br />

The Freetown Music Festival is being held in<br />

association with the National Tourist Board of Sierra<br />

Leone. It forms part of Sierra Leone’s Independence<br />

Day festivities and is intended as a celebration of<br />

Sierra Leone’s resilience in the aftermath of the Ebola outbreak. Tom Cairnes, one of the people behind the<br />

event, says: “Following months of negative headlines, we will demonstrate the wealth of music and culture that<br />

Sierra Leone has to celebrate. There are a number of other festivals in Sierra Leone. Madeng, for example, is a<br />

great cultural festival that everyone in Sierra Leone should go to. We think the Freetown Music Festival can add<br />

to this movement by focusing on showcasing live music.”<br />

The idea came when Tom Cairnes visited the New Orleans Jazz Festival in 2014. He thought that Sierra Leone<br />

should have something similar. If all goes to plan, the Freetown Music Festival will become an annual event<br />

attracting artists and visitors from across the world; and generating considerable revenue for the country’s hotels<br />

and hospitality sector, as well as funds to support young musicians in Sierra Leone.<br />

Festival headliners, such as the country’s best selling artists - Block Jones and Dallas B, will play on the main<br />

stage on Freetown’s Lumley Beach; the objective being to make the festival open to everyone in the country. In<br />

addition, ticketed VIP events will be held at Lumley beach night spots such as Papaya, O-Bar and Chez Nous.<br />

Led by Nigeria and South Africa, Africa’s music business is booming, with data on its contribution to economic<br />

growth beginning to emerge. And in the UK and US festivals have come to dominate the music industry. If it<br />

is a success the Freetown Music Festival could do a lot for Sierra Leone’s embryonic music industry. “There is a<br />

huge amount of musical talent in Sierra Leone that people aren’t listening to,” says Tom Cairnes. “We hope this<br />

festival will give them an opportunity to showcase their talent and tell a positive story about the country.”<br />

Freetown Music Festival <strong>2016</strong><br />

23rd & 24th <strong>April</strong><br />

Lumley Beach<br />

Entry: Le 5,000<br />

Freetown Uncut is a non-profit organisation that supports local musicians in Sierra Leone, providing scholarships to artists to support them write,<br />

record and perform their music and working with world-class partners to promote their music in the region and internationally.

FT<br />

Insight<br />

29<br />

www.ftinsight.net

“Congratulations on regularly publishing<br />

this material. Keep it up.”<br />

Alhaji Kandeh Kolleh Yumkella, Co Founder-African<br />

Energy Leaders Group (AELG) & Former UN Under<br />

Secretary- General - Special Rep & CEO - Sustainable<br />

Energy for All<br />

“You are always breaking new<br />

ground on the private sector front.<br />

FT Insight looks and feels great.”<br />

Francis Ato Brown, former World Bank Country<br />

Director to Sierra Leone<br />

“Loving FT Insight. Well done!”<br />

Memuna Janneh, Founder and Trustee of LunchBoxGift<br />

“I am reading the February <strong>2016</strong> edition of<br />

FT Insight. It is a beautiful publication full of<br />

factually insightful analyses of Sierra Leone’s<br />

business development and potential. Thank<br />

you, Memuna and team at FT Insight, for<br />

alerting the world of business investors to<br />

a gold mine that will be a win-win situation<br />

for both those investors that will readily<br />

seize the opportunities that abound, and the<br />

people of the nation state of Sierra Leone.”<br />

Hadji Dabo, Vericon Health Resources, LLC<br />

“A great venture.”<br />

David Mansaray, Executive Director, Finance/Chief<br />

Operating Off icer, Standard Chartered Bank, Sierra<br />

Leone<br />

“I recently came across your magazine. As a<br />

Sierra Leonean in the diaspora looking to<br />

return home, I f ind your publication to be a<br />

treasure and a delight! Thank you so much!<br />

Are there ways in which to support you? I’d<br />

love to help.”<br />

Melissa Faux, Assessment Specialist at Atlanta Public<br />

Schools<br />

“Tons of useful information and<br />

insights. Keep up the good work!”<br />

Ade Freeman, World Bank<br />

“A great addition to information sources<br />

about business in Sierra Leone. Up-to date,<br />

well-researched and great look. Keep<br />

up the high standards and good work.”<br />

Ade Daramy, Co-Editor at The Journal of Sierra Leone<br />

Studies

BEX SINGLETON<br />

&<br />

ERIKA PEREZ-LEON<br />

photo<br />

graphy<br />

video<br />

design<br />

bex@bexsingleton.com<br />

erikaperezleon@gmail.com